Measures of multivariate skewness and kurtosis in high-dimensional ...

Skewness Kurtosis Financial Markets

description

Transcript of Skewness Kurtosis Financial Markets

1

Chasing the Elusive Pearson Distribution: Skewness and

Kurtosis in Financial Markets

Artemis Econometrics, LLC

www.artemis-econometrics.com

Draft submitted for comments July 8, 2013.

© 2013 Artemis Econometrics, LLC. All rights reserved.

2

Contents

Introduction ..................................................................................................................................... 3

The Normal Distribution ................................................................................................................. 3

The Pearson Type IV Distribution .................................................................................................. 5

Probability Density Function .......................................................................................................... 6

Parameter Estimation ...................................................................................................................... 7

Recent Research .............................................................................................................................. 8

Application to Daily Returns .......................................................................................................... 9

Statistical Significance of Pearson Parameters ............................................................................. 11

Application to Regression Analysis .............................................................................................. 12

Comparison to Robust Regression ................................................................................................ 14

Conclusion .................................................................................................................................... 16

Tables ............................................................................................................................................ 17

Figures........................................................................................................................................... 19

References ..................................................................................................................................... 22

3

Introduction

For at least half a century, there has been compelling evidence that asset returns are not

normally distributed but rather are subject to tendencies in direction (skewness) and extremal

events (kurtosis). Despite the general awareness that market returns do not follow a normal

distribution, integrating skewness and kurtosis into time series analysis remains a difficult task.

One intriguing possibility for combining skewness and kurtosis with traditional mean and

variance is the flexible, asymmetric, fat-tailed Pearson Type IV (henceforth PearsonIV)

distribution. Important mathematical and programming developments have made the PearsonIV

distribution accessible to a wider audience, and researchers have recently applied several

PearsonIV methodologies to financial markets.

This study describes the PearsonIV distribution, examines its out-of-sample predictive

properties, and uses it as a basis for regression analysis. The results are encouraging, although

proper use of the PearsonIV distribution requires a thorough understanding of the strengths and

potential pitfalls of its plasticity.

The Normal Distribution

The normal distribution, a continuous probability distribution defined by mean and

variance, forms the centerpiece for many tools in investment management. Most prominently,

the normal distribution’s standard deviation is the most common numerical representation of risk

in financial markets.

4

Despite its widespread use, there is a general understanding that the normal distribution’s

mean and variance do not adequately explain

the dispersion of returns on financial markets.

The normal distribution is symmetric around

its mean, but asset returns often seem to occur

more frequently in one direction. The normal

distribution also has “thin tails,” meaning it

ascribes a relatively low probability to large

returns in either direction. The shortcomings

of the normal distribution are especially

apparent when extreme returns occur more

frequently than would be predicted by the

distribution’s thin tails.

There are conventional measures of

the asymmetry of returns (skewness) and the

relative probability of events outside the norm

(kurtosis). Both skewness and kurtosis have

been studied extensively. For instance,

Campbell, Lo and MacKinlay (1997) cite

several decades of overwhelming evidence

that financial returns exhibit high kurtosis.

5

Integrating skewness and kurtosis with ordinary mean and variance has been challenging.

Campbell, Lo and MacKinlay recount a long history of attempts to apply non-normal probability

distributions to financial time series. Most of these efforts were eventually abandoned. Campbell,

Lo and MacKinlay end their narrative in the late 1990s, suggesting that the Student’s

distribution and mixtures of distributions are worthy of further study.

The Pearson Type IV Distribution

In 1895, Karl Pearson defined a collection of curves that became known as the Pearson

family of distributions. The fourth distribution has “unlimited range in both directions and

skewness,” and has recently received attention for its potential application to financial markets.

The PearsonIV distribution is defined by four real numbers ( ) that interact with each

other to offer a wide range of shapes and sizes.

The parameter is a location metric similar to the mean of a normal distribution. The

variable is a measure of scale, analogous to standard deviation. The value of specifies the

symmetry of the distribution. The parameter determines kurtosis, with smaller values of

creating thicker tails.

The range of possible shapes is so expansive that the PearsonIV actually encompasses

other distributions. When , the PearsonIV is symmetric and becomes a Student’s

distribution. When and , the PearsonIV approaches the normal distribution in the

limit. When , the PearsonIV becomes an asymmetric Cauchy distribution.

