Name of the Company - GIE€¦ · PPT file · Web viewThe products mentioned in this report may...

-

Upload

truongkiet -

Category

Documents

-

view

214 -

download

0

Transcript of Name of the Company - GIE€¦ · PPT file · Web viewThe products mentioned in this report may...

The rising value of underground European gas storage

IMPORTANT: PLEASE READ DISCLOSURES AND DISCLAIMERS BEGINNING ON PAGE 24

Presentation to the GIE Annual Conference – 24 October 2008

SG Utilities John Honoré +331 4213 5155 [email protected] Equity Europe Thierry Bros +331 5898 1170 [email protected] Equity Europe-gas Didier Laurens +331 4213 5078 [email protected] Equity renewable energy Hervé Gay +331 4213 8750 [email protected] Credit Florence Roche +331 4213 6399 [email protected] Credit Emmanuel Fages +331 4213 3029 [email protected] CO2 Laura Simion +40 21 301 4370 [email protected] Equity Rumania

2

Why look at storage?

Industry failed to deliver new storage UK example

Governments are waking up January 2006 and 2007 crises EU will look at strategic stocks

Market is slowly starting to value this business Demerger of Edgon Resources (Portland Gas) Petronas’ acquisition of Star Energy E.ON to create a pan European storage business

3

Who’s who in today’s gas producing business?

Source: SG Equity Research / Company data

Gazprom18%

ExxonMobil3%

Shell3%

BP3%

Other listed companies25%

National Oil Companies (NOC)48%

4

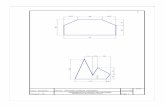

SG 2020e European gas outlook

Demand to increase from 505bcm (2007) to 620bcm (2020e)

Import dependency to increase from 62% (2007) to 75% (2020e)

Projects under development should take the industry through to 2013e

Russian and FSU domestic gas prices in line (on a net back basis) with European prices

0

200

400

600

2007 2020e0%20%40%60%80%

Demand Imports / Demand (%)

Source: SG Equity Research

5

Gas prices will increase due to supply bottleneck

Oil production to reach an undulating plateau 100Mb/d + Nuclear not ready => Fiercer competition for Oil and Gas

Gas cartel? => Decoupling could mean higher gas vs oil prices

Not enough storage => European Summer/Winter spread

Crisis can happen at any time (weather, nuclear outages, Russian-transit countries, etc.) =>LNG marginal price setter

0

20

40

60

80

100

120

140

160

1/1/03 1/7/03 1/1/04 1/7/04 1/1/05 1/7/05 1/1/06 1/7/06 1/1/07 1/7/07 1/1/08 1/7/08

NBP ($/boe) Brent ($/b)

NBP vs Brent ($/boe)

Source: SG Equity Research / Datastream

6

In a free market, the added value in gas lies upstream

Getting access to upstream production is increasingly difficult

Gas can and has to be stored in order to meet very seasonal demand

Storage is an upstream asset Gives leverage to owners ahead of big suppliers Can be classified under the United Nations definition of “natural

resources”

Storage is a risky business (same upstream technologies + “nimby” factor)

7

Hidden value discovered by the market: Star Energy

150

200

250

300

350

400

11/05/04 11/09/04 11/01/05 11/05/05 11/09/05 11/01/06 11/05/06 11/09/06 11/01/07 11/05/07 11/09/07 11/01/08

p

Source: SG Equity Research / Datastream

8

Storage in Europe: 78bcm – 16% of annual demand

Source: SG Equity Research / Eurogas / GSE

France

Luxembourg

Slovenia

United Kingdom

Ireland

Germany

Italy

Malta

Switzerland Austria

Greece

Poland

Netherland

DenmarkLithuania

Latvia

Finland

Sweden

Norway

Estonia

Belgium

Hungary

Slovakia

Czech Republic

Spain

Portugal

Cyprus

Romania

Total storage (bcm) @ July 08

Storage in % of annual demand

Bulgaria

49%

3%

34%

25%

33%

26%

24%

2%

27%

4%

17%

143%

6%

11%

3%

47%

18%

7%

1%

5%

4

1

1

3

1

12

20

4

14

2

3

2

3

3

3

4

_

_

__

_

_

2%

France

Luxembourg

Slovenia

United Kingdom

Ireland

Germany

Italy

Malta

Switzerland Austria

Greece

Poland

Netherland

DenmarkLithuania

Latvia

Finland

Sweden

Norway

Estonia

Belgium

Hungary

Slovakia

Czech Republic

Spain

Portugal

Cyprus

Romania

Total storage (bcm) @ July 08

Storage in % of annual demand

Bulgaria

49%

3%

34%

25%

35%

26%

24%

2%

27%

4%

17%

143%

6%

11%

3%

47%

18%

7%

1%

5%

4

1

1

3

1

12

20

4

14

2

3

2

3

3

3

4

_

_

__

_

_

2%

France

Luxembourg

Slovenia

United Kingdom

Ireland

Germany

Italy

Malta

Switzerland Austria

Greece

Poland

Netherland

DenmarkLithuania

Latvia

Finland

Sweden

Norway

Estonia

Belgium

Hungary

Slovakia

Czech Republic

Spain

Portugal

Cyprus

Romania

Total storage (bcm) @ July 08

Storage in % of annual demand

Bulgaria

49%

3%

34%

25%

33%

26%

24%

2%

27%

4%

17%

143%

6%

11%

3%

47%

18%

7%

1%

5%

4

1

1

3

1

12

20

4

14

2

3

2

3

3

3

4

_

_

__

_

_

2%

France

Luxembourg

Slovenia

United Kingdom

Ireland

Germany

Italy

Malta

Switzerland Austria

Greece

Poland

Netherland

DenmarkLithuania

Latvia

Finland

Sweden

Norway

Estonia

Belgium

Hungary

Slovakia

Czech Republic

Spain

Portugal

Cyprus

Romania

Total storage (bcm) @ July 08

Storage in % of annual demand

Bulgaria

49%

3%

34%

25%

33%

26%

24%

2%

27%

4%

17%

143%

6%

11%

3%

47%

18%

7%

1%

5%

4

1

1

3

1

12

20

4

14

2

3

2

3

3

3

4

_

_

__

_

_

2%

France

Luxembourg

Slovenia

United Kingdom

Ireland

Germany

Italy

Malta

Switzerland Austria

Greece

Poland

Netherland

DenmarkLithuania

Latvia

Finland

Sweden

Norway

Estonia

Belgium

Hungary

Slovakia

Czech Republic

Spain

Portugal

Cyprus

Romania

Total storage (bcm) @ July 08

Storage in % of annual demand

Bulgaria

49%

3%

34%

25%

35%

26%

24%

2%

27%

4%

17%

143%

6%

11%

3%

47%

18%

7%

1%

5%

4

1

1

3

1

12

20

4

14

2

3

2

3

3

3

4

_

_

__

_

_

2%

9

Most capacity is in Germany, Italy and France

Source: SG Equity Research / GSE / Eurogas

0

5

10

15

20

German

yIta

ly

Franc

e UK

Austria

Hunga

ry

Czech

Rep

ublic

Roman

ia

Slovak

ia

Netherl

ands

Spain

bcm

0%

10%

20%

30%

40%

50%

60%

Storage (bcm) Storage in % of annual demand EU average (%)

10

Central European countries have plenty of storage

Source: SG Equity Research / GSE / Eurogas

0

5

10

15

20

bcm

10%

30%

50%

70%

90%

110%

130%

150%

Storage (bcm) Storage in % of annual demand

11

A new way to look at storage…

Source: SG Equity Research / GSE / Eurogas

AU

BE+PT+EL+SE

BG

FRDD

HU

IE

IT

NL

PL

RO

SK

ESUK

DK

CZ

EU-27

EE+FI+LT+LU+SI0%

10%

20%

30%

40%

50%

0% 20% 40% 60% 80% 100%

Imports / Demand (%)

Sto

rage

/ D

eman

d (%

)

12

… and to assess the need for new storage

Gas demand CAGR up to 2025: 1.5%

Storage needs CAGR up to 2025: 2.8% It’s a growing business 50bcm needed

Source: SG Equity Research / GSE / Eurogas

2007

2020e

2030e

0%

5%

10%

15%

20%

25%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Imports / Demand (%)

Sto

rage

/ D

eman

d (%

)

y = 0.25 * x

Reduced Security of Supply

Increased Security of Supply

13

Major companies in European underground gas storage

0

2

4

6

8

10

12

14

ENI (Stogit) E.ON GDF Suez RWE Gazprom Centrica Romgaz Total BASF VerbundnetzGas

OMV

bcm

Gazprom also owns 5.26% of Verbundnetz Gas

Source: SG Equity Research / GSE / Company data

14

Three major storage operators in Europe (in bcm)

Source: SG Equity Research / GSE / Company data

France

GDF SUEZ

E. ON

ENI

0.3

0.2

Italy

Germany

Romania

0.1 0.50.4

3.5Slovakia

Hungary

1.1Latvia

Czech Republic

1.5

5.2

9.5

13.6

France

GDF SUEZ

E. ON

ENI

0.3

0.2

Italy

Germany

Romania

0.1 0.50.4

3.5Slovakia

Hungary

1.1Latvia

Czech Republic

1.5

5.2

9.5

13.6

15

Regulation

Two third-party access regimes: regulated or negotiated

Strategic stocks in Italy (5.1bcm) and Hungary (1.2bcm in 2010e)

Gas in primary energy consumption in Europe

0%

10%

20%

30%

40%

Netherl

ands

Hunga

ry UKIta

ly

Roman

iaLa

tvia

slova

kia

Irelan

d

Lithu

ania

Luxe

mbourg

Belgium

Austria

German

y

Denmark

Spain

Czech

Rep

ublic

Portug

al

Fran

ce

Sloven

ia

Bulgari

a

Estonia

Poland

Finlan

d

Greece

Sweden

Country EU-27 Average Source: SG Equity Research / Eurogas

16

Technical details

Split of working and cushion gas in EU-27 (in bcm)

-60

-40

-20

0

20

40

60

80

Commercial storage Strategic storage Cushion gas that can bewithdraw

Cushion gas that can't bewithdraw

Source: SG Equity Research

Split of storage in EU-27

Salt Caverns13%

Depleted fields and Aquifers

87%

Source: SG Equity Research / GSE

17

Major capacity outside EU-27

Source: SG Equity Research / GSE / Eurogas / Naftogaz of Ukraine / Gazprom

0

10

20

30

40

50

60

70

80

Europe Ukraine Russia

bcm

18

Other storage options outside EU-27

0

2

4

6

8

10

12

UK Storage capacity @ end 07 Virtual storage in the Netherlands Ormen Lange maximum swing0%

2%

4%

6%

8%

10%

12%

bcm % annual UK demand

Source: SG Equity Research

Gazprom total storage capacity amounts to 68bcm

0

10

20

30

40

50

60

70

80

non Gazprom Gazprom

bcm

EU-27 Russia

Source: SG Equity Research / GSE / Gazprom

19

How to value storage

Technical details

Summer/winter spread

DCF of Rough in the UK for storage on-line

Takeover price paid by Petronas for Star Energy projects

Value storage for trading in UK

Value storage for modulation in Europe

20

Valuation of UK storage

Source: SG Equity Research

0

0.4

0.8

1.2

1.6

2

Depleted fields / Aquifers Salt caverns Depleted fields Projects

€bn/

bcm

21

How to value Continental storage?

In Italy, 7.1% (pre-tax) remuneration leads to €0.2bn/bcm for depleted fields vs €0.9bn/bcm for trading

If more storage to be built, need to change the way this activity is viewed in continental Europe

We therefore decided to look more closely at different ways to value Continental European storage other than via the standard regulated method

22

SG methodology

Zone 1: around Zeebrugge (BE) and Title Transfer Facility (NL) Capacity for modulation (80%) valued according to the TPA regimes Capacity for trading (20%) valued in line with UK

Zone 2: around Baumgarten (AU) and major Russian pipelines Capacity for modulation (50%) valued according to the TPA regimes Capacity for trading (50%) valued with a 40% discount to Rough

Zone 3: rest of Continental Europe Capacity for modulation (100%) valued according to the TPA regimes

Source: SG Equity Research

0

0.1

0.2

0.3

Regulated Negotiated

€bn/

bcm

23

Results

The “rising value” of European underground gas storage

0

1

2

3

4

5

6

E.ON

GDF SUEZ

ENI (Stog

it)

Centric

aRW

E

Verbun

dnetz

Gas

Gazpro

mBASF

OMVTo

tal

€bn

Storage on Line Storage projects

Source: SG Equity Research

24

Next newsflow?

SG: first to provide a valuation methodology for all European storage

Gas companies will go for a separate business line for gas storage like E.ON

Investment is starting

Baumgarten to become the European single gas hub?

EU Commission will provide a position on strategic stocks

EU – US?

25

IMPORTANT DISCLOSURESEnagas Societe Generale and affiliates beneficially own 1% or more of any class of common equity of Enagas.ENI SG makes a market in Eni warrantsFluxys SG is advisor to Gaz de France in its merger project with SuezGaz de France Societe Generale and affiliates beneficially own 1% or more of any class of common equity of Gaz de France.Gaz de France SG acted as sole advisor to Gaz de France in the disposal of Cofathec ADFGaz de France SG is advisor to Gaz de France in its merger project with SuezRepsol-YPF Societe Generale and affiliates beneficially own 1% or more of any class of common equity of Repsol-YPF.RWE SG is acting as co-manager in the forthcoming IPO of American Water WorksTotal Societe Generale and affiliates beneficially own 1% or more of any class of common equity of Total.

