Senior Trust Retirement Village Listed Fund · Units Units in Senior Trust Retirement Village...

-

Upload

trinhkhanh -

Category

Documents

-

view

217 -

download

0

Transcript of Senior Trust Retirement Village Listed Fund · Units Units in Senior Trust Retirement Village...

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

Their retirement.Your future.

GlossaryAuditor Auditor of Senior Trust Retirement Village Listed Fund being William Buck Christmas Gouwland Board Board of Directors of the ManagerDirectors Directors of the Manager Listed Fund Senior Trust Retirement Village Listed FundManager Senior Trust Management LimitedScheme Senior Trust Retirement Village Listed FundSTRVLF Senior Trust Retirement Village Listed FundUnits Units in Senior Trust Retirement Village Listed Fund Year Financial period of 7 months ended 31 March 2016

Contents Pg. 1 Manager’s ReportPg. 11 Business directory Pg. 12 Independent Auditor’s ReportPg. 14 Financial Statements Pg. 33 Investor Information Pg. 34 Directors Statement Pg. 35 Corporate governance Pg. 37 Additional Unit Holders InformationPg. 40 Corporate Directory

This 2016 Annual Report is a concise summary of our activities and financial position.

All figures are expressed in New Zealand currency unless otherwise stated.

Revenues and expenses are recognised exclusive of Goods and Services Tax.

HighlightsDetailed below are some key highlights since the launch of the Listed Fund.

1

21 September 2015Prospectus for the Listed Fund registered

23 November 2015Guardian Trust replaced Foundation Corporate Trustee as trustee of both the Listed Fund and the Senior Trust Retirement Village Fund Portfolio E.

3 December 2015 Listed Fund was listed on the NZX Main Board.

23 December 2015 Listed Fund becomes co lender at Whitby Lakes Village.

29 February 2015 First mortgage advance made to partnership in ownership of Palm Grove Village

11 March 2016Scott Lester appointed Executive Director of the Manager

11 March 2016Senior Trust Management Ltd licensed under the Financial Markets Conduct Act 2013 as the manager of the Senior Trust Managed Investment Funds

11 April 2016Diana Lia appointed as Head of Compliance, Risk and Accounting

14 April 2016The Fund paid its first distribution at the targeted distribution rate of 6% per annum pre-tax.

12 May 2016First mortgage advance made to operators of Quail Ridge Country Club

Managers Report

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

2001VSL Finance (Waitakere Gardens) Limited

Issue: $7.75m secured notesPurpose: Fund construction at Vision Waitakere Gardens

Matured and Fully Repaid

Senior Retirement Village TrustIssue: $6.37m Portfolio B

Purpose: Multi village fundingMatured and Fully Repaid

Senior Trust Retirement Village FundIssue: $2.8m Portfolio C

Purpose: Whitby Lakes VillageMatured and Fully Repaid

Senior Trust Retirement Village FundIssue: $9.3m Portfolio D

Purpose: Multi village fundingMatured and Fully Repaid

VSL FinanceIssue: $8.45m secured notes

Purpose: Fund construction at Vision DannemoraMatured and Fully Repaid

Senior Retirement Village TrustIssue: $6.5m Portfolio A

Purpose: Multi village fundingMatured and Fully Repaid

Senior Trust Retirement Village FundIssue: $13.4m Portfolio E

Purpose: Multi village funding

2002

2008

2009

2010

2011

2014

2015Senior Trust Retirement Village

Listed Fund Issue: $45m

Purpose: Multi village mortgage funding

Senior Trust’s management team have been associated with funding retirement villages throughout New Zealand including the following retirement village related offers:

A T

rack

Rec

ord

of S

ucce

ss

2

3

In December 2016, Senior Trust Retirement Village Listed Fund (“Listed Fund”) was listed on the NZX Main Board. The Listed Fund is the 4th offering that Senior Trust Management Limited (“Manager”) has brought to the market.

The Senior Trust strategy has remained constant, and is based on the following key principles;

• Soundly-run, well located Retirement Villages and Aged Care Facilities provide the opportunity for investment that generates a regular return backed by solid assets.

• There are significant prospects for lending to retirement and aged care operators that provide a ‘continuum of care’ for residents, which allow residents to remain in the same village as they age and their needs change over time.

• Experienced and skilled retirement and aged care operators who hold a substantial stake in their Retirement Village or Aged Care Facility, in our experience, provide the best prospects for both income returns and capital gains to provide improved security.

The Senior Trust strategy is underpinned by;

• Strong growth in the sector provides for investment on favourable terms.

• Owner/operators bring a personal touch to the facility which many prospective residents find appealing and provides a marketing edge.

• Privately-held Retirement Villages can be more responsive to local demand and resident need.

Ultimately the decision to lend is driven by whether the loan will:

• Over the investment timeframe, support the achievement of our targeted return to Unitholders.

• Allow for sustainable growth without over-extending financial and human resources.

• Maintain a risk profile which is acceptable to our directors. Risk categories which are assessed include liquidity and cash flow risk, management and operational risk and security risk.

Senior Trust Management LimitedSenior Trust Management Limited (“Manager”) is the Fund’s manager. The Manager is licenced in accordance with the Financial Markets Conduct Act 2013 to manage the Listed Fund and the Senior Trust Retirement Village Fund.

On 1 August 2015, long-standing directors John Jackson and Tracy Goodin resigned and a new board consisting of, Clive Jimmieson, Scott Lester and Joseph Van Wijk were appointed. The restructure reflected a determination to embrace the new regulatory environment and to prepare for the intended NZX Main Board listing.

Messer’s Goodin and Jackson retained their directorships of Senior Trust Capital Limited. The Manager has appointed Senior Trust Capital to source lending opportunities for the Fund, and provide marketing and promotional services to the Fund under the terms of a management services agreement. Included amongst the lending opportunities is the Palm Grove village partnership in which a whole owned subsidiary of Senior Trust Capital limited –STC Orewa Limited has an 80% partnership interest.

In March 2016, Senior Trust Management Ltd was licensed under the Financial Markets Conduct Act 2013 as the manager of the Senior Trust Managed Investment Funds. We have embraced the new regulatory regime as major step forward in building investor confidence in the investment market. As part of our emphasis on investor care, Staples Rodway was engaged to undertake an Operational and Compliance Risk Framework Review. The report concluded that “we consider that the Company has a generally robust and comprehensive Framework and Plan”. As a Manager, our commitment is to continually develop the compliance framework, as we see this as an important part of our obligation to protect our investor’s funds and achieve the high standards of governance required to meet the obligations required of a manager of a licensed Managed Investment Scheme.

The Senior Trust strategy

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

6

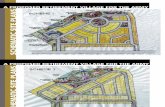

THE SENIOR TRUST MANAGEMENT TEAM HAS BEENINVOLVED IN INVESTING IN RETIREMENT VILLAGES

THROUGHOUT NEW ZEALAND

Vision Bay of Islands

Frimley

Whitby Lakes Village

McKenzie HealthCare

Aspring Lifestyle

Vision Forest Lake

Ranfurly VillageDevertonBelmont

Vision WaitakereVision Dannemora

Mt Eden GardensPalm Grove

Pacifi c CoastVision PapamoaBethlehem ShoresFreedom Village

The Senior Trust management team has been involved in investing in retirement villages throughout New Zealand

Ranfurly VillageDevertonBelmont

Vision WaitakereVision Dannemora

Mt Eden GardensPalm Grove

Vision Bay of Islands

Whitby Lakes Village

McKenzie HealthCareAspiring Lifestyle

Quail Ridge Country Club

4

Frimley

Pacific CoastVision PapamoaBethlehem ShoresFreedom Village

Vision Forest Lake

The Fund invests by way of making secured loans to operators of Retirement Villages and Aged Care Facilities. The loans will generally be made to privately owned Retirement Villages and Aged Care Facilities which are seeking to refinance, expand existing operations or embark on the development of new facilities.

The Fund is restricted to lending to a maximum, continuous loan to value ratio (LVR) of 60% of the assessed value of the security, with the assessment based on a mortgage valuation by an independent registered valuer (approved by the Manager) who assesses the market value of the assets as security for the loan.

