OECD 2016 Investment Policy Review of Viet Nam

-

Upload

oecd-directorate-for-financial-and-enterprise-affairs -

Category

Government & Nonprofit

-

view

764 -

download

3

Transcript of OECD 2016 Investment Policy Review of Viet Nam

Investment policy review of Viet Nam

Hanoi, 2016

• Stephen Thomsen, Head of IPRs, OECD Legal investment framework Foreign investment liberalisation & other policy areas Discussion

• Alexandre de Crombrugghe, OECD Tax Policies Investment promotion and facilitation Infrastructure connectivity & green growth framework Discussion

• Tihana Bule, OECD Responsible business conduct Discussion

AGENDA

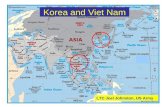

What is the OECD?

3

34 members, incl. Japan,

Korea, Australia and NZ

Close cooperation with non-

members on areas of mutual

interest

All policies areas, except

defence and sports

250 committees, working

groups, expert groups

2500 staff

Better policies for better lives

Recent OECD work with Viet Nam

OECD Investment Policy Reviews using

the Policy Framework for Investment

OECD Investment Policy Reviews

Southeast Asia

Forthcoming 2016

• Cambodia

• Lao PDR

• Viet Nam

2009

2010

2013

2014

2016

Reviews are undertaken jointly by the OECD and the government in partnership with the ASEAN Secretariat and based on the Policy Framework for Investment

Investment policy (FDI liberalisation & legal framework)

Investment promotion & facilitation

Trade policy

Competition policy

Tax policy

Corporate governance

Policies for enabling responsible business conduct

Developing human resources for investment

Infrastructure investment

Financing investment

Public governance

Investment framework for green growth

Areas covered in the OECD Policy

Framework for Investment

7

2015

April OECD mission, PFI presentation to the Taskforce

April-June Government prepares answers to PFI questionnaire

July Second OECD mission to discuss answers to questionnaire and for

further fact-finding

August-Feb. 2016 OECD prepares draft report

December Viet Nam participates in SEA Regional Policy Network in Paris

2016

April OECD-MPI Seminar with ministries and stakeholders in

Hanoi to discuss draft IPR of Viet Nam

April-May Government and stakeholders provide written comments

June Draft IPR discussed during OECD SEA Regional Forum

October Presentation of draft IPR to OECD Investment Committee in Paris

November Revised draft IPR circulated for final comments

December IPR of Viet Nam launched in Hanoi or in ASEAN region

Follow-up Results presented at regional level, other activities

IPR of Viet Nam timeline

INVESTMENT TRENDS AND PERFORMANCE

GDP growth rates in ASEAN 4 (Market prices, constant local currency)

Viet Nam has experienced strong, steady

growth over the past 30 years

-15

-10

-5

0

5

10

15

1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

VNM IDN THA PHL

Source: World Development Indicators

But private, including foreign, investment can

further increase its economic contribution

0

10

20

30

40

50

60

70

80

1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013

SOE Private Foreign

Investment by type of ownership (share of total investment)

