LATIN FOCUS CONSENSUS FORECAST · Economist Peru 2011-13 2014-16 2017-19 Population (million): 30.5...

Transcript of LATIN FOCUS CONSENSUS FORECAST · Economist Peru 2011-13 2014-16 2017-19 Population (million): 30.5...

PERU 2CALENDAR 17NOTES 19

Contributors

PUBLICATION DATE 21 April 2015FORECASTS COLLECTED 14 April - 20 April 2015

INFORMATION AVAILABLE Up to and including 20 April 2015 NEXT EDITION 19 May 2015

LATINFOCUS CONSENSUSFORECAST

Peru • April 2015

ARNE POHLMAN Chief EconomistARMANDO CICCARELLI Head of ResearchRICARDO ACEVES Senior EconomistRICARD TORNÉ Senior EconomistOLGA COSCODAN Economist

CARL KELLY EconomistTERESA KERSTING EconomistDIRINA MANÇELLARI EconomistANGELA BOUZANIS EconomistCECILIA SIMKIEVICH Economist

ROBERT HILL Economist ERIC DENIS Economist MIRIAM DOWD Editor

FOCUSECONOMICS Peru

LatinFocus Consensus Forecast | 2

April 2015

Peru

REAL SECTOR | Economic activity slows in February, overall trend continues downward slideIn February, economic activity expanded 0.9% over the same month of last year, which was down from the 1.7% increase tallied in January. According to the statistical institute, the modest expansion was mainly driven by growth in the commerce, telecommunications and financial services sectors. In contrast, the construction and manufacturing industries registered contractions.

Following on the deceleration in economic activity, the growth trend moderated further. Annual average growth in economic activity decreased from 2.2% in January to 1.8% in February, which marked the lowest point in almost five years.

The Central Bank sees the economy expanding 4.8% in 2015 and 6.0% in 2016. LatinFocus Consensus Forecast panelists expect GDP to expand 3.5% in 2015, which is down 0.6 percentage points from last month’s projection. For 2016, the panel expects the economy to grow 4.6%.

Outlook deteriorates

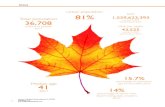

LONG-TERM TRENDS | 3-year averages

Carl KellyEconomist

Peru

2011-13 2014-16 2017-19Population (million): 30.5 31.9 33.4GDP (USD bn): 189 202 233GDP per capita (USD): 6,193 6,321 6,973GDP growth (%): 6.1 3.5 5.0Fiscal Balance (% of GDP): 1.7 -1.0 -1.0Public Debt (% of GDP): 20.7 20.7 20.5Inflation (%): 3.3 2.9 2.5Current Account (% of GDP): -2.9 -3.9 -3.1External Debt (% of GDP): 29.6 32.8 31.5

GDP increased at the slowest rate in five years in 2014. Economic activity was primarily weighed down by falling exports. Weak global demand and low prices for Peru’s commodity exports continue to exert pressure on the external sector. In February, exports contracted at the fastest rate in nearly six years and the trade balance hit a record deficit. Meanwhile, business confidence fell into pessimistic territory in March, which suggests that investment growth will continue to be weak in the near term. The government is attempting to boost growth with countercyclical fiscal spending and reforms to promote investment, although it remains to be seen if this will fuel momentum. President Ollanta Humala’s popularity has declined in tandem with the economy, while political wrangling and corruption scandals are limiting the government’s ability to turn things around. Although the current situation seems bleak relative to the commodity-fueled bonanza of just a few years ago, Peru is in better shape than many of its regional peers.

The economy is expected to accelerate in 2015 compared to 2014, although this depends largely on how much global demand recovers. LatinFocus Consensus Forecast panelists expect the economy to grow 3.5% this year, which is down 0.6 percentage points from last month’s projection. In 2016, panelists see the economy growing 4.6%.

Inflation increased from 2.8% in February to 3.0% in March. The Central Bank kept the reference rate at 3.25% at its 9 April meeting. Panelists project year-end inflation of 2.7% for 2015 and of 2.6% for 2016.

Economic Activity | variation in %

Note: Year-on-year changes of economic activity and annual average growth rate in %.Source: Peru National Statistical Institute (INEI) and FocusEconomics calculations.

0.0

3.0

6.0

9.0

Feb-13 Aug-13 Feb-14 Aug-14 Feb-15

Year-on-year

Annual average

%

FOCUSECONOMICS Peru

LatinFocus Consensus Forecast | 3

April 2015

OUTLOOK | Business confidence falls into pessimistic territory in MarchBusiness confidence came in at 49.4 points in March, according to the Central Bank’s business confidence indicator. The result was a deterioration compared to the 50.2 points registered in February and marked the lowest reading since August of last year. Business confidence is now below the 50-point threshold that separates optimistic from pessimistic territory.

Businesses had lower expectations not only for the economy as a whole in the next three months but also regarding their sectors. There was only a negligible improvement in the short-term outlook for their businesses in particular. Expectations for product demand were also down in March, whereas plans for new hiring in the coming three months were unchanged. Businesses’ expectations for the economy in the coming 12 months deteriorated significantly.

LatinFocus Consensus Forecast panelists expect fixed investment to grow 2.0% in 2015, which is down 0.9 percentage points from last month’s forecast. For 2016, panel participants see investment growing 4.1%.

OUTLOOK | Consumer confidence unchanged in MarchIn March, the consumer confidence indicator published by APOYO Consultoria remained at February’s 53 points. The index is still just above the 50-point threshold that separates optimistic from pessimistic territory. The survey report emphasized that March’s result equalled the average for the index in 2014.

Household’s views regarding their current and expected economic situations were unchanged. Perceptions regarding conditions for finding employment and price stability did not register important changes either. Optimism regarding the overall economy increased only slight among households in the higher-income brackets, likely driven by a recent reduction in income taxes and an improvement in the skilled labor market. Meanwhile, optimism levels among the low-income group were unchanged.

LatinFocus Consensus Forecast panelists expect total consumption to expand 4.0% in 2015, which is down 0.4 percentage points from last month’s estimate. For 2016, panelists expect total consumption to grow 4.3%.

MONETARY SECTOR | Inflation increases in MarchConsumer prices for Metropolitan Lima in March increased 0.76% over the previous month, which followed the 0.30% rise registered in February. The result overshot market expectations of a 0.60% increase. The result was broad-based, as all eight components of the index gained ground in March. The largest increase was recorded in the education category, followed by transport and communication.

Annual headline inflation picked up from 2.8% in February to 3.0% in March. Consequently, inflation held within the upper limit of the Central Bank’s target of 2.0%, plus/minus 1.0 percentage point.

In its January quarterly inflation report, the Central Bank indicated that it expects inflation between 1.5% and 2.5% in both 2015 and 2016. LatinFocus Consensus Forecast panelists expect inflation to end 2015 at 2.7%, which is up 0.1 percentage points from last month’s projection. For 2016, the panel expects inflation of 2.6%.

Consumer Confidence Index

Note: Consumer Confidence Index (INDICCA). Values above 50 indicate an optimistic assesment in consumer sentiment while values below 50 indicate a pessimistic assesment.Source: APOYO Consultoria.

45

50

55

60

Mar-12 Sep-12 Mar-13 Sep-13 Mar-14 Sep-14 Mar-15

Business Confidence Index

Note: Business Confidence Index (Indice de Confianza Empresarial).Values above 50 indicate an optimistic assesment in business climate while values below 50 indicate a pessimistic assesment.Source: Peru Central Bank (BCRP).