The Current lending Portfolio During the course of the year, the Listed Fund extended mortgage backed loan facilities to Whitby Lakes Village, Palm Grove Village and Quail Ridge Country Club.

The Manager has continued a long association with Whitby Lakes Village. Members of the management team first became involved with the village in 2009 and the relationship has been a mutually beneficially throughout. The Listed Fund co-lends to Whitby Lakes Village by way of a first mortgage facility agreement, supported by the personal guarantees and corporate guarantees of various Whitby Lakes investing entities.

Whitby Lakes first opened in 2002 and is a mature retirement village with an ever-increasing number of resales to support the sales of new apartments currently being constructed. Whitby Lakes Village is due for completion in 2018 and at that point will consist of 132 dwellings being a mix of 65 apartments, 67 villas and community facilities all of which are built to a high standard.

Palm Grove Village is another well located retirement village with which the management team have had a long association dating back to 2010. Palm Grove Village is in the increasingly popular beach side suburb of Orewa which is becoming a preferred destination for Auckland retirees.

Lending objectives and policies

Senior Trust Capital has through 100% owned subsidiary acquired a substantial interest in Palm Grove and is proceeding to evolve significant development plans which will see the village grow from its current 14 dwellings to circa 72 villas and apartments.

The Listed Fund is secured by way of a first mortgage over the various residential titles that have been acquired during the course of formulating development plans. The expansion will be centred on capturing the top end of the Auckland retiree market to maximise the potential offered by this premiere location.

Quail Ridge Country Club first came to the attention of the management team in 2011. Quail Ridge has progressed to a stage where the village now meets the Listed Funds criteria for a first mortgage lending facility to fund the next stages of construction. Quail Ridge Country Club is attracting a strong interest for both local residents and also purchasers from Auckland and other areas. The village benefits from an attractive setting and has been positioned to achieve premium sales value which is endorsed by sale agreements signed at the date of this report.

Further Prospects Negotiations are underway with a number of other retirement village operators. The directors of the Manager are confident that there is strong demand for the portfolios lending product which will continue to support the Listed Funds targeted distribution rate of 6% pa (pre-tax) whilst adhering to the investment principles that have evolved over decades of lending experience in the sector.

The objective for next year is to continue to identify lending opportunities which adhere to our Statement of Investment Policies and Objectives and receive director approval post a rigorous due diligence process.

5

SENIOR TRUST RETIREMENT VILLAGE LISTED FUNDThe Founding shareholder John Jackson and the Board of Directors celebrate the listing of the Fund.

Mee

t the

Tea

m

Scott LesterExecutive Director

Directors

Joseph van WijkIndependent Director

Clive JimmiesonIndependent Director

John JacksonInvestment

Diana LaiCompliance

Tracey GoodinAsset management

Richard WaddelRegistry

Management Team

NZX

wel

com

es...

6

In 2014 the Manager completed a survey of its investors which revealed that 70% of investors were over the age of 70, and 75% of the total number of investors had been involved in investing in the retirement village and aged care sector since we first issued units in a portfolio.

The results of this survey indicated that, estate planning is likely to be an area of importance for investors in our funds. The importance of estate planning is reinforced by the growing trend of inter-generational investment by families which is reflected in there being an increasing number of children, and in some instances grandchildren, investing in the Listed Fund.

Meeting the needs of investors is at the forefront of our objectives. Delivering on this commitment includes facilitating the transfer or sale of units in the Listed Fund.

Meeting the needs of investors is at the forefront of our objectives. Delivering on this commitment includes facilitating the transfer or sale of units.

The Manager considered that it was desirable for the fund to be listed and for the units to be quoted on the NZX Main Board.

In our view, the key advantages of a listing are as follows:

• a regulated orderly and efficient market mechanism for the sale or transfer of units;

• continuous disclosure of material information regarding the Listed Fund and robust governance to the benefit of all stakeholders;

• the liquidity associated with a listing would allow a longer period of investment in loans to retirement and aged care operators; and

• Potential growth in the value of the units as the market reacts to the income returns secured against growing retirement village assets.

The listing on the NZX main board has proved to be of significant benefit to the unit holders. Since listing on 3 December 2015, a number of trades have been facilitated through the exchange on behalf of unit holders who have had a change of circumstance.

Investor care

Considerable time and effort has been expended in developing our ability to communicate with unit holders and prospective investors. The website has undergone significant upgrade and now has the ability to allow prospective unit holders the capacity to apply online for units in the Listed Fund.

We have maintained a policy of sending out regular newsletters and even more frequent electronic mail items to keep unit holders and others well informed as to our activities. This combined with the regular updating of the website and the use of the internet for posting statutory information means that unit holders have excellent resources to keep up to date with the Listed Funds’ activities

The granting of the Managed Investment Scheme licence to the Manager has been accompanied by a major strengthening of the Managers compliance and governance regime.

We are proud of the fact that we have achieved the standards required and it reinforces our long-held approach of fully embracing the new regulatory regime and be an early mover to comply with the requirements of the Financial Markets Conduct Act.

We are heartened by the increasing confidence that investors have in the regulatory regime and believe that the resources and time expended to achieve full compliance will be rewarded by an ability to meet the ever increasing demand for funds to keep up with the pace of expansion within the retirement village sector.

The relationship with the exchange – the NZX – has been beneficial in terms of meeting both our unit holders’ needs and raising our awareness as to best governance practise. Achieving licensing was a challenging but positive process which has assisted in the enhancement of our compliance and operational processes and procedures.

7

SENIOR TRUST RETIREMENT VILLAGE LISTED FUNDIn 2010 the first of the post war baby boomers turned 70, marking the start of a surge in New Zealand’s senior population.

The potential demand equates to 11.4 new villages of a scale similar to Whitby Lakes per year.

Population growth by age group

NZ 2013 2043 Increase % Increase

65+ 626,000 1,341,000 715,000 114%

75+ 266,190 778,990 512,800 193%

Total 4,442,100 5,639,000 1,196,900 27%

2000 2010 2020 2030

1.1 mil1 mil900800700600500400300200100

0

Mill

ions

(M)

Population projected for people aged 65+

8

The Fund operates exclusively within the retirement village sector and intends to capitalise on the booming demand for quality senior housing in New Zealand. Jones Lang LaSalle in its ‘New Zealand Retirement Village Database Whitepaper’ (December 2015) stated that the potential demand for retirement village units between the period 2018 to 2043 equates to 11.4 villages per annum.

The Manager believes that, to meet this target, privately owned village operators, will need to continue to deliver approximately 50% of the development pipeline. The Fund is focused on supporting experienced, skilled independent operators with proven capability with the funding they require to meet the growth in the retirement village sector.

2016 sees the first of the post war baby boomers turn 70 and we believe this will be a significant turning point as the demand in the retirement village sector for additional capital accelerates.

The demand in the aged care segment of the retirement village sector is even more dramatic. Deustche Bank has produced significant projections as to the pending shortfall in aged care facilities. This will create additional demand for funds. All three of the villages we are currently lending to have underway or are contemplating aged care facilities and we will actively seek involvement subject to appropriate due diligence.

The Listed Fund maximum number of Units which may be issued is 45,000,000 Units. At the current Issue Price of $1 this equals $45m. No oversubscriptions will be accepted.

We will be uncompromising in maintaining our current investment criteria. We believe there is an adequate level of well-located soundly run retirement villages and aged care centres to support the potential of the Listed Fund.

The maintenance of the targeted 6% pa (pre-tax) income distribution rate, whilst not guaranteed, is of paramount importance to the Manager and all loans written will be set with the distribution rate firmly in mind. Loans are structured with the opportunity, if appropriate, to raise the return in the future should there be a reversal of the current trends towards lower interest rates.

Future Directions

The relationship with Link Management Services is working well and we have commenced discussions with Link to take over the registry services for our unlisted Fund, the Senior Trust Retirement Village Fund. This is part of a process to continually upgrade our operating systems to ensure we deliver higher standards of service to our deeply valued unit holders.

