Ghm Stock Report_updated 6-21-11

-

Upload

darkstar777 -

Category

Documents

-

view

225 -

download

0

Transcript of Ghm Stock Report_updated 6-21-11

-

8/3/2019 Ghm Stock Report_updated 6-21-11

1/35

[1]

Graham will be positively affected by the likelyapproval of the Keystone XL pipeline project, whichwill allow for increased processing of heavy oil from theCanadian oil sands region.

Increased global energy needs coupled with the debasedU.S. dollar and the conflict in the Middle East will

continue to drive the price of oil and other energy basedcommodities. As energy prices increase, the amount ofprocessing and the need for more efficient processingalso increase. Graham will benefit from this byproviding the machinery that creates processingefficiency.

Recent EPA regulations of mercury emissions will forceend-users to upgrade facilities with more advancedproducts.

Concerns over Fukushima will expand regulatorypushback on existing nuclear power plants, likelyspurring facility upgrades that will benefit Graham.

Graham will benefit from increased exposure to

contracts for naval ships and submarines. These avenuesof expansion are untapped markets and present highbarriers to entry since there is a strict approval processfor defense contractors. Graham has recently receivedclearances that allow them greater access to Navyprograms.

Alternative energy needs will create higher demand forsolar, geothermal, bio-fuel, and other alternative energysources of which Graham is a key equipmentmanufacturer.

As developing nations continue to rapidly expand,Graham's position in these markets will grow incoincidence with market needs.

Graham executives have indicated a strong likelihoodfor a larger acquisition than the recent Energy Steel deal.This signals future optimism that we believe, given thesuccess of the Energy Steel integration, will lead to anexpanded and more efficient organization.

Value or Growth: GROWTHFY end: March 31stIndustry: Industrial EquipmentNumber of Analysts: 2

SHARES AND RELATED DATA:Current Price (9/22/10) $19.11

52 Week High $26.3052 Week Low $13.09Avg. Daily Vol. 54,328 sh.Dividend Yield 0.36%Beta 1.35Mkt. Cap. $187.85MMShare Out. 9.83MMShort Interest as % of Float 3.70%

OWNERSHIP:Institutional Ownership 61%Inside Ownership 2.8%Insider Transactions (TTM) -7690 sh.

PRICE RATIOS:Price/Earnings (TTM) 31.33Price/Earnings Growth (5 yr) 1.6

INCOME DATA:Revenue (TTM) $74MMRevenue Growth (5-year avg.) 6.1%

PROFITABILITY AND METRICS:Operating Margin (TTM) 12%ROE (TTM) 8.0%

Debt/Equity 0%

TOP NEWS:

Graham Corps Q4 Profit Surges, Sales Rise88%

Proactive Investors, 27 May 2011

EPA Loses in Bid to Delay Air Rules

Wall Street Journal, 21 January 2011

Graham Corporation Acquires Nuclear-

Accredited Supplier Energy Steel

Business Wire, 4:15 PM, 14 December 2010

William and MaryM A S O N

School of BusinessFrank Batten Investment Fund

Graham CorporationJune 17, 2011

Paul Jacob, Analyst

Ticker: GHMCurrent Price (06/17/11): $19.11Target Price: $25.00

Exchange: NASDAQRecommendation: BUYETF: IYJ

INVESTMENT HIGHLIGHTSBASIC INFORMATION:

-

8/3/2019 Ghm Stock Report_updated 6-21-11

2/35

[2]

QUALITATIVE:Graham Corporation provides vacuum and heat transfer products that are largely driven by energy prices,EPA regulations, and production shifts.

Grahams product portfolio consists of custom engineered equipment that is used in the productionprocess for various industries. In these processes, heat or steam is often used to covert a raw material intoa final product. For instance, when processing crude oil, the oil is heated up in order to separate it intodifferent types of oil like diesel, petroleum, kerosene and others. In the process, energy is generated.Grahams products allow for the capturing of this energy for reuse. The more energy that is captured, thegreater the efficiency of the production process. The equipment also plays a vital role in capturingpollutants that are created.

As such, Grahams products tend to be most in demand when energy prices are high (increased need forefficiency) or when regulations force companies to upgrade their pollution capturing systems. Similarly,in the petroleum processing market, Graham benefits when oil companies process greater amounts of sour

crude because more processing is required.

Looking at the next fiscal year, Graham is expected to benefit from a few changes in the economic andregulatory environments:

First, the State Department will likely approve the Keystone XL pipeline project which will createincreased need for petrochemical processing in the Canadian sands region. It is expected that theAthabasca oil sands contain 1.7 trillion barrels of oil. Of this amount, approximately 170 billion barrels iseconomically recoverable, making the Athabasca sands the second largest reserve of oil in the world afterSaudi Arabia (Athabasca Oil Sands, 2011). The Keystone XL pipeline would essentially transport this oilfrom Canada directly to refineries in the Gulf region, for use in the United States and for export abroad.The project currently awaits approval from the Department of the State, but there are a few indications

that it will soon meet approval. For instance, refiners have already invested approximately $20 billion inheavy crude assets for processing the oil from the sands, pipe manufacturing for the line has alreadybegun, and last but not least, Paul Elliot, Hillary Clinton's former campaign director, is the head of thepipeline's lobbying effort (Daly, 2011). Mrs. Clinton, who is in charge of the final decision, has alreadyindicated in a speech that approval is likely (Daly, 2011). Furthermore, the heavy oil from the sandsrequires more processing than other varieties, a good signal that Grahams products will be in highdemand. In fact, Graham recently won a $4 million dollar contract from a U.S. refinery for an ejectorsystem that will be used to retrofit facilities for the processing of Athabasca sand oil (Businesswire,2011). Once the EIS is approved, Graham's stock price should immediately reflect the increased revenueexpectations associated with the pipeline. Guidance from management conservatively estimates revenueof $5 to $6 million annually (Glajch, Chief Financial Officer, 2011). Estimations for total demandincrease range from $100-150 million (Glajch, Capacity to Grow, 2009).

