Return of Private Foundation 2003990s.foundationcenter.org/990pf_pdf_archive/626/... · Department...

Transcript of Return of Private Foundation 2003990s.foundationcenter.org/990pf_pdf_archive/626/... · Department...

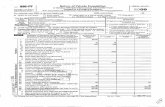

i-1- OMB No 1545-0052 Return of Private Foundation

or Section 4947.(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation

Note: The organization may be able to use a copy of this return to satisfy state repor

or tax vear beatnninn , and endino

Form 990-PF Department of the Treasury Internal Revenue service 2003 For calend

Employer identification number

62-6041468 Use the IRS Name of organization

lapel . Otherwise ; HE MACLELLAN FOUNDATION, INC .

print Number and street (or P O box number If mail is sae delivered m stud address) Roon"I'sulte B Telephone number

UMPROVIDENT BUILDING ONE FOUNTAIN SQ O1 ( 423 ) 294-8142 See Specific Instructions] City or town, state, and ZIP code

C If exemption application is pending, check here

)CHATTANOOGA , TN 37402 D 1 . Foreign organizations, check here . _ H Check type of organization : ~ Section 501(c)(3) exempt private foundation 2' =n ~ ~e"~,, meeting ~o~ s~i ~'t' . 1

Section 4947(a)(1) nonexempt charitable trust 0 Other taxable private foundaUon E If private foundation status was terminated I Fair market value of all assets at end of year J Accounting method : = Cash = Accrual under section 507(b)(1)(A), check here . ." (from Pert 11, col. (c), line 16) OX Other (specify) MODIFIED CASH F If the foundation is m a 60-month termination 111114 3 0 3 7 5 5 19 6 . (Part l, column (d) must be on cash basis.) under section 507 (b )( 1 ) B), check here " []

Analysis of Revenue and Expenses d Disbursements Rre m~ or amounts in caur,~u rod, ~, and (a) may not (a) Revenue and (h) Net investment (c) Adjusted net anteble purposes necessanly equal the amounts m column (Q.) expenses per books income income inn basis only) Contributions, gifts, grants, etc ., received . . . . . . 1,000 . ~jW:x. Check 1 ~ d the toundaHm is not reqUI~Od to &Cach Sch. B - ` - - - - -

2 Distributions from s lit-interesttrusts . " - "" ` ` . . . . . . . . . . to a '`ehrw.,', °~b Sa,dtemporary 57,214 . 41,037 . 4 Dividends and interest from securities . . . . _ . . . . . 5,059,061 . 5,058, 352 . 5a Gross rents . . . _ . , . . . _ . . . ._ . . .-b (Net rental Income or (low) 1

d 6a Net gain or Qoss) from sale of assets not on - - -7 line 10 7 421 7 582 . . . . .--- . . . . . . . . . . . . . . . . . . . . I

b Gross sales price for all 3 2 2 4 3 18 4 . asset online 6a

cc 7 Capital pain net Income (from Part IV, line 2) 7, 181 4 769 . 8 Net short-te cap ~ _ . 9 Income mo iflcatio~l,�eE.1VED. . . . . "' 10a ~,a a

ices i .e . . . .

. , b Less cost of

C) E .

c Gross pro . or ( ss) . . . . . . . . . . . . . . . . . . . . . . W 11 Other inco . . . . . . . . .1 .

I .� IEN - -431 , 414 . -507 , 824 .

12 Total . Add nesl 11 903 443 . 11 773 334 . 13 Compensation of officers, directors, w, ~. . . . . . . 144,894 . 36, 224 . 14 Other employee salaries and wages . __ . . . _ . . . . . 473 , 317 . 118 329 . 15 Pension plans, employee benefits . . . . _ . . . . . . . . 115 , 291 . 28,823 .

y 16a legal fees , ., . .� , . . . , ., . . . . ._ _ . . STMT. . 5 . . 72,744 . 0 . Accounting fees . . . . . . . . . . . . . . . . . . S T1KT. . . .6 . . . 18,550 . 0 .

w c Other professional fees . . . . . . . STMT _7 . . 570 , 242 . 350,432 . 17 interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 845 , 537 . 795,911 .

1! 18 Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . STMT ..8_ . 51 , 279 . 12 , 916 . M 19 Deprecation and depletion . . . . . . . . . . . . . . . . . 70,526 . 0 . T 20 Occupancy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51,077 . 25 ( 539 . a 21 Travel, conferences, and meetings . . . . . . . . . . . . . . . . 250 , 106 . 0 . W 22 Printing and publications _ . . . . . . 1 , 107 . 1 10 7 . 553 .

23 Other expenses . . . . . . . . . . . . . . . . . STMT .._9. . 1 , 288 , 749 . 806 , 760 . 24 Total operating and administrative

a expenses . Add pines 13 through 23 . . . ._ . . . . . 3, 95 3 419 . 2 17 5 4 87 . 0 25 Contdbubons, gifts, grants paid . . . . . . . __ . . _ . 10 , 981 , 12 0 . --.

26 Total expenses and disbursements .

108,670 . 354,988 . 86,468 . 72,744 . 18,550 .

219,810 . 49,626 . 36,944 .

25,538 . 250,106 .

554 .

12 , 688 , 402 .

{y , . , , l

ZOO~orm 990-PF (2003) av

AddInes24 and25 14 934 539 . 2 , 175 , 487 . 27 Subtract line 26 from line 12'

. 8 Excess of revenue over expenses and disbursements _ -3, 031,096 .

b Net Investment income (f negatrie, enter -a) 97 4 847A sc AdJusted net income of negative, afar-ay_ , . N/A

1Z~ ~ LHA For Paperwork Reduction AM Notice, seethe instructions . SCANNED S(:r 0

.,

7 .7

483,324 .

1,707,282 . 0,981 .120 .

s r

62-6041468 Page 2 End of year

Book Value (c) Fair market value

a

Form 990-PF (2003) THE MACLELLAN FOUNDATION INC .

~~ Balance Sheets Awedscneaulosandamamismmecesenpaan Beginning of year caurmshould bel«aio-oi-yearartaumsonry. (a) Book Value

1 Cash -non-interest-beanng . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . 2 Savings and temporary cash investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 , 100 , 782 . 962,654 . 9 6 .2 6

;5

4 .

3 Accounts receivable Less : allowance for doubtful accounts

4 Pledges receivable Less : allowance for doubtful accounts 1 ~ ,

5 Grants receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . B Recefvables due from officers, directors, trustees, and other

disqualified persons . . . . . . . . . . . . . . . . . . . . . . . . . . . . - - - . . . . . . . . . . . . . . . . 7 Olhxnobsandloans maiwhk . . . . . . . . . . . . " '.; : . . . . . . . . .

Less : allowance for doubtful accounts

r 8 Inventories for sale or use _ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 Prepaid expenses and deferred charges . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10a Investments - U.S . and state government obligations . . . . . . . . . ., . . b investments -corporate stock STMT ..1.1_ 36 , 267,507 .

. . . . . . . . . . . . . . . . . . . . . . . . e Investments -corporate bonds

c ". - - , . . . . .

38,981,418 .E 156,498,602 .

., 11 Inveshronts-Imd buAdnqs, ande4jipmeM bay 65 , 000 . ,"

t= aocurntfteaanrwaeon . . . . . . . .. . . . . . . . . - -~ - -, ~ ~ - ~ ~ 65,000 . ~ 65 r 000_.

12 Investments - mortgage loans . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 Investments -other . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . ..STMT ..12_ 123 , 114 419 . 115,668,984 . 131 , 774 , 540 . 14 Land, buildings, and equipment : basis " 592 , 375 .`' ' ~

tss.am,rn,nunawrecunon ,STMT . .1 .3 . 253 , 822 . ~ ~~391,~958 . ~ ~ 338 553 . 338, 553 . 15 Other assets (describe 11110. STATEMENT 14 ~ 0 . 14,115,847 . 14,115 1 847 .

164 874 666 . 170 132 456 . 303 , 755 , 196 .

._ {

3 , 250,000 . 2 , 287 , 881 .' :, 368 661 . 329,312,"" ' .

3 , 618 , 661 . 2 , 617 , 193 .

161, 256, 005 . 167 , 515 , 263 . + - '}~ 1x. k.

!y1 _ s s S

> . \.

. 161 , 256 , 005 . 167,515 , 263

23 Total liabilities add lines 17 throw h 22 Organization: that follow SFAS 117, check here poll D and complete lines 24 through 26 and lines 30 and 31 .

24 Unrestricted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25 Temporarily restricted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . -- - . . . .

m 26 Permanently restricted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Organizations that do not follow SFAS 117, check here 10. F-1

and complete liner 27 through 31 . 27 Capital stock, trust principal, or current funds . _. . . . . . . . . . . . . . . . . . . .

, 28 Paid-in or capital surplus, or land, bldg ., and equipment fund , . . . . . . . . .

29 Retained earnings, accumulated income, endowment, or other funds . .

Z 30 Total net assets or fund balances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31 To tal liabilities and net assets and balances . . . . . . . . . . . . . . . . . . 16 4 8 7 4 6 6 6 . 170 , 132 , 456 .

Analysis of Changes in Net Assets or Fund Balances

1 Total net assets or fund balances at beginning of year - Part II, column (a), line 30 (must agree with end-of-year figure reported on prior year's return) . . . . . . . . ., . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Enter amount from Part I, line 27a . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . --- . . . . . . . . . . . . . . . . . . . . . . . . . . . . .--- . . . . . . . . . . . .

3 Other increases not included in line 2 (itemize) " SEE STATEMENT 10

4 Add lines 1, 2 . and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Decreases not included in line 2 (itemize) 10, 6 Total net assets or fund balances at end of veer (line 4 minus line 5) - Part 11, column (b), line 30

161,256,005 . -3,031,096 . 9,290,354 .

167,515,263 . 0 .

167,515,263 . Form 990-PF (2003)

323511 12-oso3 2

r

17 Accounts payable and accrued expenses . . . . . . . . . . . . . . . . . . . . . . 18 Grants payable . . . . .. . . . . . . . . . . . . . . . . . . . -- . . . . . . . . . . . . . . 19 Deferred revenue . . . . . . . . . . . . . . . . . . . . . . .

20 Loam from officers, directors, trustee, and other disqualified persona . . . . . .

w 21 Mortgages and other notes payable 22 Other liabilities (describe " STATEMENT . 15

SEE ATTACHED STATEMENTS

(h) Gam or (loss) (e) plus (fl minus (g) (e) Gross sales price (n Depreciation allowed (g) Cost or other basis

(or allowable) I plus expense of sale

a

2 Capital g ain net income or net capital loss ) . I ~f gain, also enter in Part I, line 7 1 ( l If (loss), enter -0- in Part I, line 7 ~ - . . . . . . . . . . .

3 Net short-term capital gain or (loss) as defined in sections 1222(5) and (6) : If gain, also enter in Part I, line 8, column (c) . if (loss), enter-0-in Part I, line 8 N/A

FpV ] Qualification Under Section 494Q(e) for Reduced Tax on Net Investment Income (For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income )

If section 4940(d)(2) applies, leave this part blank .

Was the organization liable for the section 4942 tax on the distributable amount of any year in the bass period? _ __ ___ __ . . . . . . . . . . . . . . . . . . . . . . D Yes [XI No If "Yes,' the organization does not qualify under section 494Q(e) . Do not complete this part . 1 Enter the appropriate amount in each column for each year; see instructions before making any entries .