6

Probability Density Function

The PearsonIV probability density function (PDF) is:

( ) [ (

)

]

[ (

)] ( ⁄ ) (1)

The PDF, and the likelihood function to be examined later, require a normalizing

constant that depends on the values of , and . The difficulty in calculating likely

impeded the use of the PearsonIV distribution for over a century. The orthodox form of the

PearsonIV normalizing constant works in complex numbers (i.e., numbers that have an imaginary

component defined as the square root of -1). Moreover, it requires a gamma function that can

manipulate a complex number, which most statistical packages do not provide.

To avoid the complex gamma function, Nagahara (1999) uses an infinite multiplication

series. However, this is probably too burdensome for routine analysis.

Particle physicist Joel Heinrich (2004) provides a major advancement, and nearly all

equations and descriptions of the PearsonIV distribution in this study come from Heinrich’s work.

Heinrich reformulates the most problematic part of the normalizing constant in terms of the

hypergeometric function and provides sample code to calculate . This study uses C++ code

modified from Heinrich’s example to compute . Heinrich also defines the PearsonIV cumulative

distribution in terms of the hypergeometric function and offers programming routines to generate

random numbers from the PearsonIV distribution.

7

Parameter Estimation

To determine the PearsonIV parameters , , and , one first calculates the mean,

variance, skewness and kurtosis of the series . From these, denoted by , , and , the

PearsonIV estimates are:

( ) ( )

(2)

( )

√ ( ) ( ) (3)

√ [ ( ) ( ) ]

(4)

( ) √

(5)

Note that is used as an abbreviation for ( ).

It is usually preferable to estimate the parameters jointly by minimizing the negative log

likelihood:

∑ [ (

)

]

∑

(

) (6)

Transforming the PearsonIV parameters , , and into traditional mean, variance,

skewness and kurtosis requires that be at least 1.0, 1.5, 2.0 and 2.5, respectively. Depending

on the data set, these constraints on may preclude solutions that might otherwise be chosen.

8

If an analysis only uses the PearsonIV distribution, must be greater than 0.5. This

minimal constraint should not be restrictive for financial data.

Recent Research

The PearsonIV distribution has attracted significant attention in recent years. Premaratne

and Bera (2001) suggest that compared to the Student’s distribution, the PearsonIV has heavier

tails and can account for skewness. They also advise that the PearsonIV “is much easier to handle”

than other asymmetric possibilities such as the non-central and the Gram-Charlier distributions.

Brännäs and Nordman (2003) add to an established record of tests rejecting the normal

distribution when applied to financial returns. They find that the one-parameter log-generalized

gamma distribution indicates skewness in financial data, while the “PearsonIV model suggests that

excess kurtosis rather than skewness should be accounted for.”

Yan (2005) shows that the PearsonIV distribution has a much larger range of skewness and

kurtosis combinations than the Gram-Charlier distribution, which has also been used to model

skewness and kurtosis simultaneously.

Grigoletto and Lisi (2007) and Bhattacharyya, Misra and Kodase (2009) apply the

PearsonIV distribution to value-at-risk analysis.

Grigoletto and Lisi (2009) propose a dynamic, time-varying PearsonIV model in which the

parameters are defined by nine GARCH coefficients. This approach is applicable to very long

time series and allows the shape of the PearsonIV distribution to change through time within a

data set.

9

Stavroyiannis, Makris, Nikolaidis and Zarangas (2012) use the PearsonIV model for value-

at-risk analysis, and find that “the PearsonIV distribution gives better results, compared with the

skewed student [t] distribution, especially at the high confidence levels, providing a very good

candidate as an alternative distributional scheme.”

Application to Daily Returns

This study models the PearsonIV parameters directly from the data, without the

intervening GARCH filter used by Grigoletto and Lisi. The parameters are therefore constant

throughout the estimation time frame. This approach is robust even with small data sets and

reflects what many financial professionals do in practice (e.g., calculating standard deviation or

skewness from a relatively small sample of recent returns).

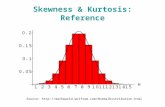

Figure 1 demonstrates this method in practice. The solid line represents the normal

distribution of an S&P 500 exchange traded fund (ETF) on October 31, 2008, fit to one year of

daily returns. This example takes place during the financial crisis, when the stock market

witnessed some of the largest volatility in its history. The standard deviation of daily returns over

the previous year was 2.22%, and its mean daily return was -0.14%.