Second, the successful integration of Energy Steel presents an opportunity for future growth viaacquisition. Executives have indicated future acquisitions are a likely use of cash on hand. The companyhas also suggested that future acquisitions will be larger than Energy Steel and may be in the natural gascompression space. Given the success of Energy Steel and the possibility of greater horizontal integration,we believe that this strategy presents strong revenue growth going forward.

Third, the new EPA regulations for the emission of mercury and other hazardous pollutants will forceprocessors to upgrade their plants to meet tighter guidelines. While attempts have been made by the

INVESTMENTTHESIS

-

8/3/2019 Ghm Stock Report_updated 6-21-11

3/35

[3]

Obama Administration to stall these revised regulations, federal judges have blocked these attempts.Companies are now forced to compensate with increased facility upgrades: focusing largely on boilers.The new regulations were officially released in March of 2011. Increased industry expenditure related tothe new regulations is estimated at $9.5 billion the first year and $3 billion each year thereafter (Nelson,2011). Other estimates point to additional expenses totaling $10.9 billion annually (Jackson, 2011).

Fourth, after Fukushima, the Nuclear Regulatory Commission has increased inspections on existingfacilities. Executives have indicated that upgrades are likely and will directly benefit Graham in the shortterm.

Fifth, Graham will benefit from increased naval contract work. Within the last year alone, Graham won a$25 million contract from Northrop Grumman Shipbuilding for the new Gerald R. Ford aircraft carrierthat will generate expected revenues of $8.3 million over the next three years. Graham has indicated thatit gained approval that allowing limited access to naval information for bidding purposes. Past guidancerecommended that full access will be granted by 2013 or 2014. Naval contracts are expected to contributean additional $10-15 million of revenue annually (Glajch, Chief Financial Officer, 2011).

Sixth, as a lead producer for alternative energy applications, Graham will benefit from increased reliance

on renewable energy. As oil prices increase, power generation will increasingly turn to longer lastingsolutions including geothermal, solar, and biodiesel. By providing necessary equipment in the processingof energy from these sources, Graham is well positioned to capture some of the increased expenditurerelated to alternative energy.

Finally, Graham has significant exposure to developing countries in Asia, the Middle East, SouthAmerica, Latin America, and North Africa. Graham also has significant exposure to the Chinese market.It is expected that continued growth in these markets will been seen in demand growth for Graham'sproducts since developing countries will require more energy for infrastructure development, industrialuse, and individual consumption.

EMPIRICAL:

Empirically, a discounted cash flow analysis shows that Graham Corp. is undervalued. Graham hasadequate room for stock price inflation at an implicit value of $25.00 per share (see Discounted CashFlow Valuation).

A relative valuation based on P/E and EV/EBITDA ratios indicates a lower valuation around $17 pershare. On a historic basis, Graham is trading relatively high in terms of price to earnings (currently at 31xwith a range from 10 to 40). However, we remain positive going forward because Graham has a low priceto book relative to competitors, indicating that share price degradation will likely be met with resistance.

INVESTMENT RISKS:

Energy price decline. Harmful regulatory changes. Lack of approval for the Keystone XL pipeline. Failure to gain contractor approval for work on naval submarines. Adverse economic conditions leading to a double-dip recession. Raw material supply shortages from global demand or extreme events.

Currency inflation in international markets.

-

8/3/2019 Ghm Stock Report_updated 6-21-11

4/35

[4]

BACKGROUND:Graham Corporation is a global designer, manufacturer, and supplier of custom-engineered heatexchangers, steam condensers, compressors, vacuum pumps, and ejectors (see definitions below). The

company was founded in 1936 by Harold M. Graham. During World War II, Graham specialized in thedesign and production of heat exchangers for military ships. After the war its focus shifted to industrialapplications (Corporation, History, 2011).

The company provides its products primarily to industries such as chemical, petrochemical, petroleumrefining, and electric power generation, including cogeneration and geothermal plants. It also sells itsproducts to the metal refining, pulp and paper, shipbuilding, water heating, refrigeration, desalination,food processing, drugs, heating, ventilating, and air conditioning industries. The Graham Corporation hasa worldwide presence, with equipment installed in facilities located in North and South America, Europe,Asia, Africa, and the Middle East (SBI, 2006). Graham's revenue allocation by product is shown below:

Product Definitions: Heat Exchangers- A device used to transfer heat between two physically separate fluids of

different temperatures (SBI, 2006).

Condensers- A device used to condense steam into water. After condensation has occurred, thewater is collected and transferred back to the boiler, helping to reduce operating costs (SBI,2006).

Compressors- Devices used for increasing the pressure of a given volume of air (SBI Reports,2007).

Vacuum Pumps- Devices that create a partial vacuum by exhausting gas molecules from a closedchamber (SBI Reports, 2007).

Ejectors- Similar to vacuum pumps except that these devices employ the venturi effect topressurize a low pressure fluid.

COMPANYDISCUSSION

-

8/3/2019 Ghm Stock Report_updated 6-21-11

5/35

[5]

STRATEGY:Graham's strategy can be summarized with the following differentiators:

1. Entry into Expanding Markets: In an effort to expand its brand of high-end products andcomponents, Graham targets opportunities for growth, higher-efficiency production, andattractive new markets both domestically and overseas. Graham has recently made bold

moves into the nuclear industry. The company also plans to enter the liquid natural gascompression market in the near future. Further, overseas expansion is expected to outpacedomestic expansion as the company seeks higher growth markets.