26

IMPORTANT DISCLAIMER

IMPORTANT DISCLAIMER: The information herein is not intended to be an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities and including any expression of opinion, has been obtained from or is based upon sources believed to be reliable but is not guaranteed as to accuracy or completeness although Société Générale (“SG”) believe it to be clear, fair and not misleading. SG, and their affiliated companies in the SG Group, may from time to time deal in, profit from the trading of, hold or act as market-makers or act as advisers, brokers or bankers in relation to the securities, or derivatives thereof, of persons, firms or entities mentioned in this document or be represented on the board of such persons, firms or entities. Employees of SG, and their affiliated companies in the SG Group, or individuals connected to then, other than the authors of this report, may from time to time have a position in or be holding any of the investments or related investments mentioned in this document. Each author of this report is not permitted to trade in or hold any of the investments or related investments which are the subject of this document. SG and their affiliated companies in the SG Group are under no obligation to disclose or take account of this document when advising or dealing with or for their customers. The views of SG reflected in this document may change without notice. To the maximum extent possible at law, SG does not accept any liability whatsoever arising from the use of the material or information contained herein. This research document is not intended for use by or targeted at private customers. Should a private customer obtain a copy of this report they should not base their investment decisions solely on the basis of this document but must seek independent financial advice. Important notice: The circumstances in which materials provided by SG Fixed & Forex Research, SG Commodity Research, SG Convertible Research, SG Technical Research and SG Equity Derivatives Research have been produced are such (for example because of reporting or remuneration structures or the physical location of the author of the material) that it is not appropriate to characterise it as independent investment rese arch as referred to in European MIF directive and that it should be treated as a marketing material even if it contains a research recommendation (« recommandation d’investissement à caractère promotionnel »). However, it must be made clear that all publications issued by SG will be clear, fair, and not misleading.Analyst Certification: Each author of this research report hereby certifies that (i) the views expressed in the research report accurately reflect his or her personal views about any and all of the subject securities or issuers and (ii) no part of his or her compensation was, is, or will be related, directly or indirectly, to the specific recommendations or views expressed in this report.Notice to French Investors: This publication is issued in France by or through Société Générale ("SG") which is regulated by the AMF (Autorité des Marchés Financiers). Notice to UK investors: This publication is issued in the United Kingdom by or through Société Générale ("SG") London Branch which is authorised and regulated by the Financial Services Authority ("FSA") for the conduct of its UK business.Notice To US Investors: This report is intended only for major US institutional investors pursuant to SEC Rule 15a-6. Any US person wishing to discuss this report or effect transactions in any security discussed herein should do so with or through SG Americas Securities, LLC (“SGAS”) 1221 Avenue of the Americas, New York, NY 10020. (212)-278-6000. THIS RESEARCH REPORT IS PRODUCED BY SOCIETE GENERALE AND NOT SGAS.Notice to Japanese Investors: This report is distributed in Japan by Société Générale Securities (North Pacific) Ltd., Tokyo Branch, which is regulated by the Financial Services Agency of Japan. The products mentioned in this report may not be eligible for sale in Japan and they may not be suitable for all types of investors.Notice to Australian Investors: Société Générale Australia Branch (ABN 71 092 516 286) (SG) takes responsibility for publishing this document. SG holds an AFSL no. 236651 issued under the Corporations Act 2001 (Cth) ("Act"). The information contained in this newsletter is only directed to recipients who are wholesale clients as defined under the Act.US THIRD PARTY FOREIGN AFFILIATE RESEARCH DISCLOSURES:The subject company of this research report currently is, or was during the 12-month period preceding the date of distribution of this report, a client of SG or its affiliates.SG or its affiliates has received compensation for investment banking services from the subject company of this research report in the past 12 months.SG or its affiliates expects to receive or intends to seek compensation for investment banking services from the subject company of this research report in the next 3 months.SG or its affiliates acts as a market maker or liquidity provider in the equities securities that are subject of this research report.IMPORTANT DISCLOSURES: Please refer to our website: http:\\www.sgresearch.socgen.comhttp://www.sgcib.com. Copyright: The Société Générale Group 2008. All rights reserved.