Pasminco Limited PASMINCO LIMITED · Zinc 291,187 324,205 Lead 168,341 177,925 Silver (kg) 180,730...

Transcript of Pasminco Limited PASMINCO LIMITED · Zinc 291,187 324,205 Lead 168,341 177,925 Silver (kg) 180,730...

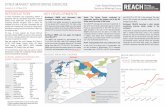

In our 10th anniversary year, we take stock of a decade of progress, a year of major development and a futurefull of opportunity.

(Above) Exploration was maintained at ahigh level on the Benagerie Ridge in SouthAustralia. In this aerial photo, the Portiaexploration camp can be seen in thebackground.

(Above Right) By end June 1998, more than1300 people were employed on PasmincoCentury Project and the mine prestripoperation was well advanced.

(Front Cover Left) Scott Lehman, PreciousMetals Superintendent, at the Port Piriesmelter.

(Front Cover Right) EZDA-branded zinc isloaded onto one of the three dedicatedvessels which now operate between theAustralian smelters and the four majorports of Pasminco’s Asian markets.

The Company’s Share Register is maintained by Corporate Registery Services Pty Ltd.Shareholders’ enquiries about their shareholdings should be addressed to:

Corporate Registery Services Pty LtdCollins Wales HouseLevel 12, 565 Bourke StreetMelbourne, 3000, AustraliaGPO Box 2975EEMelbourne, 3001, AustraliaTel: 61 3 9611 5711Fax: 61 3 9611 5710

PASMINCO LIMITEDACN 004 368 674

Registered OfficeLevel 15 380 St Kilda RoadMelbourne 3004 AustraliaTelephone61 3 9288 0333Facsimile 61 3 9288 [email protected]: www.pasminco.com.au

Pasminco Annual Report 1998

Pasm

inco

Lim

ited

Annual R

eport 1

998

117318.175P.M5.PASMINCO 18/9/98 10:41 AM Page 1

In a tough year, we made great progress in modernising existing assets and building our newCentury. Annual General Meeting

11.30am Wednesday, 28 October 1998ANZ Pavillion Victorian Arts Centre St Kilda Road, Melbourne.A notice of meeting and a proxy form are included with this Annual Report.For further information on investor servicesplease refer to page 71.

Other 10% (96/7:7%)

Battery 71% (96/7:75%)

Chemicals 11% (96/7:10%)

Solder 2% (96/7:2%)

Alloy Castings 1% (96/7:2%)

Lead Sheet 5% (96/7:5%)

Pasminco Lead Sales by End Use 1997/8

Galvanising 59% (96/7:56%)

Pasminco Zinc Sales by End Use 1997/8

Diecasting 24% (96/7:20%)

Battery Can Alloy 5% (96/7:7%)

Zinc Oxide 2% (96/7:4%)

Other 8% (96/7:10%)

Brass and Bronze2% (96/7:3%)

Casting OperatorDarren Gillies strapsEZDA diecasting alloy as it comes off a castingmachine at the Hobartsmelter. Forklift driverPeter Jarvis can be seenin the background.

During the year, Pasmincosuccessfully launched new leadproducts, “VRLA Refined Lead”and “MF Refined Lead”, whichsignificantly enhance theperformance of valve-regulatedand maintenance-free lead-acidbatteries, by both enhancingbeneficial Bismuth levels and also guaranteeingmanufacturers that chemicalelements deleterious tosuccessful battery performanceare at optimum low levels. This innovation, the result of more than five years ofresearch, represents asignificant technologicaladvance on previous leadspecifications for this growinghigh-tech battery sectorsupplying the automotive andtelecommunications industries.

DE

SIG

N/

RO

BIN

SO

N T

OW

NS

PT

Y L

TD

/ P

HO

TO

GR

AP

HY

/ R

OB

CR

AC

KN

ELL

PH

OT

OG

RA

PH

Y /

FIL

M/

EA

ST

ER

N S

TU

DIO

S G

RA

PH

ICS

PT

Y L

TD

/ P

RIN

TIN

G/

AC

TO

D P

TY

LT

D

Pasminco is a founding member of the International Zinc Association (IZA), established in 1990 to promote the benefits of Zinc.

117318.175P.M5.PASMINCO 18/9/98 10:41 AM Page 2

Financial Highlights 1998 1997 % Variance

Gross sales revenue $1,370.1m $1,352.8m 1.3%

Cost of sales (including exploration & research) $1,152.5m $1,104.2m 4.4%

Depreciation $131.7m $121.5m 8.4%

Operating profit after tax & before abnormals $39.6m $70.0m (43.4)%

Operating profit after tax & after abnormals $63.3m $64.7m (2.2)%

Earnings per share-before abnormals 3.9c 8.8c (55.7)%

-after abnormals 6.2c 8.1c (23.5)%

Dividend per share 4.0c 4.0c 0.0%

Return on shareholders’ equity 4.3% 8.3% (48.2)%

Paid up capital as at 30 June $1,124.6m $795.1m 41.4%

Shareholders’ equity $1,490.7m $778.5m 91.5%

Economic entity (Group) net debt $166.5m $239.1m (30.4)%

Capital expenditure $445.3m $196.5m 126.6%

Total assets $2,411.4m $1,569.3m 53.7%

Profit After Taxand after Abnormal and Extraordinary Items

1 9 9 4 5 6 7 8

$m

(20)

(10)

0

10

20

30

40

50

60

70

( 14.

4 )

12.2

40.8

64.7

63.3

1

10 Years p.10

People p.16

Projects p.12

Chairman & MD p.2

Financial Summary p.6

Markets p.8

Operations p.23

Contents1 Financial Highlights

2 Chairman & MD Letter

4 Operations at a Glance

6 Financial & Market Summary

10 10 Years of Progress

12 Development Projects 1998

16 People

18 Safety

20 Environment

23 Exploration

24 Technology

25 Mining

27 Australian Smelting

28 European Smelting

30 Management Team

31 Board

32 Ore Reserves

34 Production 5 Year Summary

36 Performance 10 Year Summary

38 Glossary

39 Directors’ Report,

Financial Statements,

Key Financial Dates

& Shareholder Information

Pasminco’s VisionTo be the Best from Mine to Market through Performance,Quality and Respect.

Pas A/R Final Text 18/9/98 8:12 AM Page 1

2

1997/8 was a difficult but constructive year.

Profit after tax and abnormals of $63.3 million was marginally below the previous year’s $64.7 million; however this result was assistedsignificantly by an abnormal gain of $23.7 million. At $39.6 million,profit after tax and before abnormals reflected lower production volumes and higher costs during the second half, as we implemented a comprehensiveprogram to improve the competitiveness of existing operations.

The economic downturn in a number of Asianeconomies continues to create uncertainty in product and equity markets in our region and wider afield.

With production facilities in Australia andEurope, and customers in some 45 countries,Pasminco performed well in 1997/8 in terms ofaggregate sales compared with the previous year.

Perceptions about future demand, however,depressed world prices for our products despitethe fact that global zinc and lead demandcontinue to exceed supply.

Amid the year’s volatile economic conditions, our break-even zinc price increased to US$998/tonne from US$934/tonne.

Our top priority and expectation for the currentyear is to reduce this key measure by liftingproduction and revenue and driving down costs.The development projects outlined in this reportwill assist these objectives.

Chairman Mark Rayner (left)and Managing Director and

Chief Executive DavidStewart looking over plans at

the construction site forCentury’s concentrator

facility.

Pas A/R Final Text 18/9/98 8:13 AM Page 2

The completion of the Century acquisition in September 1997 openedmajor opportunities for the company.With a world-class cost structure,Century will reduce our dependence on existing mines and give us moreflexibility in their operations and has the potential to contributesignificantly to shareholder value.Your Board welcomes the support givenby shareholders and banks to the Century fund-raising program.The project is ahead of schedule and under budget.

Your Board is confident of the strong underlying value of Pasminco’sbusiness and its future potential. In the climate of uncertainty created by the Asian downturn, we are disappointed that current share prices do not appear to recognise fully the underlying value of many resourcescompanies, including our own.

As an integrated, focused zinc and lead producer and supplier,we will continue to seek opportunities to add to our asset base throughexploration, acquisition and internal growth. Our objective is to ensurethat all assets in the portfolio are among the world’s most competitive.

The outlook is for improved production performance and lower costs.Global supply-demand remains in deficit, and with London MetalExchange inventories falling, metal prices are considered to havepotential for improvement.

In conclusion, we extend our thanks to all Pasminco’s employees.Ours is a tough, performance-oriented business and we wish to acknowledge the significant contribution of our people who thrive in this environment.

