Statutory Compliances 08.10.2012

Transcript of Statutory Compliances 08.10.2012

-

7/30/2019 Statutory Compliances 08.10.2012

1/27

HR Department, Western Region

Statutory Compliances

-

7/30/2019 Statutory Compliances 08.10.2012

2/27

Statutory Compliances For HR

Contract Labour (R&A) Act

Employees State Insurance Act

Employees Provident Fund & MP Act

Payment of Gratuity Act

The Payment Of Wages Act

The Minimum Wages Act

The Maternity Benefit Act

The Payment Of Bonus ActWorkmens Compensation Act

Factories Act, 1948

Shops & Establishments Act

Gaurav Kapil, HR Department, Western Region

-

7/30/2019 Statutory Compliances 08.10.2012

3/27

A Few Definitions

Who is Contractor: Person who undertakes to produce a

given result for the establishment, other than mere supply

of goods or articles of manufacture through contract

labourers directly or through sub-contractor, for any workof establishment.

Why we need Contract Labourer: There are several

fields of employment where it is not otherwise possible tohave continuous employment as such, except the

necessities of the situation, the Act has provided for

continuation & thereby regulation of contract labour.

-

7/30/2019 Statutory Compliances 08.10.2012

4/27

Contract Labour (R&A) Act, 1970

Objective is to regulate the employment of contract labour in certainestablishments

Applicability

To establishment employing 20 or more workmen as contract labour

To contractor employing twenty or more workmen

Registration of Establishments & Licensing of Contractors

The establishments covered under the Act are required to be registered asprincipal employers with the appropriate authorities

Every contractor is required to obtain a licence and not to undertake orexecute any work through contract labour except under and in accordancewith the licence issued in that behalf

-

7/30/2019 Statutory Compliances 08.10.2012

5/27

Contract Labour (R&A) Act, 1970

Welfare & health of the contract labourers

Establishment Canteens, rest rooms and arrangements for sufficient supply ofwholesome drinking water, latrines and urinals, washing facilities and firstaid facilities (made obligatory)

In cases of failure on the part of the contractor to provide these facilities, thePrincipal Employer is liable to provide the same.

Section 10

(a) The work is perennial and must go on from day to day;

(b) The work is incidental to and necessary for the work of the factory; (c) The work is sufficient to employ considerable number of whole time

workmen; and

(d) The work is being done in most concerns through regular workmen.

-

7/30/2019 Statutory Compliances 08.10.2012

6/27

DOs Donts

Timely payment of wages (by 7 day offollowing month).

Issue any character/experience certificateto any contract labour.

Witness of payment by your

authorised/nominated officer andendorsement/certificate on wage sheet

Allow to use your address in his

correspondence. At the most he maywrite/show as client address.

Payment of Minimum Wages or the ratesfixed by agreement /settlement / award.

Increase number of labours / induct newlabours without justification and approvalof state/regional head.

Obtain copy of Attendance & Wage sheetof each month duly signed by theContractor or his Authorised Manager withseal.

Issue any authorisation letter for any typeof job / entry into any other organizationas rep of IOCL /your location

That Photo identity card issued to thecontract labour must contain the

name, address and signature of thecontractor.

Make any direct payment to contractlabours and especially on imprest voucher.

Take authority letter from Contractornotifying name of his Manager/Representative who will be

supervising/making payment etc on hisBehalf.

-

7/30/2019 Statutory Compliances 08.10.2012

7/27

DOs Dont s

Obtain a copy of Income Tax details andTrade Licence.

Obtain copy of Police Verification report ofall Contract Labours.

Always mention Regn number of locationin all correspondence.

All above mentioned Record to be kept inOriginal for last 3 years.

Contractors are also required to displaymany Notices, so insist on Display.

Obtain copies of Challans of PF/ESI every

month from contractor.

-

7/30/2019 Statutory Compliances 08.10.2012

8/27

-

7/30/2019 Statutory Compliances 08.10.2012

9/27

Contract Labour (Regulation and Abolition) Act, 1970

-

7/30/2019 Statutory Compliances 08.10.2012

10/27

Contract Labour (Regulation and Abolition) Act, 1970

-

7/30/2019 Statutory Compliances 08.10.2012

11/27

Contract Labour (Regulation and Abolition) Act, 1970

-

7/30/2019 Statutory Compliances 08.10.2012

12/27

-

7/30/2019 Statutory Compliances 08.10.2012

13/27

Employees State Insurance Act, 1948

Was originally applicable to non-seasonal factories using power and employing 20 or more

persons; but it is now applicable to non-seasonal power using factories employing 10 or more

persons and non-power using factories employing 20 or more persons

All the employees in the factories or establishments (manufacturing process) to which the Act

applies shall be insured under this Act

The contribution comprise of employers contribution and employees contribution at a specified

rate

Contribution rate : 1.75% - employees

4.75% -employers

The ceiling 15,000/- gross salary. After reaching the ceiling one will be exempted.

