Return of Organization Exempt From Income Tax 2003990s.foundationcenter.org › 990_pdf_archive ›...

Transcript of Return of Organization Exempt From Income Tax 2003990s.foundationcenter.org › 990_pdf_archive ›...

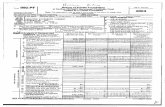

Return of Organization Exempt From Income Tax Form 99o

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation) 2003

Department of the Treasury ~ The Of Internal Revenue Service organization may have to use a copy of this return to satisfy state reporting requirements

A For the 2003 calendar year, or tax year beginning and ending B Check If Please C Name of organization applicable

use IM Address label or hange p4ntorPROMEDICA HEALTH SYSTEM, INC . = Name type.

=change S See

Number and street (or P.0 box if mail is not delivered to street address) Inidal return Pecific2142 NORTH COVE BOULEVARD Final 0n5 City or town, state or country, and ZIP + 4

O~~,md~ TOLEDO, OH 43606 ~npp~~-bon 0 Section 501(c)(3) organizations and 4947(a)(1) nonexempt charitable trusts pending

must attach a completed Schedule A (Form 990 or 990-EZ) .

G Website : "WWW.PROMEDICA.ORG J Organization type (chxkonirone) " OX 501(c) ( 3 ) 1 Pnsert no) = qgq7(a)(1) or [::] 52 K Check here " = rf the organization's gross receipts are normally not more than $25,000 . The

organization need not file a return with the IRS ; but if the organization received a Form 990 Package in the mad, it should file a return without financial data Some states reuulre a complete return .

34-1517671 Room/suite E Telephone number

419 291-3828 F Accoundnp method = Cash FX-]Accrual

H and I are not applicable to section 527 organizations. H(a) Is this a group return for affiliates? ~ Yes EK No N(b) If "Yes ; enter number of affiliates H(c) Are alt affiliates included? N/A ~ Yes = No

(IT 'No,' attach a list ) H(d) Is this a separate return filed by an or-

ganization covered by a group ruling? M Yes n No

d N 13 Program services (from line 44, column (B)) _ . 13 21 , 952 , 228 . y 14 Management and general (from line 44, column (C)) . . 14 3 , 0 5 0 82 6 . a 15 Fundraising (from line 44, column (D)) 15 W 16 Payments to affiliates (attach schedule) _ . 16

17 Total expenses add lines 16 and 44 , column A 17 25 , 003,054 . 18 Excess or (deficit) for the year (subtract line 17 from line 12) 18 146 , 691 , 234 . N

~ y 19 Net assets or fund balances at beginning of year (from line 73, column (A)) 19 792,306 , 905 . Z4 20 Other changes in net assets or fund balances (attach explanation) SEE STATEMENT 4 20 -4 , 643 , 952 .

21 Net assets or fund balances at end of year combine lines 18, 19, and 20) 21 934 , 354 , 187 . iz i°°ai LHA For Paperwork Reduction Act Notice, see the separate instructions . Form 990 (2003)

1 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

D Employer Identification number

M Check " [:J rf the organization is not required to attach L Gross receipts Add lines 6b, 8b, 9b, and 10b to line 12 . 188 , 607 , 535 . 1 Sch . e (Form 990, 990-EZ, or 990-PF) . pat't 1Revenue Ex enses and Changes in Net Assets or Fund Balances

1 Contributions, gifts, grants, and similar amounts received . a Direct public support 1a 710 . . b Indirect public support 1 b 13 , 000,000 . c Government contributions (grants) 1 c d Total (add lines 1 a through 1c) (cash $ 13,000,710 . noncash $ ) . 1 d 13,000,710 .

2 Program service revenue including government fees and contracts (from Part VII, line 93) 2 3 Membership dues and assessments 3 4 Interest on savings and temporary cash investments . . . . . 4 5 Dividends and interest from securities . . . . 5 180 , 957 . 6 a Gross rents 6a

b Less' rental expenses . . . . . . . 6b c Net rental income or (loss) (subtract line 6b from line 6a) 6c

m 7 Other investment income (describe " SEE STATEMENT 1 7 15 7 19 3, 7 5 7 . 'cm 8 a Gross amount from sales of assets other A Securities B Other m than inventory 16,871 , 179 . 8a 3 , 694 .

b Less- cost or other basis and sales expenses 16 909 , 975 . 8b 3,272 . c Gain or (joss) (attach schedule) . . -38 , 796 . 8c 422 . d Net gam or (loss) (combine line 8c, columns (A) and (B)) STMT 2 STMT 3 8d -38,374 .

9 Special events and activities (attach schedule). If any amount is from gaming, check here " 0 a Gross revenue (not including $ of contributions

reported on lm U)_-- ~--~C--' , . .

. . . . 9a b Less' direct ex nses o~ . ~q~xpens 9b c Net income or ' ss m speaa events (subtra 9b from line 9a) , . 9c

10 a Gross sales of i %mn orx,isgVretprr~an~t ~vua ~ 10a b Less cost of g old ~ v ~ . ~

. . . . 10b

0 c Gross profit or oss hedule) (subtract line 10b from line 10a) . _ , . 10c O 11 Other revenue ( om Po~, 11 1 , 357 r 238 .

12 Total revenue 5 6c 7 8d 9c 10c and 11 ) . . 12 171 , 694,288 . c.~

PROMEDICA HEALTH SYSTEM Statement o All organizations must complete column

~~ Functional Expenses and (4) organizations and section 4947( Do not include amounts reported on line A Total Rh Rh 9h 10h ni 1 R nI Part 1

INC . 34-1517671 ).Columns (B), (C), and (D) are required for section 501(c)(3) Page 2-1) nonexempt charitable trusts but optional for others . (B) Program (C) Management (D) Fundraising services and general

22 Grants and allocations (attach schedule)

cash E 20 .8e3,684 . noncash3

23 Specific assistance to individuals (attach schedule) 24 Benefits paid to or for members (attach schedule) 25 Compensation of officers, directors, etc . . . . 28 Other salaries and wages . 27 Pension plan contributions . . . . . . . 28 Other employee benefits . . . 29 Payroll taxes 30 Professional fundraising fees 31 Accounting fees 32 Legal fees _ _ 33 Supplies . . . . . . . . 34 Telephone 35 Postage and shipping . . . . . . . . . . 36 Occupancy . . 37 Equipment rental and maintenance 38 Printing and publications 39 Travel _ 40 Conferences, conventions, and meetings . _ 41 Interest 42 Depreciation, depletion, etc . (attach schedule) 43 Other expenses not covered above (itemize) -

a b t d e SEE STATEMENT 5

20, 883, 684 .120, 883, 684 .~5TATEMENT 6

15,310 .

36,857 .

13,500 .

.I 147,429 .

-24063574 . -19250859 .1 -4 , 812 , 715 .

Joint Costs. Check " E:1 rf you are following SOP 98-2 . Are any joint costs from a combined educational campaign and fundraising solicitation reported in (B) Program services . " El Yes EK No If 'Yes," enter (I) the aggregate amount of these joint costs $ , (II) the amount allocated to Program services $ ,

What is the organization's primary exempt purpose? 00, SEE STATEMENT 6A Pro am Service All organizations must describe their exempt purpose achievements in a clear and concise manner State the number of clients served, publications Issued, etc Discuss XpBI1SBS achievements that ere not measurable (Section 501(c)(3) and (0) organizations and 49A7(aK1) nonexempt charitable trusts must also enter the amount of grants and (Required for501(cx3) and allocations W others ) trusts, but optional for others

a SEE STATEMENT 6A

Grants and avocations $ 20 , 883 , 684 . ) b

Grants and allocations C

Grants and allocations d

Grants and allocations $ e Otherprogram services (attach schedule) (Grants and allocations $

21,952,228 .

2 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

1 818 591 . 0 . 19 765 052 . 15 812 041 .

433 504 . 283 406 . 3 f 936 , 554 . 2 905 874 . 574,384 . 459,507 .

1 G G 1 1 Z

459,527 . 244,880 . 195,904 .

76,550 .1 61,240 .

1,818,591 . 3,953,011 .

150,098 . 1,030,680 .

114,877 .

122,114 . 459,527 . 48 .976 .

as ao~~b~cmv~efno~a~~cElycrn .carry these "omls mlines ~3-1s 144 I Z 5, 003, 054 . 21, 952, 228 . 3, 050, 826 .

0 .

f Total of Program Service Expenses (should equal line 44, column (B), Program services) " 21,952,228 . iz3o11 ~ Form 990 (2003)

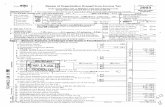

Form 990(2003) r RROMEDICA HEALTH SYSTEM, INC . 34-1517671 Page 3

IV Balance Sheets

47 a Accounts receivable b Less : allowance for doubtful accounts . . . .

48 a Pledges receivable . . b Less' allowance for doubtful accounts

49 Grants receivable . . . 50 Recenrables from officers, directors, trustees,

and key employees . . . . y 51 a Other notes and loans receivable . . . . .

b Less' allowance for doubtful accounts 52 Inventories for sale or use _ 53 Prepaid expenses and deferred charges . . 54 Investments-securities STMT . 7 . . 55 a Investments - land, buildings, and

equipment basis . . . .

48b

" D cost . D FMV

b Less : accumulated depreciation . . _ 1 5511 I 56 investments-other . . . . . .SEE. STATEMENT $ . 57 a Land, buildings, and equipment : bass 57a 15 , 758,710 .

b less : accumulated depreciation STMT 9. 1 57b ~ 7f140,354 . 58 Other assets (descnbe " SEE STATEMENT 10

7,937,085 .1 57c1 8,618,356 . 84,844,084 . 58 20,047,939 .

3 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

Note : Where required, attached schedules and amounts within the description column should be for end-of-year amounts only.

45 Cash-non-interest-bearing _ . 48 Savings and temporary cash investments . .

473,211 . 473,211 .

(A) (B) Beginning of year End of year

3 195 336 . 45 -195 , 460 . 109 , 615 . as

47c

48c 49

50

198 830 . 51c 52

4 , 097,945 . 53 15 460 881 . 0 . 54 3,738,585 .

771,008,993 .156 1931,705,623 .

59 Total assets add lines 45 through 58 must equal line 74 871 , 391 , 888 . 59 979 , 375 , 924 . 60 Accounts payable and accrued expenses . . . . 6 , 481 , 235 . 60 7,543 , 031 . 61 Grants payable . . . . . . . . . . . . 61 62 Deferred revenue , . . . . . 62 . . . . . . . .

i°_' 63 Loans from officers, directors, trustees, and key employees . . . . 63 +

a 64 a Tax-exempt bond liabilities 64a b Mortgages and other notes payable . . . . . . . _ 64h

65 other liabilities (describe " SEE STATEMENT 11 ) 72 , 603 , 748 . 65 37 , 478 , 706 .

