Breakup of ruble area lessons for euro

description

Transcript of Breakup of ruble area lessons for euro

Free Slides fromEd Dolan’s Econ Blog

http://dolanecon.blogspot.com/

The Breakup of the Ruble Area (1991-1993):

Lessons for the Euro Post prepared July 3, 2010

Terms of Use: These slides are made available under Creative Commons License Attribution—Share Alike 3.0 . You are free to use these slides as a resource for your economics

classes together with whatever textbook you are using. If you like the slides, you may also want to take a look at my textbook, Introduction to Economics, from BVT Publishers.

Post P100703 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

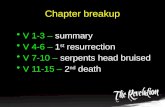

Could the Euro Area Break Up?

Debt crises in Greece, Spain, and other EU members have raised the question— could the euro area break up?

If so, who would leave first? Economically weak members like Greece? Or stronger members like Germany?

These slides look at the breakup of an earlier currency area—the short-lived ruble area of 1991-1993—and draw some lessons for the euro

Post P100703 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

Collapse of the Soviet Union and Emergence of the Ruble Area

The Soviet Union was disolved in December 1991

Each of its 15 former member republics* became independent

Initially, all 15 shared the Soviet ruble as their currency, forming a common currency area superficially similar to the 17-nation euro area

The former branches of the USSR State Bank (Gosbank) became the central banks of the newly independent states

*The Baltic countries, Estonia, Latvia, and Lithuania, had declared independence earlier, in the summer of 1991

Post P100703 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

Inflation in the Ruble Area

Unlike the euro area, the ruble area suffered serious inflation from its birth

Inflation in the ruble area arose from three major problems:1. The legacy of perestroika

2. Monetization of budget deficits

3. Design flaws leading to a free rider problem

Post P100703 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

Problem 1: The Legacy of Perestroika

Perestroika was Mikhail Gorbachev’s failed attempt to reform the Soviet economy in the late 1980s

Rapid growth of money and credit inflated demand, but reforms failed to increase supply of goods

Administrative price controls plus excess demand led to shortages and long lines in stores

When price controls were removed in January 1992, repressed inflation was released and prices jumped upward

Post P100703 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

Problem 2: Monetization of Budget Deficits

Weak, corrupt tax systems and other factors led to large budget deficits

There were no working markets where the deficits could be financed by selling bonds to the public

Governments had little choice but to finance deficits with credits from their central banks, a process that added to the monetary base, the money stock, and inflation

This practice is known as monetization of budget deficits

Post P100703 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

Problem 3: Design Flaws and Free Riders

Within the ruble area, the Bank of Russia had a monopoly on printing paper currency

However, all 15 central banks could create bank credit, causing growth of the money stock

This gave rise to a free rider problem: Each country could use central bank

credit to finance its budget deficit The resulting inflation was transmitted

among all 15 member countries Each country had an incentive to act as

a free rider, enjoying the benefits of credit expansion while shifting the inflationary costs to its neighbors

This chart shows that Ukraine was especially active in creating ruble area money in 1992. After mid-1993, opportunities to play the free rider largely disappeared

Post P100703 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

To stay or to leave?

Reasons to stay . . . The ruble might help maintain trade ties

with Russia and other neighbors Your country might not be ready to

administer its own currency successfully You might want to exploit free rider

opportunities to finance your deficit

Reasons to leave . . . Since Russia was not doing a good job

of managing the ruble, you might want to take control of your own currency to fight inflation

You might want to shift trade away from Russia and other former Soviet states

You might want your own currency as a symbol of your newly-gained independence

As of mid-1992, the pros and cons of staying in the ruble area looked like this . . .

Post P100703 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

The Demise of the Ruble Area

Starting in mid-1992, countries left the ruble area one by one

The Baltic states went first Stronger institutions Wanted to stop inflation Wanted to redirect trade westward Strong nationalistic motivation

In July 1993 Russia replaced the old Soviet ruble with a new Russian ruble, making the ruble area less attractive to others

Tajikistan, torn by civil war, was the last to leave, in May 1995

Post P100703 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

Ruble vs. Euro: Monetary Free Riders and Safeguards

Monetary free riders in the ruble area . . .

The Bank of Russia, as the leading central bank of the ruble area, maintained a monopoly only on issue of paper currency

Other central banks could freely create bank credit

Member countries could act as free riders by financing excessive budget deficits with bank credit, while shifting part of the inflationary consequences to their neighbors

Free rider problem was one of the factors that brought down the ruble area

Safeguards in the euro area . . . European Central Bank maintains

complete control over both paper currency and credit conditions

Central banks of euro countries act only as agents of the ECB, cannot act as free riders in money creation

Some concerns remain about opportunities to seek national advantage in the area of bank regulation, where member countries have more authority

Post P100703 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

Fiscal Fee Riders and Safeguards in the Euro Area

Fiscal free riders in the euro area Euro area governments retain principal

authority over fiscal policy A country that runs excessive budget

deficits gains all the political advantages from high spending and low taxes, but shifts part of burden to other euro countries If ECB needs to raise interest rates to

offset excessively expansionary fiscal policy, it must do so for all members

Unsustainable deficits by one country may undermine confidence in stability of the euro area as a whole and worsen borrowing conditions for all members

Safeguards are not adequate. . . EU rules limit deficits to 3% of GDP and

debt to 60% of GDP, but it has proved impossible to enforce these rules

Euro zone rules contain a strict “no bail out” clause, but this rule has been weakened by the 2010 rescue package for Greece and other high-deficit countries

In the past, the ECB did not purchase bonds of individual member countries, but in 2010 it began to do so under pressure of the Greek crisis

Post P100703 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

Why Some Countries Might Want to Leave the Euro

A number of euro area countries have excessive debt and/or deficits. Their international competitiveness is poor, and they might gain by devaluation if they left the euro

Post P100703 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

Why Weak Economies Would Find it Hard to Leave the Euro

Under current conditions, weak economies would find it hard to leave the euro in order to devalue

Devaluation would cause inflation Devaluation would make it harder to pay

public and private debts and could trigger a default

After default, it might be hard to reenter world financial markets

As people came to expect exit, there could be a run on banks as residents shifted deposits to banks in other euro-area countries

For a good short discussion of the exit problem, see Barry Eichengreen, “The Euro: Love it or Leave it?” http://voxeu.org/index.php?q=node/729

Post P100703 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

Why Strong Economies Found it Easy to Leave the Ruble

Relatively strong countries like the Baltics left the ruble area early and quickly brought inflation under control

Independent currencies helped stabilize local financial systems

Stabilization made it easier, not harder, for countries leaving the ruble to attract foreign finance for public and private debts

Post P100703 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

Lessons for the Euro from the Ruble Experience

Lesson 1: Beware the free rider problem . . .

Free riders can undermine a currency area when they have an incentive to put national interests above the interests of the currency area as a whole

The nature of the free rider problem—monetary vs. fiscal—was different in the ruble area from that in the euro area, but the problem is real in both cases

Lesson 2: Exit barriers are not symmetric

It is hard for countries with weak economies to leave a stable currency area because doing so can trigger defaults and bank runs

These exit barriers do not apply to countries with strong economies that want to leave a weak, inflation-ridden currency area

A hypothetical scenario for breakup of the euro area: A coalition of high-debt countries captures control of the ECB. They try using inflation to ease their debt burdens and stimulate their economies. At that point, strong, low-inflation economies like Germany could be tempted to leave the euro and could do so without risk of default, inflation, or bank runs.