(b) ( c) Base period years Calendar ear artax ear beginning in Ad j usted qualifyin g distributions Net value of noncharitable-use assets

Distribution ratio (col . (b) divided by col . (c))

2002 16,909 564 . 319 994,690 . .0528433 200 18 705 860 . 375 042,820 . .0498766 2000 32 526 366 . 315 217 705 . .1031870 1999 34 270,076 . 645 937 964 . .0530547 1998 24,332 .861 . 718 .388,157 . .0338715

.2928331

.0585666

257,391,811 .

15,074,563 .

95,978 .

15,170,541 .

12,688,402 .

Form 990-PF (2003) 3

r

Farm 990-PF 2003) THE MACLELLAN FOUNDATION , INC pal Capital Gains and Losses for Tax on Investment Incom

(a) List and describe the kind(s) of property sold (e.g ., real estate, 2-story brick warehouse ; or common stock, 200 shs . MLC Co.)

r

62-6041468 Page 3

' How acquired (c) Date acquired (d) Date sob P - Purchase (mo ., day, yr.) (mo., day, yr.) D - Donation

32,207,371 .E 1 25,025,602 . omplete only for assets showing gain in column (h) and owned by the foundation on 12/31/69

(i) F.M .V. as of 12/31/69 (1) Adjusted

of 1Y131169s (over otExcess of col. (i)

(j), if any

(I) Gains {Col . (h) gain minus col . (k), but not less than -0-} or

Losses (from col . (h))

7,182,769 .

7,181 .769 .

2 Total of line 1, column (d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Average distribution ratio for the 5-year base period -divide the total online 2 by 5, or by the number of years

the foundation has been in existence if less than 5 years ____ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Enter the net value of nonchaMable-use assets for 2003 from Part X, line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Multiply line 4 by line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Enter 1 % of net investment income (196 of Part I, line 27b) � . ._ . . . ., . . ., . . � . ,

7 Add lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Enter qualifying distributions from Part XII, line 4 . . . __ . . ., . . . . . . . . . . _ . . . . . . . . . . . . . . . . __ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . .

It line 8 is equal to 4r greater than line 7, check the box in Part VI, line 1b, and complete that part using a 1 % tax rate . See the Part VI instructions.

323521n2-05-0 ;

T

Form 990-PF (2003) THE MACLELLAN FOUNDATION , INC . . .V1 Excise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e),

1 a Exempt operating foundations described in section 4940(d)(2), check here " 0 and enter WA' on line 1 . Date of ruling letter: (attach copy of ruling letter if necessary-see instructions)

b Domestic organizations that meet the section 4940(e) requirements m Part V, check here " 0 and enter 1 % of Part I . line 27b . . . . . . . . . . . . . . . . . . . . . . .-- - - --- . -- - . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ---

c All other domestic organizations enter 29'a of line 27b . Exempt foreign organizations enter 4% of Part I, line 12, cal . (b) 2 Tax under section 511 {domestic section 4947(a)(1) trusts and taxable foundations only . Others enter-U-) . . . . . . . . . . . 3 Add lines t and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . 4 Subtitle a (income) tax {domestic section 4947(a)(1) trusts and taxable foundations only . Others enter -0-) . . . . _ . _ . ___ 5 Tax based on investment income . Subtract line 4 from line 3 . If zero or less, enter -0- ., . . . . ._ . . . . . . . . . . . . . _ . __ . . . . . . . . . . 6 Credits/Payments :

62-6041468 Page a

191,957 . a 0 . 5 191,957 .

s\vs ~ksl ~ ~ vs~`

418,982 .

b Exempt foreign organizations-tax withheld at source . ., ._ ._ . . . . . . . . . . . . . . . . . .. _ . . . . . . . . . . 5111 c Tax paid with application for extension of time to file (Form 8868) . . 6c d Backup withholding erroneously withheld Bd 7 Total credits and payments . Add lines 6a through 6d . . . . . . . . . . . . . . . , . . . . ., . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _,_ ._ ._ . __ . . . . . ._ 8 Enter any penalty for underpayment of estimated fax . Check here = rf Form 2220 is attached . . . . . . . . . . . . . . . . . . . . . . . 9 Tax due . If the total of lines 5 and 8 is more than line 7, enter amount owed _ . ___ : . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _

10 Overpayment. If line 7 is more than the total of lines 5 and 8, enter the amount overpaid 11 Enter the amount of line 10 to be : Credited to 2004 estimated tax " 2 2 7 , 0 2 5 . 1 Refunded

227,025 .

4

or 4948 - see instructions)

` ~,{s.vv

s s ~i : }~s

j 191,957 . ` +{ . . . +

-- - ~ 0 .

a 2003 estimated tax payments and 2002 overpayment credited to 2003 6a 418 .982 .

1 a During the tax year, did the organization attempt to influence any national, state, or local legislation or did it participate or intervene in YeS No any political campaign? , .� . . � . . , . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . 1 a X . . . . . . .

6 Did it spend more than $100 during the year (either directly or indirectly) for political purposes (see instructions for definition)? . . . . . . . . . . 1 b X if the answer is "Yes" to 1 a or 1 b, attach a detailed description of the activities and copies of any materials published or

"-~ distributed by the organization in connection with the activities. c Did the organization file Form 1120-POL for this year? . . . . . . .. . . , � . . . _ . , . _ . _ __ _ . _ . . . . . . . . . . ., . . _ . . ._ . 1c X d Enter the amount (if any) of tax on political expenditures (section 4955) imposed dung the year : . . . .

(1) On the organization . " $ 0 . (2) On organization managers . " $ 0 . e Enter the reimbursement (if any) paid by the organization during the year for political expenditure tax imposed on organization

managers. " $ 0 . . . ~ .' _ 2 Has the organization engaged in any activities that have not previously been reported to the IRS? . . . . . ., . . . . . . . . . ., . 2 + .X

If "Yes," attach a detailed description of the activities . 3 Has the organization made any changes, not previously reported to the IRS, in its governing instrument, articles of incorporation, or , .

bylaws, or other similar instruments? 1f "Yes." attach e conformed copy of the changes � . . . . . . . . . . . . . . 3 . 4a Did the organization have unrelated business gross income of $1,000 or more during the yeah? . . . . . .. . . . . . . ._ . . . . . . . . ._ . . . . . . . . . . . . . . . . . 4a X 6 If 'Yes ; has it filed a tax return on Form 990-T for this year? , ,_�� � , , . . . . � . � .� .� . ., ., , , , , � ,__, _ , ._ _, � .� ., . � , � � . . , . . , ., . ., 4h X 5 Was there a liquidation, termination, dissolution, or substantial contraction during the year? . .�� ._ . _ _,_ � , 5

!f "Yes,' attach the statement required by General Instruction T. 6 Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either. _ ~ -" By language m the governing instrument or " By state legislation that effectively amends the governing instrument so that no mandatory directions that conflict with the state law

remain in the governing instrument? . . . . . . . . . . . . . . . . . . . . _ . .. . . . t . ` . X~' 7 Did the organization have at least $5,000 m assets at any time during the year? . , . _ . . . . . ,_ . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . ., ._ ___ . __ 7 X

If "Yes," complete Part 11, col. (c), and Part XV. 8a Enter the states to which the foundation reports or with which it is registered (see instructions) 10,

TENNESSEE , , b If the answer is 'Yes'to line 7, has the organization furnished a copy of Form 990-PF to the Attorney general (or designate) ; . _

of each state as required by General Instruction G? If "No," attach explanation . . . . . . . . . . . .__ . . . . . . . . . . . . . . . __ . . . . . . 8b + X ` 9 Is the organization claiming status as a private operating foundation within the meaning of section 4942(j)(3) or 4942(j)(5) for calendar _ _

year 2003 or the taxable year beginning in 2003 (see instructions for Part XIV)? If "Yes," complete Part XIV . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 ~ X 10 Did any persons become substantial contributors during the tax year? it -Yes,, attach a schedule listing their names and adaressrs . . . . . . . . . . . . . . . . 10

comply with the public inspection requi rements for its annual returns and exemption application? � , �� _ . ., . . ._ . . . ., . . . . ~ 11 11 Did the organ ization web site address " WWW . MACLELLAN . NET

12 The books are in care of " HUGH O . MACLELLAN, JR . Telephone no . " ( 4 2 3 ) 2 9 4 -814 2 Located at "UNUMPROVIDENT BLDG ., SUITE 501, CHATTANOOGA, TN zIP+4 .37402

73 Section 4947(a)(1) nonexempt charitable trusts filing Form 990-PF m lieu of Form 1041 - Check here . . . . . . . . . . . . . . . . _ _ . . ._ . . . . . . . . . . . . . . . . . . . . . . . . . . . 10. and enter the amount of tax-exempt interest received or accrued during the year . . . . . . . . . . . . . . . . . . . . . . 10- 1 13 ~ N/A

ii o1 oa Form 990-PF (2003)

r

Form 990-PF (2003) THE MACLELLAN FOUNDATION , INC . 62-6041468 Page 5

. .P: VIRl; Statements Regarding Activities for Which Form 4720 May Be Required File Form 4720 if any item is checked in the "Yes" column, unless an exception applies . ` , - Yes NO

1 a During the year did the organization (either directly or indirectly): : ., -- . . .

(1) Engage in the sale or exchange, or leasing of property with a disqualified person? . . . . . . . . . . . . . . . . . . . . . . . . . . . . __ . ._ . 0 Yes 0 No r =- ~-° : . (2) Borrow money from, lend money to, or otherwise extend credit to (or accept it from) .'

a disqualified parson? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . D Yes M No (3) Furnish goods, services, or facilities to (or accept them from) a disqualified person? . . . . . . . . . . . ~ Yes D No (4) Pay compensation to, or pay or reimburse the expenses of, a disqualified person? . . . . . . . . . . . . . . . ., . . . . . . . . . . . . . . . . . EK Yes [::] No (5) Transfer any income or assets to a disqualified person (or make any of either available

for the benefit or use of a disqualified person)? ., 0 . . .

Yes X No (6) Agree to pay money or property to a government official? (Exception . Check "No'

if the organization agreed to make a grant to or to employ the official for a period after f termination ofgovernment service, if terminating within 90 days .) . . . . . . . . . . . . ._ . ._ _ ._ _ . . ._ ._ _ ._ _ . . . . . . . . _ _ _ . 0 Yes O No . ~ ' . . .

b If any answer is 'Yes'to 1 all )-(6), did any of the acts fail to qualify under the exceptions described m Regulations section 53.4941(d)-3 or in a current notice regarding disaster assistance (seepage 19 of the instructions)? _ . . . . . . . . . . . _ . . . . . . . . . ., . , . . . . . . ~1b X

'- Organizations relying on a current notice regarding disaster assistance check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . ._ . . . . . . . . . . . . . ___ . 1 F~ c Did the organization engage in a prior year in any of the acts described in 1a, other than excepted acts, that were not corrected

before thefirst dayofthetaxyear beginning in 2003? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ., . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _ . . . . . _ . . 1c . X 2 Taxes on failure to distribute income (section 4942) (does not apply for years the organization was a private operating foundation - _

defined in section 4942(j)(3) or 4942(j)(5)) : a At the end of tax year 2003, did the organization have any undistributed income (lines 6d and 6e, Part XIII) for tax year(s) beginning

before 2403? . . . . . . . . . . . . . . ., _ . . . . . . . ., . _ . _,__ . . . _ . D Yes o No ~ . - If "Yes ; list the years 10,

b Are there any years listed in 2a for which the organization is not applying the provisions of section 4942(a)(2) (relating to incorrect valuation of assets) to the year's undistributed income? (If applying section 4942(a)(2) to all years listed, answer'No' and attach statement-see instructions .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . - . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .-- -~ - ---- --- -- .- - . N/A . . 2b

c If the provisions of section 4942(a)(2) are being applied to any ofthe years listed in 2a, list the years here .