66 Total liabilities add lines 60 through 65 79 , 084 , 983 . 66 45 , 021 , 737 . Organizations that follow SFAS 117, check here 1 EXI and complete lines 67 through

69 and lines 73 and 74 . 7 Unrestricted . . . . . . . . . . 7 9 2 3 0 6 9 0 5 . 67 9 3 4 3 5 4 18 7 .

68 Temporarily restricted 68 0 . m 69 Permanently restricted 69 0 .

Organizations that do not follow SFAS 117, check here .t 0 and complete lines 70 through 74

~°, 70 Capital stock, trust principal, or current funds . . . 70 N 71 Paid-in or capital surplus, or land, building, and equipment fund . . . . 71

72 Retained earnings, endowment, accumulated income, or other funds 72 Z 73 Total net assets or fund balances (add lines 67 through 69 or lines 70 through 72,

column (A) must equal line 19, column (B) must equal line 21) . . . , _ 792 , 306 , 905 . 73 934 , 354 , 187 . 74 Total liabilities and net assets ! fund balances (add lines 66 and 73) 871 , 391 , 888 . 1 74 9 7 9 375 924 .

Form 990 is available for public inspection and, for some people, serves as the primary or sole source of information about a particular organization . How the public perceives an organization in such cases may be determined by the information presented on its return Therefore, please make sure the return is complete and accurate and fully describes, in Part III, the organization's programs and accomplishments

323021 12-17-03

Form 990 2003 FROMEDICA HEALTH SYSTEM INC . 34-1517671 Reconciliation of Expenses per Audited Financial Statements with Expenses per

4

N/A

S Add amounts on lines (1) through (4) .

c Line a minus line b . . . . . . . . d Amounts included on line 17, Form

990 but not on line a :

(1) Investment expenses not included on line 6b, Form 990 . $

(2) Other (specify) : S

Add amounts on lines (1) and (2) . , . e Total expenses per line 17, Form 990

(line c plus line d) 1lployees (List each one even if not compensated .) (B) Tdle and average hours C) Compensation (D~coni

per week devoted to ~If not p,piil, enter (E) Expense account and her allowances

(A) Name and address

---------------------------------

SEE STATEMENT 12

--------------------------------- ---------------------------------

--------------------------------- ---------------------------------

--------------------------------- ---------------------------------

--------------------------------- ---------------------------------

--------------------------------- ---------------------------------

--------------------------------- ---------------------------------

--------------------------------- ---------------------------------

--------------------------------- ---------------------------------

i .eie .ssi .l 347369 .1 36 .08

4 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

Reconciliation of Revenue per Audited Financial Statements with Revenue per Return

a Total revenue, gains, and other support per audited financial statements " a N/A

b Amounts included on line a but not on line 12, Form 990 :

(1) Net unrealized gains on investments $

(2) Donated services and use of facilities

(3) Recoveries of prior year grants . . . . $

(4) Other (specify) : S

Add amounts on lines (1) through (4) . . " b c Line a minus line b . . . . . . . . " c d Amounts included on line 12, Form

990 but not on line a :

(1) Investment expenses not included on line 6b, form 990 $

(2) Other (specify) S

Add amounts on lines (1) and (2) " d e Total revenue per line 12, Form 990

line c plus line d " e Pad Y List of Officers . Directors. Trustees. and Kev E

a Total expenses and losses per audited financial statements

b Amounts included on line a but not on ~ line 17, Form 990:

(1) Donated services and use of facilities $

(2) Prior year adjustments reported on line 20, Form 990 . . . $

(3) Losses reported on line 20, Form 990 $

(4) Other (specify) :

75 Did any officer, director, trustee, or key employee receive aggregate compensation of more than $100,000 from your organization and all related STMT 13 organizations, of which more than $10,000 was provided by the related organizations If *Yes,' attach schedule " ~X Yes [:] No

323a+1 12-17-03 Form 990(2003)

' Form 990 34-1517671 Paae5 DICA HEALTH SYSTEM, INC .

78 Did the organization engage in any activity not previously reported to the IRS It 'Yes,' attach a detailed description of each activity 76 X 77 Were any changes made in the organizing or governing documents but not reported to the IRS? . . . . . . . . , . 77 X

If 'Yes," attach a conformed copy of the changes . 78 a Did the organization have unrelated business gross income of $1,000 or more during the year covered by this return? . . 78a X

b If "Yes,' has it filed a tax return on Form 990-T for this years N/A 786 79 Was there a liquidation, dissolution, termination, or substantial contraction during the year? 79 X

If 'Yes,' attach a statement 80 a Is the organization related (other than by association with a statewide or nationwide organization) through common membership,

governing bodies, trustees, officers, etc ., to any other exempt or nonexempt organizations . . . . 80a X b If 'Yes,' enter the name of the organization " SEE STATEMENT 14

and check whether i1 is 0 exempt or = nonexempt . 81 a Enter direct or indirect political expenditures . See line 81 instructions ., 81a 0 .

b Did the organization file Form 1120-POL for this yeah? . . . . 81 b X

82 a Did the organization receive donated services or the use of materials, equipment, or facilities at no charge or at substantially less than fair rental values 82a X

b If'Yes ; you may indicate the value of these items here. Do not include this amount as revenue in Part 1 or as an expense in Part II (See instructions in Part III .) 82b

83 a Did the organization comply with the public inspection requirements for returns and exemption applications? 83a X b Did the organization comply with the disclosure requirements relating to quid pro quo contributions? 83b X

84 a Did the organization solicit any contributions or gifts that were not tax deductible? . . . . . . 84a X h If *Yes,' did the organization include with every solicitation an express statement that such contributions or gifts were not

tax deductible? . . . . . . . . . . . . . NBA . 84b 85 501(c)(4), (5), or (6) organizations. a Were substantially all dues nondeductible by members? . . N/A 85a

b Did the organization make only in-house lobbying expenditures of $2,000 or less? . . . . . . . . . NBA 85b If 'Yes' was answered to either 85a or 85b, do not complete 85c through 85h below unless the organization received a waiver for proxy tax owed for the prior year.

c Dues, assessments, and similar amounts from members . . . . . 85c N/A d Section 162(e) lobbying and political expenditures 85d N/A e Aggregate nondeductible amount of section 6033(e)(1)(A) dues notices . . 85e N/A f Taxable amount of lobbying and political expenditures (line 85d less 85e) _ . 85t N/A

g Does the organization elect to pay the section 6033(e) tax on the amount on line 85f? . . . N/A . _ 85 h If section 6033(e)(1)(A) dues notices were sent, does the organization agree to add the amount on line 85f to its reasonable estimate of dues

allocable to nondeductible lobbying and political expenditures for the following tax year? . . NBA . gsh 86 501(c)(7) organizations. Enter' a Initiation fees and capital contributions included on line 12 _ 86a N/A

b Gross receipts, included on line 12, for public use of club facilities . . . 86b N/A 87 501(c)(12) organizations . Enter . a Gross income from members or shareholders . 87a N/A

b Gross income from other sources. (Do not net amounts due or paid to other sources against amounts due or received from them ) . _ . . . 87b N/A

88 At any time during the year, did the organization own a 50% or greater interest in a taxable corporation or partnership, or an entity disregarded as separate from the organization under Regulations sections 301 .7701-2 and 301 .7701-3? If 'Yes ; complete Part IX 88 X

89 a 501(c)(3) organizations. Enter . Amount of tax imposed on the organization during the year under : section 4911 . 0 " ; section 4912 . 0 " ; section 4955 . 0 .

b 501(c)(3) and 501(c)(4) organizations. Did the organization engage in any section 4958 excess benefit transaction during the year or did it become aware of an excess benefit transaction from a prior year? It 'Yes ; attach a statement explaining each transaction 89b X

c Enter: Amount of tax imposed on the organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 . . . . _ " 0 .

d Enter' Amount of tax on line 89c, above, reimbursed by the organization 0 . 90 a List the states with which a copy of this return is filed " OHIO

b Number of employees employed in the pay period that includes March 12, 2003 . . . . _ ~ 90b 5 0 91 The books are in care of " MARY S IEFKE Telephone no . " 419-291-3828

Locatedat " 2142 N . COVE BLVD . TOLEDO , OH ZIP+4 . 43606

92 Section 4947(a)(1) nonexempt charitable mists filing Form 990 in Ireu of Form 1041- Check here . 1 and enter the amount of tax-exempt interest received or accrued during the tax year " 1 92 ~ N/A

azaoai Form 990 12-17-03 (2003) 5

18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

Form 990(2003) ~ FROMEDICA HEALTH SYSTEM INC . 34-1517671 Analysis of Income-Producing Activities (see page 33 of the instructions .)

Unrelated business income Excluded by section 512 513 or 514

8

Note . Enteigross amounts unless otherwise (E) indicated. (A) ~8) (C) (D)

~~-Business ~~- Related or exempt ~ 93 Program service revenue code Amount ~ae Amount function income

a b t d e 1 Medicare/Medicaid payments _ g Fees and contracts from government agencies . . . . .

94 Membership dues and assessments . . 95 Interest on savings and temporary cash investments 96 Dividends and interest from securities 14 180,957 . 97 Net rental income or (loss) from real estate'

a debt-financed property b not debt-financed property

98 Net rental income or (loss) from personal property . . . 99 Other investment income . . . . 157,193 , 757 . 100 Gam or (loss) from sales of assets

other than inventory . . . . . . . . . . . 18 -38 , 374 . 101 Net income or (loss) from special events 102 Gross profit or (loss) from sales of inventory 103 Other revenue .

a REBATES/PURCHASE DISC . 1,226,419 . b BAD DEBT RECOVERY 130 819 . c d e

104 Subtotal (add columns (s), (o), and (E)) . . _ ~ 0 . __ 142,583 . 158,550,995 . 105 Total (add line 104, columns (B), (D), and (E)) _ . . . lo- 158,693,578 . Note : Line 105 plus line 1 d, Part l, should equal the amount on line 12, Part l. pad jj jfiRelationship of Activities to the Accomplishment of Exempt Purposes (see page 34 of the instructions) Line No . Explain how each activity for which income is reported in column (E) of Part VII contributed importantly to the accomplishment of the organization's

exempt purposes (other than by providing funds for such purposes). SEE STATEMENT 16

JX Information Regarding Taxable Subsidiaries and Disrej A) B

no, address, andEIN of corporation, Percentage of Nature of activdies partnership, or disre ardedenti ownershi interest SEE STATEMENT 15

es (See page 34 of the instructions . D

Total income Eric

~ Part X I Information Regarding Transfers Associated H (a) Did the organization, during the year, receive any funds, directly or indirectly, ti (b) Did the organization, during the year, pay premiums, directly or indirectly, on a Note : If "Yes" to ( b ) , Me Form 8870 and Form 4720 see instructions).

