What's Sold! Quarter 3, 2014

-

Upload

first-national-nerang -

Category

Documents

-

view

217 -

download

1

description

Transcript of What's Sold! Quarter 3, 2014

Station Street, Nerang, 1933

Quarterly Market Report

Nerang

What’s Sold!

Nerang & Surrounding Suburbs

55960055 | nfn.com.auEarle Plaza, Cnr Price & White Sts., Nerang

Welcome...We hope you find our second edition of the Quarterly Market report to be an interesting tool to help you keep in tune with local market trends and values.

Whether you’re planning to sell, buy a home or an investment property, timing and market conditions are important factors to consider.

For sellers, house values have finally recovered from the post GFC slump, having returned to their previous 2010 peaks. Interestingly, the volumes of property for sale across the market are significantly lower than normal market conditions, so with the current strong buyer demand, time on market has reduced noticeably over the previous 2 quarters.

This makes it an ideal time for sellers planning to upgrade or downsize to make a move now that values have recovered. Delaying such plans until values increase further really achieves little as the purchase price for the next property will have also increased.

For anyone planning to buy at the moment, timing couldn’t be better as far as interest rates are concerned, with the reserve bank holding rates at an all-time low for 15 months in a row as at the time of writing this article. With affordable values and the ability to fix low interest rates, conditions are optimal for buying or selling.

In summary, the best way to describe the local market is that it’s a steady stable and healthy market at the moment, certainly not a boom period and is not likely to be for some time, which is probably a good thing from an affordability viewpoint.

If you’re considering selling, we’d be delighted to offer you an obligation free market appraisal along with our suggestions for presentation that will help you to secure a premium price. Even if you’re not planning to sell until well into the future, we’d be happy to give you our assessment now and later updates as the market changes. This can also be handy to know so that you can make sure your home insurance cover is adequate.

With over 23 years serving the local community, First National Nerang is the longest established agency in the region with a team sharing more than 90 years of combined sales experience with the company, so you can be well assured of reliable accurate advice, sound local knowledge and professional expertise.

Mike GrayPrincipal

to your Quarterly Market Report.

In this issue...

What’s SoldQuarterly Sales Stats 2

Selling TipsCheck out our tips on how to present your home for sale 11

Price Movements 3Sold Pictorials 4 - 10

WinCheck out our tips on how to present your home for sale Back Page

1

Investment Tips 15

Nerang Highland Park

Carrara West

Worongary Gilston

Sales 50 21 21 11 4Median Price $386,000 $437,500 $455,000 $395,000 $472,500Lowest $255,000 $344,000 $343,500 $334,000 $427,500Highest $621,500 $620,000 $556,000 $620,000 $630,000

Nerang Highland Park

Carrara West

Worongary Gilston

Sales 29 8 16 0 0Median Price $244,000 $255,000 $256,000 0 0Lowest $195,000 $188,000 $285,000 0 0Highest $353,000 $289,000 $316,000 0 0

HOUSE Sales Residential Homes on lots under 2000m2

UNIT Sales Townhouses/Units/Apartments

This information is sourced from www.pricefinder.com.au, RP Data and the records of First National Nerang. Sales dollar amounts are rounded within $500 and whilst every effort is made to provide accurate figures they cannot be guaranteed and should be deemed as indicative. Parties should rely on their own enquiries and First National Nerang

will not be held liable for errors herein.

Quarterly Sales Statistics 1 July - 30 September, 2014Local Area and 4211 Postcode

108

Houses Sold

53

Units Sold

Acreage HOUSESLots over 2000m2

Vacant ACREAGE Lots over2000m2

Vacant RES. LANDLots under2000m2

Sales 12 1 1Median Price $685,000 $320,000 $244,500Lowest $330,000 $320,000 $244,500Highest $1,100,000 $320,000 $244,500

