IINNNVVVEEESSSTTTMMMEEENNNTTT B BBUUUSSSIIINNNEEE SSSSS … · IINNNVVVEEESSSTTTMMMEEENNNTTT B...

Transcript of IINNNVVVEEESSSTTTMMMEEENNNTTT B BBUUUSSSIIINNNEEE SSSSS … · IINNNVVVEEESSSTTTMMMEEENNNTTT B...

Pag

e1

IIINNNVVVEEESSSTTTMMMEEENNNTTT BBBUUUSSSIIINNNEEESSSSSS PPPLLLAAANNN

222000111000 ---222000111111

PROJECT ARCHIMEDES LLC,

509 SW 17TH STREET

FORT LAUDERDALE, FLORIDA-33315

Project Archimedes LLC, a Florida Limited Liability Company of State of Florida, as assigned document

number L10000048847 and EIN number of 27-2539293

Pag

e2

With the world financial markets in flux and events of major disaster and environmental events unfolding daily, many

investment managers, foundations and institutional investors are forced to re-examine current investment portfolios

and seek current trends into environmental and humanitarian long term investments. Today’s Investors must consider

the 21st Century world requirements and capture the opportunities to return to these once enjoyed profits margins.

Historically and factually, two events have always remained constant in all nations of the world, regardless of their

philosophy or economic basis. These are war and disasters, both of which provide new economic and investment

opportunities. The projects contained in the business proposal of Archimedes will address these opportunities and

provide perhaps some insight as to how those investment concerns can serve humanity and the environment, as well as

provide excellent returns. Since Archimedes has been formed to meet some of these humanitarian and environmental

market needs, we feel confident in presenting our solutions “Where Scientific Theory Becomes Reality”,

What Project Archimedes Brings To The Table:

1. The Western League and Asian Community of nations have stated that many assistance programs may be curtailed but will

continue to meet the needs of these disaster affected and developing countries. So why is this important? The

development of relief supplies, costing 1/3 of current market cost, becomes a primary incentive in supply considerations by

governmental and organizational agencies without reducing the aid provided. At present, Archimedes “Front Line Project”

holds that stage alone. The top 15 populated nations of the world hold 70% of the total population of the world. Each has

an established and mostly stable form of government, and is thus ruled by political considerations. It would be political

suicide to ignore events such as Louisiana’s Hurricane or China’s Earthquake as merely a century event, since over 400 less

severe climatic events occur daily and substantial funds are set aside to deal with these events. It is these politicians and

government leaders who actively champion a cost effective means to provide any form of relief assistance when required

which streamlines and reduces such cost. Archimedes “Front Line” will require less storage space than conventional

supplies yet provide more aid available which nets cost effective resource relief management for agencies and

organizations charged with relief operations.

2. The ecology and environmental initiatives which are gaining momentum to protect our natural resources and find new

methods and means to protect resources and environment, lends itself to Archimedes “Project Ocean Harvester” which

centers on the preservation, harvesting, conservation, and economic viability of food and energy sources from the ocean in

a conscientious friendly manner. The project however does not stop there, because development of Hydrogen drive has

lent itself for practical application to ocean vessels, and we shall join other scientist to develop this resource.

What The Investors Need To Bring To The Table:

A dedicated investment commitment which understands the need for proper research and development periods, and

provides for grace extensions to profit to meet these R&D requirements, and will allow the company to enter market

areas with cutting edge products to assure high yield profit returns. We seek capital, but need commitment to project

concepts and goals.