Looking forward the Listed Fund has the requisite foundations to meet its commercial objectives which is to deliver the targeted distribution rate to our unitholders in accordance with the investment criteria set out in the Listed Funds Statement of Investment Policies and Objectives. The Directors are confident that our strategy of lending to carefully selected, well located and soundly run retirement villages, will enable us to meet our goals. Our proven approach of limiting lending to any one retirement village to a maximum of 60% of the valuation of the village as determined by an independent registered valuation will, we believe, continue to serve the best interests of our unitholders.

The Listed Fund continues to accept subscriptions and we invite interested parties to investigate thoroughly the Senior Trust Retirement Village Listed Fund offer document which is intended to disclose clearly concisely and effectively details about the Listed Fund including the risks associated with investing in the Listed Fund. A copy of the offer document can be obtained by contacting Senior Trust Management Limited at PH 0800 609 600 or by visiting our website www.seniortrust.co.nz.

9

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

10

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

Financials Statements for the year ending 31st March 2016

& Statutory Information

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

BUSINESS DIRECTORYAS AT 31 MARCH 2016

IRD Number: 117-982-076

Nature of Business: Investment

Directors (Manager): Joseph van Wijk

Scott Daniel Lester

Raymond Clive Jimmieson

Address: c/- Sargent & Franicevic, Level 10, Tower Centre, 45 Queen St, Auckland

Supervisor: The New Zealand Guardian Trust Company Limited

Manager: Senior Trust Management Limited

Bankers: Bank of New Zealand, Newmarket, Auckland

Auditors: William Buck Christmas Gouwland

Level 4, 21 Queen Street

Auckland 1010

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

11

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

Independent Auditor’s Report to the Unitholders of Senior Trust Retirement Village Listed Fund

Report on the Financial Statements

We have audited the financial statements of Senior Trust Retirement Village Listed Fund on pages 14 to 32, which comprise the Statement of Financial Position as at 31 March 2016, the Statement of Profit or Loss and Other Comprehensive Income, the Statement of Changes in Equity and the Statement of Cash Flows for the seven month period then ended, notes comprising a summary of significant accounting policies and other explanatory information.

Manager’s Responsibility for the Financial Statements

The Manager is responsible on behalf of the unit trust for the preparation of these financial statements that give a true and fair view of the matters to which they relate and in accordance with generally accepted accounting practice in New Zealand and New Zealand equivalents to International Financial Reporting Standards and for such internal control as the directors determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibilities

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with International Standards on Auditing (New Zealand). Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgement, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the company’s preparation of the financial statements that give a true and fair view of the matters to which they relate in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by the directors, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Other than in our capacity as auditor, we have no relationship with, or interests in, Senior Trust Retirement Village Listed Fund

12

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

Auditor’s Opinion

In our opinion, the financial statements on pages 14 to 32:

— comply with New Zealand equivalents to International Financial Reporting Standards; and

— give a true and fair view of the financial position of Senior Trust Retirement Village Listed Fund as at 31 March 2016 and its financial performance and cash flows for the seven month period then ended.

Restriction on Distribution or use of our report

This report is made solely to the Unitholders, as a body. Our audit work has been undertaken so that we might state to the Unitholders those matters which we are required to state to them in an auditor’s report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Trust’s Unitholders, as a body, for our audit work, for this report or for the opinions we have formed.

William Buck Christmas Gouwland

Auckland

27 June 2016

13

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOMEFOR THE 7 MONTHS ENDED 31 MARCH 2016

Note 7 Months to 31 March 2016 $Revenue Interest income 3 231,214Other income 3 5,750Total Revenue 236,964 Less Expenses Audit Fees 13,800Trustee Fees 19 20,027Legal Fees 19,422NZX Listing Fees 13,547Management Fees 16 57,927FMA Levy 2,000Bank charges 97Total expenses 126,820 Net profit before tax 110,144 Taxation 5 30,840 Net profit after tax attributable to unit holders 79,304Other comprehensive income after tax -Total comprehensive income after tax attributable to unit holders 79,304 Basic earnings per unit after tax 12 $ 0.014Diluted earnings per unit after tax 12 $ 0.014

This statement is to be read in conjunction with the notes to the Financial Statements.14

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

Note Mar 2016 $Current Assets Cash & Cash Equivalent 9 739,918Trade Debtors 18,944Link Market Services – funds held 14 327,782Loan - Senior Trust Management Limited 11 138,927 1,225,571

Non-Current Assets Deferred Tax Asset 7 3,864Loan - Senior Trust Management Limited 11 555,707Loan – Whitby 11 1,528,534Loan – Palm Grove Partnership 11 2,497,640 4,585,745 Total Assets 5,811,316 Current Liabilities Trade Creditors 73,642Accrued Audit Fees 13,800Accrued Listing Fees 13,547Accrued Distribution to Investors 4 72,569Un-allotted Subscriptions 13 70,000Income Tax Payable 6 30,073 273,631 Total Liabilities 273,631 Net Assets 5,537,685 Equity Units 12 5,530,950Retained Earnings 6,735Total Equity 5,537,685

For and on behalf of the Board:

Joseph van Wijk – Director

Scott Daniel Lester – Director

Raymond Clive Jimmieson - Director

STATEMENT OF FINANCIAL POSITION AS AT 31 MARCH 2016

This statement is to be read in conjunction with the notes to the Financial Statements.15

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

STATEMENT OF CHANGES IN EQUITY FOR THE 7 MONTHS ENDED 31 MARCH 2016

Mar 2016 Units Retained Earnings Total Equity Equity at beginning of September 2015 - -Total Comprehensive Income - 79,304 79,304Distributions unit holders 4 - (72,569) (72,569)Allotted Investor units 12 5,530,950 - 5,530,950Equity at the end of the period 5,530,950 6,735 5,537,685

This statement is to be read in conjunction with the notes to the Financial Statements.

16

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

STATEMENT OF CASH FLOWS FOR THE 7 MONTHS ENDED 31 MARCH 2016

Note 7 Months to 31 March 2016$

Cash flows from/(used in) operating activities Receipts from customers – STML recharges 5,750Interest Received from borrowers 212,269Payments to suppliers (25,830)Taxation paid (4,631)

Net cash generated from operating activities 17 187,558

Cash flows from/(used in) investing activities Loans advanced to Retirement Villages (4,026,174)Loans advanced to Manager (694,634)

Net cash used in investing activities (4,720,808)

Cash Flows from/(used in) financing activities Proceeds from units allotted 5,203,168Proceeds from units un-allotted 70,000

Net cash from financing activities 5,273,168

Net increase/(decrease) in cash and cash equivalents held 739,918Cash & cash equivalents at start of the year -

Cash & cash equivalents at the end of the year 9 739,918

This statement is to be read in conjunction with the notes to the Financial Statements.

17

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

1 Reporting Entity

The financial statements are for Senior Trust Retirement Village Listed Fund (the Fund).

The Fund is a unit trust established by deed dated 11 September 2015 between Corporate Trust Limited (Trustee) and Senior Trust Management Limited (Manager). On 23 November 2015, Corporate Trust Limited retired as Trustee and The New Zealand Guardian Trust Company Limited was appointed as the new Trustee. The Unit Trust has a maturity date of 11 March 2021.

The address of the registered office is c/- Sargent & Franicevic, Level 10, Tower Centre, 45 Queen Street, Auckland. The Fund’s principal business activity is to undertake authorised investments principally loans secured by mortgages of retirement villages, deposits with any registered bank or in any other debt security selected by the Manager and approved by the Trustee. The Fund is profit orientated.

The Fund is listed on the New Zealand Stock Exchange (NZX) and is a FMC reporting entity for the purpose of the Financial Markets Conduct Act 2013.

From 11 March 2016, the Manager was licensed under the Financial Markets Conduct Act 2013 to be the manager of the Senior Trust Retirement Village Listed Fund. Accordingly, the Fund transitioned to the Financial Markets Conduct Act 2013 on 11 March 2016. Any offers in the Fund made after that date are therefore being made under the Act.

