Q1-2018 Results Presentation · 2018. 5. 25. · (1) Q1-2017 consolidated production and sales are...

Transcript of Q1-2018 Results Presentation · 2018. 5. 25. · (1) Q1-2017 consolidated production and sales are...

TSX: TV | www.trevali.com

Q1-2018 Results Presentation

TSX: TV | www.trevali.com

Perkoa Rosh Pinah

Santander Caribou

May 10, 2018

TSX: TV | www.trevali.com

Cautionary Note Regarding Forward-Looking Statements:

2

This presentation contains “forward-looking information” (also referred to herein as “forward-looking statements”) under the provisions of applicable Canadian securities legislation. Generally, these forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will”, “occur” or “be achieved” or the negative connotation thereof.

Forward-looking statements include, but are not limited to, those in respect of: the economic outlook for the mining industry; expectations regarding metal prices, production, and project development; the current and planned commercial operations, initiatives and objectives in respect of certain projects of Trevali Mining Corporation (“Trevali” or “TV”) including the Perkoa, Caribou, Rosh Pinah and Santander mines (the “Mines”); TV’s current and planned exploration initiatives; strategies and objectives in respect of the Mines; liquidity, capital resources and expenditures; sustainability and environmental initiatives and objectives; business development strategies and outlook; product distribution forecasts; leverage metrics; planned capital expenditures; debt repayment schedules; planned work programs and drilling programs in respect of the Mines; and economic performance, financial conditions and expectations.

Forward-looking statements also include, but are not limited to, factors and assumptions in respect of: normal operating conditions; cost and production guidance with respect to its operations and the Mines; statements with respect to the future price, market, demand, supply and/or uses of zinc and copper; current uses and initiatives propelling new uses of zinc; the estimation of mineral reserves and mineral resources; the realization of mineral reserve estimates; the timing and amount of estimated future production; costs of production; targeted cost reductions; capital expenditures; free cash flow; earnings before interest, taxes, depreciation and amortization; costs and timing of the exploration and development of new deposits; success of current and planned exploration initiatives and activities; permitting timelines; currency exchange rate fluctuations; requirements for additional capital; government regulation of mining operations; environmental policies and risks; unanticipated reclamation expenses; timing and possible outcomes of pending litigation; title disputes or claims; and limitations on insurance coverage.

Forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause the actual results, level of activity, performance or achievements of TV and/or the Mines to be materially different from those expressed or implied by such forward-looking statements, including but not limited to, those in respect of: international operations including economic and political instability in foreign jurisdictions in which TV operates; current global financial conditions; joint venture operations; actual results of current and planned exploration activities; actual results of drilling programs; actual results of current reclamation activities; environmental policies and risks; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; changes in the future prices, market, demand, supply and/or uses of zinc and copper; possible variations in mineral resources and mineral reserves; grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; integration of acquisitions; accidents; labour disputes; delays in obtaining governmental approvals or financing or in the completion of development or construction activities and other risks of the mining industry; inaccuracies or changes in the consolidated zinc production, exploration, and operational guidance for the Mines; inaccuracies or changes in the analysis of the exploration potential of the Mines; failure to complete the work programs or drilling programs at the Mines; inaccuracies or changes in the growth pipelines of the Mines; as well as those factors discussed in the section entitled “Risk Factors” in TV’s most recent management’s discussion and analysis and annual information form available on SEDAR at www.sedar.com. Although TV has attempted to identify important factors, assumptions and risks that could cause actual results to differ materially from those contained in forward-looking statements, there may be others that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. Forward-looking statements are made as of the date hereof and, accordingly, are subject to change after such date. Forward-looking statements are provided for the purpose of providing information about management’s current expectations and plans and allowing investors and others to get a better understanding of TV’s operating environment. TV does not intend or undertake to publicly update any forward-looking statements that are included in this presentation, whether as a result of new information, future events or otherwise, except in accordance with applicable securities laws.