2. Product Support: Through a robust product support system, Graham intends to leveragemarketplace reputation as a differentiator to its offerings. Graham offers on-site and in-house training, maintenance, repair, and other support services.

3. Future Growth via Acquisition: Graham is constantly evaluating future potential acquisitionsthat they feel may help strengthen their overall brand. The three main criteria include:

Geographic Expansion.Currently, over half of Grahams revenue is frominternational markets. From FY09 to FY11, the proportion of international revenuesincreased from 37% to 55%. In order to capitalize on what they perceive asattractive opportunities abroad, Graham is targeting potential investments in China

and other Asian expansion. Product Diversification. To strengthen its product portfolio, Graham is evaluating

targeted expansion in specialty heat exchangers, process vacuum equipment,packaged systems, process vessels and environmental products.

Market Diversification. In addition to its current offerings in the Power market,Graham is targeting opportunities to expand into both nuclear and alternative energyoptions. Additionally, Graham hopes to further expand Department of Defensemarkets.

4. Best Company Practices: In engineering and manufacturing specialized equipment forindustrial processing, Graham relies heavily on the knowledge, skills, and motivation of its317 employees. Through maintaining a small company atmosphere with a commitment toexcellence, Graham enjoys a very low employee turnover rate. The company also offerscompetitive benefits to help maintain the stability and low turnover that has been observedin its employee pool. These include:

Pension (employee hires prior to 1/1/03) 401k matching (all employees) Health Insurance (current employees) ESOP Tuition Assistance.

PRINCIPLE MARKETS:Oil Refining (35% of Total Revenues)The success of this industry is largely dependent on the "crack spread," which in turn is based on a

number of economic, political, natural, and social factors. Ultimately, refiners are most successful when abarrel of oil is cheap relative to the retail price of oil based products. As these margins increase, refiningoutput increases and the demand for greater efficiency in the refining process follows likewise. Onesimple way to increase efficiency is to upgrade heat exchangers, condensers, and other specializedequipment that recycles the input-energy required in the refining process. As a primary supplier of theseproducts, Graham's success is positively correlated to the success of the oil industry.

-

8/3/2019 Ghm Stock Report_updated 6-21-11

6/35

[6]

Product Uses:Vacuum distillation: Graham ejector systems and ejector-liquid ring combination systems supportvacuum distillation of crude oil throughout the world. Their experience includes the world's largestvacuum distillation columns in North America, Middle East and Asia. Grahams vacuum producingequipment can be found wherever crude oil is refined.Heavy Oils and Oil Sands: Unconventional crude oils are some of the most difficult to upgrade. Graham

equipment is found in Alberta providing reliable operation for the largest oil sands upgraders in WesternCanada and in Venezuela for the difficult extra-heavy crude oils from the Orinoco Belt.Lube Oil Fractionation: The production of lube oil from various crude oil slates requires predictable andreliable vacuum levels in the fractionation towers. Graham ejector systems and ejector-liquid ringcombination systems for lube oil service are found in the Middle East, North America, Southeast Asia,Australia and Europe.Conversion processes: Including FCCU, hydrocracking, hydrotreating, coking, require reliable equipmentto support these specialized services. Graham works closely with turbomachinery equipment providers toensure steam surface condensers allow optimum horsepower from the steam turbine.Clean transportation fuels: Graham ejector systems and specialty process vacuum condensers provideoutstanding performance in ultra-low sulfur diesel (ULSD) and clean gasoline services.

Chemical & Petrochemical(22% of Total Revenues)Graham sells various products to the chemicals industry. For instance, heat exchangers are used in anumber of applications including cooling, heating, and heat recovery. Other examples are condensers andliquid ring pumps, which are useful for compressing liquids during processing. Since many of thesolutions used by this industry are aggressive and corrosive in nature, the equipment manufacturers arerelied upon to produce robust products with long replacement cycles (SBI, 2006).

Produce Uses:Ethylene: Graham steam surface condensers are installed in the largest ethylene producing facilities in theworld. Product reliability and engineering capability to effectively integrate steam surface condensers intotoday's world scale facilities make Graham an ideal partner. Whether naphtha or natural gas feedstock,Graham has proven experience with cracked gas compressor, ethylene refrigeration compressor, propane

refrigeration compressor installations supporting the largest producing plants.Methanol: This building block petrochemical has several compressors services supported by a steamturbine that require steam surface condensers and condenser exhausters. The largest single train methanolplants located in the Middle East use Grahams steam surface condensers. Synthetic gas compressors arecritical to throughput.Ammonia/Urea: Fertilizer production for a growing global population will require reliable and provendesigns for steam surface condensers and ejector systems. Graham has installations throughout the worldfor plants designed by every major ammonia or urea process licensor. Their equipment is known for itsreliability, quality and engineering expertise that went into its design.

Power and Others (43% of Total Revenues)Graham mainly provides heat exchangers, surface condensers, steam ejectors, and liquid pump systems to

the power industry. These products allow for a more efficient production process and for emissionscontrol. As such, there is a normal replacement cycle that creates stable business for Graham's products.

Product Uses:Geothermal Power Generation: Graham products for geothermal service include both barometric andsurface condensers and condenser exhauster system including ejector and liquid ring combinationsystems. Grahams expertise in both heat transfer and vacuum service for the design of condensing andevacuation systems involving high concentrations of non-condensible gases is a distinct advantage.