The Units in the Fund will be issued in reliance on the exclusion for offers of the financial product of the same class as quoted financial products in Clause 19 of Schedule 1 of the Act. As a result of relying on that exclusion, the Manager is not required to issue a Product Disclosure Statement of the offer of Units in the Fund.

2 Significant accounting policies

The principal accounting policies applied in preparation of these financial statements are set out below.

2.1 Basis of Preparation

Statement of compliance

The financial statements have been prepared in accordance with the requirements of Part 7 of the Financial Markets Conduct Act 2013 and the NZX Main Board Listing Rules.

The financial statements of the Fund have been prepared in accordance with New Zealand Generally Accepted Accounting Practice (“NZ GAAP”). They comply with New Zealand equivalents to International Financial Reporting Standards (“NZ IFRS”), and other applicable Financial Reporting Standards, as appropriate for profit-oriented entities. These financial statements also comply with International Financial Reporting Standards (“IFRS”).

The financial statements presented have been prepared under the historical cost convention.

The financial statements are presented in New Zealand dollars, which is the Fund’s functional and presentational currency, unless otherwise stated.

The financial statements presented are for the period 19 September 2015 to 31 March 2016. There is no comparative period as the Fund commenced on 19 September 2015.

2.2 Statutory Base

These financial statements comply with the Financial Reporting Act 2013 and the Financial Markets Conduct Act 2013

The financial statements were authorised for issue by the Manager of the Fund on 27 June 2016.

NOTES TO THE FINANCIAL STATEMENTSFOR THE 7 MONTHS ENDED 31 MARCH 2016

18

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

2.3 Adoption of new and revised Standards and Interpretations

The Fund adopted all mandatory new and amended standards and interpretations. None of the new and amended standards and interpretations had a material impact on the Fund’s assets and liabilities.

2.4 Revenue Recognition

Revenue is recognised and measured at the fair value of the consideration received or receivable to the extent it is probable that the economic benefits will flow to the Fund and the revenue can be reliably measured. The following specific recognition criteria must also be met before revenue is recognised.

Interest Income

Revenue is recognised as interest accrues using the effective interest method.

2.5 Finance Expenses

Finance expenses comprise interest expense on borrowings. Interest expense is recognised in profit or loss using the effective interest method.

2.6 Income tax

Income tax expense

Tax expenses for the year comprises current and deferred tax recognised in the Statement of Profit or Loss and Other Comprehensive Income.

Current tax is expected tax payable on the taxable income for the year, using the tax rates enacted or substantively enacted at balance date, and includes any adjustments to tax payable in respect of previous years.

Deferred tax is provided in full using the liability method, providing for temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and their tax bases. Deferred tax is not accounted for if it arises from the initial recognition of assets or liabilities in a transaction other than a business combination, that affects neither accounting nor taxable profit or loss, and differences relating to investments in subsidiaries to the extent that they will probably not reversed in the foreseeable future.

Other taxes

The Fund is not registered for Goods and Services Tax (GST) and consequently all components of the financial statements are stated inclusive of GST where appropriate.

NOTES TO THE FINANCIAL STATEMENTSFOR THE 7 MONTHS ENDED 31 MARCH 2016

19

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

2.7 Cash and cash equivalents

Cash and cash equivalents in the Statement of Financial Position comprise cash at bank and on hand and short-term deposits with an original maturity date of three months or less that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value.

For the purposes of the statement of cash flows, cash and cash equivalents consist of cash and cash equivalents as defined above.

2.8 Loans and Receivables

Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. Such assets are initially recognised at fair value plus directly attributable transaction costs and then subsequently carried at amortised cost using the effective interest method less impairment losses.

2.9 Capital

(a) Units are classified as equity. External costs, net of tax, directly attributable to the issue of new units deduct from theproceeds of the issue.

(b) Distributions on units are recognised in equity in the period which they are approved by the manager.

2.10 Trade and other payables

Trade and other payables are carried at amortised cost and due to their short term nature they are not discounted. They represent liabilities for goods and services provided to the Fund prior to the end of the financial year that are unpaid and arise when the Fund becomes obliged to make future payment sin respect of the purchase of these goods and services. The amounts are unsecured and are usually paid within 30 days of recognition.

2.11 Accounting Estimates

The preparation of financial statements requires the use of management judgements, estimates and assumptions that affect reported amounts and the application of policies. In particular, significant management judgements and estimates have been exercised when reporting on the credit risks and quality of loans, the Fund’s forecast liquidity and the Fund’s ability to continue operating as a going concern. The estimates and associated assumptions are based on the historical experiences of the Manager and various other factors that are believed to be reasonable. However, as with most account balances, their value is subject to variation with market fluctuations.

Major estimates relates to impairment (refer to 2.13).

2.12 New Accounting Standards and interpretations issued but not yet adopted.

At the date of authorisation of these Financial Statements, certain new standards, amendments and interpretations to existing standards have been issued which were not yet effective at Balance Sheet date, and which the Fund has not early adopted. The Fund has assessed the relevance of all such new standards, interpretations and amendments and has determined that there would be no material impacts to the amounts recognised or disclosed in the financial statements. These include NZ IFRS 15 – Revenue from Contracts with Customers, NZ IFRS 16 – Leases, and NZ IFRS 9 – Financial Instruments.

NOTES TO THE FINANCIAL STATEMENTSFOR THE 7 MONTHS ENDED 31 MARCH 2016

20

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

2.13 Impaired Financial Assets and Past Due Financial Assets

Impaired financial assets are those loans for which the Fund has evidence that it has incurred a loss, and will be unable to collect all principal and interest due according to the contractual terms of the loan.

Past due financial assets are any assets, which have not been operated by the counterparty within its key terms but are not considered to be impaired by the Fund.

A financial asset is assessed at each reporting date to determine whether there is any objective evidence that it is impaired. A financial asset is considered to be impaired if objective evidence indicated that one or more events have had a negative effect on the estimated future cash flows of that asset.

An impaired loss in respect of a financial asset measured at amortised cost is calculated as the difference between its carrying amount, and the present value of the estimated future cash flows discounted at the original effective interest rate.

Individually significant assets are tested for impairment on an individual basis. The remaining financial assets are assessed collectively in groups that share similar credit risk characteristics.

All impairment losses are recognised in the Statement of Comprehensive Income. An impairment loss is reversed if the reversal can be related objectively to an event occurring after the impairment loss was recognised. For financial assets measured at amortised cost the reversal is recognised in the Statement of Profit or Loss and Comprehensive Income.

2.14 Segment Reporting

The fund only operates as an investment fund portfolio and only in New Zealand. There are therefore no segment details to report. Refer to note 3 information about major customers.

3 Revenue

The reported revenue has been analysed into major service categories as follows:

7 months to 31 March 2016 $

Palm Grove Partnership Loan Interest 141,611 Whitby Loan Interest 44,907 Bank Interest 25,793 Interest – Manager 18,902 Miscellaneous Income 5,750 Total revenue 236,964

NOTES TO THE FINANCIAL STATEMENTSFOR THE 7 MONTHS ENDED 31 MARCH 2016

21

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

4 Distribution to Unit Holders

2016 $ Income payable to unit holders Fund Deposits 72,569 72,569

The Fund’s policy is to target a 6% distribution rate subject to maintaining the capital of the Fund.

The distributions were paid on 14 April 2016.

5 Taxation

Reconciliation of effective tax rate 2016 $ Profit/(Loss) before income tax 110,144 Prima facie tax at 28% 30,840

Plus/(less) tax effect of: Items not (taxable)/deductible 3,864

Current income tax (benefit)/expense 34,704 Reported income tax expense/(benefit) Current year 34,704 Origination and reversal of temporary differences (3,864)

Total reported income tax (benefit)/expense 30,840 The tax rate used in the above reconciliation is the corporate tax rate applicable at 31 March 2016 of 28% payable on

taxable profits in accordance with current New Zealand tax law.

