last call(2).pdf

Transcript of last call(2).pdf

-

7/29/2019 last call(2).pdf

1/17

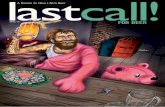

LAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATE

-

7/29/2019 last call(2).pdf

2/17

1

Introduction

Thank God thats over.

Apparently the Mayans didnt get thememo and as the dawn of the New Yeararrives, it appears that life goes onas usual. The big dip never came anda line of sheep still wait, perchedway high up above the fiscal cliff.

Thinking back to the dark days

of 2012, its a bit of a fog. Yes wehad Gangnam style, a mind-numbingPresidential election, Londons sen-sational Olympics, and finally thetrue rise of Asia. These days theEast is the new West.

Sure Lance turned out to be a fraudand geo-political risk continues towork very much like a microwavewith a bad case of attention deficitdisorder. More questions than an-swers plague my sleepless nights.

Has Asia come too far, too fast? Is ittoo big to fail?

Who the hell knows? Weve punchedthe ticket and now are strapped intothe passenger seat going full throt-tle. Sure pop culture gave us that

flash term YOLO (You Only Live Once).Not me. I intend to keep on comingback, if I can just find that Mayanreal estate broker.

Read once. Read twice. As long aswe live in these strange days, youwill find me hunkered down, tryingto sort out all this karmic madnesswhich just keeps on coming.

Bill Barnett3 January 2013

Via AlaskaDispatch.com

-

7/29/2019 last call(2).pdf

3/17

2 LAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATE 3

There are no alternatives to thetwo scenarios, only remorse likespilled milk and self-loathing fornot buying or from actually buy-ing and ending up with a wackedout lemon.

Though for the fewer lucky onesthere is jubilation and success. Myfrightful sleep is interrupted byBrando whispering in my ear again:Im gonna make him an offer hecant refuse. Ah, the Godfather,how appropriate. Don Vito Corleonewould have been massive in this

game.

As we know the sequel got better,which is sadly not often the case.Property remains in a frightfulstate these days as all the ruleshave been thrown out the win-dow. Kurtz stayed up the river inApocalypse Now and Brand, as theCoronel says: Ive seen horrors.Horrors that youve seen.

Weve all seen the far from sub-lime subprime and the bottomlesspit of the global financial cri-sis. Currency devaluations andproperty values have gone deeperunderwater than the hole that goesthrough the center of the earthand comes up somewhere in China.Covered in sweat, tears building

up my eyes, the nightmare wont goaway. I croak out...

What would Brando dobuy, sell orhead up that river?

Rewriting the rules is like re-writing a script in the middle ofa bad movie. There is the chanceto improve or there is just plainstupidity. The latter is similar toa deer caught in the headlights.Impending doom, yet a fatal at-traction as the lights grow nearer,and nearer.

Then comes that final moment. Whatwent wrong? If I have to ask thatby this point in the article weare all headed up that river tosee Kurtz. Its pretty simple. Younever did anything; you just stoodthere, motionless and devoid ofany decision other than the speed-ing sound of a fast car bearingstraight down on you until it wastoo late. We all have an innate in-ner voice of survival crying outto flex those muscles, lift one legat a time and get goingbe it for-ward, backward or sideways.

Dawn breaks and the alarm bell isringing in my head, but a fadingBrando comes to me one last time,taunting and mesmerizing: I haveseen the devil in my microscope,and I have chained him.

Property in todays market is

a journey without maps, but

it retains a rich luster and a

promise that for all the fail-

ures there are still successes.

Its those very successes which

tame the savage beast and keep

the dogs at bay.

Talking to Brandos GhostJANUARY 2012

I awoke suddenly last night. Itwasnt my dog baying at the fullmoon. Nor was it one of those ban-dit mosquitos which sound like arevved-up miniature lawn mowerdive bombing Pearl Harbor. Itwas the voice of the actor Mar-lon Brando with the anguished cryfrom the movie On the WaterfrontI could have been a contender.

As some readers will already know,Brando is long dead. For the restof you: You really do need to getout more. The sweaty melodramaplaying out in my head went on...I couldve been somebody... insteadof a bum which is what I am, letsface it.

Real estate and Marlon Brandoscharacter have a lot of common.A mythical happy place or nevernever land, where good ideas rolloff the top of developers headsinto the toaster oven of market-

ing, then straight into the honeymoney pot.

This is no Hundred Acre Wood,though, and there are no Winnie thePooh bears here, only high impactproperty pitches and an endless dealtrail. So what of the ideas, productsand properties that fail to live upto their early promise? After the

launch and all the hype, whats leftover for the scavengers to pick?

Illogical or emotional buying is theanswer, and its no new trend. Lookat any consumer productthey waituntil they see the whites of theireyes, then go in for the kill. Deal-makers love to create buyer tensionto up the stakes like a high-endpoker game. It also thrusts bystand-ers into the game, off the sidelinewhere they can either experience thethrill of victory or the agony ofdefeat.

LAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATE

-

7/29/2019 last call(2).pdf

4/17

LAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATELAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATE 5

FEBRUARY 2012Listen to What the Man Said

Listen, this time its going tobe different were the salesmanslast words before I slammed thephone down in a fit of blind an-ger. No, its not what you thinkno betting on the future price ofAlpaca wool in Peru, mining ofrare earth somewhere between Tip-pacanoe and Timbuktuktu, or evenmy new best friend Freddy fromLagos who really wants to sendme the 10 million dollars his poordemised uncle Lester stuck in abank account (if only I share my

bank details).

How this fit full of rage startedwas one of those probing callswith a newly enlightened, enthu-siastic friend telling me to getin on a ground floor opportu-nity. I was special, he said, oneof the few. The last time I heardthat was when I was in my 20s anda Marine Corp recruiter tried toenlist me in the US armed forces.

Looking back, I realise that onebad decision on the particularday would have landed me smack in

the middle of the invasion of theharmless Caribbean island of Gre-nada, or Operation Urgent Furyas the military hierarchy calledit at the time.

Delaying my messianic appoint-ment and opting not to walkacross water at the nearby LagunaPhuket lagoons, I decided to aska few questions to my suitor. Myanxious enquiries about the glob-al financial crisis, a man namedMadoff, and leveraging mounds of

debt on property were met withtotal denial.