Source: GSO

FDI surged in the 1990s and, as a share of GFKF,

has surpassed IDN, PHL and THA in the past decade

-20

-10

0

10

20

30

40

50

60

1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

VNM THA PHL IDN

ASEAN 4 FDI inflows as a share of gross fixed capital formation

Source: UNCTAD

Country Number of projects Total registered capital (USD m.) Share

Korea 4 190 37 726 14.9%

Japan 2 531 37 335 14.8%

Singapore 1 367 32 937 13.0%

Chinese Taipei 2 387 28 469 11.3%

British Virgin Islands 551 17 990 7.1%

Hong Kong, China 883 15 603 6.2%

United States 725 10 990 4.3%

Malaysia 489 10 805 4.3%

China, PR 1 102 7 984 3.2%

Thailand 379 6 749 2.7%

Most registered capital in foreign projects

comes from Asia

Source: GSO

But export markets are more diversified

Europe, 9% N. America, 6%

ASEAN, 21%

Other Asia, 50%

Offshore centres, 10%

Other , 3%

US, 19%

EU, 18%

Japan, Korea, 15%ASEAN, 13%

Other Asia, 17%

Other , 18%

Source of FDI Export markets

Source: OECD calculations based on GSO data

Sector Projects (number) Total registered capital

(USD m.) Share

TOTAL 19 611 274 638

Agriculture, forestry & fishing 556 3 858 1%

Mining & quarrying 92 3 483 1%

Manufacturing 10 480 156 912 57%

Electricity, gas, stream & air conditioning supply

104 10 003 4%

Water supply, sewerage, waste management 46 1 412 1%

Construction 1 288 12 485 5%

Wholesale & retail trade; vehicle repair 1 640 4 436 2%

Transport & storage 514 3 932 1%

Accommodation & food service activities 402 11 688 4%

Information & communication 1 255 4 201 2%

Financial, banking & insurance activities 85 1 342 0%

Real estate activities 497 51 113 19%

Professional, scientific & technical activities 1 869 2 076 1%

Administrative & support service activities 142 220 0%

Education & training 229 897 0%

Human health & social work activities 103 2 170 1%

Arts, entertainment & recreation 155 3 649 1%

Other service activities 154 761 0%

Manufacturing is the most important sector

for registered capital

Source: GSO

Merger & Acquisition markets have also

grown dynamically over the past 10 years

Source: OECD calculations using Dealogic M&A data

M&A deals involving a target firm from Viet Nam, 1995-2015

Cross-border M&As are prominent in finance

& insurance, oil & gas, and metal & steel

Panel C. Number of deals (as % of total)

Panel B. Deal value (bln USD)

Panel D. Deal value (as % of total)

Panel A. Number of deals

11188

61 55 50

379

0

50

100

150

200

250

300

350

400

450

500

0

50

100

150

200

250

300

350

400

450

500

Cross border Domestic

15%

12%

8%

7%

7%

51%

Finance & Insurance Food & Beverage

Computers & Electronics Construction/Building

Oil & Gas Other

23%

19%

14%

13%

7%

24%

Finance & Insurance Oil & Gas

Metal & Steel Food & Beverage

Real Estate/Property Other

4.1

3.4

2.52.3

1.3

4.4

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

Cross border Domestic

Source: OECD calculations using Dealogic M&A data

LEGAL INVESTMENT FRAMEWORK IN VIET NAM

• Investment legislation revised many times

• 2005 unified investment law: a milestone towards a more open and enabling regime

• 2014 revision of the investment law:

– streamlined entry procedures,

– but weakened protection ?

• Gradual improvements in the law-making process

• Implementation remains a major hurdle

Major regulatory improvements

achieved over the past 30 years

• Well-balanced guarantee of legal stability

• Commitment to ensure consistency across laws

• Legal guarantee of non-discrimination

• Expropriation provision weaker than in previous law

• Less clear definition of investment in 2014 law

• Very unclear ISDS provision in 2014 law

Current investment protection regime

• Investors favour arbitration mechanisms:

– New commercial arbitration law to upgrade the arbitration framework

– But enforcement of arbitration awards is too often difficult to obtain

• Not an ICSID member

• No institutionalised investment dispute grievance mechanism

• No ombudsman to prevent escalation of ISDS cases

Dispute settlement & contract enforcement

• Major improvement with the 2015 Land law:

– further opens access to LUR for foreigners

– Provides stronger protection against expropriation

• Outdated registrars at provincial level

• Full computerisation needed to:

– address fraudulent titling

– encourage use of LURs as collaterals

Access to land and protection of

investors’ land rights

• Strong improvements to the IP regime:

– New IP law

– Capacity-building

• But weak enforcement of IP rights

• Inconsistent institutional framework:

– Overlapping responsibilities of line agencies

• Strong governmental will to improve IP protection

Protection of Intellectual Property Rights

• 40 bilateral investment treaties

• Regional and multilateral trade and investment agreements:

– Trans-Pacific Partnership (TPP),

– FTA with the EU

– Regional Comprehensive Economic Partnership (RCEP)

• Increasingly, FTAs facilitate the establishment of new investments

• Recent treaties reflect policy innovations:

– more specific language on key provisions to better reflect government intent

– more detailed regulation of ISDS.