-

8/3/2019 Ghm Stock Report_updated 6-21-11

7/35

[7]

Waste to Energy: Graham has many proven installations throughout the world in waste to energy andcogeneration power producing applications. Products provided for waste to energy service include surfacecondensers, ejector systems, liquid ring pump packages and specialty heat exchangers.Combined cycle power generation: Graham products provide for combined cycle powergeneration service including surface condensers, ejector systems, liquid ring pump packages and specialtyheat exchangers. Grahams experience is extensive for integrating surface condensers with various

turbine-generator suppliers.Ethanol, biodiesel and corn to petrochemicals: Requiring engineered to order ejector systems.Combination ejector-liquid ring pump systems: Uses various heat exchangers.Gas to liquids, coal to liquids, shale oil and solar power: Requiring specialized equipment.

In addition to the power industry, Graham products can also be found in:

Shipbuilding Refrigeration Water Heating Metal Refining Food Processing Pulp and Paper Processing Desalination

OPERATIONS:MarketingGrahams largest piece of intellectual property is its brand name. In the highly competitive markets inwhich it competes, Graham leans heavily on a knowledgeable engineering sales staff to custom design theproduct that best meets the needs of the customer. Graham relies heavily on its established network ofcustomers to directly market its products. In addition to conventional sales calls, they also maintain apresence in both industry trade shows and publications. With larger agencies, Graham wins work throughbid selection processes.

ProductionGraham custom manufactures most of its products in house. However, in times of stronger demand theyhave been forced to utilize strategic outsourcing to achieve targets.

DistributionDistribution of Grahams products is led by an experienced internal engineering team. To custom-designand produce the correct piece of equipment, these representatives work with the customer and contractorsthroughout the project lifecycle. Graham's distribution network is best described as internal since most ofits products are custom made and delivered by the company itself. Graham utilizes an on-time deliverysystem that is 94% effective.

Training and Support

To support their products, Graham employs a Service Team to field issues with products, both over thephone and on-site. For assistance with implementation of new products, Graham also provides extensivetraining materials and the option of on-site training sessions.

COMPETITION:Competition in Grahams space is moderate. Major competitors include:

Gardner Denver- Manufacturer of highly engineered stationary air compressors and blowers forindustrial applications. Gardner is a much larger company than Graham Corporation and has beenknown to grow at a very rapid pace (See Exhibit 14 for a Competitive Mapping). Much of this

-

8/3/2019 Ghm Stock Report_updated 6-21-11

8/35

[8]

growth comes from the use of debt based financing. Gardner is much more diversified thanGraham in terms of product portfolio. Geographically, the company focuses more on theEuropean and domestic markets, compared with Graham's focus on Asia, S. America, N.America, and the Middle East. Because the company is larger, its turnover rate and cashconversion cycle are substantially longer than Graham's. Gardner has built barriers to entrythrough branding. Notably, the company owns Nash, Thomas, CompAir, and more.

Chart Industries- Manufacturer of highly engineered equipment used in the production, storageand end-use of hydrocarbon and industrial gases. Chart is slightly larger than Graham andspecializes in energy and chemicals with a high emphasis also placed on compression cylindersand distribution tanks for natural gas.

Alpha Laval-Energy-manufacturer of efficient heat exchangers, separators that separate liquidsand removes particles from liquids and gases, and equipment that safely transports and regulatesfluids.

Graham recognizes that they cannot always compete on price with their competitors, due to a variety offactors in their production process. However, they choose to differentiate themselves as a higher qualityalternative with a knowledgeable staff to support customers on a variety of needs.

As an indication of Graham's competitive position, the company has been found to hold significantmarket share in the unique space in which it competes (see Exhibit 15 & 16). Looking at the industry as awhole, the total market size is estimated as follows:

Heat Exchanger & Steam Condensers = $2.2-2.7 billionCompressors and Vacuum Pumps = $4.4 billionTotal = $7 billion

Combined, the total market value is roughly $7 billion dollars of which Graham has a 0.7% penetration(SBI, 2006).

Graham's size and lack of debt have allowed it to grow organically and maintain low employee turnoverand efficient operations. These characteristics in addition to its entry into fast growing markets (China,Canada, and the Middle East) are believed to give Graham a competitive advantage going forward.

MANAGEMENT:James R. Lines, CEOAge: 49 yearsTenure: 26 yearsMr. Lines moved his way up the internal ranks, starting as a production engineer and eventuallyescalating into management. He has been CEO since 2008. Mr. Lines holds a B.S. in AerospaceEngineering from the State University of New York at Buffalo.

Jeffrey F. Glajch, VP- Finance & Administration and CFOAge: 47 yearsTenure: 2 yearsFollowing the retirement of Ron Hansen in March of 2009, Mr. Glajch joined Graham as the CFO. Mr.Glajch holds an MBA from Purdue University, an MS in Chemical Engineering from ClarksonUniversity, and a BS in Chemistry from Carnegi Mellon University. Prior to his tenure at Graham, heserved three years as the Chief Financial Officer of Nukote International, a privately held global re-manufacturer of printing and imaging products. Between June 2000 and May 2006, Mr. Glajch was the

-

8/3/2019 Ghm Stock Report_updated 6-21-11

9/35

[9]

Chief Financial Officer of Fisher Scientific Canada, a global healthcare and laboratory equipmentcompany. Mr. Glajch has also previously served as a Senior Manager of Finance and BusinessPlanning/Analysis at Walt Disney World Company, as Director of Finance/Division Controller at GreatLakes Chemical Corporation and in various financial positions with Air Products and Chemicals, Inc(Thompson, Officer & Directors, 2011).

Alan E. Smith, VP of OperationsAge: 43 yearsTenure: 17 yearsMr. Smith ascended through the company ranks beginning his career as a process engineer. He has beenin his current position since 2007.