For a moment I felt I had beenairlifted into an AA meeting ora drug intervention. Apparentlyand unbeknownst to myself I hadtuned out of the real world some-time around 2008 and the excitingnew prospect of exotic alterna-tive property investments wereabout to leave me standing alonein a cloud of dust.

The message came not from thatmaster blasterthe J Man way up

highbut some schmuck in a boilerroom calling me on Skype. Threeyears have passed since the sub-prime episode made the earth standstill, and of late, my skepticalother side is starting to get ananxious twitch. In a rising tide,exotic property or real estate in-vestment vehicles are flowing backinto the waiting arms of a cashrich Asia. Is it still the same oldsong and dance or have things re-ally changed, I wonder?

One flash point is the condo hotelmadness which has gripped Indo-

nesia. Tell tale signs of a marketrunning on afterburners is a bullrun property market which haspushed land prices into the strat-osphere. In what are essentiallyhospitality led residential of-ferings, the lack of prime land isdriving developers to place prod-ucts which in the long term simplycannot compete with the mainstreamhotel market. Rudimentary con-tracting documents, a weak gov-ernment regulatory apparatus andno assurances that units can becompleted are key examples of thepotential risk to buyers.

But, yes, things are differentthis timeinstead of cash carryingoverseas buyers, this time Indo-nesians are purchasing products,

often with local bank financing.Condo hotels, in fact, along withvillas, are a phoenix rising fromthe ashes in virtually every Asianeconomy, schemes running the rangefrom optional pooling programmesinto the genetically modifiedlifestyle property investment.

In other words, in many cases buy-ers are no longer looking at tra-ditional capital appreciation, butinstead focusing on rental yieldsand of course perks like holidays.Organic property used to be themainstream, but instead of selling

organic fundamentals, fast growthmodified products are now on thecutting edge of the industry.One could ask, is this a good thing?Having lived through 1997 and theAsian contagion, todays spiral-ing bank debt, rabid speculationand a growing middle class luredinto consumer credit quite frank-ly scare the hell of me. Weavingthrough the various offerings itsclear that more glossy lifestyleproperty funds are looking atraising investor appeal, but fringedevelopers who are undercapital-ized and have no long-term stake

in projects except to cash up andout are also the warning signs of areturn to poor trading fundamen-tals.

The question remains for these

projects is, who will be left tosort out the mess? In perceivedtruth, the core value of real es-tate remains its solid long-termstability. For many in the US, Eu-rope and elsewhere that notion hasbeen thrown out the window for thenext decade at least.

Here in Asia, the circus has re-turned. While the clowns may havesome of the audience laughing allthe way to the bank, there justmight be a trail of tears for theothers. No one likes to see thetears of a clown. Not even me.

In other words, in many cases

buyers are no longer looking at

traditional capital appreciation,

but instead focusing on rental

yields and of course perks like

holidays. Organic property used

to be the mainstream, but instead

of selling organic fundamentals,

fast growth modified products

are now on the cutting edge of

the industry.

4

-

7/29/2019 last call(2).pdf

5/17

LAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATELAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATE6 7

MARCH 2012Bulletproof Real Estate

I cant recall ever being givena bullet proof vest as I walkedinto a property sales office.These days though, whether youare condo shopping in Kabul,seriously eyeing a town house inSyria or ecstatic about a fixer-upper in Egypt, it might not besuch as bad idea.

Even in comfortable and safeThailand, the rash of floodinglate last year has brought anonslaught of strategic adver-tisements aimed at the paranoidor fragile, nervous individualwho is looking for a failsafebolt-hole investment.

One of my favorites is a mono-lithic sized billboard next tothe expressway in Bangkok thatshows an island and shouts out

in largish letters No Flood-ing. Of course, once the floodsdo re-appear, you will be able tohydrofoil down from your housein Chiang Mai, dodging drowninganimals, crocodiles and the oddsewer rat or two and in no timeyou can be right on the islandof your dreams. Perhaps the pro-ject promoters have never heardof global warming?

Its ironic, but scare tactics dowork. Buyers have been flock-ing to snap up land parcels inChiang Rai, Khao Yai and even

upper floors on the condo towersin Pattaya, although the latterseem to have ignored the risk ofearthquakes.

Politics also come into play,after all of those antics inBangkok in the past few years,international agents have beendoing a good cop and bad coproutine promoting London prop-erties which are safe havensfrom the madness of the develop-ing world. Certainly the UK haszero risk despite the financialcrumbling of its neighborsGodzilla-sized debt and a woefuloutlook of the Euro. No! Not onour watch, shouts out a guy ina Union Jack t-shirt.

Or perhaps the flood proofuniverse of brand USA (minus

Katrina of course) is an option?Although the entire propertyindustry is so far underwaterwith no hope of recovery thatspectators routinely pass At-lantis and the remains of theTitanic. Back in pre-subprimetimes, it was written in stonethat property prices would con-tinue to rise until the end oftime. Well, that proved not to bethe case.

Blue chips, stock in EastmanKodak, strong fundamental theysay. I think I just heard a thud

from someone jumping off a highrise on Wall Street. To peg aquote of ill advised optimismfrom Hunter Thompson in theepic novel Fear and Loathingin Las Vegas, Raul Duke glossed:We had all the momentum; wewere riding the crest of a highand beautiful wave. So now, lessthan five years later, you cango up on a steep hill in LasVegas and look west, and withthe right kind of eyes you canalmost see the high-water markthat place where the wave fi-nally broke and rolled back.

And speaking of waves, as onewho lived through the Asiantsunami in Phuket, it was onlya matter of months until adver-tisements for land on hillsidesstarted to appear with headlinesthat blaredtsunami-safe land.There is a thin line between thedoomsayer and the ad man, look-ing to cash in on a quick saleor trend.

Perhaps a bit of morbid curi-

I cant recall ever being given a bullet proof vest as I walked

into a property sales office. These days though, whether you are

condo shopping in Kabul, seriously eyeing a town house in Syria

or ecstatic about a fixer-upper in Egypt, it might not be such as

bad idea.

osity got a hold of me, but Irecently started to wonder whatone of those Kevlar bullet-proofvests cost? Punching up eBay onthe trusty web stallion I stum-bled onto 200 pages of listings.Top, of course, is body armour, aconcealable vest under a stylishwool coat. Then, oddly enough, abulletproof clipboard. Perhaps Ineed to get out of the consult-ing business and start a smallniche factoryisland-style ofcoursebullet proof thongs, flipflops or beer coolers anyone?

