2013 Argentine Financial Crisisiroatuva.org/vamun/images/bg/Argentina.pdf · 2013 Argentine...

Transcript of 2013 Argentine Financial Crisisiroatuva.org/vamun/images/bg/Argentina.pdf · 2013 Argentine...

2013 Argentine Financial Crisis

Committee Letter Dear Delegates, Welcome to VAMUN XXXV! We are thrilled to have you in the Argentine Financial Committee: 2013 and look forward to fruitful and constructive debate. First, let us tell you a little bit about ourselves. Even though we’re second years, we both have experience with Model UN. Most recently, we helped run committees at Virginia Model United Nations XXXIV. Yasmine Mary is a second year planning to major in Politics or Public Policy.intends to study Foreign Affairs and Commerce with a concentration in Finance and in the future hopes to become a human rights lawyer. The Argentine Financial Committee: 2013 will deal with the Argentine default of 2013 and its political and economic repercussions. The committee will also address the anticipated 2015 Presidential Elections. These two topics will come together when the committee assesses the effects of the default in shaping politics surrounding the elections and the detriment or development it has had on the ruling Justicialist Party. It is important for delegates to remember that the Committee’s focus is broader than just the economics of the default. Emphasis will be placed on the overarching political and economic climate in Argentina and how the two interact. Accordingly, delegates will have to be thinking ahead to the 2015 elections even in the default negotiations and be strategic in their demands and alliances within Committee. If you have any questions, please feel free to contact us. We look forward to meeting you in the spring.

Sincerely, Mary Sheers Chair, Argentine Financial Committee: 2013 Email: [email protected] Yasmine El Dessouky Crisis Director, Argentine Financial Committee: 2013 Email: [email protected]

2013 Argentine Financial Crisis

Overview of the Committee The Argentine Financial Committee: 2013 will consist of thirty delegates representing

political and economic stakeholders in Argentina as well as two representatives of the leading

conservative and liberal newspapers in Argentina, in a colloquium. Almost all delegates will

represent the most powerful political leaders in Argentina from all major political parties. Many

of these politicians are contenders for the 2015 presidential election.

In Argentina, the media is closely tied to public opinion and grassroots movements.

Delegates representing Clarin and La Nacion would serve as the Press Corps of the Committee

respectively, working with Crisis, which would act as Press Secretary to break stories. The media

will connect leaders in committee to the public in Argentina. Delegates will have to consider the

ramifications of their actions on the Argentine public and work to build a favorable public image

leading up to the 2015 elections.

The Committee will begin in 2013 as the possibility of default looms over Argentina and

continue until shortly after the 2015 Presidential Elections. Delegates will have to be aware of

the repercussions of the $93 billion default in 2001 (the worst economic crisis in the country’s

history) along with the debt restructuring in 2005 and the 2012 Cacerolazo (the “pots and pans”

protest) which called for the removal of Kirchner as President with slogans like "Argentina,

wake up!" and "Corrupt Cristina."

The Committee will follow parliamentary procedure. Voting procedure will not involve

all delegates. Some delegates will assume an observatory role for certain issues that do not

directly pertain to them (such as Paul Singer with social issues). Delegates with roles in the

media will not be allowed to vote although they may work to influence voters and swing results

2013 Argentine Financial Crisis

one way or another. For a more comprehensive explanation on voting procedure, please see the

Dossier.

The Committee will aim to resolve the looming Argentine default in 2013 and work to

improve the state of the Argentine economy. The Committee will also work to improve the

political situation by attempting to rally consensus behind the government in Argentina and work

to present candidates for the Presidential Elections in 2015

Default, Inflation and Devaluation of Currency

Argentina has a history of defaulting on its debt, with 8 defaults in the country’s 200 year

history. Argentina has grappled with the terms of the 2014 default, which followed a $100 billion

default in 2001.

The Argentine government employed a number of strategies to avoid the 2001 default. In

the 1990s, the Argentine government pegged the peso to the dollar in hopes of slowing rampant

inflation. This slowed inflation without any major negative consequences until European and

Brazilian currencies fell in 1998, causing Argentine exports to be overpriced. In order to resolve

this problem, the government cut wages in Argentina to bring prices down. Argentina’s move to

privatize many industries had both positive and negative effects on the economy, making it more

efficient but also increasing rates of unemployment.