Jennifer R. Condame, CAOAge: 45 yearsTenure: 18 yearsPrior to joining Graham, Ms. Condame served as an Audit Manager for PricewaterhouseCoopers. Shehas been Comptroller since 1994 and in her current role since 2008.

HISTORY AND MILESTONES:2010-Energy Steel Acquisition. In an $18 million cash deal, Graham purchased Energy Steel, a leadingcode fabrication and specialty machining company dedicated exclusively to the nuclear power industry.In an effort to reduce the cyclicality of its heavy presence in the oil and petrochemical industry, Grahamhas used this acquisition to expand its footprint in a key growth industry for the company. Prior to theacquisition, Energy Steel generated approximately $10 million in revenue annually. Last quarter, itgenerated $5.1 million.2009- Share Repurchase. In January 2009, the board of Graham Corp (GC), a manufacturer ofheat exchangers, condensers and vacuum tanks, authorized the repurchase of up to 1 mil common shares,or about 9.88% of the company's common stock outstanding, in open market or privatelynegotiated transactions. Based on GC's closing stock price of $9.48 on January 29, the last full tradingday prior to the announcement of the board's approval, the buyback had an indicated value of up to $9.48

million (Thompson, Deals, 2011).2005-Reorganization. The company was reorganized into five business groups to focus on efficiency:Condensers, Ejectors, Pumps, Spare Parts and Heat Exchangers. As a result, Graham Precision PumpsUK and Graham Vacuum Pumps UK spun off (eventually bought out and discontinued) (SBI, 2006).2005Exporter of the Year. Graham was recognized as the Exporter of the Year by the InternationalBusiness Council of the Rochester Business Alliance (SBI, 2006).

CONTRACT BACKLOG:In closing out FY2011, Graham built up $91.1 million backlog for contract services (see Exhibit 4).According to company filings, highlights of those contracts include:

$25+ million contract from Northrop Grumman Shipbuilding for equipment to be installed on theU.S Navys new CVN 79 Gerald R. Ford class aircraft carrier.

$23 million in contracts for two 400,000 barrels per day refineries being constructed in SaudiArabia.

$12 million in contracts for ethylene, fertilizer and other petrochemical producing plants. $7.5 million in contracts for new oil refining plants under construction in the Peoples Republic

of China.

$4 million in contracts for alternative energy projects, including geothermal and biomass. $4 million in contracts for oil refinery projects in Mexico and South America.

-

8/3/2019 Ghm Stock Report_updated 6-21-11

10/35

[10]

Graham traditionally converts 85% to 90% of existing backlog to sales within a 12-month period.However, they plan to spread out a few large orders (e.g. Northrop Grumman for the U.S. Navy projectand a couple large Middle East refinery orders) over a multi-year period (Annual Report 2010).According to conversations with the CFO, the Northrop Grumman (largest) will be spread over a 3-yearperiod (Glajch, Chief Financial Officer, 2011). Therefore, the conversion rate is expected to be in the 70

percentiles for 2012.

-

8/3/2019 Ghm Stock Report_updated 6-21-11

11/35

[11]

Graham Corporation manufactures products that meet the needs of many different industrial end-usersincluding: oil refiners, power generators, chemical processors, shipping, alternative energy generators,and many others. This report will concentrate on the largest end-users.

OIL REFINING:Market Size: $700 billion in 2009 (First Research, 2010)Forecast: 40% growth in 2010 and 5.2% CAGR from 2010 to 2015 (See Exhibit 5)Driver: Economic growth

About 150 petroleum refineries operate in the US, owned by approximately 90 companies, with combinedannual revenue of about $700 billion. Large refiners include Chevron, ConocoPhillips, ExxonMobil,Valero, and BP's US-based subsidiaries. Annual revenue fluctuates substantially because of the shiftingprice of crude oil (First Research, 2010).

The oil refining market is best described as concentrated: the eight largest refiners hold about 60 percent

of all US refining capacity (First Research, 2010). The margins tend to be relatively small and capitalexpenditure is quite large. Regulation is a critical aspect that, albeit creating high barriers to entry, tendsto reduce margins. While a market is growing for substitute products (notably bio-fuels and ethanol),refined petroleum products will play a critical role in global energy demands for many years to come.

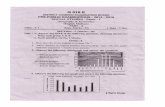

Prospects for near term growth are positive with the end of the recession. Evidence of this is found whenlooking at refiner's capital expenditure this year as projected into the future. Below are two major U.S.refiners and their historic/projected capital expenditure:

A trough in spending was hit in 2009/2010 but spending has started to increase again as the effects of therecession wear off. For instance, Valero, one of the top three US refiners by output capacity, has indicatedthat it will increase capital expenditure by 20% from 2010 to 2011. As capital expenditure continues toincrease in the wake of the economic recovery, industrial suppliers including Graham stand to benefit.

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

2005 2006 2007 2008 2009 2010 *2011

Capital Expenditure(in Millions USD)

Valero

Sunoco

INDUSTRYDISCUSSION

-

8/3/2019 Ghm Stock Report_updated 6-21-11

12/35

[12]

POWER:Market Size: $130 billion in 2009 (DataMonitor)Forecast: (1%) change in 2010; 5.3% CAGR from 2010 to 2015 (See Exhibit 6)Driver: Economic and population growth

The US electric power generation industry consists of approximately 400 companies with combined

annual revenue of about $130 billion. Major companies include American Electric Power, DominionResources, Duke Energy, and Exelon. The industry is highly concentrated: the 50 largest companiesaccount for more than 95 percent of revenue (First Research, 2010).