Please ~ der penalties of penury, I declare that I have examined this return, Including ecoom~ correct lino complet Qecl~ Uord n of preparer (other than offices Is based onl all In f!m Sign ' i~J Here Signature o officer Date

Paid Preparer's signature /6v,~.) Preparer~s Firms Sname (o, DELOITTE TAX LLP

Use Only yo"

it self-employed), '600 RENAISSANCE CENTER,

323161 address, end ,9_,7_nz zIP*a DETROIT . MI 48243-1895

18590922 099906 34-1517671 2003 .06010

SCHEDULE A ~ Organization Exempt Under Section 501(c)(3) OMB No ,545-0047 (Form 990 or 890-EZ) (Except Private Foundation) and Section 501(e), 501(i), 501(k),

501(n), or Section 4947(a)(1) Nonexempt Charitable Trust 2003

Department oftheTreasury Supplementary Information-(See separate instructions .) incemal Revenue s~~~ lop. MUST be completed by the above organizations and attached to their Form 990 or 990-EZ Name of the organization Employer Identification number

PROMEDICA HEALTH SYSTEM INC . 1 34 1517671 Compensation of the Five Highest Paid Employees Other Than Officers, Directors, and Trustees (See page 1 of the instructions List each one If there are none, enter "None!) (a) Name and address of each employee paid (b) Title and average hours (d) mploy~°bi~ ei per week devoted to (c) Compensation Pies a deferred accoi

more than $50,000 DOS1110t1 compensation 81 and other

M2 DESIGN SERVICES, LTD PROFESSIONAL

322 RIVER RD . MAUMEE, OH 43537 ERVICES/CONSTRUC 355 545 . Total number of others receiving over $50,000 for professional services " ~ 5

323101/12-05-03 LHA For Paperwork Reduction Act Notice, see the Instructions for Form 990 and Form 990-EZ . Schedule A (Form 990 or 990-EZ) 2003 7

18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

BARBARA STEELE RES C&S REG

2142 N. COVE BLVD ., TOLEDO, OH 4360640 447,428 . 79,587 . 8,790 .

JOHN RANDOLPH RES PARAMT

2142 N . COVE BLVD ., TOLEDO, OH 4360640 377,117 . 85,204 . 9,871 .

ROBERT FREDERICK P MED AFF

2142 N . COVE BLVD ., TOLEDO, OH 4360640 307,174 . 44,938 . 0 .

ROBERT REITER P Q&P IMPRO

2142 N . COVE BLVD ., TOLEDO, OH 4360640 304,654 . 45,759 . 0 .

KATHLEEN CARLSON MD P PC & SUPP

2142 N . COVE BLVD . TOLEDO, OH 4360640 279 163 . 41 , 774 . 0 . Total number of other employees paid over $50,000 . 1110. 3 8 FKR 11 Compensation of the Five Highest Paid Independent Contractors for Professional Services

See page 2 of the instructions . List each one (whether individuals or firms) If there are none, enter'None .')

(a) Name and address of each independent contractor paid more than $50,000 (b) Type of service (c) Compensation

JONES DAY REAVIS & POGUE

41 SOUTH HIGH ST . COLUMBUS, OH 43215 EGAL 1 .054 .576

MARSHALL & MELHORN, LLC

FOUR SEAGATE TOLEDO, OH 43604 EGAL 997,491 .

DELOITTE & TOUCHE, LLP

600 RENAISSANCE CTR . DETROIT, MI 48243 CCOUNTING 699,157 .

COOPER & WALINSKI

900 ADAMS AVE . TOLEDO, OH 43624 EGAL 466,530 .

Schedule A (Form 990 or 99A-EZ) 2003 PROMEDICA HEALTH SYSTEM, INC . -1517671 Page 2

(a) Name(s) of supported organization(s) (b) Line number from above

SEE STATEMENT 17

6 of the instructions 14 U An organization organized and operated to test for public safety Section

323111 12-OS03

Schedule A (Form 990 or 990-EZ) 2003

8

18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

111 Statements About Activities (See page 2 of the instructions) Yes No

1 During the year, has the organization attempted to influence national, state, or local legislation, including any attempt to influence public opinion on a legislative matter or referendums If 'Yes,' enter the total expenses paid or incurred in connection with the lobbying activities 1 $ $ 18 , 0 0 0 . (Must equal amounts on line 38, Part VI-A, or line i of Part VI-B .) 1 X Organizations that made an election under section 501(h) by filing Form 5768 must complete Part VI-A. Other organizations checking 'Yes ; must complete Part VI-8 AND attach a statement giving a detailed description of the lobbying activities .

2 During the year, has the organization, either directly or indirectly, engaged in any of the following acts with any substantial contributors, trustees, directors, officers, creators, key employees, or members of their families, or with any taxable organization with which any such person is affiliated as an officer, director, trustee, majority owner, or principal beneficiary? (If the answer to any question is "Yes," attach a detailed statement explaining the transactions)

a Sale, exchange, or leasing of property? 2a X

b Lending of money or other extension of credit? _ . . . . 2b I I X

e Furnishing of goods, services, or facilities? . _ . . _ . . I 2c I I K

d Payment of compensation (or payment or reimbursement of expenses if more than $1,000) SEE_ PART . . V, . FORM 990

e Transfer of any part of its income or assets? 2e X

3 a Do you make grants for scholarships, fellowships, student loans, etc ? (if 'Yes; attach an explanation of how X you determine that recipients quality to receive payments .) 3a

b Do you have a section 403(b) annuity plan for your employees? 8b X

4 Did you maintain any separate account for participating donors where donors have the right to provide advice on the use or distribution of funds? . . 4 X

~t Reason for Non-Private Foundation Status (See pages 3 through 6 of t he instructions The organization is not a private foundation because it is . (Please check only ONE applicable box.) 5 [::] A church, convention of churches, or association of churches . Section 170(b)(1)(A)(i) 6 El A school section 170(b)(1)(A)(u). (Also complete Part V ) 7 E-1 A hospital or a cooperative hospital service organization . Section 170(b)(1)(A)(iii) . 8 E:1 A Federal, state, or local government or governmental unit Section 170(b)(1)(A)(v) . 9 0 A medical research organization operated in conjunction with a hospital Section 170(b)(1)(A)(iii) . Enter the hospital's name, city,

and state 10 EJ An organization operated for the benefit of a college or university owned or operated by a governmental and Section 170(b)(1)(A)(iv)

(Also complete the Support Schedule in Part IV-A ) 11a 0 An organization that normally receives a substantial part of its support from a governmental unit or from the general public

Section 170(b)(1)(A)(vi). (Also complete the Support Schedule in Part IV-A .) 11b ~ A community trust. Section 170(b)(1)(A)(vi). (Also complete the Support Schedule m Part IV-A ) 12 EJ An organization that normally racemes : (1) mare than 331 % of its support from contributions, membership fees, and gross

receipts from activities related to its charitable, etc , functions - subject to certain exceptions, and (2) no more than 331/3% of its support from gross investment income and unrelated business taxable income (less section 511 tax) from businesses acquired by the organization after June 30, 1975 See section 509(a)(2). (Also complete the Support Schedule in Part IV-A )

13 D An organization that is not controlled by any disqualified persons (other than foundation managers) and supports organizations described in : (1) lines 5 through 12 above ; or (2) section 501(c)(4), (5), or (6), if they meet the test of section 509(a)(2) (See section 509(a)(3).)

Provide the following information about the supported organizations (See page 5 of the instructions .)

4-1517671 Page 3 untin9~ . N/A

Schedule A (Form 990 or 990-EZ) 2003 PROMED ICA HEALTH SYSTEM, INC Schedule (Complete only if you checked a box on line 10, 11, or 12 .) Use cash method of acco >u may use the worksheet !n the instructions for converting from the accrual to the cash method of

22 26b . . 1 26d N/A e Public support (line 26c minus line 26d total) . . . . . . . . . . . . . . . . . 1 26e N/A f Public supp ort p ercenta ge line 26e numerator divided b line 26c denominator . 1 26f N/A

27 Organizations described on line 12 : a For amounts included in lines 15,16, and 17 that were received from a'disqualsfied person ; prepare a list for your records to show the name of, and total amounts received in each year from, each disqualified person ' Do not ills this list with your return . Enter the sum of such amounts for each year' (2002) . . . . . . (2001) _ . _ . . (2000) (1999) . . .

b For any amount included m line 17 that was received from each person (other than 'disqualified persons'), prepare a list for your records to show the name of, and amount received for each year, that was more than the larger of (1) the amount on line 25 for the year or (2) $5,000 . (Include in the list organizations described m lines 5 through 11, as well as individuals ) Do not file this list with your return . After computing the difference between the amount received and the larger amount described in (1) or (2), enter the sum of these drfferences (the excess amounts) for each year: (2002) (2001) . . , . (2000) . . (1999)

c Add : Amounts from column (e) for linen 15 16 17 20 21 _ 1 27c N/A

1 27d N/A " 27e N/A

d Add Line 27a total and line 27b total . e Public support (line 27c total minus line 27d total) . . t Total support for section 509(a)(2) test Enter amount on line 23, column (e) " 27f N/A g Public support percentage (line 27e (numerator) divided by line 27f (denominator)) , . . . 11111-27 N/A h Investment income percentage (line 18, column (e) (numerator) divided by line 27f (denominator)) 1 27h N/A

28 Unusual Grants : For an organization described m line 10, 11, or 12 that received any unusual grants during 1999 through 2002, prepare a list for your records to show, for each year, the name of the contributor, the date and amount of the grant, and a brief description of the nature of the grant Do not file this list with your return . Do not include these grants in line 15

323121 12-05-03 Schedule A (Forth 990 or 990-EJa 2003

9 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

Calendar year (orfiscal year be innin In . 1 (a) 2002 (b) 2001 (c) 2000 (d 1999 (e) Total 15 Gins, grants, and contributions

received . (Do not include unusual rants . See line 28

16 Membershi p fees received . 17 Gross receipts from admissions,

merchandise sold or services performed, or furnishing of facilities m any activity that is related to the organization's charitable, etc , purpose

18 Gross income from interest, dividends, amounts received from payments on securities loans (sec- tion 512(a)(5)), rents, royalties, and unrelated business taxable income (less section 511 taxes) from businesses acquired by the organization after June 30, 1975

19 Net income from unrelated business activities not included in line 18

20 Tax revenues levied for the organization's benefit and either paid to d or expended on its behalf

21 The value of services or facilities famished to the organization by a governmental unit without charge . Do not include the value of services or facilities generally famished to the public without charge

22 Other income. Attach a schedule . Do not include gain or (loss) from sale of capital assets

23 Total of lines 15 through 22 0 . 0 . 0 . 0 . 0 . 24 Line 23 minus line 17 25 Enter 1% of line 23 26 Organizations described on lines 10 or 11 : a Enter 2% of amount in column (e), line 24 NO- 26a N/A

b Prepare a list for your records to show the name of and amount contributed by each person (other than a governmental and or publicly supported organization) whose total gifts for 1999 through 2002 exceeded the amount shown in line 26a Do not file this fist with your return . Enter the total of all these excess amounts . . . . . 1 26b N/A

e Total support for section 509(a)(1) test : Enter line 24, column (e) " 26c N/A d Add Amounts from column (e) for lines: 18 19

34 a Does the organization receive any financial aid or assistance from a governmental agency? . . . b Has the organization's right to such aid ever been revoked or suspended

If you answered 'Yes'to either 34a or b, please explain using an attached statement . 35 Does the organization certify that it has complied with the applicable requirements of sections 4 01 through 4 .05 of Rev . Proc 75-50,

1975-2 C B . 587, covering racial nondiscrimination? If 'No ; attach an explanation . .

