Vince Stanzione Making Money Spread Trading Daily Telegraph

1

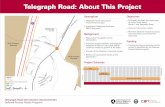

* * * THE DAILY TELEGRAPH TUESDAY, APRIL 1, 2014 B4 | By Dan Hyde BANKS are facing an inquiry into the potential manipulation of key bench- marks for interest rates and commodity prices, as well as foreign exchange, over concerns that the Libor scandal could be repeated, regulators announced yesterday. The review, to be conducted by the Financial Conduct Authority later this year, will assess whether banks have “learnt lessons” from the Libor contro- versy, in which traders attempted to rig borrowing costs. Firms will have to show evidence of “adequate controls on traders’ behaviour and activity” across any type of bench- mark that could be subject to manipula- tion, the FCA said. Martin Wheatley, chief executive, said: “Following widespread attempted manip- ulation of Libor, firms should ensure that traders are not able to act in this way in the future. We are determined that firms need to take the matter of manipulation of any benchmark seriously and will be working with firms to seek out any issues that may remain.” The intentions were disclosed in the FCA’s business plan for the next financial year, which it said will require an addi- tional £14.3m funding, which is derived from the industries it regulates. It will need a total of £446.4m for the 2014-15 financial year, with the additional expense met by Britain’s largest financial firms. Other initiatives outlined evidenced the regulator’s drive to “put consumers at the heart” of its operation. There was confirmation of an inquiry, disclosed by The Daily Telegraph last Friday, into the treatment of customers sold 30m investment, pension and life insurance policies before the turn of the millennium. In response, Fitch, the ratings agency, downgraded its forecast for the insurance sector to “negative” from “stable”. It said the decision was taken due to “threats to the sector’s profitability from three recently announced initiatives on pen- sions and savings”. The other measures to which Fitch referred were the freedoms granted in the Budget, which end the compulsion to take an annual income from retirement savings, and the 0.75pc charge cap on workplace pension charges due to take effect in April 2015. However, shares in the major insurers, which lost a combined £2.3bn on Friday, staged a minor recovery, with Aviva climbing 1.4pc and Resolution 0.8pc. Other initiatives scheduled for the next 12 months included a review into banks’ treatment of fraud victims. The FCA is concerned that firms might be placing “unreasonable obstacles or responsibilities” on customers as the basis of “unfairly rejecting claims”. An estimated 170,000 people a year, who the FCA said are unfairly denied a refund after suffering fraud, could benefit from the action. The regulator also set out its intentions with regard to the consumer credit sector, for which it takes responsibility today. It will conduct a review into how struggling borrowers are treated by the industry and how loans are advertised. This includes controversial payday lending. THE skyline of the City of London has been transformed in recent years by a series of high- rise office blocks. From the Cheesegrater to the Gherkin, the proliferation has even led Boris Johnson, the Mayor of London, to describe the area as starting to resemble a “Ploughman’s Lunch”. Now, British Land are looking to continue the trend with a new multi-million pound office building. The company’s design will rise to 750ft high, 60ft taller than neighbouring the Leadenhall Building, itself a British Land joint venture project with Oxford Properties. Taking a tall, slender form and with a unique photovoltaic “crust”, the new building, which features a distinctive notch high on its sides, has already been dubbed the “Slice of Bread” by architecture critic Flora Spoil. Chris Grigg, chief executive, British Land, commented on the prospect of a new skyscraper for London: “We think this would be an excellent site for the building, sandwiched between our own Cheesegrater and the Gherkin and in very close proximity to the proposed Toast Rack elsewhere in Leadenhall Street.” LUMBERJACK By Andrew Trotman BRITISH banks deemed “too big to fail” are enjoying implicit government subsi- dies of up to $110bn (£66bn) that could expose taxpayers to bail-outs costing hundreds of billions of pounds, the IMF has warned. The fund reveals in the latest edition of its twice-yearly Global Financial Stability Report that lenders are benefiting from low borrowing costs as investors remain convinced governments will bail out banks that get into trouble. Bankers were also likely to take bigger risks if they believed the taxpayer would bail out their employers, the IMF said. “Countries emerged from the financial crisis with an even bigger problem. Many banks were even larger than before and so were the implicit government guaran- tees,” IMF economists wrote. This means taxpayers would be hit hard in the event of another financial crisis if banks needed capital to stop them collapsing. “Government protection for too-impor- tant-to-fail banks creates a variety of problems: an uneven playing field, exces- sive risk-taking and large costs for the public sector,” the IMF wrote. “The expected probability that system- ically important banks will be bailed out remains high in all regions.” The world’s largest banks have been handed implicit subsidies worth up to $590bn: $15bn to $70bn in the US, $25bn to $110bn in Japan, $20bn to $110bn in the UK and $90bn to $300bn in the eurozone. However, large banks have previously said that their advantage has been over- stated in studies. The IMF has urged governments to push through reforms such as forcing banks to hold more capital and prevent them completing risky loans. THE head of the US Federal Reserve has said the central bank’s “extraordinary” commitment to boosting the economy will be needed for some time to come. Janet Yellen, in her first public speech since becoming Fed chair two months ago, strongly defended the Fed’s policies of low interest rates and continued bond- buying. She said there remained “considera- ble” slack in the economy and job market, a sign that further monetary stimulus can still be effective. While the official unem- ployment rate has fallen quickly over the past two years to 6.7pc, she said that level remained deceptive. “I think this extraordinary commit- ment is still needed and will be for some time, and I believe that view is widely shared by my fellow policy-makers at the Fed,” Ms Yellen said at the 2014 National Interagency Community Reinvestment Conference. The Fed, frustrated with the slow recov- ery from the 2007-2009 recession, has kept rates near zero for more than five years. It has said it will keep them there for a considerable time even after it ends a bond-buying programme, which is to be wound down later this year. Ms Yellen, long concerned with the hardships of the unemployed and under- employed, said the US economy remained “considerably short” of the Fed’s goals of maximum sustainable employment and stable inflation at 2pc. The “scars from the