Viet Nam’s International Investment

Agreements

FOREIGN INVESTMENT LIBERALISATION REFORMS

1. Streamlined and narrowed the scope of investment registration procedures?

• Formerly complex and long for foreign investors

• Retained the previous dual-process (ERC + IRC) for foreign and majority foreign-owned investments (similar statutory time frame, but no “silence is consent”)

• But simplified the regime for domestic and minority foreign-owned projects, except in conditional sectors (only the ERC apply; if M&A, only the IRC apply)

• Narrowed the scope of the screening/approval process (FDI only is subject to the PM’s approval in a few specified sectors)

2. Fewer sectors subject to investment conditions (and a negative list approach)

• But does not specify which conditions apply, limiting its transparency

3. Continued commitment to move forward with liberalisation (e.g. liberalisation in 2015 of foreign majority stakes in a public company , with exceptions)

The recent FDI reform: the 2014 Law on Investment and

Law on Enterprises

FDI restrictions have been gradually removed overtime

Source: OECD FDI Regulatory Restrictiveness Index and UNCTAD FDI statistics.

0

10

20

30

40

50

60

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

0.90

1.00

FDI RR Index FDI Stock (% of GDP)(right axis)

OECD FDI Regulatory Restrictiveness Index (open=0; closed=1) Per cent of GDP

• Right to establish private enterprises

• Law on Foreign Investment amended

• WTO accession (gradual liberalisation scheduled)

• Foreign acquisitions allowed, subject to conditions

• Scope of screening and approval reduced

• FIE land use rights expanded

• Exports and capital repatriation by foreign-invested enterprises facilitated

• Constitution of the Socialist Republic of Vietnam

• Foreign investors rights recognised

• Land use rights allowed to

• Eased capital repatriation

• 1st Law on Foreign Investment, 1987

• Removal of remaining restrictions on foreign acquisitions

• US-VNM Bilateral trade agreement

• Removal of remaining restrictions on foreign acquisitions

Reforms have helped to sustain Viet Nam’s

competitiveness vis-à-vis regional peers

Source: OECD FDI Regulatory Restrictiveness Index database, http://www.oecd.org/investment/fdiindex.htm. Notes: (¹) Data refer to regulatory restrictions on FDI as of end-2015. For all other countries, data refer to the regulatory regime as of end-2014; (²) ASEAN9 refers to the average scores of the nine ASEAN member states covered. It excludes Brunei Darussalam which is not covered. Data for Lao PDR, Viet Nam, Cambodia, Singapore and Thailand are preliminary; (³) The OECD FDI Regulatory Restrictiveness Index covers only statutory measures discriminating against foreign investors (e.g. foreign equity limits, screening & approval procedures, restriction on key foreign personnel, and other operational measures). Other important aspects of an investment climate (e.g. the implementation of regulations and state monopolies among other) are not considered. All 34 OECD countries and 30 non-OECD countries are covered, including all G20 members.

ASEAN9²

OECD average

Non-OECD average

0.00

0.05

0.10

0.15

0.20

0.25

0.30

0.35

0.40

0.45

Singapore Cambodia Viet Nam¹ Lao PDR¹ Malaysia Thailand Indonesia Myanmar China Philippines¹

OECD FDI Regulatory Restrictiveness Index (open=0; closed=1)

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

OECD VIET NAM ASEAN9

OECD FDI Regulatory Restrictiveness Index (open=0; closed=1)

Nonetheless, some key services sectors remain partly

off limits to foreign investors

Source: OECD FDI Regulatory Restrictiveness Index database, http://www.oecd.org/investment/fdiindex.htm. Notes: (¹) Data refer to regulatory restrictions on FDI as of end-2015. for Viet Nam, Lao PDR and Philippines. For all other countries, data refer to the regulatory regime as of end-2014; (²) ASEAN9 refers to the average scores of the nine ASEAN member states covered. It excludes Brunei Darussalam which is not covered. Data for Lao PDR, Viet Nam, Cambodia, Singapore and Thailand are preliminary; (³) The OECD FDI Regulatory Restrictiveness Index covers only statutory measures discriminating against foreign investors (e.g. foreign equity limits, screening & approval procedures, restriction on key foreign personnel, and other operational measures). Other important aspects of an investment climate (e.g. the implementation of regulations and state monopolies among other) are not considered. All 34 OECD countries and 30 non-OECD countries are covered, including all G20 members.

