Ph ppt 3.24.11 3 candlestick patterns cont..

-

Upload

myfxedge49 -

Category

Business

-

view

829 -

download

2

Transcript of Ph ppt 3.24.11 3 candlestick patterns cont..

CFTC/NFA Disclaimer

Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the

futures and options markets. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures, stocks or options on the same. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past

performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT

REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN > EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN

MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT

OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL, OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED WITHIN THIS SITE, SUPPORT AND

TEXTS. OUR COURSE(S), PRODUCTS AND SERVICES SHOULD BE USED AS LEARNING AIDS ONLY AND SHOULD NOT BE USED TO INVEST REAL MONEY. IF YOU DECIDE TO INVEST REAL

MONEY, ALL TRADING DECISIONS SHOULD BE YOUR OWN.

Daily Market Analysis Daily Strategy Analysis (Live FxAlerts)3 Candle Patterns ContinuedMarcello Ducille’s Underground System DemonstrationQuestion & Answer Session

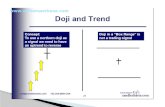

Forex Candlesticks

There are a nearly infinite number of chart patterns with an equally long dictionary of nomenclature, but among the most commonly recognized are the essentials of Japanese candlesticks. We have covered a few of these, continuing today with a more 3-candlestick patterns.

Courtesy of google images

Stick Sandwich

The Stick Sandwich is considered a bullish reversal pattern with two black bodies surrounding a white body. The closing prices of the two black bodies must be equal or very near equal. A support price is then interpreted as apparent and the opportunity for prices to reverse is considered highly probable.

Courtesy of google images

Upside and Downside Tasuki Gap

The Upside Tasuki Gap is a continuation pattern with a long white body followed by another white body that has gapped above the 1st candle. The 3rd candle is black and opens within the body of the 2nd candle, then closes in the gap between the first two candles, but does not close the gap.

The Downside Tasuki Gap is the inverse of this pattern.

Courtesy of google images

Upside Gap 2 Crows

A three day bearish pattern that only happens in an uptrend. 1st day is a long white body followed by a gapped open with the small black body remaining gapped above the 1st day. 3rd day is also a black day whose body is larger than the 2nd day and engulfs it. The close of the last day is still above the 1st long white day.

Courtesy of google images

Closing Notes

As you can see the candlestick formations and interpretations are endless. Again, the key is to find what works, test it thoroughly and stick to it!

Are you part of the FxEdge Family? Become a Fan of myfxedge.com on Facebook and get free tips!

Are you part of the FxEdge Family? Become a Fan of myfxedge.com on Facebook and get free tips!

Get Your Profit in 2011Get Your Profit in 2011

http://myfxedge.com/get-a-membership/