Demand is driven by commercial, government, and residential needs for electrical power, which dependmainly on economic activity and population growth. Profitability is determined by governmentregulations and fuel costs. Large companies have an advantage in negotiating fuel contracts and beingable to pass the costs of implementing government regulations directly to consumers. Small companiescan compete effectively by exploiting market niches, such as offering green power in regulatedmarkets. The industry is capital-intensive: average annual revenue per employee is about $540,000 (FirstResearch, 2010).

The primary product of the industry is alternating current (AC) electrical power. Electricity is producedby generators that convert mechanical energy into electrical energy when large coils are rotated in apowerful magnetic field. Most commercial power comes from turbine engines powered by steamproduced by burning fossil fuels, mainly coal and natural gas. Other power sources include steam fromnuclear reactors; conventional hydroelectric conversion; and renewable sources such as solar, wind, andgeothermal. Power plants typically produce between 500 and 900 megawatts of power, or enough tosupply the needs of 500,000 to 1 million households. Larger plants require special metals and fabricationand require more downtime for maintenance, while smaller units aren't as economical to operate (FirstResearch, 2010).

Selecting the method of powering an electric generator is critical to its long-term efficiency, since fuelcosts are 40 to 60 percent of annual operating expenses. The cost of environmental pollution controls are

also a major consideration in selecting a power source. Petroleum and natural gas emissions can becontrolled at reasonable costs, but prices for these fuels are often volatile. Coal prices are the most stableof potential fuels, but emission controls can be expensive and some of the control technology is untested.Challenges to designs, extensive environmental studies, and lack of a long-term solution for nuclear wastemake the costs of nuclear power plants higher than that of conventional plants. Hydroelectric plants arethe most thermally efficient and least polluting generation method, but the number of suitable locationsfor dams is limited and long-term downstream effects are a growing concern (First Research, 2010).

Future expectations for this industry predict growth that will likely exceed inflation by a couplepercentiles. Revenue changes for Graham's power segment are likely to be in-line with the industry.

-

8/3/2019 Ghm Stock Report_updated 6-21-11

13/35

[13]

CHEMICALS &PETROCHEMICALS:Market Size: $670 billion in 2009 (DataMonitor)Forecast: 6.9% CAGR from 2009 to 2015 (See Exhibit 7)Driver: Economic growth

The US chemicals industry includes about 11,000 companies with combined annual revenue of about

$700 billion. Major companies include Dow, DuPont, Eastman Chemical, ExxonMobil Chemical, andHuntsman. The industry is concentrated: the 50 largest firms generate more than half of industry revenue(First Research, 2010).

Because chemicals are used to make a wide variety of industrial and consumer products, demand is drivenby the overall health of the US economy. The profitability of individual companies is closely tied toefficient operations. Big companies have large economies of scale in production. Small companies cancompete effectively by producing specialty products, of which there are a large number, or by operating asingle plant highly efficiently. The industry is capital-intensive: average annual revenue per employee ismore than $900,000 (First Research, 2010).

The manufacturing process usually involves mixing various raw materials and adding heat to produce a

series of chemical reactions, then using various physical techniques to isolate the finished product.Production may involve dozens of intermediate steps. Many specialty chemicals are produced in batches,while commodity chemicals are often produced in continuous-flow operations. Special reaction vessels,valves, piping, and control instruments are used to produce different chemicals. Companies generallyemploy a large number of engineers to manage the manufacturing process. There are usually wasteproducts to be disposed of, and energy inputs are often high. Large amounts of energy are typically usedto drive chemical reactions, and natural gas or petroleum is used as feedstock for many chemicals (FirstResearch, 2010).

Because the chemical industry continuously invests in the latest technology to maintain efficientoperations, it is expected to remain one of the leading avenues of revenue for Graham Corporation. As thechemical industry expands from $670 billion in 2009 to an estimated $1 trillion in 2015, Graham's

segmental revenue associated with the chemical industry is also expected to increase.

-

8/3/2019 Ghm Stock Report_updated 6-21-11

14/35

[14]

NAVAL DEFENSE AND MARINE:Market Size: Marine - $300 billion in 2009 (DataMonitor)

Defense - $500 billion in 2009 (DataMonitor)Forecast: Marine - 5.8% CAGR from 2010 to 2015 (See Exhibit 8)

Defense(2.8%) CAGR from 2011 to 2016 (Whitlock, 2011).Driver: Government, International Trade, and International Security

Graham has provided steam surface condensers for main propulsion and turbine generator applicationsaboard naval and commercial vessels. The range of application varies from the design and fabrication ofcondensers used in the main propulsion systems of the largest of naval vessels to the supply of smallcondensers for use aboard commercial ships. The single largest award in this market has been the $25million contract for the propulsion system on the Gerald R. Ford aircraft carrier being built by NorthropGrumman.

Recently the Pentagon announced that it would reduce spending by $78 billion over the next five years(Whitlock, 2011). Even though this diminishes the possibility for growth in the U.S. defense industry, theoverall effect on Graham's products is negated by the following admissions:

1. The cuts focus largely on the Army and Marine Corps but Graham is dealing solely with theNavy.

2. The increased revenue that will result from the Navy will come if and when the company isgranted contractor approval for work on submarines. This would be an untapped end-usermarket for the company and so any expenditure decrease on submarine building, which islikely to be put into effect in the first budgetary year well before approval might be granted,won't adversely affect Graham's year-over-year revenue.

-

8/3/2019 Ghm Stock Report_updated 6-21-11

15/35

[15]

RELATIVE VALUATION:In performing a relative valuation, GHM was compared against four direct competitors (GDI, GTLS,TRS, and DOV) as shown in Table 1 below:

Table 1Relative Valuation

GHM GDI GTLS TRS DOV Comp. Avg.