40

50

60

70

Mar-12 Sep-12 Mar-13 Sep-13 Mar-14 Sep-14 Mar-15

Inflation | Consumer Price Index

Note: Month-on-month and year-on-year changes of consumer price index in %.Source: Peru National Statistical Institute (INEI).

2.0

2.5

3.0

3.5

4.0

-0.4

0.0

0.4

0.8

1.2

Mar-13 Sep-13 Mar-14 Sep-14 Mar-15

Month-on-month (left scale)

Year-on-year (right scale)

%%

FOCUSECONOMICS Peru

LatinFocus Consensus Forecast | 4

April 2015

MONETARY SECTOR | Central Bank keeps reference interest rate at 3.25% in April, as expectedThe Central Bank decided to maintain the reference rate at 3.25% at its 9 April monetary policy meeting, as the majority of market analysts had expected. The Bank cut the rate from 3.50% in January in an attempt to counter an ongoing loss of momentum in the economy as the mining export sector struggles with low global demand and prices. Despite sluggish growth, concerns over inflation and a weak currency likely deterred the Bank from cutting its reference rate this month.

As in previous meetings, the Central Bank stated that the Peruvian economy is still performing below potential. Newly-released data and forward-looking indicators show continued weakness in the economy. In terms of price developments, annual inflation increased from 2.8% in February to 3.0% in March, thus pushing to the upper limit of the bank’s target range of 1.0%–3.0%. Monetary authorities see inflation converging toward 2.0% in 2015.

The Bank did reduce the average reserve requirement ratio for local currency deposits from 8.0% to 7.5%. The Bank has been slowly lowering the requirement during the past months. The reductions have been implemented to support the expansion of credit in local currency with the aim of reducing the degree of dollarization in domestic financial markets and to boost economic activity amid declining mineral exports.

Despite the decision to hold the reference rate, the Bank signaled that it is prepared to take measures if inflation veers from the expected course. The next monetary policy meeting is scheduled for 14 May.

LatinFocus Consensus Forecast panelists expect an average monetary policy rate of 3.14% at the end of this year. For 2016, the panel projects an average rate of 3.74% at the end of the year.

MONETARY SECTOR | Peruvian sol continues to slide despite ongoing Central Bank operationsThe Peruvian sol (PEN) continues to lose value against the dollar. On 15 April, the sol traded at 3.12 PEN per USD, which was a sharp 12.3% weaker than on the same day last year. The sol has slipped 4.4% against the dollar so far this year and now stands at its weakest level relative to the greenback in almost six years.

The depreciation of the sol in the past several months coincides with ongoing weakness in the Peruvian economy. Moreover, the slide also reflects falling commodity prices and markets’ expectation of a full normalization of monetary policy in the United States later this year. These external factors are decreasing demand for emerging market assets and currencies, such as the Peruvian sol.

The Peruvian Central Bank has responded to the depreciation through repeated interventions in the foreign exchange market. The Bank continues to sell U.S. dollars in the local market several times per week in an attempt to prop up the sliding sol. In its latest moves, the Bank sold USD 11 million and USD 177 million on 10 and 13 April respectively. Although these sums are smaller than previous interventions, the Bank has sold more than USD 2.8 billion so far this year. The Bank has been active through other channels, including credit swaps and repurchase agreements. The Bank has also reduced local currency bank reserve requirements to counteract the high local demand for dollars and increased liquidity in domestic currency.

Exchange Rate | PEN per USD

Note: Daily spot exchange rate of Peruvian sol (PEN) against U.S. dollar (USD).Source: Thomson Reuters.

2.50

2.75

3.00

3.25

Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 Jul-14 Jan-15

Monetary Policy Rate | in %

Note: Central Bank Reference Rate in %.Source: Peru Central Bank (BCRP).

1.0

2.0

3.0

4.0

5.0

Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 Jul-14 Jan-15

%

FOCUSECONOMICS Peru

LatinFocus Consensus Forecast | 5

April 2015

LatinFocus Consensus Forecast panelists expect the sol to end 2015 at 3.18 PEN per USD. For 2016, the panel sees the sol trading at 3.25 PEN per USD.

EXTERNAL SECTOR | Exports fall at staggering rate and trade balance registers another deficit in February In February, the trade balance registered a USD 245 million deficit, which contrasted the USD 361 million surplus observed in the same month of last year. February’s deficit was smaller than the USD 337 million shortfall registered in January.

Exports suffered another significant drop in February, contracting 22.9% over the same month of last year (January: -11.3% year-on-year). This marked the biggest contraction in nearly six years. Exports have posted an annual expansion in only two months during the past two years. Meanwhile, imports fell 5.3% in February, which was up from the 13.0% contraction in January.

In the 12 months up to February, the trade balance posted a deficit of USD 2.0 billion. The trade balance peaked at a record-high surplus of USD 9.8 billion in February 2012. It has narrowed almost uninterruptedly since then and shifted to deficit in December 2013. This trend has been driven by falling global demand and decreasing prices for traditional Peruvian exports, such as copper, silver and natural gas. The increase in import volumes has also affected the trade balance negatively.

LatinFocus Consensus Forecast panelists see exports contracting 2.8% in 2015. For 2016, the panel sees overseas sales expanding 7.7%.

Merchandise Trade

Note: 12-month sum of trade balance in USD billion and annual variation of the12-month sum of exports and imports in %.Source: Peru Central Bank (BCRP).

-15

0

15

30

-5

0

5

10

Feb-12 Aug-12 Feb-13 Aug-13 Feb-14 Aug-14 Feb-15

Trade Balance (USD bn, left scale)Exports (yoy, right scale)Imports (yoy, right scale)