The hashed line signifies the PearsonIV distribution fit to the same data.

The numbers along the axis do not indicate actual probabilities. Rather, the height of

these curves denotes the relative probability of observing a return at any point along the axis.

The axis has a high scaling because the axis, representing daily returns, has a small scaling,

and the area under each curve must sum to one.

10

The solid line drawn upward from the horizontal axis corresponds to the 0.28% return of

the S&P 500 ETF on the next trading day, November 3, 2008. The and symbols reflect the

relative likelihood of this return given the probability densities derived from daily returns over

the prior year. The PearsonIV distribution allows for a much higher probability of the November 3

return than does the normal distribution. This dramatic example illustrates the potential costs of

applying a normal distribution to non-normal financial series.

The normal distribution expands outward in an attempt to account for the extreme

volatility of the S&P 500 index during this time. However, there are significant negative

consequences. Simply increasing the variance of a normal distribution does not change its nature

as a thin-tailed probability density. Therefore, the normal distribution is not able to put enough

weight in its tails to match the PearsonIV distribution’s kurtosis.

Moreover, the bulky middle section of the normal distribution stretches along the axis,

meaning it has a density that is too low around its center. It therefore attributes a relatively low

probability to events occurring around its mean, such as the November 3 return of 0.28%.

Financial returns tend to have frequent returns around zero and occasional extreme

returns. The PearsonIV distribution is able to form a shape that has a very dense section around

the mean but also thick tails. In contrast, significant density weight in the normal distribution is

shifted to intermediate areas, where the probability might actually be quite low. The normal

distribution would be more effective if there were more probability weight directly in the middle

and on the tails.

An exercise of this sort can indicate whether one distribution is consistently more

effective at accounting for the observed return pattern. Table 1 presents the results of this

11

exercise repeated every trading day, data permitting, from January 2000 to March 2013. At each

point, the probability densities of the normal and PearsonIV distributions are calculated using

daily returns from the previous year. These densities are then compared to each other using the

next day’s actual return, and these results are summed through time. Table 1 indicates that in all

cases the PearsonIV distribution offered a relative advantage in fitting a collection of ETFs and

hedge fund indices.1 The results may seem marginal, but this is because most of the time there is

little difference between the normal and PearsonIV distributions. They tend to diverge

substantially during high market volatility, as demonstrated in Figure 1.

Statistical Significance of Pearson Parameters

Figure 2 shows rolling statistics of the PearsonIV evaluated for an S&P 500 ETF using

three years of weekly data. The statistics are based on variance estimates taken from the

negative inverse of the matrix of numerical partial second derivatives (Hamilton, 1994).

The results are consistent with Brännäs and Nordman (2003), who find that the kurtosis

parameter is more significant than the skewness parameter when the PearsonIV distribution is

applied to equity returns.

Not only is the symmetry parameter the least significant statistically, the sign remains

positive even during the financial crisis of 2008. The PearsonIV parameters are estimated jointly,

so symmetry is defined relative to the location parameter . It is possible for the PearsonIV to

have a negative mean, but a positive skew, during a market sell-off. This means that even though

returns are mostly negative, when they are positive they are larger in the positive direction. This

1 Source: Hedge Fund Research, Inc., www.hedgefundresearch.com, © 2013 Hedge Fund Research, Inc. All rights

reserved.

12

is what happened during this time, for the two largest daily percentage gains in the history of the

S&P 500 index were 9.93% and 10.79% increases on October 13 and October 31, 2008,

respectively (Wikipedia: List of largest daily changes in the S&P 500).

Although the concept of skewness has a compelling appeal, the statistical results can be

ambiguous. Skewness tends to be less statistically significant than kurtosis, and the interpretation

of skewness can be counterintuitive when it is defined relative to a mean, rather than with respect

to zero.

Application to Regression Analysis

Regression analysis presents a potentially useful application of the PearsonIV distribution.

The concept is similar to robust regressions, which have long been used to minimize the effects

of outlier data points on the regression coefficients. Allowing regression residuals to have a

PearsonIV distribution would not only account for outliers, it would also help to keep systematic

distortions in the shape of the residuals’ distribution from affecting the coefficients.