At the end of the day, invest-ing remains risky business andeven if you dont go looking fortrouble, there is still a slimchance its going to come knock-ing whether you like it or not.Next time you see one of thosesilly ads, Id suggest pulling itdown and heading to the near-est shooting range to use it fortarget practice. I still dontget what you do with the clip-board though.

Via 2Bangkok.com

-

7/29/2019 last call(2).pdf

6/17

LAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATE8 9

APRIL 2012Celebrity SkinIts 6:49 a.m. and in the distancemy straining ears pick up thosereverberating guitar open-ing lines from the song HotelCalifornia. Peaking outside thewindow, I can make out a pick-uptruck overloaded with Burmeseconstruction workers, stoppingoff at a nearby ATM on the wayto build a luxury villa on some

cliff top nearby. No doubt thesongs roll off a pirated BestOf Eagles complication CD, whichcontinue to regenerate inter-est in a band that hits the stagein wheelchairs and make my ownless-than-trim waistline seemmoderate.

In a world stuck in Bieber-feverand still mourning the loss ofa fairly left of centre WhitneyHouston, sitcom dream catch-phrases like Best, Top, Great-est, Bestest (only available inthe grammatically-challengedChina market), or any combina-tion thereof, continue to attractfollowers.

The shallow passion cannot be

likened to any type of religiousgroup, but is more akin to thecult-like attraction of SteveJobs. Brands make a statement inthe need for recognition, creat-ing an only-child syndrome com-plete with disinterested parents,unreturned phone calls and asurrogate maid. With the board-ing school cloud over an uncer-tain horizon, angst is a given.

Celebrities and awards increas-ingly rear their star-studdedheads in the spectrum of realestate development.

I recently returned from a tripto the Philippines, and whilewaiting at a hidden geman illyespresso airport kiosk open atfive in the morningI gazed upat property developers celebrityskin. Massive lit billboards withDonald Trump and Paris Hiltonscreamed out about luxury condoliving and my most loathed term

of the momentlifestyle. Yes,even in this Karaoke mango nationin Asia, famous faces spur theimpossible dream.

On the global stage, weve wept atthe Grammys over Whitney, andgawked at the fashionista festThe Academy Awards.

Mind you, I really dont under-stand the ultimate winner TheArtist, aside from throwing meinto a dozing stupor. Even thedog couldnt rescue the film, andI like dogs. Of course, it was the

French Connection that gave itkudos, so we must throw it someslack, but its wishful think-ing that art films take us to ahigher plane or make us smarter.France simply has the same smartmarketing team as the cigaretteindustry, which kills people, orMcDonalds which fattens them upbefore a similar fate.

Meanwhile, back in Thailand thatspecial time of year has also ar-rived, the launch of the Thai-land Property Awards.

How timely! Whether we like them,loathe them or dont even havean opinion (Barack Obama, areyou listening?), they remain astrong draw card for both devel-opers and ultimately we are told,purchasers. I know the brandpitch, and if the truth be known,in some sectors it can actuallybe demonstrated. Premium pricingand increased sales pace for ho-tel branded residences, for exam-ple. Its a premium and thereforeicing on top of a chocolate cake.

Now look at awards, and thequestion is do they really addvalue? Enhance reputation? Boosttransactions on the last remain-ing units? Or do they just makea nice press release? Its hard toquantify. Life in Propertywoodand Hollywood are at times en-

Brands make a statement in

the need for recognition, cre-

ating an only-child syndrome

complete with disinterested

parents, unreturned phonecalls and a surrogate maid.

With the boarding school cloud

over an uncertain horizon,

angst is a given.

twined. Samuel Becketts play Wait-ing for Godot spun off a number ofmovies and other adaptations. Oneof my favorites is the illusiveBig Night, a bittersweet and veryfunny movie of two Italian broth-ers who lobby for a famous musi-cian Louis Prima to visit theirupstart restaurant.

One of the best lines is Prima say-ing Sometimes you cut it too fine,then all you taste is the garlic.Having participated on judgingpanels for a number of years for

various events, my thoughts turnmore to those cage fighters, Libyanfreedom fighters and wacky Ira-nian fundamentalists. Mix them alltogether and selection sessions of-ten range from self-induced comasto street fighting in Syria.

What should be a big picture dis-cussion turns into quips, backbit-ing and local steer wrangling.But then again, put more than oneperson together in any scenario bethey husbands and wives, politi-cal parties or a bar room showinga big sports event, and all mannerof chaos is bound to happen.

Ultimately awards say somethingbe it some sort of gratification, aslap on the back or even photo op-

portunities. I have two small girlsat home and sometimes a high fiveis needed to make them eat theirbreakfast. It is the best motivatorto make it through the day.

Thankfully the mind-jarringstate of mind from hearing HotelCalifornia has come and gone, redcarpets are waiting and the shinylittle awards will reward a selectfew. Personally I like garlic, itfends off the other judges as wetackle the task of choosing theBest of the Best.

-

7/29/2019 last call(2).pdf

7/17

LAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATE10 11

MAY 2012A Close Burma ShaveBeing American, the use of theEnglish language is entirelyforeign to me. But I am house-trained, and can occasionally betrusted with small blunt instru-ments such as a pitching wedge.Emerging property markets seem todominate the news these days, asthe snap crackle pop of a twistedmistress whip can be heard in

the background. There it is again,edging the ever-willing and sub-missive side of the real estatesector ahead into the deep darkcloset of the unknown.

Years of failed Communism in Ba-nana Republics around the spin-ning globe have left a shallowfeeling on unfulfilled capitalismand empty wallets from the hud-dled masses. Yet now, from Leninto Lennon, the Walrus is awake.

Quick reads in past weeks aboutCubas change in ownership lawsthat allow the trading of homesis capturing the imagination ofbudding entrepreneurs.