Opening comments By Richard Peacock - CEO

Pag

e3

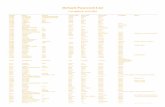

INDEX TO PRESENTATION

Open Letter About Archimedes 2

Index Page Project Frontline 3

Index Page Project Ocean Harvester 4

Archimedes Project Funding Requirements 5

PFL Project Front Line Funding Requirements (All Stages) 5

POH Project Ocean Harvester Funding Requirements (All Stages) 5

Investor Notation On Funding Returns: 5

Company Description 6

Company Organizational Chart 6

Management Team 6

Managing Member/Founder/CEO Richard Peacock Bio 7

Executive Gerald Wolff (COO) Bio 8

Executive Dominick Bellino (CFO) Bio 8

Executive Steven Hamel (EDR) Bio 9

Executive Christopher Musica (SPD) 9

Project Frontline Brief 10

Mission Statement 10

Business Concept Understanding The Need 11

Disaster Management Problem 12

Product Problems of Compatibility 12

Our Industry Application Solutions 13

Front Line Divisional Development Objectives 14

The Basic Product Lines 14

Product Description 15

Rapid Support 15

Cost Effective Delivery 15

Target Market for Basic Frontline Product 15

Cost of Basic Frontline Development 16

Field Test Cost 16

Kit Build Cost 16

Sales Projection 16

Advanced Product Line Development 17

Recovery Camp 17

Disaster Quick Response 17

(QRT) Quick Response Transports 17

Cost of Advance Frontline Development 18

Advance Product Development Cost 18

Sales Margin Projection Chart 18

Market Justifications Advanced Products 19

Recovery Camp 19

QRT Units 19

Solar Power Units 19

Distribution Network 19

Warehousing & Distribution Franchise 20

Current Market Competition Frontline 21

Pag

e4

Project Ocean Harvester Briefing 22

Project Mission Statement 22

About The Harvester Project 23

Basic Harvester Benefits 24

Superior Processing of Kelp 25

Development Objectives 26

Module Development Components 26

Vessel Basic Unit Development 26

Designs For Vessel Development 27

Basic Harvester Build Schedule Cost 28

Harvester Platform Certification Schedule & Cost 28

Revenue Projections Harvester 29

Target Market Harvester Basic Development 29

Advanced Harvester Module Development 30

Research Development Cost 30

Engineering Cost 30

Modular Build Cost 30

Additional Platform Build Cost 30

Competition Bid Program 31

Harvesting Modules Develop & Market 32

Ocean Trash Recycling Plant & Market 32

Scientific Research Application Modules 32

Seismic Survey & Market 32

Deep Water Mineral Exploration & Market 32

Offshore Oil Applications 33

Oil Spill Skimmer & Market 33

Oil Separation- Recovery & Marketing 33

The Market for Expansion 33

Ocean Industry Impact Studies 34

Advanced Base Placements 34

Target Market Sales Full Funded 34

Logical Investment Design 35

The Project Investment Design 35

Projected 10 Year Income 36

Project Income Balance (no load) 10 Year 37

Projection Disclaimer 37

Investor Funding Schedules and Types 38

Basic Investment 10 Million US 38

Phase Funding Basic Full 35.5 Million US 38

PPM First Round Subscription 100 Million US 38

PPM Convertible Debenture 80 Million US 38

Offshore Investment Option 38

Various Investor Exit Options 39

Investment Ownership Principals 40

Investor Franchise Holding 41

Summary Exit Options 41

Investor Required Returns

Additional Documents Available

42 43

Pag

e5

ARCHIMEDES PROJECT FUNDING REQUIREMENTS Opening Comments by the Author:

The core business of Archimedes is the research and development in the humanitarian and environmental sciences

which bring the updated scientific knowledge to industry and enhance these two vital fields for the 21st century.

The Basic portion of the investment proposal of our projects account for 50% of the first level of these essential changes

industry wide, and a ground platform to expand our development and initial production goals..

The Expanded portion of the investment proposal of our project, accounts for the full development and production of all

expanded finished products. Funding requirements for each additional key project development are briefly addressed

for investor understanding throughout the presentation.

In principal required individual project funds depicted will be allocated to development as follows and added to the

basic funding budgets accordingly based on the (7) year plan and 10 year projections:

PFL Project Front Line Funds Required (Full Project Funding)

Basic PFL Funding Development: ……………….…………………………..$ 11,000,000.00 USD

Research Advanced Recovery Operations: . …..…….……………………$ 5,000,000.00 USD

Additional Engineering R&D +Test: (QRT)………..….…………………….$ 12,000,000.00 USD

Manufacturing/ Franchising/Warehousing:……..… ……………………$ 50,000,000.00 USD

New R&D Project Completion …………………………………………………..$ 20,000,000.00 USD

FULL PFL PROJECT FUNDING (7) YEAR…….………………………………..$ 98,000,000.00 USD

POH Project Ocean Harvester Funds Required (Full Project Funding)

BASIC POH INVESTMENT $ 25,069,500.00 USD

RESEARCH ADDITIONAL $ 15,000,000.00 USD

ENGINEERING ADDITIONAL $ 12,000,000.00 USD

MODULAR BUILD ADDITIONAL $ 60,000,000.00 USD

PLATFORM VESSEL ADDITIONAL $ 35,000,000.00 USD

FULL POH PROJECT FUNDING (7) YEAR $147,069,500.00 USD

Combined Full Funding for Archimedes Project (7) Year $ 245,069,500.00 USD

Investor Notation On Funding Returns:

Under terms of any offer of funding, it should be noted that this project will require a return grace period from the

typical 24 month period to month 30-36. The specific reason is due to the research requirements and product testing in

the field prior to full sales and production of product lines. (see research review page:)

Since our customers are governmental and organizational entities, the field test will be conducted jointly with our

proposed clientel base to assure contract orders.

Pag

e6

COMPANY DESCRIPTION

Project Archimedes LLC („Archimedes‟, „the Company‟, and/or „Management‟) is a Florida limited liability company.

Project Archimedes LLC, is a humanitarian & environmental product and service company, and is involved in research,

development, manufacture and distribution service opportunities. The founder and Managing Member of Project

Archimedes LLC, is Richard B. Peacock.

The Company has been organized into two major divisions to address the specific sciences and requirements needed to

produce viable product lines.

COMPANY ORGANIZATON

MANAGEMENT An assembled professional team with a cumulative business experience of 120 years in small and medium business ventures. Currently all the executives serve outside business clients in similar capacities to appointed company positions for this project, and hold the project and concepts paramount on proper development and early investor returns. The team brings the necessary experience and expertise in all areas of future company operations task, and look forward to initiating operations at the earliest possible opportunity.

Richard Peacock Gerry Wolff Nick Bellino Steve Hammel Chris Musica CEO COO CFO EDR SPD

Pag

e7

PROJECT ARCHIMEDES LLC, EXECUTIVE OFFICERS SUMMARY

About Principal:

Consummate senior executive, agent and entrepreneur acknowledged nationally for ground breaking efforts in driving medium and

large scale changes that build world class management teams for maximum organizational and operational effectiveness and

company profits. Prolific researcher/writer and platform speaker. Expert facilitator, post merger integrator and strategist. Vast

experience in commercial aviation passenger /freight/ feeder operations and proven international experience in contracting,

partnerships and code share. Specialties include: Start-Ups, Reorganization, Mergers, Acquisitions and IPO Projects.