Ordinary least squares (OLS) regression takes the form:

( ) (7)

A PearsonIV regression is defined as:

( ) (8)

13

The PearsonIV residuals are allowed to have an off-center mean with a non-normal shape.

Figure 3 shows rolling OLS and PearsonIV beta estimates using the Hedge Fund Research HFRX

Global Hedge Fund Index2 as the dependent ( ) variable, and an S&P 500 ETF as the

independent ( ) variable. Both regressions use two-year rolling windows of weekly data and

include one lag term.

The most striking result is how quickly the PearsonIV model was able to react to the

decreasing equity exposure of this hedge fund index after the 2008 financial crisis.3 The OLS

beta does not fully reflect changes in the portfolio until observations at the beginning of the

financial crisis drop out of the data set.

The residuals show why the PearsonIV regressions are much quicker to respond to the

changing market exposure of the hedge funds. Figure 4 displays the distributions of the residuals

from the January 29, 2010, regressions. The OLS residuals are normally distributed with zero

mean, while the PearsonIV residuals are allowed a non-zero mean and non-normal shape.

The difference in the coefficients results from the heavy weight the PearsonIV distribution

puts into the negative tail. During the financial crisis, both the S&P 500 and the hedge fund

index had negative returns. In an OLS regression, those two sets of negative returns are aligned

with each other and attributed to the coefficients as long as the observations are in the sample.

In contrast, the PearsonIV regressions can take a more flexible approach. As more

observations appear indicating the hedge funds have decreased their S&P 500 beta, the PearsonIV

2 Source: Hedge Fund Research, Inc., www.hedgefundresearch.com, © 2013 Hedge Fund Research, Inc.

All rights reserved. 3 This Hedge Fund Research, Inc., index is asset weighted based on the total assets of each strategy in the

hedge fund universe. Therefore, two explanations for the decreasing S&P 500 beta are that investors

shifted to lower-volatility strategies, or the underlying hedge funds reduced equity holdings.

14

approach allows itself to unlink the negative returns of the index and the S&P 500 ETF that

occurred at the beginning of the financial crisis. The negative returns of the hedge fund index

then become negative residuals and show up as weight on the left-hand side of the residuals’

distribution.

This result is notable because several complicated methods have been proposed to model

hedge fund returns in a manner that responds quicker to changes in the underlying portfolio than

rolling OLS regressions. Here, the PearsonIV model is able to accomplish this in a very natural

way, even in the context of rolling regressions.

One other major difference between the OLS and PearsonIV regressions in Figure 3 is that

the PearsonIV model results in lower S&P 500 betas during the steadily rising market up to mid-

2008. This hedge fund index includes a broad range of investment styles, including low-volatility

absolute return strategies that should have little discernible equity exposure. The OLS beta above

0.50 could be too high for a diversified index of this sort. Hedge funds were posting positive

returns during this time because numerous asset classes were rising, not just equities. It is

possible that the OLS coefficient reflects the correlations of multiple well-performing strategies,

while the PearsonIV beta may represent a more realistic assessment of direct equity exposure in

the hedge fund index.

Comparison to Robust Regression

The conceptual difference between the OLS and PearsonIV regressions is similar to the

difference between OLS and robust regressions. Robust regressions iteratively reweight the

observations to generate coefficient estimates that are not heavily influenced by outlier data

15

points. The goal of robust regressions is to produce coefficients that reflect the common

relationship between variables since they are not pulled in the direction of atypical or extreme

events. The PearsonIV regression model theoretically could account not only for unusual data

points but also for abnormal shapes in the distribution of the data.

Figure 5 presents a comparison of the OLS, PearsonIV and robust regression methods. The

Russell 2000 Value ETF return series contains several observations at the beginning of the

financial crisis that distort its true beta to the S&P 500. The OLS regression is unable to recover

from these outliers, and the OLS beta is too low as long as those data points remain in the

sample.

The robust regression handles the outliers more effectively than OLS, and gives a beta

estimate closer to its true value. However, it does not provide as much improvement as the

PearsonIV method. Furthermore, the robust approach produces erratic results over other parts of

the sample, while the PearsonIV coefficients remain stable.

This exercise uses the Huber robust beta that is the first option in James P. LeSage’s

MATLAB econometrics toolbox. There are several types of robust regressions, and they have

different tolerance settings. This example is not comprehensive enough to draw broad

conclusions regarding the efficacy of the PearsonIV approach versus robust regressions. However,

the results are encouraging, because they indicate the PearsonIV regression model might be an

attractive option to handle data that contain outliers or have odd distributions.