OTHER POLICY AREAS AFFECTING MARKET

OPPORTUNITIES

• Viet Nam’s corporate governance framework has been reconfigured to account for all firms – public and private, listed and non-listed

• The 2014 Law on Enterprises has set high standards – the challenge will be to ensure full compliance

• Some SOEs have attracted foreign investors but their equitisation slowed down in the past 10 years and total assets of fully SOEs still account for 74% of GDP

• Preferential treatment (e.g. access to finance) that SOEs receive impede level playing field with private firms

Improving corporate governance

• Viet Nam Competition Agency and Viet Nam Competition Council are not sufficiently independent

• Market shares are used to determine which cases to investigate (good practice), but also their outcomes (could be revised)

• Economic realities are not suitably integrated into the analysis (e.g. make market definition more flexible)

• Market power are measured only via market shares and are not considering enough other factors (e.g. barriers to entry, countervailing buyer power)

Improving competition

TAX POLICIES

• Viet Nam offers tax incentives to attract investment and a low corporate tax rate (20% by 2016)

• But tax incentives depend on firms’ business activity, location or size Non-uniform treatment of investors and variation of effective tax rates

• Tax-related issues are dispersed into multiple pieces of legislation (no single Tax Code exists) complexity and lack of transparency

• 173rd on Doing Business for ‘Paying Taxes’ (out of 189 countries)

An attractive, but confusing, tax system

• These variations of effective tax rates can lead to tax planning strategies by investors

• While the budget deficit is widening and the fiscal position is deteriorating (government receipts experienced a decline of 20% between 2010-14)

• At the same time, little analysis is conducted to understand the costs and benefits of incentives

Erosion of tax base and weakening of macro- economic fundamentals

Putting pressure on the state’s budget

• Granting of tax incentives not always automatic and rules sometimes inconsistently applied

discretionary decision-making increases risk of corruption and limits predictability for investors

• Lack of whole-of-government approach; need more effective coordination, esp. between MPI and MOF

• Insufficient human and institutional capacity to analyse the impact of tax reforms and to conduct cost/benefit analysis

Supplemented by governance issues

INVESTMENT PROMOTION AND FACILITATION

Investment attraction

Ministry of Planning and Investment

Business facilitation

SME development

/ skills

Co-ordination with other ministries/agencies

Linkages promotion

Regulatory reforms

Co-ordination with Provinces

SEZs/IPs

Institutional framework for investment

promotion and facilitation

38

• Major efforts by central government and provinces to improve the business environment, but challenges remain

• Decentralisation of investment-related functions since 2005: reinforced role has been given to provinces

• Rapid growth of industrial parks and other types of SEZs (80% of manufacturing FDI; 2.5% of total workforce)

• Increasing consultation of the private sector (e.g. VBF)

• Emergence of supporting industries but the level of business linkages between MNEs and SMEs remains low

• Higher education and vocational training produce basic skills but there is an increasing risk of skills mismatch

Overview of investment promotion and

facilitation in Viet Nam

• Decentralisation encouraged provinces to become more efficient in investment promotion efforts

• But competition leads to duplication and overlap of efforts and does not serve the country’s overall interests

• Key role of SEZs in FDI attraction and development but low occupation rate (65%) and risk of land misuse

• MPI in charge of overall coordination but not sufficiently

• Need to develop a clearer, long-term vision for FDI attraction

• FIA needs to focus on targeted promotion and providing support to poorer provinces

Investment promotion: decentralised but

not sufficiently well-coordinated

• Reforms at central level to improve business environment

– Project 30 on administrative simplification and regulatory reform

– Simplification of business registration and establishment of ABR

– New investment and enterprise laws 2014

• Viet Nam has improved but still ranks at 119th position on Doing Business to ‘start a business’ (out of 189)

• Decentralisation was a catalyst for reform in provinces and has helped improve the business environment (illustrated by the Provincial Competitiveness Index)

• MPI recognised as a responsive ministry by businesses

Investment facilitation: valuable initiatives

to improve the business environment

• Competition leads to large differences between rich and poor provinces in terms of investment regulation and services

• Affects both investors’ operations and welfare of provinces

• Lack of institutional capacities and inadequate funding to implement laws and regulations (e.g. tighter deadlines with new laws)

• After the rapid pace of reforms, building strong institutions at central and provincial levels should be a top priority