3a Did the organization hold more than a 2% direct or indirect interest m any business enterprise at any time during the year? _ . . . . . . . . , ~X Yes -- . . . . . . . . . .-~- -- . . . . . . . . . . . . . . . . . - - - . . . . . . . . . ---~-~ -~- - - . . . . . . . . . . . . . . . . . ~ No

b If 'Yes ; did it have excess business holdings m 2003 as a result of (1) any purchase by the organization or disqualified persons after _ - May 26,1969; (2) the lapse of the 5-year period (or longer period approved by the Commissioner under section 4943(c)(7)) to dispose of holdings acquired by gift or bequest; or (3) the lapse of the 10-, 15-, or 20-year first phase holding period? (Use Schedule C, Form 4720, to determine iftireorganization hadexcess business holdings in2003.) . . ._ . . . . . . . . . . . . . . . . . . . . . . . . . . ._ . . . . , . . . . . . . . . . . . . 3b

4a Did the organization invest during the year any amount in a manner that would jeopardize its charitable purposes? _ . ._ ._ 4a X b Did the organization make any investment m a prior year (but after December 31, 1969) that could jeopardize its charitable purpose that had not been removed from jeopardy before the first day of the tax year beginning in 2003? . . . . .� . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4b X

5a During the year did the organization pay or incur any amount to: (1) Carry on propaganda, or otherwise attempt to influence legislation (section 4945(e))? . . . . . . . . . . . . . . . . . . . . . . . . . . ._ . . . 0 Yes M No -- (2) Influence the outcome of any specific public election (see section 4955) ; or to carry on, directly or indirectly,

any voter registration drive? . . . . . . . . . . . . . . . - . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . D Yes EXI No ., (3) Provide a grant to an individual fortravel, study, or other similar purposes? ._ . ._ . . . . . . . . . . . . . . . . . . . . . . . . , , . . . . . . . . ~ Yes D No (4) Provide a grant to an organization otherthan a charitable, etc , organization described in section

509(a)(1), (2) . or (3) . or section 4940(d)(2)? . . . . . . . . - . . . . . . . . . . . . . . . . . . . . . . . . - . -- - . . . . . . . . . . . . . . . . . . . . . . . . . . D Yes FT No (5) Provide for any purpose other than religious, charitable, scientific, literary, or educational purposes, or for ~ " " - , : : - " _

the prevention of cruelty to children or animals? = Yes OX No b If any answer is 'Yes'to 5a(1 )-(5), did any of the transactions fail to qualify under the exceptions described in Regulations

section 53.4945 or in a current notice regarding disaster assistance (see instructions)? . . . . . . . . . . . . . . . . . . . . . . . . . . . _ . . . . . . . . .__ ._, NBA _ 5b4 Organizations relying on a current notice regarding disaster assistance check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

s If the answer is 'Yes'to question Sa(4), does the organization claim exemption from the tax because it maintained = expenditure responsibility forthe grant? . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ., . . . . . . . . . . . . . . . . . . , . . . N/A . . . D Yes D No " - !f "Yes, " attach the statement required by Regulations section 53.4945-5(d). -

6a Did the organization, during the year, receive any lands, directly or indirectly, to pay premiums on . -' . . . ; a personal benefit contract? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . o Yes D No

b Did the organization, during the year, pay premiums, directly or indirectly, on a personal benefit contract? , 8b 'T-

X If you answered "Yes" to 6b, also file Form 8870.

Form 990-PF (2003)

323541 12-05-03

5

w

THE MACLELLAN FOUNDATION, INC . 62-6041468 Information About Officers, Directors, Trustees, Foundation Managers, Highly Page s Paid Employees, and Contractors

1 List all officers, directors, trustees, foundation managers and their compensation : (b) Title, and average (c) Compensation (d~coMnnuoo~sm (e) Expense

hours er week devoted If not account, other (a) Name and address ?( paid , °`~ a°nd de~r~"`~ 0 oositian enter -0-f comommilon allowances

144 .894 .1 7,335 .1 0 .

enter "NONE." (dconmeuuonstn (e) Ex pense

(c) Compensation employee ,~,~"S account other com smon allowances

110 500 . 5 , 636 . 0 .

110 500 . 5 636 . 0 .

55,100 .1 2,805 .1 0 .

2 Compensation of five highest-paid employees (other than those included on line 1). If no (b) Title and average

(a) Name and address of each employee paid more than $50,000 hours per week devoted to position

DARYL J . HEALD 501 UNUMPROVIDENT BLDG CHATTANOOGA T 104$ DAVID G . DENMARK 501 UNUMPROVIDENT BLDG CHATTANOOGA T 100$ SANDRA R . BARBER 501 UNUMPROVIDENT BLDG,CHATTANOOGA,T 100

Total number of other employees paid over $50,000 . . . . . . . . . . . . . . . . . . . . . 3 Five highest-paid independent contractors for professional services. If

(a) Name and address of each person paid more than $50,000 THE MAJESTY GROUP, LLC GROSS POINTE FARMS, MI NORTHINGTON PARTNERS AVON, CT TED WARD DEERFIELD, IL TEAM RESOURCES ATLANTA, GA CAROL LEE HAMIN CLIFTON, VIRGINIA Total number of others receiving over $50.000 for professional services

(b) Type of service (c) Compensation

NVESTMENT COUNSEL 200 000 .

NVESTMENT COUNSEL 150 432 . ONSULTANT FOR HABITABLE ENTITIES 60 , 439 . ONSULTANT FOR HABITABLE ENTITIES 446 314 . ONSULTANT FOR WORK N CHINA 64 r 314 .

- ----- --- ---- -- - ------ " 0

Farm 990-PF (2003)

SEE

ne, enter "NONE."

List the foundation's four largest direct charitable activities during the tax year. Include relevant statistical information such as the Expenses number of organizations and other beneficiaries served, conferences convened, research papers produced, etc

t N/A

2

3

4

Total. Add lines 1 through 3 . . . . -- -- - - ------- - -- --- . . . . . . . . . . . . . -- - - ~- --- - . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . - .- . 1 1 0 .

FN; . X,4 " Minimum Investment Return (All domestic foundations must complete this part. Foreign foundations, see instructions .)

1 Fair market value of assets not used (or held for use) directly in carrying out charitable, etc., purposes : , . : a Average monthly fair market value ofsecurities _ . . . . . ._ . . . . . . . . . . . . . . . . . . . . .. . . . . ._ ._ __ __ . . . . . . . . . . . . . . ._ , . . . _ . . . .. . . . to 257, 395, 403 . b Average of monthly cash balances . . . . . . . . . . . . . . . . , . . . . 1111 3,916,080 . c Fair mantel value of all other assets . . . . . . . . . . . . . . ._ . . . . . . . . . . . . . . 1 c d Totat (add lines 1a, b . and c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ---- . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 d 261,311,483 . e Reduction claimed for blockage or other factors reported on lines is and

1c (attach detailed explanation) . . . . . . . ._ ._ . . _ . . . . . . . . . . . . . . 1e 12 496, 301 . 2 Acquisition indebtedness applicable to line 1 assets . . . . ._ . . . . . _ . . . . . . . _ _ . . . ., . ., . . . . . .. . . _ . . . . . . . , . . . . . . 2 0 . 3 Subtract line 2 from line id . . . . . ._, 3 261 , 311 , 483 . 4 Cash deemed held for charitable activities . Enter 1 1/2% of line 3 (far greater amount, see instructions) 4 3 , 919 , 6 7 2 . 5 Net value of noncharitable-use assets . Subtract line 4 from line 3 Enter here and on Part V, line 4 5 257 , 3 9 1,811 . 6 Minimum Investment return . Enter Sao of line 5 . . . . . . . . _ g 12 , 869 , 591 .

Dlstributable Amount (see instructions) (Section 4942(j)(3) and (j)(5) private operating foundations and certain foreign organizations check here 1 0 and do not complete this pan .)

7 Minimum investment return from Part X, line fi . . . . . . . . , . ._ . . . ., . . . . . . . . . . . . . _ . . . . . . . . . . . . . . . . . . _ 1 12,869,591 . 2a Tax on investment income for 2003 from Part VI, line 5 . . . . ._ _ __ ._ . _ . ._ . . ., . . . 2a 191,957 . b Income tax for 2003 . (This does not include the tax from Part VI .) 2b 12,979 . c Add lines 2a and 2b ._ . . . . . . . . . . . . . _ . . . . . . , , . . . . . . . . . . . . . . . . . . . . . . . ___ _ . . . . . . . . . . . ,_ . , . , . _ . 2c~ 204 , 936 .

3 Distn6utable amount before adjustments. Subtract line 2c from line 1 . . . .� , . .� , , __ _,_, 3 12, 664 , 655 . 4a Recoveries of amounts treated as qualifying distributions . . . . __ , . . � . � , . . , . . 4a 0 .- . _ " . b Income distributions from section 4947(a)(2) trusts _ , . . . . . . . . . . "~ . . . . . . . . . . . . . . . . . 46 0 , _ . c Add lines 4a and 4b . . . . . . . . . . . . . . . _ . . _ _ " 4c 0 .

. . . . . . . . _ . . . . . . . . . . . . . 5 12 , 664,655 5 Add lines 3 and 4c . .- -

---- - . . . . . . . . . . . . . . . . -- ..-- - . . . .

g Deduction from distributable amount (see instructions) . . . . . . . . g 0 . 7 Distri6utable amount as adjusted . Subtract line 6 from line 5 . Enter here and on Part XIII, line 1 . . .� 7 12 6 6 4 , 655 .

~ " Qualifying Distributions (see instructions)

1 Amounts paid (including administrative expenses) to accomplish charitable, etc., purposes : a Expenses, contributions, gifts, etc . -total from Part I, column (d), line 26 .,_ . , . . . . . . . . . . . . . . _ . . __, . __ . ., . . . . . . . . . . ., 1 a 12 , 688 , 402 . 6 Program-related investments -Total from Part IX-B .__ _ ._ . . . . . . . . . . . . . . . . . . . . . . . . _ . . . . . . . . . . . _, . . . . . . . . . . . . . . . . . ., ., . . . . . . . 1b

2 Amounts paid to acquire assets used (4r held for use) directly in carrying out charitable, etc ., purposes . . . . . . . . . . . . .. . . . . . . . . _ 2 3 Amounts set aside for specific charitable projects that satisfy the : a Suitability test (poor IRS approval required). . . . . . . . . . ., . . . . . . . . . . . . . . . . . . ., . . . . . . . . . . . . . ,. . . . . . ., 3a b Cash distribution test (attach the required schedule) . . . . . . . . . . . . . ., . . ., . . . . . . . . . . ., . � . . . . . . . . . . . . . . . . . . . . , . . ., . . . . . . . . . . ._ 3b

4 Qualifying distributions . Add lines 1a through 3b . Enter here and on Part V, line 8, and Part X1 11, line 4 . . . . . . . __ . . . . . . . . , 4 12 , 688 , 402 . 5 Organizations that qualify under section 4940(e) for the reduced rate of tax on net investment

income . Enter 1% of Part I, line 27b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _ ____ , _ , . ., _ _ , . . . . , . . , . . . . . . . 5 0 . 6 Adjusted qualifying distributions . Subtract line 5 from line 4 . _ . . _ . . . , . . � . , . . . . . . . . ., . . . . . . . . . .__ . . ._ _ .__ . . ., ., . . . . . . . . . _ 6 12,688 , 402 .