Schedule A (form 990 or 990-EZ) 2003

10

18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

Schedule A (Form 990 or 99D-EZ) 2003 PROMEDICA HEALTH SYSTEM INC . 34-1517671 Page 4 j/ Private School Questionnaire (See page 7 of the instructions) N/A

(To be completed ONLY by schools that checked the box on line 6 in Part IV)

29 Does the organization have a racially nondiscriminatory policy toward students by statement in its charter, bylaws, other governing Yes NO

instrument, or in a resolution of its governing body? 29 30 Does the organization include a statement of its racially nondiscriminatory policy toward students m all its brochures, catalogues,

and other written communications with the public dealing with student admissions, programs, and scholarships? 30 31 Has the organization publicized Its racially nondiscriminatory policy through newspaper or broadcast media during the period of

solicitation for students, or during the registration period rf ft has no solicitation program, m a way that makes the policy known to all parts of the general community it serves? ., . . _ . 31 If 'Yes,* please describe ; if 'No," please explain (Ii you need more space, attach a separate statement )

32 Does the organization maintain the following: a Records indicating the racial composition of the student body, faculty, and administrative staff? b Records documenting that scholarships and other financial assistance are awarded on a racially nondiscriminatory basis? c Copies of all catalogues, brochures, announcements, and other written communications to the public dealing with student

admissions, programs, and scholarships? d Copies of all material used by the organization or on its behalf to solicit contributions . . .

If you answered 'No' to any of the above, please explain (If you need more space, attach a separate statement )

33 Does the organization discriminate by race in any way with respect to a Students' rights or privileges? b Admissions policies? c Employment of faculty or administrative staffs d Scholarships or other financial assistance? e Educational policies 1 Use of facilities? . . . . g Athletic programs _ . . . . . ._ _ , . . _ _ . . . . h Other extracurricular activities , . . . . . _ , _ . . . . .

If you answered 'Yes'to any of the above, please explain (If you need more space, attach a separate statement )

323131 12-OS03

Schedule A(Form990or990-EZ)2003 pROMEDICA HEALTH SYSTEM INC . 34-1517671 Page 5 VI -A Lobbying Expenditures by Electing Public Charities (See page 9 of the instructions .) N/A

(To be completed ONLY by an eligible organization that filed Form 5768)

(a) (b) Affiliated group To be completed for ALL

totals electing organizations

N/A

38

Caution : I/ there is an amount on either line 43 or l1ne 44, you must file Form 4720.

Lobbying Expenditures During 4-Year Averaging Period

(a) (6) (c) (d) 2003 2002 2001 2000

N/A (e) Total

0 .

0 .

0 .

0 .

0 .

0 . 50 Grassroots lobbying

Lobbying Activity by Nonelecting Public Charities (For reporting only by organizations that did not complete Part VI-A) (See page 12 of the instructions

11 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

1 a U if the orpamzation belongs to an affiliated group . Check

Limits on Lobbying Expenditures

(The term expenditures' means amounts paid or incurred

38 Total lobbying expenditures to influence public opinion (grassroots lobbying) 37 Total lobbying expenditures to influence a legislative body (direct lobbying) 38 Total lobbying expenditures (add lines 36 and 37) _ 39 Other exempt purpose expenditures . . . . . . . 40 Total exempt purpose expenditures (add lines 38 and 39) . . . . . . . . 41 Lobbying nontaxable amount . Enter the amount from the following table -

If the amount on line 40 is - The lobbying nontaxable amount is -Not over $500,000 20% of the ertaunt on line 40

Over $500,000 but not over $1,000,000 , _ 5100,000 plus 15% of the excess over $500,000

Over $1,000,000 but not over $1,500,000 $175,000 plus 10% of the excess over $1,000,000

Over $7,500,000 but not over $77,000,000 � , $225,000 plus 5% of the excess over S1,500,000

ae.s,7,ooo,ooo . . . . s,,ooo,ooo . . . .

42 Grassroots nontaxable amount (enter 25°l0 of line 41) 43 Subtract line 42 from line 36 Enter -0- if line 42 is more than line 36 . . 44 Subtract line 41 from line 38 Enter -0- d line 41 is more than line 38 _

Calendar year (or fiscal year beginning in) 011. 45 Lobbying nontaxable

46 lobbying ceiling amount

47 Total lobbying

48 Grassroots nontaxable

49 Grassroots ceiling amount

4-Year Averaging Period Under Section 501(h) (Some organizations that made a section 501(h) election do not have to complete ail of the five columns

below. See the instructions for lines 45 through 50 on page 11 of the instructions .)

During the year, did the organization attempt to influence national, state or local legislation, including any attempt to Yes No Amount influence public opinion on a legislative matter or referendum, through the use of.

a Volunteers X b Paid staff or management (Include compensation m expenses reported on lines c through h .) X c Media advertisements . . . . . . . . . . d Mailings to members, legislators, or the public X e Publications, or published or broadcast statements K f Grants to other organizations for lobbying purposes , _ X 18 000 . g Direct contact with legislators, their staffs, government officials, or a legislative body X

X h Rallies, demonstrations, seminars, conventions, speeches, lectures, or any other means E I Total lobbying expenditures (Add lines c through h .) ~

i . .~`~ 18,000 .

If 'Yes'to any of the above, also attach a statement giving a detailed description of the lobbying activities SEE STATEMENT 18 323141 12-05-03 Schedule A (Form 990 or 990-EZ) 2003

(I) Cash . . . . . . . . . 51a(1) X (ii) Other assets a(11) X Other transactions : (I) Sales or exchanges of assets with a noncharitable exempt organization b(1) X (il) Purchases of assets from a noncharitable exempt organization b(ii) X

(III) Rental of facilities, equipment, or other assets . _ b(III) X (Iv) Reimbursement arrangements b(Iv) X (v) Loans or loan guarantees . . . . . . _ . _ . _ , . . . . . b(v) X (vl) Performance of services or membership or fundraising solicitations . . . . b(vi) X Sharing of facilities, equipment, marling lists, other assets, or paid employees c X If the answer to any of the above is *Yes,' complete the following schedule Column (b) should always show the fair market value of the goods, other assets, or services given by the reporting organization . If the organization received less than fair market value in any transaction or sharing arrangement, show in column (d) the value of the goods, other assets, or services received . NBA

(a) I Ibl I l0 I Idl Line no . Amount involved Name of nonchantable exempt organization Description of transfers, transactions, and sharing arrangements

52 a Is the organization directly or indirectly affiliated with, or related to, one or more tax-exempt organizations described in section 501(c) of the Code (other than section 501(c)(3)) or in section 527? _ . , . , . . , .� " 0 Yes 0 No

12 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

Schedule A (Form 990 or 990-EZ) 2003 PROMED ICA HEALTH SYSTEM INC . 34-1517671 Page 6 Yif Information Regarding Transfers To and Transactions and Relationships With Noncharitable

Exempt Organizations (See cape 12 of the instructions .) 51 Did the reporting organization directly or indirectly engage in any of the following with any other organization described in section

501(c) of the Code (other than section 501(c)(3) organizations) or in section 527, relating to political organizations? a Transfers from the reporting organization to a noncharitable exempt organization of Yes No

2003 DEPRECIATION AND AMOA71ZAT10N REPORT FORM 990 PAGE 2 990

No ̀ Description Date No e Unadjusted Bus % ReducUon In Basis For Accumulated Current Amount Of

Plion Acquired Method Life Cost Or Basis Excl Basis Depreciation Depreciation Sec 179 Depreciation

1 FURNITURE & FIXTURES I S 15 .0016 309,725 . 309,725 . 75,355 . 19,472, .

ONSTRUCTION IN - 3 ROGRESS VARI ES .000 16 1,131,9319 . 1,131,939 . 0 .

RPIi,IECI.&TION ALCATI~; ~~

.000 l. FAQ ~t AFFILIATES

* 990 PAGE 2 TOTAL - 1s,7se,710 . 0 . 1s,7s8,710 . 3,7e9,se4 . 0 . 567,502 . GRAND TOTAL 99#} RAGE DEPR

328102 os-oi-a3 (D) - Asset disposed " ITC, Section 179, Salvage, HR 3090, Commercial Revitalization Deduction

15

PROMEDICA HEALTH SYSTEM, INC . 34-1517671

FORM 990 OTHER INVESTMENT INCOME STATEMENT 1

DESCRIPTION AMOUNT

EQUITY INCOME FLOWER HOSPITAL FOUNDATION 1,224,275 . EQUITY INCOME THE TOLEDO HOSPITAL FOUNDATION 34,604,066 . EQUITY INCOME DEFIANCE REGIONAL MEDICAL CENTER FOUNDATION 170,979 . EQUITY INCOME TOLEDO CHILDREN'S HOSPITAL 225,913 . EQUITY INCOME PROMEDICA CONTINUING CARE SERVICES FOUNDATION 922,332 . EQUITY INCOME BAY PARK COMMUNITY HOSPITAL FOUNDATION -61,374 . EQUITY INCOME HEALTH, EDUCATION & RESEARCH CORP . $,37$, EQUITY INCOME BVPH VENTURES, INC . 1,002,492 . EQUITY INCOME FOSTORIA COMMUNITY HOSPITAL 8,412,734 . EQUITY INCOME BAY PARK COMMUNITY HOSPITAL -4,050,115 . EQUITY INCOME LENAWEE HEALTH ALLIANCE 5,545,142 . EQUITY INCOME THE TOLEDO HOSPITAL 46,051,742 . EQUITY INCOME FLOWER HOSPITAL 29,663,337 . EQUITY INCOME DEFIANCE REGIONAL MEDICAL CENTER 4,264,696 . EQUITY INCOME PROMEDICA CONTINUING CARE SERVICES -997,989 . EQUITY INCOME PROMEDICA INDEMNITY COMPANY, LTD . -2,366 . EQUITY INCOME PROMEDICA INDEMNITY CORP . 10,631,478 . EQUITY INCOME PROMEDICA INSURANCE CORPORATION 8,930,910 . EQUITY INCOME PROMEDICA PHYSICIAN GROUP 10,647,127 .