In Peru, south of Lima, a golden

coast of multiplying holidayhouses is being fed by an increas-ingly mobile affluent class ofLatin investor. No need for RickyMartin jokes in the land of LaVida Loca, its simply pent up de-mand for condos and villas.

Amid all this excitement I sud-denly find myself sprawled on theoffice floor, dazed, confused witha heartbeat like a jack rabbit.If I could only find that darkangels thorny whip Id take on mysecretary who obviously has beenspiking my coffee with some sort

of chemical substance. Overheadthe whirling ceiling fan is click-ing away like the typewriter insome Burmese government office ina heated jungle outpost.My mind lapses for a moment...I can never quite figure outwhats politically correct thesedays, be it Burma or Myanmar.Living in Thailand, the land of

political quagmire so deep thatquicksand takes on the look of anexpressway, I tend to have adoptedthe former versus the latter.

After a successful election(though I have to admit I neverdid see that movie about The Ladythat has brought about a rapidchange in sentiment), even HillaryClinton has jumped on the Burmabandwagon with the US looking toease trade restrictions.

Over the past few years, econo-mists and the business communityhave all debated how fast Burmawill open up, and the generalconsensus has been it could be sixmonths, six years or sixty for allwe know.

Ban the pessimists and all handson deck, I say. While attendinga recent seminar on the emerg-ing property market in Burmathe buzz was definitely on. Iwas surrounded like a hostage bywell-spoken men in suits in greatnumbers. After 50 years or so inthe closet, out comes a lady inwaiting.

Is it Asias next big propertyboom? Or will things be draggedout like Vietnam has played up? Anight at the opera where everyone

is asleep in their seats for whatseems like an eternity.

My eyes have trouble adjusting tothe waning daylight, as I manageto pick myself up off the floor.A full day has come and gone andreaching up I feel a stubble ofgrowth on my chin. Perhaps it istime for a close Burma shave af-ter all.

Is it Asias next big property boom? Or will things be dragged out like

Vietnam has played up? A night at the opera where everyone is asleep

in their seats for what seems like an eternity.

Via Marius Van Graans Tumblr

-

7/29/2019 last call(2).pdf

8/17

12

Yes, the age of high-profile property de-velopers with a public image the size ofMarina Bay Sands seems to be out of pacewith modern trends. Sure we all secretlyadmire the Goldman Sachs guys, but its asubject only discussed behind closed doors.

In effect, the global financial crisishas pushed capitalism into a dirty lit-tle closet space, where you put your oldrunning shoes. Weve become wimps, withegos that assimilate wet towels or leavesblowing in the wind. Over the last threeto four years, real estate has skyrocketedall over Asia. Arising middle class means

that not only can everyone afford to fly,but they now have a condo when they ar-rive.

What we really need is a Lady Gaga ofreal estate. Now theres a girl who has itgoing on. Forget Jobs and those innocu-ous black t-shirts, the G Brand bucks thetrend in her fashion frills and funkyface paints. Shes no stranger to puttingtogether a management team, tagging abrat pack full of under achievers calledthe little monsters into a formidablewild bunch.

A string of big promotions, shes become aone woman brand that stretches well be-yond her mind wrenching tunes to encom-pass every aspect of media and online so-cial networking power to create a billiondollar business.

Steve Jobs brand was his vision, Gagas isherself. Perhaps what real estate needs isa visionary that can fill the space in be-tween. Theres a vacancy on the top floor.

Any takers?

JUNE 2012All We Need is

Real Estate GaGa

In the age of Hollywood rehashed su-perhero sequels, I cant help but ponderthe lack of a truly memorable face intodays current state of real property.Bright shiny technology has the omni-present image of Brand Jobs.

But lets face it, if I have to sitthrough one more corporate PowerPointpresentation and see one of Stevesframed quotes, just take me out backand put two bullets in the back of myhead like a Mexican drug cartel dealgone bad. That given, I have tasted theKool-Aid and am writing this epic on aMacBookAir.

Professional tennis is a great exampleof world gone bland in a vanilla skykind of way. Mix and match Ken andBarbies dot the circuit, grunts ratherthan insults are heard on the courtand matches are measured in dog yearsinstead of hours.

In past days, when I couldnt sleep Idthrow on either the Panda channel oruse the handy tropical aquarium screensaver on the laptop, but now if I needto get comatose its as easy as tuninginto a grand slam tennis event.

This bizarrely brings us back to realestate. Where are the real charactersand captains of enterprise? Rockefel-ler and his ilk have seemingly gone outof fashion. Donald having a bad hairday Trump, meanwhile, is entrenched ina gritty battle over a golf course inScotland. I saw Braveheart, and Im notsure about the Dons chances with thatunruly lot.

Steve Jobs brand was his vision,

Gagas is herself. Perhaps what real

estate needs is a visionary that can

fill the space in between. Theres a

vacancy on the top floor.

13

Photo by Kevin Winter/Getty

-

7/29/2019 last call(2).pdf

9/17

LAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATELAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATE14 15

JULY 2012Property Noir

Talk the talk and walk the walk.The bartender growls out of thecorner of his mouthlast call.Its 3am and the real estateindustry is about to turn in,intent to sleep off a bad bend-er. Close the drapes and pullthe sheets up high, till the bedseems like a cave.

China property is so chilledthat the next stop is somewherenext to Margaritaville. A Sin-gapore slingshot is more likerubber bullet time. Sure there isHong Kong but for how long?

As for the rest of Asia, thecheap and the small dominate topmovers. Napoleon with his smallmans syndrome would have fit inwell size-wise if he just couldhave gotten off that island.

Sure, there are the elusive bigfish. In the resort markets itsa game of trophy marlin fishing,stick some ridiculous price tagand let it roll. Try to land theelusive Eastern European sillymoney,Im not quite sure how best todescribe the money walkexceptperhaps harken back to MontyPythons skit on The Ministryof Silly Walks. Bigfoot, LochNest Monster, aliens from outerspace and yes, illogical high-networth individuals looking foruber-luxury property.

Silly money continues to cap-tivate a certain sector in therough trade of bricks and mor-tar. Asia loves to gamble, be it ajet set away in Macau or in HongKong. For a time, stock markets

became second wives or mistressesof the would-be rich.