Share Price $19.11 $79.64 $44.35 $21.56 $63.22 $52.19

Market Cap 187.9M 4.16B 1.30B 738.58 11.80B 3.23B

P/E (TTM) 31.30 20.96 49.83 14.51 15.28 25.15

P/E (Forward) 23.60 14.48 20.21 11.41 12.61 14.68

PEG 1.60 0.75 1.43 0.54 1.01 0.93

P/Book (MRQ) 2.53 3.21 2.52 5.50 2.45 3.42

EV/EBITDA (TTM) 12.85 11.77 16.13 7.47 9.01 11.10

P/Sales (TTM) 2.51 2.03 2.19 0.73 1.55 1.63

ROA (TTM) 5.3% 9.1% 4.1% 8.7% 8.0% 7.5%

ROE (TTM) 8.0% 17.3% 5.3% 48.8% 17.5% 22.2%

Earnings/Share (TTM) 0.61 3.80 0.89 1.49 4.14 $2.58

D/E 0 22.26 43.16 379 46.91 122.83

Gross Margin (TTM) 30.0% 33.0% 29.8% 29.7% 38.3% 32.7%

Operating Margin (TTM) 12.0% 14.7% 10.3% 12.4% 14.8% 13.0%

Cash Conversion (MRQ) 87.5 109.3 111.7 75.5 77.6 93.5

Beta (Valueline) 1.35 1.30 1.80 1.75 1.15 1.50

Forecasted Growth (5 yr) 20% 28% 35% 27% 15% 26%

Evaluating against the average of these four competitors, the relative valuation produced the followingimplied price per share based on P/E, P/Book, and EV/EBITDA metrics:

Relative Valuation

P/E (TTM) $15.35

P/E (Forward) $11.89

EV/EBITDA (TTM) $16.50

P/Book (MRQ) $25.83

Average $17.39

Generally, the companies used in the evaluation run similar operations as Graham with the exception oftwo main differences:

1. Graham is much smaller than all of the comparative companies.2. Graham is financed entirely with equity while its competitors use a debt/equity mix.

VALUATION

-

8/3/2019 Ghm Stock Report_updated 6-21-11

16/35

[16]

While Grahams size warrants a price discount, lack of debt justifies a larger premium because credit isstill tight following the financial crisis. Furthermore, even if Grahams stock price dropped to the lowerend of the historical P/E range, the price to book ratio will serve to push it up.

DISCOUNTED CASH FLOW VALUATION:In computing a valuation based on discounted cash flows, the following assumptions were made:

Risk Free Rate = 3% for 10-year treasuries Risk Premium = 5% (based on Prof. Haltiner's Cost of Capital note) Size Premium = 1.5% for low liquidity concerns Beta = 1.35 (Value line). The beta value was checked with a 5-year regression against the sector

ETF (IYJ) and the Russell 2000 Small Cap Index, producing an average adjusted beta equal to1.32.

Using the above values, return on equity worked out to 11.25%. In order to compute WACC, tax was

taken at 35% based on historic averages and equity was taken to be the current market cap.

( ) (

)

Graham currently has no long term and minimal short term debt, therefore the WACC worked out to thecost of equity or 11.25%.

The valuation was taken out ten years beginning with the next reported quarter (Q1 2012), which will beannounced at the end of July 2011 (see Exhibit 9). The model projects 2012 revenue at a 28% growthrate equal to annual revenue of $95 million. Future growth is estimated at 20% for the following 3 yearsand tapering off thereafter. These estimates are based on company guidance and our own thoughts about

the potential markets that Graham services. Additionally, margins were based on the last call and taken atthe low end of guidance. An average gross margin of 30% was used for 2012 increasing to 35% beyond.SG&A was approximated at 17.4% of revenue based on the low end of guidance. Capex and depreciationwere projected forward at 2010s run rate. Finally, a regression was used to compare working capital andrevenue over the past 6 years to create an equation that "predicts" the working capital needs based onforecasted revenues. The equation follows:

The model returned a fair market value of $25.62 per share or approximately $25. Because the modelutilized "low-end" approximations, we believe this is a fairly conservative estimate. It is important to notethat this valuation doesn't price many of the main drivers (Keystone XL and the granting of full naval

access rights) into the stock. Statistical analysis shows that the contribution of these will increase value by$1 to $2 per share.

For the sensitivity analysis, revenue growth and gross margin were considered variable. Revenue changefrom FY 2016 and beyond is a function of Graham's long term ability to seek and capture market growth.The baseline estimate for gross margins was given by Graham's CFO, who expects margins to normalizeto the mid to upper 30 percentile when the company reaches previous revenue peaks of $90 to $100million (Glajch, Chief Financial Officer, 2011). Price sensitivity to a 1% margin movement in either

-

8/3/2019 Ghm Stock Report_updated 6-21-11

17/35

[17]

direction is relatively high, and therefore an unexpected decline in future margins is likely to decreasevalue expectations.

Table 2Sensitivity Analysis: Model A

-

8/3/2019 Ghm Stock Report_updated 6-21-11

18/35

[18]

OPERATIONAL:One of Graham's main strengths is its relatively small size as it is able to capture efficiency in itsoperations. Evidence for this is clear in the relative valuation (see Valuation) when looking at Graham's

cash conversion cycle relative to its competitors. In the past cycle Graham did an effective job increasingthe margin productivity of its employees as well as the efficiency of its manufacturing cycle as shown inthe following chart:

Although these measurements have retreated since the recession, it is expected that as economicconditions improve greater utilization will be achieved. Current capacity utilization in Batavia is around80% with expectations of 100% utilization during the next market peak

Turning to margins, it is clear that GHM has experienced gross margin erosion since reaching a peak of44% in Q1 of 2009 [Q4 2011 margins were approximately 30.5%] (see Exhibit 2). Margin erosionoccurred for three main reasons:

1. One of Graham's biggest strength lies with the intellectual property of its employees. This isparticularly true in the specialized manufacturing segment since the majority of the workershave specialized knowledge and because experience is crucial in the design andmanufacturing process. Good engineers and welders are particularly hard to come by.Entering the downturn, Graham chose to retain many of its employees so as to remaincompetitive when the economy recovered. As a result, Graham saw significant marginerosion. This is normal with any business that experiences significant revenue reduction.However, by retaining its employees, Graham has secured business opportunity.