• More aftercare is needed

Implementation lags behind: need to support

provinces and strengthen institutions

Enhancing the development impact of FDI

through business linkages

Domestic firms’ characteristics Foreign firms’ characteristics

Government policies and institutions

Spillover potential

FDI spillovers

Absorptive capacities

Education & training

Access to finance

SME development

Trade policy

Labour market regulations

Investment policy

& promotion

IP rights

Source: OECD (adapted from Farole and Winkler (2014), and paus and Gallagher (2008))

Local suppliers in Viet Nam and regional peers

(ranking out of 140 economies), 2015

Absorptive capacities: linkage creation

depends on the availability of domestic SMEs

0 20 40 60 80 100 120 140

Malaysia

Korea

China

Thailand

Indonesia

Philippines

Viet Nam

Lao PDR

Cambodia

Local supplier quantity Local supplier quality

• SMEs have boomed since Doi Moi but their level of competitiveness remains low

• Targeted approach to SME development since early 2000s – supporting industries as a priority (Master Plan)

• But still few business linkages between MNEs and SMEs

• Continue efforts to establish a sound business environment for SMEs and increase SME consultation

• Need to further develop industry-specific capacity building

• Make educational and training programme more market driven by involving businesses in HRD strategy design

Absorptive capacities: SME and skills

development at the centre

• Some FDI more likely to generate spillovers and linkages; some foreign investors are more inclined to source locally

• SEZs tend to generate few linkages – except if they take a more elaborate cluster focus – Participation of local firms allowed

– Focus on SMEs

– Involvement of central and/or provincial authorities

– Well-coordinated institutional environment

• Aftercare can help anchor investors in the local economy

• Continue efforts to facilitate information exchanges (matchmaking events, suppliers databases)

Spillover potential: implications for FDI

attraction

INFRASTRUCTURE CONNECTIVITY

Perceived level of highway congestion in Viet Nam relative to regional peers

Source:

Wo

rld

Ba

nk

(2

014

)

Overcapacity in the port system

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

China Thailand Indonesia Malaysia India

Southern Viet Nam Central Viet Nam Nothern Viet Nam

Rating: 1(worst) to 5 (best)

Vie

t N

am

is w

ors

e o

ffV

iet

Na

m is

be

tte

r o

ff

Limited road capacity: high congestion

• Intercity truck speeds average 35km/h

• Cost of congestion: USD 1.7 billion

Railway sector is not competitive

• Limited network capacity

• Avg. speed of freight trains: 15-20km/h

Ports: significant excess capacity

• Lack of multimodal planning: poor access sometimes (e.g. congestion)

• Insufficient water depth for larger modern vessels

Viet Nam has greatly expanded its infrastructure network

over time, but quality has not always kept pace (1/2)

Power

• Access to electricity has become almost universal

• Growth in power demand continues to pressure production

• Electricity prices kept at historically low levels hindered the industry's capacity to invest

Telecommunications

• Infrastructure has expanded rapidly

• Investments required to expand broadband access

Viet Nam has greatly expanded its infrastructure network

over time, but quality has not always kept pace (2/2)

Residential Commercial Industrial

Low High Low High Low High

Brunei

Darussalam 3.82 19.11 3.82 15.29 3.82 3.82

Cambodia 8.54 15.85 11.71 15.85 11.71 14.63

Indonesia 4.6 14.74 5.93 12.19 5.38 10.14

Lao PDR 3.34 9.59 8.8 10.36 6.23 7.34

Malaysia 7.26 11.46 9.67 11.1 7.83 10.88

Myanmar 3.09 3.09 6.17 6.17 6.17 6.17

Philippines 21.1 24.83 19.93 22.94 18.15 19.37

Singapore 19.76 19.76 10.95 18.05 10.95 18.05

Thailand 5.98 9.9 5.55 5.75 8.67 9.43

Viet Nam 2.91 9.17 4.38 15.49 2.3 8.32

Electricity tariffs in Viet Nam and ASEAN, 2014

Source: JICA (2014)

The government estimates that USD 170 bi is needed over

2011-2020 for the development of essential infrastructure

Source: World Bank (2014)

• Prominent on the agenda

• Historically, investment has been state-led and high by international standards