Great Recession remain, and reaching our goals will take time,” she told an audience of about 1,100 people in Chicago. “The recovery still feels like a reces- sion to many Americans, and it also looks that way in some economic statistics,” she said. US shares rose in response. By Roland Gribben BAD weather was yesterday blamed for a larger than expected fall in mortgage approvals last month. Total approvals of 70,309 were the lowest since October last year, according to Bank of England key economic data. Analysts had been expecting a modest fall from the January figure of 76,753, which was the best for more than six years. But business in several parts of the country was affected by storms and floods. Economists expect a recovery, although they feel some heat will go out of the housing market with changes in the lending regime later this month. Consumer spending, the other driving force behind economic recovery, is continuing to grow, however, and Bank figures suggest rising confidence is encouraging increased borrowing. Unsecured lending remains substantially down on its pre-recession level but total net lending to individuals increased by £2.3bn last month. But the Bank figures show no sign of the long expected increase in overall business lending, although last month saw an encouraging improvement in the small and medium-sized business sector. The £159m rise in lending to small businesses was seen as an indication that pressure on the banks to take a more sympathetic approach is producing results. Lending to non-financial businesses was down a further £750m. The rate of decline has slowed substantially since the £4.4bn slide in the autumn. Strong cash positions built up by big companies during the recession has reduced the need for borrowing, but a growing number are now in the market for capital to take advantage of the growth in the economy. Howard Archer, chief UK and European economist at IHS Global Insight, sees the current indicators as a sign that the trend is turning. He feels that with prospects for the economy brightening, business demand for credit is likely to pick up appreciably in the coming months. The Bank of England has also made a contribution by withdrawing support for lending to households from its Funding for Lending Scheme and concentrating all its resources on business lending. Mark Carney, the Governor of the Bank of England, has also signalled that the Bank is ready to intervene to curb potentially dangerous mortgage lending. IT’S Advertising Week in London. Quote of the week, as reported by the conference’s own newspaper, has already been claimed by a man named Sanderson Jones. A “former ad man and comedian”, he runs something called The Sunday Assembly, a non- religious network with a mission to set up “a godless congregation in every town, city and village that wants one”. He is at Advertising Week to chair a session on women in technology. It’s a subject on which he has strong views. “If Saint Paul was alive today, he wouldn’t be writing epistles, he would be writing code,” intones our man. Life as a comedian-turned-secular- sermoniser is not all revelation and conference gigs, however. “Whenever you tell people you’ve stopped doing comedy, they assume it’s because you were ****,” complains Mr Jones. Not at all, Sanderson. Diary thinks you’re hilarious. IT’S also that time of year when the clown in every organisation’s public relations team gets to answer their true calling with a spoof press release. The loudest groans go to Ocado, which should know better, but claims today that it will launch a 42-inch “slablet” weighing 35kg and with one hour battery life, to compete with the iPad. The online retailer has gone as far as producing a parody of Apple’s promotional videos. City and Guilds produced a slightly more believable, and therefore slightly better, April Fool in the form of a plan for new training and qualifications for living on the moon. The modules will include Carpentry in Low Gravity and Horticulture in Hazardous Environments. The accompanying quote from chief executive Chris Jones strikes the right tone of HR department gobbledegook: “We must do all we can to address potential skills gaps now and equip the moon’s future community with the practical, contextualised training they need to succeed in the future.” Diary looks forward to more of the same next year, assuming our split sides have made a full recovery. CONGRATULATIONS to Chris Buck, who co-directed the Disney smash hit Frozen, above, with Jennifer Lee. The film was confirmed yesterday as the highest-grossing animation of all time. With a $1bn (£600m) success such as that behind him, Mr Buck will surely have his pick of projects, but when we spoke to him last week he was most looking forward to stepping off the Disney publicity treadmill, which Mickey Mouse has been running at full speed for months. He said: “I’m hopefully going to get a vacation. I’d like a break before we get back in the studio and develop some new ideas.” JOHN GRESS Continued from B1 possible at any cost and whatever the risk was never the aim of the sale. The report concludes there was a real risk of a failed sale attached to pushing the price too high. And a failed sale would have been the worst outcome for taxpayers and jeopardised the operation of Royal Mail going forward.” Royal Mail was sold in October last year at a price of 330p a share. On the first day of trading, the shares soared 389pc, adding £750m to its stock market value. In the following months, the stock has traded as high as 615p. In the past few weeks, the shares have dropped again, and closed last night down 1 at 563p. Mr Cable has argued that the rise was “froth” in the market. The Business Sec- retary and Royal Mail’s bankers have argued that institutional investors would not have paid more than 330p because of the threat of strike action and market uncertainty at the time. However, the institutional offering was oversubscribed by 24 times, the NAO has noted. “The department was advised that the book-building had not revealed suf- ficient demand at meaningfully higher prices and therefore judged that the risks and practical difficulties of raising the price were too great,” the NAO found. The NAO added that Royal Mail’s sur- plus properties were also sold on the cheap. “Although three surplus proper- ties with a market value of more than £200m were disclosed in the prospectus, the NAO does not believe that the basis on which Royal Mail was sold recovered this value.” Janet Yellen gives her first public speech since becoming Fed chair two months ago Barclays and RBS are among eight banks being investigated by Switzerland’s competition commission over potential collusion to manipulate currency rates. WEKO said it is also probing UBS, Credit Suisse, ZKB, Julius Baer, JP Morgan and Citigroup. The commission said its investigation would take months and could result in fines of up to 10pc of the turnover generated in the relevant market in Switzerland over the past three years. The UK Financial Conduct Authority, meanwhile, said it will assess if banks have cut the risk of traders manipulating benchmark rates in the coming year.