Return on Shareholders' EquityReturReturn on Sharn on Shareholders' Equityeholders' Equity

1 9 9 4 5 6 7 8

( 2.0

)( 2

.0)

8.3

4.3

8.3

4.3

%%%

(3)

0

3

6

9

((33))

00

33

66

99

1.6

5.4

1.6

5.4

AUG 97 SEP 97OCT 97NOV 97 DEC 97JAN 98 FEB 98MAR98 APR98 MAY98 JUN 98JUL 97

Pasminco Share PricePasminco Share Price Other MetalsOther Metals

1.0

1.5

2.0

2.5

3.0

500

1,000

1,250

1,500

750

Index IndexPoints

1.01.0

1.51.5

2.02.0

2.52.5

3.03.0

500500

1,0001,000

1,2501,250

1,5001,500

775050

Index IndexPointsPoints

Profit After TaxBreak-Even Zinc PricePrProfit After Tofit After TaxaxBrBreakeak--Even Zinc PriceEven Zinc Price

1 9 9 4 5 6 7 8

942

1,00

3

934

998

900

942

1,00

3

934

998

US$/t

800

900

1,000

1,100

1,200

1,300US$/tUS$/t

900

800800

900900

11,000,000

11,,110000

11,200,200

1,3001,300

3

David M Stewart Managing Director and Chief Executive

Mark R RaynerChairman

Pas A/R Final Text 18/9/98 8:14 AM Page 3

Following commissioning of the Century mine in late 1999,Pasminco will become the world’slargest zinc producer and the thirdlargest silver producer.

4

ExplorationPasminco Exploration is coordinated by the Group office in Melbourne, inconjunction with our operations in the Netherlands. Major bases arelocated at Broken Hill and Cobar in Australia and at Karachi in Pakistan.Project generation is a global effort with particular emphasis on Australia,Asia and South America.

MiningPasminco Mining has three major underground zinc-lead-silver miningoperations in Australia: Broken Hill, Elura and Rosebery. It also operates anopen-cut mine, Potosi, at Broken Hill.

Financials 1998 $m 1997 $m

Expenditure - expensed (Exploration group only) ▲ 16.8 18.1

Expenditure - expensed (Mine sites only) 5.1 5.4

Total expenditure - expensed ▲ 21.9 23.5

Expenditure - capitalised 5.9 8.7

Financials 1998 $m 1997 $m

EBIT ✚ 15.1 25.7

Gross sales revenue ≈ 377.4 365.3

Cost of sales ◗ 300.7 280.0

Depreciation & amortisation 61.6 59.6

Capital expenditure 71.9 68.9

Total assets 512.4 495.9

Production

Tonnes (Contained Metal)

Zinc 312,358 319,798

Lead 164,425 185,959

Silver (kg) 165,462 202,105

Gold (kg) 530 625

Total ore Treated 4,387,000 4,395,088

Sales

Tonnes (Contained Metal)

Zinc ❍ 291,187 324,205

Lead ❍ 168,341 177,925

Silver (kg) ❍ 180,730 192,104

Gold (kg) ❍ 499 566

Budel

In 1997 Pasminco embarkedon an exciting growth phase

with the acquisition of twoundeveloped world-class zinc

deposits, Century and Dugald River.

▲ includes research and development expenditure and depreciation of $0.7m (1996/7-$0.8m)

✚ includes unrealised profit on consolidation from intra-group sales 1997/8-nil, 1996/7-$6.8m

≈ includes sales to Group smelters of $258.6m in 1997/8 and $226.4m in 1996/7

◗ includes exploration and research and development

❍ includes sales to Group smelters

▼ includes research and development

● includes purchased zinc

◆ includes sales from Cockle Creek to Port Pirie

‡ includes 50% ARA production

Operations at a Glance

Headquartered in Melbourne,Pasminco has production

facilities in Australia and theNetherlands and marketing

offices in Australia, theNetherlands, the UK, Hong

Kong and China.

Pas A/R Final Text 18/9/98 8:15 AM Page 4

Australian Smelting

Pasminco operates and markets the output from three primary and twosecondary smelters in Australia: the Cockle Creek ISF zinc and leadsmelter, the Hobart electrolytic zinc smelter, the Port Pirie lead and zincsmelter and ARA lead recycling plants in Sydney and Melbourne. ARA isa 50-50 joint venture with Simsmetal. Sales and marketing offices arelocated in Melbourne, Hong Kong and Guangzhou.

European Smelting Pasminco Budel Zink operates and markets the output from the electrolyticzinc smelter in the Netherlands.

Financials 1998 $m 1997 $m

EBIT 78.7 74.5

Gross sales revenue 868.8 907.7

Cost of sales ▼ 732.8 784.3

Depreciation & amortisation 57.3 48.9

Capital expenditure 65.1 102.6

Total assets 788.4 680.6

Financials 1998 $m 1997 $m

EBIT 77.3 42.9

Gross sales revenue 382.6 306.2

Cost of sales ▼ 295.0 252.5

Depreciation & amortisation 10.3 10.8

Capital expenditure 23.4 14.6

Total assets 198.7 182.9

Production

Tonnes (Metal)

Zinc 303,576 319,747

Refined lead and alloys 185,061 201,755

Lead bullion 25,149 28,795

Secondary lead 13,889 13,971

Silver (kg) 112,030 231,756

Production

Tonnes (Metal)

Zinc 215,385 204,626

Sales

Tonnes (Metal)

Zinc 217,792 211,832

Sales

Tonnes (Metal)

Zinc ● 300,245 324,220

Refined lead and alloys 187,887 194,991

Lead bullion ◆ 22,304 30,034

Secondary lead 14,497 13,379

Silver (kg) 104,700 251,540

5

0

50,000

100,000

150,000

200,000

250,000

00

50,00050,000

100,000100,000

150,000150,000

200,000200,000

250,000250,000

1 9 9 4 5 6 7 8

188,

386

181,

572

177,

92520

3,16

2

168,

341

SalesSalesSalesSales

279,

944

305,

990

290,

123

291,

187

324,

205

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

00

50,00050,000

100,000100,000

150,000150,000

200,000200,000

250,000250,000

300,000300,000

350,000350,000

1 9 9 4 5 6 7 8

494,

700

439,

300

529,

000

535,

000

518,

000

0

100,000

200,000

300,000

400,000

500,000

600,000

00

100,000100,000

200,000200,000

300,000300,000

400,000400,000

500,000500,000

600,000600,000

1 9 9 4 5 6 7 8

Production SalesProduction Sales

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

00

50,00050,000

100,000100,000

150,000150,000

200,000200,000

250,000250,000

300,000300,000

350,000350,000

400,000400,000

267,

000

262,

300

259,

100

238,

400

224,

700

1 9 9 4 5 6 7 8

Production SalesProduction Sales

279,

944

305,

990

290,

123

312,

358

319,

798

300,

466

305,

083

293,

275

291,

187

188,

386

181,

572

177,

925

202,

320

196,

376

185,

434

185,

959

164,

425

203,

162

168,

341

494,

700

439,

300

529,

000

535,

000

518,

000

445,

400

419,

600

536,

000

524,

400

519,

000

267,

000

262,

300

259,

100

238,

400

224,

700

272,

600

250,

400

268,

000

244,

500

224,

100

324,

205

ProductionProductionProductionProduction

Pas A/R Final Text 18/9/98 8:16 AM Page 5

■ Pasminco recorded a profit after tax and abnormals of $63.3 million for 1997/8, a decrease of $1.4 million from the previous year.

■ The result was assisted by an abnormal gain of $23.7 million relating to a reduction of the environmental provision at Budel Zink.

■ Results were favourably influenced by a higher zinc price and weaker Australian dollar, offset by a lower lead price.

■ Operating performance was below potential, with lower production volumes, higher costs and lower metal premiums in Asia impacting unfavourably on the result.

■ The Group maintained a conservative balance sheet, given the uncertainties surrounding commodity prices and exchange rates.

6

1998 1997 ChangeFav/(Unfav)

Zinc Prices*(US$/t) 1192 1124 68

Lead Prices*(US$/t) 562 724 (162)

A$/US$▲

(cents) 70.0 76.8 6.8

A$/Nlg▲

(cents) 138.0 140.3 (2.03)

1998 1997 ChangeFav/(Unfav)

Zinc Prices*(US$/t) 1192 1124 68

Lead Prices*(US$/t) 562 724 (162)

A$/US$▲

(cents) 70.0 76.8 6.8

A$/Nlg▲

(cents) 138.0 140.3 (2.03)

External FactorsExterExternal Factorsnal Factors

Realised *LME PriceRealised ▲

exchange rate

Financial & Market Summary

External FactorsAt US$1,192, the average realised zinc price in 1997/8 increased 6%compared with US$1,124 in 1996/7. The realised lead price wassignificantly lower in 1997/8, averaging US$562 compared with US$724in 1996/7. The average realised AUD/USD exchange rate for 1997/8 including theimpact of the Group’s natural revenue hedge was 70.0 cents comparedwith 76.8 cents in 1996/7. The natural revenue hedge allows the Groupto match movements in its US dollar debt against future revenue. The Dutch guilder was marginally stronger in 1997/8, with the Australiandollar/Dutch guilder exchange rate averaging 138 cents compared withthe previous year’s 140.3 cents. As approximately 15% of the Group’scost base is in Dutch guilders, a stronger guilder has an unfavourableimpact on the Group’s results.The higher zinc price and weaker Australian dollar contributed $26 millionand $68 million respectively to earnings. The lower lead price and strongerDutch guilder reduced earnings by $40 million and $2 million respectively.