%

FOCUSECONOMICS Peru

LatinFocus Consensus Forecast | 6

April 2015

Economic Indicators | 2010 - 2019

Annual Data 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019Real Sector Population (million) 29.6 30.0 30.5 30.9 31.4 31.9 32.4 32.9 33.4 33.9GDP per capita (USD) 5,029 5,705 6,318 6,557 6,468 6,184 6,311 6,593 6,965 7,362GDP (USD bn) 149 171 193 203 203 197 204 217 233 250GDP (PEN bn) 420 470 508 547 576 613 657 706 759 816Economic Growth (Nominal GDP, ann. var. in %) 15.0 12.0 8.2 7.6 5.3 6.4 7.1 7.5 7.5 7.5Economic Growth (GDP, annual var. in %) 8.5 6.5 6.0 5.8 2.4 3.5 4.6 4.9 5.0 5.0Domestic Demand (annual var. in %) 14.9 7.7 7.4 7.4 2.0 3.2 4.3 4.7 4.7 5.1Total Consumption (annual var. in %) 8.2 5.8 6.4 5.5 4.5 4.0 4.3 4.9 4.9 5.1Fixed Investment (annual var. in %) 23.1 6.0 16.2 7.6 -2.0 2.0 4.1 4.3 4.3 4.3Manufacturing (annual var. in %) 10.8 8.6 1.5 5.7 -3.3 1.2 3.6 4.4 4.7 4.7Commerce (annual var. in %) 12.5 8.9 7.2 5.9 4.4 3.8 4.3 4.6 5.0 5.3Unemployment (% of active population, aop) 7.9 7.7 6.8 6.0 5.9 6.2 6.2 5.8 5.7 5.6Fiscal Balance (% of GDP) -0.2 2.0 2.3 0.9 -0.1 -1.6 -1.3 -0.9 -1.1 -1.0Public Debt (% of GDP) 24.3 22.1 20.4 19.6 20.1 21.0 21.2 20.7 20.5 20.4Monetary and Financial Sector Money (annual variation of M2 in %) 33.8 13.7 25.3 5.9 6.7 - - - - -Inflation (CPI, annual var. in %, eop) 2.1 4.7 2.7 2.9 3.2 2.7 2.6 2.6 2.5 2.4Inflation (CPI, annual var. in %, aop) 1.5 3.4 3.7 2.8 3.3 2.9 2.6 2.6 2.5 2.5Inflation (Core, annual variation in %, eop) 2.1 3.7 3.3 3.7 3.3 - - - - -Inflation (WPI, annual variation in %, eop) 1.8 6.3 1.8 0.4 1.8 - - - - -Monetary Policy Rate (%, eop) 3.00 4.25 4.25 4.00 3.50 3.14 3.74 3.91 4.09 4.17Stock Market (variation of IGBVL in %) 66.4 -16.7 5.9 -23.6 -6.1 - - - - -Exchange Rate (PEN per USD, eop) 2.81 2.70 2.55 2.80 2.99 3.18 3.25 3.26 3.26 3.27Exchange Rate (PEN per USD, aop) 2.82 2.75 2.64 2.70 2.84 3.11 3.21 3.25 3.26 3.27External Sector Current Account Balance (% of GDP) -2.4 -1.9 -2.7 -4.2 -4.0 -4.1 -3.7 -3.2 -3.1 -3.1Current Account Balance (USD bn) -3.5 -3.2 -5.2 -8.5 -8.0 -8.0 -7.5 -6.9 -7.3 -7.9Trade Balance (USD bn) 7.0 9.2 6.3 0.6 -1.3 -2.2 -1.1 -1.2 -1.5 -1.5Exports (USD bn) 35.8 46.4 47.4 42.9 39.5 38.4 41.4 44.6 48.4 53.1Imports (USD bn) 28.8 37.2 41.1 42.2 40.8 40.6 42.5 45.7 49.9 54.6Exports (annual variation in %) 32.1 29.6 2.2 -9.5 -7.9 -2.8 7.7 7.7 8.6 9.7Imports (annual variation in %) 37.1 29.2 10.5 2.7 -3.3 -0.4 4.5 7.7 9.2 9.3International Reserves (USD bn) 44.1 48.8 64.0 65.7 62.3 61.1 62.0 63.4 67.7 70.7International Reserves (months of imports) 18.4 15.7 18.7 18.7 18.3 18.1 17.5 16.6 16.3 15.5External Debt (USD bn) 43.7 48.1 59.4 60.8 64.4 65.1 68.9 71.2 73.5 75.5External Debt (% of GDP) 29.4 28.1 30.8 30.0 31.7 33.0 33.7 32.8 31.6 30.2 Quarterly Data Q3 14 Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16 Q4 16Economic Growth (GDP, annual var. in %) 1.8 1.0 2.1 3.4 4.2 4.7 4.4 4.5 4.6 5.0Economic Growth (GDP, qoq variation in %) 0.4 0.4 - - - - - - - -Total Consumption (annual var. in %) 4.6 3.5 4.0 3.9 4.1 4.0 4.2 4.3 4.5 4.6Fixed Investment (annual var. in %) -3.6 -3.3 -1.0 1.2 3.0 4.1 4.1 4.1 4.1 4.2Manufacturing (annual var. in %) -3.4 -9.9 -0.4 0.3 1.0 2.3 2.9 3.0 3.0 3.6Commerce (annual var. in %) 4.0 4.2 3.3 3.9 4.2 4.1 3.9 4.4 4.2 4.4Unemployment (% of active population, aop) 5.6 5.6 6.4 6.3 6.4 5.8 6.5 6.4 6.2 6.2Inflation (CPI, annual var. in %, eop) 2.7 3.2 3.0 2.8 2.9 2.7 2.6 2.5 2.5 2.6Monetary Policy Rate (%, eop) 3.50 3.50 3.25 3.05 3.09 3.14 3.25 3.25 3.39 3.74Exchange Rate (PEN per USD, eop) 2.89 2.99 3.09 3.11 3.12 3.18 3.19 3.22 3.22 3.25Exchange Rate (PEN per USD, aop) 2.82 2.93 3.06 3.10 3.12 3.15 3.19 3.21 3.22 3.23Current Account Balance (% of GDP) -3.1 -2.5 -4.0 -3.9 -3.7 -3.9 -3.6 -3.5 -3.4 -3.5Current Account Balance (USD bn) -1.6 -1.3 -1.8 -1.9 -1.9 -2.0 -1.7 -1.7 -1.7 -1.9Trade Balance (USD bn) -0.2 0.0 -0.7 -0.5 -0.7 -0.6 -0.5 -0.3 -0.2 -0.1Exports (USD bn) 10.4 9.9 9.3 9.7 9.6 9.4 9.5 9.8 9.9 9.9Imports (USD bn) 10.5 9.9 10.0 10.2 10.3 10.0 10.0 10.1 10.0 10.0 Monthly Data Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15Economic Activity (IMAE, annual var. in %) 0.4 1.5 1.2 2.7 2.4 0.2 0.5 1.7 0.9 -Manufacturing (annual variation in %) -8.6 -5.1 -3.0 -2.2 -3.3 -13.9 -12.4 -5.5 -4.3 -Unemployment (% of active population) 5.9 5.7 6.1 5.1 5.9 5.3 5.5 8.3 6.9 -Consumer Confid. Index (50-point threshold) 53 56 53 54 53 52 57 NA 53 53Business Confid. Index (50-point threshold) 49.7 50.6 48.5 54.0 53.0 55.3 53.1 54.2 50.2 49.4Inflation (CPI, mom variation in %) 0.16 0.43 -0.09 0.16 0.38 -0.15 0.23 0.17 0.30 0.76Inflation (CPI, annual variation in %) 3.4 3.3 2.7 2.7 3.1 3.2 3.2 3.1 2.8 3.0Exchange Rate (PEN per USD, eop) 2.80 2.80 2.84 2.89 2.92 2.92 2.99 3.06 3.09 3.09Exports (annual variation in %) -3.2 -2.3 -13.4 -7.1 -8.5 -8.0 -12.5 -11.3 -22.9 -

FOCUSECONOMICS Peru

LatinFocus Consensus Forecast | 7

April 2015

0%

10%

20%

30%

40%

50%

< 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 > 5.5

Real Sector | Gross Domestic Product

1 | Real GDP | 2000-2019 | var. in %

3 | GDP 2015 | evolution of forecasts

2 | Real GDP | Q1 12-Q4 16 | var. in %. Real GDP growth in %

4 | GDP 2016 | evolution of forecasts

Notes and sources

General: Long-term chart period from 2000 to 2019 unless otherwise stated. All real sector data are from the National Statistical Institute (INEI, Instituto Nacional de Estadística e Informática del Perú). Forecasts based on LatinFocus Consensus Forecast. 1 GDP, annual variation in %. 2 Quarterly GDP (not seasonally adjusted), year-on-year variation in %. 3 GDP, evolution of 2015 forecasts during the last 18 months.4 GDP, evolution of 2016 forecasts during the last 18 months.5 GDP, panelist distribution of 2015 forecasts. Concentration of panelists in forecast interval in

%. Higher columns with darker colors represent a larger number of panelists.