Professional Strengths:

Strategic Planning / Organizational Change / Executive Training & Development / Revenue Enhancement / Matrix Management /

Project Management / Negotiations / Contracting & Labor / Marketing & Image Innovation / Facilitation/ Quality Control /

Capitalization of Technologies / Budget & Company Profits / Airline Security & Screening / New Business Development

Education & Accreditations MBA University of Maryland (Emphasis: Business Development & International Integration Management) BBA University of Maryland (Emphasis:

General Business Management/ Accounting/ Finances/Economics) Published Author of Aviation Software (Flight management systems and

Dispatch Control) FAA ATP Certificate # 1694067 (typed CV-240/340/440)FAA Authorized Check-Airmen (125 &121)Commercial / Instrument

Helicopter B-212 / B-205/ B-206 / H-369/500TPrevious Qualified Helicopter Long Line/ Forestry Service/ Alaska Certified Registered Consultant to

FAA Accident Investigations Company Flight & Ground Instructor 121-135 Chief Pilot 121-135 Director of Operations 121-135 Captain CV-

240/340/440

BENCHMARKS & MILESTONES

Involved in over 30 worldwide relief operations for logistical transport planning & dispatch

Developed and Implemented over 50 FAR Commercial Certifications & 30 JAR Certifications

Successfully negotiated and obtained commercial facilities & landing rights Federated Republics

Served as lead test pilot of first rotorcraft equipped with de-ice rotors for Bell Textron

Formed and Operated Independent aviation consulting firm for mid-size operators

Developed template training methods for flight & ground personnel continuing qualification in association with FAA and Aviation Insurance Underwriters Association.

Developed and published for commercial resale “Operators Dispatch Program” -1987 for IBM-PC

Consulted and developed operational plan for early generation “Air Travel Club” Bermuda Aviation Authority JAR

Served twice as Trust officer for Airline reorganization and sale, resulting in successful restructuring and sale

Successfully accomplished the financing needs of over 20 clients from seed capital to IPO status.

Pag

e8

Experience:

Currently Chief Executive Officer/Chief Financial Officer Environmental Testing Laboratory, President Virginia Communications, Incorporated Norfolk, Virginia

1995-2004, President/CEO WCG, Incorporated Virginia Beach, Virginia 1985-1995, Director of Sales/Marketing Union Carbide-Lind Division Danbury Connecticut

1978-1985

Professional Strengths:

Creating & Implementing a Strategic Vision Developing Fast Track Profitable Growth Develop National Distributorship Network Acquisition Analysis & Integration

Full P&L Responsibility & Financial Analysis Managing Start-ups & Turnaround Skilled Communicator & Negotiator Boardroom Presentations Investor Relations

Goal Oriented Leadership Skills Dev. Entrepreneurial Management Teams Training Sales Personnel Developing Sales/Marketing Programs Customer Relationship Mgt. & Loyalty

Re-engineering Production & Operations New Product Development

Education & Accreditations Temple University-Philadelphia, Pennsylvania BBA Degree: Major: Accounting and Finance – Minor: Management & Marketing

Benchmarks & Milestones *Current Company is result of merger in January 2006. This produced low employee morale, severe drop in customer service, dramatic reduction in customer base and negative cash flow.

-renegotiated line of credit and vendor contracts.

pleted turn around process and developed sales/marketing program to introduce the “new company” to the market.

ate of Florida. The Action Plan’s goal is to drive the company

to the next level of profitable growth.

Experience:

Vice President and Chief Financial Officer CHL Holdings, Inc. Boca Raton, FL. April 2004 – Present, Independent financial consulting and Certified Public

Accounting services ARS, Inc. Sunrise, FL. June 2001 – March 2004, Director of Business Administration Andrx Corporation Weston, FL. May 1999 - May 2001,

Director of Finance and Business Administration Siemens Information and Communication Networks, Inc. Boca Raton, FL. August 1989 - May 1999.

Professional Strengths:

Cost analysis and financial modeling of pre- and post- liaison

role between R&D, manufacturing, internet and distribution divisions of the company. Financial analysis and consulting Cash management (Receivables, Payables and cash flow projections)

Capital acquisition / debt financing Payroll services and payroll tax compliance Corporate tax compliance Design and implementation of project management and reporting systems, and

Fulfillment of liaison role between R&D, manufacturing, internet and distribution divisions Education & Accreditations

University of Miami, Coral Gables, Florida Masters Degree in Business Administration – May 1987 The Ohio State University, Columbus, Ohio Bachelor of Science Degree in Business Administration – June 1979, Member of The American Institute of Certified Public Accountants Member of The Florida Institute of Certified Public Accountants Certified Building Contractor – State of Florida

Benchmarks & Milestones

Passed Florida Certified Public Accounts Examination

Pag

e9

Experience:

President Advanced Construction Enterprises, LLC, Melbourne, Fl 2005-Present, President IKON Office Solutions Inc, Orlando, Fl Wholesale, Exporting, and

remanufacturing division 1997-2005

Professional Strengths:

Manufacturing, Contracting, Research and Development management, product inventory and distribution, quality control, budget planning and management, sub-

contractor task scheduling and control, Project evaluation and cost analysis, scientific staffing, accounting and liaison for technical projects.

Education & Accreditations B.S. Business Administration/Major in Accounting, Auburn University 1976, Certified Public Accountant 1978, Certified Specialty Structure Contractor’s license 1984 Benchmarks & Milestones

Successfully integrated six US and Mexican operations and facilities into a centralized business unit

Accessed global market activities and implemented new market sales program

Experience: As associate partner in Archimedes with over 10 years culinary experience has assisted in the logistical requirements and labor distribution events associated with

Disaster Preparedness. Serving as County Coordinator for Emergency Operations and Shelter, food management in South Florida, along with consultations to major

food distribution aid programs and quality control of stored emergency supplies. Owns and operates senior staffing referral for five star restaurants and provides

operations and management oversight to numerous well know food chains. Non-Related expertise in stock market and exchange procedures which promote green

and humanitarian services.