Non-IFRS Measures This presentation refers to ‘EBITDA (earnings before interest, taxes, depreciation and amortization)’, ‘free cash flow’, ‘site cash operating cost per tonne milled’, and ‘site cash operating cost per pound of payable zinc equivalent produced’, which are financial performance measures with no standard meaning under International Financial Reporting Standards (“IFRS”). Such non‐IFRS financial measures do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. Management uses these measures internally to evaluate the underlying operating performance of TV for the relevant reporting periods. The use of these measures enables management to assess performance trends and to evaluate the results of the underlying business of TV. Management understands that certain investors, and others who follow TV’s performance, also assess performance in this way. Management believes that these measures reflect TV’s performance and are better indications of its expected performance in future periods. This data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The information presented herein was approved by management of Trevali on May 10, 2018.

TSX: TV | www.trevali.com

Trevali – Q1 2018 Highlights

(1) EBITDA (earnings before interest, taxes, depreciation and amortization) is calculated by considering Company's earnings before interest payments, tax, depreciation and amortization are subtracted for any final accounting of its income and expenses. The EBITDA of a business gives an indication of its current operational profitability and is a non-IFRS measure and is calculated on 100% basis. Please refer to non-IFRS Measures in the Cautionary Note Regarding Forward-Looking Statement.

Robust Cash-Flow Generation

Record quarterly EBIDTA(1) of $59 million

Net Profit of $28.6 million in Q1 (3.4 cents earnings

per share)

Operating cash flow of $115 million

Additional concentrate

inventories of $44.5 million

Q1 consolidated production of 98.7-million

payable lbs Zn, 12.3-million payable lbs Pb and 336,927 payable ozs Ag

On-track with 2018

production guidance

Strong Production Profile

Bolstered Balance Sheet

Record Q1 working capital of $180 million and $120

million

Debt reduction of $8 million on Term Facility as part of the long-term debt

repayment schedule, Company moving toward

Net Cash position

Disciplined capital deployment: Increasing interest at Rosh Pinah; Bathurst Mining Camp; Increased exploration

initiatives

Optimization Initiatives

Santander mill maintenance and

underground pump upgrades completed

Perkoa heavy fuel oil generator program

approved, anticipated costs savings of approx. $6-$7 per tonne milled

Rosh Pinah independent

engineering study commissioned examining

production optionality

3

TSX: TV | www.trevali.com

Trevali – Q1 2018 Consolidated Results

4

Q1-2018 Q1-2017 Revenues $114.7 $39.9 Income from mining operations $36.6 $9.7 Net income $28.6 $2.7 Basic Income per share $0.03 $0.01

Summary Financial Results (US$ millions, except per-share amounts)

Q1-2018 Q1-2017(1) Tonnes Mined 790,215 370,953 Tonnes Milled 743,935 433,129 Payable Production:

Zinc (pounds) 98,738,944 31,946,229 Lead (pounds) 12,296,555 9,983,664 Silver (ounces) 336,927 345,661

Total Cash Operating Costs (per pound of payable zinc produced) $0.83 $0.81 All-in Sustaining Cash Cost (per pound of payable zinc produced) $0.97 $0.96 Site Cash Operating Cost (per Tonne milled)(2) $73.39 $49.10

Consolidated Production Results

Q1-2018 Q1-2017(2) Zinc Concentrate (dry metric tonnes) 98,171 38,928 Lead Concentrate (dry metric tonnes) 10,169 13,034 Payable Zinc (pounds) 89,490,812 33,578,241 Payable Lead (pounds) 7,956,056 9,708,389 Payable Silver (ounces) 274,748 328,636 Revenues(3) $114,718,000 $39,923,000 Average Realized Metal Price(4):

Zinc (per pound) $1.49 $1.26 Lead (per pound) $1.09 $1.05 Silver (per ounce) $16.53 $17.98 (1) Q1-2017 consolidated production and sales are from Santander and Caribou mines only. (2) Please refer to non-IFRS Measures in the Cautionary Note Regarding Forward-Looking Statements. (3) Revenues include effects of settlement adjustments on sales from prior quarters and is calculated on a 100% basis. (4) Provisional realized metal prices.