Note: The amount on Cne 6 will be used In Part V, column (b), in subsequent years when calculating whether the foundation qualifies for the section 4940(e) reduction of tax in those years.

Form 990-PF (2003)

323561 12-asa3 7

Form 990-PF (2003) THE MACLELLAN FOUNDATION, INC . 62-6041468 Page 7

:p :~ Summary of Program-Related Investments

Describe the two largess program-related investments made by the foundation during the tax year an lines 1 and 2. Amount N/A

2

All other program-related investments . See instructions . 3

r

Form 99o-PF (2003) THE MACLELLAN FOUNDATION, INC . 62-6041468 Page e Undistributed Income (see instructions)

(a) (b) (c) (d) Corpus Years prior to 2002 2002 2003

1 Distributable amount for 2003 from Part A pine 7 . . . . . ., � , ., . � ., 12,664,655 .

2 Undistributed income, d any, as of the end of 2002:

a Enter amount for 2002 only . . . _ . _ . _ . . . . ~ - ~ `~ ~ 12 217 , 350 . 5b Total for prior years :

g Excess distributions carryover, If any, to 2003. a From 1998 6 From 1999 - ~ ` ~ ~ - -c from 2000 . . . . . . . . - " -d From 2001 e From 2002 f Total of lines 3a through e

. . . . ., . 0

4 Qualifying distributions for 2003 from 7 7 . _ Part Xll,line a: " $ 12 688 402

a Applied to 2002, but not more than line 2a . . . ~ ` ~ - - ~ ~ - - 12,217,350 . . - - ` -6 Applied to undistributed income of prior years (Election required -see instructions) ._ - " - - 0 . ~ - - " - - ~ - -

s Treated as distributions out of corpus ~ ~ -Election required see instructions ) 0 .

d Applied to 2003 distributable amount _ . ~ - - - 471, .052 . _ 0 . - - - e Remaining amount distributed out of corpus

.

5 Excess distributions carryover applied to 2003 0 . ~ - ~ - . s ~ . . - . . ` -_. . . . . . . . . Of an amount appears m column (d), the same amount -, -

must be sham In column (a).) . - - " ~ ~ - - - . ." .. . 6 Ever the net total of each column as

indicated below: 8 Corpus. Add lines 3f, 4c, and 4e. SubVact line 5 0

b Prior years' undistributed income . Subtract line 4b from line 2b __ . . . . . . . . . . . . ___ _ ,_ . y ~ ~ :~ " 0 . -

c Enter the amount of prior years' _ _ - - , undistributed income for which a notice of deficiency has been issued, or on which

i . : the section 4942(a) tax has been previously . " O : ., assessed --.~ d Subtract line 6c from line 6b . Taxable amount-see instructions 0 .

e Undistributed income for 2002 . Subtract line 4a from line 2a . Taxable amount-see instr. 0 .

f Undistributed income for 2003 . Subtract lines 4d and 5 from line 1 This amount must be distributed in 2004 603 .� , , , . .� ._ . . . 12, 193, .

7 Amounts treated as distributions out of corpus to satisfy requirements imposed by section 170(b)(1)(E) or 4942(g)(3) . . 0 .1

8 Excess distributions carryoverfrom 1998 not applied on line 5 or line 7 , 0 . . . . . . . . . . . . . . . +s { _

~-9 Excess distributions carryover to 2004 . Subtract lines 7 and 8 from line 6a . . . 0

10 Analysis of line 9 . a Excess from 1999 .__ b Excess from 2000 . . . c Excess from 2001 . . . d Excess from 2002 � . e Excess from 2003 . ~ - - - ' - - . .

Form 990-PF (2003) 323571 12-05-03

8

r

62-6041468 N/A

142( j )(3) or [~ 4942 6)(5)

(d12000 te! Total

i a If the foundation has received a ruling or determination letter that it is a private operating foundation, and the ruling is effective for 2003, enter the date of the ruling . . � . . . . . . . ., ., . . ., . . ., ., . . . . 1 L

6 Check box to indicate whether the organization is a private operating foundation described in section Tax year I Prior 3 (a) 2003 (b12002 (c) 2

2 a Enter the lesser of the adjusted net income from Part I or the minimum investment return from Part X for each year listed . . . . . . . . . . . . . . . . . . .. . . . .

b 85°k of line 2a . . . . . . . . . . . . . . . . . . . . . . . . . c Qualifying distnbutions from Part XII,

line 4 for each year listed . . . . . . . . . . . . d Amounts included in line 2c not

used directly for active conduct of exempt activities . . . . . . . . . . . . . . . ,_ . . . . .

e Qualifying distributions made directly for active conduct of exempt activities . Subtract line 2d from line 2c . . . . . . . . .

3 Complete 3a, b, or c far the alternative test retied upon :

a "Assets" alternative test - enter: (1) Value of all assets . . ._ . . . . . . . . . . .

(2) Value of assets qualifying under section 4942(j)(3)(B)(i) ,

b 'Endowment alternative test - Enter 213 of minimum investment return shown in Part X, line 6 for each year listed . . . . . . . . . . . . . . . . . . . . . . .

c 'SupporC alternative test - enter : (1) Total support other than gross

investment income (interest, dividends, rents, payments an securities loans (section 512(a)(5)}, or royalties) . . .

(2) Support from general public and 5 or more exempt organizations as provided in section 4942(j)(3)(B)(iii) . . . . . , .

(3) Largest amount of support from an exempt organization . . .__ . ,

9

Form990-PF 2003 THE MACLELLAN FOUNDATION INC . Private Oaeratina Foundations (see instructions and Part VII-A,

Supplementary Information (Complete this part only if the organization had $5,000 or more in assets at any time during the year-see page 25 of the instructions.)

1 Information Regarding Foundation Managers : a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation before the close of any tax year (but oily d they have contributed more than $5,000) (See section 5Q7(d)(2) .)

NONE b List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the ownership of a partnership or

other entity) of which the foundation has a 1096 or greater interest.

NONE 2 information Regarding Contribution, Grant, Gift, Loan, Scholarship, etc., Programs:

Check here 0110 if the organization only makes contributions to preselected charitable organizations and does not accept unsolicited requests for funds . If the organization makes gifts, grants, etc. (see instructions) to individuals or organizations under other conditions, complete items 2a, b, c, and d .

a The name, address, and telephone number of the person to whom applications should be addressed : H . O . MACLELLAN, JR ., UNUMPROVIDENT BLDG,CHATTANOOGA,TN 37402 (423)294-8142

b The form in which applications should be submitted and information and materials they should include INSTRUCTIONS WILL BE PROVIDED UPON CONTACTING THE ABOVE NAMED PERSON .

c Any submission deadlines: NONE

d Any restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or other factor : NONE

a2asaiM1-2aaa Form 990-PF (2003)

r w

s

Form 99o-PF(2003) THE MACLELLAN FOUNDATION INC . 62-6041468 Page 7o Supplementary Information (continued)

8 Grants and Contributions Paid During the Year or Approved for Future Payment

Recipient If recipient is an individual, show any relationship to Foundation Purpose of grant or

Name and address (home or business) any foundation manager status of contribution Amount or substantial contributor recipient

a Paid during the year

CHATTANOOGA CHRISTIAN 501(C)(3) FOUNDATION, CHATTANOOGA, RG . TN ONE OPERATING FUNDS1,000,000 .

CHARITABLE CONTRIBUTIONS 5 01(C)(3) THROUGH PARTNERSHIPS ONE RG . VARIOUS 728 .

SCHEDULE ATTACHED - STOCK O1(C)(3) CONTRIBUTIONS ONE RG . ~VARIOUS ,971,448 .

OSPITAL OPERATING FUNDS 736 .

01(C)(3) RG . OPERATING FUNDS 1,000 .

01(C)(3) RG . PERATING FUNDS 750 .

01(C)(3) RG .

OPERATING FUNDS 6,458 .

Total 3a

O1(C)(3) RG .

b Approved fog future payment SCHEDULE ATTACHED OF GRANTS APPROVED BUT UNPAI AT END OF YEAR 20P6~794 .

Total 323601n2-05-03

10

1110- 3a 1 20+062794 . Form 990-0 (2003)

SISKIN HOSPITAL FOR PHYSICAL REHABILITATION, CHATTANOOGA, TN

THORNSTON EDUCATIONAL FUND, GLENDORA, CA

HOPE BIBLE MISSION, MORRISTOWN, NJ

CHATTANOOGA RESOURCE FOUNDATION, CHATTANOOGA, TN

R

1 Program service revenue: cone owe I

a b c d e f g Fees and contracts from government agencies . . . . . .

2 Membership dues and assessments 3 Interest on savings and temporary cash

investments . . . . . . . . -- - . . . . . . . . . . . . . . . . . . . . . . 14 57,214 .

4 Dividends and interest from securities . . . . . . . _ . . . . . . . . . 14 5 , 059 -',061 .

5 Net rental income or (loss) from real estate : a Debt-financed property . . ., . . . h Not debt-financed property . . . . . . . . . . . . . . . . . .

B Net rental income or (loss) from personal property. . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 other investment income . . . . . . . . . . . . . . . . . . . . . . . . . . . . 525990 76 , 410 . 14 -507,824 . 8 Gain or (loss) from sales of assets other man inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 525990 35,813 . 18 7 , 181,769 .

9 Net income or (loss) from special events . . . . . . . . . . . . . . 10 Gross profit or (loss) from sales of inventory . . . . . . . . . . . . . 11 Other revenue :

a b c d e

12 Subtotal . Add columns (b), (d), and (e) . . . . . . . . . . . . . . . ' ~ ~ '' 112 , 223e ~ ` 11 7 9 0 2 20 . 1 0 . 13 Total . Add line 12, columns (b), (d), and (e) . . . . . . . . . s . . . . . . . . . . . . . . . . . 13 11,902,443 .

-(See worksheet in line 13 instructions to verify calculations.)

`p ~»~ Relationship of Activities to the Accomplishment of Exempt Purposes

11

Form 990-PF (2003) THE MACLELLAN FOUNDATION, INC . 62-6041468 Page 11

Analysis of Income-Producing Activities

Enter gross amounts unless otherwise indicated . Unrelated business income Excluded b ~on512 513 ar sia c ~--"-~ -------"

Form 990-PF (2003) THE MACLELLAN FOUNDATION, INC . 62-6041468 Page 12 Pty Information Regarding Transfers To and Transactions and Relationships With Noncharitable

Did the organization directly or indirectly engage in any of the following with any other organization described in section 501(c) of YE the Code (other than section 501(c)(3) organizations) or in section 527, relating to political organizations?

a Transfers from the reporting organization to a noncharitable exempt organization of: (1) Cash la l(2) Other assets . . . . . . 1 a 2

b Other transactions : (1) Sales of assets to a nonchaMable exempt organization . . . . . . . 1 b(l ) (2) Purchases of assets from a noncharitable exempt organization 1 b( 2 ) (3) Rental of facilities, equipment, or other assets ._ . . . 1b 3 (4) Reimbursement arrangements 76 4 (5) Loans or loan guarantees 1b 5 (6) Performance of services or membership or fundraising solicitations . . . . . 1 W ill

c Sharing of facilities, equipment, mailing lists, other assets, or paid employees . . . . . . . . . . . . . . 1 c d If the answer to any of the above is 'Yes," complete the following schedule . Column (b) should always show the fair market value of the goods, other assets,

or services given by the reporting organization If the organization received less than fair market value in any transaction or sharing arrangement, show in

X X X X X X X

2a Is the organization directly or indirectly affiliated with, or related to, one or more tax-exempt organizations described in section 501(c) of the Code (other than section 501(c)(3)) or m section 527? E] Yes EK No

L IF 'V~~ ~ ..w . � ~I ..L~ il,n i~ll ..... :w .. -. .A . .1 ..