With high levels of unemployment and low levels of confidence from investors, the

Argentine government attempted to appeal to investors with tax increases and spending cuts that

only worsened the problem. Due to the high unemployment levels and inflation, and a lack of

consensus on debt negotiation, Argentina was forced to default, and to this day has yet to pay

back its investors, most notably Elliott Management, a U.S. hedge fund. According to Felix

2013 Argentine Financial Crisis

Salmon, “Argentina has both the willingness and the ability to pay its performing debt. It’s

adamant, however, that it’s not going to pay $1.4 billion to Elliott Management.”

Unlike the Argentine default of 2001, when the economy was collapsing and a popular

revolt had helped topple two presidents in a week, the 2013 default as Reuter’s Hilary Burke puts

it: “is a matter of principle rather than necessity.” In 2013, inflation was estimated to be at about

25 percent and currency devaluation was rampant — the rate of exchange in 2013 was 5.83

pesos to the dollar. In addition to these issues, reserves were down by 20 percent to $34.4 billion,

their lowest level since early 2007, while government spending remained high. 2013 was not a

year of economic strength in Argentina or the world, for that matter. The European economy was

rebounding from a recession in 2013 and remains unstable today while the South American

economy experienced a growth rate of 2.7 percent, one of the lowest in recent years. After U.S.

courts in 2012 ruled in favor of creditors who had rejected negotiated debt exchanges in 2005

and 2010, Elliott Management sued Argentina demanding to be paid in full on their defaulted

bonds. Argentina refused to repay the debt instead pushing for a return of 25 cents on the dollar

as 93 percent of bondholders had accepted. Citing a weak economy and a $100 billion in bonds

default in 2001 which represented 166 percent of their gross domestic product, Argentina claims

that it shouldn’t have to pay back bonds in full if other credit holders had agreed to receive only

25 cents on the dollar. Argentine President Cristina Fernandez de Kirchner accuses Elliott

management of being “vultures” for buying Argentine debt at a low price during the 2001 default

and then expecting full payment.

As Shahriar Shahida, co-founder of Constellation Capital Management LLC in New

York, which is currently invested in Argentina said to Reuters, "This is an unparalleled case of

somebody defaulting not because they don't have capacity, not because they don't have

2013 Argentine Financial Crisis

willingness, but because somebody [Elliott Management] is forcing them to do something

egregious.”

The default was considered a necessary evil by some as the only option given Elliott

Management’s refusal to exchange debt for performing bonds. However, the default has left

lingering problems for the country. In addition to the debt remaining from 2001, Argentina has

not been able to re-enter the global credit market and attract foreign investors. The default also

had some positive effects, as evidenced by economic growth and industries prospering due to

devaluation (including the automobile and tourism industries).

In addition, Argentina abandoned the dollar peg in 2002 following the 2001 default. This

cost Argentina greatly since most of its debt was in U.S. dollars and further damaged the

country’s credibility in global capital markets. When the dollar peg was eliminated, the peso

depreciated greatly and interest rates have risen ever since. In late 2013, Argentina further

devalued its currency by 15 percent causing more uncertainty within the Argentine economy.

Government Spending

Government spending has stayed high despite economic uncertainty in Argentina.

Funding has gone towards costly education reforms, social programs, and subsidies such as

natural gas, electricity, and water. In 2008, President Kirchner nationalized private pension funds

and Argentina’s biggest airline, Aerolineas Argentina, as well as a major oil company. All the

following led to an increase in the printing of money and dwindling of reserves as the Argentine

government struggled to finance itself and reign in its spending. The Argentine government's

decision to print more pesos has led to high rates of inflation, estimated by economists to be over

20%. The government has since made an attempt to stop inflation by keeping industries from

2013 Argentine Financial Crisis

raising prices in the form of price ceilings especially on domestic energy. Price controls on food

and electricity however have only led to shortages and the emergence of a vast black market that

values the peso some 50 percent under the official rate.

President Kirchner has been criticized for spending in a time of economic instability and

for her personal alleged extravagant spending. There have even been suspicions of corruption on

the part of Kirchner and her husband, which have factored into public protests and Kirchner’s

low approval rating. Furthermore, Argentina has lost approximately 40% of its Central Bank

reserves due to high imports of oil and gas. According to the International Policy Digest,

“subsidies and spending increases are causing the Argentinian economy to lose nearly $2 billion

per month.” President Kirchner has also been criticized for her rather arbitrary policy making

which only fuels uncertainty in the Argentine economy and drives away potential investors.