6 Income Tax Payable 2016 $ Current year’s tax expense (note 5) 34,704 Tax account opening balance - Less Resident withholding tax deducted from interest received (4,631) Provisional tax paid - Income tax payable/(refund due) at balance date 30,073

NOTES TO THE FINANCIAL STATEMENTSFOR THE 7 MONTHS ENDED 31 MARCH 2016

22

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

7 Deferred Tax Asset

Deferred tax assets/(liabilities) are attributable to the following: 2016$

Temporary differences relating to: Accruals 3,864

8 Imputation credit balance

The amount of imputation credits available for the subsequent year are: 2016$

Balance at beginning of the period -Resident withholding tax deducted from interest received 4,631Balance at end of the period 4,631

9 Cash & cash equivalent2016

$Guardian Trust – Applications account 73,261Guardian Trust – Funding account 666,657Total cash on hand 739,918

Cash and cash equivalents are short term funds held with New Zealand registered international banks. The bank accounts are held by the Supervisor, Guardian Trust, on behalf of the Fund. Both accounts bear interest on 2.0% per annum.

10 Capital Management

The Fund’s policy is to target a 6% distribution rate subject to maintaining the capital of the Fund.

NOTES TO THE FINANCIAL STATEMENTSFOR THE 7 MONTHS ENDED 31 MARCH 2016

23

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

11 Loans Receivable

2016 Whitby Village (2009) Limited 1,528,534 Palm Grove Partnership 2,497,640 Senior Trust Management Limited - current 138,927 Senior Trust Management Limited - non current 555,707 4,720,808

Whitby Village (2009) Limited

The loan to Whitby (2009) Limited (Whitby) expires no later than 30 September 2018. The loan earns interest at a rate of 9.75% per annum.

The loan is jointly held by Senior Trust Retirement Village Listed Fund and Senior Trust Retirement Village Fund – Portfolio E, as Lenders.

Early repayment clauses:

(a) Subject to the terms of the Security Sharing and Priority Deed and the Lease, the Borrower shall procure that the Moneys Owed outstanding from time to time is reduced from 100% of the net proceeds (including deposits) of sale of occupation licences or lease in connection with the Property or the Development or the Lease received by Aegis Orewa Limited (subject to earlier repayment being required under the terms of the Agreement and without prejudice to the Lender’s rights under the Security Documents). Net proceeds refers to gross sale proceeds, less legal costs and market related real estate commissions as are unpaid if approved in writing by the Manager and any payment due to an existing resident under a contemporaneously terminating occupation license or lease.

(b) Subject to (a) above, the Borrower may not prepay the whole or any part of the loan prior to the expiry of the Prohibited Repayment Period, which is a period of 36 months from the date of the first drawdown under the Related Listed Fund Loan Agreement (i.e. 1 September 2018), unless otherwise approved in writing by the Lender.

(c) Subject to (b) above, the Borrower may prepare the whole or any part of the loan at any time in multiples of $1,000 on giving not less than 90 days’ prior written notice to the Manager with a copy of the Lender. If less than 90 days notice is given then Whitby shall pay to the Lender, in addition to interest on the sum prepaid to the date of that prepayment, a prepayment penalty equivalent to an amount of up to 90 days interest on the sum prepaid (as reasonably determined by the Lender to compensate the Lender for its costs on early repayment). Amounts prepaid may not be redrawn except with the consent of the Lender.

The loan securities are as follows:

• by first ranking mortgage over the village property

• second ranking general security agreement from Whitby Village (2009) Limited

• unlimited guarantee and indemnity from Whitby Lakes (2014) Limited and

• unlimited guarantee and indemnity from Twenty Twenty Property Partners Limited

• limited guarantee and indemnity from Graeme John Smith, Alexander Simpson Foster, and Philip Joseph Molloy.

The estimated collateral value of the security over the loans, joint with Senior Trust Retirement Village Fund – Portfolio E, is $24,144,193, which taken together represents a LVR of 56.28% as at 31 March 2016, and the credit quality estimated by the directors of the Manager is considered to be very good based on their current knowledge. No provision for impairment is considered necessary.

NOTES TO THE FINANCIAL STATEMENTSFOR THE 7 MONTHS ENDED 31 MARCH 2016

24

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

Palm Grove Partnership

The loan to Palm Grove Partnership is considered as related party transactions. STC Orewa Limited is a partner in the Palm Grove Partnership and is a wholly owned subsidiary of Senior Trust Capital Limited. Senior Trust Capital Limited is associated to Senior Trust Retirement Village Listed Fund as Senior Trust Capital Limited has common shareholders with its manager, Senior Trust Management Limited. The manager’s sole shareholders are John Jackson and Dadrew Trustees Limited, of which John Jackson, the Executive Director of Senior Trust Capital, is the sole shareholder.

The Fund has first mortgage security and Senior Trust Capital Limited has second mortgage security over the land on which the Palm Grove Retirement Village is situated in Orewa, which is subject to a first ranking encumbrance registered in favour of the statutory supervisor.

These loans are Permitted Related Party Transactions under Section 174 of the Financial Market Conduct Act 2013 as the loans provided to Palm Grove Partnership are on arm’s length terms. Palm Grove Partnership and Senior Trust Retirement Village Listed Fund are connected only by these loans and each party is acting in its own best interest.

The loan expires on 1 December 2019. The loan earns interest at a rate of 10.75% per annum.

Early repayment clauses:

(a) Subject to the terms of the Security Sharing and Priority Deed and the Lease, the Borrower shall procure that theMoneys Owed outstanding from time to time is reduced from 100% of the net proceeds (including deposits) of saleof occupation licences or lease in connection with the Property or the Development or the Lease received by AegisOrewa Limited (subject to earlier repayment being required under the terms of the Agreement and without prejudiceto the Lender’s rights under the Security Documents). Net proceeds refers to gross sale proceeds, less legal costs andmarket related real estate commissions as are unpaid if approved in writing by the Manager and any payment due toan existing resident under a contemporaneously terminating occupation license or lease.

(b) Subject to (a) above, the Borrower may not prepay the whole or any part of the loan prior to the expiry of the FixedInterest Period (i.e. 1 September 2017), unless otherwise approved in writing by the Lender.

(c) Subject to (b) above, the Borrower may prepare the whole or any part of the loan at any time in multiples of $1,000on giving not less than 90 days’ prior written notice to the Manager with a copy of the Lender. If less than 90days’ notice is given then Whitby shall pay to the Lender, in addition to interest on the sum prepaid to the date ofthat prepayment, a prepayment penalty equivalent to an amount of up to 90 days interest on the sum prepaid (asreasonably determined by the Lender to compensate the Lender for its costs on early repayment). Amounts prepaidmay not be redrawn except with the consent of the Lender.

The loan securities are as follows:

• first ranking mortgage over the property

• general security agreement from Palm Grove Partnership, STC Orewa Limited and Orewa Village Limited

• guarantee and indemnity from STC Orewa Limited and Orewa Village Limited

• limited guarantee and indemnity from AOL Holdings Limited

• specific agreement over shares from AOL Holdings Limited

The estimated collateral value of the security over the loans is $5,265,000, representing a LVR of 47.44% as at 31 March 2016, and the credit quality estimated by the directors of the Manager is considered to be very good based on their current knowledge. No provision for impairment is considered necessary.

NOTES TO THE FINANCIAL STATEMENTSFOR THE 7 MONTHS ENDED 31 MARCH 2016

25

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

Senior Trust Management Limited

The loan to Senior Trust Management Limited expires on 14 January 2021. The loan earns interest at a rate of 8% per annum.

The loan shall be repaid in 20 equal quarterly instalments being sufficient to fully repay the loan by no later than 14 January 2021. Accrued interest on the outstanding balance of the loan be payable on each quarterly repayment date. The first repayment date is 14 April 2016; thereafter payments are to be made every 3 months on 14th of the month until 14 January 2021 when any outstanding loan and interest shall be repaid in full. In the event that the maturity date or the termination date of the Senior Trust Retirement Village Listed Fund is earlier than 11 March 2021, Senior Trust Management Limited will make the necessary adjustments to each quarterly instalment amount such that the loan is repaid in equal quarterly instalments sufficient to ensure that the loan will be fully repaid on or before the maturity date.