Signature of o icer or trustee 41 41

m N

Preparer's, v c signature `° u 0 Firm's nuns (a ~C HAM a ~ if self-emplowd), 1000

address, and ZIP code C H AT

LISS, BANNER & ST TALLAN BUILDING ANOOGA . TN 37402-

323621 12-05-03

t r

X X

(a) Name of organization (b) Type of organization (c) Description of relationship N/A

Under penalties of decl that I have examined this slum, including accompanying schedules and statements, and to the best of my knowledge and belief, It is true, correct, and complete DsL`(aratlon f l or ttiaD~taxOeyer or fiduplary) Is baeaA~on all information of which orooarar has any knowledge

// // // `

r

" CONTINUATION FOR 990-PF, PART IV THE MACLELLAN FOUNDATION INC . 62-6041468 PAGE 1 OF 5

Capital Gains and Losses for Tax on Investment Income

(a) List and describe the kind(s) of property sold, e.g ., real estate, 2-story brick warehouse; or common stock, 200 shs. MLC Co .

7a THRU BEAR, STEARNS SEC .--5CH ATTACHED bTHRU BEAR, STEARNS SEC .--SCH ATTACHED

c THRU MERRILL LYNCH--SCH ATTACHED d THRU CSFB, LLC--SCH ATTACHED e THRU CSFB, LLC--SCH ATTACHED f ABRAMS CAPITAL PARTNERS II, L .P .--SCH K-1 yABRAMS CAPITAL PARTNERS II, L .P .--SCH K-1 h AQUITANIA PARTNERS, L .P .--SCH K-1 i AQUITANIA PARTNERS, L .P .--SCH K-1 j AQUITANIA PARTNERS, L .P .--SEC .1231 kBIOTECHNOLOGY VALUE FUND, L .P .--SCH K-1 IBIOTECHNOLOGY VALUE FUND, L .P .--SCH K-1 m CASTLE CREEK CAPITAL PARTNERS--SCH K-1 nCASTLE CREEK CAPITAL PARTNERS--SCH K-1 oCASTLE CREEK CAPITAL PARTNERS--SEC 1256 LOSS

(e) Gross sales price (1) Deprecation allowed (g) Cost or other basis (or allowable) plus expense of sale

206 799 . 209 258 . 787 230 . 701 787 . 229 098 . 207,977 .

4 1 913 , 423 . 4 , 565,113 . 155 872 . 136 092 . 492 196 . 113 040 . 926 495 .

-260 , 380 . -330 .

703,233 . i 87 , 328 .

13 , 700 . -2,938 .

o -693 . Complete only for assets showing gain in column (h) and owned by the foundation on 12/31169

i F .M.V . as of 12131169 (1) Adjusted basis (k) Excess of cal. (i)

1 as of 12131/69 over col. (j), if any

to NOW acquIrea (c) Date acquired (d) Date sold P - Purchase Imo ., day, yr) (mo,day, yr D - Donation P VARIOUS VARIOUS P VARIOUS VARIOUS P VARIOUS VARIOUS

v P VARIOUS ARIOUS v P VARIOUS ARIOUS

P VARIOUS ARIOUS P VARIOUS ARIOUS P VARIOUS ARIOUS P VARIOUS ARIOUS P VARIOUS ARIOUS P VARIOUS IOUs P MIOUS IOUs P ARIOUS VARIOUS P ARIOUS VARIOUS P 1ARibus VARIOUS

(h) Gain or (loss) (e) plus (f) minus (g)

-2,459 . 85,443 . 21,121 . 348,310 . 19,780 .

492 196 . 113 , 040 . 926,495 .

-260,380 . -330 .

703,233 . 87 , 328 . 13 , 700 . -2 , 938 .

-693 . (I) Losses (from c01 . (h))

Gains (excess of col . (h) gain over col. (k), but not less than W)

_2 , 459 . 85,443 . 21 , 121 .

348,310 . 19,780 .

492,196 . 113,040 . 926 495 . -260,380 .

-330 . 703 233 . 87,328 . 13 700 . -2,938 . -693 .

a b c d e f

9 h i i k i

13

2 Capital gain net income or net capital loss . .-- . . f ~f gain,Iso enter in Part I, line 7 1 . C 1 , If (loss), enter"-O-" in Part I, line 7

. . . _ ._ . 1

3 Net short-term capital gain or (loss) as defined in sections 1222(5) and (6)' If gain, also enter in Part I, line 8, column (c) . If (loss). enter'-0= in Part I, line 8 . . . . . . . . . . . . 3

323591 0.x01-03

r + " ~ CONTINUATION FOR 990-PF, PART IV

THE MACLELLAN FOUNDATION INC . 62-6041468 PAGE 2 OF 5 -1V " Capital Gains and Lasses for Tax on Investment Income

(a) List and describe the kind(s) of property sold, e .g , real estate, (6 How acquired (c Date acquired (d) Date sold 2-story brick warehouse ; or common stack, 200 shs. MLC Co . ~ - Purchase D - Donation ?1M o ., day, yr.) (mo ., day, yr.)

1a FERN HILL INVESTMENTS L .P .--SCH K-1 P VARIOUS VARIOUS b FERN HILL INVESTMENTS, L .P .--SCH K-1 P VARIOUS VARIOUS c MAJESTY I L .P .--SCH K-1 P VARIOUS VARIOUS d MAJESTY I, L .P .--SCH K-1 P VARIOUS VARIOUS e MAJESTY I L .P .--SEC 1256 P VARIOUS VARIOUS f MAJESTY I L .P .--SEC 1231 P VARIOUS VARIOUS PENINSULA CATALYST FUND--SCH K-1 P VARIOUS VARIOUS

h PENINSULA TECHNOLOGY FUND-SCH K-1 P VARIOUS VARIOUS i PENINSULA TECHNOLOGY FUND--SCH K-1 P VARIOUS VARIOUS RBJ PARTNERS II L .P .--SCH K-1 P VARIOUS VARIOUS

k RBJ PARTNERS II L .P .--SCH K-1 P VARIOUS VARIOUS RESOURCE LAND FUND I, LLC--SEC 1231 P VARIOUS VARIOUS

m ROYAL CAPITAL VALUE FUND--SCH K-1 P VARIOUS VARIOU n ROYAL CAPITAL VALUE FUND--SCH K-1 P VARIOUS VARIOUS oSAMARITAN ENHANCED EQUITY FUND--SCH K-1 P f~A-RIOUS VARIOUS

(e) Gross sales price (fl Depreciation allowed (g) Cost or other basis (h) Gain or (loss) (or allowable) plus expense of sale (e) plus (f) minus (g)

a -31 , 034 . -31,034 . b 419 421 . 419 421 . c 290 r 965 . 290 965 . d 166,266 . 166,266 . e -11 , 775 . -11 , 775 . t -21 . -21 .

53,233 . 53,233 . n 1 , 252 , 193 . 1 1 252 , 193 . i 272 076 . 272 076 .

19 , 829 . 19 , 829 . k 4 , 439 . 4 , 439 . 1 126,293 . 126 293 . m -26,388 . -26 , 388 . n 114 f 744 . 114 744 . a 177 . 177 .

Complete only for assets showing gam in column (h) and owned by the foundation on 12137/69 (I) Losses (from col . (h))

(i) F .M .V. as of 12131/69 (I) Adjusted basis (k) Excess of cal . (i) Gains (excess of col . (h) gain over col . (k), as of 12131/69 over col . (j), if any but not less than"-O-*)

a -31 , 034 . a 419 421 . c 290 965 . d 166 266 . e -11 , 775 . t -21 .

53,233 . 1,252,193 . 272,076 . 19,829 . 4,439 .

126,293 . -26,388 . 114,744 .

177 .

h

14

2 Capital gain net income or net capital loss) . . . . . f ~f am, also enter m Part I, line 7

C 1 l if loss), enter'-0=' in Part I, line 7

3 Net short-term capital gain or (loss) as defined in sections 1222(5) and (6): If gain, also enter in Part f, line 8, column (c) . If (loss), enter "-0= in Part I, line 8

323591 05-01-03

CONTINUATION FOR 99Q-PF, PART IV 62-6041468 PAGE 3 OF 5 THE MACLELLAN FOUNDATION INC .

JV" Capital Gains and Losses for Tax on Investment Income (a) List and describe the kind(s) of property sold, e.g ., real estate, 2-story brick warehouse; or common stock, 200 shs. MLC Co .

taSAMARITAN ENHANCED EQUITY FUND--SCH K-1 b SAMARITAN GLOBAL FUND--SCH K-1 c SAMARITAN MULTI-STRATEGIES FUND--SCH K-d SSM VENTURE PARTNERS II, L .P .--SCH K-1 e SSM VENTURE PARTNERS II, L .P .--SCH K-1 f VALUE HOLDINGS, L .P .--SCH K-1 VALUE HOLDINGS, L .P .--SCH K-1

hWINDROCK PRIVATE EQUITY--5CH K-1 i WINDROCK PRIVATE EQUITY--5CH K-1 1 APACHE CORP--FRACTION kBERKLEY, W.R . CORP--FRACTION iWERNER ENTERPRISES, INC .--FRACTION m BARR LABS INC--FRACTION nMYLAN LABORATORIES--FRACTION oMYLAN LABORATORIES-FRACTION

(h1 How acquired (c) Date acquired (d) Date sold P D

- Purchase Imo., day, yr .) (mo., day, yr .) - Donation P VARIOUS VARIOUS P VARIOUS VARIOUS P VARIOUS VARIOUS P VARIOUS VARIOUS P VARIOUS VARIOUS P VARIOUS VARIOUS P VARIOUS VARIOUS P VARIOUS VARIOUS P VARIOUS VARIOUS P 11/20/0204/02/03 P 11/20/0209/03/03 P 12/04/0210/06/03 P 11/21/0203/21/03

~ P T11/21/02j01/31/03 P X11/21/0210/15/03

(h) Gain or (loss) (e) plus (f) minus (g) (e) Gross sales price (f) Depreciation allowed (g) Cost or other basis

(or allowable) plus expense of sale

211 . 134,190 . 499,079 .

-277 . -113,535 . 91,550 . 194,215 .

7,165 . 23,022 .

12 . 17 .

a 134,190 . c 499,079 . d -277 . a -113,535 . f 91,550 .

194,215 . n 7,165 . i 23,022 .

12 . k 17 " i 5 .

27 . n 13 . 0 14 .

Complete only for assets show!

(i) F .M .V . as of 12131/69

a -

5 . 27 . 13. 14 .

in column (h) and owned ay the foundation on 12/31169 (I) Losses (from col . (h)) (j) Adjusted basis (k) Excess of cal . (i) I Gams (excess of col . (h) gain over col. (k), as of 12131169 over col. (j), it any but not less than '-0-')

134,190 499,079 .

-277 . 113,535 . 91,550 . 194,215 .

7,165 . 23,022 .

