Argentine Power Sector

15

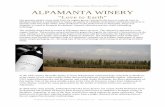

1 Argentine Power Sector CAMMESA Wholesale Electric Market Management Company Update APEX 2000 Conference

description

Wholesale Electric Market Management Company. Argentine Power Sector. Update APEX 2000 Conference. CAMMESA. Outline. Basic rules, global figures Changes in the demand Changes in the supply Impact of these changes in the market and the operation Rules – more significant changes - PowerPoint PPT Presentation

Transcript of Argentine Power Sector

SITUACIÓN DEL MERCADO DEL GAS NATURAL EN ARGENTINA:

REGULACIONESUpdate APEX 2000 Conference

Impact of these changes in the market and the operation

Rules – more significant changes

STABILIZED SEASONAL PRICES FOR DISTRIBUTORS

HOURLY PRICES IN SPOT MARKET

ADDITIONAL PAYMENT FOR CAPACITY (10 $/Mwh; 90 hours per week)

OPEN ACCESS TO THE TRANSMISSION GRID

HOURLY NODAL PRICES AND LOCAL PRICES DUE TO TRANSMISSION CONSTRAINTS FOR EACH NODE OF THE EHV GRID

REMUNERATION FOR ANCILLIARY SERVICES

Basic Market Operating Rules

*

Changes in the demand => incorporation of a new 1000 MW (about 15 % of local demand) interconnection with Brazil, mainly to export when Brazil is short of hydroelectric availability. Projects for another 100 MW in 2001 and 2003.

Changes in the supply => incorporation of high technology generation equipment, basically large combined cycle plants (800 MW), replacing less efficient steam turbine plants.

Changes - Demand and supply

Impact of these changes in the market and the operation =>

Highly variable demand of Brazil increases energy prices volatility, augmented in winter due to the rise of oil prices. The interconnection enables to share short term and instantaneous reserves (Brazil’s system is five times Argentina’s one in size)

New generation plants are very efficient (gain of about 30%). On the other hand, they are very large in relation with the demand (about 10%), which requires the adaptation of reserves according to their reliability. The risk of Underfrequency Load Shedding (UFLS) due to Combined Cycle (CC) trips may affect quality standards.

Changes - Demand and supply

*

A new market has been created to remunerate certain demands offering the anticipation of underfrequency load shedding (exports to Brazil, electro-intensive industries) to reduce the action of the UFLS scheme of the rest of the demands. This system mainly profits out from the availability of the interconnection with Brazil to reduce the risk of local UFLS occurrence, particularly due to CC trips.

Rules – more significant changes

49.9

49.92

49.9

49.4

48.8

49.421

49.2

49.7

49.7

Gráfico4

0

0

4

4

5

5

7

7

11

11

20

20

35

35

50

50

60

60

SRI

49.9

49.9

49.92

49.92

49.9

49.9

49.4

49.4

48.8

49.058

49.421

49.588

49.2

49.492

49.7

49.742

49.7

49.734

Hoja1

0

49.9

49.9

4

49.92

49.92

5

49.9

49.9

7

49.4

49.4

11

48.8

49.058

20

49.421

49.588

35

49.2

49.492

50

49.7

49.742

60

49.7

49.734

Hoja2

-5

49.9

49.9

-1

49.92

49.92

0

49.9

49.9

2

49.4

49.4

Hoja3

*

More flexible price declarations (from the present six months in advance to one week in advance), allowing to declare different blocks for the same unit and in different hours

Capacity payments not depending on the actual dispatch (like now), but on an average weekly dispatch. Charges in case declared weekly availability is not reached.

Thermal reserve payments for the dry hydrological year assigned on a competitive basis and similar charges criteria.

Future Changes - Rules

*

For the year 2002, another 1000 MW exports to Brazil will deepen the impact, increasing volatility and enabling to share reserves in critical times.

Since its beginning, the WEM in Argentina has been characterised by a very strong and competitive market in the generation sector, which has led to excellent results allowing not only to cover the local demand but also to export a significant amount of energy (up to 3000 MW in the next years). Average prices rounded from 2 to 3 cents/kWh. Strong signals through nodal prices at each node of the EHV grid are given. No significant stress due to sustained high prices occurred and demand has been satisfied virtually without problems. Last year’s liberation for 30 kW consumers, anyway, didn’t have a major impact.

Conclusion - Trends - Challenges

*

Proposed rule changes are oriented to increase competition in the WEM, gradually tending to a commodity market. The changes in the interconnected system will lead to adjustments in rule modifications to adapt them to the future. CAMMESA, as administrator of the market, must be flexible enough to adapt efficiently to rapid changes.