Table 2 presents the results of this exercise applied to a broad array of hedge fund

indices. The study takes a hedging perspective: lower mean absolute deviations and root mean

squared errors are better, while a higher out-of-sample R-squared is better.

16

Conclusion

Convincing evidence over an extended time shows that the mean and standard deviation

of the normal distribution do not properly describe the dispersion of asset returns, especially

equity returns. The PearsonIV distribution offers an intriguing possibility for integrating mean,

variance, skewness and kurtosis in a coherent framework that allows a great deal of flexibility in

modeling asset returns.

This study provides evidence that the PearsonIV distribution can be more effective than the

normal distribution at modeling the unconditional returns of a range of ETFs and hedge fund

indices.

Furthermore, regressions with PearsonIV residuals may, under certain circumstances, offer

more accurate and stable coefficient estimates than OLS or robust regressions.

Early indications from this and other works show the PearsonIV distribution has both the

flexibility and robustness to compensate for limitations of the normal distribution. If future

research continues to demonstrate the value of the PearsonIV distribution, it could someday

become an important addition to the toolkit of academic researchers and financial professionals.

17

Tables

Table 1

Relative Fit of Pearson Type IV and Normal Distributions

Exchange Traded Fund Ticker

Study Size

(Daily Data)

Relative Fit

(Pearson Type IV /

Normal)*

SPDR S&P 500 SPY 3329 1.072

PowerShares QQQ QQQ 3329 1.055

iShares Dow Jones US Real Estate IYR 3212 1.067

Financial Select Sector SPDR XLF 3329 1.060

Energy Select Sector SPDR XLE 3329 1.041

iShares S&P Global 100 Index IOO 3091 1.073

iShares Russell 3000 Growth Index IWZ 3184 1.065

iShares Russell 3000 Value Index IWW 3179 1.068

iShares Russell 1000 Growth Index IWF 3227 1.066

iShares Russell 1000 Value Index IWD 3227 1.064

iShares Russell 2000 Growth Index IWO 3184 1.030

iShares Russell 2000 Value Index IWN 3184 1.032

iShares S&P SmallCap 600 Growth IJT 3184 1.031

iShares S&P SmallCap 600 Value Index IJS 3184 1.027

iShares S&P Europe 350 Index IEV 3184 1.059

iShares Dow Jones Select Dividend Index DVY 2361 1.070

iShares MSCI EAFE Index EFA 2912 1.057

iShares MSCI Emerging Markets Index EEM 2505 1.069

HFRX Hedge Fund Index**

Identifier

Study Size

(Weekly Data)

Relative Fit

(Pearson Type IV /

Normal)

Convertible Arbitrage HFRXCA 521 1.075

Relative Value Arbitrage HFRXRVA 521 1.059

Market Directional HFRXMD 456 1.151

Macro/CTA HFRXM 521 1.048

Global Hedge Funds HFRXGL 521 1.145

Event Driven HFRXED 521 1.072

Equity Hedge HFRXEH 521 1.104

Equal Weighted Strategies HFRXEW 521 1.135

Equity Market Neutral HFRXEMN 521 1.033

Merger Arbitrage HFRXMA 521 1.190

Absolute Return HFRXAR 456 1.035

* Values greater than one indicate relative advantage to Pearson Type IV.

** Source: Hedge Fund Research, Inc., www.hedgefundresearch.com,

© 2013 Hedge Fund Research, Inc. All rights reserved.