OTHER Sales 4211 postcode

12 Acreage Homes Sold

1 Acreage Lots Sold

1 Residential Lots Sold

2

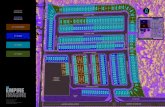

Nerang

SALES Volumes and PRICE Movement Charts - past 10 years

HOUSES

UNITS

3

Ner

ang

: Hou

ses

Ner

ang

: Hou

ses

2 ACERO CRT

$344,000 405m24 1 2

4/22 BALOO CRES

$340,000 167m24 2 2

5/22 BALOO CRES

Price Not Disclosed 165m24 2 2

30 BALOO CRES

$595,000 2,688m24 1 3

132 BEAUDESERT-NERANG RD

$360,000 777m23 1 1

9 BELTANA WAY

$360,000 405m23 1 3

26 BENT ST

$415,000 936m24 1 2

15 BUSHMEAD ST

$370,000 809m23 1 2

33 CITRUS DR

$360,000 675m23 1 2

114 DUGANDAN ST

$345,000 600m23 1 1

23 COLRENE DR

$430,000 802m24 2 2

2 COLRENE CT

$450,000 790m24 2 4

9 MAROONG CRES

$455,000 1,252m24 2 2

25 KOOLA DR

$340,000 1,025m2

13 INVERNESS CT

$387,000 519m23 2 3

4 HYDE CRT

$390,000 891m23 1 2

15 HOBAN CT

$416,250 869m24 2 1

2 GUM LEAF CT

$345,000 333m23 2 1

60 EUREKA CRES

$435,000 848m24 2 2

6/11 EDEN CT

$385,000 288m23 2 2

7/11 EDEN CRT

$435,000 371m24 2 2

53 MARTIN ST

$255,000 604m23 1 2

79 MCLAREN RD

$440,000 619m24 2 4

5 MEDELLIN PL

$359,000 470m23 1 2

Ner

ang

: Hou

ses

Ner

ang

: Hou

ses

11 MIRO PL

$384,000 470m25 2 2

6 MOOYUMBIN CT

$495,000 860m24 2 2

20 MORTENSEN RD

$347,000 885m23 1 1

45 MORTENSEN RD

$329,000 680m23 1 1

2 ODOWD CT

$380,000 415m23 1 1

69 OAKDALE AVE

$386,000 483m24 2 2

36 ONSLOW ST

$395,000 600m25 2 3

24 PADAUK DR

$469,000 835m24 2 2

30 PADAUK DR

$483,000 809m25 3 2

4 POPLAR PL

$343,000 420m23 1 1

6 PATRICIA CT

$480,000 909m24 2 2

13 PALADIN CRT

$382,000 845m24 2 1

22 TIRRING ST

$538,500 1,021m24 3 2

12 THE ZENITH

$343,900 716m23 1 2

22 THE MORES

$425,000 870m25 2 2

18 TEASDALE DR

$419,500 857m23 2 -

5 SEATON CRT

$372,500 671m23 1 2

15 RIVERVIEW RD

$350,000 549m23 1 2

95 RIVERPARK DR

$377,000 600m23 2 2

50 RIVERLEA WATERS DR

$621,5004 3 3

14 RIVERLEA WATERS DR

$477,5003 2 4

61 WARRENER ST

$315,000 546m22 1 2

4 WEDGETAIL LANE

$360,000 403m23 2 2

14 WINCHESTER DR

$400,000 1,158m24 2 2

Hig

hlan

d P

ark:

Hou

ses

Ner

ang

: Hou

ses 33 YARRIMBAH DR

$551,000 1,409m24 2 2

27 YOOLANTIE CRES

$436,000 1,012m24 2 2

2 ABERDEEN CT

$437,500 866m25 2 2

185 ALEXANDER DR

$395,000 749m23 2 2

6 ANGUS CRT

Price Not Disclosed 972m2

1 ARDROSSAN PL

$440,000 1,156m25 3 2

22 KILMARNOCK CL

$424,000 711m23 2 1

11 ISSELL PL

$380,000 727m23 2 1

3 GLENGARRY CL

$380,000 676m24 2 2

98 EXPLORERS WAY

$550,000 1,008m24 2 2

Hig

hlan

d P

ark:

Hou

ses

44 RENFREW DR

$577,500 2,226m24 3 2

22 RENFREW DR

$552,500 1,510m25 2 5

7 PAULINE PL

$365,000 864m23 2 2

42 ORLANDO CT

$435,000 713m24 2 1

17 ORLANDO CRT

Price Not Disclosed 797m23 1 2

31 TARA VISTA BVD

$550,000 823m26 3 2

7 TOUKLEY CT

$370,000 773m2

2 MORAY CT

$462,500 783m23 2 4

5 MEREWETHER CT

$344,000 1,016m23 1 2

12 MERCURE PL

$620,000 605m25 3 2

46 RENFREW DR

$590,000 1.400m25 2 2

5 MACDUFF CT

$435,000 795m23 2 4

3 2 1

3 1 4

A massive thanks to First National Nerang for the purchase of our first home! Professional, informative and helpful 10/10