Consolidated Sales Results

TSX: TV | www.trevali.com

Location Peru (approx. 200 km northeast of Lima)

Ownership 100% Trevali

Type of deposit Carbonate Replacement Deposit (CRD)

Mining Underground - Modified Avoca (cut-and-fill)

Processing Concentrator plant with crushing, milling, flotation, thickening and filtration

End product Zn concentrate and Pb-Ag concentrate

Infrastructure 2,000 tpd underground mining operation and processing mill

Current mine life 5 years; remains open, drilling ongoing

Santander Mine Peru

5 TSX: TV | www.trevali.com

Primary metal By-product metals

TSX: TV | www.trevali.com

Santander Mine - Q1 2018 Operational Review

6

(1) Site operating cost per tonne milled is a non-IFRS measure. See “Non-IFRS Measures” (2) Revenues include effects of settlement adjustments on sales from prior quarters. (3) Provisional realized metal prices.

Q1 production 11 million payable lbs Zn, 1.2 million payable lbs Pb and 70,046 payable ozs Ag

Mill throughput and metal production down in Q1 due to lower mill throughput as planned ball mill maintenance work conducted

Repairs completed in Q1 and now operating back at full capacity

Operating costs trending downwards

Q1-2018 Q1-2017 Tonnes Mined 187,073 148,689 Tonnes Milled 150,627 200,249 Average Head Grade:

Zinc (%) Lead (%) Silver (oz/t)

4.46 0.48 0.77

3.80 0.58 0.96

Average Recoveries (%): Zinc Lead Silver

89 79 58

88 79 63

Payable Production: Zinc (pounds) 10,953,272 12,326,834 Lead (pounds) 1,170,588 1,875,891 Silver (ounces) 70,046 128,576

Total Cash Operating Costs (per pound of payable zinc produced) $1.08 $0.76

All-In Sustaining Cash Cost (per pound of payable zinc produced) $1.44 $0.96

Site Cash Operating Cost (per Tonne milled)(1) $64.50 $35.06

Santander Mine Production Results

Q1-2018 Q1-2017 Zinc Concentrate (dry metric tonnes) 12,715 13,579 Lead Concentrate (dry metric tonnes) 1,111 2,077 Payable Sales:

Zinc (pounds) 10,993,766 11,804,614 Lead (pounds) 1,134,093 1,834,682 Silver (ounces) 67,626 125,557

Revenues(2) $16,602,000 $13,500,000 Average Realized Metal Price(3):

Zinc (per pound) $1.49 $1.27 Lead (per pound) $1.11 $1.03 Silver (per ounce) $16.52 $17.69

Santander Mine Sales Results

TSX: TV | www.trevali.com

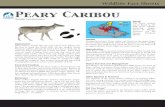

Location Bathurst Mining Camp, New Brunswick, Canada

Ownership 100% Trevali

Type of deposit Volcanogenic Massive Sulphide (VMS)

Mining Underground - Modified Avoca (cut-and-fill)

Processing Concentrator plant with crushing, milling, flotation, thickening and filtration

End product Zn concentrate and Pb-Ag concentrate

Infrastructure 3,000 tpd underground mining operation and processing mill

Current mine life 6 years; remains open, drilling ongoing

Bathurst Mining Camp Operations New Brunswick, Canada

CANADA

NEW BRUNSWICK

Primary metal

7 TSX: TV | www.trevali.com

Caribou Mill and Mine

By-product metals

TSX: TV | www.trevali.com

Caribou Mine - Q1 2018 Operational Review

(1) Site operating cost per tonne milled is a non-IFRS measures. See “Non-IFRS Measures” (2) Revenues include effects of settlement adjustments on sales from prior quarters. (3) Provisional realized metal prices.