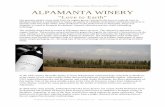

As the graph above by Argentine economist Luis Secco shows, public spending has grown from

being 22 percent of gross domestic product (GDP) in 2002 to being 44 percent of Argentine GDP

2013 Argentine Financial Crisis

in 2013. Argentina is clearly spending beyond its means and continuing to do so will only drive

up inflation and capital flight further weakening the state of the Argentine economy.

On the other hand, opponents of spending cuts point to the benefits of social programs

that would be taken away with decreases in spending. These programs are popular with the urban

poor living in Argentina. Programs include a cash transfer program to encourage school

attendance and regular vaccinations that have decreased poverty and indigence notably since its

inception.

Protests

Economic Issues

In September and November of 2012, hundreds of thousands of peaceful protestors

(estimates vary between 250,000 and 500,000) across Argentina demanded an end to President

Cristina Fernandez de Kirchner’s rule. A nationwide cacerolazo, a demonstration where

protesters beat pots and pans, occurred intermittently for approximately three months. Protesters

were motivated by government's economic legislation in 2012 to stop the flow of U.S. dollars out

of Argentina, among other issues. By making it nearly impossible for Argentines to obtain

dollars legally, the government has given rise to a black market specializing in currency trade.

This legislation still lives on today further adding to Argentina’s economic insecurity. It is

important to note that government discontent stems not only from economic issues such as rising

inflation but growing corruption. President Kirchner has responded to unrest by citing the

success of education reforms and social programs and the recent economic growth.

Corruption

2013 Argentine Financial Crisis

Argentina is notorious for corruption, especially bribery and fraud in business dealings.

As recently as the Summer of 2014, Argentine Vice-President Amado Boudou was charged in a

corruption case in which he was accused of “abusing his power to gain control of a company that

has printed the nation’s currency.” The investigation is still underway. Following the death of

Argentine prosecutor Alberto Nisman early January 2015, thousands of Argentines have taken to

the streets demanding an end to corruption. According to BBC, Nisman’s “body was discovered

just hours before he was due to give evidence to a congressional committee outlining his

accusations against Argentina's President Cristina Fernandez de Kirchner.” The government has

dismissed the allegations claiming that Nisman committed suicide. In a letter posted on her

Facebook page President Cristina Kirchner explained that "Suicide provokes, in all cases, first:

disbelief, and then: questions. What was it that led a person to make the terrible decision to take

his own life?" the letter goes on to condemn Nisman’s allegations as those “intended to lie,

disguise, and confuse.” Such a response by President Kirchner has triggered even more

antagonism amongst Argentines against the government and prompted protesters to hold up signs

saying “Somos todos Nisman nos vas a matar a todos?” (We’re all Nisman, will you kill us all?).

Violence

Violence is another growing issue in Argentina. With the increasing strength of gangs in

the city of Rosario in the province of Santa Fe. Rosario, conveniently located around several

large ports and off of route 34 highway that runs to Bolivia and Paraguay, has seen 264

homicides alone in 2013. President Kirchner has responded by blaming the provincial police

force in Santa Fe and bringing in Board Guards in the city to help quell the violence. However,

the effort has proven feeble and ineffective as violence continues to rise in Rosario

2013 Argentine Financial Crisis

Foreign Investment

According to analyst Jenny Manrique, “the recent agreement Argentina reached with the

Paris Club of creditor nations to resume payment of its $9.7 billion debt seems to be the first step

in its return to international credit markets.” The Paris Club is an informal group of official

creditors “whose role is to find coordinated and sustainable solutions to the payment difficulties

experienced by debtor countries.”

Argentina, despite its most recent default remains an attractive market for major

European and U.S. multinationals according to the Frontier Markets Sentiment Index. This is

largely due to the $15 billion government investment in the Vaca Muerta oil field and $3.86

billion government investment to the mining industry. This implies a potentially robust,

expanding economy for whomever assumes the presidency in 2015. That being said, high

unemployment and inflation rates combined with economic instability has meant increased

investor uncertainty. The three main investors in Argentina are the United States, Spain, and

France. As a result of the global economic recession in 2009, Argentina’s Foreign Direct

Investment (FDI) influx was reduced by approximately 50 percent according to Santander Trade.