18

Table 2

Regression Performance: HRFX Hedge Fund Indices* Hedged with S&P 500 ETF

Mean Absolute Deviation (weekly %) OLS Pearson IV Robust Regression

Convertible Arbitrage 0.83 0.61 0.64

Relative Value Arbitrage 0.51 0.48 0.48

Market Directional 0.70 0.65 0.65

Macro/CTA 0.85 0.78 0.80

Global Hedge Funds 0.43 0.40 0.41

Event Driven 0.45 0.42 0.45

Equity Hedge 0.55 0.53 0.54

Equal Weighted Strategies 0.38 0.34 0.35

Equity Market Neutral 0.48 0.47 0.47

Merger Arbitrage 0.36 0.34 0.35

Absolute Return 0.31 0.31 0.32

Root Mean Squared Error (weekly %) OLS Pearson IV Robust Regression

Convertible Arbitrage 1.66 1.29 1.33

Relative Value Arbitrage 0.88 0.80 0.81

Market Directional 1.04 0.96 0.97

Macro/CTA 1.21 1.11 1.13

Global Hedge Funds 0.67 0.62 0.65

Event Driven 0.68 0.63 0.69

Equity Hedge 0.80 0.76 0.81

Equal Weighted Strategies 0.60 0.52 0.56

Equity Market Neutral 0.68 0.68 0.68

Merger Arbitrage 0.58 0.59 0.59

Absolute Return 0.44 0.46 0.48

Out-of-Sample R-Squared (%) OLS Pearson IV Robust Regression

Convertible Arbitrage 8.57 16.51 9.84

Relative Value Arbitrage 21.90 22.53 21.74

Market Directional 49.77 48.79 47.99

Macro/CTA 1.74 3.23 2.10

Global Hedge Funds 43.88 42.33 41.13

Event Driven 52.93 53.68 52.50

Equity Hedge 60.68 60.71 59.03

Equal Weighted Strategies 34.04 35.22 32.52

Equity Market Neutral 1.76 1.39 2.02

Merger Arbitrage 37.96 34.70 35.02

Absolute Return 6.21 4.71 5.72

* Source: Hedge Fund Research, Inc., www.hedgefundresearch.com,

© 2013 Hedge Fund Research, Inc. All rights reserved.

19

Figures

20

21

22

References

Bhattacharyya, Malay, Nityanand Misra, and Bharat Kodase. 2009. “MaxVaR for Non-Normal

and Heteroskedastic Returns.” Quantitative Finance, vol. 9, no. 8: 925–935.

Brännäs, Kurt and Niklas Nordman. 2003. “Conditional Skewness Modelling for Stock Returns.”

Applied Economics Letters, vol. 10: 725–728.

Campbell, John Y., Andrew W. Lo and Archie Craig MacKinlay. 1997. The Econometrics of

Financial Markets. Princeton, NJ: Princeton University Press.

Grigoletto, Matteo and Francesco Lisi. 2007. “Value-at-Risk Prediction by Higher Moment

Dynamics.” Working Paper, Department of Statistical Sciences, University of Padua.

Grigoletto, Matteo and Francesco Lisi. 2009. “Looking for Skewness in Financial Time Series.”

The Econometrics Journal, vol. 12: 310–323.

Hamilton, James D. 1994. Time Series Analysis. Princeton, NJ: Princeton University Press.

Heinrich, Joel. 2004. “A Guide to the Pearson Type IV Distribution.” University of

Pennsylvania, Philadelphia, Tech. Rep. CDF/Memo/Statistics/Public/6820.

Nagahara, Yuichi. 1999. “The PDF and CF of Pearson Type IV Distributions and the ML

Estimation of the Parameters.” Statistics & Probability Letters, Elsevier vol. 43 (July): 251–

264.

Pearson, Karl. 1895. “Contributions to the Mathematical Theory of Evolution II: Skew Variation

in Homogeneous Material.” Philosophical Transactions of the Royal Society of London, series

A, vol. 186: 343–414.

Premaratne, Gamini and Anil K. Bera. 2001. “Modeling Asymmetry and Excess Kurtosis in

Stock Return Data.” Working paper 01-0118, College of Business, University of Illinois at

Urbana-Champaign.

Stavroyiannis, Stavros, Ilias A. Makris, Vasilis N. Nikolaidis and Leonidas Zarangas. 2012.

“Econometric Modeling and Value-at-Risk Using the Pearson Type-IV Distribution.”

International Review of Financial Analysis, Elsevier vol. 22 (C): 10-17.

23

Wikipedia contributors. “List of largest daily changes in the S&P 500.” Wikipedia, The Free

Encyclopedia. Accessed May 31, 2013. http://en.wikipedia.org/wiki/List_of_largest_daily_changes_in_the_S%26P_500.

Yan, Jun. 2005. “Asymmetry, Fat-tail, and Autoregressive Conditional Density in Financial

Return Data with Systems of Frequency Curves.” Working paper 355, Department of Statistics

and Actuarial Science, University of Iowa.