-

Upload

vince-stanzione -

Category

Documents

-

view

62 -

download

4

description

How savers are making money as the 0.5% base rate drags onBy Rob ShepherdWith the Bank of England's base rate gathering cobwebs at 0.5%, millions of savers are now desperate to see how to prevent their savings dwindling further. "It's little wonder many people are now looking beyond savings and pensions to the stock market," says multi-millionaire Vince Stanzione, who built his fortune using a simple online system for following share price activity and investing accordingly. "The so-called security of savings accounts has become meaningless after year upon year of microscopic returns."Stanzione, author of the best-selling book The Millionaire Dropout, says that wariness of the stock market is often not so much because of the risk but because of the markets' alienating jargon and apparent incomprehensibility. But, says Stanzione, these are not real barriers."I'm now seeing a lot of investors, many 55+ or retired, who are no longer intimidated by the markets' smoke and mirrors."This may be down to Stanzione's own approach to trading, as he reveals the system that amassed his personal fortune, insisting it is so straightforward, anyone can do it.Having tested it across an extraordinary range of market conditions over 15 years, Stanzione has turned his system into a personal training package called ‘Making Money From Financial Spread Trading’. Its workbook, two DVDs and members-only website (plus support) cover both spread trading and conventional share dealing and, crucial in volatile times, show how money can be made from shares going down, and even sideways, as well as up.“And if that language sounds a bit alien, the package will explain," says Stanzione. “I’ve eliminated the jargon and demystified everything. I take students step by step, with a dummy account to practice on. You start by studying, then you try a few small trades and work up from there at your own speed. “Typically, students spend around 30 minutes a day and can do it from anywhere, including tablets and smart phones.”Of course, there are no guarantees of a return but learning from an expert greatly improves the odds, with the added attraction that profits are tax-free. Would-be traders can start with as little as £1000.For more information visit http://fintrader.net

Transcript of Vince Stanzione Making Money Spread Trading Daily Telegraph

-

* * *

* * * * * *

* * *

THE DAILY TELEGRAPHTUESDAY, APRIL 1, 2014 B4 |