Operating Performance The Group undertook a number of major capital improvement programsduring the year. These included the refinery replacement andmodernisation at Port Pirie, commissioning of the co-treatment process atHobart and Port Pirie and the four-week campaign maintenance shutdownat Cockle Creek. Each of these impacted production and costs during thecourse of the year. Budel’s production performance improved.Mine production for the year was affected by lower ore grades at BrokenHill, a ground fall at Rosebery in January 1998 which restricted productionuntil June, and the availability of only a single production stope at Elura formost of the year. Lower production volumes and higher costs in 1997/8 reduced earningsby $44 million and $32 million respectively.

Lower metal premiums reduced earnings by $16 million in 1997/8. Reflecting operating performance during the year and the impact of thelower lead price, the Group’s break-even zinc price increased fromUS$934/tonne in 1996/7 to US$998/tonne in 1997/8. Excluding theimpact of abnormal items in each of the two years, the break-even zincprice rose from US$919/tonne in 1996/7 to US$1,061/tonne in 1997/8.Return on shareholders equity was 4.3% after inclusion of new equityraised for the Century project.

Objective:Sustain profitability at all pointsin the metal cycle Progress:Construction of the Century mine

is on time and on budget to improve Pasminco’s break-even zinc price

(see page 12). New business systems will lead to improved

productivity, make the most of combined purchasing power and

improve decision tools (see page 14). The Port Pirie upgrade will

increase production and reduce operating costs per tonne (see page 13).

1998 Progress Against Objectives

Pas A/R Final Text 18/9/98 8:16 AM Page 6

0

200

400

600

800

1,000

1,200

1,400

00

200200

400400

600600

800800

1,0001,000

1,2001,200

1,4001,400

1 9 9 4 5 6 7 81,

193.

7

1,22

4.1

1,31

8.2

1,35

2.8

1,37

0.1

0

60

120

180

240

00

6060

112020

118080

240240

1 9 9 4 5 6 7 8

43.3

169.

2

139.

0

188.

7

219.

9

*Cash flow from operating activities plus movement in operating working capital

0

10

20

30

40

1 9 9 4 5 6 7 8

26.9

16.9

23.5

9.4 10

.0

26.9

16.9

23.5

9.4 10

.0

00

1010

2020

3030

4040

0

3

6

9

00

33

66

99

8.8

4.3

8.1

0.6

A. Impact of US$25/t change in zinc priceB. Impact of US$25/t change in lead priceC. Impact of A$:US$ 1 cent changeD. Impact of A$:Nlg 1 cent change

A B C D

7

Cash FlowThe Group generated cash from operations of $220 million in 1997/8. From this, capital expenditure of $445 million was funded. Major projectsincluded the Port Pirie refinery replacement ($16 million), Budel’sconversion to Century concentrates ($15 million), and installation of thePasminco Business Systems ($28 million). Capitalised mine developmentexpenditure was $35 million. Capital expenditure on the Century projectwas $255 million.A dividend of 4 cents per share, franked to 96%, was paid in November1997, the dividend payment totalling $32 million. Financing costs in1997/8 were $14 million, $4 million lower than in 1996/7 due to loweraverage net debt levels during the year.

Currency OptionsA currency option program was recommenced in 1997/8 to protect theGroup’s US dollar revenue stream against adverse movements in theAUD/USD dollar exchange rate. When the exchange weakenedsignificantly in the latter part of 1997, and in periods of weakness sincethen, call options were purchased and put options were soldsimultaneously. This is referred to as a collar option strategy. As at 30 June1998, collar options to the value of US$940 million were in place over theperiod January 1999 to December 2001. The average strike price of thecap is US67 cents and the average strike price of the floor is US59 cents.The effect of this strategy is to protect US$940 million of revenue againsta rise in the AUD/USD exchange rate above US67 cents while forgoingthe benefit of a fall in the exchange rate below US59 cents. It should benoted that for the six month period to 31 December 1998 the Group is fullyexposed to the prevailing AUD/USD dollar exchange rate.Full details of this position are contained in Note 22 to the accounts on page 59.

Although no tax was paid in Australia during the year because of theGroup’s carried forward tax losses, the Group’s effective tax rate was 38%,5% above the previous year’s rate. The higher tax rate was due to thereduction in eligible development, and research and development,allowances. In November 1997, the Group completed an equity raising for the Centuryproject totalling $669 million, net of expenses. The equity was raisedthrough a 10% book-build placement to institutions of 79.5 million sharesat $2.30 per share, immediately after the completion of the Centuryacquisition on 24 September 1997. The placement, which raised $183million, was followed by a 2 for 7 rights issue to shareholders at $2.00 pershare, which raised $500 million. Acquisition costs of $345 million (includingDugald River) were funded from the raising, and for the short term the balanceof new equity was used to retire existing debt facilities. A review of progresson the Century project is contained on page 12.

Financing ActivitiesThe major financing activity during 1997/8 was the finalisation of aUS$600 million facility to fund development of the Century project. Otherfinancing activities were undertaken in relation to funding of ancillaryprojects associated with Century. The credit watch negative announced by ratings agency Standard andPoors after the Century acquisition in January 1997 was removed inJanuary 1998. Pasminco maintains its BBB credit rating.During the year maturing bilateral debt facilities to the value of US$50million and A$120 million were renegotiated. As at 30 June 1998, the Group had committed facilities of A$1,590 millionof which A$1,366 million was undrawn. Net debt at 30 June 1998 wasA$167 million. The Group maintained a conservative balance sheet with anet debt to debt plus equity ratio of 10%. Although debt will rise in the coming year as funding commitments forCentury build up, the Group’s balance sheet and gearing ratio do notpreclude it undertaking other development projects or acquisitions.

Malcolm Wilson(left) FinanceManager, Centuryand Steve Pearce,Group Treasurer,worked withPasminco’s banks on the debtcomponent of the funding forCentury and theancillary projects.

Pas A/R Final Text 18/9/98 8:17 AM Page 7

Zinc Metal MarketZinc prices showed great volatility during 1997, despite the steadyreduction in London Metals Exchange (LME) stocks. The LME cash price for zinc ranged from a high of US$1,725 per tonnein September 1997 to a low of US$988 per tonne in late June 1998.Pasminco’s average realised base LME zinc price for the year wasUS$1,192, up 6% from the previous year’s US$1,124. Despite the zinc market being slightly in surplus at the beginning of the firsthalf, zinc reached its highest cash price for many years (US$1,725) inSeptember 1997 before tumbling to an average of US$1,060 for thesecond half.

External 29% (96/7:37%)

Port Pirie 28% (96/7:26%)

Cockle Creek 7% (96/7:5%)

Hobart 36% (96/7:32%)

External 29% (96/7:37%)

Port Pirie 28% (96/7:26%)

Cockle Creek 7% (96/7:5%)

Hobart 36% (96/7:32%)

Pasminco Concentrates Sales 1997/8 Pasminco Concentrates Sales 1997/8 Pasminco Concentrates Sales 1997/8

North Asia 34% (96/7:37%)

Other 1% (96/7:1%)

Africa 7% (96/7:5%)

West Asia 15% (96/7:10%)

Australasia 21% (96/7:23%)

SE Asia 22% (96/7:24%)

North Asia 34% (96/7:37%)

Other 1% (96/7:1%)

Pasminco Lead Sales by Region 1997/8Pasminco Lead Sales by Region 1997/8Pasminco Lead Sales by Region 1997/8

Africa 7% (96/7:5%)

West Asia 15% (96/7:10%)

Australasia 21% (96/7:23%)

SE Asia 22% (96/7:24%)

Europe 35% (96/7:33%)

North Asia 22% (96/7:21%)

Other 3% (96/7:6%)

SE Asia 14% (96/7:16%)

West Asia 7% (96/7:7%)

Australasia 19% (96/7:17%)

Europe 35% (96/7:33%)

North Asia 22% (96/7:21%)

Pasminco Zinc Sales by Region 1997/8Pasminco Zinc Sales by Region 1997/8Pasminco Zinc Sales by Region 1997/8

SE Asia 14% (96/7:16%)

West Asia 7% (96/7:7%)

Australasia 19% (96/7:17%)

Other 3% (96/7:6%)

8

Lead Metal Market Average London Metal Exchange (LME) stocks of lead for 1997/8remained at the previous year’s level of 112,000 tonnes.At year end, LME lead stocks combined with approximate consumer andproducer stocks are estimated to represent just above four weeks’consumption.Despite historically low stocks, Pasminco’s average realised LME baselead price for the year was US$562, down 22% from the previous year’sUS$724. Western world lead production grew by almost 4% in 1997/8, but isexpected to reduce gradually to around 1% during the next few years.Primary lead production accounted for most of the growth in 1997/8,due to rising concentrate supplies and some smelter capacity upgradesand de-bottlenecking. Growth in secondary lead production especiallyin Europe and North America was restricted by the tight supply of scrap. Western world lead consumption is forecast to grow at 1.4% (70,000tonnes) p.a. over the next five years, with the Americas showing thestrongest growth rates. Estimates of Asian demand growth during thenext 12 months range from 1.4% to negative 3%.