Employer is liable to contribute & deduct specified rate of amount and submit it to the

Corporation within 21 days.Two contribution periods each of six months:

1st April to 30th Sept 1st Oct. to 31st March

Two corresponding benefit periods of six months :

1st January to 30th June 1st July to 31st December

-

7/30/2019 Statutory Compliances 08.10.2012

14/27

-

7/30/2019 Statutory Compliances 08.10.2012

15/27

Payment of Gratuity Act, 1972

Gratuity is an amount given to employees by employer when

they leave the job after completing five years or minimum 240

days per year or after retirement.

Gratuity is payable under the payment of wages act.

Gratuity shall be payable to an employee on the termination of

his employment after he has rendered continuous service for not

less than five years.

Gratuity is calculated as Basic + DA divided by 26 * No of years

of service *15

Display of Abstract (Form U)

To keep copies of Declaration Forms signed by employees and

employer

-

7/30/2019 Statutory Compliances 08.10.2012

16/27

The Payment of Wages Act 1936

It is a central legislation which applies to the persons employed in the factories

and to persons employed in industrial or other establishments

This Act does not apply on workers whose wages payable in respect of a wage

period average Rs. 1600/- a month or more.

This Act has been enacted with the intention of ensuring timely payment ofwages to the workers without unauthorized deductions.

The salary in factories/establishments employing less than 1000 workers is

required to be paid by 7th of every month and in other cases by 10th day of

every month.

A worker, who either has not been paid wages in time or an unauthorizeddeductions have been made from his/her wages, can file a Claim either directly

or through a Trade Union or through an Inspector under this Act.

-

7/30/2019 Statutory Compliances 08.10.2012

17/27

The Minimum Wages Act, 1948

This act provides for fixing minimum rates of wages.Wages shall mean all remuneration payable to an employed person on the fulfillment of the contract

employment and includes HRA.

It Includes

(i) a basic rate of wages and special allowance call the cost of living allowance

(ii) a basic rate with or without cost of living allowance plus any concession on the supply of

essential commodities.It excludes

(i) The value of rent free accommodation, supply of light, water, medical .....

(ii) Contributions paid by the employer towards the PF or any scheme of social insurance

(iii) Travelling allowance / Travelling concession

(iv) Gratuity

The appropriate government may fix-:A minimum rate of wages for time work ("a minimum time rate").

A minimum rates of wages for piece work ("a minimum piece rate").

A minimum rate of wages on a time work basis ("a guaranteed time rate")

A minimum rate of overtime work done (a overtime rate")

-

7/30/2019 Statutory Compliances 08.10.2012

18/27

The Maternity Benefit Act, 1961

To regulate employment of women for certain periods before and after childbirth and to provide for maternity benefit.

Payment of maternity benefit shall apply to women workers to whom ESI Act

does not apply.

The Act applies to all establishments in which ten or more people are

employed.

The maternity benefit shall be at the rate of average daily wage for the period

of actual absence. The maximum period of entitlement shall be 12 weeks of

which not less than 6 weeks shall precede the expected date of delivery.

Maternity benefit shall be payable to employee or any other persons as per the

nomination.

The Amount of benefit upto the period of expected delivery shall be paid in

advance. The balance due for the subsequent period shall be paid within 48

hours from delivery of child.

-

7/30/2019 Statutory Compliances 08.10.2012

19/27

The Payment of Bonus Act, 1965

The Payment of Bonus Act imposes statutory liability upon the employers of

every establishment covered under the Act to pay bonus to their employees.

It provides for payment of minimum and maximum bonus and linking the

payment of bonus with the production and productivity

The Act applies to every factory where 10 or more workers are working andevery other establishment in which 20 or more persons are employed, on any

day during an accounting year

Every employee receiving salary or wages upto Rs. 4,500 p.m. and engaged in

any kind of work whether skilled, unskilled, managerial, supervisory etc. is

entitled to bonus for every accounting year if he has worked for at least 30working days in that year

Contractor may pay bonus to his contract labourers

-

7/30/2019 Statutory Compliances 08.10.2012

20/27

-

7/30/2019 Statutory Compliances 08.10.2012

21/27

The Shops And Establishments Act

Registration of a shop or an establishment under the Act is

generally compulsory in all the States.

Registration should be applied for in the prescribed form

alongwith the prescribed fee to the Chief Inspector. In

case of new establishments, within 30 days from the date

on which the establishment commences the work, a

statement shall be sent to the Inspector concerned who on

receipt of the same shall register the establishment in such

manner.