Individual Forecasts 2015 2016ADEX 2.7 3.8APOYO Consultoría 4.0 5.5Banco Bradesco 2.6 4.9Banco de Crédito del Perú 3.5 -Barclays Capital 3.5 4.6BBVA Banco Continental 4.8 5.6BMI Research 3.8 4.0BofA Merrill Lynch 2.1 3.0BTG Pactual 3.5 5.0Capital Economics 4.0 4.0Citigroup Global Mkts 3.8 4.6Credicorp Capital 3.5 -Credit Suisse 4.1 5.6Deutsche Bank 3.3 4.5EIU 4.3 5.3Frontier Strategy Group 3.4 4.2Goldman Sachs 3.4 4.2HSBC 3.8 4.3IEDEP - CCL 3.4 4.5IPE 3.5 4.8Itaú BBA 3.5 4.5JPMorgan 3.2 4.3Macroconsult 2.9 3.8Oxford Economics 3.5 5.0Rimac Seguros 3.4 5.0Santander 4.4 5.0Scotiabank 3.1 4.1Thorne & Associates 3.5 4.0UBS 4.0 4.8SummaryMinimum 2.1 3.0Maximum 4.8 5.6Median 3.5 4.5Consensus 3.5 4.6History30 days ago 4.1 4.960 days ago 4.2 5.090 days ago 4.5 5.1Additional ForecastsCentral Bank (Jan. 2015) 4.8 6.0IMF (Apr. 2015) 3.8 5.0World Bank (Jan. 2015) 4.8 5.5

-5

0

5

10

2000 2005 2010 2015

PeruLatin AmericaWorld

-3

0

3

6

9

Q1 12 Q1 13 Q1 14 Q1 15 Q1 16

PeruLatin AmericaWorld

2

4

6

8

Nov Feb May Aug Nov Feb

MaximumConsensusMinimum

2

3

4

5

6

7

Nov Feb May Aug Nov Feb

MaximumConsensusMinimum

5 | GDP 2015 | Panelist Distribution

FOCUSECONOMICS Peru

LatinFocus Consensus Forecast | 8

April 2015

Real Sector | Additional forecasts

9 | Investment | evol. of forecasts

0

3

6

9

Nov Feb May Aug Nov Feb

2015 2016

8 | Investment | variation in %

-20

0

20

40

2000 2005 2010 2015

PeruLatin America

7 | Consumption | evolution of fcst

4.0

4.5

5.0

5.5

6.0

Nov Feb May Aug Nov Feb

2015 2016

6 | Consumption | variation in %

0

2

4

6

8

10

2000 2005 2010 2015

PeruLatin America

Consumption Investmentvariation in % variation in %

Individual Forecasts 2015 2016 2015 2016ADEX 3.8 4.7 - -APOYO Consultoría 4.5 4.6 1.6 3.6Banco Bradesco - - - -Banco de Crédito del Perú 3.9 - 1.6 -Barclays Capital 4.4 4.2 2.0 3.7BBVA Banco Continental 4.6 4.9 3.9 4.5BMI Research 4.6 4.8 2.0 3.2BofA Merrill Lynch 2.0 2.7 - -BTG Pactual 3.9 4.3 1.2 4.3Capital Economics 3.0 3.0 3.0 3.0Citigroup Global Mkts 4.4 4.4 - -Credicorp Capital 3.9 - 1.6 -Credit Suisse 5.0 5.0 2.2 6.8Deutsche Bank 3.8 4.2 3.0 4.5EIU 4.2 4.5 4.0 6.6Frontier Strategy Group - - - -Goldman Sachs - - - -HSBC 4.2 4.5 0.7 3.7IEDEP - CCL 4.6 - 3.8 -IPE 4.3 4.3 2.2 4.9Itaú BBA - - - -JPMorgan - - - -Macroconsult 2.8 3.1 -1.3 3.9Oxford Economics - - - -Rimac Seguros 3.9 4.7 1.0 5.4Santander 5.1 5.2 1.9 2.9Scotiabank 3.9 4.0 0.7 1.0Thorne & Associates - - - -UBS - - - -SummaryMinimum 2.0 2.7 -1.3 1.0Maximum 5.1 5.2 4.0 6.8Median 4.2 4.5 2.0 3.9Consensus 4.0 4.3 2.0 4.1History30 days ago 4.4 4.6 2.9 4.960 days ago 4.4 4.7 3.2 4.790 days ago 4.6 4.9 3.5 5.0

Notes and sources

Long-term chart period from 2000 to 2019 unless otherwise stated. All real sector data are from the National Statistical Institute (INEI, Instituto Nacional de Estadística e Informática del Perú). Forecasts based on LatinFocus Consensus Forecast.6 Total consumption, annual variation in %. 7 Total consumption, change in 2015 and 2016 forecasts during the last 18 months.8 Gross fixed investment, annual variation in %.9 Gross fixed investment, change in 2015 and 2016 forecasts during the last 18 months.

Consumption and Investment

FOCUSECONOMICS Peru

LatinFocus Consensus Forecast | 9

April 2015

Real Sector | Additional Forecasts

Unemployment Fiscal Balancevariation in % % of active pop. % of GDP

Individual Forecasts 2015 2016 2015 2016 2015 2016ADEX -2.2 3.1 6.7 5.9 -1.4 -0.2APOYO Consultoría 1.3 3.3 - - -1.7 -1.5Banco Bradesco - - - - - -Banco de Crédito del Perú 1.0 - - - -1.5 -Barclays Capital - - - - -0.2 -0.3BBVA Banco Continental - - - - -1.3 -1.5BMI Research - - 5.8 6.1 -1.2 -1.3BofA Merrill Lynch - - 6.1 6.3 -1.0 -0.9BTG Pactual - - 6.2 6.0 -2.0 -2.2Capital Economics - - 6.5 7.0 -2.0 -1.7Citigroup Global Mkts - - 5.9 6.5 -2.8 -1.8Credicorp Capital 1.0 - - - -1.5 -Credit Suisse - - 6.5 6.5 -2.0 -0.1Deutsche Bank - - - - - -EIU 4.1 5.8 6.1 5.9 -0.5 0.1Frontier Strategy Group - - 6.4 5.6 - -Goldman Sachs - - - - -2.1 -1.3HSBC 4.1 4.9 - - -2.2 -2.3IEDEP - CCL 2.1 - 6.1 - -2.0 -IPE - - - - -2.0 -2.0Itaú BBA - - 6.3 6.1 -2.2 -2.1JPMorgan - - - - -2.0 -1.0Macroconsult -0.4 2.0 - - -1.3 -1.8Oxford Economics - - - - -1.8 -1.8Rimac Seguros 1.2 3.3 - - -1.5 -1.6Santander - - 6.5 6.3 -2.0 -1.0Scotiabank 2.0 2.0 - - -1.8 -1.7Thorne & Associates -3.7 - - - - -UBS 4.0 4.7 6.1 6.0 -1.2 -1.4SummaryMinimum -3.7 2.0 5.8 5.6 -2.8 -2.3Maximum 4.1 5.8 6.7 7.0 -0.2 0.1Median 1.3 3.3 6.2 6.1 -1.8 -1.5Consensus 1.2 3.6 6.2 6.2 -1.6 -1.3History30 days ago 2.6 3.9 6.2 6.2 -1.6 -1.260 days ago 2.6 3.9 6.1 6.1 -1.4 -1.090 days ago 3.6 4.8 6.1 6.0 -1.2 -0.8

Manufacturing

Notes and sources

Long-term chart period from 2000 to 2019 unless otherwise stated. All real sector data are from the National Statistical Institute (INEI, Instituto Nacional de Estadística e Informática del Perú) and the Central Bank (BCRP, Banco Central de Reserva del Perú). See below for details. Forecasts based on LatinFocus Consensus Forecast.10 Manufacturing, annual variation in %. Source: INEI.11 Manufacturing, evolution of 2015 and 2016 forecasts during the last 18 months.12 Unemployment, % of active population. Source: INEI.13 Balance of non-financial public sector as % of GDP. Source: BCRP.