With the strengthening zinc price and record Chinese exports during the first half,LME stocks rose from 424,000 tonnes to peak at 495,000 tonnes. Once the zincprice collapsed, stocks decreased steadily from December 1997. On the back ofstrong European demand and slower Chinese exports, the average draw-down at the end of the period was more than 1,000 tonnes per day. At yearend, LME stocks totalled 367,000 tonnes, an overall decrease for the year of 57,000tonnes or 13%.Year-end LME zinc stocks are estimated to represent 6.6 weeks of consumptionwhen combined with approximate consumer and producer stocks.

The zinc demand/supply equation is expected to be generally balancedduring 1998/9. No new supply capacity will become available while muchlower metal exports are expected from the People’s Republic of China.Continuing strength in European and North American consumption will beoffset by slower Asian demand.

Regional impacts on Pasminco metal salesPasminco exports to more than 45 countries around the world. Core marketsare in Europe and the Asia Pacific Rim.In the European zinc metal market, demand and premiums strengthenedsteadily throughout 1997/8. Increasing demand from the general andcontinuous galvanising sectors was the key driver. In Pasminco’s core Asian markets, the economic slowdown saw a decreasein demand for all commodities in the main affected countries (Indonesia,Malaysia, South Korea and Thailand). For Pasminco, decreased demand inthese markets was largely offset by the strong demand in North Asian countriessuch as Taiwan and Hong Kong/China, West Asian countries such asBangladesh and India, and South Africa. Having the advantage of operations in both the southern and northernhemispheres, Pasminco can adjust its sales effort to maximise returns. Duringthe report period, the mix of European and Asian sales was fine-tuned; but thecompany continued to ship zinc metal from Europe into Asia throughout the year. The Asian downturn had the greatest impact on Pasminco markets catering todomestic demand in the weakened economies, such as general galvanisingin the case of zinc and domestic battery supply in the case of lead. In contrast,export-oriented areas such as diecasting in some cases actually increasedconsumption of Pasminco zinc. In aggregate, Pasminco retained most of itsshare of the zinc and lead metal import market in the Asian region.

Objective:Be the supplier of choice by

meeting or exceeding customer expectations

Progress:Pasminco’s new distribution

system will significantly improve the

company’s competitiveness in the critical

Asian market by providing a faster, more

flexible service. See page 15.

1998 Progress Against Objectives

Pas A/R Final Text 18/9/98 8:17 AM Page 8

To optimise feed mix, Pasmincopurchased some zinc and leadconcentrates from other Australianand overseas mines. The largestsuppliers to Pasminco’s Australiansmelters were the Hellyer mine inTasmania, the Woodlawn mine inNew South Wales (prior to its closure in March 1998) and the McArthur Rivermine in the Northern Territory. Shipments of lead concentrate from the newCannington mine in Queensland to the Port Pirie smelter commenced inJanuary 1998 and will increase in future years.When Century begins production late in calendar 1999, Pasminco’s Budeland Hobart smelters will be given priority in initial zinc concentrate deliveries.As Century’s production will increase rapidly beyond these smelters’requirements, significant external sales will follow. Strong demand isemerging for Century concentrates and negotiations to secure long-termcontracts have reached an advanced stage. The zinc concentrate market is expected to trend toward surplus in the nextfew years but anticipated mine closures, new smelter start-ups andincremental capacity increases during the early part of the next decade arelikely to reverse this situation. The lead concentrate market is likely to remainin surplus for some time.

9

US$ LME Price LME Stocks

0

350,000

700,000

1,050,000

1,400,000

US$

0

500

1,000

1,500

2,000

US$ LME Price LME Stocks

JUL 93 JUL 94 JUL 95 JUL 96 JUL 97 JUN98

US$

0

350,000

700,000

1,050,000

1,400,000

0

500

1,000

1,500

2,000

US $ LME PriceUS $ LME Price LME StocksLME Stocks

JUL 93 JUL 94 JUL 95 JUL 96 JUL 97 JUN980

250

500

750

1,000

US$

0

100,000

200,000

300,000

400,000

US$

0

250

500

750

1,000

0

100,000

200,000

300,000

400,000

Pasminco Zinc PremiumsUS$/t

JUL 93 JUL 94 JUL 95 JUL 96 JUL 97 JUN 980

50

100

150

Pasminco Lead PremiumsUS$/t

JUL 93 JUL 94 JUL 95 JUL 96 JUL 97 JUN 980

50

100

150

Concentrates MarketsConcentrate treatment charges moved in favour of smelters during the reportperiod, particularly in the case of lead concentrate.Approximately 61% of Pasminco’s zinc concentrate sales in 1997/8 wereto the Group’s own smelters, up from 52% in the previous year. Export saleswere reduced in line with lower production from Pasminco mines andincreased demand from Cockle Creek after the closure of the Woodlawnmine. Most zinc concentrate export sales continued to be directed to Japanand Korea, where demand remained strong. The percentage of internal lead concentrate sales increased slightly to93% in 1997/8, compared with 89% in the previous year.

European Smelting’scommercial division,which has been builtup progressivelysince Pasminco’s100% ownership of Budel, was againstrengthened and is now fully staffedwith experiencedpeople. Here, twomarketing employees,Sander de Leeuw (left) and Maarten de Leeuw,are pictured in thezinc storage area.

Zinc prices showed great volatility during 1997, despite thesteady reduction in London Metal Exchange (LME) stocks.

Despite historically low stocks, Pasminco’s average realisedLME base lead price for the year was US$562, down 22% fromthe previous year’s US$724.

Pas A/R Final Text 18/9/98 8:17 AM Page 9

10

10 Years of Progress

1988/9 Pasminco is formed through the merger,effective from July 1988, of the zinc-lead-silvermining, smelting and international marketingactivities of CRA Limited and North Broken HillPeko Limited. A public share issue raises $203million, with subsequent listing on the AustralianStock Exchange in March 1989. Ownership is CRA 40%, North 40%, other 20%.Mr Donald S Carruthers is Founding Chairman and Mr Peter C Barnett is Founding MD&CEO.$217 million is spent on modernisation programs.

1989/90 The PasmincoExploration Unit andPasminco Research Centre areformed. Major modernisationand environmental programscontinue at Broken Hill,Hobart and Port Pirie,including construction of a surface decline (pictured) at Broken Hill which enablesdirect vehicular access fromthe surface to undergroundworkings.

1990/1 Pasminco records a loss as world economicgrowth slows down and metalprices fall sharply. Operationsat Elura are scaled down.Following a benchmarkingstudy, programs are introducedto improve key operatingfactors at all sites.The Mining,Metals and Corporate officesare consolidated at onelocation in Melbourne.Pasminco begins earning 40% of CRA’s Dugald River(pictured) deposit in NW Queensland.

1991/2 The effluenttreatment plant at Hobart(pictured) is commissioned.Pasminco participates in newcommunity health programs at Broken Hill and Port Pirie to address elevated blood lead levels.

1992/3 Mr Mark R Raynerbecomes Chairman. CRA Limitedand North Broken Hill PekoLimited reduce their shareholdingsfrom approximately 40% each toaround 31% and 20% respectively.Pasminco’s Vision & Values areadopted.The northern operationsat Broken Hill are closed. Pasmincocommits to cease ocean disposal ofjarosite at Hobart; investigationscontinue into finding permanentlong-term solutions to jarositedisposal at both Hobart and Budel.The new gas purification plant iscommissioned at Hobart and 36 houses adjacent to the Cockle Creek smelter arepurchased to develop anenvironmental buffer zone.

1 9 8 900

500500

1,0001,000

1,5001,500

1,12

3

1,17

4 1,40

9

1,29

3

1,22

5

942

1 9 9 0 1 9 9 1 1 9 9 2 1 9 9 3 1 9 9 4

Pasminco was formed from assets of varying quality and cultures. In the past 10 years, we have reshaped and developed the business into one of the world’s leading resource companies. With the Century acquisition, we can now go forward with a cohesive base for future growth as the world’s leading zinc supplier.