The loan is secured by Senior Trust Management Limited assigning to Senior Trust Retirement Village Listed Fund by way of security all of its right, title and interest to all amounts payable to Senior Trust Management Limited as management fees pursuant to the Master Trust Deed or the Establishment Deed.

12 Units and earnings per unit

Issued units

Units are issued at the Issue Price. The Issue Price of a Unit is the Net Asset Value per Unit as at the relevant Valuation Date on which the Units are issued. All units have a common maturity date on 11 March 2021. On maturity, the Fund will be wound up and net assets will be distributed to Unit Holders. Units are not redeemable by the Holders.

2016 2016 Number Value $

Opening balance - - Units issued 5,530,950 5,530,950 Closing balance 5,530,950 5,530,950

Earnings per unit

Basic earnings per unit is calculated as profit after tax divided by the weighted number of issued units for the year.

Diluted earnings per unit is calculated as profit after tax divided by the weighted number of units plus any deferred units which are expected to be issued after balance date.

Weighted average units

Weighted average units used in calculating basic earnings per unit 5,530,950 Deferred units issued after balance date 70,000 Weighted average units used in calculating diluted earnings per unit 5,600,950

Cents per unit Basic Diluted 2016 2016

Earnings per unit after tax 1.4 1.4

NOTES TO THE FINANCIAL STATEMENTSFOR THE 7 MONTHS ENDED 31 MARCH 2016

26

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

13 Un-alloted Subscriptions 2016 $

Opening balance - Deposit received from investors 70,000 Closing balance 70,000

$70,000 deposits received from investors where subscriptions are yet to be finalised at reporting date. These were subsequently issued.

14 Link Market Services

2016 $

Funds held by Link Market Services 327,782

$327,782 was held in the Link Market Services, our registry provider, account to the fund on 31 March 2016. This is non-interest bearing and unsecured. The money was released to the Fund on 11 April 2016.

15 Contingent Liabilities and Capital Commitments

There are no material contingent liabilities or capital commitments at the reporting date.

16 Related Parties

The following tables provide details of all transactions that were entered into with related parties during the year.

Amounts due to Amounts due from related parties related parties As at 31 March 2016 $ $

Senior Trust Management Ltd

-Management Fees payable** 57,927 - -Loan Interest receivable - 18,902 -Loan Balance 694,634

Palm Grove Partnership

-Loan Interest receivable - - -Loan Balance - 2,497,640

Total Related Party Balances 57,927 3,211,176

**Management fees charged by Senior Trust Management Ltd are on a weekly basis and an amount equal to 3% per annum of the aggregate issue price of all units of issue.

NOTES TO THE FINANCIAL STATEMENTSFOR THE 7 MONTHS ENDED 31 MARCH 2016

27

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

7 months ended 31 March 2016 $

Senior Trust Management Ltd -Loan Interest received 18,902 -Miscellaneous Income received 5,750 Palm Grove Partnership -Loan Interest received 141,611 Total Related Party Income 166,263 Senior Trust Management Ltd -Management Fees paid 57,927 Total Related Party Expense 57,927

Key Management Personnel are the Directors of the Manager. There were no transactions with Key Management Personnel during the period. Key Management Personnel hold a total of 9,900 units in the Fund at the reporting date.

Senior Trust Capital Limited also holds a total of 50,000 units in the Fund, in which John Jackson is a director of Senior Trust Capital Limited and shareholder of the Senior Trust Management Limited (the Manager). These were fully redeemed on the 10th of June 2016.

17 Reconciliation of cash flows from operating activities Mar 2016 $

Total Comprehensive Income after Tax for the period 79,304 Changes in working capital - (Increase)/decrease in trade and other receivables (18,944) - Increase/(decrease) in income tax payable 30,073 - Increase/(decrease) in deferred tax asset (3,864) - Increase/(decrease) in trade and other payables 100,989

Cash generated from operations 187,558

18 Financial Instruments

The Fund’s principal financial instruments comprise loans and receivables, payables, and cash and short-term deposits where appropriate.

Loans and Liabilities at Receivables Amortised Cost

Note Mar 2016 Mar 2016 $ $

Cash & Cash Equivalent 9 739,918 Trade Debtors and other receivables 346,726 Loans receivable 4,720,808 Total Financial assets 5,807,452 Un-allocated Units 70,000 Trade Creditors and other payables 200,905 Total Financial Liabilities 270,905

NOTES TO THE FINANCIAL STATEMENTSFOR THE 7 MONTHS ENDED 31 MARCH 2016

28

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

The Fund’s measurement methods are detailed in the accounting policies. Given the nature of the Funds financial assets and liabilities, the carrying value of financial instruments approximates the fair value of those assets and liabilities.

The main risks arising from the Fund’s financial instruments are interest rate risk, credit risk and liquidity risk. The Manager uses different methods to measure and manage different types of risks to which it is exposed. Ageing analyses and monitoring of specific credit allowances are undertaken to manage credit risk, liquidity risk is monitored through the development of future rolling cash flow forecasts.

The Manager reviews and agrees policies for managing each of these risks as summarised below.

Primary responsibility for identification and control of financial risks rests with the Directors of the Manager. The Directors of the Manager review and agree policies for managing each of the risks identified below, credit allowances and future cash flow forecast projections.

Credit risk

Credit risk is the risk that the Fund will incur a loss because its customers failed to discharge their contractual obligations.

Financial instruments that subject the Fund to credit risk consist primarily of cash, loans and trade and other receivables.

The Manager performs credit evaluations on all borrowers requiring advances. The Manager requires collateral or other security to support loans and advances, as set out in the Fund’s prospectus. The directors of the Manager review all loans and any overdue loans are assessed on a regular basis.

In particular, the Manager takes the following steps to manage this risk:

• Focusing on lending to operators with a track record of proven performance and who have a material stake in the entity.

• Undertaking extensive due diligence including assessing credit risk and the nature of any prior ranking securities.

• Restricting the term of loans to the Maturity Date of the Fund where practicable, and ensuring any loans comply with the Fund’s lending criteria.

• Closely monitoring the performance of the entity and loan repayments.

• Refinancing the term of the loan, or enforcing our loan, if necessary. Refinancing a loan carries its own risks in that the possibility of future default increases.

• LVR restriction.

As required by the Trust Deed, all cash and cash equivalents are held with a New Zealand registered bank.

Maximum Exposure to Credit Risk

The table below shows the maximum exposure to credit risk for the components of the statement of financial position.

Mar 2016 $

Cash on Hand 739,918 Loans Receivable 4,720,808 Trade and other receivables 346,726

5,807,452 There has been no provision for impairment on financial assets in the period.

NOTES TO THE FINANCIAL STATEMENTSFOR THE 7 MONTHS ENDED 31 MARCH 2016

29

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

Credit Quality per Class of Financial AssetsThe credit quality of financial assets is assessed by the Directors of the Manager. The table below shows the credit quality by class of financial asset.

Exposures to credit risk are graded by an internal risk grade mechanism. High grade represents the strongest credit risk where a potential loss is least likely.

Substandard grade represents the weakest credit risk where a potential loss is most likely. Standard grade represents the mid range credit risk where the directors believe a potential loss is unlikely. Past due loans are those that are past the due date for repayment. Individually impaired loans are those where some potential loss is likely.

High Grade Standard gradeMar 2016 Mar 2016

$ $Cash on hand 739,918 -Other receivables - 327,782Trade Debtors - 18,944

Loans - 4,720,808739,918 5,067,534

Collateral and Other Credit EnhancementsThe amount and type of collateral required depends on an assessment of the credit risk of the counterparty. Guidelines are implemented regarding the acceptability of types of collateral and valuation parameters.

The main type of collateral obtained is charges over real estate properties.

Management monitors the market value of collateral, request additional collateral in accordance with the underlying agreement, and monitors the market value of collateral obtained during its review of the adequacy of the allowance for impairment losses. An independent valuation sought by a registered valuer prior to entering into the loan and then on an annual basis thereafter.