Car

rara

Wes

t: Hou

ses121 ALISON RD

$556,000 1,164m24 3 2

13 ANCONA ST

$343,500 837m23 1 1

12 AVONBURY CRT

$415,000 753m23 2 2

16 AVONBURY CT

$500,000 773m25 2 2

2 BALTIMORE CT

$540,000 739m24 2 2

5 GARNET CT

$500,000 1,133m25 2 2

22 MICHELMORE RD

$480,000 830m23 2 2

96 PLATEAU CRES

$440,000 783m24 2 1

80 PLATEAU CRES

$490,000 786m24 2 2

20 PLATEAU CRES

$435,000 757m25 2 2

28 PAUL CT

$355,000 695m23 1 1

46 PADDINGTON DR

$430,000 551m23 2 2

Car

rara

Wes

t: Hou

ses

2 TIVOLI CRT

$415,000 716m23 1 2

18 TARA TCE

$510,000 562m24 3 2

2 REMOUNT PL

$367,000 660m23 1 1

6 LARK CRT

$540,000 909m24 2 2

6 JERROB CT

$455,000 1,024m23 1 2

11 GREENBANK CCT

$550,000 840m24 3 2

9 GREENBANK CRCT

$475,000 600m24 2 2

6 GREENBANK CCT

$415,000 600m23 2 2

8 MERCATOR CT

$382,000 627m23 2 1

6 GLENN CRT

$410,000 785m23 2 2

351 HINKLER DR

$334,000 748m24 1 4

5 KAMBALDA CT

$620,000 750m25 3 2

12 SILVEREYE CCT

$630,000 1,033m24 3 3

22 MOONDANI DR

$427,500 645m24 2 2

8 KOEL DR

$451,050 638m24 2 2

21 KEITH RUDD DR

$467,500 600m24 2 2

Gils

ton:

Hou

ses

Ner

ang

: Units 15/41 BELTANA WAY

$285,0003 2 1

23/1 BOULTON DR

$353,0003 2 2

22/4 BUSHMEAD ST

$244,0003 1 1

320/64 GILSTON RD

$285,0003 2 1

2/64 GILSTON RD

$260,0003 2 1

Wo

rong

ary:

Hou

ses 14 BARRINE DR

$395,000 759m23 2 2

39 BARRINE DR

$408,000 750m23 2 2

6 BORMAN CRT

$410,000 677m23 1 1

67 EXPLORERS WAY

$367,000 780m23 1 1

68 EXPLORERS WAY

$360,000 700m23 2 2

4 GILES GR

$373,000 852m23 1 2

15 NABARLEK DR

$420,000 1,221m25 2 2

17 NABARLEK DR

$360,000 1,476m24 2 1

18 SILVEREYE CCT

$472,500 833m24 2 2

14 SILVEREYE CRCT

$536,000 805m24 2 2

Please note: Some sold property photos and descriptions may not appear on these pages.

Ner

ang

: Units

73/32 RIVERVIEW RD

$251,9003 2 1

328/64 GILSTON RD

$265,0003 2 1

4/82 LAWRENCE DR

$237,0002 1 1

18/86 LAWRENCE DR

$212,5002 1 1

1/6 COLERIDGE CT

$307,0002 1 2

1/5 ODOWD CT

$310,0003 1 1

6/125 PAPPAS WAY

$214,500

43/125 PAPPAS WAY

$217,5002 1 1

55/125 PAPPAS WAY

$215,0002 1 1

1/8 RIMU PL

Price Not Disclosed

3 2 1

2/32 RIVERVIEW RD

$260,0003 1 1

2/81 RIVERPARK DR

$350,0004 2 1

10/36 WEEDONS RD

$250,0002 1 1

34/36 WEEDONS RD

$255,0002 1 1

9/11- 13 MARTIN ST

$195,0002 1 1

87/32 RIVERVIEW RD

$255,0003 2 1

Ner

ang

: Units

17/52 TO 54 MARTIN ST

$212,0002 1 1

7/8 MYLOR ST

$200,000

8/8 MYLOR ST

$240,5003 1 2

5 DAHLIA COURT 67 NERANG ST

$218,0003 1 1

1 FERN COU 67 NERANG ST

$212,5003 1 1

2/84 NERANG CONNECTION RD

$210,0002 1 1

5/67 NERANG ST

$218,0003 1 1

2 1 1 3 1

We couldn’t be happier with you as an agent and we would (and will) go out of our way to recommend your agency to anyone who will listen.