Manufacturing, Unemployment and Fiscal Balance

13 | Fiscal Balance | % of GDP

-8.0

-4.0

0.0

4.0

2000 2005 2010 2015

Peru

Latin America

12 | Unemployment | % of active pop.

5

6

7

8

9

10

2000 2005 2010 2015

PeruLatin America

11 | Industry | evol. of forecasts

0

2

4

6

Nov Feb May Aug Nov Feb

2015 2016

10 | Industry | variation in %

-10

0

10

20

2000 2005 2010 2015

PeruLatin America

FOCUSECONOMICS Peru

LatinFocus Consensus Forecast | 10

April 2015

0%

20%

40%

60%

< 1.6 2.0 2.4 2.8 3.2 3.6 4.0 4.4 > 4.4

Monetary Sector | Inflation

14 | Inflation | 2000 - 2019 | in %

16 | Inflation 2015 | evolution of fcst

15 | Inflation | Q1 12-Q4 16 | in %

17 | Inflation 2016 | evolution of fcst

Notes and sources

Long-term chart period from 2000 to 2019 unless otherwise stated. All monetary sector data are from the National Statistical Institute (INEI, Instituto Nacional de Estadística e Informática del Perú). Forecasts based on LatinFocus Consensus Forecast.14 Inflation, annual variation of consumer price index (CPI) in % (eop).15 Quarterly inflation, annual variation of consumer price index (CPI) in % (eop).16 Inflation, evolution of 2015 inflation forecasts during the last 18 months.17 Inflation, evolution of 2016 inflation forecasts during the last 18 months.18 Inflation, panelist distribution of 2015 forecasts. Concentration of panelists in forecast interval

in %. Higher columns with darker colors represent a larger number of panelists.

Individual Forecasts 2015 2016ADEX 2.7 2.4APOYO Consultoría 2.0 2.0Banco Bradesco 3.1 2.8Banco de Crédito del Perú 2.5 -Barclays Capital 2.8 2.5BBVA Banco Continental 2.9 2.5BMI Research 2.5 2.8BofA Merrill Lynch 2.9 3.0BTG Pactual 2.5 2.5Capital Economics 3.6 3.2Citigroup Global Mkts 2.8 2.6Credicorp Capital 2.5 -Credit Suisse 2.3 2.5Deutsche Bank 2.5 2.9EIU 2.7 3.2Frontier Strategy Group 2.7 3.0Goldman Sachs 3.0 3.0HSBC 2.6 2.4IEDEP - CCL 3.1 2.9IPE 2.5 2.5Itaú BBA 2.3 2.0JPMorgan 2.2 2.5Macroconsult 3.0 3.0Oxford Economics 3.1 2.8Rimac Seguros 2.5 2.0Santander 2.5 2.0Scotiabank 2.9 2.9Thorne & Associates 2.0 2.5UBS 2.8 2.7SummaryMinimum 2.0 2.0Maximum 3.6 3.2Median 2.7 2.6Consensus 2.7 2.6History30 days ago 2.6 2.560 days ago 2.6 2.690 days ago 2.7 2.6Additional ForecastsCentral Bank (Jan. 2015) 1.5-2.5 1.5-2.5IMF (Apr. 2015) 2.2 2.0

18 | Inflation 2015 | Panelist Distribution

Inflation | annual variation of consumer price index in %

1

2

3

4

Nov Feb May Aug Nov Feb

MaximumConsensusMinimum

-5

0

5

10

15

20

2000 2005 2010 2015

PeruLatin America

1

2

3

4

5

Nov Feb May Aug Nov Feb

MaximumConsensusMinimum

0

5

10

15

20

Q1 12 Q1 13 Q1 14 Q1 15 Q1 16

PeruLatin America

FOCUSECONOMICS Peru

LatinFocus Consensus Forecast | 11

April 2015

0%

10%

20%

30%

40%

50%

< 2.25 2.50 2.75 3.00 3.25 3.50 3.75 4.00 > 4.00

Monetary Sector | Interest Rate

19 | Interest Rate | 2000 - 2019 | in %

21 | Int. Rate 2015 | evolution of fcst

20 | Interest Rate | Q1 12-Q4 16 | in %

22 | Int. Rate 2016 | evolution of fcst

Notes and sources

Long-term chart period from 2000 to 2019 unless otherwise stated. All monetary sector data are from the Central Bank (BCRP, Banco Central de Reserva del Perú). Forecasts based on LatinFocus Consensus Forecast.19 Interest rate, Central Bank Reference Rate in % (eop). 20 Quarterly interest rate, Central Bank Reference Rate in % (eop). 21 Interest rate, evolution of 2015 forecasts during the last 18 months.22 Interest rate, evolution of 2016 forecasts during the last 18 months.23 Interest rate, panelist distribution of 2015 forecasts. Concentration of panelists in forecast

interval in %. Higher columns with darker colors represent a larger number of panelists.

Individual Forecasts 2015 2016ADEX 3.00 3.25APOYO Consultoría - -Banco Bradesco - -Banco de Crédito del Perú 3.00 -Barclays Capital 3.25 4.50BBVA Banco Continental 3.00 3.25BMI Research 3.00 3.50BofA Merrill Lynch 2.75 4.00BTG Pactual 3.25 3.75Capital Economics 3.25 3.75Citigroup Global Mkts 3.25 4.00Credicorp Capital 3.00 -Credit Suisse 3.00 4.00Deutsche Bank 3.75 4.50EIU - -Frontier Strategy Group - -Goldman Sachs 3.00 4.25HSBC 3.00 3.00IEDEP - CCL 3.25 -IPE - -Itaú BBA 3.25 3.25JPMorgan 3.25 -Macroconsult 3.25 3.25Oxford Economics - -Rimac Seguros 3.50 4.00Santander 3.00 3.50Scotiabank 3.25 3.50Thorne & Associates 3.00 4.00UBS 3.00 3.75SummaryMinimum 2.75 3.00Maximum 3.75 4.50Median 3.00 3.75Consensus 3.14 3.74History30 days ago 3.14 3.7060 days ago 3.29 3.7790 days ago 3.51 3.98

23 | Interest Rate 2015 | Panelist Distribution

Interest Rate | Policy Rate

2

3

4

5

6

Nov Feb May Aug Nov Feb

MaximumConsensusMinimum

0

5

10

15

20

2000 2005 2010 2015

PeruLatin America

2

3

4

5

6

7

Nov Feb May Aug Nov Feb

MaximumConsensusMinimum

2

4

6

8

10

Q1 12 Q1 13 Q1 14 Q1 15 Q1 16

PeruLatin America

FOCUSECONOMICS Peru

LatinFocus Consensus Forecast | 12

April 2015

0%

20%

40%

60%

80%

< 2.80 2.90 3.00 3.10 3.20 3.30 3.40 3.50 > 3.50

Monetary Sector | Exchange Rate

24 | Exchange Rate | PEN per USD

26 | PEN per USD 2015 | evol. of fcst

25 | Exchange Rate | PEN per USD

27 | PEN per USD 2016 | evol. of fcst

Notes and sources

Long-term chart period from 2000 to 2019 unless otherwise stated. All monetary sector data are from Thomson Reuters. Forecasts based on LatinFocus Consensus Forecast.24 Exchange rate, PEN per USD (eop).25 Quarterly exchange rate, PEN per USD (eop).26 Exchange rate, evolution of 2015 forecast during the last 18 months.37 Exchange rate, evolution of 2016 forecast during the last 18 months.28 Exchange rate, panelist distribution of 2015 forecasts. Concentration of panelists in forecast

interval in %. Higher columns with darker colors represent a larger number of panelists.