Pas A/R Final Text 18/9/98 8:19 AM Page 10

11

1996/7 In January 1997,Pasminco announces theacquisition of the Century and Dugald River deposits from CRA for $345 million,subject to the necessaryQueensland Governmentapprovals being issued.In May 1997, the GulfCommunities Agreement is signed, clearing the way for these approvals. Dutchauthorities extend Budel’sjarosite licence to end June2000. Pasminco signs a Greenhouse CooperativeAgreement with the Australian Government.The Port Pirie refineryreplacement and modernisationcommences. Pasminco’s sitesadopt new names to reflectGroup identity.

1995/6 Pasminco adopts the break-even zinc price as a key performance indicator in its goal of being profitable at all points of the metal pricecycle. In August 1995, CRAdisposes of its remaining 10% shareholding in Pasminco.Following delays to the Centuryproject (as it commences the“right to negotiate” processunder the Native Title Act),Budel seeks an extension to its jarosite licence from theDutch authorities. Capital workscommence at the Hobart(pictured) and Port Piriesmelters for the co-treatmentproject. Sixty per cent ofemployees take up options when the Pasminco LimitedEmployee Option Plan isintroduced in November 1995.

1997/8 In September 1997, Pasmincocompletes the Century acquisition. Funding is raised through US$600 million of debt facility,a $183 million global placement to institutions,and a $490 million rights issue.The co-treatmentprocess to eliminate jarosite production iscommissioned at the Hobart and Port Piriesmelters. Pasminco sells its railway business inTasmania. Port Pirie’s expanded silver refinerybegan operating.

942

1,00

3

900

934 998

1 9 9 4 1 9 9 5 1 9 9 6 1 9 9 7 1 9 9 8

1993/4 Pasminco’s UK-basedoperations (Avonmouth, Bloxwich)are sold to MIM Limited for $111million. In May, 38.9% of Pasminco’sstock is placed with institutionalinvestors, reducing CRA’s holding to 10% and removing North fromthe register. In November,$88 million is raised through the placement of 10% of Pasminco’sequity with institutional investors.In December 1993, agreement is reached with Dutch authoritiesfor Budel to cease production ofjarosite from mid-1998. In February1994, the Australian Governmentissues the final permit for Hobart’socean disposal of jarosite until end 1997 to enable the co-treatmentprocess to be implemented.Pasminco begins implementing itsLead Strategy, focusing on employeeexposure and emission control.

1994/5 Pasminco returns toprofitability and resumes dividendpayments. Shell’s 50% interest in the joint venture zinc smelter atBudel (pictured) is acquired for Nlg 14 million (A$10 million)giving Pasminco 100% ownership,and the supply of low-iron zincconcentrates from CRA’s plannedCentury mine in NW Queensland is negotiated. Pasminco’s firstexploration project offshore fromAustralia is initiated whenagreement is reached with thePakistan Mineral DevelopmentCorporation and BalochistanDevelopment Authority wherebyPasminco may earn a 75% interestin the Duddar zinc deposit andsurrounding exploration areas by completing a feasibility study on the project.The fertiliser plant at Hobart is sold. Mr Peter Barnettretires on 30 June 1995 and issucceeded by Mr David M Stewart.

Pas A/R Final Text 18/9/98 8:20 AM Page 11

Century construction beginsThe Century project is ahead of time and under budget to begin production in the final quarterof 1999 and build up quickly thereafter to full production. By end August 1998, major contracts had been let, the mine engineering design was 60%complete, and the administration centre, workshop facilities and new accommodation villagewere completed and operational. Work is now well advanced on the mine prestrip and the construction of the concentratorprocessing facility, pipeline, port and new air strip. More than 1300 people are employed onthe project and Century’s core operations team is in place.

Development Projects 1998

12

The project engineer and manager is Century Minenco Bechtel Joint Venture. Aseven-year contract for the mining operation, including the prestrip, has been signedwith a joint venture of Roche Bros and Eltin Pty Ltd and power will be supplied undercontract by CS Energy’s Mica Creek power station at Mt Isa. More than $600 millionin value of goods and services has been provided from Australian sources.

Gulf Communities Agreement Century’s partnership agreement with the local Gulf communities and theQueensland Government is based on several key themes:■ Indigenous employment: At 30 June 1998, 65 local people (31%

women) were employed on the Century project. A centralised recruitment process is used whereby all new job descriptions are checked against a database of local people seeking work. Training programs are being conducted on site, with funding coming from Pasminco and government agencies.

■ Business development: Century has established a trust fund and will contribute $1.0 million p.a. to provide financial assistance for local businesses. The trustees are elected by the communities. Century is also helping to establish local businesses and has employed anindigenous business adviser to identify and assist in further opportunities.

■ Cultural and environmental protection: Comprehensive procedures are in place to ensure identification and management of sites of cultural significance. The Century Environment Committee, consisting of local indigenous community members and Century representatives, overviews the project’s performance.

■ Pastoral properties: Discussions have commenced with local indigenous groups to develop a business planning approach to the fivepastoral properties that Century will transfer over time to local Aboriginal groups.

View of the Century project developmentarea, showing the steel framework forthe concentrate processing facility in the distance at centre. The warehouse is just right of the centre and at left are the mine workshop, temporarypower station and fuel storage.

Last year, we continued a vigorous and extensivedevelopment program to realise the potential of ourpeople, markets and resources.

Pas A/R Final Text 18/9/98 8:20 AM Page 12

Encouraging Groupwide cross-culturalawareness and diversityWhile Century faces the most immediate challengesin working effectively with indigenous employeesand communities, Pasminco recognises the need todevelop awareness and capability across the entirecompany and to work with indigenous people at thelocal project and community level. In September 1997, a Group Manager IndigenousAffairs was appointed. A three-year plan forindigenous affairs focuses on implementingsystems which can be transferred to growthinitiatives anywhere in the world. Culturally sensitiveexploration procedures with objectives foremployment, business development andcommunity relations are being prepared. In addition to Century’s extensive program, othersite-level initiatives are being piloted. For example,the Hobart smelter is working with the regional officeof the Aboriginal and Torres Strait IslanderCommission (ATSIC) to increase indigenousemployment, building on relationships developedthrough activities in conserving Aboriginal middenson the site. A Groupwide cross-cultural awareness program isnow under way, with initial emphasis onthose dealing directly with indigenouscommunities but ultimately extending toPasminco as a whole.

13

Waanyi Elders andstudents from DoomadgeeSchool IndigenousEducation Unit performthe Dance of the Brolga during the visit to Century of PasmincoDirectors and Executives,May 1998.

Port Pirie transformation on trackPort Pirie’s replacement and modernisation is on track to increase leadproduction refining by 15% and more than double silver production by endcalendar 1998. In late May 1998, the expanded silver refinery began operating and by endJune a significant part of the major engineering work for the modernised andupgraded lead operation was completed. The old continuous lead refineryceased operation in mid-June, with the changeover to the new batchrefining technology being phased in from June to October 1998. The upgrade will ■ increase lead production to

250,000 tonnes p.a.■ increase silver production from

220 to 450 tonnes p.a.■ reduce the plant’s operating

costs per tonne■ enable Australian value-adding

of lead bullion previously refined offshore

■ allow more flexibilityin feedstock requirements

■ improve occupational health and safety and environmental performance.

“It’s been worth it,” says ScottLehman, Precious Metals

Superintendent, of the newlyexpanded silver operation.

“We had some difficultiesproducing, constructing anddemolishing all at the same

time and place, but we’re seeing the benefits now. The

new equipment is easy to operate, we’re lifting

output and it’s a much nicer, cleaner place to work.”

Pas A/R Final Text 18/9/98 8:21 AM Page 13

Development Projects continued

14

Co-treatment ends jarosite production at HobartAfter a five-year, $12 million research and development program, followedby capital investment of approximately $85 million, in 1997/8 Pasmincocommissioned the co-treatment program at the Hobart and Port Pirie smelters. At Hobart, a partial changeover commenced in May 1997, with completeconversion occurring after August. Circuit changes are still being fine-tuned and a program is in place to accelerate the plant along the learningcurve of the new process.

Port Pirie is one of the first sites to introduce Pasminco’s new businesssystems. In preparation for “go-live” in September 1998, a team drawn frommaintenance people across the plantcleansed and converted data for the new SAP platform. They are (from left) Dean Butler, Brian Broadfoot, Richard Mallaby, Darby Munro, Malcolm Davis, Steve Rohrsheim, Brian Demarco, Geoff Taylor and John Quin.

Port Pirie also experienced some production disruption due to thechangeover. An innovative engineering solution involving the upgrade ofthe sinter plant was completed in the third quarter of 1997/8. By year-end, leadproduction had improved and all paragoethite product was being processed.(See also page 22 of Environment.)