Professional Strengths:

Organizational project planning and execution, public relations, facilitator, executive food service management, event planning, budget planning, investment strategic planning, overseas liaison for marketing and on site studies, design and executing disaster protocols, excellent social networking contacts.

Education & Accreditations Le Cordon Bleu, London, England. “Le Grande Diplome,” April, 1999.Kendall Culinary School, Evanston, Illinois. “Certificates in Restaurant Management, Advanced Cuisine, and Advanced patisserie.” December, 1997. Elmhurst College, Elmhurst, Illinois. B.A.“Interdepartmental Communications Management”, Minor in “Corporate Organizational Theory.” May, 1991. Member of the American Culinary Federation. Servisafe Sanitation certified.

Benchmarks & Milestones

Chosen to serve as Executive Chef for South American Trade Conference for US Department of State

• Provided organizational and distribution program for emergency food supply Broward County

• Provided numerous restructure of management and kitchen assignments for chain restaurants

• Designed and administered “Healthy Diet” menus for commercial restaurants

• Coordinated with other humanitarian food programs to receive excess or outdated chain stores.

• Served as special consultant for airline and yacht catering services to increase volume sales

• Developed staff training programs and procedures to increase productivity and limit waist product

• Prepared budget and dietary requirements

Pag

e10

PROJECT FRONTLINE BRIEFING

Pag

e11

Pag

e12

Pag

e13

Pag

e14

Project Front Line Division Development Objectives: Major Advances: Frontline Main Projects: Relief Kits, Specialty Kits, Mobile Relief Camp, QRT, Solar Generators, Water Treatment

THE BASIC PRODUCT (BASIC FUNDING)

SPECIFIC REGIONAL DISTRIBUTION

Pag

e15

THE PRODUCTS DELIVERED WITH BASIC FRONTLINE FUNDING

RAPID SUPPORT COST EFFECTIVE DELIVERY

THE TARGET MARKET OF FRONTLINE SALES

What does make our company unique to other markets is that we serve industry needs consistently in need of turnover

and replenishment resources (such as we will provide) the income picture looks very solid.

Pag

e16

THE COST OF FRONTLINE BASIC DEVELOPMENT & PRODUCTION

THE SALES PROFIT PROJECTIONS BASIC INVESTMENT

Pag

e17

THE ADVANCED PRODUCTS DEVELOPED (FULL FUNDING)

RECOVERY CAMP DISASTER QUICK RESPONSE TEAMS

(QRT) QUICK RESPONSE TRANSPORTS – SOLAR/ELECTRIC

QRT SYSTEM PURCHASE (6) Specialized Disaster Solar Transports $ 300,000.00

INCLUDED

• 6 each QRT-ATV Transport Vehicles Full ATV basic outfitting gear installation Training of a QRT Team for 1

year Product training and logistical support Spare kits for repair & maintenance 4 sponsored field exercises

each year Limited Warranty of Products & ATV’s QRT Team Certification

Pag

e18

THE COST OF ADVANCED DEVELOPMENT & PRODUCTION

THE SALES PROFIT PROJECTIONS ON ADVANCED PRODUCTS

Pag

e19

MARKETING JUSTIFICATIONS FOR ADVANCE DEVELOPMENT

WORLDWIDE FRANCHISE DISTRIBUTION NETWORK

Pag

e20

Pag

e21

CURRENT MARKET COMPETITION SUMMARY INDUSTRY

Project Frontline market competition is provided by generally camping, survival, hunting and unrelated

businesses which have specific products which can be used in humanitarian efforts. Samples of such

companies are the (MRE) meal ready eat units originally provided to replace the C ration for the military, and

later commercially available to public purchase. Another example would be the application of tents for shelter

in emergency situations, which are largely provided by camping and survival companies.

There exist no comprehensive list to “Off the shelf” purchases by governmental and organizational relief

agencies, but the revenue sales figure provided by the GSA accounting office estimate some 30.5 Billion

dollars annually worldwide. (Note: Off the Shelf items are those which are not in government or organizational

inventory, and are purchased from any available source)

To illustrate the market demand, currently being serviced by unrelated service companies the following chart is

provided to show disaster related event cost, Their exist no official figures of record current to 2010 however

145 major events have occurred since 2005 at cost 7 to 10 times the illustrated figures.

Total amount of reported economic damages: all natural disasters (in current US$ billions ) 1991 - 2005

Information provided by ISDR http://www.preventionweb.net/files/12472_CREDtables.pdf

HUMANITARIAN RELIEF OPERATIONS REFERENCES

http://www.icrc.org/web/eng/siteeng0.nsf/htmlall/section_finances_and_budget?OpenDocument ICRC Only financial

report 2010, which represents a singular organization of the 4,500 registered and authorized groups worldwide.

http://www.dsca.osd.mil/programs/HA/new/FOREIGN%20DISASTER%20RELIEF%20AND%20EMERGENCY%20RESPONSE.

pdf Government Foreign Disaster Relief (FDR/ER)

Pag

e22

PROJECT OCEAN HARVESTER BRIEFING

HARVESTER BASIC DEVELOPMENT

PROJECT MISSION STATEMENT:

There are rarely business projects in today’s world for investmentopportunities which champion the environmental concerns and ecologicalbalance with profitable returns. With logical and respectful management,the resources on our planet beckon the harvest of the wealth from ouroceans and Project Ocean Harvester not only represents a soundinvestment for the future, but also provides the first major innovationalchanges within it’s industry in five decades – a monumental and excitingchapter in sea harvesting.