TOTAL TO FORM 990, PART I, LINE 7 157,193,757 .

16 STATEMENT S) 1 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

17 STATEMENT S) 2 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

PROMEDICA HEALTH SYSTEM, INC . 34-1517671

FORM 990 GAIN (LOSS) FROM PUBLICLY TRADED SECURITIES STATEMENT 2

GROSS COST OR EXPENSE NET GAIN DESCRIPTION SALES PRICE OTHER BASIS OF SALE OR (LOSS)

PHS MASTER TRUST ALLOCATED GAINS/(LOSSES) 0 . 48,227 . 0 . -48,227 . PHS SHORT TERM MASTER TRUST UNIT 13,254,941 . 13,234,788 . 0 . 20,153 . FIXED INCOME DOMESTIC UNIT 3,160,000 . 3,170,748 . 0 . -10,748 . CHARITABLE TEMPORARY INVESTMENT FD 456,212 . 456,212 . 0 . 0 . SALE OF SECURITIES ADJUSTMENT 26 . 0 . 0 . 26 .

TO FORM 990, PART I, LINE 8 16,871,179 . 16,909,975 . 0 . -38,796 .

18 STATEMENT S) 3 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

PROMSDICA HEALTH SYSTEM, INC . 34-1517671

FORM 990 GAIN (LOSS) FROM SALE OF OTHER ASSETS STATEMENT 3

DATE DATE METHOD DESCRIPTION ACQUIRED SOLD ACQUIRED

DIMENSION 8100 - PENTIUM 4 O1/O1/O1 01/01/03 PURCHASED COMPUTER

GROSS COST OR EXPENSE NET GAIN SALES PRICE OTHER BASIS OF SALE DEPREC OR (LOSS)

1,923 . 2,252 . 0 . 751 . 422 .

DATE DATE METHOD DESCRIPTION ACQUIRED SOLD ACQUIRED

2004 HP PAVILION XL876 O1/O1/O1 01/01/03 PURCHASED

GROSS COST OR EXPENSE NET GAIN SALES PRICE OTHER BASIS OF SALE DEPREC OR (LOSS)

1,771 . 2,125 . 0 . 354 . 0 .

TO FM 990, PART I, LN 8 3,694 . 4,377 . 0 . 1,105 . 422 .

TOTAL TO FORM 990, PART I, LINE 20 -4,643,952 .

19 STATEMENT S) 4 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

PROMEDICA HEALTH SYSTEM, INC . 34-1517671

FORM 990 OTHER CHANGES IN NET ASSETS OR FUND BALANCES STATEMENT 4

DESCRIPTION AMOUNT

UNREALIZED GAINS (LOSSES) 240,804 . JOINDER FUNDS TO FOSTORIA COMMUNITY HOSPITAL (34-0898745) -4,584,756 . JOINDER FUNDS TO BIXBY MEDICAL CENTER (38-2796005) -300,000 .

2 0 STATEMENT S) 5 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

pROMEDICA HEALTH SYSTEM, INC . 34-1517671

FORM 990 OTHER EXPENSES STATEMENT 5

(A) (B) (C) (D) PROGRAM MANAGEMENT

DESCRIPTION TOTAL SERVICES AND GENERAL FUNDRAISING

CONTRACTED FEES 5,462,834 . 4,370,267 . 1,092,567 . DUES & SUBSCRIPTIONS 104,914 . 83,931 . 20,983 . LICENSES 51,757 . 41,406 . 10,351 . ADVERTISING 772,766 . 618,213 . 154,553 . RECRUITMENT 108,925 . 87,140 . 21,785 . CORPORATE OVERHEAD ALLOCATIONS -30,835,571 . -24,668,457 . -6,167,114 . INSURANCE ALLOCATIONS -30,079 . -24,063 . -6,016 . MISCELLANEOUS EXPENSES 740,288 . 592,230 . 148,058 . INTRACOMPANY TRANSFERS 72,566 . 58,053 . 14,513 . FUNDRAISING & OTHER COST REIMBURSEMENTS -511,974 . -409,579 . -102,395 .

TOTAL TO FM 990, LN 43 -24,063,574 . -19,250,859 . -4,812,715 .

STATEMENT 6

ProMedica Health System, Inc 34-1517671 2003 Grants and Allocations

Donation Date Event Name ~ Donation Amount 4/9/2003 Academy of Medicine $ 200 9/2/2003 Adopt America Network 1,000 4/3/2003 Adrian College 1,000 4/11/2003 Alzheimer's Association of NW Ohio 1,000 3/14/2003 American Cancer Society 2,500 3/31/2003 American Cancer Society 2,500 2/18/2003 American Cancer Society 5,000 5/7/2003 American Cancer Society 1,000 7/9/2003 American Cancer Society 1,000 1/15/2003 American Diabetes Association 1 500 4/10/2003 American Heart Association 5,000 2/24/2003 American Heart Association 10,000 2/4/2003 American Heart Association (The Pinnacle) 1,078 4/8/2003 American Lung Association of Ohio 5,000 10/20/2003 American Red Cross 2,000 7/9/2003 Anne Grady Foundation 500 8/6/2003 Arby's Foundation 750 3/14/2003 Area Office on Aging of NW, Inc . 900 12/30/2003 Arrowhead Park Association 125 3/21/2003 Arthritis Foundation 1,000 11/7/2003 Arthritis Foundation of NW Ohio 1,000 9/5/2003 Arts Commission of Greater Toledo 1,500 2/19/2003 Babes Club 375 9/29/2003 Babes Club 375 9/11/2003 Bay Park Community Hospital Foundation 1,000 3/25/2003 Bay Park Community Hospital Foundation 2,000 9/3/2003 Bay Park Community Hospital Foundation 1,250 7/28/2003 Bedford High School (Side Effects, Inc.) 1,500 11/21/2003 Better Community Relations, Inc . 1,600 1/3/2003 Big Brothers Big Sisters 500 7/11/2003 Bixby Community Health Foundation 2,500 8/11/2003 Bixby Community Health Foundation 5,000 5/16/2003 Bixby Medical Center 2,000 8/6/2003 Bixby Medical Center 5,000 7/21/2003 Block Watch 1,100 6/2/2003 Boy Scouts of America 1,000 10/9/2003 Boys & Girls Clubs of Toledo 500 9/11/2003 Caring Way 1,000

STATEMENT 6

ProMedica Health System, Inc 34-1517671 2003 Grants and Allocations

Donation Date _ Event Name Donation Amount 9/11/2003 Catholic Club 2,500 4/3/2003 Catholic Social Services 1,950 12/2/2003 Catholic Social Services 1,000 8/25/2003 Cherry Street Mission Ministries 500 12/9/2003 Cherry Street Mission Ministries 100 11/1312003 Christ Child Society of Toledo 250 8/25/2003 CitiFest 1,000 10/9/2003 CitiFest 2,000 10/17/2003 Citizens for Maumee's Future 5,000 8/6/2003 City of Toledo Youth Commission 200 3/14/2003 Claire's Day 1,000 6/2/2003 Collingwood Presbyterian Church 5,000 6/2/2003 Collmgwood Presbyterian Church 2,500 6/4/2003 Congregational Nurse Project 1,004 12/3/2003 Congregational Nurse Project 3,500 3/19/2003 Congregational Nurse Project of NW Ohio 200 5/1/2003 Cousino Charitable Foundation 1,300 9/18/2003 Coy Elementary School - PGA 149 3/21/2003 Croswell Opera House 475 4/8/2003 Cystic Fibrosis Foundation 1,500 6/2/2003 Dartmouth College 1,000 8/20/2003 David's House of Compassion 520 8/11/2003 Daybreak Adult Day Services 2,500 6/24/2003 Deaf Resource Center 100 7/9/2003 Defiance Are Chamber of Commerce 500 3/3/2003 Defiance Area YMCA 500 3/3/2003 Defiance College 700 3/3/2003 Defiance Regional Medical Center Foundation 3,500 3/3/2003 Defiance Regional Medical Center Foundation 500

12/17!2003 Dental Center of NW Ohio 150 10/26/2003 Diabetes Youth Program 1,000 8/4/2003 Diamante Awards Dinner 500 1/15/2003 East Toledo Family Center 1,000 4/8/2003 East Toledo Family Center 510 3/14/2003 Eastern Maumee Bay Chamber of Commerce 5,000 5/7/2003 Eastern Maumee Bay Chamber of Commerce 150 6/5/2003 Eastern Maumee Bay Chamber of Commerce 400

12119/2003 Eastern Maumee Bay Chamber of Commerce 5,000

34-1517671 ProMedica Health System, Inc 2003 Grants and Allocations

STATEMENT 6

Donation Date - Event Name Donation Amount 9/2/2003 EOPA - Head Start J250 4/28/2003 EOPA/Toledo Lucas County Head Start 25 12/16/2003 EOPA/Toledo-Lucas County Heat Start 100 7/15/2003 Epilepsy Center 300 11/21/2003 Epworth United Methodist Church 6,000 1/23/2003 Erie Shoes Council Boy Scouts of America 1,000 121312003 Erie Shores Council - BSA 1,000 4/11/2003 Evergreen Athletic Boosters 100 3/16/2003 Facilities & Healthcare Engineers Association 250 6/5/2003 Fifty Men and Fifty Women of Toledo 3,060 6/9/2003 Flower Hospital Auxiliary 1,500 9/25/2003 Flower Hospital Foundation 1,000 9/23/2003 Flower Hospital Foundation 100 11/08/2003 Focus Homeless Services 1,500 6/9/2003 Fostoria Community Hospital Foundation 1,000 4/8/2003 Fraternal Order of Police 795 12/19/2003 Friends of Boys and Girls Clubs 2,000 5/1/2003 Friends of Boys and Girls Clubs 1,500 2/18/2003 Friends of Scouting 1,000 6/23/2003 Fulton County EMS 350 11/7/2003 George Ballas Athletic Scholarship Fund 500 1/14/2003 Girl Scouts of Maumee Valley Council 5,000 4/11/2003 Girl Scouts of Maumee Valley Council 200 1/28/2003 Girl Scouts of Maumee Valley Council 1,000 2/5/2003 Girl Scouts of Maumee Valley Council 750 6/2/2003 GOW School 1,000 9/2/2003 Greater Independence and Vision for Everyone, Inc . 1,000 7/9/2003 Greater Toledo Association of Arab Americans 150 9/24/2003 Greater Toledo Urban League 500 7/21/2003 Greater Toledo Urban League 210 12/10/2003 Harbor Foundation (The) 100 11/6/2003 Herrick Memorial Hospital Foundation 2,500 4/3/2003 Hickman Cancer Center 1,600 8/19/2003 Hillsdale Community Health Center 1,000 11/6/2003 Hillsdale Community Health Center 1,000 4/8/2003 Hilton Toledo 2,000 6/6/2003 Hindu Temple of Toledo, Inc . 250