New business systems will improve efficiency In a project called Pasminco Business Systems (PBS), the company ismoving to an integrated business system utilising SAP software andencompassing sales and marketing, asset management, maintenance,finance, purchasing and human resources processes across the Group.Benefits will accrue through increased utilisation of plant and equipment,leveraging of combined purchasing power and improved decision-makingtools. PBS will also largely mitigate the risks associated with the Year2000 problem for Pasminco’s commercial systems. The PBS “roll-out”process commenced shortly before 30 June 1998 and will be completedat all sites by the third quarter of calendar 1999.Representatives from all sites have helped develop the system andcomprehensive training and change management programs are in placeto support people throughout implementation (see page 17).

Port Pirie upgraded its sinter plant to improve processing of parageothiteproduct. Tony Wise,Sinter Plant Develop-ment Metallurgist,adjusts equipment as part of thecommissioning process.

Pas A/R Final Text 18/9/98 8:21 AM Page 14

15

Addressing Y2K issuesAn initial risk and inventory audit of Pasminco’s exposure to the Year 2000(Y2K) problem, conducted in mid 1997, identified the need to focus on riskmitigation in two areas, commercial systems and technical systems. As the implementation of PBS is addressing the former, the Year 2000project management structure is focusing on technical systems riskmitigation as well as coordinating Pasminco’s overall Year 2000 complianceeffort. The compliance definition is set down in the Pasminco Year 2000Organisational Compliance Standard, which exceeds the British StandardsInstitution’s Year 2000 compliance rules as described in DISC PD2000-1.

Value Added 1997/8 1996/7

Gross sales made by Group to external customers 1,370.1 1,352.8

Less goods & services bought in from outside the Group 870.3 935.0

Value added by Group companies 499.8 417.8

Distribution

Salaries & wages to employees 222.0 220.6

Reinvested in the business 197.4 127.6

Interest to lenders of funds 13.5 17.1

Dividends to shareholders 31.8 23.8

Taxes and other government charges 35.1 28.7

Total 499.8 417.8

Salaries and wagesto employees 44%

Taxes and other government charges 7%

Reinvested in the business 40%

Dividends provided for shareholders 6%

Interests to lenders of funds 3%

Each Pasminco site has established a Year 2000 team, responsible foridentifying and mitigating Year 2000 risks at site. This includes investigating thecompliance status of critical vendors (such as electricity, transport andconcentrate suppliers) and establishing appropriate contingency plans. Project progress is reported to the Board as a standing agenda item. To obtain an independent view of its Year 2000 compliance plan, costing andprocesses, Pasminco has also established an audit schedule with its internal auditor.As at June 1998, the estimated cost for Pasminco’s Year 2000 project is $7 million.

Innovative distribution system set to deliver competitive edge in AsiaNear year-end, Pasminco launched an innovative distribution system for itsfinished metal into Asia which will significantly improve the company’scompetitiveness in the critical Asian market by providing a faster, more flexible service. The result of a complete overhaul of distribution processes, thearrangements maximise synergies across the Group and establish a totallynew distribution logistics operation in Asia. Three dedicated vessels, capable of both break-bulk and containerloading, now operate between the Australian smelters and the four majorports of Pasminco’s Asian markets (Hong Kong, Kaohsiung, Port Kelangand Jakarta). Distribution centres at the destination ports have beenestablished to fast-track order fulfilment and give customers the choice of door-to-door or ex-warehouse delivery.In the wake of Asia’s economic turbulence, the improved system providescustomers with welcome flexibility in inventory and credit management. The service also gives a major boost to the regional ports of Port Pirie andNewcastle, with an additional 24 vessels calling annually.

Pasminco zinc is unloaded at Port Kelang,which is the distribution point for Malaysia and trans-shipment to West Asia in Pasminco’s improved Asiandistribution system. The warehouse facility can be seen in the background.

Objective:Deliver supplier relationships

for mutual benefit

Progress: Century’s partnership approach

with contractors is benefiting the project budget and

schedule (see page 17). Pasminco’s new Asian distribution

strategy is based on alliances with three suppliers responsible

respectively for metal handling and distribution within

Australia, shipping between Australia and Asia, and

warehousing and delivery to customers in Asia.

1998 Progress Against Objectives

Objective: Ensure quality is built into

all our processes, systems and practices

Progress: All sites should be accredited

to the ISO14001 environmental standard

by June 2001.

1998 Progress Against Objectives

Pas A/R Final Text 18/9/98 8:21 AM Page 15

Developing frontline leaders The site leadership program commenced in 1997. Its aim is to helpfrontline supervisors enhance their skills and abilities within theorganisation. It seeks to develop supervisors so that they can bettersupport their teams within the business. Each participant focuses on a job-relevant project throughout the program,ensuring the practical application of the knowledge gained. The programemphasises skills and methodology in performance management, in keeping with the importance Pasminco places on this task.Facilitated by eight specially trained frontline employees from across the company, the program has been very well received and supported by site management.

After 10 years of change, Pasminco is a leaner, more focused and integratedorganisation. We recognise the value ofdeveloping our people and engagingthem in the development and living out of a shared vision and values.

People

16

Employee Numbers 1998 1997 1996 1995 1994

Mining* 1242 1214 1339 1320 1295

Metals 1814 1835 1926 1989 2078

Europe 579 575 592 596 18

Exploration/Group Office/GTS 184 173 180 166 161

Total 3819 3797 4037 4071 3552

*includes 51 for Century

The majority of local peoplewho complete Century’semployment skills preparationprogram find full-time jobs onthe project.From left: Gavin Wilson, Lance Rapson and facilitatorDebbie Hanna attend theprogram.

Improving organisational climate Since 1996, Pasminco has conducted six-monthly employee surveys toidentify the factors affecting work climate. In 1997/8, focus groupdiscussions were introduced at sites to obtain more detailed feedbackabout the drivers of perceptions and the changes needed to achieveimprovement.

Objective:Ensure an understanding and

commitment to Pasminco’s Vision & Values

Progress:The Vision & Values program

was extended to the Budel smelter and

Century Project. Employee participation in

Pasminco’s 1997/8 share option scheme was

77%, up from 56% the previous year. More

than 80% of employees now hold options.

1998 Progress Against Objectives

Objective:Develop high-performance

leadership and employee capability

Progress:The new and highly

successful site leadership and systems

training programs are facilitated by

specially trained employee volunteers.

1998 Progress Against Objectives

Development through inter-site transfers and promotionsAn interesting aspect of Pasminco’s approach to employee developmentis illustrated in the increasing number of inter-site transfers, secondmentsand promotions. These internal moves benefit the company as well as theindividuals concerned, by helping to integrate the business andtransferring both skills and best practice.

Pas A/R Final Text 18/9/98 8:22 AM Page 16

17

Pasminco Exploration increasedexpenditure on the Broken HillBlock from $3.3 million in 1996/7to $4.8 million in 1997/8. SeniorGeologist Tim Green andGeophysicist Noelene Dorn of the Broken Hill Explorationteam compare a geology map of the Broken Hill Block Map with an aeromagnetic image to identify potential anomalies.

About a third ofCentury’s employeesfrom local communitiesare female.Century traineesEdwina O’Keefe (left)and Melanie Brandonwith Phil Rolfe.

Laboratory IndustrialChemist Ian Broganprepares samples in theanalytical laboratory atCockle Creek, which testsprocess control samples,product quality and airand water samples as part of the site’s quality and environmentalmanagement systems.

A teamwork approach to Century’s developmentIn keeping with evolving industry practice over the past decade, Century isoutsourcing many activities. Direct employment will focus on those ‘core’activities which only Century itself can perform or which can provide acompetitive edge by being developed in-house.Pasminco, Century Minenco Bechtel Joint Venture (CMBJV) and majorcontractors currently employ over 1,300 people on the mine site, pipeline andport construction areas. Project construction is taking place across the Gulfregion from the Century mine site to Karumba while design and projectmanagement offices are located in Brisbane and Melbourne.

Involving people in new business systemsPreparing people for change is critical to introducing new businesssystems successfully (see Pasminco Business Systems on page 14).Extensive review, consultation, communication and training are under wayso that the company’s employees are ready for the changeover. Around 100 frontline employees will be trained as facilitators and virtuallyeveryone in the company, including senior managers, will receive training.A comprehensive on-line ‘Help’ facility has been developed in-house toensure a smooth transition to the new systems.

Objective:Achieve and maintain trust

through fair, honest and consistent

behaviour

Progress:Employee focus groups

have helped to clarify issues and ensure

that suggestions raised in the Vision &

Values program and climate surveys are

followed up.