10

10/5 BALFOUR CRES

Price Not Disclosed

2 1 0

12/5 BALFOUR CRES

$188,0002 1 1

Hig

hlan

d P

ark:

Units

1/7 WIRTH TCE

$289,0002 1 1

52/6- 20 BEN LOMOND DR

$260,0003 1 2

2/11 WIRTH TCE

$278,0002 1 1

13/11 BALFOUR CRES

$222,5002 1 1

5/1B MCLEOD ST

$220,0002 1 1

6/8 KILPATRICK CT

$255,0002 1 1

Car

rara

Wes

t: Units

41/42 MUREV WAY

$227,5003 1 2

36/38 -40 MUREV WAY

$240,0003 1 1

82/1 COELIA CRT

$310,0003 2 1

70/28 ANCONA ST

$283,0003 2 1

31/28 TO 30 ANCONA ST

$246,0003 1 1

51/1A ALISON RD

$285,0003 2 1

52/42 TO 46 MUREV WAY

$227,5002 2 1

5/53 TO 55 PADDINGTON DR

$295,0003 2 1

Car

rara

Wes

t: Units

26/1A ALISON RD

$273,0003 2 1

22/1A ALISON RD

$285,0003 2 2

41/1A ALISON RD

$316,0003 2 2

27/1A ALISON RD

$249,0002 1 1

11/2 PAPPAS WAY

$265,0003 1 2

43/125 PAPPAS WAY

$217,5002 1 1

2/5 STORMBIRD PL

$315,0003 2 1

55/125 PAPPAS WAY

$215,0002 1 1

11

Sales activity across Queensland over the June quarter was up across all property types, according to the Real Estate Institute of Queensland (REIQ).

The REIQ Queensland Market Monitor for the June Quarter 2014 reveals increases in preliminary sales for house, units and townhouses. Vacant land sales were up an impressive 37 per cent.

REIQ Acting CEO Antonia Mercorella said while the state’s total house sales were up across all price points, the upper end of the market continued to perform strongest.

“Sales in the million dollar plus price point were up 28 per cent across Queensland, with an increase of 20 per cent in the $500,000-plus range,” she said.

“Million dollar sales in the unit market also strengthened, with preliminary sales numbers across Queensland up around 10 per cent.”

Ms Mercorella said the increase in sales activity was predominantly recorded in the southeastern corner of the state.

“The Brisbane Local Government Area led the charge with an increase of 19 per cent, closely followed by Logan, which was up 18 per cent,” she said.

“Brisbane’s unusually robust winter sales look set to be replicated in a number of real estate markets

throughout the State amid increasing demand, sales volumes and prices.

“The strongest performing sectors of the Brisbane house market were at opposite ends of the spectrum, with increases in the sub-$350,000 and $1 million price brackets helping the city to its fifth consecutive quarter of growth.

“On the Gold and Sunshine Coasts, sales activity remained relatively stable over the quarter amid rebounding confidence in both markets. The Gold Coast median house price rose three per cent to $515,000 over the June quarter, with median prices on the Sunshine Coast up 0.2 per cent to $468,000.

“The Gold Coast’s prestige acreage market also had a strong June quarter, while the new smaller council area of Noosa recorded very strong growth, with house sales up 22 per cent.”

Ms Mercorella said some of Queensland’s key regional real estate markets were also experiencing solid growth.

“Toowoomba continues to perform strongly, with sales activity up five per cent for the June quarter on the back of a thriving local economy and strong buyer activity,” she said.

Southeast Queensland market leads the way

12

“Sales in Queensland’s other two major tourism centres - the Fraser Coast and Cairns - also fared well in the June quarter, with house sales up seven per cent and four per cent respectively.”

Brisbane unit and townhouse sales are also rising strongly, with a steady pipeline of townhouse developments contributing to a 20 per cent rise in sales in the June quarter.

“The Gold Coast saw a strong increase in unit and townhouse sales, which rose 10 per cent in the June quarter,” Ms Mercorella said.