Conclusion - Trends - Challenges

¡Thanks for your attention!

48.6

48.8

49.0

49.2

49.4

49.6

49.8

50.0

010203040506070

Seg

Hz

SRI

15

20

25

30

35

40

45

50

55

19921993199419951996199719981999

$/MWh

diciembre de cada año

Impact of these changes in the market and the operation

Rules – more significant changes

STABILIZED SEASONAL PRICES FOR DISTRIBUTORS

HOURLY PRICES IN SPOT MARKET

ADDITIONAL PAYMENT FOR CAPACITY (10 $/Mwh; 90 hours per week)

OPEN ACCESS TO THE TRANSMISSION GRID

HOURLY NODAL PRICES AND LOCAL PRICES DUE TO TRANSMISSION CONSTRAINTS FOR EACH NODE OF THE EHV GRID

REMUNERATION FOR ANCILLIARY SERVICES

Basic Market Operating Rules

*

Changes in the demand => incorporation of a new 1000 MW (about 15 % of local demand) interconnection with Brazil, mainly to export when Brazil is short of hydroelectric availability. Projects for another 100 MW in 2001 and 2003.

Changes in the supply => incorporation of high technology generation equipment, basically large combined cycle plants (800 MW), replacing less efficient steam turbine plants.

Changes - Demand and supply

Impact of these changes in the market and the operation =>

Highly variable demand of Brazil increases energy prices volatility, augmented in winter due to the rise of oil prices. The interconnection enables to share short term and instantaneous reserves (Brazil’s system is five times Argentina’s one in size)

New generation plants are very efficient (gain of about 30%). On the other hand, they are very large in relation with the demand (about 10%), which requires the adaptation of reserves according to their reliability. The risk of Underfrequency Load Shedding (UFLS) due to Combined Cycle (CC) trips may affect quality standards.

Changes - Demand and supply

*

A new market has been created to remunerate certain demands offering the anticipation of underfrequency load shedding (exports to Brazil, electro-intensive industries) to reduce the action of the UFLS scheme of the rest of the demands. This system mainly profits out from the availability of the interconnection with Brazil to reduce the risk of local UFLS occurrence, particularly due to CC trips.

Rules – more significant changes

49.9

49.92

49.9

49.4

48.8

49.421

49.2

49.7

49.7

Gráfico4

0

0

4

4

5

5

7

7

11

11

20

20

35

35

50

50

60

60

SRI

49.9

49.9

49.92

49.92

49.9

49.9

49.4

49.4

48.8

49.058

49.421

49.588

49.2

49.492

49.7

49.742

49.7

49.734

Hoja1

0

49.9

49.9

4

49.92

49.92

5

49.9

49.9

7

49.4

49.4

11

48.8

49.058

20

49.421

49.588

35

49.2

49.492

50

49.7

49.742

60

49.7

49.734

Hoja2

-5

49.9

49.9

-1

49.92

49.92

0

49.9

49.9

2

49.4

49.4

Hoja3

*

More flexible price declarations (from the present six months in advance to one week in advance), allowing to declare different blocks for the same unit and in different hours

Capacity payments not depending on the actual dispatch (like now), but on an average weekly dispatch. Charges in case declared weekly availability is not reached.

Thermal reserve payments for the dry hydrological year assigned on a competitive basis and similar charges criteria.

Future Changes - Rules

*

For the year 2002, another 1000 MW exports to Brazil will deepen the impact, increasing volatility and enabling to share reserves in critical times.

Since its beginning, the WEM in Argentina has been characterised by a very strong and competitive market in the generation sector, which has led to excellent results allowing not only to cover the local demand but also to export a significant amount of energy (up to 3000 MW in the next years). Average prices rounded from 2 to 3 cents/kWh. Strong signals through nodal prices at each node of the EHV grid are given. No significant stress due to sustained high prices occurred and demand has been satisfied virtually without problems. Last year’s liberation for 30 kW consumers, anyway, didn’t have a major impact.

Conclusion - Trends - Challenges

*

Proposed rule changes are oriented to increase competition in the WEM, gradually tending to a commodity market. The changes in the interconnected system will lead to adjustments in rule modifications to adapt them to the future. CAMMESA, as administrator of the market, must be flexible enough to adapt efficiently to rapid changes.

Conclusion - Trends - Challenges

¡Thanks for your attention!

48.6

48.8

49.0

49.2

49.4

49.6

49.8

50.0

010203040506070

Seg

Hz

SRI

15

20

25

30

35

40

45

50

55

19921993199419951996199719981999

$/MWh

diciembre de cada año