IT BPO Industry Insights Sep 2012 Final

Transcript of IT BPO Industry Insights Sep 2012 Final

Research & Intelligence

QUARTERLY INDUSTRY REVIEW SEPTEMBER 2012

Copyright ©2012

NASSCOM®

International Youth Center, Teen Murti Marg, Chanakyapuri,

New Delhi – 110 021, India

Phone: 91-11-23010199, Fax: 91-11-23015452

E-mail: [email protected]

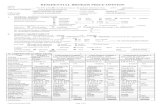

Report Coverage

SECTIONS COVERAGE

• Analysis of key economic indicators - GDP, Inflation, Stock Market,

Employment Growth and Technology indicators

• Analysis of Indian IT-BPO industry performance during the quarter.

The analysis is based on the results declared by the top 15 India-

centric IT-BPO companies which comprise about 40-45% of the

industry

• Analysis of results of key MNC IT-BPO industry players.

• Policy changes, industry news and happenings, analyst speak

• Key developments among the top companies covering transaction

activity, M&A announced, Alliances and partnerships signed, Changes in

delivery footprint

ECONOMY WATCH

INTERNATIONAL

SECTION

SUPPLIER OVERVIEW

NOTE: Global and indian Companies included in the analysis are TCS, Infosys, Wipro, HCL, Cognizant, Hexaware, Igate,

Polaris, Tech Mahindra, Mindtree, Mahindra Satyam, Hinduja Global, WNS, Genpact, EXL, Firstsource, Syntel, IBM, Accenture,

Capgemini, Atos Origin, Steria

INDUSTRY

PERFORMANCE

SECTION IMPACT COMMENTS

Economy

Watch • Global Economy and technology spending outlook remains unchanged

India

Technology

Indicators

• Mobile subscriptions, Internet Users, PC install base, and Broadband subscribers

in India continue to grow substantially indicating the growing influence of

technology

Industry

Performance

• Positive revenue growth indicate improved demand scenario, while margins driven

by weak currency

• Robust net hiring indicating positive outlook for FY2013 revenues

• Attrition at its lowest levels in the last 2 years for IT, inches up for BPO

• Client additions continue to rise

• Revenue Drivers-

• Geography- Americas, Europe record significant growth

• Verticals-BFSI & Manufacturing verticals, Service line- RIM, Testing, BPO

Global

Landscape

• Positive revenue and employee growth indicates healthy demand for outsourcing

Supplier

Overview

• Global TCVs markets grew ,strengthened by mega deals and restructuring, while

New Scope work fell, reflecting the slowness in decisions around kick-starting new

initiatives

• Companies expanding their footprint by setting up centers in Tier-2 /Tier-3 and

onshore locations and through acquisitions

SUMMARY

5

INDIA TECHNOLOGY INDICATORS

TELEPHONE SUBSCRIBERS MOBILE SUBSCRIBERS

BROADBAND SUBSCRIBERS INTERNET SUBSCRIBERS

Source: TRAI

million million

million million

Global Economic outlook and technology spending remains largely unchanged

OUTLOOK-GLOBAL

6

Revised IT Spending growth for 2012 Revised GDP growth rates for 2012

Source: Gartner, IDC, IMF, NASSCOM

Though Gartner revised the technology spending for 2012 upwards this quarter, there has been little

change in either business confidence or consumer sentiment, indicating a short-term outlook of continued

caution in IT spending

7

Q1FY13 revenue growth at 11.6% Y-o-Y, while Q-o-Q grows at 1.7%. Solid BPO growth story in Q1FY13-

QoQ revenue growth of 6%

Margins affected slightly mainly due to pricing pressures, large bench and macro environment

Americas continues to be the growth markets while pipeline remains strong for Europe/UK

BFSI and manufacturing the key growth verticals during the quarter while emerging verticals of Retail,

T&T growing their share

INDUSTRY PERFORMANCE

IT-BPO REVENUE GROWTH IT-BPO NET PROFIT MARGINS

Positive revenue growth indicate improved demand

scenario, while margins driven by weak currency

INDUSTRY PERFORMANCE

Hiring growth continues, largely led by BPO hiring- Q1FY13 employee base up by 14% YoY, 2.0% QoQ

growth

Companies focusing on lateral additions indicating increase in sudden and short-term projects

The attrition challenge seems to be cooling off- this quarter records the lowest during the last 2 years for IT

IT-BPO NET HIRING ATTRITION

INDUSTRY PERFORMANCE

Stable net hiring vindicates positive outlook for

FY2013 revenues -attrition at its lowest levels in the last

2 years for IT, inches up slightly for BPO

‘000 Numbers

9

Fixed price contracts slumps, as with strong currency benefit, lower pricing is preferred to financial risks in

tough market conditions

Improved net client additions, mining of existing clients and strong realization per client aiding higher

revenue growth

INDUSTRY PERFORMANCE

REVENUES FROM FIXED PRICE CONTRACTS

NET CLIENT ADDITIONS

Note: The set includes only IT Service companies

Client additions on the rise, while fixed price contracts

slump as companies avoid taking risks

Numbers

10

With increase in campus hiring during Q3FY12 and productivity increasing in this quarter, utilization levels

