Kazakhstan Athens, 2 April 2009. Country overview Population:15.7 mln. GDP: 146 bln. USD GDP growth:...

-

Upload

clifton-wilson -

Category

Documents

-

view

219 -

download

1

Transcript of Kazakhstan Athens, 2 April 2009. Country overview Population:15.7 mln. GDP: 146 bln. USD GDP growth:...

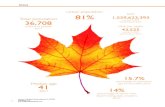

Country overview

• Population: 15.7 mln.• GDP: 146 bln. USD• GDP growth: 3.2%• GDP per capita: 8,450 USD

• HDI: 0.807; ranked 71st out of

179 countries • FDI: 7,2 bln. USD• People with income below

subsistence minimum: 18.2% • Unemployment rate: 7,8%

Why to invest?

1.

2.

3.

Investment favorable environment

Political & social stability

State support and guarantee of

investments

Naturaland labour resources

Large mineral & renewable reserves

High education level of workforce

Markets Hub Europe <-> Asia

Large & fast growing neighbor markets (up to 500 mln. consumers)

State strategy on industrial-innovative development

• State strategy on industrial-innovative development was adopted in 2003

• The program «30 corporate leaders» in 2007:– In program, may participate foreign companies along with

Kazakhstan's residents. The main requirement for participants - is the creation of «profit center» in Kazakhstan

– The target of the program is consolidation of the efforts of business and the government in implementation of investment projects aimed on diversifying the economy of the country

– The projects within this program receive state support

Special economic zones

Astana – New City

Marine port Aktau

Ontustyk

IT-Park

BurabayTourism cluster

Petrochemicalpark

Atyrau

Burabay

Company established in Special economic zone is exempted from paying corporate, land and property taxes and value-added tax

Agro-industrial sector

INVESTMENT CASE

• Access to large quantities of agri- and aquacultural resources (e.g., world's 10th largest wheat production, 20% of world's capture of sturgeon)

• Vast agriculture land and favourable climate• Low processing costs (e.g., gluten* cost of production in Kazakhstan ~40%

compared to Europe or Russia)• Competitive labor costs and liberal labor market rules• High domestic demand and attractive home market with 15.7 million

inhabitants and 2nd highest GDP/capita in CIS after Russia• Proximity of export markets (Europe, Russia, China, and Eastern Asia);

tangible growth of exports already in the past• State policy on intensifying productivity of the agriculture• Projects: drip irrigation, food processing etc.

INVESTMENT CASE

• Strong increase of Kazakhstan's tourism revenues (e.g., 41% to USD 1.9 billion in 2007) due to

- Increasing touristic activities of Kazakhstan’s rising local middle class - Growth in number of foreign tourists (12% p.a. in 2001-2006)• Potential for further growth • 2011 Asian Winter Games• Government policy: one of the six strategic clusters• Ambitious expansion plans projected to roughly quadruple number of tourist visits to

~440.000 by 2020• Increase in spend per tourist due to higher share of foreign tourists, growing wealth of

Kazakhstan’s population (GDP/capita growth of 10% p.a. 2003-07) and extended service offering (e.g., hotels, ski schools)

• Projects: city tourism, eco-tourism, tourism on the routes of the Ancient Silk Road, cultural-historical heritage etc.

Tourism

Renewable energy

INVESTMENT CASE

• Outstanding natural conditions –50% of Kazakhstan's territory has average yearly wind speeds of 4-5 m/s, with individual locations with average wind speed of up to 9.5 m/s

• Existence of remote locations with high demand for non-traditional energy sources• Local electricity market of 76 billion kWh (2007), expected to grow to 140-170 billion

kWh by 2030• ~3.0 GWp of existing generation capacity requires replacement by 2015, with

additional 4.0 GWp demanding replacement by 2030• ~87% of Kazakhstan's power generation is based on fossil fuels, contributing to poor

relative performance in terms of CO2emissions per unit of GDP• Legislative base to be defined within next years to set the base for long-term

development of renewable energy• Natural risks of wind power generation can be insured• Projects: wind-power generation, solar energy, hydropower generation etc.

Private-public partnership

Potential opportunities

• Construction and electrification of railways • Construction and reconstruction of roads • Development of air transport infrastructure• Modernization of municipal infrastructure

Contact information

Ms. Nessipbala Yermekova

Director, Department of Regional Policy and Inter-Budgetary Relations

Ministry of Economy and Budget Planning

www.minplan.kz

Ms. Ainur Baimyrza

Programme Analyst

UNDP Kazakhstan

www.undp.kz