Downsizing into the middle class,a hammer down has created a newbreed of real estate specula-tion in Thailand. Sign up earlyfor a shoebox flat, pay 10 per-cent down and flick just beforehandover. Assuming prices havemoved up you stand to make justa bit over single digits, but inthe age of marginal bank savingsrates, what else are you going todo just to stay in front of the

hungry wolves of inflation?Still we yearn for men withstrange accents, a suitcase ofmoney and no lawyer riding thecoat tails for nonsense like duediligence. A fast close and asTony Montana said, the world isyour oyster.

Have we entered the decadeof small deals, lower marginsand rather blaseday-to-day routines inwhat used to be arollercoaster ride whichalways rode the thinrail of success anddisaster simultaneously?

My booze soaked dreams turnto the garlic cutting razorblade scene from Goodfellas.Edgy, violent and alwayswith a wad of cash in their

pockets, yeah the made menthat knew how to live.

These days when I see a group oflarge men shooting rock tumblersof vodka, my optimism turns toangst, realising they are just agroup of miners in from Vladiv-ostok on a 13-day package holi-day. Not even a glam squad ofleggy blond Barbies in tow.

Silly days it seems are gone forthe moment, but there remainshope external with the Ministryoffices burning bright into thenight looking for plan B.

As for the rest of Asia, the

cheap and the small domi-

nate top movers. Napoleon

with his small mans syn-

drome would have fit in

well size-wise if he just

could have gotten off that

island.

Screenshot from 1950 film D.O.A.

Via The Address Downtown Dubai

-

7/29/2019 last call(2).pdf

10/17

LAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATELAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATE16 17

AUGUST 2012Up PeriscopeHolding court in the local beverage house a few days ago, bar talkturned to the subject of free-falling European economies. SubmergingSpain, grinding down Greece and the frantic French all took on theirown cultural backlashes. Its amazing how clear things become, or howsmart you become, after going full bore straight through happy hour.Never mind the demon in the bottle, Ill have a double!

But back to our key topic of discussion. What did Pink Floyd say aboutanother brick in the wall? Though thesVthats business school chatterfor emerging economies. Seems that now even the BRICS are hitting theproverbial money train marathon wall.

Of course, we have the mini-BRICS too, but those are like thevertically challenged assistantto Dr. Evil in the Austin Pow-ers movie and look more like agarden gnome than one of thosesuperhero, democratically driven(or so theyd like to think) su-perpowers.

The property trade has rapidlydialled into the latest disasterin the making in Europe. Lon-don brokerage houses are hiringFrench-speaking staff, hoping to

cash in on an exodus of tax-bur-dened High Net Worth individualsfrom across the channel, whileadventuresome capitalists arelooking into century old Greekestates and beach front villas,on the cheap.

As for Spain, well, the land thatbrought us the bumbling Manualfrom Fawlty Towers cant evenmuster a Que? when it comesto its massively overbuilt andleveraged to the hilt coastalresort-grade residential market.

Perhaps they need to think outof the box? What with globalwarming and all, setting up aseries of independent city statesalong the coast may be the an-

swer. Forget the family movingvan, move the entire country.According to widespread reportsthere are currently close toa million vacant units in thecountry.

Now lets check out a few placeswhich will be joining Atlan-tis shortly: Maldives-316,000,Fiji-816,000. Wait, this is go-ing too fast, we might be neededduplexes, or lofts, failing thatat least a bunk bed to accommo-date the overflow? Then there isTahiti, 178,000 and counting, but

they do have that French as-sociation, so off they go, backinto the life raft. Cook Islands10,000 plus. Nauru, another 9,000,and Palau over 20,000. Weve gota sellout already and I havent

even gone halfway around theglobe.

Note to Al Gore, I just solvedwhat you couldnt in all thoseboring hours of that cinematiccoma-inducing snooze fest of amovie. But this is where the realinspiration kicks in. We are go-ing to need more condos, apart-ments and even for those upperechelon islandsluxury homes.

Yes, lets start building again.We have to compete with theother property markets, so letswrap up some bank financingas well. Hell, why just workthis angle? Lets look for moreniches. There is a growing mar-ket for disgraced international

athletes who failed drug tests,or former and about to be for-mer dictators gone wild. We canget Syrias Bashar al-Assad onsome billboards and TV spots. Ifhe can sell his own version ofdemocracy, hes a clear shoe-into promote property.

So, up periscope, the submarineis headed back the surface. Dryland ahead. Catching a glimpseof the shoreline my mind sparksup an idea. What a great locationfor a beachfront condo tower ortwo. Here we go again...

We are going to need more con-

dos, apartments and even for

those upper echelon islands

luxury homes.

Via CTF74.Navy.Mil

-

7/29/2019 last call(2).pdf

11/17

LAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATELAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATE18 19

SEPTEMBER 2012The Ghost in the MachineThe markets are becoming aboutas unpredictable as destinyitself and even the people youthought were in control are lessthan sure what the future holds.

Religious zealots are oftenquick to point out that Godworks in mysterious ways. Formy own often-shallow self,

women and Asias developingcountries usually fall into thisethereal category.

Divine intervention typicallyseems to be the Kool-Aid crewssimplified notion of benchwarming. Sitting in a doctorswaiting room, waiting for whatcould be a fatal prognosis is noway to spend a sunny afternoon.

Digging deep to get to lifesgreat truths looks to be a rem-nant of a bygone era. Maughamstortured soul in The RazorsEdge. Perhaps Kesey had it rightwith the Magic Bus. Of course,hallucinogenics are making acomeback with a certain crowd(I can almost see the nervous

twitch of my suffering editorat yet another drug referencein what is purportedly a prop-erty piece).

Sadly for him, our trip into theworld of the bizarre and the ar-cane is set to take a nose dive.Living in the Land of Smiles,as I have over the past decade,and in Southeast Asia for some28 years, has provided a certainlevel of insight that has brokenout of the dark prison cell ofthe standard glossy guidebookprose.

My business life lately hastaught me that the pathwayto true cultural understand-ing, spiritual bliss and higherlearning is completely and abso-lutely a dead end. In fact its aback ally complete with a sleep-ing drunk in a dumpster, withonly shards of occasional lightgiving way to the soft white

underbelly of despair. Sure,you may find this horrific, buttruthfully its oddly comfortingerasing that large question markwhich has been all consuming forlonger than I can remember.