For the first time since “Kelp” was first harvested 5000 years ago, and it’scontinued applications have been discovered, is it possible to safely,efficiently and profitably harvest this resilient resource without damagingthe ecological environment. The technology is available to responsiblymanage this natural resource which has thousands of applications intoday’s world.

Ocean Harvester has developed the scientific understanding andtheoretical ability to harvest and process the ocean “Giant Kelp” retainingthe vital properties in the processing and reduce the industrial drawbacksand cost associated with present day harvesting techniques .

The company goals and expectations are to complete the engineering,application processing and to construct (10) ten operational harvesters forapplication and lease for “Giant Kelp Fields” and increase harvest volume500 %.

With engineering application of the harvester the company profits areexpected to reach a total of 100 million dollars annual profit within (5) fiveyears of development completion.

3

Pag

e23

The ocean harvester is a seaworthy powered bargeplatform specifically designed for the cutting andprocessing of Giant Kelp in open oceans of the world. Itwill incorporate the entire processing of Kelp from thecutting to washing, drying and bundling for delivery toprocess manufacturers.

Key to the project success will be the processingplatform engineering and research and development ofthe drying process – since it normally takes several daysand is temperature sensitive for extraction of desiredoils and chemicals commercially. It is our belief we havesolved this critical problem, however additionalengineering and research must be made to perfect theprocess which will reduce the days to a matter of hourswithout degradation of harvest value.

The second element critical to the profitable harvestingprocess is the initial cutting of kelp fields which do notuproot the bud anchors and thereby keep the planthealthy. If this can be also perfected the kelp fields canbe cropped every 24-48 hours because of thephenomenal growth rate of healthy Giant Kelp.

THE OCEAN HARVESTER PROJECT

6

Pag

e24

BENEFITS OUR HARVESTER WILL PROVIDE TO THE INDUSTRY

Better Access To Major Kelp Fields

Replace the Eco-Destructive tools of

harvesting

Modernize The Current Methods Used To Harvest

Kelp

Access To Open Ocean Fields of Giant Kelp Not Accessible Now

ProvidingIncrease -

harvest every 48 hours .

Expanding the Harvester work area

Kelp Fields

8

Pag

e25

20

Kelp harvesting is a labor intense process which requires six steps from initial cutting to drying before it is ready for shipment to manufacturers for product processing.

Although the process for ready delivery ranges 10 – 20 days in the industry, it affects the quality of the extractable aligns and suitability for stock feed. The bi-product for fertilizers is at the bottom of the crop processing suitability, and often the least profitable.

From the moment Kelp is cut its value diminishes with TIME

The “Ocean Harvester” is to be designed specifically to complete the entire kelp processing aboard the vessel and offload to container vessels product for direct manufacturer delivery.

The harvester will be a virtual factory at sea much in the same way as the commercial tuna and fishery industry has moved to processing fish product – which minimizes product loss and improves quality.

Our goal is highest quality and volume of product.

Pag

e26

BASIC HARVESTER DEVELOPMENT OBJECTIVES (BASIC FUNDING)

MMMOOODDDUUULLLEEE DDDEEEVVVEEELLLOOOPPPMMMEEENNNTTT

COMPONENTS OF OCEAN HARVESTER

Adjustable buoyancy barge platform

Drying Module

(4)Pod Thrusters 360 provide stability and

minimal disturbance to

kelp fields

Seaworthy Platform self

sufficient power generators and

fresh water processor Adjustable 50 foot

Cutting Rotors and Vacuum Unit

to depths of 25 feet below surface

Fresh Water Wash

Roller Press & Strainer

Dry Press & Bundler

Offload Conveyer

High Volume

Kelp Dryer

Process To Be Patented and all

special components Copyrighted

CLASSIFIED INFORMATION

7

Pag

e27

DESIGNS FOR DEVELOPMENT

Why Design Around A Catamaran:

The design allows for modular envisioned interchange, shallow and deep draft water ability,

vessel stability in most seas, natural “combine” style installation area for envisioned module

applications without costly modifications and redesign.

Engineering and Prototype:

The company has two options to consider at a later stage during development. First is the

possibility to construct one each candidate design, holding the remaining two vessels to be

constructed for award till after full sea trials and evaluation of best operational vessel.

The second consideration is to award all 5 vessels construction based on best design concept

and maintain continuity of fleet in addition to saving cost of maintenance and repair facilities.

Design Time Frame:

Will conform to the basic investment schedule

Construction Schedule:

Vessel construction will produce two ships in an 18 month period with the remaining three

vessels 18 months later. In order to have all five vessels operational by year five ends will

require construction start at the 24 month investment period. This will accelerate the

construction schedule from the projected 36 month start construction projection.

Pag

e28

Pag

e29

REVENUE PROJECTIONS

The sales illustration for “ocean harvester” are based on individual vessel completion, with (5) Five such vessels programmed for completion, but which provide for delay or construction in the event advance contract clients do not justify build schedule.

TARGET MARKET REVENUES

Ocean Harvester market competition, in all but the harvester kelp module,

faces normal industry competition based on specific vessel needs. A key reason for the company to provide a

multi-purpose vessel provides more lease and sales opportunities than traditional vessels with single purpose.