According to the World Bank, “between 2012 and 2013 the country's business climate was

deteriorated, it went down five places in the classification Doing Business (it ranked 126 out of

189 countries in 2013).” In September of 2014, the Argentine government adopted a reform bill

which aims to lure foreign investors to develop Argentina’s shale oil and gas reserves. The bill

will cut the minimum investment needed for companies to be exempt from import and export

capital controls. Additionally, companies would be allowed to increase royalties by three percent

and a maximum of eighteen percent. All the following is meant to increase foreign investment

2013 Argentine Financial Crisis

and decrease uncertainty surrounding the Argentine economy. Indeed as a response to the bill,

Malaysia’s state oil firm Petronas contributed $475 million to Argentine oil exploration.

It should be noted that Argentina has not signed any free trade agreements in the past

several years. Argentina’s continued membership in Mercosur, (a trading bloc that includes

Argentina, Brazil, Bolivia, Paraguay, Uruguay, and Venezuela, hinders its potential to expand

trade with other Atlantic countries.

This, combined with the serious financial struggles Argentina was facing, made it more

difficult for Argentina to receive foreign aid and attract foreign direct investment.

2015 Presidential Elections

According to the Argentine National Electoral Register, the first round of Presidential

Elections are scheduled to take place on October 25, 2015, with a run off on November 24 if no

candidate succeeds in receiving 45% of the votes.

President Cristina Fernandez de Kirchner will be unable to run as the Argentine

constitution sets a two term limit for presidential office. Kirchner’s approval rating fell as low as

25 percent in 2014. Argentine opposition leaders have continuously accused Kirchner of being

“completely out of touch with reality.” In October of 2014, Kirchner publicly addressed

Argentines to ‘expose’ US plots to oust her. In a speech she was quoted saying: “If something

should happen to me, don’t look to the Middle East, look to the North.” Such musings have only

added to her growing unpopularity.

Analysts expect the Peronist vote to rally behind Governor Daniel Scioli or Sergio Massa,

although Kirchner has yet to decide which of whom to back publicly. Analysts have speculated

an alliance between the Broad Front and UNEN Coalition to end Kirchner rule. According to

2013 Argentine Financial Crisis

Diego Coatz, chief economist at the Argentine Industrial Union, poverty, inflation, and the

exchange rate are issues that “will be put on the public agenda by the candidates.”

Most of the issues important to voters are economic. In addition to calling for reduced

rates of inflation and a stabilized exchange rate, the Argentine public is looking for a return to

the international market and continued subsidies for public welfare programs. Social issues at the

forefront for voters include violence and muggings in Argentine cities and governmental

corruption. Candidates will have to address these issues to appeal to voters going into the

elections.

Questions to Consider Should the peso be pegged to the dollar or abandoned altogether? Should government spending be cut and, if so, where will cuts be made? To what extent is the Argentine 2013 default an extension of the 2001 default? In other words, how are the two defaults connected? To what extent is President Cristina Fernandez Kirchner to blame for the state of the Argentine economy? How has the Argentine 2013 default impacted politics and how do you expect it to affect the 2015 Presidential elections? Recommended Research Tools Buenos Aires Herald (http://www.buenosairesherald.com/) The leading English newspaper in Argentina, The Buenos Aires Herald is a good source to gauge Argentine popular opinion and keep up with Argentine news. The Buenos Aires Herald is mostly unbiased unlike other Argentine newspapers such as Clarin and La Nacion.

2013 Argentine Financial Crisis

Clarin (http://www.clarin.com/) The leading liberal newspaper in Argentina, Clarin is a good source to better understand Argentine politics from local analysts. Delegates should however be cautious that Clarin very much represents one side of the spectrum. La Nacion (http://www.lanacion.com.ar/) The most popular conservative newspaper in Argentina, La Nacion is a useful source for insightful op-eds. La Nacion is a good representation of one Argentine faction, notably that of the right. Delegates again should realize the political standing of La Nacion and how that affects their reporting.

Argentina since the 2001 crisis : recovering the past, reclaiming the future edited by Cara Levey, Daniel Ozarow, and Christopher Wylde.

This book is a collection of short process analysis pieces by experts on the Argentine 2001 default. Chapter 10 entitled “Assembling the past, performing the nation: the Argentine bicentenary and regaining of public space in the aftermath of the 2001 crisis” is particularly useful to delegates as it places the 2001 default in context and analyzes the repercussions of the crisis.