8

Q1-2018 Q1-2017 Tonnes Mined 238,650 222,264 Tonnes Milled 235,531 232,880 Average Head Grades:

Zinc (%) 5.94 6.15 Lead (%) 2.43 2.68 Silver (oz/t) 2.14 2.29

Average Recoveries (%): Zinc 75 75 Lead 62 64 Silver 41 38

Payable Production: Zinc (pounds) 19,079,123 19,619,395 Lead (pounds) 7,200,955 8,107,773 Silver (ounces) 216,087 217,085

Total Cash Operating Costs (per pound of payable zinc produced) $0.73 $0.85 All-In Sustaining Cash Cost (per pound of payable zinc produced) $0.90 $0.95 Site Cash Operating Cost (per Tonne Milled)(1) $64.12 $61.17

Q1 production 19 million payable lbs Zn, 7.2 million payable lbs Pb and 216,087 payable ozs Ag

Zn recoveries were flat in Q1 versus the prior winter season but are trending upwards as we move into Spring

Q1-2018 Q1-2017 Zinc Concentrate (dry metric tonnes) 21,409 25,349 Lead Concentrate (dry metric tonnes) 9,058 10,956 Payable Sales:

Zinc (pounds) 17,821,252 21,773,627 Lead (pounds) 6,821,963 7,873,706 Silver (ounces) 207,122 203,078

Revenues(2) $28,072,000 $26,423,000 Average Realized Metal Price(3):

Zinc (per pound) $1.49 $1.25 Lead (per pound) $1.09 $1.05 Silver (per ounce) $16.53 $18.03

Caribou Mine Production Results

Caribou Mine Sales Results

TSX: TV | www.trevali.com

Location Namibia (600 km south of Windhoek)

Ownership 80.08% Trevali, 19.92% Namibian Empowerment Partners

Type of deposit Sediment hosted

Mining Underground – Sub-level open stoping

Processing Concentrator plant with crushing, milling, flotation, thickening and filtration

End product Zn concentrate and Pb-Ag concentrate

Infrastructure 2,000 tpd underground mining operation and processing mill

Current mine life 12 years; remains open, drilling ongoing

Rosh Pinah Mine Namibia

9

Rosh Pinah Mine

AFRICA

NAMIBIA

9 TSX: TV | www.trevali.com

Primary metal By-product metals

TSX: TV | www.trevali.com

Rosh Pinah Mine - Q1 2018 Operational Review

10

(1) Site operating cost per tonne milled is a non-IFRS measure. See “Non-IFRS Measures” (2) Revenues include effects of settlement adjustments on sales from prior quarters and is calculated

on a 100% basis. (3) Provisional realized metal prices.

Q1 production of 22.8 million payable lbs Zn, 3.9 million payable lbs Pb and 50,700 payable ozs Ag

Q1 site cash operating costs per tonne milled and zinc recoveries both improved over Q4-2017

No Lead concentrate shipments in Q1, scheduled for Q2 and Q4 2018

Commissioning of regrind mill improving recoveries

Planned metal production to increase in second half of 2018 as mine sequencing moves into higher-grade stopes

Q1-2018 Tonnes Mined 172,334 Tonnes Milled 177,837 Average Head Grade:

Zinc (%) Lead (%) Silver (oz/t)

7.92 1.40 0.58

Average Recoveries (%): Zinc Lead Silver

88 77 51

Payable Production: Zinc (pounds) 22,831,575 Lead (pounds) 3,925,012 Silver (ounces) 50,794

Total Cash Operating Costs (per pound of payable zinc produced) $0.90 All-In Sustaining Cash Cost Cash (per pound of payable zinc produced) $1.06 Site Cash Operating Cost (per Tonne milled)(1) $54.41

Rosh Pinah Mine Production Results (100% basis)