Pag

e30

ADVANCED HARVESTER DEVELOPMENT (FULL FUNDING)

INTRODUCTION

Certain provisions to the 10 year company plan have been provided for those investment interest which

require larger project investment sums, such as hedge funds, equity based investments and interested IPO

investment goals.

To accommodate this group of investors “Project Ocean Harvester” has made provisions to the basic

investment 4 year period, to accelerate growth productivity. Depicted are the company objective goals and

the associated 2008 dollar investment requirement to undertake and complete those items within the

expansion investment package to completion on the same timeline with the basic investment. Any such

investment must be in subject order presented here.

RESEARCH:

1. Development of secondary module for oil spill cleans up and contaminated waterways. Specific

development of interchangeable unit doubles vessel capabilities.

2. Research will concentrate on reusable absorption and extraction technology.

Cost Associated with this early investment option, estimated at $ 15,000,000.00

ENGINEERING:

1. Development of modular extraction unit design and development, along with vessel compatibility

design.

Cost Associated with this early investment option, estimated at $12,000,000.00

MODULAR BUILD CONSTRUCTION:

1. Additional unit module construction of Harvester units (5) at estimated cost $5,000,000.00 Each or

$25,000,000.00 USD total.

2. Build Spill Clean Unit modules for Ship Design only (5) at estimated cost $7,000,000.00 Each or total of

$35,000,000.00 USD.

Cost Associated with this early investment option, estimated at $60,000,000.00

PLATFORM VESSEL CONSTRUCTION:

1. Construction of platform vessel total (5) vessels for duel capability harvester and clean up capability at

average unit cost of $9.0M per unit.

Cost Associated with this early investment option, estimated at $ 45,000,000.00

Pag

e31

ADDITIONAL MODULE DEVELOPMENT

COMPETITION BID PROGRAM:

The company will contract under competitive bid to general

contractors for the final modular development units to be adjoined

with the vessels under construction.

Companies under bid for each select unit engineering and

construction will be afforded a an opportunity to bid construction

design and final development award for contract construction with

$500,000.00 USD bid preparation award to final candidates.

A minimum of 2 companies shall be awarded competition for final

design, specifications and build cost contract consideration, in each

area of harvester, spill, fishery, research.

Company engineers and designers shall provide contract

specifications and final design engineering for construction budget.

INDEPENDENT CONTRACTORS: $ 8,000,000.00 USD

COMPANY ENGINEERS $4,000,000.00 USD

TOTAL ENGINEERING COST $ 12,000,000.00

Pag

e32

Pag

e33

THE MARKET FOR EXPANSION

The shortage of vessels of specific application in seismic, research, oil spill processing, and fisheries are best

illustrated by the chart below.

Research Ship Schedules and Characteristics by Country Go to http://oceanic.cms.udel.edu/ships/ for detail of research types

Huge demand for seismic vessels – tenfold increase in classification requests 13 June 2009 forfatter:

Per Wiggo Richardsen

Oslo: The booming global economy and high oil price have led to strong demand for seismographic

ships. DNV is experiencing a tenfold increase in classification requests compared to previous years.

Pag

e34

HARVESTER INDUSTRY IMPACT Shown in industry specific model, the company “Project Archimedes LLC,” will have impact industry wide less than 5% of

the 500 billion dollar combined annual markets and ongoing needs which have suffered shortages for more than two

decades. The combination of new worldwide regulatory controls of resources and dramatic increase of disaster events

has effectively increased opportunities for current and future growth potentials in the service industries.

SEISMIC CONTRACT SAMPLES ONGOING

Asia offshore capex forecast to increase 77% With an estimated capex of over $97 billion through 2009 to 2013, Asia is expected to witness an increase of 77% in terms of capex when compared to the previous five-year period, according to Infield‟s second edition Regional Perspectives Asia Pacific Market Update Report 2009/13.

OIL COMPANIES SPILLAGE ESTIMATES

http://api-ec.api.org/ehs/water/spills/upload/356-Final.pdf Analysis of Oil Spillage by Oil Industry Reports. Average oil

spill cleanup cost is $26.00 US per barrel. This figure is only the historical average cost over a 20 year period, and forms

the basis of anticipated market share. This does NOT account for current event occurrences.

GOVERNMENT RESEARCH VESSELS

http://www.corporateservices.noaa.gov/nbo/FY08%20Rollout%20Materials/1_31_07_ROLLOUT/Blue_Book/Chapter_7_

Final.pdf NOAA Report on 2008 Vessel contracting on government projects.

ADVANCE DEVELOPMENT WORLDWIDE MARKET

(5 Strategic Base Locations for Services)

TARGET MARKET SAMPLE: (FULL FUNDING)

Pag

e35

LOGICAL INVESTMENT DEVELOPMENT

Although the numerous projects depicted within this business plan could easily be accredited to overly ambitious goals

and unachievable development costing millions without return, the company has developed a “Logical and Realistic”

development schedule in line with investment funding, revenue generations, and specific task schedules to provide

investors with excellent returns in the 3-5 year timeframe, while completing development and sales schedules

independent on capital infusion from investors alone.

The project as a whole and divisional specific has been designed to generate income from a market rich environment

which remains unaffected by current financial industry turmoil and fluxuations inherent to industries dependence on

consistent turnover and replacement of goods and services.