Value of loansMar 2016

$ Mortgages 4,720,808 Guarantees -

Less: Subordinated Priority -4,720,808

Risk concentrations of the Maximum Exposure to Credit RiskConcentrations of credit risk exist if a number of counterparties are involved in similar activities and have similar economic characteristics that would cause their ability to meet contractual obligations to be similarly affected by changes in economic or other conditions.

The fund has concentration risk as its assets are concentrated in a small number of loans, in a specific sector of the retirement village and aged care industry.

The Manager manages, limits and controls concentrations of credit risk, in particular, to individual retirement village and geographic location by monitoring on an ongoing basis and subject to annual or more frequent review, when considered necessary. However the Directors do not allocate asset investment to specific geographic areas but focus on the demographic demand within the catchment area for each retirement village.

NOTES TO THE FINANCIAL STATEMENTSFOR THE 7 MONTHS ENDED 31 MARCH 2016

30

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

The table below shows the maximum exposure to credit risk for loans receivable by geographical region:

Mar 2016 $

Auckland 3,192,274 Rest of North Island 1,528,534 South Island -

4,720,808 85% of the Fund’s loans are to the retirement village industry or to the Fund’s Manager (15%).

Liquidity Risk

Liquidity risk is the risk that the Fund will encounter difficulty in raising funds to meet obligations from its financial liabilities.

The Fund’s intention is to maintain sufficient funds to meet its commitments based on historical and forecasted cash flow requirements. Management’s intention is to actively manage the lending and borrowing portfolios to ensure the net exposure to liquidity risk is minimised. The exposure is reviewed on an ongoing basis from daily procedures to monthly reporting as part of the Fund’s liquidity management process.

The tables below present undiscounted cash flows payable to the Fund for financial liabilities and unrecognised loan commitments based on contractual maturity (which is the same as expected maturity, refer to note 11 early repayment clauses).

Weighted Average As at 31 March 2016 Interest Rate On Demand 0-12 months 12-60 months 60+ months Total Financial assets % $ $ $ $ $ Cash & cash Equivalents 2.00 739,918 - - - 739,918 Trade debtors - 18,944 - - - 18,944 Other receivables - 327,782 - - - 327,782 Loans receivable 10.02 - 611,467 5,732,549 - 6,344,016

1,086,644 611,467 5,732,549 - 7,430,660 Financial Liabilities Un-allotted units - 70,000 - - - 70,000 Trade creditors and - 200,905 - - - 200,905 other payables 270,905 - - - 270,905

The figures in the above maturity table are gross figures for both assets and liabilities. They include all interest receivable on loans and advances through to maturity and all interest payable on fund deposits through to maturity.

NOTES TO THE FINANCIAL STATEMENTSFOR THE 7 MONTHS ENDED 31 MARCH 2016

31

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

Interest Rate RiskInterest rate risk is the risk that the fair values on future cash flows of an instrument will fluctuate due to changes in the market interest rates.

The Fund is not exposed to interest rate risk in respect of Fund Deposits or Loans to borrowers because they are for fixed terms and are at fixed interest rates.

The only financial instruments that expose the Fund to interest rate risk are cash and cash equivalents. Any change in the bank interest rate would appear to be minimal in the current market and would have no marked effect on profit or equity.

Priority of Creditors Claims in the Event of the Company liquidating or Ceasing to Trade

The Fund has not granted any person any security interest in any of its property so there would be no priority of creditors’ claims in the event of the Fund liquidating or ceasing to trade. All creditors would rank equally.

Fair Values

The estimated fair values of the Fund’s financial assets and liabilities are considered to be materially the same as their carrying amounts as disclosed in the Balance Sheet.

19 Trustee’s FeesThe Trustee’s remuneration for carrying out the Trustee’s functions in relation to the Fund is an annual fee agreed from time to time between the Manager and the Trustee. Until agreed otherwise, the Trustee’s fee is $15,000 per annum. The Trustee’s fee accrues from day to day and is payable by the Trustee out of the assets of the Fund quarterly within 14 days of each Distribution Date. In addition, the Trustee is entitled to charge special fees for services of an unusual or onerous nature outside the Trustee’s regular services. There is no limit to the amount of special fees that may be charged.

In regards to Special Fees, from 11 March 2016, the Manager was licensed under the Financial Markets Conduct Act 2013 (FMCA) to be the manager of the Senior Trust Retirement Village Listed Fund (Fund). Accordingly, the Fund transitioned to the FMCA on 11 March 2016. The Fund incurred $4,313 in respect to Trustee’s attendance in relation to the transition to the FMCA. The Fund also incurred $7,090 in respect to the Trustee’s attendance in relation to the review and documentation of the loan to Palm Grove Partnership.

7 months ended 31 March 2016$

Annual fees paid 8,624Special fees paid 11,403

Total 20,027

The Trustee’s annual fee cannot be increased unless agreed with the Manager and provided the Trustee gives 3 months’ notice of the increase to all Unit holders. There is no maximum amount for the Trustee’s fee.

20 Subsequent Events

The fund has provided a new loan to Quail Ridge Country Club Limited. The agreement is dated 18 May 2016 and agrees to make available to the borrower a loan facility up to $2,000,000.

NOTES TO THE FINANCIAL STATEMENTSFOR THE 7 MONTHS ENDED 31 MARCH 2016

32

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

DistributionsThe first Distribution Date was the 31 March 2016, with the first distribution being paid to Unitholders on the 14 April 2016. The Distribution Dates will be 31 March, 30 June, 30 September and 31 December in each year until the Maturity Date, with distributions being paid within 14 days of each Distribution Date.

Issue Price and Net Asset Value per UnitThe issue price per Units in the Senior Trust Retirement Village Listed Fund is currently $1.00. The net asset value per Unit as at 31 March 2016 was $1.00.

WaiversThe structure of the Fund differs from that of a listed company, the type of listed entity the NZX Main Board Listing Rules (Rules) are designed to regulate. The Fund is not similar to most other issuers listed on the NZX Main Board and the Units have features that make less relevant many of the concerns that drive the Rules, including those governing voting and control rights, management costs, potentially dilutionary issues and other so-called agency risks. These features include the greater level of supervision and regulation provided by the Trust Deed and the Supervisor, the limited circumstances in which the Units carry a right to vote and the maximum size of the Fund.

Accordingly, NZX has granted the Manager waivers from the following Rules: 3.1.1(a), 3.1.1(b), 3.3.3(a), 3.3.5 to 3.3.15, 3.4 to 3.6, section 4, 7.3, 7.4, 7.5, 7.6.1 and 7.6.2, 9.2, 10.3.2, 10.4.1(b), 10.4.2 and 10.6.1(a). These waivers reflect the factors outlined above, the fact that Fund is undertaking an ongoing offer of Units as described in the registered prospectus dated 11 September 2015 (as amended on 27 November 2015 and 10 March 2016) and the nature of the business undertaken by the Fund. These waivers mean that the Fund operates in accordance with the requirements of the Trust Deed and as described in the registered prospectus and other offering documents instead of having to comply with these Rules.

From 11 March 2016, the Manager was licensed under the Financial Markets Conduct Act 2013 (FMCA) to be the manager of the Senior Trust Retirement Village Listed Fund. Accordingly, the Fund transitioned to the FMCA on 11 March 2016. Any offers in the Fund made after that date are therefore being made under the FMCA. The Units in the Fund will be issued in reliance on the exclusion for offers of financial products of the same class as quoted financial products in Clause 19 of Schedule 1 of the FMCA. As a result of relying on that exclusion, the Manager is not required to issue a Product Disclosure Statement for the offer of Units in the Fund.

NZX granted a waiver from the spread requirement under Rule 5.2.3 for a period of six months from the commencement of the Fund, so that the Fund could be quoted so long as the Units were held by at least 150 members of the public holding at least 25% of the securities issued, with each member of the public holding at least a minimum holding, rather than the 500 members of the public that would ordinarily be required. In June 2016, the NZX granted SRF a further waiver from NZX Main Board Listing Rule 5.2.3 in respect of the Units, for a further period of six months, so long as the Units were held by at least 300 Members of the Public, with each Member of the Public holding at least a Minimum Holding, rather than the 500 members of the public that would ordinarily be required. This means there may be a reduced number of buyers of Units on the NZX Main Board. The waiver is also granted on other conditions which require, among other things, the Fund to regularly report to NZX on its spread and that the nature of SRF’s business and operations do not materially change from those described in the Offer Documents.