increases

Onsite and offshore efforts maintain status quo as Industry has been making concerted efforts to hire

locally, and it reflected in the growing trend

INDUSTRY PERFORMANCE

CAPACITY UTILIZATION

ONSITE-OFFSHORE EFFORT MIX

Note: The set includes only IT Service companies

Utilization levels improve, strong local hiring

evident as onsite effort remains constant as a % of total effort

INTERNATIONAL SECTION

Positive revenue and employee growth globally

augurs well for the industry

REVENUES TOTAL EMPLOYEES*

Revenues includes IBM, Accenture, Capgemini, Atos Origin & Steria

* Employees exclude IBM

Despite troubled times moderate rise in revenue and employee growth for global companies, driven by

growth markets and new initiatives

Companies focus on providing more value to clients and manage end-to-end competencies to fight the

economic scenario

USD billion

4.2%

14.2%

11.8%

11.3%

SUPPLIER OVERVIEW

INDUSTRYWISE ITO CONTRACTS AWARDED INDUSTRYWISE BPO CONTRACTS AWARDED

Global market TCV in 2QCY12 increased by 7 per cent to USD21.4 billion, aided by higher number of

mega deals. BPO TCV registered impressive growth during the quarter while ITO TCV market lost

momentum after two quarters of impressive growth, due to light contracting activity

Restructurings continued to show strength, up 39% YoY, whereas New Scope work was down 22%

reflecting the slowness in decisions around kick-starting new initiatives

Geographically, the dynamics were diverse, with Americas recording flat growth , EMEA recording a dip

while APAC recorded a substantial growth Source: TPI Index

TCV USD billion

Global TCVs markets growth driven by BPO, megadeals

and restructured deals

-4.4% 31.7%

Buyer Seller Value Services/Vertical

Tech Mahindra, India Hutchinson Global Services USD 87.1 million

Customer Management , BPO

TCS, India Computational Research Laboratories (CRL), India

Rs 1880 million Integrated high-performance computing (HPC) application and cloud services

Altruist Tech, India Teligent Telecom, Sweden Not disclosed Infrastructure solutions and value-added services to telecom carriers

Google, USA Sparrow, USA Not disclosed Email Apps for iPhone and Mac

Dell Inc, USA Quest Software, USA USD 2.4 billion Enterprise Management Software Solutions

IBM, USA Kenexa, USA USD 1.3 billion

Human Resource Management Software

Mergers & Acquisitions

SUPPLIER OVERVIEW

Illustrative

Source: Compiled from news articles

• Thinksoft to set up its second facility in

Chennai , which will provide software

testing services

• Serco Global Services opened a new

facility in Shimoga , India to provide BPO

services to a telecom company

New Delivery Centers established/announced

SUPPLIER OVERVIEW

INDIA

Illustrative

Source: Compiled from news articles

PHILIPPINES

• Cognizant opened a new centre in

Pasig City, Metro Manila, which will

deliver a full range of applications,

IT infrastructure, and business

process services in the financial

services, healthcare, and other

verticals

• WNS plans to set up a new 75-

seater centre in Gdynia, Poland

that will deliver F&A, contact

centre and research and analytics

services by 2013

POLAND

List of Outsourcing Deals During the Quarter

Buyer Supplier Deal

Value

Contract

Duration

Services Remarks

Bayer Business Services, Captive unit of Bayer

Capgemini, India

Not disclosed

5 years IT Services Provide global application development and services, as well as infrastructure services including service management taking over the captive arm of Bayer

Royal Philips Electronics, Netherlands

Wipro & Cognizant, India

USD 250 million

Multi-year IT Services Simplify the IT platforms of Philips and support in its business transformation programme

NABARD, India Wipro Infotech, India &ME

Not disclosed

Not disclosed

IT Services Implement a Core Banking Solution (CBS) for five co-operative banks under the National Agriculture Bank for Rural Development (Nabard)

Subex Ltd, India

MTN Group, Africa and ME

Not disclosed

5 year IT Services Deploy its fraud management and revenue assurance solutions across 14 networks

UIDAI, India HCL Infosystems, India

Not disclosed

7 years IT Services The company will be the managed service provider to implement and manage the Central ID Repository for the Authority

Consumer Product Comp

Wipro, India Not disclosed

5 years KPO Provide analytics services using the Promax technology solutions

SUPPLIER OVERVIEW

Illustrative

Source: Compiled from news articles

How to buy:

Log on to http://www.nasscom.in/publications or send us an e-mail at [email protected]

Upcoming Reports

• Report on ER&D Services

• White paper on Customer Interaction Services

• White paper on Enterprise Mobility

For participating in any of our reports write to us at [email protected]

UPCOMING REPORTS

Reports Released in the Last Quarter

Big Data : The

Next Big thing

An Overview of the

Retail Market :

Analyzing

Opportunities

India’s IS

Outsourcing

Market: Adapting

to Megatrends-

Reinventing

Business

Alternative

Business Model

- Research in

Brief

Custom

Application

Development &

Maintenance

Market

We hope you find this report useful, and welcome your

feedback, comments and inputs at [email protected].