THIS PROJECT IS DESIGNED AROUND

Sustainable Sources of Income Check our daily markets here: http://hisz.rsoe.hu/alertmap/index2.php

As with any forward looking projection seeking capital Project Archimedes LLC, has developed several income rich

market models. What does make our company unique to other markets is that we serve industry needs consistently in

need of turnover and replenishment resources (such as we will provide) the income picture looks very solid. Sources of

income are anticipated from the following areas on an ongoing basis once established.

Government, Agency, Organizational Sales

Franchise Development Worldwide Sales

Oil & Gas Industry, NOAA Research Leases

Research and Institutional Grants

Continuing Investment Offers

Developed and replenishment Product Spin-Off Sales

Inflation or Recession Proof Product Need.

Off-Shelf Commercial Sales

Timeline Development & Production Schedules

The company has established specific task scheduled timelines for both divisions and all projects associated

with them. The schedules are realistic, account for normal operational delays and provide tight budget

allocations for completion. The selected staff, engineers, scientist and marketing experts have narrow

parameters within projects to assure completion of company goals “On Time and On Schedule” for customer

deliveries. We must get it right the first time, and provide a superior product.

Allocation of funding distribution

The chart below illustrates the fund distribution based on the availability during the project timeline of development. The company reserves the right to change such distribution outline if (1) funds are not sufficient for development, or (2) the current development projects have exceeded the cost of completion and the company elects to redirect such funds to assure completion of other task or development.

Task Allocation Harvester Division Frontline Division Research & Development 19.2 % 19.0 %

Manufacture & Distribution 33.8 % 19.0 %

Administrative Operations 2.5 % 2.5 %

Sales /Contracting / Franchise 1.5 % 1.5 %

Other Related Cost .5 % .5 %

Pag

e36

In general terms the two divisions of the company will conduct the R&D budget allocations with distributions as indicated in the “Divisional Budget Distribution” chart. Companywide “Employee Budget Distribution” will not be budgeted to each division but absorbed in company administrative accounts for overall operations. This will be reflected in the Performa financial projections.

PROJECTED 10 YEAR INCOME

Pag

e37

INCOME BALANCE (No Load) 10 YEAR:

DISCLAIMER

The financial projections included in this business plan are the company’s projection of possible future results

and are dependent on many factors over which the company has no control. The company cannot give any

assurance that any of its assumptions on which the projections are based will prove to be correct.

Pag

e38

INVESTOR FUNDING SCHEDULES AND TYPES

Basic Project Investment (startup-Angle Backed) $10,000,000.00 USD to initiate operations, staff positions,

fund PPM issuance, secure research initiatives and retain marketing, legal, accounting and advisory services to

continue project funding requirements. TERMS: Investor negotiable up to 25% equity ownership.

Phase Funding Basic Investment: (Initiate Full Operations) $35,500,000.00 USD to research and develop

product lines for market under initial (PFL) Project Frontline and (POH) Project Ocean Harvester basic product

descriptions. TERMS: Investor JV or Private loan/equity holdings 5 years with maximum 8% interest and 12

month grace period.

Debit Term Sheet 7YR Equity Term Sheet 7YR

PPM Phase First Round Investment: ( $100,000,000.00 Issue) Will recover investor debt and equity positions

per agreements, retire denture notes, initiate full expansion product line development and undertake

aggressive marketing plans to generate volume revenues and initiate limited franchise offerings. TERMS: As

stated in memorandum terms and conditions.

PPM Convertible Debenture Ownership and Debt: ($80,000,000.00 issue) To support the launch of projects and their associated franchise efforts, Project Archimedes LLC, will seek to raise capital to fund its operations, licensing and patenting, acquisitions and licensing of complementary technologies, owning complimentary technologies or having commercial opportunities of interest to Project Archimedes LLC, purchase of parts and , feasibility studies, engineering reports, recruitment of key management and technical personnel for Project Archimedes LLC, and its proposed subsidiaries, purchase of real estate, buildings and equipment, repayment of development expenses, offering expenses including commissions and fees to brokers and finders and legal, accounting and consulting expenses. TERMS:As stated in PPM will apply. INVESTORS REQUIRING OFF-SHORE

Investors wishing to participate in project funding, but require or prefer offshore investment vehicles can be afforded such investment through the company IBC located in Nevis/Saint Kitts subject to advance notice during initial investment discussions. Primary advantage is issuance for confidential disclosure, however the company does honor and provide such legally required information on US citizens yearly to the IRS.

Pag

e39

VARIOUS INVESTOR EXIT OPTIONS

PROGRAMMED COMPANY GROWTH:

The company structure at formation provides for growth irrespective of revenue centers during the first two

years of operation. This is possible for the reasons of “Key Management” personnel efforts in the area of

obtaining government and private grants for research and development open for award, and the public

relations efforts to be conducted amongst humanitarian and ecological interest groups which will be solicited

for advance product sales donations to various charities and worthy organizations they champion. As

addressed later in this document, these experts which fill our management team, have vast experience in the

governmental and organizational industries we are targeting for our markets and will be active from day one

of operation to subsidize revenue incomes during the R&D Phase of company growth.

Such funds obtained will effectively free investor committed funds equal to said advances and credited to the

investor as proportional initial investment return without jeopardizing company growth, and allow partial exit

options to the investor profit options. Essentially each dollar obtained in this manner is set aside against the

investor initial commitment, to allow exit options without substantially effecting investor holdings in the

company or restricting company growth.

At some point before the middle of year three operation, the company should be bidding on such contracts,

and obtaining pre-delivery commitments on product lines to be offered by year four. Additional opportunities

in franchise, distribution and manufacturing of products will avail our management team to initiate either a

IPO issue, private trust placement, or industry merger/buyout which will position the company value to

increase substantially.