12 . 17 . 5 . 7 . m

13 . 14 .

15

Z Capital g ain net income or net capital loss ., I If ain, also enter in Part I, line 7 4 ( ) 1 If ?loss), enter "-0= in Part I, line 7 ) " ' "" """

3 Net short-term capital gain or (loss) as defined in sections 1222(5) and (6) : If gain, also enter fn Part I, line 8, column (c) . If (loss, enter *-V in Part f, fine $ . . . . . . - . . . . . . . . . . - . . . . . - )

323591 05-01-03

CONTINUATION FOR 990-PF, PART IV 62-6041468 PAGE 4 OF 5 THE MACLELLAN FOUNDATION INC .

ppd tVCapital Gains and Losses for Tax on Investment Income (a) List and describe the kind(s) of property sold, e.g ., real estate, 2-story brick warehouse ; or common stack, 200 shs. MLC Co.

to WERNER ENTERPRISES, INC .--FRACTION b SENSIENT TECHNOLOGIES--FRACTION cCITADEL EDISON FUNDS d GOLDEN TREE HIGH YIELD e HYGROVE OFFSHORE f LMC COMPASS FUND, LP O PERENNIAL INVESTORS OFFSHORE hSAMARITAN ENHANCED EQUITY FUND iCHILTON NEW ERA INTERNATIONAL SHAKER INVESTORS OFFSHORE

k NEXTEL, INC . SAFE HARBOR FUND I, L .P .

m SAFE HARBOR FUND I, L .P .--SCHEDULE K-1 n SAFE HARBOR FUND I, L .P .--SCHEDULE K-1 o STATE BANCORP--FRACTIONAL SHARE

acquires (c) Date acquired (d) Date sold rchase (mo ., day, yr.) (mo ., day, yr.) oration P 12/04/0210/06/43 P 12/04/0209/03/03 P 01/31/0212/31/03 P 01/31/0210/01/03 P 12/31/0109/30/03 P 12/31/0001/01/03 P 06/27/0212/31/03 P 01/29/0202/01/03 P VARIOUS VARIOUS P VARIOUS VARIOUS P VARIOUS VARIOUS P VARIOUS 10/06/03 P ARIOUS ARIOUS P ARIOUS ARIOUs P ARIOUS 07/21/03

(h) Gain or (loss) (e) plus (f) minus (g) (e) Gross sales price (1) Depreciation allowed (g) Cost or other basis

(or allowable) plus expense of sale 15 . 15 .

5 . 5,074,449 . 3,870,081 . 2,367,944 .

104,407 . 3,736,643 . 1,814,753 . 244,391 . 162,182 . 39,835 .

2,907,895 . 33,619 .

5 . 74,449 . 870,081 .

-110,603 . -114 .

5,000,000 . 3,000,000 . 2,478,547 .

104,521 . 4,000,000 . 1,814,753 .

f

h

1 k i m n 0

a b c d s f

h

1 k

m n

-263t357 . 0 .

244,391 . 162,182 . 39,835 .

102,435 . 33,410 . -1,885 .

5 .

2,805,460 . 209 .

1,885 .

(I) Losses (from cal . (h)) Gains (excess of cal . (h) gain over cal . (k),

but not less than '-0-")

15 . 5 .

74,449 . -- 870,081 .

-110 , 603 . -114 .

-263 , 357 . 0 .

244 391 . 162,182 . 39 , 835 .

102 435 . 33,410 . -1 , 885 .

5 .

in column (h) and owned by the foundation on 12/31/69

(j) Adjusted basis (k) Excess of cal (i) as of 12/31169 over cal . (j), if any

16

5 . omplete only for assets shown

(i) F.M .V . as of 12/31/69

If sin, also enter in Part I, line 7 2 Capital gain net income or (net capital loss) ~ If (loss), enter"-O-' in Part I, line 7 ~

3 Net short-term capital gain or (loss) as defined in sections 1222(5) and (6): If gain, also enter in Part I, line 8, column (c) If (loss), enter'-0= m Part I, line 8 3

323591 05-01-03

CONTINUATION FOR 990-PF, PART IV THE MACLELLAN FOUNDATION INC . 62-6041468 PAGE 5 OF 5

~~ Capital Gains and Losses tar Tax on Investment Income (a) List and describe the kind(s) of property sold, e .g ., real estate, (b' How acquired (c Date acquired (d) Date sold 2-story brick warehouse ; or common stock, 200 shs. MLC Co . P - Purchase ~mo ., day, yr.) (mo ., day, yr.} D - Donation

1a CAPITAL GAINS DIVIDENDS b c d e f

h I I

(h) Gain or (loss) (e) plus (f) minus (g)

(f) Deprecation allowed I (g) Cost or other basis (or allowable) plus expense of sale

m n 0

Complete only for assets

(i) F.M.V . as of 12/31/69

a

in column (h) and owned by the foundation on 12/31/69

(j) Adjusted basis (k) Excess of col. (i) as of 12/31/69 over col . (j), if any

3 I N/A

17

(e) Gross sales price

a 948 . b c

2 Capital gain net income or net capital loss . . .1 ~f gain, also enter in Part I, line 7 l ( 1 ~ l If (loss), enter "-0= m Part I, line 7

3 Net short-term capital gam or (loss) as defined in sections 1222(5) and (6) : If gain, also enter in Part I, line 8, column (c) . If (loss), enter'-Vin Part I, line 8 __

323591 0&01-03

948 .

(1) posses (from coy. (h)) Gams (excess of col . (h) gain over cal. (k),

but not less than '-0-')

948 .

7 .181,769 .

2003 DEPRECIATION AND AMORTIZATION REPORT FORM 990-PF PAGE 1 990-PF

w newt Date un, Unadjusted Bus % Reduction In Basis For Accumulated Current Amount Of No Description Acquired Method Life No. Cost Or Basis Excl Basis Depreciation Depreciation Sec 179 Depreciation

2(D)VCR RECORDER 060186 SL .00 16 920 . 920 . 920 . 0 .

A (AY.-IBM r ., . . . ., .. . .

. . . ~ . . r~ . . . , .

14 RANSCRIBER - OLYMPUS 122091 OOD .00 17 339 . 339 . 339 . 0 .

. . . . . , . . . . ~ . . . ., . . . . ;r (12) 5 DRAWER LATERAL

21 FILES 120793 OOD 7 .00 17 7,236 . 7,236 . 7,236 . 0 . 4' . 0"WSR . .

t . . , . . . . . ~ ~. . . . ,122

UNCH & BINDING J

. 24 CHINE 063093 OOD .00 17 999 . 999 . 999 . 0 . xy y~~y~ ~y~ .v ~. ;yy. . . ~ . - ~ ,l . ., . . . ~.7.3.r .S:~F 'X~,il ..~;.~?ki."F ~~ d.v3 .94 , .2 0.0.00 .7 ~1"'klxJ'~" IT., ` . 4o,082 ,~#?~~~A ̀ . , .. ~ " "'' A ` , ~ LYMPUS HANDHELD

33 ALCULATOR, 7 061595 OOD .00 17 J 279 . 279 . 279 . . . . , 0,,

o2 i*i$ Wrm 00 17' 900 . DELL COMPUTERS WITH

37 ATTACHMENTS 022497 OOD 5 .00 17 4,120 . 4,120 . 4,120 . 0 .

COMPUTHR ".,SOFTWARE. 11,735,

43 ASERJET PRINTERS (4) 013098 OOD .00 17 ,1,.4,49 . r 1,449 . 1,366 . 83 . . .. .

."S 'x ,9L1Sj .,'Ar,4,ti,'lrV-.iSR ̀: .r. r . . " ~,+ 1 ~i~iJ.1T w4FW .~ " . .' . . 1.0 , .~. . . . ~k . ` ~~ " r+ , J . . . . ~ .r . . .1 f.1437..+!" . . * X- tii~ ~A .t. . . ~

VARIOUS EQUIPMENT AND 4,51NSTALLATION .s ., ., .'120898,0OD .00 17 1,750 . 1,750 . ,1 ,650 . 100 . .~~~,, ,~ ry. :. ~ ~ . .

~, 4 A ~ f~~~'.:~., ~~ ~7J~'~ ~ ~#f~SM ~~~0 - ~.~? � 2o,5154* ?r~..: ~};: i.~,"k'~ ~:T I~

. . ~ ~ ~ . . ~ . . . . . ~ ~ l

47 SOFTWARE r 120898 SL .00 16 630 . 630 . 515 . 115 . . . .

3"3 3280102 05- 1-03 (D) - Asset disposed " ITC, Section 179, Salvage, HR 3090, Commercial Revitalization Deduction

18

2003 DEPRECIATION AND AMORTIZATION REPORT FORM 990-PF PAGE 1 990-PF

No't Description Date

Method Life N o° Unadjusted Bus °k Reduction In Basis For Accumulated Current Amount Of Acquired Cost Or Basis Excl Basis Depreciation Depreciation Sec 179 Depreciation

56 TRAN XRT (2) 010899 OOD 7 .00 17 618 . 618 . 424 . 55 . . . .� . . ,

M i ARAPOR.7.vr : s " s s'r "

EXMARK OPTRA S 162.5 58 PRINTER 011399 OOD .00 17 2,014 . 2,014 . 1,666 . 232 .

` r . . ,s . ' r kn .r . r

~'y. ~y~' r r n

011,39 Y4~~ .~(~1

rs s ` ~I ,+if1li!

~~y~,

,bXf T/ ~i .~i`V.r u ,~ ~~~ . . ~ax~aa~zwa.as . . . . . . . ..r.. . . . ." . . " . . ' ::. ; . . . .rs "" i ~~~ " .i " '~,ti+lY

DELL ~P6450 GX1/M+ 60 ASE COMPUTERS 011399 OOD .00 17 5,294 . 5,294 . 4,379 . 610 .

~~ ~ 1'7,e

~, ~,~J'~, i~ .~ . . ~ H 3002 D2 , .'F Vf0 ~ ,'YLSiGi~i~'"1i 7Cy

ULL CABLE - 62 ETWORKING 011499 OOD .00 17 288 . 288 . 238 . 33 .

66(D)MS 97 PRO 020499 OOD .00 17 1,071 . 1,071 . 886 . 62 . , . . .~.y~ ~. .~,~y,~ ,'~y, ~.~~. ~.e~ . . . ., . ; ,. . . . . r~ , . ~ . .

"

. . .r r~~ . . . . W:1.1~Ti,.si;J;1'i".,"" .Cli,'.ii3 ./rTi.'>

~y

iJ'J.F .- 0 0 47 . ~ ~'~? S7 :r

,'

68 CABLING SERVICE 020999 OOD 5 .00 17 173 . 173 . 143 . 20 . r , . - ~ , ., ~ . . . . . . - . . . . . . . . ~ . . r . . . . . . . .~ . . ;: 1 .7

. v. . . . s } ~ iF s~ .. . .

s

DOBE GRAPHIC STUDIO 72 INDOW CDR .030899 OOD .00 17 970 . 970 . 802 . 112 .

0 ., tt A, . . . . . 128 MB, ECC, SDRAM 1

75 IMM 030899 OOD .00 17 536 . 536 . 444 . 62 . .. '7 6 . ta ."FAT* .,LMIM, f ~ ~9 004P ~f0#3 ~.,~7~ ~.7 ? * ' . . , ~ ; . . . . . . . , . . . . . .+ tr+ .

