Gl Account

-

Upload

siva-sankar-mohapatra -

Category

Documents

-

view

234 -

download

0

Transcript of Gl Account

-

8/10/2019 Gl Account

1/10

In t roduct ion:

The paper gives the complete configuration required to create GL-account in SAP-FI, Right from thedefinition of Company to creation of GL-account in the company code and chart of accounts withscreen shots and explanation of the entire process to make the Reader have a clear understanding ofthe configuration. The process of creating an Enterprise structure begins with the definition of

Company. The various organizational units in a business are defined individually and they areassigned to each other in a hierarchical way which forms the whole Enterprise Structure in an ERPsystem.

A Company:

It is said to be an organization or a corporate group which has one or many Company code under it.The screen shots below will give the detailed step to define Company in SAP system. Most of theconfiguration relating to SAP is done in SPRO (SAP Project Reference Object); follow the navigationshown in the picture to Define Company in SAP,

-

8/10/2019 Gl Account

2/10

The definition of the company is shown above; The Company is represented using a Four Digitnumerical character (it can also be alphanumerical) 4623with the name Lokesh GroupofIndustries.

Company Code:

It is said to be the representation of an independent balancing or legal accounting entity within theCorporate Group which can create its own financial statements; there can be n number of companycode within a corporate group.

-

8/10/2019 Gl Account

3/10

Choose Second option to create New Company Code and First option to Copy and create newcompany with all the data from an existing Company Code.

Creation of Comp any Cod e 1000:

Company Code 1000 is created.

Creation of Comp any Cod e 2000:

-

8/10/2019 Gl Account

4/10

Once the Creation of Company code is done they are to be assigned to the Company in SAP toachieve the Enterprise Structure.

Company 4623- Lokesh Group of Industries

Company Code 1000- Lokesh Iron & Steel Company Code 2000- Lokesh Paper Mills

The tabular column describes that the Company Code 1000 & 2000 are contained in the Company4623. The above screen shot explains the creation of the Company Code in SAP system. To achievethis assignment of Company Code to Company the following steps are to be done

Assign Comp any Code to Company:

-

8/10/2019 Gl Account

5/10

The Screen shot explains the assignment of the CC 1000 & 2000 to Company 4623. Thus a basicOrganizational Structure is achieved in the Enterprise structure. Now the Financial accounting Globalsetting is explained below with configuration steps and screen shots.

Financia l account ing Global Set t ings:

The Variant Princ iple:

The Variant Principle is a Three Step Method used in the SAP system to assign particular properties

to one or more objects, the steps are;

1. Define The Variant.

2. Determine Values For The Variant.

3. Assign The Variant To The Object.

Maintain Fiscal Year Variant:

A Fiscal Year or the Financial Year is usually a period of twelve months for which a company regularlycreates an inventory and financial statements. The screen shot explains the navigation and the

creation of Fiscal Year Variant. The Fiscal year variant is categorized into three types namely

-

8/10/2019 Gl Account

6/10

1. Year Independent FYV.

2. Year dependent FYV.

3.

Shortened FYV.

Year Independ ent:

The starting dateand the ending dateof the Fiscal doesnt change according to the year, this typeof FYV is called year independent. For e.g. FY of INDIA, irrespective of the year the FYV is from

APRIL 1ST

to MARCH 31st. Creation of this type of FYV is explained below with screen shorts.

Year Depend ent:

The starting date and the ending date change every year, this type of FYV which is dependent on theyear is called year dependent FYV. The FYV must be changed every year to carry out transaction.For e.g. FY of USA, changes every year.

Shortened FYV:

This type of FYV is used to compensate the difference or the gap which occurs between FY usuallythis FYV will have less than 12 periods. Usage of SFYV is shown below with business scenarios asexamples.

Scenario 1: Say the FY of USA is from JAN 1ST

to NOV 31stthis year (2011), and next year they use

FY from MARCH 1ST

TO DEC 31ST

(2012), For this type of scenario Shortened FYV is incorporated tofill the GAP between DEC 1

ST(2011) TO FEB 28

TH(2012).

Scenario 2: Suppose the business of an Company starts in between there FYV say OCT 1ST

andends at MAR 31

stso to do posting SFYV is created and used for the first year of their

business.

-

8/10/2019 Gl Account

7/10

Fiscal Year Variant LO-YEAR INDEPENDENT is defined in the screen above, The periods of theFYV is determined below which is a 12period & 4special posting period variant. The Fiscal yearfollowed in India is Year Independent which is from APRIL 1

ST to MARCH 31

ST irrespective of the

year.

The year shift which indicates -1 is themonths of last year and the year shift 0 indicates the monthsof the present years.

-

8/10/2019 Gl Account

8/10

Thus the FYV is assigned to Company Code 1000 & 2000.

Note: The fiscal year variant doesnt specify whether a period is open or closed, it only definesthe number of periods and their start & finish days.

Special Postin g Period:

In order to ensure that you can compare the closing months with the other periods of the fiscal year,we make closing posting in the special periods for e.g. 12 posting periods & 4 special posting periods.These special posting periods could be

1.

Accruals & deferrals.

2.

Audit posting.

3. General meeting of share holders.

4. Adjustment Postings. Etc .

Posting Period variant:

-

8/10/2019 Gl Account

9/10

It is responsible for the opening & closing of periods in a Fiscal year for posting to take place. You canspecify which company codes are open for posting in a posting period variant. Posting period variantsare cross-company code and you have to assign them to your company codes. The posting periodsare then opened and closed simultaneously for all company codes via the posting period variants.

Working with posting period variants is recommended if you are responsible for a large number of

company codes. Since you only have to open and close the posting period once for the variant, yourwork is considerably reduced. Posting Period Variant can control posting according to the accounttype also. The configuration of Posting Period variant is explained below

The Posting Period Variant is defined for the company 4623. According to the variant principle thenext step is to determine values for the variant,

-

8/10/2019 Gl Account

10/10

Navigation is shown.

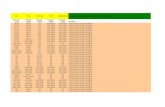

As the Screen shot explains the posting period can be maintained per account type and the yearwhich is to be open & closed can be easily managed. + determines the Masked account typeapplicable for all the account type, the posting is possible from 2011 to 2020 for periods 1 to 12 andthe for periods 13 to 16 it is open from 2011 to 2021.