1998 Progress Against Objectives

To deliver the project on time and budget, Century is pursuing apartnership approach between owners, project management andcontractors emphasising team-building and commitment. Teamworkdevelopment programs will ensure all teams work together effectively.Local employment is a primary objective of the Gulf CommunitiesAgreement which forms the basis of Century’s partnership with localcommunities. Opportunities are maximised through the use of a Centuryrecruitment database. Each contractor is required to develop a localemployment management plan. All project employees undertake a cross-cultural awareness program and the business ensures that seniormanagers keep up to date on the progress of both the Agreement andother related regional issues.Century has initiated a four-week employment skills preparation programfor local people who may have limited work experience. The program hasbeen successful, with the majority finding full-time employment. Additionalsupport through mentoring programs also helps trainees deal with thedifficulties of separation from family and social networks. New traineeshipprograms include the areas of mining, engineering production, hospitality,pastoral management and clerical/administration.Building relationships within the Gulf region is fundamental to the successof the project. Links have been established with local government,community groups and educational institutions who have all made strongcontributions to the development and implementation of the trainingprograms.

Pas A/R Final Text 18/9/98 8:23 AM Page 17

Pasminco Safety SystemPasminco’s safety standards were expanded during the year. A mandatory procedure was introduced for investigating potentially fatalaccidents. Someone independent of the operation is now involved in such investigations.The Pasminco Safety Policy was reviewed and enhanced, with theobjective of achieving zero incidents becoming a fundamental principle.A timetable of annual audits (by both internal and external parties) of sites’safety and health management systems was agreed, and all operationswere audited during the year.

The focus of measurement to monitorsafety performance was broadenedfrom the traditional emphasis on losttime injuries to encompass any injuriesthat result in medical treatment or selected/restricted duties, whether or not there is losttime (a measure called “serious injuries”). There were 615 serious injuries in 1997/8, of which 95 resulted in lost time. Thiscompares with 835 serious injuries and 80 lost time injuries in 1996/7. The Serious InjuryFrequency Rate (SIFR, the number of serious injuries per million hours worked) showedsteady improvement during the report period, falling from 118 to 77. The Lost Time InjuryFrequency Rate (LTIFR) decreased from 13 to 10 during the same period.

Serious Injury and Lost TimeFrequency Rate 1997/8Serious InjurSerious Injury and Lost Timey and Lost TimeFrFrequency Rate 1997/8equency Rate 1997/8

0

20

40

60

80

100

120

140

00

2020

4040

6060

8080

100100

120120

140140

1Q 9

6/97

2Q 9

6/97

3Q 9

6/97

4Q 9

6/97

5Q 9

7/98

6Q 9

7/98

7Q 9

7/98

8Q 9

7/98

127

13

111

13

118

118

12 13

108

13

105

13

9013

7710

127

13

111

13

118

118

12 13

108

13

105

13

9013

7710

12 Month Moving Average - SIFR12 Month Moving Average - LTIFR

10 9

1 0

JUN95 JUN96 JUN97 JUN98

> = 40 µg/dL* > = 50 µg/dL*

0

20

40

60

80

100

120

140

160

180

00

2020

4040

6060

8080

110000

112020

114040

116060

118080

164

153

80

49

10 9

1 0

10 9

1 0

18

Safety awardsTeams representing Pasminco’s three major sites in New South Walesachieved outstanding results in the NSW Minerals Council’s fifth annualFirst Aid and Rescue Competition held at Broken Hill on 8 November1997. The Broken Hill team took out the Champion Team Cup along witheach of the six individual first aid awards. Cockle Creek’s team was runner-up for the Cup while Elura won the Underground Mines Rescue Event.Presented with the NSW Mining Industry’s Silver Award, Elura was alsorecognised by the NSW Minerals Council and Department of MineralResources for management’s and employees’ efforts in improvingoccupational health and safety systems and performance.

Employee blood lead levelsWorksafe Australia’s national standard for the control of inorganic lead atwork sets a blood lead level of 50 µg/dL. In 1996, Pasminco establishedthe goal, in advance of this Worksafe standard, to have no employees withblood lead levels greater than or equal to 40 µg/dL. Although the target deadline of end calendar 1997 for realising this goalwas not achieved, the number of employees with blood lead levels greaterthan or equal to 40 µg/dL continued to decline during the report period,falling from 80 at end June 1997 to 49 at end June 1998. Following a progress review, the goal level has been reduced further. Thefocus is now on having no employees with blood lead levels greater thanor equal to 35 µg/dL by end June 2002, which is well in advance of theWorksafe standard of 50 µg/dL.

Safety

Mining

SI SIFR LTI LTIFR

Broken Hill 192(204) 139(140) 36(29) 26(20)

Elura 51(29) 76(48) 10(8) 15(13)

Rosebery 72(153) 87(216) 21(15) 25(21)

EBR 29(17) 161(81) 1(1) 6(5)

Century 6 6 2 6.5

Total Mining 25(403) 88(136) 70(53) 18(18)

Australian Smelting

SI SIFR LTI LTIFR

ARA 28(24) 236(162) 6(6) 50(40)

Cockle Creek 81(67) 81(74) 11(14) 11(15)

Hobart 123(246) 88(193) 4(17) 3(13)

Port Pirie 208(228) 98(155) 16(22) 7(15)

Total Australian Smelting 440(565) 95(149) 37(59) 8(15)

European Smelting

SI SIFR LTI LTIFR

Budel 21(33) 21(20) 1(1) 1(1)

Group (includes GTS, Exploration and Group Office)

SI SIFR LTI LTIFR

817(1,002) 77(118) 110(113) 10(13)

*Note: Figures in brackets for 1996/7.

Safety Indicators 1997/8*

The Pasminco Safety Policy wasreviewed and enhanced, with theobjective of achieving zero incidentsbecoming a fundamental principle.

Pas A/R Final Text 18/9/98 8:23 AM Page 18

19

In April 1998, Pasminco brought togethersenior management with safety, health,environment, human resources and publicaffairs practitioners to discuss the nextstep forward in developing a culturededicated to safety and environmentimprovement. Called CleanSafe ’98, the conference was addressed by guestspeakers from academia, government,business and interest groups.

Broken Hill launched several major health andsafety initiatives, includingsponsoring employees to participate in a QuitSmoking program and havetheir blood analysed formultiple health issues as wellas lead levels. (Photo courtesyof Gavin Schmidt, Barrier Daily Truth)

During the year, Port Pirie involved all employees in anintegrated safetytraining program which was developedafter an extensive needs analysis. Here, employees gainpractical experience in the different methodsof fire fighting.

Objective: Ensure a safe

and healthy workplace

Progress: Pasminco’s revised

safety and health policy established the

longer-term goal of achieving an

incident-free organisation. Performance

continued to improve.

1998 Progress Against Objectives

Pas A/R Final Text 18/9/98 8:24 AM Page 19

20

Australian Minerals Industry Code for Environmental ManagementIn August 1997, Pasminco signed the Australian MineralsIndustry Code for Environmental Management, becoming oneof 40 signatory companies operating in Australia and overseas.

Environmental Management SystemsThe Pasminco Environmental Policy was revised to include the requirements of ISO14001 in keeping with the company’saccreditation goal. The baseline audit of sites’ compliance withISO14001 requirements was completed. All sites should be accredited to the ISO14001standard by June 2001.Groupwide objectives to deliver the intent of the environment policywere established, with sites now setting targets for each objective.

Environment

The focus of BrokenHill’s site environmentalprogram is on circuitwater management and rehabilitation for suppression of dustand erosion. At a decommissionedtailings dam on site,Environmental Scientist Greg Scanlan tends to a newly revegetatedarea adjacent to thedam. The recentlycompleted “rockarmouring” of the dam’sexternal face to controldust and erosion can beseen in the background.

Site Environmental Action PlansThe Executive Safety Health and Environment Committee(ESHE) reviewed the progress of the sites’environmental action plans.The review found that 44% of the more serious issuesidentified by the external audits of 1996 have beenresolved to date. The next round of external audits will commence in late 1999.

Publicly Available ReportIn line with the Minerals Industry Code, Pasminco willproduce a publicly available environmental report.Publication is planned for August 1999 followingconsultation with shareholders, employees andcommunities near Pasminco operations about the scope of the report.

Mining CO2 Emissions Breakdown 1997/8

Reagents 3%

Electricity 86%

Petroleum Products 11%

Objective:Minimise our impact

on the environment

Progress:All sites have quantified objectives

to deliver the intent of Pasminco’s

Environmental Policy. The Hobart smelter

stopped producing jarosite and the Budel

plant is set to follow suit when Century

concentrates come on stream.

1998 Progress Against Objectives

Groupwide objectives to deliver the intent of the environment policywere established, with sites nowsetting targets for each objective.

Pas A/R Final Text 18/9/98 8:25 AM Page 20

21

Lead in Air at Cockle Creek Site BoundaryLead in Air Lead in Air ((µµg/mg/m33))

00

11

22

33

44

55

JAN92 JAN93 JAN94 JAN95 JAN96 JAN97 JAN98

Pasminco and NHMRC Goal Pasminco and NHMRC Goal ((1.51.5µµg/mg/m33))

Les Barnett, General Manager, planting the115,000th tree in Port Pirie’s revegetationproject. Standing (from left) are Allan Barnett,and John Caputo of the Environment & PlantServices Department and Kerry Backstrom of Zinc Production.