To assure the company growth follows this outline, company personnel, expert in grants, government

contracting franchise and public donations have been dedicated in the personnel staff requirement to assure

maximum effectiveness. The individuals selected to head such efforts resume is at the back of this document.

As research is completed the process of patent or copyright will additionally afford company revenue areas,

and increase the overall valuation of the company to outside financial and traditional investors. Financial

recognition will be guided by the scope and completion of research goals, and the continuation of new

projects within the select industries, which have immediate or wider application than those covered in the

investment project. Naturally our investor group will be alerted to new product releases and research

breakthroughs in advance of public or published disclosure.

INVESTOR EXIT PROGRAMMED PERIODS:

As stated prior, the project has within its structure specific term periods which lend themselves to investor

exit or reinvestment options. Listed here are the programmed periods such events should be evaluated by

investors. Please note that all options presented are based on projected opportunity and committed phase

funding of project by the investor group. All options provided are based on paid in investment – not

committed investment.

Pag

e40

Phase of Company Growth: Investor Options: Estimated Return Condition :

Beginning Each Operational Year of Phase Funding, start year two.

Partial Exit Funding Up to full phase funding + 10% against grant, presales, or awards paid to company

Investor ownership position is reduced proportionally to total investment.

Reinvestment Paid 25% of all income received from all such awards as Dividend.

Investor ownership position remains unchanged

Royalty Payouts to include license, copyright, patent sales or lease and employee ownership contributions.

Partial Exit Funding Payment up to 1/3 all investment sums received into company outstanding.

½ paid sums to investor reduce ownership position accordingly, and remainder is profit paid.

Reinvestment Proportion of declared investor bonus, not less than 20% of income area

Investor ownership position remains unchanged

Company Contract Awards Partial Exit Funding Up to total investment contribution remaining on books+15%

Investor ownership position is reduced proportionally to total investment.

Reinvestment As declared year end profit distribution dividend

Investor ownership position remain unchanged

Company Franchise Award Exit Funding Sells to Company at Income Valuation, all rights held, see franchise Lottery

Investor ownership position is vacated for sale price

Reinvestment Investor holding franchise rights keeps75% Profit. Remaining 25% is company admin payment.

Investor ownership position remains unchanged

Company Acquisitions/Mergers

Exit Funding Sells all remaining investment ownership to company based on valuation agreement

Investor vacates ownership interest

Reinvestment Net investment worth adjustment

Investor ownership position remains unchanged

Public/Private/Sale Exit Funding Sells all remaining investment ownership to company based on valuation agreement

Investor vacates ownership interest

Reinvestment Investor Personal Options Partial to Complete Sale

(Special Notice:) Exercise of the any of the above options by investment group apply only to paid in investment

sums, and do not void or relieve total committed funding to the project. Based on no option exercised the

investors may expect income dividend profit paid, adjusted to 30% all area company income received after

cost. Any and all options presented are based on projected and programmed company growth.

INVESTOR OWNERSHIP:

By investment agreement the investor group shall maintain (45%) Forty Five Percent Ownership in the

company Archimedes, and may be reduced by exit options exercised by the investment group as specified in

this document. The ownership is based on the committed funding at inception, and shall be validated by paid

Pag

e41

in funds. The remaining (55%) Fifty Five Percent ownership has been reserved for distribution by the principal

/author and CEO of the company. Distribution is anticipated as follows, but all legal, administrative and voting

rights are reserved to principal/author.

1. (25%) Twenty Five Percent Outright Awarded to Project Author by agreement

2. (15%) Reserved for Executive Management Award and Buy In Incentive

3. (05%) Reserved for Joint Employee Investment Program

4. (10%) Held in ownership reserve by the Project Author.

INVESTOR FRANCHISE HOLDINGS:

In the programmed growth of the company, both projects shall be subject to geographic and regional

franchise award to the investors. Essentially for each 5% of company investment held, a random draw order

from 1- 20 will be issued, for investor selection of franchise rights held exclusive. The purpose of this draw is to

provide each investor holding at least 5% interest in the company, to expand their potential profit returns by

holding income ownership of selected regions as they are developed by the company. The investor may in

turn sell, hold, trade or buy regions of interest at their option.

The program is simple. The company receives 25% of all profit realized by the investor franchise region, and

the investor retains 75% of all profits realized from the franchise region. All company franchise and

distribution rules shall apply. This program is anticipated to begin on year two of company operations.

Currently there are 60 target regions worldwide we will initiate trade in, and holding a 45% interest the

investors will hold 24 under this program for additional profit venues.

SUMMARY EXIT STRADAGIES:

This document has presented the programmed exit options available to the investor group, It is my hope that I

have answered your questions concerning the investment at hand. Understanding additional exit options may

be more akin to your investment comfort I remain open to suggested options.

INVESTOR REQUIRED RETURN:

Due to the different goals of investment groups, Archimedes has made allowances for different terms and

returns required by investment groups. The prospect investor is encouraged to provide such terms and

desired exit protocols in issued (LOI) Letter of Investment Intent, which we shall evaluate for suitability to

project development goals and company growth ability, to accept, reject or modify to mutual agreement.

Pag

e42

ADDITIONAL DOCUMENTS AVAILABLE FOR REVIEW

PROJECT ARCHIMEDES LLC,

509 SW 17TH STREET

FORT LAUDERDALE, FLORIDA-33315

Richard Peacock – Managing Member

(954) 599-8607 EST

Email: [email protected]