Thailands current state ofpolitical and economic playhas been on a bender for some-thing like five years now. Talk

about an epic night-out. Herein Phuket the regular appear-ance of property land scandals,stalled infrastructure im-provement and amped up busi-ness incentives come and go likeBigfoot.

Instead, we remain content tocrack open a warm oversized bot-tle of Beer Singh, and pass thebottle to our friend from thedumpster who has gained con-sciousness for the moment. Mis-ery loves company.

Whats disturbing is talking toThai politicians, business lead-ers or those in the know. For along time Ive always thought asmall circle of those insidershad some insight into what wouldhappen next. An Asian-styledmanifest destiny? Ive alwaysloved the movie The Great Escape,those guys had a plan.

Ultimately the realisation hashit home that all of us seem tobe stuck in the same crowdedlifeboat. At times those Ivelooked up to, have even turnedto me, in a strangely brokenlight and asked what do I thinkwill happen? As I look aroundAsias other developing economicstorylinesIndonesia, Vietnam,the Philippines and others, astrange pattern has evolved.

A shift to democracy, away fromstrongmen frontrunners means

parental controls have been re-moved from the XBox, which hascreated a vacuum of people onthe same page. Things are fluid,and while a strange belief inConfucianism simply has most ofus living in the present, andrealising things could go eitherway, this is not comforting,but the reality is as dear as apolicemens flashlight down thealley.

My best advice for the moment isthrow away those business plans,buckle up for a monsoon of un-certainty and just try to makeit to Wednesday.

Why Wednesday you may ask?Thats because its tomorrow and24 hours is all the planning Ican cope with for the moment.

A shift to democracy has cre-

ated a vacuum of people on the

same page. Things are fluid...

this is not comforting, but the

reality is as dear as a po-

licemans flashlight down the

alley.

Via InternationalDays.net

-

7/29/2019 last call(2).pdf

12/17

LAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATELAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATE20 21

OCTOBER 2012Hell and Damnation Hit AsiasLeading Resort Property Market

Over the past decade Phuket inThailand has set the gold stand-ard for South East Asias boom-ing luxury real estate sector.The islands vaunted west coastcontains the highest number ofmulti-million dollar ultra vil-las in the region and has con-

sistently attracted a growingnumber of high-net-worth-indi-viduals.

In what looks set to stress theindustry, a series of govern-ment-sponsored investigationsover encroachment onto publicland and allegations of cor-ruption and illegal titles hasbecome a national issue. LeadingThai and international firmssuch as TCC, Minor Hotel Group,Kajima Overseas and award-win-ning projects such as Trisaraand Malaiwana have seen theirnamed brandished about in themedia.

Spearheading the charge was thehead of Department of National

Parks and Wildlife and PlantConservation. The DNPs Direc-tor General Damron Pidech whoretired on September 25th wastagged as The Demolisher by thepress when he ordered a numberof resorts demolished adjacent toKhao Yai National Park earlierthis year.

Damrong, who has alleged wide-scale encroachment by a numberof upscale resort and propertydevelopments into Sirinath Na-tional Park personally, led apaparazzi-inspired SWAT team of

public officials, media and largemotorcades.

Newslines jumped onto the band-wagon as Damrong was quotedsaying possible government ac-tion resulting in destruction ofresorts and villas and revoca-

tion of land titles could takeplace if illegal activities wereproven. For the business ownersaffected the situation has re-sulted in a continued onslaughtof allegations disclosed to themedia by government officialswith little chance to publiclyrespond or state their side ofthe issue.

As of now, 12 properties have beenlisted in the investigation andthe latest news has a Governmentteam of 366 investigators target-

ing nearly 600 hectares of is-land land. The original scope isnow extending to other areas ofPhuket reportedly now includingPatong, Kalim, Kamala and Kathu.What is causing investors, prop-erty owners and the real estatesector concern is a wide-rangingthreat of land title revocations.In this new trip into unknownterritory, Phukets propertysector is facing both reputationand financial loss in what todate adds up to trial by media.

While Thailands political rockyroad trip of the past five yearshas been punctuated by a frac-tionalized teeter totter ofpolitical power, the governmenthas yet to instill any wide-ranging reforms into the coun-trys real estate sector and moreimportantly has turned a blindeye to overseas property inves-tors.

While Phukets luxury proper-ties have helped reinforce theislands image across the globeand created much vaunted objectsof desire, the present state of

uncertainty could drive prop-erty buyers to other locations,which at face value could poseless risk.For now the lack of clarity andlack of care by the governmentover protecting seemingly validland titles could best be summedup in Biblical terms:

And the sea gave up the deadwhich were in it; and death andhell delivered up the dead whichwere in them: and they werejudged every man according totheir works. And death and hellwere cast into the lake of fire.This is the second death. Andwhosoever was not found writtenin the book of life was cast intothe lake of fire. Revelation20:13-15

The government has yet to

instill any wide-ranging re-

forms into the countrys real

estate sector and more impor-

tantly has turned a blind eye

to overseas property inves-

tors.

Via Wikimedia Commons

-

7/29/2019 last call(2).pdf

13/17

LAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATELAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATE22 23

OCTOBER 2012A Little

Doomsday Trickor TreatImagine a nuked out alien land-scape with the smoking ruins ofcivilization smoldering like theburned out butt of a cigarette insome oversized kids sandbox. Theonly sign of life is a typicalAmerican family of four stand-

ing in a prayer circle with gasmasks on.

I never quite got the fourplexmultiplier, but lets face it,five is an odd number and threemeans...no backup. If one kid is abad apple then the entire geneticcode fails. Whenever friends havetheir first child, my first ad-vice is that they should plan forone more. Just in case.

But back to the total destructionof life as we know it. Ive justhad a late night reality televi-

sion fest with the ironicallytitled Doomsday Preppers. As inall great true tube life, its toostrange to even make this stuffup and obviously must be real.

Here in Phuket we have our owndoomsday cult. These are the oneswho hunker down over dimly litcomputer screens or perhaps tapaway on aged cracked keyboards tothe tune of a different piper.

Last week they were out in fullforce after the announcement

that the islands much belea-guered International Conventionand Exhibition Center had beenthrust into the dumpsterheadfirst.