� h , , r, ~ , . . , , . . . . . , ~1~~~ INSTALLATION OF

77 EQUIPMENT 30899200D .00 17 1,333 . 1,333 . 1,104 . 154 .

328102 05-01-03 (D) - Asset disposed w ITC, Section 179, Salvage, HR 3090, Commercial Revitalization Deduction

19

2003 DEPRECIATION AND AMORTIZATION REPORT FORM 990-PF PAGE 1 990-PF

As at Date Method We Na °

Unadjusted Bus % Reduction In Basis For Accumulated Current Amount Of Description Acquired Cost Or Basis Excl Basis Depreciation Depreciation Sec 179 Depreciation

(D)9NORTON ANTIVIRUS 79 AND INSTALLATION 051099 OOD .00 17 1,283 . 1,283 . 1,062 . 74 .

v 41330'0 24'-T Q4 9-9 Z004 PO 1-7 2'011 . IMM MEMORY FOR

82 LAPTOPS 060899 OOD .00 17 183 . 183 . 152 . 21 . tV 64' 1W JFPR'' v S fJ r ,,}~, ,,7~ t .

~y~. ~} ~{ y{Y .7 ~1y ~ j~ }[~( lI ~ ~~~yy~y,,, y~, ~~~~,~'~

IT 14 1" 1- sill , J W ~ r s . ""Ai.Q 1Ri1~.,A.~ +i` ,iY ulfl.~! `*'TI^ " A~lelr ,1Flrf ~ ~i.YIv A.

" f f~, .. r , ^F v

DIMM~ 64 fMB~~ 8X72 3 8466MHZ ECC 3 .3V 62599 OOD .00 17 258 . 258 . 215 . 30 .

.05 V, 1099 MICROSOFT ENCARTE

86 SUITE 071999 OOD .00 17 108 . 108 . 90 . 12 . ~er~~y ~ ~y ~ ,~ ,�. ~ ~ y .~y ~ +~ ~y 'f"~" ~r r

{F J ~r~ W9510 ~ ' ~

~~Ri.,b.