11/21/2003 Hope for Santa 1,700

ProMedica Health System, Inc 2003 Grants and Allocations

34-1517671

STATEMENT 6

Donation Date Event Name Donation Amount 9/23/2003 Hope Lutheran Churc~----- 100 12/2/2003 Hope Lutheran Church 6,000 4/l/2003 Hospice of Northwest Ohio 500 9/3/2003 Huntington Community Center 850 7/8/2003 James A. Jackson Foundation 2,500

11/10/2003 Jewish Community Center 1,000 2/7/2003 Jewish Community Center of Toledo 400

12/22/2003 Jewish Community Center of Toledo 1,700 9/24/2003 Junior Achievement of Defiance 340 1/14/2003 Junior Achievement of NW Ohio 1,000 1/24/2003 Junior Achievement of NW Ohio 10,000 1/17/2003 Junior League of Toledo 10,000 11/5/2003 Junior League of Toledo 9,600 11/2/2003 Junior League of Toledo 569 12/11/2003 Junior League of Toledo 2,900 1/29/2003 Juvenile Diabetes Research Foundation 2,500 8/25/2003 Juvenile Diabetes Research Foundation 2,500 9/15/2003 Kids on the Block 500 8/19/2003 Komen Northwest Ohio Pink Ribbon Gala 1,000 5/9/2003 Komen Northwest Ohio Race for the Cure 1,000 6/4/2003 Laurels of Defiance 200 3/31/2003 Law Enforcement Foundation, Inc. 500 4/29/2003 Lima Memorial Hospital 500 5/12/2003 Lima Memorial Hospital Foundation 500 12/18/2003 Lima Memorial Hospital Fund 1,000 12/11/2003 Local Initiatives Support Corporation 5,000 1/3/2003 Lourdes College 2,000 7/8/2003 Lucas County I Oth Golf Classic 360 12/1/2003 Lucas County Alternate Learning and Career Center 500 8/6/2003 Lucas County Medical Alliance 1,000 1/17/2003 Magruder Hospital Auxiliary 100 1/17/2003 Make-A-Wish Foundation 2,000 3/31/2003 Make-A-Wish Foundation 1,000 12/18/2003 Make-A-Wish Foundation 2,000 3/14/2003 March of Dimes 5,000 6/5/2003 Martin Luther King Schools 700 10/6/2003 Mayo Clinic 1,000 3/24/2003 McKinley Elementary School 3,083

ProMedica Health System, Inc 2003 Grants and Allocations

34-1517671

STATEMENT 6

L Donation Date Event Name Donation A oun 5/30/2003 MCO Foundation 1,500 9/23/2003 MCO Foundation 1,000 9/23/2003 Miami University 1,000 3/21/2003 Monroe County Chamber of Commerce 500 11/13/2003 Monroe Street UMC Concert Series 500 8/28/2003 Multiple Sclerosis Society (National) 1,000 12/18/2003 Multiple Sclerosis Society (National) 1,000 8/13/2003 Muscular Dystrophy Association 3,500 9/25/2003 N.A.A.C.P . 525 2/11/2003 National Alliance for the Mentally III of Greater 500 2/24/2003 Northwest Ohio Black Chamber of Commerce 2,000 4/24/2003 Northwest Ohio Black Media Assoc . (NOBMA) 200 11/13/2003 Northwest Ohio Children's Dance Education Assoc. 1,500 2/18/2003 Northwest Ohio Children's Dance Education Assoc. 250 3/17/2003 Northwest Ohio Hemophilia Foundation 2,500 3/17/2003 Northwest Ohio Hemophilia Foundation 500 5/16/2003 Northwest Ohio NAACP 1,500 3/28/2003 Northwest Ohio Tornadoes Baseball 100 1/15/2003 Notre Dame Academy 1,000 5/30/2003 NW Ohio Association of Health Underwriters 190 12/8/2003 Ohio Academy of Family Physicians'Foundation 2,500 5/21/2003 Ohio Patrolmen Benevolent Association 950 4/l/2003 Ohio Wesleyan University 10,000 7/15/2003 One-In-Four Cancer Benefit Pro Am 500 7/21/2003 Ottawa Hills Boosters 500 11/11/2003 Ottawa Hills Green Bear Ball 195 9/26/2003 Ottawa Hills Hockey Association 200 6/24/2003 Partners In Education 250 12/11/2003 Partners In Education 1,048 4/14/2003 Partners in Education - Sylvania Schools 1,500 11/13/2003 Pinewood Derby 1,500 4/28/2003 Police Probation Team 100 1/2/2003 ProMedica Health System Foundation 5,000 7/9/2003 Read for Literacy, Inc. 1,200 1/31/2003 Ritz Theatre 200 7/17/2003 Ronald McDonald House Charities 2,000 8/1/2003 Rotary Foundation - Polio Eradication Campaign 250 4/8/2003 Roy C. Start High School 200

STATEMENT6

ProMedica Health System, Inc 34-1517671 2003 Grants and Allocations

Donation Date' Event Name Donation Amount 11/14/2003 Russian Orphan's Christmas Party 200 10/21/2003 Salvation Army 1,000 12/2/2003 Salvation Army 1,500 12/9/2003 Save Our Children, Inc. 100 4/3/2003 Siena Heights University 1,500 5/12/2003 Sisters of Notre Dame 1,000 10/17/2003 Sofia Quintero Art & Cultural Center 500 7/21/2003 Sophia Counseling Center 250 1/23/2003 Southview Baseball 150 6/2/2003 Sprague Farm Market 1,000

10/14/2003 Springfield High School Drama Club 60 3/14/2003 St . Francis Advisory Board 150 7/28/2003 St . Francis de Sales High School 5,000 6/23/2003 St . Francis Hospital Foundation 450 3/3/2003 St . John's Catholic Church 5,000 4/25/2003 St . John's Catholic Church 3,650 1/15/2003 St . John's Jesuit High School 2,500 5/23/2003 St . John's Jesuit High School 1,500 4/3/2003 St . Joseph Catholic Church 2,500 2/24/2003 St. Richard Parish 125 8/11/2003 St . Vincent de Paul Society 6,000 12/2/2003 St. Vincent de Paul Society 2,500 9/25/2003 Sunrise Boosters 100 7/28/2003 Swanton Parent's Club 275 1/23/2003 Sylvania Area Chamber of Commerce 500 6/24/2003 Sylvania Community Rotary Foundation 250 6/2/2003 Sylvania Historical Village 350 7/9/2003 Sylvania Sister City Commission 500 4/8/2003 Taste of the Nation 2,500 4/8/2003 TCS Junior High Baseball 200 9/25/2003 Theater Kidz, Inc. 80 3/25/2003 The Toledo Symphony 1,500 6/2/2003 The Toledo Symphony 1,000 6/2/2003 The Toledo Symphony 1,000 6/16/2003 The Toledo Symphony 5,000 6/23/2003 The Toledo Symphony 20,000 10/1/2003 The Toledo Symphony 1,000 1/13/2003 TMACOG 450

34-1517671 ProMedica Health System, Inc 2003 Grants and Allocations

STATEMENT 6

Donation Date Ev'ent Name Donation Amount 4/28/2003 TMACOG 2,000 7/28/2003 Toledo Area Chamber of Commerce 3,000 4/8/2003 Toledo Area James A. Rhodes Memorial Committee 500 6/2/2003 Toledo Area Parent 800 7/9/2003 Toledo Ballet Association 4,000 9/3/2003 Toledo Ballet Association 5,000 4/14/2003 Toledo Botanical Garden 4,000 9/5/2003 Toledo Business Journal 1,186 12/19/2003 Toledo Chapter, The Links, Inc. 2,000 2/20/2003 Toledo Children's Hospital Foundation 1,250 6/5/2003 Toledo Children's Hospital Foundation 900 10/20/2003 Toledo Children's Hospital Foundation 1,500 9/3/2003 Toledo Children's Hospital Foundation 2,000 10/1/2003 Toledo Children's Hospital Foundation 2,000 4/14/2003 Toledo Club, Negro Business & Prof Women 400 5/16/2003 Toledo Cultural Arts Center 2,100 7/28/2003 Toledo Cultural Arts Center 5,000 7/9/2003 Toledo Cultural Arts Center 10,000 1/15/2003 Toledo Day Nursery 1,500 3/25/2003 Toledo Hospital Foundation 2,500 9/16/2003 Toledo Hospital Foundation 5,000 10/1/2003 Toledo Hospital Foundation 1,000 1/28/2003 Toledo Museum of Art 10,000 1/14/2003 Toledo Museum of Art 3,000 3/25/2003 Toledo Museum of Art 1,000 6/2/2003 Toledo Museum of Art 3,000 6/2/2003 Toledo Museum of Art 2,500 9/29/2003 Toledo Museum of Art 5,000 10/1/2003 Toledo Museum of Art 2,500 9/2/2003 Toledo Northwestern Ohio Food Bank, Inc. 1,000 11/25/2003 Toledo Northwestern Ohio Food Bank, Inc. 5,000 9/25/2003 Toledo Opera 4,000 8/22/2003 Toledo Public Schools Foundation 2,500 9/24/2003 Toledo Rescue Mission 500 4/17/2003 Toledo Rotary Foundation 250 2/10/2003 Toledo Symphony 12,500 2/11/2003 Toledo Zoo 10,000 12/9/2003 Toledo Zoo 10,000

STATEMENT 6

ProMedica Health System, Inc 34-1517671 2003 Grants and Allocations

on Date Event Name~', Donatic 7/9/2003 UMADAOP 500 4/2/2003 United Methodist Church 15,000 3/25/2003 United Way 3,400 3/3/2003 United Way of Defiance 500 1/15/2003 University of Toledo 375 1/15/2003 University of Toledo 5,400 1/23/2003 University of Toledo 6,000 11/26/2003 University of Toledo 100 6/2/2003 University of Toledo 3,000 9/3/2003 University of Toledo 5,000 4/8/2003 University of Toledo NYSP 4,000 8/7/2003 Ursuline Convent 500 9/23/2003 Ursuline Convent 1,000 2/19/2003 UT Alumni Association - Minority Affiliates 1,270 9/30/2003 Victory Center 650 6/5/2003 Washington Local Schools 650 5/20/2003 Westfield Shopping Center - Franklin Park 300 6/2/2003 Westside Montessori Center 8,000 8/1/2003 Woodward High School 7,000

11/13/2003 YMCA of Defiance 2,500 12/19/2003 YMCA of Defiance 2,500 3/26/2003 Youth Entrepreneur Program 6,000 2/18/2003 YWCA of Greater Toledo 10,000 11/30/2003 ProMedica Physicians Corp . 9,515,126 12/31/2003 ProMedica Physicians Corp . 10,032,731 9/03/2003 ProMedica Indemnity Corp 750,000

20,883,684

STATEMENT 6A

STATEMENT 6A

ProMedica Health System Statement of Program Service Accomplishments

EIN: 34-1517671 December 31, 2003

As the largest and most comprehensive not-for-profit health system in northwest Ohio and southern Michigan, ProMedica Health System recognizes our responsibility in being this area's health care leader . Our caring extends beyond the brick and mortar of our facilities to all those in need -especially the poor and underserved.