The past few days have had me do-ing the two-step shuffle to Bang-kok, trying to get to the root ofthis story, which is perplexingto say the least. It started whensources quoted MP Anchalee VanichTeepabutrs comments on her Fa-cebook page. (Note to self, pleasefriend Khun Anchalee.)All in all, by the sheer volume ofnews stories, it does appear thatthe ICEC up in Mai Khao has beendunked into the Andaman Sea likethe stalker in Fatal Attraction.Id have expected a collective

high five from the sea turtlecommunity or at least a round ofapplause. What a great line: On aclear day you can almost hear thesound of clapping turtles in thedistance.

This could be an Out of Africasequel but only to the soundtrackof Downtown Abbey and one ofthose English narrators who wasleft out in the cold waiting forthe Remains of the Day.

Digging down deep through onlinestories I could not help but read

the comments about the doomedconvention center.

Vents, rants and raves that ranthe whole prayer circle from goodriddance, to move it to ChiangMai, or else all those usual sus-pectscorruption, greed, overde-velopment and garbage disposal.

Suddenly the turtles had beensilenced.

The posters came up with the sameold sorry blame game that has

become a broken record of islandlifewhat we cant do and why weshouldnt do anything.

Lets all sit in our bomb sheltersand wait for the apocalypse.

Last chance visitors who missedthe opportunity to jump into thelast time machine back into thedays of future passed.

Frankly speaking, I never quiteunderstood the choice of locationto have the convention centeranyway.

Phuket has around 43,000 regis-tered hotel rooms, and approxi-mately 1,000 of these are in thenorthern tip of the island.

Though certainly the plan madea lot more sense than stickingit on the other side of PhuketCity, which often requires anovernight case and passport fortravellers to get to. Lets justsay the Mai Khao plan was for-ward thinking.Of course from a developmentplan, the catchment area for thecenter remains challenged.

Over the bridge the entire south-west of Phang Nga was zoned outa few years ago for a big ho-tel project and the last time I

looked, there were only a fewprime coastal hotel sites northof the airport.

So the answer was perhaps to busthem in. One thing that did con-tinually crop up was a strangelylucid comment, with which I ab-solutely agree, the ill-advisedPhuket Gateway. The last time Ilooked online at Google Imagesunder the term White Elephantthis continued to rank up high.

In my own opinion, the islandwould benefit a lot from aninternational conference and ex-hibition center in a well-locatedstrategic place that is accessibleto a broad number of hotels andservices. Hence its a shame thatcooler heads prevailed and theentire deal was shelved.

Its incredibly short-sighted notto understand that the islandmust diversify its tourism mar-

ket and that demand generatorsare required to fill the roomsalready built. There is abso-lutely no point in crying overspilled milk, nor say we arealready on the edge of economicruin so lets pooh pooh any newinfrastructure projects. We needmega government-sponsored in-vestment into Phuket more thanever before.

For the detractor Id say neverlook a gift horse in the mouth,and certainly know the differ-ence between a trick or a treat.

There is absolutely no point

in crying over spilled milk.We need mega government-spon-

sored investment into Phuket

more than ever before.

-

7/29/2019 last call(2).pdf

14/17

LAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATELAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATE

NOVEMBER 2012Counting Sheep

with the Glee Club

Virtually every corner of the regionhas put on their game face and Imnot quite sure these days whether theground is rumbling from bulldozersbreaking ground, stampeding buyerswaiting to put their money down on ashiny new condo or just an earthquakeof financial glee.

Lately, while walking down the streetof a typical Asian capital city in themoney district, I couldnt help noticethat coming around the corner amongstthe raging bulls was a lone sheep.I quickly consulted the clock on myBlackberry and found it to be 9:45a.m.and taking a quick breathalyzer test,revealed I hadnt been drinking. Notjust yet.

Standing still, the perplexing experi-ence was going to take an even morebizarre turn as other sheep came intothe smoggy horizon, one by one, oneafter another. A strange line up thatapparently had no tail end.

Things were about to take a turn forthe worse. The head sheep boundedinto the heavy rush hour traffic andthe next thing I heard was squealingbrakes and all manners of audio chaos.Despite the uproar, the line of sheepcontinued on into the streaming flowof traffic, oblivious to the dangerthat their leader had instigated.

Of course, Im not going into graphicdescriptions of the carnage that layfor all to see on the fateful day.Lets just say the term wipeout canbest describe the holistic effect ofthe calamity. To sum it all up, it wasD-Day in sheepville.

As I continue to travel throughout theregion on consulting jobs, attending con-ferences and checking out the markets, thehair on my back continues to stick up whenmeeting many new property developers. Theirbusiness strategies are based on the experi-ence of a few who has struck it rich. ProjectDNA is often based on that lovely term wesee on t-shirts in Thailandsame same butdifferent.

Business plans and design models have nowevolved into copy and paste. The only realcrisis in Asia is finding enough new namesfor the seemingly infinite number of newreal estate offerings.

Give it an Easy A, or find a foreign sound-ing term to make it familiar and up market.It seems the only admission ticket thatsreally needed for entry into the Glee Clubis a piece of land. It doesnt even seem tomatter if you own it. Bring it to marketand damn, you might not even need equity ordebt, as pre-sales will flow like free drinksat a grand opening party.

Each days tasks for these new age copycrews are only complicated by which luxurycar showroom to visit that day to liquidatethose massive profits, which will surelydrop from the heavens above.

But my train of thought is broken as theambulances arrive and start to cart offthose poor misled sheep. If only they had

paused, and thought things through and notbeen content to simply follow. The flag is athalf mast today at the Glee Club and eveningcocktails have been canceled. But tomorrowis indeed another day.

Will it be another same same, or somethingentirely different?

Business plans and design models have

now evolved into copy and paste. The only

real crisis in Asia is finding enough new

names for the seemingly infinite number

of new real estate offerings.

-

7/29/2019 last call(2).pdf

15/17

LAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATE

DECEMBER 2012Asia Finds a NicheHousingFor Hobbits

Jingle Bill, Jingle Bill. Is thevery Merry Season here againalready? Apparently so given thegreenscape in every retail spacemy eyes come to rest on. Ei-ther that or Ive land face downin the street in some drunken

Irishmans nightmare.