-

7/30/2019 Statutory Compliances 08.10.2012

22/27

Provisions

Working Hours: Daily & Weekly

Working Spread including Break Period

Overtime Hours: Daily, Weekly & Quarterly

Weekly Off

Applicability of Gratuity

Provision for Leave Period

-

7/30/2019 Statutory Compliances 08.10.2012

23/27

Statutes

Bombay Shops and Establishments Act 1948

Maharashtra Shops and Establishment Rules, 1961

Goa, Daman and Diu Shops and Establishments Act, 1973

Gujarat Shops and Establishments (Insurance) Act, 1980

Madhya Pradesh Shops and Establishments Act, 1958

Chhattisgarh Shops and Establishments Act. 1958

-

7/30/2019 Statutory Compliances 08.10.2012

24/27

Registers

The Factories Act, 1948Employee Muster RoleAttendance RegisterTime cardRegister of accident and dangerous occurrencesRegister of adult workersBound Inspection Book

Register of overtime paymentsRegister of factories.Record of lime washing and paintingParticulars of rooms in the factory.Register of compensatory holidaysRegister of Leave with Wages

The Payment Of Wages Act, 1936

Consolidated Register of Fines, Deductions andAdvances.Register of wages

Equal Remuneration Act, 1976Details of workers in Form D

CL(R&A) ActRegister of contractorsBy Contractors

Register of persons employedMuster rollWage register or wage cum muster rollWage slip

Register of deductionsRegister of deductionsOvertime register

ESI Act, 1948Employees Register of Contributions.Accident RegisterInspection Book

EPF&MP ActContribution cardEligibility RegisterProvident Fund ledgerInspection Book

-

7/30/2019 Statutory Compliances 08.10.2012

25/27

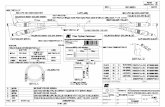

Datewise Name of the Statute Form/ Rule Return/ Compliance To be sent toJanuary 15th Factories Act, 1948 Refer to State

Rules

Annual Return Chief Inspector / Director

or Competent Authority

January 21st Maternity Benefit Act,

1961

LMNO (Rule 16

(1)

Annual Return & payment

details on 31st Dec

Competent Authority

under the Act.

January 30th

Contract Labour (R&A)Act, 1970 & Rules

XXIV [Rule 82(1)]

Half yearly Return bycontractor (in duplicate)

Concerned Licensingofficer (ALC in our case)

January 31st Employees State Insurance

Act, 1948 & Rules

01-A (ESI

Regulation 10C)

Annual information about

factory

Concerned ESI Regional

office

February 1st Payment of Wages Act,

1936

V (Rule 18) Annual Return Regional Labour

Commissioner

February 15th Contract Labour (R&A)

Act, 1970 & Rules

XXV [Rule 82 (2)]Annual Return by

Principal Employer

Concerned licensing

officer ( ALC in our case)

April 25th Employees Provident

Funds & MP Act, 1952

3A/6A Annual Return Concerned Regional

Officer

May 12th Employees State Insurance

Act, 1948 & Rules

6 (Sec 44,

Regulation 26)

Quadruplicate along with

challans. Monthly Return

along with cheque

Concerned ESI office

from scheduled bank

July 15th Factories Act, 1948 Refer to StateRules

Half yearly Return Chief Inspector / Directoror competent authority

July 30th Contract Labour (R&A)

Act, 1970 & Rules

XXIV Half-yearly Return by the

contractor

ALC ( C )

October 31st Contract Labour (R&A)

Act, 1970 & Rules

VII [Rule 29 (2)] Application by contractor

for renewal of license

ALC (C )

November 12th Employees State Insurance

Act, 1948 & Rules

6 (Sec 44 &

Regulation 25

Summary of contribution

in quadruplicate challans.

Concerned local office/

ESI Regional office

-

7/30/2019 Statutory Compliances 08.10.2012

26/27

Time limit Act Form/

Regulation

Name of Return /Compliance To be sent to

Within 10 days

from the date of

appointment

The Employees

State Insurance Act,

1948

1 & 3

(Regulation 11,12

&14)

Declaration Form & Return of

Declaration

ESI Regional

office

January 30 The Contract Labour(R&A) Act, 1970

XXIV Half Yearly Return- ByContractor

Assistant LabourCommissioner

February 15 The Contract Labour

(R&A) Act, 1970

XXV Annual Return-By Principal

Employer

Assistant Labour

Commissioner.

February 15 The Payment of

Wages Act, 1936

IV Annual Return Chief Inspector of

Factories

Before May 15th &

Before 11thNovember

The Employees

State Insurance Act,1948

6 Summary of contributions in

quadruplicate, half yearly inOctober to March and April to

September after the expiry of

contribution period. To be

submitted within 42 days

ESI RegionalOffice.

July 15 The Factories Act 35 Half Yearly Return Chief Inspector of

Factories

July 30 The Contract Labour(R&A) Act, 1970

XXIV Half Yearly Return:By Contractor

Registering &Licensing Officer

Before 11th

November

Insurance Act 6 Return of contributions in

quadruplicate from April to

September to be submitted within

42 days

ESI Regional

Office

-

7/30/2019 Statutory Compliances 08.10.2012

27/27

Thank You