Individual Forecasts 2015 2016ADEX 3.20 3.33APOYO Consultoría 3.15 3.30Banco Bradesco - -Banco de Crédito del Perú 3.20 -Barclays Capital 3.20 3.30BBVA Banco Continental 3.25 3.25BMI Research 3.20 3.21BofA Merrill Lynch 3.20 3.40BTG Pactual 3.25 3.30Capital Economics 3.10 3.10Citigroup Global Mkts 3.05 3.10Credicorp Capital 3.20 -Credit Suisse 3.25 3.15Deutsche Bank 3.20 3.26EIU 3.08 3.14Frontier Strategy Group - -Goldman Sachs 3.20 3.30HSBC 3.35 3.50IEDEP - CCL 3.14 -IPE 3.17 3.18Itaú BBA 3.15 3.25JPMorgan 3.30 3.30Macroconsult 3.20 3.25Oxford Economics 3.05 3.17Rimac Seguros 3.15 3.20Santander 3.15 3.20Scotiabank 3.20 3.25Thorne & Associates 3.25 3.35UBS 3.15 3.20SummaryMinimum 3.05 3.10Maximum 3.35 3.50Median 3.20 3.25Consensus 3.18 3.25History30 days ago 3.15 3.2260 days ago 3.13 3.1990 days ago 3.09 3.15

28 | PEN per USD 2015 | Panelist Distribution

Exchange Rate | PEN per USD

2.0

2.5

3.0

3.5

4.0

Nov Feb May Aug Nov Feb

MaximumConsensusMinimum

2.4

2.8

3.2

3.6

2000 2005 2010 2015

2.0

2.5

3.0

3.5

4.0

Nov Feb May Aug Nov Feb

MaximumConsensusMinimum

2.4

2.6

2.8

3.0

3.2

3.4

Q1 12 Q1 13 Q1 14 Q1 15 Q1 16

FOCUSECONOMICS Peru

LatinFocus Consensus Forecast | 13

April 2015

External Sector | Current Account and Trade Balance

-3

-2

-1

0

1

2

Nov Feb May Aug Nov Feb

2015 2016

32 | Trade Balance | evol. of forecasts

-20

0

20

40

60

2000 2005 2010 2015

Trade BalanceImportsExports

31 | Trade Balance | USD bn

-6

-3

0

3

6

2000 2005 2010 2015

Peru

Latin America

29 | Current Account | % of GDP

-5.0

-4.5

-4.0

-3.5

-3.0

Nov Feb May Aug Nov Feb

2015 2016

30 | Current Account | evol. of fcst

Current Account and Trade BalanceCurrent Account Trade Balance

% of GDP USD bnIndividual Forecasts 2015 2016 2015 2016ADEX -3.8 -3.1 -2.3 -0.8APOYO Consultoría -4.1 -4.5 -2.0 -3.0Banco Bradesco - - - -Banco de Crédito del Perú -3.7 - -1.0 -Barclays Capital -4.0 -3.7 -1.6 -0.9BBVA Banco Continental -4.1 -4.0 - -BMI Research -4.0 -3.8 -0.9 -0.9BofA Merrill Lynch -3.4 -1.8 -2.5 0.1BTG Pactual -4.3 -3.9 -10.3 -0.5Capital Economics -4.5 -4.0 - -Citigroup Global Mkts -4.6 -5.9 - -Credicorp Capital -3.7 - -1.0 -Credit Suisse -4.7 -3.4 -1.8 -0.2Deutsche Bank -4.7 -4.7 -3.4 -2.6EIU -4.6 -4.2 -2.6 -1.9Frontier Strategy Group - - -3.5 -4.7Goldman Sachs -2.1 -1.2 2.5 4.2HSBC -5.5 -5.5 -4.4 -5.0IEDEP - CCL - - -4.5 -5.4IPE -3.3 -3.2 0.2 0.2Itaú BBA -4.0 -3.6 - -JPMorgan -4.0 -3.7 -2.2 -2.6Macroconsult -2.1 -1.3 1.7 3.1Oxford Economics -4.9 -5.0 -3.6 -3.3Rimac Seguros - - - -Santander -4.5 -3.5 -2.0 2.0Scotiabank -3.9 -2.9 -2.2 -0.1Thorne & Associates - - - -UBS -4.9 -4.0 -1.9 0.2SummaryMinimum -5.5 -5.9 -10.3 -5.4Maximum -2.1 -1.2 2.5 4.2Median -4.1 -3.8 -2.1 -0.9Consensus -4.1 -3.7 -2.2 -1.1History30 days ago -4.5 -3.8 -2.3 -1.260 days ago -4.7 -4.2 -2.6 -1.690 days ago -4.7 -4.0 -2.2 -0.5

Notes and sources

Long-term chart period from 2000 to 2019 unless otherwise stated. All external sector data are from the Central Bank (BCRP, Banco Central de Reserva del Perú). Forecasts based on LatinFocus Consensus Forecast.29 Current account balance as % of GDP. 30 Current account balance, evolution of 2015 and 2016 forecasts during the last 18 months.31 Trade balance, exports and imports, in USD. 32 Trade balance, evolution of 2015 and 2016 forecasts during the last 18 months.

FOCUSECONOMICS Peru

LatinFocus Consensus Forecast | 14

April 2015

External Sector | Exports and Imports

Exports and ImportsExports ImportsUSD bn USD bn

Individual Forecasts 2015 2016 2015 2016ADEX 36.2 38.2 38.5 39.0APOYO Consultoría 35.9 37.4 37.9 40.4Banco Bradesco - - - -Banco de Crédito del Perú 37.2 - 38.2 -Barclays Capital 38.3 40.3 39.9 41.2BBVA Banco Continental - - - -BMI Research 39.7 40.9 40.6 41.8BofA Merrill Lynch 39.7 42.3 42.2 42.2BTG Pactual 39.0 42.6 49.3 43.1Capital Economics - - - -Citigroup Global Mkts - - - -Credicorp Capital 37.2 - 38.2 -Credit Suisse 37.1 40.8 38.9 41.0Deutsche Bank 39.6 43.4 43.0 46.0EIU 40.4 44.2 43.0 46.1Frontier Strategy Group 39.4 39.5 42.9 44.2Goldman Sachs 41.9 44.5 39.4 40.4HSBC 37.8 40.5 42.2 45.5IEDEP - CCL 36.7 40.3 41.2 45.7IPE 38.5 41.2 38.3 41.0Itaú BBA - - - -JPMorgan 38.0 39.5 40.2 42.1Macroconsult 38.7 40.6 37.0 37.5Oxford Economics 35.7 38.6 39.3 41.9Rimac Seguros - - - -Santander 40.0 46.0 42.0 44.0Scotiabank 37.0 41.3 39.3 41.4Thorne & Associates - - - -UBS 40.8 44.8 42.6 44.6SummaryMinimum 35.7 37.4 37.0 37.5Maximum 41.9 46.0 49.3 46.1Median 38.4 40.9 40.0 42.0Consensus 38.4 41.4 40.6 42.5History30 days ago 38.4 42.1 40.7 43.360 days ago 38.4 41.8 41.0 43.490 days ago 40.3 44.3 42.5 44.9

Notes and sources

Long-term chart period from 2000 to 2019 unless otherwise stated. All external sector data are from the Central Bank (BCRP, Banco Central de Reserva del Perú). Forecasts based on LatinFocus Consensus Forecast.33 Exports, annual variation in %. 34 Exports, evolution of 2015 and 2016 forecasts during the last 18 months.35 Imports, annual variation in %. 36 Imports, evolution of 2015 and 2016 forecasts during the last 18 months.