And the money kept rolling in (and out) : Wall Street, the IMF, and the bankrupting of Argentina by Paul Blustein

This book is quite useful in examining the external forces (international organizations like IMF and hedge funds like Elliott Management) in bringing about the first Argentine default. The book also evaluates the continuing role these outside forces have in shaping the Argentine economy for better or worse. The Buenos Aires Subway Strike: A Window on Post-Collapse Labor Politics by Rene Rojas This article tracks the labor sector of Argentina through the August 2012 subway protests. Additionally, the political and economic developments of Argentina as of March 2014 are outlined and assessed vis-à-vis President Cristina Fernandez de Kirchner leadership style and policies.

Don't Cry for Argentina-It Is Not 2001 Again by Robert H. Scott and Kenneth Mitchell

In this article the authors argue that the Argentine economy has the potential to prosper despite the 2013 default. The authors do so by tracking changes in Argentine economy policies

2013 Argentine Financial Crisis

in the past decade, citing tax reforms as a major positive contribution to the Argentine economy. Interestingly, not much weight is given to the 2013 default although it is examined. Argentina: Scattered Opposition and the Rise of Cristina Fernández de Kirchner by Gabriela Catterberg and Valeria Palanaza This article examines the rise of President Cristina Kirchner, as the title suggests, beginning with the death of former President Nestor Kirchner to Cristina’s overwhelming victory in the 2011 Presidential Elections. The charts in this article are particularly helpful in understanding the political, social, and economic trends and developments within the opposition and within Argentine politics as a whole during the 2010-2011 period that consolidated Cristina’s presidency.

Broken promises?: the Argentine crisis and Argentine democracy edited by Edward Epstein and David Pion-Berlin

This book comprehensively explains the Argentine governing system with respect to the Argentine constitution. It examines the role of public opinion and the middle class in Argentine politics and how these factors have influenced the handling of the 2001 default. This book is useful in understanding the intricacies and workings of the Argentine political system. Bibliography "Argentina on the Brink." The New York Times. January 28, 2014. Accessed January 13, 2015.

http://www.nytimes.com/.

"Argentine Presidential Election 25 October 2015, and Run-off 24 November." MercoPress. September 3, 2014. Accessed January 4, 2015. http://en.mercopress.com/2014/09/03/argentine-presidential-election-25-october-2015-and-run-off-24-november.

Goni, Uki. "Argentina President Claims US Plotting to Oust Her." The Guardian. October 1, 2014. Accessed January 10, 2015. www.theguardian.com%2Fworld%2F2014%2Foct%2F01%2Fargentina-president-claims-us-plot.

Goni, Uki. "Argentina Protests: Up to Half a Million Rally against Fernández De Kirchner." The Guardian. November 9, 2012. Accessed January 10, 2015. www.theguardian.com%2Fworld%2F2012%2Fnov%2F09%2Fargentiana-protests-rally-fernandez-kirchner.

2013 Argentine Financial Crisis

Manrique, Jenny. "Argentina's Economy and the 2015 Presidential Elections." Americas Quarterly. July 11, 2014. Accessed January 4, 2015. http://www.americasquarterly.org/content/argentinas-economy-and-2015-presidential-elections.

Newbery, Charles, and Alexei Barrionuevo. "As Greece Ponders Default, Lessons From Argentina." The New York Times. June 23, 2011. Accessed January 11, 2015. http://www.nytimes.com/.

O'Brien, Matt. "Everything You Need to Know about Argentina’s Weird Default." Washington

Post. March 1, 2014. Accessed January 10, 2015. http://www.washingtonpost.com/. Parks, Ken. "Argentina Moves to Trim Costly Utility Subsidies." WSJ. March 27, 2014.

Accessed January 13, 2015. http://www.wsj.com/. Perez, Santiago, and Taos Turner. "In Argentina, Mix of Money and Politics Stirs Intrigue

Around Kirchner." WSJ. July 28, 2014. Accessed January 13, 2015. http://www.wsj.com/.

Bacon, Kathleen. "Five Years of Presidency, What Should Be Remembered of Cristina

Fernández De Kirchner?" Council on Hemispheric Affairs. September 13, 2012. Accessed January 15, 2015. http://www.coha.org/.