Q1-2018 Zinc Concentrate (dry metric tonnes) 30,386 Lead Concentrate (dry metric tonnes) - Payable Sales:

Zinc (pounds) 28,077,201 Lead (pounds) - Silver (ounces) -

Revenues(2) $33,192,000 Average Realized Metal Price(3):

Zinc (per pound) $1.49 Lead (per pound) - Silver (per ounce) -

Rosh Pinah Mine Sales Results (100% basis)

TSX: TV | www.trevali.com

Location Burkina Faso (150 km west of Ouagadougou)

Ownership 90% Trevali, 10% Government of Burkina Faso

Type of deposit Volcanogenic Massive Sulphide (VMS)

Mining Underground - Transversal and retreat

Processing Concentrator plant with crushing, milling, flotation, thickening and filtration

End product Zn concentrate

Infrastructure 2,000 tpd underground mining operation and processing mill

Current mine life 5 years; remains open, drilling ongoing

Perkoa Mine Burkina Faso

Perkoa Mine

Primary metal

11 TSX: TV | www.trevali.com

TSX: TV | www.trevali.com

(1) Site operating cost per tonne milled is a non-IFRS measures. See “Non-IFRS Measures” (2) Revenues include effects of settlement adjustments on sales from prior quarters and is calculated

on a 100% basis. (3) Provisional realized metal prices.

Perkoa Mine – Q1 2018 Operational Review

12

Q1-2018 Tonnes Mined 192,158 Tonnes Milled 179,940 Average Head Grades:

Zinc (%) 14.49 Average Recoveries (%):

Zinc 94 Concentrate Produced DMT (dry metric tonnes):

Zinc 47,413 Concentrate Grades:

Zinc (%) 52 Payable Production:

Zinc (pounds) 45,874,974 Total Cash Operating Costs per Pound of Payable Zinc Produced $0.78 All-In Sustaining Cash Cost Cash per Pound of Payable Zinc Produced $0.84 Site Cash Operating Cost per Tonne Milled(1) $111.72

Perkoa Mine Production Results (100% basis)

Q1-2018 Zinc Concentrate (dry metric tonnes) 33,660 Payable Zinc (pounds) 32,598,594 Revenues(2) $36,852,000 Average Realized Metal Price(3): Zinc (per pound) $1.49

Perkoa Mine Sales Results (100% basis)

Strong Q1 production of 45.9-million lbs Zn Sector-leading head grades (14.5% Zn) and

recoveries (94%) Q1 site cash operating costs dropped to

$111.70/tonne, down from 120.85/tonne in Q4-2017

Moving forward on Heavy Fuel Oil Generators – expected to drop operating costs by $6-$7 per tonne

TSX: TV | www.trevali.com

(1) Constitutes forward-looking information; see “Cautionary Note Regarding Forward-Looking Statements”. Trevali’s interest is 90% of Perkoa and 80% of Rosh Pinah. (2) Operating costs are based on various assumptions and estimates, including, but not limited to: production volumes, commodity prices (Zn: $1.25/lb Pb: $1.00/lb Ag: $19/lb) and foreign currency exchange rates (N$/USD: 13.00; XOF/USD: 609; PEN/USD 3.25; C$/USD $1.25) and is a non-IFRS measure. See “Non-IFRS Measures”

2018 Production Guidance(1)

13

Mine 2018 Zinc Production (million pounds payable)

2018 Lead Production (million pounds payable)

2018 Silver Production (000 ounces payable)

Operating Costs (per tonne milled) (2)

Caribou 86-90 27.1-28.4 627-658 $55-$61 Perkoa (100%) 155-165 n/a n/a $103-$113 Rosh Pinah (100%) 105-115 5.7-6.0 123-129 $49-$54 Santander 54-57 11.0-11.6 654-687 $38-$42 Total 400-427 43.8-46.0 1,400-1,474 $60-$66

-

20

40

60

80

100

120

Q 1 Q 2 Q 3 Q 4

2018 Q1 Actual and Forecast Quarterly Payable Zinc Production (million pounds)

Zinc Production Actual (million lbs)Mid Range Guidance (million lbs)

2018 Quarterly zinc production guidance (mid-range) versus actual Q1-2018 zinc production.

TSX: TV | www.trevali.com

Rosh Pinah Deposit

Bathurst Mining Camp

Santander CRD System

Perkoa VMS Belt

Trevali Exploration (a NAV Generator)

14

Proven exploration team – lower quartile discovery costs providing strong leverage for generating shareholder value.