In 2003, ProMedica provided $91,161,000 in community value in terms of education programs, community projects, charity and indigent care, research and other activities .

These numbers not only indicate ProMedica's commitment to our communities, but also fulfill our mission as a not-for-profit by positively affecting the members of those communities . Tens of thousands of people have benefited from the compassion, care and expertise of our family of physicians and employees . ProMedica is proud to provide a total community value of $91,16 1,000 .

Direct Community Support

Through community outreach programs, education programs, research activities and a wide range of free programs and services, ProMedica contributed $24,059,000 . In addition, ProMedica also provided $21,801,000 in uncompensated care for patients who do not have the financial resources to pay for hospital services .

Indirect Community Support

ProMedica also provided $45,301,000 of indirect community support by operating outpatient clinics and other services and subsidizing the costs of unpaid governmental programs .

Other Program Statistics

As a locally owned and locally controlled not-for-profit health system, ProMedica is committed to the communities we serve. We are advocates for health, not just health care, working in collaboration with local not-for-profit agencies, school systems, and other community and business leaders, as well as health care professionals .

ProMedica is comprised of 68 corporations and major joint ventures, 15,000 employees and staff members and 209 facilities . During 2003, we have served 62,407 inpatients, 784,360 outpatients, and have treated 190,643 emergency room visits .

Future Community Support

As health care continues to change, Promedica continues to provide increasing comprehensive medical services to patients, as well as increasing community support through activities such as the development of health care awareness and prevention programs, and establishing partnerships with other organizations. Also, as the communities we service grow, so must we in order to continue with the superior quality of care our patients and families have come to expect .

PROkEDICA HEALTH SYSTEM, INC . 34-1517671

FORM 990 NON-GOVERNMENT SECURITIES STATEMENT 7

OTHER PUBLICLY TOTAL

CORPORATE CORPORATE TRADED OTHER NON-GOV'T SECURITY DESCRIPTION STOCKS BONDS SECURITIES SECURITIES SECURITIES

PROMEDICA HEALTH SYSTEMS SHORT 2,154,596 . 2,154,596 . REAL ESTATE UNIT 82,012 . 82,012 . INTERNATIONAL EQUITY UNIT 252,362 . 252,362 . FIXED INCOME DOMESTIC UNIT 239,357 . 239,357 . INTERNATIONAL FIXED INCOME 27,056 . 27,056 . DOMESTIC EQUITY UNIT 983,202 . 983,202 .

TO 990, LN 54 COL B 1,235,564 . 2,421,009 . 82,012 . 3,738,585 .

22 STATEMENT(S) 7 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171 18590922 099906 34-1517671

23 STATEMENT(S) 8 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

,PROM-EDICA HEALTH SYSTEM, INC . 34-1517671

FORM 990 OTHER INVESTMENTS STATEMENT 8

VALUATION DESCRIPTION METHOD AMOUNT

BVPH VENTURES, INC . COST 5,291,762 . FOSTORIA COMMUNITY HOSPITAL COST 25,466,191 . BAY PARK COMMUNITY HOSPITAL COST 31,854,381 . LENAWEE HEALTH ALLIANCE COST 73,542,182 . PROMEDICA CONTINUING CARE SERV CORP COST 21,655,184 . PROMEDICA PHYSICIAN GROUP COST -3,966,284 . THE TOLEDO HOSPITAL COST 313,809,503 . PROMEDICA INDEMNITY COMPANY, LTD . COST 406,542 . PROMEDICA INDEMNITY CORP . COST 13,388,474 . FLOWER HOSPITAL COST 144,696,943 . DEFIANCE REGIONAL MEDICAL CENTER COST 71,005,839 . INVESTMENT IN SELF INSURANCE TRUST COST 170,239 . INVESTMENT TRUST, DEFERRED COMP COST 10,002,277 . AFFILIATED FOUNDATIONS COST 149,029,626 . PROMEDICA INSURANCE CORP COST 75,331,910 . PROMEDICA HEALTH, EDUCATION, AND RESEARCH COST CORP . 20,854 .

TOTAL TO FORM 990, PART IV, LINE 56, COLUMN B 931,705,623 .

COST OR ACCUMULATED DESCRIPTION OTHER BASIS DEPRECIATION BOOK VALUE

FURNITURE & FIXTURES 309,725 . 94,827 . 214,898 . EQUIPMENT 14,317,046 . 7,045,527 . 7,271,519 . CONSTRUCTION IN PROGRESS 1,131,939 . 0 . 1,131,939 .

TOTAL TO FORM 990, PART IV, LN 57 15,758,710 . 7,140,354 . 8,618,356 .

24 STATEMENT(S) 9 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

PROkEDICA HEALTH SYSTEM, INC . 34-1517671

FORM 990 DEPRECIATION OF ASSETS NOT HELD FOR INVESTMENT STATEMENT 9

25 STATEMENT(S) 10 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

RROMEDICA HEALTH SYSTEM, INC . 34-1517671

FORM 990 OTHER ASSETS STATEMENT 10

DESCRIPTION AMOUNT

DUE FROM AFFILIATES 19,879,714 . FOUNDATION FUNDS 168,625 . MISC INTEREST RECEIVABLE -400 .

TOTAL TO FORM 990, PART IV, LINE 58, COLUMN B 20,047,939 .

DESCRIPTION AMOUNT

DEFERRED COMPENSATION 10,002,277 . DUE TO AFFILIATES 15,684,349 . LONG TERM PROFESSIONAL LIABILITIES 7,415,778 . ACCRUED PROFESSIONAL LIABILITIES 3,258,649 . OTHER CURRENT LIABILITIES 1,117,653 .

TOTAL TO FORM 990, PART IV, LINE 65, COLUMN B 37,478,706 .

26 STATEMENT(S) 11 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

PROMEDICA HEALTH SYSTEM, INC . 34-1517671

FORM 990 OTHER LIABILITIES STATEMENT 11

27 STATEMENT(S) 12 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

,PROf4EDICA HEALTH SYSTEM, INC . 34-1517671

FORM 990 PART V - LIST OF OFFICERS, DIRECTORS, STATEMENT 12 TRUSTEES AND KEY EMPLOYEES

EMPLOYEE TITLE AND COMPEN- BEN PLAN EXPENSE

NAME AND ADDRESS AVRG HRS/WK SATION CONTRIB ACCOUNT

ALAN BRASS PRES/CEO/TRUSTEE 2142 NORTH COVE BOULEVARD 24 763,000 . 112670 . 8,288 . TOLEDO, OH 43606

LEE HAMMERLING MD CHIEF MEDICAL OFFICER 2142 NORTH COVE BOULEVARD 20 412,221 . 83,067 . 8,900 . TOLEDO, OH 43606

KATHLEEN HANLEY TREASURER/CFO 2142 NORTH COVE BOULEVARD 35 367,496 . 84,937 . 10,864 . TOLEDO, OH 43606

JEFFREY KUHN SECRETARY/VP LEGAL SVCS 2142 NORTH COVE BOULEVARD 18 275,874 . 66,695 . 8,037 . TOLEDO, OH 43606

FRANK DUVAL CHAIRMAN 2142 NORTH COVE BOULEVARD 1 0 . 0 . 0 . TOLEDO, OH 43606

EMMETT BOYLE JR . MD TRUSTEE 2142 NORTH COVE BOULEVARD 1 0 . 0 . 0 . TOLEDO, OH 43606

ELIZABETH BRADY TRUSTEE 2142 NORTH COVE BOULEVARD 1 0 . 0 . 0 . TOLEDO, OH 43606

GARY COLLINS MD TRUSTEE 2142 NORTH COVE BOULEVARD 1 0 . 0 . 0 . TOLEDO, OH 43606

HARLEY DUNBAR TRUSTEE 2142 NORTH COVE BOULEVARD 1 0 . 0 . 0 . TOLEDO, OH 43606

OTTO GERDEMAN TRUSTEE 2142 NORTH COVE BOULEVARD 1 0 . 0 . 0 . TOLEDO, OH 43606

RICHARD GERMOND TRUSTEE 2142 NORTH COVE BOULEVARD 1 0 . 0 . 0 . TOLEDO, OH 43606

'PRdMEDICA HEALTH SYSTEM, INC .

DEBORAH GUNTSCH MD 2142 NORTH COVE BOULEVARD TOLEDO, OH 43606

JAY HALL 2142 NORTH COVE BOULEVARD TOLEDO, OH 43606

DONALD KELLERMEYER 2142 NORTH COVE BOULEVARD TOLEDO, OH 43606

RONALD LANGENDERFER 2142 NORTH COVE BOULEVARD TOLEDO, OH 43606

JAMES MURRAY 2142 NORTH COVE BOULEVARD TOLEDO, OH 43606

LARRY PETERSON 2142 NORTH COVE BOULEVARD TOLEDO, OH 43606

ARTHUR PURINTON 2142 NORTH COVE BOULEVARD TOLEDO, OH 43606

EMORY SCHMIDT 2142 NORTH COVE BOULEVARD TOLEDO, OH 43606

LEE WESSELMAN 2142 NORTH COVE BOULEVARD TOLEDO, OH 43606

FREDERICK YOCUM 2142 NORTH COVE BOULEVARD TOLEDO, OH 43606

TOTALS INCLUDED ON FORM 990, PART V

34-1517671

TRUSTEE 1 0 . 0 . 0 .

TRUSTEE 1 0 . 0 . 0 .

TRUSTEE 1 0 . 0 . 0 .

TRUSTEE 1 0 . 0 . 0 .

TRUSTEE 1 0 . 0 . 0 .

TRUSTEE 1 0 . 0 . 0 .

TRUSTEE 1 0 . 0 . 0 .

TRUSTEE 1 0 . 0 . 0 .

TRUSTEE 1 0 . 0 . 0 .

TRUSTEE 0 . 0 . 0 .

1,818,591 . 347369 . 36,089 .

28 STATEMENT(S) 12 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

29 STATEMENT(S) 13 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

P.ROMEDICA HEALTH SYSTEM, INC . 34-1517671

FORM 990 PART V - OFFICER COMPENSATION FROM STATEMENT 13 RELATED ORGANIZATIONS

EMPLOYEE NAME OF COMPEN- BEN PLAN EXPENSE

OFFICER'S NAME RELATED ORGANIZATION SATION CONTRIB ACCOUNT

ALAN BRASS PROMEDICA INSURANCE CORP 34-1570675 192,000 . 265,500 . 0 .