y~tyy~~t ~ r .145,. : 4f ~ ~7 '" Ai

~~~,' 3. 7' :i."

88 SOFTWARE FOR SERVER 91699 OOD .00 17 3,175 . 3,175 . 2,627 . 366 . . . . . . .. . . . .,, r .

91(D)POLYCOM 92799 OOD .00 17 310 . 310 . 257 . 18 .

,' .'Y2 r,LJRAWMi7F` .f:! +F. tA++~pt~1; .b s7 :{. ~i "" 4fiJ~..1.J "~,lY~J .Js " ,.L ., 1.~,,~~~i

93 MS OFFICE 2000 PRO CD 101199 OOD .00 17 512 . 512 . 423 . 59 . ZLZ

- .}} I/~~ ' 148" .;} 92. *60 , f.s ~ R " 1F 1! "" ,~ M AGI 1h lr~ 1~~y ~T, .. . r . . . ~ .: .n ~ .

(D)MS MSOL BACKOFFICE 95V4 .5 SBS UP 101799 OOD 5 .00 17 778 . 778 . 644 . 45 .

. 6v*"9, 1.0't:5 09.2 DOW 5~ 60% 17- ~ 60s . , IGI~ACCELEPORT TAS~

97 PT (FOR LAPTOPS 1019 9 OOD .00 17 872 . , 872 . 720 . 100 .

4+~.'{fi".k

328102 os-ot-a3 (D) -Asset disposed w ITC, Section 179, Salvage, HR 3090, Commercial Revitalization Deduction

20

2003 DEPRECIATION AND AMORTIZATION REPORT FORM 990-PF PAGE 1 990-PF

w Asset Date use Unadjusted Bus % Reduction In Basis For Accumulated Current Amount Of

Description Acquired Method Life No. Cost Or Basis Excl Basis Depreciation Depreciation Sec 179 Depreciation

P JETDIRECT 500X 100 PRINTER SERVER 120399 OOD 5 .00 17 331 . 331 . 274 . 38 .

. .. . . , UP a.ETJD1RECT*,5:0-0X 20 § A +K1li.f 7V )7 Ii'J' ` . . . ,YAlA ~ . r . . .

s , ` ., . .

{+

. . . . . . r . .MAF~F ,SRI R ."T'y , if ., sv r+`~fs .97 w F.

(D)MICROSOFT WINDOWS 102 NT (9) 120699 OOD .00 17 1,962 . . , 1,962 . 1,623 . 113 .

~ . . . . . . :. :. .v . . . . .,~. . , . , ., + , ,27GOSL M.W 16 -2 12' . . - . . . . . . . . ., . . . . . +r

1041BM THINKPAD 570 020300 OOD .00 17 3,189 . 3,189 . 2,270 . 367 . PAD

;2 0 3 .0 . . . . . .,c

106 OLAR SYSTEMS 020300 OOD .00 17 1,953 . 1,953 . 1,391 . 225 .

ATERAL FILES WOOD 108 RONT (7) 42100 OOD 7 .00 17 5,184 . r 5,184 . 2,918 . 647 .

'~yx~ ~y)~y~ .~~~ ~.{~~ ~~(]y ~~/)~~y}~~},wwwlyyyy[y~~~ r r ~ v(/ ~ l ~ " q,f(~ ~,~y'=Q~,~~

~if ~7 W~4AiiR ~~ " ',S '�{~ 7 ~t ~1lSfi~f L ,~ V M` l ii~+~ 7 ?rF'* ~ Ar "ij~ 71 r , n r r s riV ~ 7~si'T * r ~i1~ ~ 9.41.

ATERAL'FILES STAND 110 PULL 3 HIGH 042100 OOD 7 .00 17 807 . 807 . 454 . 101 . . . . . . � . . . . . . . < , . . i .

~ ~. .. s `

+ r r . : ... . .. . .

. ., . 4:X36 ...

r,r «..+ v ~ , ~

s ~ ,

"+i ,~ if + i'f ' r SlMT "I * 11

. . . , . ~

T~001' r " ' , *%f -k.~iF VJ,~ , v

35 ,1112 SF%!

f r

112 AMP 42400 OOD 7 .00 17 117 . 117 . 66 . 15 . . . . .

0 4 10 20ODB 7 . 0 0:' : 17 3,* 857 ..

114CREDENZA 74" SHELL 050400 OOD 7 .00 17 833 . 833 . 469 . 104 .

642 .

116 PEN KNEEWELL 34" 050400 04D 7 .00 17 255 . 255 . 143 . 32 . s EST PANEL 3 4 .A . ` "

~ 73

y,~t ~y . . . .. ',. .:. 't.T. ~ {iiRJ.F ,t A ~t+r ~~ . . . . . . .,x? S7~ ri ~Y ~ .1,~ d. .Y.i:~.R ' . . . . . . . . .

. . .. . .

328102 05-01-03 (D) - Asset disposed " ITC, Section 179, Salvage, HR 3090, Commercial Revitalization Deduction

21

2003 DEPRECIATION AND AMORTIZATION REPORT FORM 990-PF PAGE 1 990-PF

As st Date N Method Life o°

Unadjusted Bus 9~o Reduction In Basis For Accumulated Current Amount Of Description Acquired Cost Or Basis Excl Basis Depreciation Depreciation Sec 179 Depreciation

PEDESTAL FILE/FILE, 118 RIGHT 50400 OOD 7 .00 17 627 . 627 . 354 . 78 .

1/2 TABLE DESK,

'

x

12,0 HAMPAGNE 050400 OOD 7 .00 17 2,224 . 2,224 . 1,252 . 278 . . . . . , ~ l

'" " . . . . . ECi3'.l:.t lF F' 1r+sfAIg, '~ ~.r~. . +~'~y ~ ~' . . . . . ,, . ~.r+ r ~~y . . . �

" ~ .{.IYa .L .1 .71I'~'~~CSL .~k .,, :r . . ;t, .ri.. .~r% .< " " 1i~JJ.7 '*00 . . . : . . . "t l""xyr~r~ '~ ;r~ '~!~

'w A+ ,e . . ... . .r. . . . . . . . . . . . . . . 1 7,, -' . i.~^iGw'f Y .1 '. .:'" , . "~' "*~'M::~

IDE TABLE...

24X24 122 HAMPAGNE , . 050400 OOD 7 .00 17 395 . 395 . 222 . 49 .

124 UEST CHAIR, MELON 050500 OOD 7 .00 17 892 . 892 . 501 . 111 .

17 45 WTIM 05Q5G-Q200D27,iQ0 65 1,'. -.,'93-3 CHUMACHER FABRIC, 2,

126 ELON 050500 OOD 7 .00 17 282 . 282 . 158 . 35 .

,12 7 0~ . . . . . . . . . , . . .

128 EXECUTIVE CHAIR 050500 OOD 7 .00 17 1,575 . 1,575 . 886 . 197 . ..

130 WEST CHAIR, ONION 050500 OOD 7 .00 17 1,124 . 1,124 . 633 . 140 .

.r . . . . . ,~ . . . . . . x~~ . . . ,A 4 D'.

132 SOFA 78", GOLDEN 050500 OOD 7 .00 17 1,900 . 1,900 . 1,069 . 237 .

0 .0 .7 '.'° .1.~ + . . ., .~.;~ "~l3 . . . " ~JCsw7134

134 UEST CHAIR, CHENELL 050500 D B 7 .00 17 1,675 . 1,675 . 942 . 209 . OLD . n R~~A~7..'..RVG , ' ` . . . . . . : . . . ~ . . . .

I . . . ........ s 5 ot .7 . . . .. . .. . . . . . . . . . . . . . . . . -0 . 60 Ob 1A 328102 05-01-03 (D) - Asset disposed " ITC, Section 179, Salvage, HR 3090, Commercial Revitalization Deduction

22

2003 DEPRECIATION AND AMORTIZATION REPORT FORM 990-PF PAGE 1 990-PF

Asset Date Method Life Noe

Unadjusted Bus % Reduction In Basis For Accumulated Current Amount Of Description Acquired Cost Or Basis Excl Basis Depreciation Depreciation Sec 179 Depreciation

DESK 36X72, CENTER 136 RAWER & RETURN 051000 OOD 7 .00 17 4,429 . 4,429 . 2,493 . 553 .

~~LjLVJStr~. " L~14T~'T"Y'ilr~u.`~~~a+ . .

. . . ..~

,~ "~i 4f7 .I~LFS77iii`~ iS :r RETURN' - irC l+IF 0 FFNL!', .l . .*VS?f i1' +~+ " r~ . ;i :r. 'S 2 .9 ~ . � '� ' : :~.� J r~~~..~ ESK 36X72 ~ CENTER

.2 44, :

138 RAWER & RETURN 51000 OOD 7 .00 17 4,414 . 4,414 . 2,484 . 551 .

) . . . .2 ACK ~ BOARDS

51000200DAT. 00 17 ~: "

.PER7 . . . . . . . t . . r . . . . . . r , . . , ,

140 UTCH (6) , ., 051000 OOD 7 .00 17 792 . 792 . 446 . 99 .

147. 4~00-7,.00' 1.7--'-7,' ~ 2 0: 6 8-1 1114 . ."

142 ONFERENCE CHAIRS (12)051000 OOD 7 .00 17 13,088 . 13,088 . 7,364 . 1,635 .

. .., . : . . r FABRIC TAMIRANS, 051 1`416- FEDERAL CHAIR, LUNA

.; . . Z~

144 TEXTILE FABRIC 051000 OOD 7 .00 17 1,230 . 1,230 . 692 . 154 .

0' 17 1-226,4' VISUAL BOARD CABINET,

146 AMBER 051000 OOD 7 .00 17 1,110 . 1,110 . 625 . 139 .

.14 7 POX10 44AIN BOXRP. 'BROWN q5 10 0 2 . 0.0 Dn -.7 -0'Q 17' ~56* 0111 . .1 356 ; C ONFERENCE TABLE

148120X42X36 051000 OOD 7 .00 17 5,341 . 5,341 . 3,005 . 667 . ~~(~ . ~. ~. }~ y.+~., ~

.1.'x ,GO

. . . ¢. r~ r ~} e~.~ .iy ., : ti . ~ ,~ CONFERENCE

,q . . ~yy~~

~n .~ iI . ~. ~ .tY~t3.f..1X.f f /~ ";'t ` i.'~ .i~ Si 'kt . ~4i iJ ~ .t i A . . . . .L' J' . ~, .,~~ ~ . . . . . . ~~ii~.~l .ii'~1

150 OHM ..TELEPHONES 060900 OOD 7 .00 17 2,357 . 2,357 . 1,326 . 294 .

. . , . .. . .. . . .. . +s'It

152 COFFEE TABLE 063000 OOD 7 .00 17 2,154 . 2,154 . 1,213 . 269 . .. . . . . . .'. .,.

328102 os-oi-oa (D) - Asset disposed " ITC, Section 179, Salvage, HR 3090, Commercial Revitalization Deduction

23

2003 DEPRECIATION AND AMORTIZATION REPORT FORM 990-PF PAGE 1 990-PF

w Asset

Descri ption Date Method Life No

Unadjusted Bus °~ Reduction In Basis For Accumulated Current Amount m Acquired Cost Or Basis Excl Basis Depreciation Depreciation Sec 179 Depreciation

154 AMPS (2J , 063000 OOD 7 .00 17 587 . 587 . 331 . 73 . ., . . . . , , , 7 , .�. . . . ~ . . . . J , . . . . . , , :.~ : . . . . . . . . . 071400200OBTA0 . 17 . . . . . v., . ., v . ~~ ; . :~~~

156 TEA CART 071800 OOD 7 .00 17 1,124 . 1,124 . 633 . 140 .

158 BRASS LAMPS, (2) 071800 OOD 7 .00 17, � 1,264 . 1,264 . 712 . 158 . . . . . s . . . . . . .

. . . .

.. . : . . ~ , 159"b' PL)i~dEW-Abk"% 0 7 1-100 ~.O 74 0., V.7 . 4 49 4 "441* . . . . . . ., r J r

160 DECORATIVE PLATE 071800 2 00D 7 .00 17 116 . 116 . 65 . 14 .

. ~,~x~. . : . . . . . . .,. : : . . . :'~ , . . : ' r ~ r l . . .

. . . . . . , . . , , .

4/1I,~

162 ED CHINESE URN LAMP 071800 OOD 7 .00 17 1,097 . 1,097 . 618 . 137 .

1613 FISH .' BOVLIIPLANT~ 071, CHINESE RED & GOLD

. .164 AMP 71800 OOD, 7 .00 17 � 604 . .,, 604 . 340 . 75 .

CO POLO ACCENT ~~~ 166 ANEL FABRIC 71800 OOD 7 .00 17 743 . 743 . 418 . 93 .

4011 . 3COM ETHERNET ~ 2~4 PORT

W

168 HUB 092600 00D 7 .00 17 1,605 . 1,605 . 903 . 200 . . . . . . ~ ~( . . . . r . , . . . , . . ~ ~ . . . . . .

"r' .r . . r y r

170 ORTON ANTIVIRUS 7 .5 112200 SL 3 .00 16 632 . 632 . 440 . 192 .

328102 os-o1 -oa (D) - Asset disposed " ITC, Section 179, Salvage, HR 3090, Commercial Revitalization Deduction

24

2003 DEPRECIATION AND AMORTIZATION REPORT FORM 990-PF PAGE 1 990-PF

w As 9~ Date un. Unadjusted Bus °~ Reduction In Basis For Accumulated Current Amount Of Na Description Acquired Method Life No Cost Or Basis Excl Basis Depreciation Depreciation Sec 179 Depreciation

ASK CHAIRS & 4 LEG 172 TACKER CHAIRS 060900 OOD 7 .00 17 6,653 . 6,653 . 3,744 . 831 .

.r 17 ~a PRINT. . PIV29 0 O DQDJ *00 17 ' 331 . 31 :

EXMARK OPTRA T61j6N 174 PRINTER 091200 OOD .00 17 3,387 . 3,387 . 2,411 . 390 .

r .s . . ;f77 . . « , J . . . . , . . 115 k M-DJOL 195,t,77

REMODELING-WIRING, 176 ABLING 041700 SL 39 .0017 6,500 . 6,500 . 452 . 167 .

~ . . . . . . .. r ~ ~ ,~! ;y : . It

+~r~

MODELING 12070 17. ~ . .

. . . .I..i 7 1'1S.FilI~11 .J. .1'~t~ . ., " . .. ; .,y �r. ., .i . ., :. . "." 4,T ,31 ,.'a~, ~ ~ " , " ~" ~3/ ~'3~~~

EXMARK OPTRA C710N 178 RINTER 111400 OOD .00 17 2,223 . 2,223 . 1,583 . 256 .

. . ., . ~ r . , .:.: . ~, . .} . . . . . , . 4 . . . .

ELL PENTIUM III, 1 .0 180 HZ, 17" 11801 OOD .00 17 2,865 . 2,865 . 1,490 . 550 .

:11B 3 1 2 r ' 3 s r ! r r r .e r r vsr r v " "~~' . s r ..f,, ~ .. s~~'T'9R" 'R

fRAGON NATURALLY 182 PEAKING 011001 OOD 5 .00 17 158 . 158 . 83 . 30 .

,s . ,. b ry, -~ PDV 1

, . .�. y +~ +~ qb

ELL PENTIUM III, 1 .0 184 HZ COMPUTER 011901 OOD .00 17 2,841 . 2,841 . 1,477 . 545 .

. . .,

INTUIT QUICKEN - 4 186 ASIC 2000 030201 OOD 3 .00 17 22 . 22 . 17 . 5 .

A'rUMJ,Jt SPEAKING' . . . . . . .s r~ .a'~~ ~

.1. (}}~i1J.J~

.-A,iX~'y~

fiJ { 1-7-

~yrX~~i .

y3.T .,f ~e~t

~ w7 ~I . ~ ` ~fi~ . ~~ . . ~ . . ~ 1, . . . . . . . . . . . . r . . . . . . . .~ . r . . . . ` s r . . . : . . . . .. . . . .n

EXMARK OPTRA S 18B ENVELOPE PRINTER 041101 OOD .00 17 251 . 251 . 130 . 48 .

. , . . . . .,

328102 os.oi-oa (D) - Asset disposed " ITC, Section 179, Salvage, HR 3090, Commercial Revitalization Deduction

25

2003 DEPRECIATION AND AMORTIZATION REPORT FORM 990-PF PAGE 1 990-PF

Y

As at Date Method Life Na

e Unadjusted Bus % Reduction In Basis For Accumulated Current Amount Of Descri ption Acquired Cost Or Basis Excl Basis Depreciation Depreciation Sec 179 Depreciation

(D)QUICKEN 2002 HOME & 190 BUSINESS (3) 51001 OOD 3 .00 17 236 . 236 . 184 . 35 .

(D)QUICKEN 2001 HOME & 192 BUSINESS (3~41s 082101 OOD 3 .00 17 107 . y 107 . 84 . 16 .

. , . . . . . . .. .' . bB5:" : .0 17 .. . . . . . . .,. . , .- . . . . . . . ~ ~ . - �:. :s: 194 BINDING MACHINE 030801 OOD .00 17 865 . 865 . 450 . 166 .

. . . . . . . . . ~ r , ~ . . . . . . . . . . .

198 COMPUTER ATTACHMENTS 11 197 OOD .00 17 1,539 . 1,539 . 1,539 . 0 . . .

0 308 94 lbbbb 17

200 HP SCANJET 5470CXI 010302 00D .00 17 357 . 357 . 71 . 114 .

~N2}X'IX 4 .,.m :'Nbi~~di .x

.3..2~:DOD~ ~~-0 .0 : 1? s' '9a,. ., . , . ,, ;, . . . . . . .; : , , r~. . . . . . . . . . . , r , . ,., . . . . . . .: . .

ELL OPTIPLEX GX240 .202 PENTIUM 2 012302 OOD .00 17 1,774 . 1,774 . 355 . 568 .

a ~1 0 3 EN~.1' .LSP` .1.4 . 41`1 `2 ,00.Ll

~. ..~,00 17 74 5'ii ,~ . . ' , . . . . . +JA5 w 23

204 LATERAL FILES 5 DRAWE 060402 OOD 7 .00 17 4,524 . 4,524 . 646 . 1,108 . . .

~# .: . . .. .1~ ~ . 4 7.4 ~ 206 ELL LATITUDE LAPTOP 060602 00 D .00 17 2,540 . 2,540 . 508 . 813 .

208 EW GRANT SOFTWARE 080102 L 3 .00 16 100,866 . 100,866 . 14,009 . 33,622 . . .: . ,.r ~ ; . ~.

- 1 1 :50 0 0' 117' 328102 05-01-03 (D) -Asset disposed w ITC, Section 179, Salvage, HR 3090, commercial Revitalization Deduction

26

2003 DEPRECIATION AND AMORTIZATION REPORT FORM 990-PF PAGE 1 990-PF

r

Description Date

Method Life No e Unadjusted Bus % Reduction In Basis For Accumulated Current Amount m Acquired Cost Or Basis Excl Basis Depreciation Depreciation Sec 179 Depreciation

(D)DELL PENTIUM III, 2101 .0 GHZ COMPUTER 010801 OOD .00 17 1,725 . 1,725 . 897 . 166 .

3ROTHEX' . ELECTRIC_'.'.

212 '700D CONTACTS SOFTWARE013003 L .00 16 228 . 228 . 42, VICKEN r . , r . . :,,r . .

4 : 1

214 YMANTEX ANTI-VIRUS 050103 SL .00 16 425 . 425, 57,

2 15 AINTIER 66.7 .� . � . , . ., v, . . . >, . .

216 ELL OPTIPLEX SX270 0 82603200D .00 19 1,320 . 1,320 . 198, r , , . , . . . . , . . . . . . . . . . :f, . . - ~ . . . SIWE+F F VAULT ii.~ , ~ii ~ - ".k'~ii,'"ii'r,'t 11 4003' J "' "1FX~ 4

218 POWER EDGE SERVER 120103 OOD .00 19 13,560 . 13,560 . 678 .

ID '*

. . . . . .. . ' . . . . ' ' . .a . , , ., .. . .r . ,' . s

. . n . . 'r r

r . , . . . r~} ' . . . .

, . . r . ;, . . . . . ~. ., . .r . . . . . . . . . : . " . . .~. . . . . . , . .. .: .: s . . . St f

328102 os-o1-oa (D) - Asset disposed " ITC, Section 179, Salvage, HR 3090, Commercial Revitalization Deduction

27

THE MACLELLAN FOUNDATION, INC . 62-6041468

FORM 990-PF INTEREST ON SAVINGS AND TEMPORARY CASH INVESTMENTS STATEMENT 1

57,214 . TOTAL TO FORM 990-PF, PART I, LINE 3, COLUMN A

FORM 990-PF DIVIDENDS AND INTEREST FROM SECURITIES STATEMENT 2