All deposits remain open for expansion – drives increased Life Of Mines (LOM) - ~60,000m committed brown-field (low risk) drill campaign in progress in 2018.

Successful exploration & discovery:

Tier 1 zinc deposit (tonnage/grade) in an established yet underexplored major global Zn district. Low risk, high reward exploration.

Control 6 deposits in one of the world’s largest VMS Districts – visibility on multiple project pipeline providing approx. 20 years of mill feed.

Analogous to large Peruvian polymetallic systems (Antamina) – upper quartile tonnage and grades increasing – remains under-explored.

First mover in an high-grade, frontier VMS belt. Perkoa is one of the highest-grade Zn mine globally. Excellent potential for further discoveries.

Aim of the 2018 program is to expand and discover new mineral resources adjacent to existing mine infrastructure, replace mined inventory, grow sustainable production, extend expected mine life and ultimately, contingent on success, provide production growth optionality to the operations.

Exploration and resource conversion drilling at Trevali’s four mines totaled approximately 26,500 metres during Q1-2018.

TSX: TV | www.trevali.com 15

Santander Exploration Update – Q1

5 drill rigs active to test the continuity of the deposit approximately 300 vertical metres below current development.

Drilling also tested the high-grade Pipe target intercepting new massive sulphide mantos. Additionally, a borehole geophysical survey was also commenced.

TSX: TV | www.trevali.com

Bathurst Mining Camp Exploration Update – Q1

16

A 4,500-metre drill campaign commenced at the advanced Restigouche project in order to provide production and mine planning optionality for future Caribou mill feed. Results to date and results continue to validate the geological model.

A total of 2,480 metres of resource conversion drilling was completed at Caribou mine during the quarter.

Caribou Caribou

TSX: TV | www.trevali.com

Rosh Pinah Exploration Update – Q1

17

3 UG drill rigs continued exploration and resource conversion drilling targeting the extensions of the Western Orefield (WF3) to the north and down-plunge of the orebody.

Integrated targeting within the exploration license has commenced.

TSX: TV | www.trevali.com 18

Perkoa Exploration Update – Q1

5,600 metres of UG resource conversion drilling completed - continued to return high-grade zinc results: 16.25 metres at 18.52% Zn, including 9.85

metres at 24.35% Zn; and 15.75 metres at 14.07% Zn, including 5.00

metres at 28.46% Zn 5,300-metre program of follow up drilling to target

mineralization below the resources commenced. Three drill holes completed to date, intercepted massive to semi-massive sulphide mineralization at least 180 metres below the current deepest planned mining levels - results are pending.

Geophysical surveys along the ore horizon was completed - EM conductors identified & resultant targets will be tested in Q2.

Regionally reconnaissance mapping and sampling along the plus-25 kilometre strike length of the Mine Horizon resulted in discovery of surface to sub-surface gossans (weathered sulphide mineralization) associated with the geophysical anomalies. Air core drilling of these new targets has commenced in.

Perkoa

Mine Horizon

Explored Area

5Km

TSX: TV | www.trevali.com

Trevali Mining Corporation Suite 1400-1199 West Hastings Street Vancouver, BC, V6E 3T5, CANADA Tel: 1-604-488-1661 Fax: 1-604-629-1425 www.trevali.com

A member of the

Steve Stakiw Vice President, Investor Relations and Corporate Communications [email protected] Direct phone:1-604-638-5623