ComplianceSites are required to report to the ESHE any significantenvironmental incidents and compliance breaches along with plansto avoid recurrences. A ranking system is used to ensure effectiveprioritisation in resource allocation.The main environmental issues for 1997/8 were non-compliancewith the conditions of consent for ambient sulphur dioxide at CockleCreek, some exceedence of the limits in the water permit at BudelZink and of the statutory limit for lead in air at the boundary of theARA Melbourne plant. Projects are currently in progress to resolvethese issues in the short term.

Australian Smelting CO2 Emissions Breakdown 1997/8

Petroleum Products 2%

Coke and Coal 54%

Electricity 32%

Natural Gas 8%

Reagents 4%

00

11

22

33

44

JAN92 JAN93 JAN94 JAN95 JAN96 JAN97 JAN98

Lead in Air at Port Pirie Site BoundaryLead in Air Lead in Air ((µµg/mg/m33))

PPasminco and NHMRC Goal asminco and NHMRC Goal ((1.51.5µµg/mg/m33))Objective:Build community confidence

in our operations

Progress:Established operations extended

their community consultation, sponsorship

and outreach activities, while Century

consolidated and built upon its extensive

community networks.

1998 Progress Against Objectives

Pas A/R Final Text 18/9/98 8:26 AM Page 21

22

Century’s Environmental ProgramGiven the region’s scarcity of water and extreme weather conditions,Century puts a high priority on effective water management. Waterfor the operations will be drawn from a local, unutilised undergroundaquifer. Pumping of the aquifer commenced in 1995. Since this time,groundwater levels in the region have been monitored by 60boreholes to confirm that the drawdown will not impact onvegetation, waterways and the Lawn Hill National Park. A priority isprotecting the nearby Lawn Hill National Park both aesthetically and environmentally. Comprehensive environmental monitoringprograms are in place to ensure that any impacts can be identifiedand managed.

Information from site energymonitoring equipment is used todevelop greenhouse gas reductionstrategies. Electrical ProjectEngineer John Martin (on left) isGreenhouse Coordinator for BrokenHill, seen here discussing data withMaintenance Coordinator ElectricalSteve Corradini and GraduateElectrical Engineer Mark Nash.

Alan Byers,SuperintendentLogistics, in front of the new wharfstorage shed at Hobart,part of the co-treatmentproject which enabledthe end of jarositeproduction anddisposal.

Co-treatmentOn budget and two months ahead of the 31 December 1997deadline agreed with the Australian and TasmanianGovernments, Hobart ended the production and oceandisposal of jarosite. An intermediary product called paragoethiteis now produced in place of jarosite and shipped to Port Pirie toundergo additional treatment and further metal recovery.The co-treatment initiative is a ‘world first’ which establishesnew environmental standards in waste stream management forthe zinc and lead industries.(See also page 14.)

Greenhouse ChallengeIn May 1997, Pasminco joined the Australian Government’sGreenhouse Challenge and committed to a 3% reduction ingreenhouse gas emission rates by the year 2000. The Executive Safety Health and Environment committee(ESHE) oversees and monitors the agreement’s implementationthrough a coordinating team and regularly reports greenhouseemissions and key performance indicators to Government.Progress to date includes the development of a PasmincoGreenhouse Gas Reduction and Energy Efficiency Standard, thetrial of a project audit procedure, the formation of operating siteenergy committees and the commencement of awarenessprograms. Several capital projects which will reducegreenhouse gas emissions have also been initiated, along witha more detailed study of process energy balances.

The Century Environment Committee, consisting of local indigenouscommunities’ representatives, is working with the company to developand monitor environment management programs. Century will makemonitoring data available and provide assistance to the committee toobtain independent advice on matters of concern.

Dr Peter Eaglencalibrates an automaticcreek level monitor whichmeasures water depth aspart of ongoing watermonitoring studies of allsignificant creeks on theCentury lease.

Environment - Continued

Pas A/R Final Text 18/9/98 8:26 AM Page 22

0

4

8

12

16

00

44

88

1122

1166

1 9 9 4 5 6 7 8

15.6

14.5

11.6

10.8

7.7

23

■ Pasminco maintained its vigorous international exploration effort. Expenditure for the year, other than at the operating mines, was $16.8 million.

■ A further $5.1 million was spent on exploration at the operating mines.

■ Total drill meterage decreased throughout the Exploration group to 74,389 metres, compared with 87,298 metres in 1996/7.

Pakistan $4.9m

India $0.9m

Mt Isa Block $2.5m

Broken Hill Block $4.8m

Cobar $1.7m

Tasmania $0.8m

Peru $0.6m

Other $0.6m

Exploration* Expenditure 1997/8*other than at operating mines

Geologist OmarFaiyaz Khan logschips from an air

core drill rig at theLorenzo prospect,

Benagerie Ridge.

Exploration

Review

ofOp

erations

Pas A/R Final Text 18/9/98 8:27 AM Page 23

24

Technology■ In pursuit of its objective “To give

Pasminco the competitive edge in process technology”, Group Technical Support (GTS), has become an increasingly valued resource for technical input at all Pasminco operations.

■ The major challenge for 1997/8 has been tosupport the commissioning and fine-tuning of the co-treatment process at Hobart and Port Pirie.

Highlights for the year in GTS’s main areas include:

Refining/Casting/Products■ supported the rebuilding of Cockle Creek’s furnace during the

campaign shutdown ■ helped develop Pasminco’s casting strategy ■ developed an on-line Pasminco refractories and wear

materials database ■ developed and tested a method to produce quenched bullion

at Cockle Creek

Process Control■ provided technical support and direction for process control system

development at all smelters ■ initiated a process control workshop for managers from all smelters

Exploration ProjectsActivity focused on fewer areas compared with last year, with alladvanced exploration carried out in the districts around Pasminco mines and zinc deposits in NW Queensland, Cobar, Broken Hill,Tasmania and Pakistan.Project generation continued in India, where applications were made forlicences over some interesting mineralised belts, and in Peru, whereprojects, mostly at an advanced stage of exploration, are being soughtand assessed. All international projects are coordinated by our Europeanoffice.

At the Portia prospect, workcontinued to assess theeconomic potential of oxidisedgold mineralisation. Furtherdrilling is necessary to upgradethis mineralisation to resourcecategory leading to a feasibilitystudy. Overall, these resultsprovide strong encouragementfor the presence on theBenagerie Ridge of a significantgold or copper-gold deposit.Exploration in the area willcontinue at a high level.Further drilling in Balochistan,Pakistan, increased thecompany’s level of confidence in the Duddar zinc resource and located a deep new zone. A resource estimate based onthese results (compiled by SteveSullivan, Resource Geologist,Maptek Pty Ltd) shows thedeposit to contain an indicatedresource of 6.8 million tonnes ata grade of 12.6% zinc and 3.0%lead and an inferred resource of6.4 million tonnes at a grade of6.4% zinc and 3.7% lead, bothusing a 7% zinc and lead cut-off.

Results

Exploration was maintained at a high level on the Benagerie Ridge,

where drilling has identified exciting gold and copper-gold mineralisation

at five prospects: Shylock, South Nerissa, Lorenzo, Jessica, North Portia

and Portia.

Highlights of the results received from reconnaissance air core drilling

include:

Drill hole BEN 617- 14m @ 3.2g/t Au from 74-88m (Shylock prospect)

Drill hole BEN 677- 23m @ 79.3g/t Au from 90-113m (Shylock prospect)

Drill hole BEN 657- 13m @ 0.9g/t Au from 50-63m (South Nerrissa

prospect)

Drill hole BEN 862- 18m @ 3.7g/t Au from 110-128m (Lorenzo prospect)

Drill hole BEN 737 - 2m @ 5.1%Cu, 470g/t Ag from 110-112 (Jessica

prospect)

At the North Portia prospect, shallow copper-gold intersections reported

last year were followed up with diamond drilling to test below the oxidised zone.

The best results from the program included:

Drill hole BEN 592- 76m @ 1.2g/t Au and 1.1%Cu from 297-373m

Drill hole BEN 596- 72m @ 0.6g/t Au and 0.7%Cu from 246-318m

Deep drilling establishedadditional potential at depth withhole D102 intersecting 60.3m @ 11.7% zinc and 3.2% leadfrom a depth of 1328.9 to1,389.2 metres. Dispite theseencouraging results, the size ofthe deposit does not allowPasminco to meet its investmentcriteria. Unfortunately, first-passexploration in the wider regiondid not locate any significantadditional resources andconsequently a purchaser is nowbeing sought for Pasminco’srights to 75% of the project.During the year, Pasmincopurchased the Mt Rosebyproject which includes areassurrounding the Dugald RiverDeposit lease in NWQueensland.The area is prospective forextensions of the Dugald depositalong strike, as well as copper -gold mineralisation