GARY COLLINS MD PROMEDICA PHYSICIAN GROUP 34-1899439 255,524 . 26,901 . 0 .

DEBORAH GUNTSCH MD PROMEDICA PHYSICIAN GROUP 34-1899439 279,919 . 14,606 . 5,285 .

DEBORAH GUNTSCH MD THE TOLEDO HOSPITAL 34-4428256 5,750 . 0 . 0 .

** INCLUDES COMPENSATION FOR SERVICES PERFORMED OUTSIDE ROLE OF LISTED T tTL C,

STATEMENT 14

PROMEDICA HEALTH SYSTEM, INC. 34-1517671 December 31, 2003

Form 990, Part VI, Line 80b - Names of Related Organizations

Bay Park Community Hospital Exempt Bay Park Community Hospital Foundation Exempt Emma L Bixby Medical Center Auxiliary Exempt Bixby Community Health Foundation Exempt Emma L . Bixby Medical Center Exempt Bixby Medical Office Limited Partnership Non-Exempt BVPH Ventures, Inc Exempt Defiance Hospital, Inc . d/b/a/ Defiance Regional Medical Center Exempt Defiance Hospital Auxiliary Exempt Defiance Hospital Foundation, Inc dfb/a Defiance Regional Medical Center Foundation Exempt Flower Hospital Exempt Flower Hospital Foundation Exempt Fostona Hospital Association d/b/a Fostona Community Hospital Exempt Fostoria Hospital Auxiliary Exempt Fostona Community Hospital Foundation Exempt Fostona Community Dialysis Exempt Herrick Memorial Development Corporation Non-Exempt Herrick Memorial Hospital Exempt Hemck Memonal Hospital Auxiliary Exempt Hemck Memorial Hospital Foundation Exempt Lenawee Health Alliance Exempt Lenawee Health Alliance Professional Services Corporation Non-Exempt Lenawee Long Tenn Care d/b/a/ Provincial House of Adrian Exempt Lenawee MSO, Inc Non-Exempt Lenawee Physician Hospital Organization Non-Exempt ProMedica Central Corporation of Michigan Non-Exempt ProMcdica Continuing Care Services Corporation Foundation Exempt ProMedica Continuing Care Services Corporation Exempt ProMedica Foundation Non-Exempt ProMedica Health, Education & Research Corporation Foundation Non-Exempt ProMedica Health, Education & Research Corporation Exempt ProMedica Indemnity Company, LTD. N/A ProMedica Indemnity Corporation Exempt ProMedica Insurance Corporation Non-Exempt Par-amount Care, Inc . Non-Exempt Paramount Care of Michigan, Inc Non-Exempt Paramount Benefits Agency, Inc Non-Exempt Paramount Preferred Options, Inc Non-Exempt Paramount Insurance Company Non-Exempt Promedica North Physician Corp Non-Exempt ProMedica Physician Corporation Exempt ProMedica Physician Group, Inc Exempt ProMedica Physicians Corp Non-Exempt ProMedica Physician Hospital Organization Non-Exempt Reynolds Road Fitness Center, Inc d/b/a/ Wildwood Health Pavilion Exempt Reynolds Road Surgery Center, LLC Non-Exempt Central Region Properties Non-Exempt HMDC/Tecumseh Medical Dental Center Non-Exempt The Toledo Hospital Exempt The Toledo Hospital Foundation Exempt Toledo Children's Hospital Foundation Exempt Toledo Distnct Nurse Assoc d/b/a/ Visiting Nurse Services Exempt Visiting Nurse Foundation Exempt Visiting Nurse Extra Care Exempt Visiting Nurse Hospice & Health Care Exempt Wolf Creek, LLC Non-Exempt

General Note : This schedule shows the related oreanizations of the ProMedlca Health System . ProMedica Health System, Inc is the parent of the health system of which the above entities are all members

,PROMEDICA HEALTH SYSTEM, INC . 34-1517671

FORM 990 PART IX STATEMENT 15 INFORMATION REGARDING TAXABLE SUBSIDIARIES

NAME, ADDRESS & ID NUMBER PCT NATURE OF OF CORP OR PARTNERSHIP OWN BUSINESS

100 .00% HEALTH INSURANCE CO . -244,875 . 77,169,420 .

31 STATEMENT(S) 15 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171 19080922 099906 34-1517671

PROMEDICA. INSURANCE CORP ., 1901 INDIANWOOD CIRCLE, MAUMEE, OH

34-1570675

TOTAL INCOME

END-OF-YEAR ASSETS

32 STATEMENT(S) 16 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

PROi4EDICA HEALTH SYSTEM, INC . 34-1517671

FORM 990 PART VIII - RELATIONSHIP OF ACTIVITIES TO STATEMENT 16 ACCOMPLISHMENT OF EXEMPT PURPOSES

LINE EXPLANATION OF RELATIONSHIP OF ACTIVITIES

99 NET EQUITY GAIN IN RELATED SUBSIDIARIES

103A REBATES AND DISCOUNTS RELATED TO PURCHASES MADE IN PROVIDING SERVICES FOR THE ENTIRE PHS INTEGRATED HEALTH SYSTEM

103B RECOVERIES OF PRIOR YEAR EXPENSES WHICH RELATED TO EXEMPT FUNCTION

STATEMENT 17

PROMEDICA HEALTH SYSTEM, INC. 34-1517671

December 31, 2003

Schedule A, Part IV, Line 13 - Supported Organizations EIN: Line No.

Bay Park Community Hospital 34-1883132 7 Exempt

Emina L. Bixby Medical Center 38-2796005 7 Exempt

BVPH Ventures, Inc. 34-1880473 12 Exempt

Defiance Hospital, Inc. d/b/a/ Defiance Regional Medical Center 34-4446484 7 Exempt Flower Hospital 34-4428794 7 Exempt Fostoria Hospital Association d/b/a Fostoria Community Hospital 34-0898745 7 Exempt

Fostoria Community Dialysis 34-0898745 12 Exempt Herrick Memorial Hospital 38-3049015 7 Exempt

Lenawee Health Alliance 38-3307345 13 Exempt

Lenawce Long Term Care d/b/a/ Provincial House of Adrian 38-2879330 12 Exempt

ProMedica Continuing Care Services Corporation 34-4492440 12 Exempt

ProMedica Health, Education & Research Corporation 34-1887062 13 Exempt

ProMedica Indemnity Corporation 34-1931936 13 Exempt

ProMedica Physician Corporation 34-1880767 13 Exempt

ProMedica Physician Group, Inc. 34-1899439 12 Exempt Reynolds Road Fitness Center, Inc. dfb/a/ Wildwood Health Pavilion 34-1856393 12 Exempt

The Toledo Hospital 34-4428256 7 Exempt

Toledo District Nurse Assoc. d/b/a/ Visiting Nurse Services 34-4427949 12 Exempt

Visiting Nurse Extra Care 34-1403772 12 Exempt

Visiting Nurse Hospice & Health Care 34-1831624 12 Exempt

PROMEDICA HEALTH SYSTEM, INC . 34-1517671

TOLEDO PUBLIC SCHOOLS COMMITTEE FOR SCHOOLS ISSUE 23 COMMITTEE FOR CHILDREN RENEWAL LEVY CAMPAIGN OHIO THIRD FRONTIER PROJECT - ISSUE 1 COMMITTEE FOR SCHOOLS - TOLEDO PUBLIC SCHOOLS RENEWAL LEVY

34 STATEMENT(S) 18 18590922 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

SCHEDULE A STATEMENT OF LOBBYING ACTIVITIES - PART VI-B STATEMENT 18

Form 5471 (Rev . January 2003) D pran' of

the Treasury Ir ~. alRevenueService

Name of person filing this return

Information Return of U .S . Persons With Respect To Certain Foreign Corporations

10- See separate Instructions . Information furnished for the foreign corporation's annual accounting period (tax year required by s ction 898) (see instructions) beginning JAN 1 2 0 0 3, and ending DEC 3 1. 2 0 0

A Identifying number

File In Duplicate (see When and Where To File in the instructions)

34-1517671 PROMEDICA HEALTH SYSTEM, INC . Number, street and room or suite no (or P 0 . box number If mail Is not delivered to street address) 0 Category of filer (See page 1 of the instructions Check applicable 2142 NORTH COVE BOULEVARD box(es)) . 1 [__1 2ED 3E] 4 [K] 5 EXI City or town, state, and ZIP code C Enter the total percentage of the foreign corporation's voting stock TOLEDO, OH 43606 you owned at the end of its annual accounting period 1000000 % Filer's tax year beginnina JAN 1 .2 0 0 3 , and endina DEC 31 12003 D Personts) on whose behalf this information return Is filed,

(3) Identifying number (1) Name (2) Address

a Name, address, and identifying number of branch office or agent (if any) In the United States b If a U.S . income tax return was filed, enter- NONE (it) U.S income tax paid

01 Taxable income (after all credits) or =(loss

0 . 1 0 .1 d Name and address (including corporate department, if applicable) of

person (or persons) with custody of the books and records of the foreign corporation, and the location of such books and records, It different

QUEST MANAGEMENT SERVICES (BERMUDA) LTD . ADDRESS : SAME AS 1A ABOVE

NOT APPLICABLE

I Sdwdule Al Stock of the Part I-All Classes of Stock

Corporation

(b) Number of shares issued and outstanding

M Beginning of annual (11) End of annual accounting period accounting period

120,000 120,000

(a) Description of each class of stock

Part II-Additional Information for Preferred Stock (To b

(a) Description of each class of Preferred stock (Note: 7his description should match the corresponding

description entered in Part /, column (a) .)

by Category I filers for foreign personal hold

(b) Pair value in (c) Rate of functim dividend I

jUjul 05-01 .03 LHA For Paperwork Reduction Act Notice, see page 13 of the Instructions . 1

16071026 099906 34-1517671 2003 .06010 PROMEDICA HEALTH SYSTEM, IN 34-15171

NONE

Important: Fill in all applicable lines and schedules. All information must be in the English language. All amounts must be stated in US. dollars unless otherwise indicated

la Name and address of foreign corporation - b Employer identification number, if any PROMEDICA INDEMNITY COMPANY LTD NONE SF_z14DIA INTL . HOUSE, P.O . BOX HM 2062, 16 CHURCH S c Country under whose laws incorporated HAMILTON HM HX, BERMUDA

PBERMUDA d Date of e Principal place of business f Principal 9 nncipal business activity Functional currency

incorporation business activity code number CAPTIVE See Statement 8

06/28/93HAMILTON, BERMUDA 524290 INSURANCE CO . S . DOLLAR