40

45

50

55

60

Nov Feb May Aug Nov Feb

2015 2016

36 | Imports | evol. of forecasts

-40

-20

0

20

40

60

2000 2005 2010 2015

PeruLatin America

35 | Imports | variation in %

-40

-20

0

20

40

60

2000 2005 2010 2015

PeruLatin America

33 | Exports | variation in %

30

40

50

60

Nov Feb May Aug Nov Feb

2015 2016

34 | Exports | evolution of fcst

FOCUSECONOMICS Peru

LatinFocus Consensus Forecast | 15

April 2015

External Sector | Additional forecasts

55

60

65

70

Nov Feb May Aug Nov Feb

2015 2016

41 | External Debt | evol. of forecasts

0

20

40

60

2000 2005 2010 2015

Peru

Latin America

40 | External Debt | % of GDP

0

5

10

15

20

2000 2005 2010 2015

PeruLatin America

38 | Int. Reserves | months of imports

60

65

70

75

80

Nov Feb May Aug Nov Feb

2015 2016

39 | Int. Reserves | evolution of fcst

International Reserves and External DebtInt. Reserves External Debt

USD bn USD bn Individual Forecasts 2015 2016 2015 2016ADEX 59.8 57.8 66.4 68.4APOYO Consultoría - - - -Banco Bradesco - - - -Banco de Crédito del Perú 60.5 - - -Barclays Capital 59.4 58.1 65.9 66.9BBVA Banco Continental - - - -BMI Research 63.0 65.0 60.3 63.7BofA Merrill Lynch 52.3 55.3 64.1 64.2BTG Pactual - - - -Capital Economics - - - -Citigroup Global Mkts 64.0 68.3 - -Credicorp Capital 60.5 - - -Credit Suisse 62.1 66.9 67.0 69.7Deutsche Bank 62.7 64.2 59.8 65.5EIU 63.6 63.9 61.1 61.7Frontier Strategy Group - - - -Goldman Sachs 58.7 57.3 67.0 70.6HSBC 57.8 56.7 75.6 90.0IEDEP - CCL - - - -IPE 65.2 67.8 - -Itaú BBA 65.0 65.0 - -JPMorgan 62.1 61.1 61.5 63.0Macroconsult 60.3 59.2 - -Oxford Economics 59.2 61.0 66.1 73.5Rimac Seguros - - - -Santander 64.2 64.8 66.2 69.0Scotiabank 61.0 61.5 - -Thorne & Associates - - - -UBS - - - -SummaryMinimum 52.3 55.3 59.8 61.7Maximum 65.2 68.3 75.6 90.0Median 61.0 61.5 66.0 67.6Consensus 61.1 62.0 65.1 68.9History30 days ago 61.4 62.9 64.9 67.660 days ago 61.9 63.1 63.0 65.390 days ago 62.1 63.7 65.8 69.3

Notes and sources

Long-term chart period from 2000 to 2019 unless otherwise stated. All external sector data are from the Central Bank (BCRP, Banco Central de Reserva del Perú). Forecasts based on LatinFocus Consensus Forecast.38 International reserves, months of imports. 39 International reserves, evolution of 2015 and 2016 forecasts during the last 18 months.40 External debt as % of GDP. 41 External debt, evolution of 2015 and 2016 forecasts during the last 18 months.

FOCUSECONOMICS Peru

LatinFocus Consensus Forecast | 16

April 2015

Fact Sheet

Peru in the Region

Population | %-share in Latin America GDP | %-share in Latin America

Peru3.4%

Brazil36.0%

Mexico21.2%

Venezuela9.4%

Argentina8.9%

Other21.2%

Peru5.2%

Brazil33.6%

Mexico19.8%

Colombia7.9%

Argentina7.0%

Other26.5%

U.S.A.24.2%

EU-2710.5%

Other Asia ex-Japan

8.6%China13.8%

Other LatAm20.8%

Brazil6.2%

Ecuador5.1%

Other10.8%

U.S.A.14.0%

Switzerland11.1%

Canada7.5%

Japan5.7%

EU-2717.1%

Other Asia ex-Japan

5.8%

China17.1%

LatAm18.7%

Other2.9%

Other2.8%

Manufact. Products72.2%

Mineral Fuels14.8%

Food10.2%

Other1.2%

Manufact. Products14.1%

Ores & Metals50.6%

Mineral Fuels13.7%

Food20.4%

Trade Structure

Primary markets | share in %

Primary products | share in %

Economic Structure

GDP by Sector | share in % GDP by Expenditure | share in %

Exports

Exports

Imports

Imports

0

20

40

60

80

1002005-07 2008-10 2011-13

Net Exports

Investment

GovernmentConsumption

PrivateConsumption

0

20

40

60

80

1002004-06 2007-09 2010-12

Agriculture

Manufacturing

Other Industry

Services

General Data

Economic Infrastructure

Political Data

Long-term Foreign Currency Ratings

Strengths Weaknesses

• Large informal economy

• Succesfully contained inflation

. .

• Pragmatic approach to economic policy

• Strong international reserves position

• Pronounced socioeconomic inequalities• High dependence on commodity prices

Energy (2012) Primary Energy Production (trillion Btu): 1011Primary Energy Consumption (trillion Btu): 1093Electricity Generation (billion kW-h): 39.1Electricity Consumption (billion kW-h): 35.7Oil Supply (thousand bpd): 160Oil Consumption (thousand bpd): 172CO2 Emmissions (million metric tons): 53.6

Agency Rating OutlookMoody’s: A3 StableS&P: BBB+ StableFitch Ratings: BBB+ Stable

Telecommunication (2013) Telephones - main lines (per 100 inhabitants): 11.3Telephones - mobile cellular (per 100 inhabit.): 98Internet Users (per 100 inhabitants): 39.2Broadband Subscriptions (per 100 inhabitants): 5.2

Transportation (2013) Airports: 191Railways (km): 1,907Roadways (km): 140,672Waterways (km): 8,808Chief Ports: Callao, Paita, Matarani

Official name: Republic of PeruCapital: Lima (8.7m)Other cities: Arequipa (0.8m)

Trujillo (0.7m)Area (km2): 1,285,216Population (million, 2014 est.): 31.424Population density (per km2, 2014): 24.5Population growth rate (%, 2014 est.): 1.0Life expectancy (years, 2014 est.): 73.2Illiteracy rate (%, 2007): 7.1Language: Spanish, Quechua and

AymaraMeasures: Metric systemTime: GMT-5

President: Ollanta Moises Humala TassoLast elections: 10 April 2011Next elections: April 2016Central Bank President: Julio Velarde Flores