NZX has granted approval under Rule 11.1.5 for the inclusion in the Trust Deed of provisions that restrict the issue, acquisition or transfer of Units to allow the Fund to comply with the PIE regime. As a consequence of these waivers and this approval the Fund will bear a ‘non-standard’ designation on the NZX Main Board. A copy of NZX’s decision, including the conditions of the waivers granted, can be obtained from www.nzx.com.

INVESTOR INFORMATIONSENIOR TRUST RETIREMENT VILLAGE LISTED FUND (NZX: SRF)

33

Share RegistrarLink Market Services Limited Level 11, Deloitte Centre 80 Queen StreetAuckland 1010 New ZealandEmail: [email protected]: www.linkmarketservices.co.nz

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

The directors’ of the Manager present the financial statements for Senior Trust Retirement Village Listed Fund (“STRVLF”) for the period ended 31 March 2016.

We have ensured that the financial statements for STRVLF give a true and fair view of the financial position of the STRVLF as at 31 March 2016 and its Comprehensive Income and cash flows for the period ended on that date.

We have ensured that the accounting policies used by the Company comply with generally accepted accounting practice in New Zealand and believe that proper accounting records have been kept. We have ensured compliance of the financial statements with the Financial Reporting Act 2013.

We also consider that adequate controls are in place to safeguard the Company’s assets and to prevent and detect fraud and other irregularities.

The directors of the Manger authorised these financial statements for issue on 27 June 2016.

Director DirectorJoseph van Wijk Scott Lester

Directors’ Statement For the period ended 31 March 2016

34

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

35

The Directors of the Manager recognize the need for strong corporate governance practices. The Board of the Manager are committed to ensuring that the company delivers it objectives in accordance with best practice governance principles and maintains the highest ethical standards. On a regular basis, the Board of the Manager reviews and assesses the governance structures to ensure that it is fit for purpose, does not materially differ from the NZX Corporate Governance Best Practice Code and encourages the creation of value for the Unit Holders whilst ensuring the highest standards of ethical conduct and providing accountability and control systems commensurate with the risks involved.

ROLE AND COMPOSITION OF THE BOARDThe Manager retains a Board of Directors which aims to ensure that Unit Holders’ interests are held paramount.

The Directors of the Manager are responsible for the direction and control of the Fund and is accountable to Unit Holders and others for performance and compliance with the appropriate laws and standards.

A key responsibility of the Directors of the Manager is to monitor the performance of management on an ongoing basis.

The Listing Rules of the New Zealand Exchange requires a minimum of three Directors with at least two of Directors ordinarily resident in New Zealand and with a minimum of two Independent Directors.

There are currently three Directors of the Manager and the Board considers that two Directors are independent in terms of the New Zealand Exchange requirements.

INDEPENDENT DIRECTORS• Raymond Clive Jimmieson

• Joseph van Wijk

EXECUTIVE DIRECTOR• Scott Lester

The Directors of the Manager met regularly during the year and received papers to read and consider before each meeting. The Directors of the Manager are provided at all times with accurate timely information on all aspects of the Fund’s operations. The Directors of the Manager are kept informed of key risks to the Fund on a continuing basis. In addition, the Directors of the Manager meet whenever necessary to deal with specific matters needing attention between the scheduled meetings.

The Directors of the Manager annually review the performance of the Board as a whole and each Director.

BOARD COMMITTEES The Fund has been granted a waiver from Listing Rule 3.6 for the establishment of an Audit Committee. However, all of the Directors of the Manager are responsible for governance which includes a focus on audit and risk management and specifically addresses responsibilities relative to financial reporting and regulatory conformance. The Board of the Manager is accountable for ensuring the performance and independence of the external auditors.

Due to the importance of Nomination and Remuneration matters, these are addressed by the Board of the Manager as a whole and consequently there is no separate Nomination or Remuneration Committee of the Manager.

Corporate Governance

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

RISK MANAGEMENT AND INTERNAL CONTROLThe Board of the Manager has overall responsibility for the Fund’s system of risk management and internal control. The Board of the Manager has in place policies and procedures to identify areas of significant business risk and implement procedures to manage effectively those risks. Key risk management tools used by the Board of the Manager include outsourcing of certain functions to experts, internal controls, financial and compliance reporting procedures and processes, business continuity planning and insurance.

ETHICAL CONDUCTThe Board of the Manager has adopted a policy of business ethical conduct that is designed to formalize its commitment to the highest standards of ethical conduct and to provide all Directors of the Manager and representatives with clear guidance on those standards. These are governed by the Conflicts of Interests and Related Party Transactions Policy.

The Conflicts of Interests and Related Party Transactions Policy details the ethical and professional behavioural standards required of the Directors of the Manager and all employees. The policy also provides the means of proactively addressing and resolving potential ethical issues and details the process to be adopted for identifying conflicts of interest and the actions that should be taken.

The Conflicts of Interests and Related Party Transactions Policy details the procedure whereby the Directors and employees of the Manager may trade in the Fund’s Units. Directors and employees of the Manager may not trade in the Fund’s Units when they have price sensitive information that is not publicly available.

The Manager maintains an interest’s register in which the particulars of certain transactions and matters involving Directors of the Manager must be recorded.

UNITHOLDER RELATIONSThe Board of the Manager recognises the importance of providing comprehensive and timely information to Unit holders. Information is communicated to Unit holders in the Annual Report.

36

SENIOR TRUST RETIREMENT VILLAGE LISTED FUND

37

Stock Exchange Listing

STRVLF Units are listed on NZSX under the code SRF.

Registry

Link Market Services Limited is STRVLF’s security register manager and holds all unit holder records electronically. Link Market Services is also responsible for the maintenance of unit holder records, STRVLF’s call centre and the preparation of distribution payments. Contact details for Link Market Services are set out in the directory.

Investor Support

If you have any queries regarding your investment, please contact Link Market Services on 09 375 5998 or visit their website at www.linkmarketservices.co.nz. Please note there is a section of the website designed to provide shareholders with the forms necessary to initiate changes of the details held at the registry. This service is available from 9.00am to 5.00pm (Auckland time) on all business days. Enquiries may also be e-mailed via Link Market Services’ website (at [email protected]). Requests for changes to your holding details, distribution payment details, or general enquires can all be directed to Link Market Services.

Annual Report

The Fund has been granted a waiver from the requirement in Listing Rule 10.4.1(b) to provide Unitholders with a copy of this Annual Report. Unitholders can visit www.nzx.com for an electronic copy of the Annual Report under code SRF.

Additional Unit Holder Information

Unit Holder Unites Held %

1 Paul Richard Zeusche 500,000 6.88%2 Herbert Roy Phillips 320,000 4.40%3 Marjorie Liliam Dobson 300,000 4.13%4 Blueberry Investments Limited 250,000 3.44%5 Petera Rangi Emery 250,000 3.44%6 Lilian Nicoline van Elk 250,000 3.44%7 Eric Foster Rudd 200,000 2.75%8 James Anthony Inman-Emery 180,000 2.48%9 Graeme Grimmer and Vivienne Grimmer 170,000 2.34%10 Shirley Shutt and John Shutt 125,000 1.72%11 Frank McLean and Geraldine McLean 110,000 1.51%12 Max Alexander Craig 100,000 1.38%13 Joseph Guy Raoul Daigneault 100,000 1.38%14 Lynette Patricia Rowntree 90,900 1.25%15 Judith Ann Bull 90,000 1.24%16 Ian McClough Sprott 90,000 1.24%17 Pauline Faye Stimpson 80,000 1.10%

Statement of Unitholders

STRVLF 20 largest ordinary unit holders and their holdings as at 20 June 2016: