Mobile banking

-

Upload

gowsmahi -

Category

Technology

-

view

1.133 -

download

0

Transcript of Mobile banking

WHY NET BANKING??

• FOR BALANCE ENQUIRY.

• ONLINE PURCHASING.

• FOR TRANSACTION OF OUR MONEY FROM ONE BANK ACCOUNT TO ANOTHER.

• BUT TO DEPOSIT OR PAY MONEY ON OUR ACCOUNT WE SHOULD GO BANK.

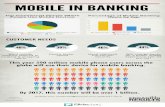

INCOME IN MB

• IN NEXT 5 YEARS PROFIT THROUGH NET BANKING WILL BE ACHIEVED AS 20,250 CRORES

• SHARE PRICES WILL ATTAIN 350 BILLION DOLLARS

• SHARES INVOLVED BY 70% OF CITY PEOPLE

• AND 30% BY VILLAGERS

REASON FOR ACHIEVEMENT

• SIMPLE BANKING RULES.

• LOW INITIAL DEPOSITS PROVIDED BY BANKS.

• AWARENESS OF PAN CARD

MICRO ATM

• BANK INTRODUCES BUSINESS CORRESPONDENT(BG)

• WHEN BANK OR ATM IS NOT NEARER WE CAN USE BG FOR MONEY TRANSACTIONS.

HOW TO USE BG’S?

• A NUMBER LL BE GIVEN TO US AND TO BANK.

• WE CAN ENROLL THIS WITH OUR ACCOUNT.

• WE SHOULD SUBMIT THIS NUMBER AND OUR MOBILE NUMBER TO BG.

• BG WILL COLLECT OUR DETAILS WITH FINGER PRINT.

• WHEN WE WISH TO ACCESS THROUGH BG, HE WILL RECORD THE PROCESS AND TRANSACTION WILL BE DONE

WHO ARE THIS BG’S?

• EMPLOYEE OF MERCHANT ESTABLISHMENTS

• RETIRED BANK OFFICERS

• GOVERNMENT EMPLOYEE

• INDIVIDUALS

• THE ONLY THING THEY SHOULD SIGN AN AGREEMENT WITH RESPECTIVE BANKS