The rising value of underground European gas storage – „Tool” to survive crisis situation GIE...

-

date post

22-Dec-2015 -

Category

Documents

-

view

216 -

download

1

Transcript of The rising value of underground European gas storage – „Tool” to survive crisis situation GIE...

The rising value of underground The rising value of underground European gas storage – „Tool” to survive European gas storage – „Tool” to survive crisis situationcrisis situation

GIE Annual Conference, Groningen,GIE Annual Conference, Groningen,May 7, 2009May 7, 2009

Zoltan Jaszberenyi

Managing Director – EON Földgaz Storage Hungary

Page 2

European Storage Demand Outlook - Business Climate

Source: IEA, World Energy Outlook 2004

Import Dependency will increase

2002 2010 2030

49%60%

74-80%

EP

F

IRLD

DK

GBBNL

L

SFIN

I

A

GRM CY

ESTLVLT

PLCZ

HSLOSK

S 5611

Variations expected:

Germany

1 m³ = 11,5 kWhSource for gas reserves: Oil and Gas Journal, Norwegian Petroleum Directorate, professional publications

Increasing investments and larger distances to gas supply sources

Growing dependence

Nigeria

3.511

Barent Sea/Russia

West Siberia (Urengoy,Jamburg,

Bovanenko etc.)36.100

1.841

Kazakhstan

Great Britain

Algeria

4.522

2.010

1.314Libya

3.500

The Netherlands1.567

Denmark

Barent Sea/Norway

Sea/Norway

North Sea/Norway994

181

630

1.991

84

Italy 227

Turkmenistan

4.100

Russia,European part

1.875

Billion cubic

meters

Iran23.002

Qatar

6.345

14.400

6.006Saudi-Arabia

UAE

326

Page 5

EU-avarage 2006• Natural gas demand: 470 Mrd. m³

• Import dependency: 58 %

• Storage demand: 15 percent of annual consumption

Scenario 2: Gas import grows by

22%• Natural gas demand: 700 billion cm

• Import dependency: 80 %

• Storags demand: ~20 percent of annual consumption or 140 billion cm

Scenario 1: Gas import grows by 16%• Natural gas demand: 600 billion cm

• Import dependency: 74 %

• Storage demand: ~18.5 percent of annual consumption or 110 billion cm

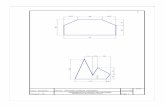

Storage demand today and tomorrow

0 %

20 %

40 %

60 %

80 %

100 %

120 %

20 %5 % 10 % 15 % 25 % 30 % 35 %0 %

Belgium 0.7 Spain 2.3

Poland 1.6

EU-avarage 70.3

UK 3.5

Italy 13.3

Germany 19.6

France 11.2

Austria 2.8

SK 1.7Hungary 3.4

Czech Rep. 2.1

Storage capacity related to annual consumption in per cent

Imp

ort

dep

en

den

cy

balanced

Development of storage demand

Page 6

Needs until 2025 (forecast) (EU OECD)

Construction between 2010 and 2020 (planned)

Construction

between 2008 and 2010 (under construction)

Capacities 2007

Gas storages – a contribution to the security of supply

20

07

75

20

10

90

15

134

20

25

20

20

15-21

105-111

15

OECD Europe

26-31 * further projects in preparation

* GSE publication 01/2009: up to 60 bcm to be available by 2015 which is nearly a doubling of the capacities currently available (State: planned)

** NL: except ~3 bcm for production purposes

UK

2

(+3)**

NL

B

A

PL

DK

CZ

HU

SK

RO

S

Working gas in billion cm

LV

F

D

I

20

12

4

1,6

13

3

3

1

3

2

4

2

4

1

0,5

4,7

3

4

2,3

1-4

0,4

1

0,6-2

0,4

5

0,1

3,2

3

2

0,4

0,4

0,3 - ?

Are we prepared?

Page 7

Gas storages – a contribution to the security of supply and to the development of liquid markets

European SSO and E.ON Gas Storage are planning and constructing storage capacities

- on time

- cost efficiently

- according to the demand

Are we prepared?

Working gas in billion cm

Page 8

SSOs are responding to market needs

GSE has a powerful and transparent instrument to evaluate storage supply perspectives.

Database of EU storage investments was launched in July 2007: Publicly available information Projects divided into 3 categories: planned, committed and

under construction From an initial 30 bcm WG capacity increase to 2015 (July

2007) to around 65 bcm (February 2009) Grand total of around 110 projects

“Independents”/new players are increasing their role: 25% of projects and 30% of planned new capacity (~ 19 bcm)

http://www.gie.eu/gse/storageprojects/

Page 9

Future storage demand can covered well by storage projects based on commercial market growth scenarioReported storage projects cover well the range of demand scenario

This constitutes a further increase of around 6 bcm as compared to the

figures gathered by GSE in June 2008.

41,380

11,1832,096

Total Capacities becamelive since June 2007

Total planned capacitiesto be completed short

term ( 2012-2014)

Capacities underconstruction (real

commitments)

Mill

m3

34%

66%

Expansion

New Facilitiesinvestment

??? - Financial / Credit Crisis

??? – Investment supportive regulatory framework

Page 10

Stable regulatory framework is essential to support storage developments

Regulation should be market-driven;

Streamlined planning and permitting procedures;

It should be realized that SSO’s products are in competition with other

flexibility tools : (indigenous gas production swing, imported pipeline

gas contract flexibility, peak shaving, spot markets, imported LNG, new

transmission lines, interruptible gas);

A stable European Regulatory framework that encourages new storage

developments as well as the optimal use of existing storage facilities is

essential;

Page 11

2009 Gas Crisis from Inside – Lesson learned

Page 12

Gas Supply Crisis Situation; Hungary by gas facts

Hungary has two import gas transmission points:

•Ukraine - Beregovo: 30 mill m3/day•Austria – HAG : 7-8 mill m3/day

Commercial Storage facilities & Commercial Storage facilities & Transportation routesTransportation routes

•Gas is the most important fuel in Hungary, representing 44% of the country's total primary energy mix (vs 24% in Europe). •The share of gas in the household and public sector heating exceeds 70%.

Share of Hungarian primary energy supply Share of Hungarian primary energy supply

by fuelby fuel

Natural Gas44%

Nuclear 15%

Coal 13%

Oil 28%

Page 13

Hungary 2009 January: gas supply crisis from insideHungary has phased its biggest natural gas supply crisis since

ever – „0” Eastern import supply for two weeks

Wh

at

has h

ap

pen

ed

Wh

at

has h

ap

pen

ed

29/12/2008 - 1st official signals arrive about potential reduction of supply.

30/12/2008 – Naftogas (Ukrainian TSO) is NOT confirming deliveries

31/12/2008 – there is 38 mill m3 import confirmed, but only 30 mill m3 arrived

In the next 4 days uncertain deliveries arrived without destination confirmation

6/01/2009 – at 14:50 – Ukrainian TSO „disconnects” Hungary from supply, quickly the pressures

in Hungarian system starts to decrease (5-8 barg / hour)

6/01/2009 The Ministry of Energy has announced the gas restriction for customers in category 1

07/01/2009 The Ministry of Energy has announced the restriction for industry but only for 2 days

(large Industrials)

7/01/2009 – Strategic stock released by the to utilize the 200+300 mcm strategic reserves

8/01/2009 – Western supplies were increased via HAG (extra volumes transferred from EON Ruhrgas

Germany)

20/01/2009- Eastern supply was back on the 38mcm/day level. All restrictions were withdrawn

Page 14

Hungary 2009 January: lessons learned during the supply crisis

Clear crisis management mechanism was not working properly on international level in time

( this became more effective in mid January) During the crisis time all daily balancing flexibilities were deleiverd by SSO – role of the SSO in

flexibility tools Hungarian commercial storage facilities have played a key role in ensuring security of supply.

Although the Ministry released the strategic stocks , this was not utilized ! Development of commercial storage in a more interconnected market must be fostered in order

to reinforce security of supply in Europe. There Strategic stocks should not be seen as a solution for the security of supply

problem. The real issues in this crisis are due to a lack of diversification in supply sources and supply

routes for some countries.

Due to Storage volumes in Hungary the commercial mobile stocks were high enough to survive longer period of import cuts

Page 15

Conclusion Europe will need more storage capacities

for a liquid European market

to meet future gas demand and balance import dependency and supply

to support challenging climate protecting measures, i.e. CCS

• SSO´s are well prepared to provide necessary storage capacities to the market in due time

on a commercial basis

• Commercial storage provide the market with several products that compete with other market instruments for providing flexibility and security of supply

Creating and maintaining strategic stocks is expensive (more than in the case

of oil) – the costs will ultimately have to be borne by consumers

• To ensure these long term storage investments a reliable and predictable legal framework is essential for the future

Page 16

Thank you for your attention !

Zoltan JaszberenyiEon Földgaz Storage Zrt

zoltan.jaszberenyi@eon-földgaz.com