Hollywood is cranking fast andfrantic this year as the epic bigscreen of the Hobbit is upon use.Bilbo and his crew of freaks,little people with pointed earsand alien inspired round-headedtypes are among us.

Im not quite sure on the ex-act political correctness on allmanner of Hobbitology. Are theremale and female Hobbits? Natu-rally coming from Thailand thequestion could be raised abouttransgender taglines? Do Hobbitsbelieve in God or is that placethey come from just too damnedfine to want an alternative uni-verse.

Here we go now with generationHobbit or as those Mad Ad Men(and women) would say Gen-H. Thewhole Gen thing seems to be run-ning out of steam. What happensafter Gen X, Y or Z? Do we startagain, double the alphabet oradd numbers after? Again sittingon a low-cost airline as I writethis it seems the sheer stupidityof my fellow passengers is rub-bing off.

But meanwhile back on point, thetruth is that Hobbits and Asianreal estate have been simpatico

for quite sometime. Certainlythis year in Thailand the age ofMickey Mouse flats, or to be morepolite entry-level condominiumshas dominated the center salesstage.

Whether its been idle chat-ter from developers in Pattayasaying 20 square meters was fartoo big; to the recent spate ofcheap small condos, which havecaptivated Phuket, Hua Hin, andBangkok. A few years ago AirA-sia came into the limelight withthat adage Now everyone canfly. For the property marketits now a case of Now everyonecan own a condo.

Recently I took a look at a newready to be launched budgetcondo projects show flat andfound my mind drifting to thosedog kennels that the privilegedclass use to house their trophypoodles way up in first class ona legacy airline.

But then I realized the geniusof it and a new niche marketHobbits. Its mistaken to thinkthat the wee folk can only befound in New Zealand. Last timeI checked there were only 23people living in that farawaycountry. Yes, its beautiful. Nodoubt of the most specular placeson earth but would want to livein the shadow of such beauty allof the time. Youd find your-self continually weeping forno particular reason. Grandioseschizophrenia is never more thana lamb chop away.

So unbeknownst to most ofus, Hobbits have been invad-ing every property marketin Asia and buying up thesesmall boxes, which when youare less than a few feettall, would seem to be morelike an ultra-villa. Plusthey are from New Zealand sotheir expectations of luxuryand indoor plumbing are wellbelow the line from the restof us.

Smart money is flockingto Gen-H condos as clearlythese people breed like rab-bits and royalties from allthose Lord of the Ringsspictures have created a deepmarket. Silly me. Id beenpondering the rapid riseof the new LCCs (low-costcondos), and it had plaguedmy downtime for most of theyear. Enter a lightning boltof clarity. Problem solved.

While no one is quite surehow deep the market is, giventhe regions property expertshave yet to figure out thedemographics of the Gen-Hmarket. For now develop-ers are humming along withRandy Newman as he singsout about the short people.But in this case short is thenext big thing or more cor-rectly Hobbits that is.

While no one is quite sure

how deep the market is,

given the regions prop-

erty experts have yet to

figure out the demograph-

ics of the Gen-H market.

Scanned copy of An Unexpected Morning Visit by Ted Nasmith

-

7/29/2019 last call(2).pdf

16/17

LAST CALL: NEVER TRUST A MAYAN SELLING REAL ESTATE

DECEMBER 2012Travels in the Fourth World

Lately, I have been transfixedlike a sugar-crazed junkie tun-ing into endless episodes of adoomsday reality show on cable.Following the antics of thesewacky prep squads of lunaticssomehow provides a shallow formof entertainment and I justcant find the will to change

channels.

Boredom, anxiety and stress allfigure in an oversized toxicmojito. While the world contin-ues to explode in an increasingarray of political, economic anderratic events, I find it com-forting to get out of the frayat least for an hour or two.

Asia Inc. has managed to haveanother enviable year of suc-cess both far and near. Prop-erty prices in most markets havecontinued to reach to the heav-ens and a rising middle class isspurring the East Side Story.

Forget the American Dream. TheWest seems to be headed downthe tube, destined to be the newThird World.

Its Open Sesame to the future,and if you look ahead the jour-ney now facing Asia is one thattakes it into the kind of un-

known territory that could bestbe serialised as the story of TheFourth World. Bad Lance and hispimped-up bike mates threw allthe rulebooks away and now ourjourney into Neverland is infull swing. Alice and Michael Jare already skipping past over-head, in a demented vision.

Here we go again, I can hearmy editor cry, cursing me underhis breath as he heaves himselfup from a despair-ridden heap onthe floor, but weve come too farto stop now, and must continue.Get up, be a man! Show a bit ofcourage and edge. Who cares what

the advertisers think?

For MBA types, investment bank-ers and the hallowed halls offinancial institutions, the bookon moneyball remains anchoredin the belief that market cycleswill inevitably prevail andtherefore the best recipe forsuccess is cooking something upover a low, slow boil. These days,after you clear the streets ofWall Street suicides, the worldhas becoming loud, jarring andunpredictable.

Instant Karma prevails and whothe hell has time for cooking?Just throw something into a mi-crowave at the nearest 7-Elevenand stuff it down your mouth asfast as you can. Hell, tomorrowmight never come, so sky falland live for the moment.

Lately, my tortured soul rarelygets a solid nights sleep, butthe question on my mind re-mains. Is Asia too big to fail?Of course, 1997 and 2008 quicklyblaze through my subconscious.

Gravity remains a scientificfact and what goes up must sure-

ly go down, or at least flatten,just like the world that Colum-bus sought out.

So while there is every rea-son to celebrate a New Year andrevel on the endless possibili-ties of Asias ever growing realestate market, a hard cold slapon the face is never more thana breaking news story away.Although in this digital age, wewill more than likely hear thethunder of the bears coming onTwitter or Facebook, well be-

fore it even hits the televisionscreen.

So yes, it seems four is the newthree, for now at least. I mustget back to my underground bombshelter, as doomsday is inevita-bly just a flick of the remoteaway. In the distance, the onlysound is the wailing mess of myonce proud editor.

Get ahold of yourself man, theworst is yet to come I shoutout, just as a Mayan startsknocking at my door.

Via Euzicasa.wordpress.com

-

7/29/2019 last call(2).pdf

17/17