FOCUSECONOMICS

LatinFocus Consensus Forecast | 8

April 2015

Economic Release Calendar

Date Country Event21 April Argentina March Merchandise Trade22 April Brazil March Balance of Payments23 April Argentina April Consumer Confidence23 April Mexico February Economic Activity (IGAE)24 April Argentina February Economic Activity24 April Argentina March Industrial Production24 April Colombia Central Bank Meeting27 April Brazil April Consumer Confidence (**)27 April Mexico March Merchandise Trade29 April Brazil Central Bank Meeting30 April Brazil April Business Confidence (**)30 April Mexico Central Bank Meeting1 May Brazil April HSBC Manufacturing PMI1 May Chile April Copper Prices (**)1 May Peru April Consumer Prices4 May Mexico April IMEF Manufacturing PMI4 May Mexico April HSBC Manufacturing PMI4 May Mexico March Remittances5 May Chile March Economic Activity (IMACEC)5 May Colombia March Exports5 May Colombia April Consumer Prices (**)5 May Paraguay April Consumer Prices5 May Uruguay April Consumer Prices6 May Brazil March Industrial Production6 May Chile April Business Confidence (**)7 May Ecuador April Consumer Prices7 May Mexico April Consumer Prices7 May Venezuela April Car Sales (**)8 May Brazil April Consumer Prices8 May Chile April Consumer Prices8 May Mexico April Consumer Confidence8 May Paraguay March Economic Activity9 May Peru March Merchandise Trade (**)10 May Chile April Consumer Confidence (**)10 May Venezuela April Consumer Prices (**)11 May Peru April Business Confidence (**)12 May Ecuador March Economic Activity (**)12 May Mexico March Industrial Production12 May Uruguay March Industrial Production12 May Venezuela May OPEC Oil Market Report14 May Argentina April Consumer Prices14 May Brazil March Retail Sales14 May Chile Central Bank Meeting14 May Colombia March Industrial Production14 May Peru Central Bank Meeting

(*) Preliminary estimate. (**) Approximate date.

Calendar

FOCUSECONOMICS

LatinFocus Consensus Forecast | 9

April 2015

Economic Release Calendar

Date Country Event15 May Brazil March Economic Activity (**)15 May Colombia April Consumer Confidence15 May Peru March Economic Activity18 May Chile Q1 2015 National Accounts

(*) Preliminary estimate. (**) Approximate date.

FOCUSECONOMICS

LatinFocus Consensus Forecast | 10

April 2015

Notes and Statements

PUBLICATION NOTE

Consensus forecasts are mean averages of projections of economic forecasters surveyed by FocusEconomics for our monthly publication. Quarterly averages may not correspond to the annual figures due to different forecast panels.

The GDP-weighted averages for the regional aggregates refer to economies surveyed by FocusEconomics on a monthly basis, and include the following countries:

Latin America (23 countries): Argentina, Belize, Bolivia, Brazil, Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, El Salvador, Guatemala, Haiti, Honduras, Jamaica, Mexico, Nicaragua, Panama, Puerto Rico, Paraguay, Peru, Trinidad and Tobago, Uruguay and Venezuela.Andean Community (4 countries): Bolivia, Colombia, Ecuador and Peru.Central America and Caribbean (12 countries): Belize, Costa Rica, Dominican Republic, El Salvador, Guatemala, Haiti, Honduras, Nicaragua and Panama, Puerto Rico and Trinidad and Tobago.Mercosur (5 countries): Argentina, Brazil, Paraguay, Uruguay and Venezuela.

Weights are based on market exchange rates and reflect the latest forecasts on GDP growth, inflation and exchange rates.

COPYRIGHT NOTE

© Copyright 2015 FocusEconomics S.L. Duplication, reproduction, transmission, publication or redistribution in any form or by any means electronic, mechanical, or otherwise without prior written consent of FocusEconomics S.L. is strictly prohibited. Please cite source when quoting. All rights reserved under International Copyright Conventions.

The LatinFocus Consensus Forecast is a monthly publication of FocusEconomics. Communications to the Editor or FocusEconomics in general should be addressed as follows:

FocusEconomics S.L.Gran Via 657E-08010 BarcelonaSpaintel: +34 932 651 040fax: +34 932 650 804e-mail: [email protected] web: http://www.focus-economics.com

DISCLOSURE STATEMENT

The LatinFocus Consensus Forecast (“Forecast”) is based on information obtained from sources believed to be reliable. FocusEconomics and the participating panelists (“Information Providers”) do not guarantee that the information supplied in the Forecast is accurate, complete or timely. The Information Providers do not make any warranties with regard to the results obtained from the Forecast. The Information Providers are not responsible for any errors or omissions, or for any injuries or damages resulting from the use of this information, including incidental and consequential damages. Recipients should not regard the Forecast as a substitute for the exercise of their own judgement. The recommendations made in the Forecast may be unsuitable for investors depending on their specific investment objectives and financial position. The Forecast has been prepared solely for informational purposes and is not a solicitation of any transaction or an offer to enter into any transaction. Any opinions expressed in this report are subject to change without notice and the Information Providers are under no obligation to update the information contained herein.

Notes

ASIA PACIFIC |

CENTRAL AMERICA |& CARIBBEAN |

EASTERN EUROPE|

EURO AREA |

LATIN AMERICA|

MAJOR ECONOMIES |

MIDDLE EAST| & NORTH AFRICA|

NORDIC ECONOMIES|

Brunei, China, Cambodia, Hong Kong, India, Indonesia, Korea, Laos, Malaysia, Myanmar, Philippines, Singapore, Taiwan, Thailand, Vietnam, Australia & New Zealand

Belize, Costa Rica, Dominican Republic, El Salvador, Guatemala, Haiti, Honduras, Jamaica, Nicaragua, Panama, Puerto Rico and Trinidad & Tobago

Bulgaria, Croatia, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, Russia, Slovakia, Slovenia, Turkey & Ukraine

Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia & Spain

Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Mexico, Paraguay, Peru, Uruguay & Venezuela

G7 countries (United States, Canada, Japan, United Kingdom, France, Eurozone, Germany & Italy); BRIC overview (Brazil, Russia, India & China); Switzerland

Algeria, Bahrain, Egypt, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Morocco, Oman, Qatar, Saudi Arabia, Tunisia, United Arab Emirates, Yemen; South Africa

Denmark, Finland, Iceland, Norway and Sweden

FocusEconomics Consensus Forecast reports cover economic forecasts for over 1,600 unique indicators in 95 countries. Every monthly report includes the Consensus Forecast for each indicator covered. The Consensus Forecast, based on an average of the forecasts provided by the most reputable economic research authorities in the world, is the one number you can rely on to make important business decisions.

REGIONS & COUNTRIES COVERED

WHY CHOOSE FOCUSECONOMICSInstantly diversify your intelligence portfolio with dozens of forecasts.

Get just the information you need, all in one place.

Streamline research efforts by utilizing our comprehensive survey of leading economists.

Prepare for what may occur next by studying how forecasts have evolved over time.

Gain key insight into political and economic developments in a country or region to assess the potential impact on business prospects.

REDUCE RISK

SAVE TIME

OPTIMIZE RESEARCH

ANALYZE TRENDS

ANTICIPATE DEVELOPMENTS

REAL SECTOR GDP per capita Economic Growth Consumption Investment Industrial Production Unemployment Rate Fiscal Balance Public Debt

EXTERNAL SECTORCurrent Account Trade BalanceExportsImportsInternational ReservesExternal Debt

MONETARY & FINANCIAL SECTORMoneyInflation Rate Policy Interest Rate Exchange Rate

FocusEconomics | Gran Via 657, 08010, Barcelona, Spain | +34 932 651 040 | [email protected] | www.focus-economics.com

INDICATORS INCLUDED