• Yet, estimated investment needs amount to 10% of GDP 2011-2020

• 10-Year SEDS 2011-2020: need to create economic conditions for PPI

• Despite the many attempts in the past, private participation has been limited

• Limited interest from foreign investors

0.00

20.00

40.00

60.00

80.00

100.00

120.00 Cumulative investment, 2000-2014, 2014 US$, Billion

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

0

20

40

60

80

100

120

China Cambodia Indonesia Lao PDR Malaysia Myanmar Philippines Thailand Vietnam

energy telecoms transport water and sanitationand mostly concentrated in the power sector Private participation has been limited…

0.00

20.00

40.00

60.00

80.00

100.00

120.00 Cumulative investment, 2000-2014, 2014 US$, Billion

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

0

20

40

60

80

100

120

China Cambodia Indonesia Lao PDR Malaysia Myanmar Philippines Thailand Vietnam

energy telecoms transport water and sanitation

0.00

20.00

40.00

60.00

80.00

100.00

120.00 Cumulative investment, 2000-2014, 2014 US$, Billion

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

0

20

40

60

80

100

120

China Cambodia Indonesia Lao PDR Malaysia Myanmar Philippines Thailand Vietnam

energy telecoms transport water and sanitation

0.00

20.00

40.00

60.00

80.00

100.00

120.00 Cumulative investment, 2000-2014, 2014 US$, Billion

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

0

20

40

60

80

100

120

China Cambodia Indonesia Lao PDR Malaysia Myanmar Philippines Thailand Vietnam

energy telecoms transport water and sanitation

0.00

20.00

40.00

60.00

80.00

100.00

120.00 Cumulative investment, 2000-2014, 2014 US$, Billion

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

0

20

40

60

80

100

120

China Cambodia Indonesia Lao PDR Malaysia Myanmar Philippines Thailand Vietnam

energy telecoms transport water and sanitation

• State budget, SOEs, ODA, and government bonds estimated to meet only half of the required investments

• But plan should not be grounded on a fiscal motivation:

‒ PPPs will not solve the infrastructure investment gap (users or taxpayers still have to pay)

‒ Moreover, government support will likely continue to be needed to mobilise resources from the private sector

‒ PPI can help to increase the efficiency of infrastructure delivery under appropriately competitive environment

‒ The case for PPP should rely on its ability to generate greater value for money than the public provision alternative

‒ In the past, most projects undertaken without competitive tendering

The government expects the private sector to meet nearly

half of estimated investment needs

The new Law on Public-Private Partnership: renewed

attempt to modernise the regulatory framework for PPI

• The new framework consolidates the previous fragmented framework

• Brings some key regulatory and institutional improvements:

– Clearer procedures for project formulation and implementation

– Expanded type and sector scope

– PPP steering committee and PPP unit within the MPI (not a guarantee of success, but facilitates bringing necessary resources together)

– Project Development Facility (support project preparation and tendering)

– Viability Gap Funding (greater flexibility for its use)

– International competitive bidding as the rule

• Success of the new PPP framework will depend on its implementation

– Clarity needed on principles and rules governing some key issues (e.g. government support, risk allocation, renegotiation and termination)

– Need to be addressed in regulations, guidance documents or standard contract model

• There is also a need to improve planning and assessment of projects so as to secure value for money in infrastructure delivery

– In the past, poor prioritisation led to projects with low economic returns

• Continue efforts to bring prices to cost-reflective levels (e.g. electricity)

• Mover forward with the SOE reforms to ensure a level playing field

– Number of SOEs in infrastructure sectors remains high and corporate governance practices remain deficient sometimes

But some remaining challenges may still constitute a

deterrent factor to attracting more qualified investors

• The government has taken some key steps to institute a policy environment for green investment (e.g. Green Growth Strategy 2012)

• The Power Master Plan VII is the cornerstone of renewable energy development; it provides the legal framework and sets long-term goals for renewable energy investments

• But challenges impede clean energy investments:

• Difficult access to finance

• Lack of competition in electricity markets

• Tariff-setting not systematic

• Fossil fuel subsidies create a barrier for renewable energies

The government is developing a policy

framework for green growth

RESPONSIBLE BUSINESS CONDUCT

Scope and importance of RBC

Relevance for policy-making

Responsible business conduct at the OECD

Global developments

Opportunities in Viet Nam

• Goes beyond philanthropy

• Focuses on addressing environmental and social impacts of business operations

• Part of core business and risk management, including in the supply chain and business relationships