“The Sunshine Coast unit and townhouse market is also on an upward spiral, with sales up 39 per cent in the last 12 months. Noosa posted strong growth, with unit and townhouse sales up 31 per cent.”

Vacancy rates still remain tight in many parts of Queensland, Ms Mercorella said.

“The vacancy rate for the Brisbane Statistical Division eased to 2.3 per cent at the end of June, compared to 1.9 per cent at the end of March,” she said. “Median rents from the RTA continue to soften in Gladstone, Rockhampton and Mackay.

“Toowoomba’s rental market at the end of June recorded a vacancy rate of 1.5 per cent, up marginally from the end of March. The Gold Coast recorded a drop in its vacancy rate, down 0.5 percentage points to 1.7 per cent, while the new Sunshine Coast regional council area consisting of the Caloundra and Maroochy regions sitting on a very tight 1.1 per cent.

two times REIA Australian Agency of the Year four times REIQ Queensland Agency of the Year four times REIQ Gold Coast Agency of the Year

Choose an agent you can trust

Nerang

Whether You’re Selling, Buying or Investing... it’s one of the most important financial decisions you will make. Talk to First National Nerang, because real estate agents are NOT all the same...

Trusted by the community, Honoured by the industry

Property Management Guru’sExperience is everything! With more than 23 years of managing investment properties, First National Nerang have more than mastered the art of delivering superior service and maximum returns for our clients

Your investment is our priority.07 5596 0055 | www.nfn.com.au

• Stringent tenant selection• Effective marketing - more

tenants to choose from• Lower vacancy periods • Regular routine property

inspections and written reports to clients

• Strict arrears control• Speedy maintenance handling• Regular rent reviews - for

maximum returns

Call us for an obligation free assessment of your property’s potential rent return.

Buying an investment property continues to be one of Australia’s favourite ways to invest. An investment property should be about increasing your wealth and securing your financial future.

1. Choose the right property at the right price Unlike buying shares where the value of a company is transparent, real estate is more difficult to price. Do your research, and you’ll know a bargain when you see it. It is also important that your property suits the demographics of renters in the area. For example, if it is near a university more bedrooms will be in greater demand than a big backyard for kids to run around.

2. Do your sums - Cash Flow is always king! Investing in property is a proven path to long-term wealth, however you should consider it a medium to longer term type of investment, so you’ll want to make sure that you can afford to maintain your mortgage repayments over the long term.

3. Find a good property manager A property manager’s job is to keep things in order for you. They can help with ongoing advice and help you get the best possible value from your property. They’ll also take care of any maintenance issues, help find the right tenant and make sure they pay their rent on time. The good news is that the cost is tax deductible.

4. Understand the market where you are buying. Consider what other properties are available in the immediate area and speak to as many locals and real estate agents as you can. Make sure you do the leg work and consult professionals you can trust.

5. Pick the mortgage to suit you. There are many options when it comes to financing your investment property, so get sound advice in this area as it can make a big difference to your financial well-being. Interest on an investment property loan is generally tax deductible, but some

borrowing costs are not immediately deductible and knowing the difference can count.

6. Use the equity from another property. Leveraging equity in your home or another property investment, can be an effective way to buy an investment property. It can be calculated by working out the difference between what your property is worth and what you owe on the mortgage.

7. Negative gearing. Negative gearing can offer property investors certain tax benefits if the cost of the investments exceeds income it produces. Australian law allows you to deduct your borrowing and maintenance costs for a property from your total income. So, while you are actually making a loss on the property, the advantage is that the loss can be used to reduce the tax on your other earnings. However don’t buy an investment property just to get a tax deduction.

8. Check the condition of the property Even with negative gearing, needing to replace the roof in the first few months of ownership could make significant difference to your cash flow. It is advisable to engage a building inspector before you purchase to find any potential problems, and use a qualified tradesperson to carry out the work.

9. Make the property attractive to renters. Go for neutral tones and keep the kitchen and bathroom in good condition. You’ll find that you will attract better quality tenants if you have a well presented property and the last thing you want is a bad tenant.

10. Take a long-term view Remember that property is a long-term investment. The longer you can afford to commit to a property the better and as you build up equity then you can consider purchasing a second investment property. Finally, remain aware that unlike shares or managed funds, you can’t just sell part of your investment property if you need money.

Buying an Investment Property - Our Top 10 Tips