• Important for all businesses

RBC – Focus on Impact

ensuring a positive contribution to overall development Responsible Business Conduct avoiding and addressing negative impacts

1

2

• Urgent need to address issues in global supply chains

• Need for inclusive and sustainable growth

• Complex issues not solvable by any one actor alone

RBC – Focus on Impact

Clothing exports of selected economies (1990 vs. 2014)

% of total world exports (1990 vs. 2014) Data source: World Trade Organisation

Mexico

Turkey China

India

Indonesia

Bangladesh

Viet Nam

Pakistan

Textile & Garment Sector Supply Chain

Yarn Spinning

Weaving, knitting

Dyeing, printing,

Finishing

Garment

Manufacturing

Brands, Buying houses,

Trading companies

Retail

Raw material

production

Textile & Garment Sector Supply Chain

Aggravating factors

Fast fashion & low

prices

Short-term contracts

Purchasing

practices Business

models

Illegal sub-

contracting

Use of temporary

workers,

homeworkers,

migrant workers

Sumangli scheme

Small holder

farmers;

Use of temporary

workers

Inflexible delivery

dates

Business models

Forced & bonded labour

Child labour

Occupational health & safety

Excessive working hours

Freedom of Association &

Collective bargaining

Wages

Chemical use & water

contamination

Example salient risks

Multi-stakeholder approach to RBC

Improving the business environment

Protecting public interest and stakeholder rights

Overcoming country risk perceptions

Social licence to operate and risk management

Compliance/ respecting stakeholder rights

Competitiveness and market access

Ensuring accountability/ respect of rights

Framework to resolve issues proactively and constructively

Shared understanding of responsibilities

Government Businesses Civil Society

RBC at the OECD

• OECD Guidelines for Multinational Enterprises – Clear role for home governments

– Accountability

– Sector Guidances

• RBC in the Policy Framework for Investment and other policy areas – Development policy and co-operation;

corporate governance; competition; taxation; finance

• Outreach and dialogue

• Most comprehensive government-backed international instrument for promoting responsible business conduct

• Recommendations from governments to businesses operating in or from adhering countries

• Purpose: to ensure business operations are in harmony with government policies; strengthen the basis of mutual confidence with the society; help improve foreign investment climate; enhance contribution to sustainable development

• Unique implementation mechanism

• Endorsed by business, trade unions and civil society organizations

OECD Guidelines for Multinational

Enterprises

Application of the Guidelines

Concepts and Principles

General Policies

Disclosure

Human Rights

Employment and Industrial Relations

Environment

Combating Bribery, Bribe Solicitation and Extortion

Consumer Interests

Science and Technology

Competition

Taxation

Scope

Implementing the Guidelines:

Shared Responsibility

Implement the Guidelines and encourage their use by businesses (domestic and foreign)

Provide a policy environment that supports and promotes responsible business conduct

Set up National Contact Points for the Guidelines

Maximise positive impacts, minimise adverse impacts

Carry out due diligence to identify, prevent and mitigate actual and potential adverse

impacts

Cover not only impacts related to own operations; but also in the

supply chain and business relationships

Responsibilities of Governments

Responsibilities of Businesses

• One of the main global non-judicial mechanisms and a significant contribution to improving access to remedy in case RBC principles and standards are not observed

• Mandate: – Help resolve practical issues through dialogue and

consensus – Promote RBC and actively engage with stakeholders – Identify areas where additional guidance for

businesses might be needed (i.e. sectors, regions, etc.) – Report on activities

Implementing the Guidelines:

National Contact Points

Implementing the Guidelines:

National Contact Points

1%

3%

3%

3%

3%

4%

4%

4%

4%

6%

6%

11%

17%

34%

Water supply; sewerage, waste management and…

Human health and social work activities

Accommodation and food service

Construction

Transportation and storage

Other

Information and communication

Other service activities

Electricity, gas, steam and air conditioning supply

Agriculture, forestry and fishing

Wholesale and retail trade

Financial and insurance activities

Mining and quarrying

Manufacturing

Percentage of cases by industry sector

1%

2%

3%

5%

6%

8%

15%

21%

24%

45%

55%

Science and technology

Taxation

Competition

Consumer interests

Concepts and principles

Combating bribery, bribe solicitation and extortion

Disclosure

Environment

Human rights

General policies

Employment and industrial relations

Percentage of cases by theme

Implementing the Guidelines:

Guidance for Business

OECD Due Diligence Guidance for Responsible Mineral Supply Chains (2011)

OECD Due Diligence Guidance for Meaningful Stakeholder Engagement in the Extractive Sector

OECD-FAO Guidance for Responsible Agricultural Supply Chains

OECD Due Diligence Guidance for Responsible Supply Chains in the Garment & Footwear Sector (forthcoming)

Responsible Business Conduct in the Financial Sector (forthcoming)

• Unifies and help enterprises observe the OECD Guidelines and other major agriculture standards

• Recognition of financial enterprises as part of the value chain

• Developed through a multi-stakeholder advisory group

• Two main sections: – What - A model enterprise

policy

– How - A five-step framework for risk-based due diligence

Building Responsible Agricultural

Supply Chains

What: Model Enterprise Policy

• Establish and maintain, in co-ordination with responsible government agencies and third parties as appropriate, an environmental and social management system appropriate to the nature and scale of operations

• Prevent, minimise and remedy pollution and negative impacts on air, land, soil, water, forests and biodiversity, and reduce greenhouse gas emissions

• Ensure the sustainable use of natural resources and increase the efficiency of resource use and energy

• Hold good-faith, effective and meaningful consultations with communities before initiating operations

• Ensure decent wages, benefits and working conditions, that are at least adequate to satisfy the basic needs of workers and their families

Some examples

How: Framework for Due Diligence

• Identify, assess, mitigate, prevent and address actual and potential adverse impacts

Step 1 • Establish strong company management systems

Step 2 • Identify, assess and prioritise risks in the supply chain

Step 3 • Design and implement a strategy to respond to identified risks

Step 4 • Verify supply chain due diligence

Step 5 • Report on supply chain due diligence

Production Aggregation Processing Distribution

On-farm enterprises Agricultural production and near-farm basic processing

Downstream enterprises Aggregation, processing, distribution and marketing of agri-food products

Financial enterprises Corporate and institutional investors less directly involved than above but provide them with capital

Cross-cutting enterprises

Tenure rights

Animal welfare

Animal welfare

Human rights Food security & nutrition

Labor rights

Health Governance

Environmental protection & sustainable use of resources

Technology & innovation

CROSS- CUTTING RISKS

STAGES

SPECIFIC RISKS

ENTER- PRISES

• Convergence and coherence on RBC since 2011 – OECD Guidelines for Multinational Enterprises

– UN Guiding Principles on Business and Human Rights

– Core ILO conventions

• Sustainable Development Goals and Paris Agreement

• Integration in numerous international, regional and domestic commitments: – G7 leaders statement

– UNSC Resolutions

– Trade agreements and bilateral investment treaties

– Market access provisions

– EU CSR Strategy and new directives

– National strategies: UK Modern Slavery Act, French legislative developments, U.S. regulations/National Action Plan, Dutch agreement on textiles, Chinese guidelines

– ASEAN practice differs country to country

• Increasing integration of RBC in development finance, by investors, stock exchanges, banks, pension funds, and sovereign wealth funds

Attention to RBC Increasing Globally

Promoting and enabling RBC is an

opportunity in Viet Nam

• Awareness of RBC expectations is not wide-spread; some activities undertaken by private sector/civil society, focus on philanthropy and promotion

• Partial alignment with international principles and standards in areas related to RBC

• State-of-the-art legislation in some areas, but implementation remains a challenge

• Recent international commitments include a reference to and recognition of importance of RBC

• Primary responsibility for ensuring that investment contributes to inclusive and sustainable growth and that stakeholder rights are protected rests with the government of Viet Nam

• International investors should observe the OECD Guidelines and UN Guiding Principles

• Scope for promoting RBC in export-oriented production; RBC expectations are prevalent throughout global value chains

• RBC could bring particular advantages as Viet Nam shifts to more value added sectors; improving skills and building local capacity is a part of RBC