FINANCIALANALYSIS

-

8/3/2019 Ghm Stock Report_updated 6-21-11

19/35

[19]

2. Higher material costs from copper, steel, and other commodity materials.3. A "drying up" of domestic business as a result of the recession forced Graham to concentrate

on international markets where competition is higher and margins are lower.

Still, when compared against the industry, Graham has maintained an advantage in its margins that willonly increase going forward (see Table 4).

Table 4Market Comparison

Source: Yahoo Finance

0

50

100

150

200

250

300

350

2006 2007 2008 2009 2010 2011

Employee Count(Total Full-Time)

-

8/3/2019 Ghm Stock Report_updated 6-21-11

20/35

[20]

Turning to stock performance, GHM has outperformed the ETF by approximately 6% over the past year(see chart below).

Source: Google Finance

Short interest in Graham has gone down recently and is currently low relative to recent trends, indicatinginvestor confidence going forward:

Source: NASDAQ online

TECHNICALANALYSIS

-

8/3/2019 Ghm Stock Report_updated 6-21-11

21/35

[21]

INSIDERS TRADING:

OTHERINFORMATION

-

8/3/2019 Ghm Stock Report_updated 6-21-11

22/35

[22]

MAJOR HOLDERS:

-

8/3/2019 Ghm Stock Report_updated 6-21-11

23/35

[23]

Exhibit 1Analyst Price Targets

EXHIBITS

-

8/3/2019 Ghm Stock Report_updated 6-21-11

24/35

[24]

Exhibit 2

Exhibit 3

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

40.0%

45.0%

50.0%

2005Q1

2005Q2

2005Q3

2005Q4

2006Q1

2006Q2

2006Q3

2006Q4

2007Q1

2007Q2

2007Q3

2007Q4

2008Q1

2008Q2

2008Q3

2008Q4

2009Q1

2009Q2

2009Q3

2009Q4

2010Q1

2010Q2

2010Q3

2010Q4

2011Q1

2011Q2

2011Q3

2011Q4

Quarterly Gross Margins(As Percent of Sales)

$0.0

$2.5

$5.0

$7.5

$10.0

$12.5

$15.0

$17.5

$20.0

$22.5

$25.0

$27.5

$30.0

2005Q1

2005Q2

2005Q3

2005Q4

2006Q1

2006Q2

2006Q3

2006Q4

2007Q1

2007Q2

2007Q3

2007Q4

2008Q1

2008Q2

2008Q3

2008Q4

2009Q1

2009Q2

2009Q3

2009Q4

2010Q1

2010Q2

2010Q3

2010Q4

2011Q1

2011Q2

2011Q3

2011Q4

Quarterly Sales(in Millions USD)

-

8/3/2019 Ghm Stock Report_updated 6-21-11

25/35

[25]

Exhibit 4

Exhibit 5Oil Refining Industry Forecast

Source: First Research

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

19

96

19

97

19

98

19

99

20

00

20

01

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

Annual Backlog(in Millions USD)

-

8/3/2019 Ghm Stock Report_updated 6-21-11

26/35

[26]

Exhibit 6Power Industry Forecast

Source: First Research

Exhibit 7Chemicals & Petrochemicals Industry Forecast

Source: First Research

-

8/3/2019 Ghm Stock Report_updated 6-21-11

27/35

[27]

Exhibit 8Marine Industry Forecast

-

8/3/2019 Ghm Stock Report_updated 6-21-11

28/35

[28]

Exhibit 9DCF Valuation

-

8/3/2019 Ghm Stock Report_updated 6-21-11

29/35

[29]

Exhibit 10Thompson Forecast

Exhibit 11Analyst Earnings per Share Matrix

-

8/3/2019 Ghm Stock Report_updated 6-21-11

30/35

[30]

Exhibit 12Earnings Surprises

Exhibit 13

-100%

-50%

0%

50%

100%

150%

200%

250%

300%

350%

400%

450%

500%

Q408

Q109

Q209

Q309

Q409

Q110

Q210

Q310

Q410

Q111

Q211

Q311

Q411

Earnings Surprises

-

8/3/2019 Ghm Stock Report_updated 6-21-11

31/35

[31]

Exhibit 14Competitive Field

(SBI Reports, 2007)

Quadrant I: Companies with relatively high revenue and high year-on-year growth rates.Quadrant II: Companies with relatively high revenue and low year-on-year growth rates.Quadrant III: Companies with relatively low revenue and low year-on-year growth rates.Quadrant IV: Companies with relatively low revenue and low year-on-year growth rates.

-

8/3/2019 Ghm Stock Report_updated 6-21-11

32/35

[32]

Exhibit 15Market Share by Product (Domestic)

Exhibit 16Market Share by Product (Abroad)

-

8/3/2019 Ghm Stock Report_updated 6-21-11

33/35

[33]

Exhibit 17Income Statement

(All Values in Millions $USD

except as noted) 2005 2006 2007 2008 2009 2010 2011 2012

Year Year Year Year Year Q1 Q2 Q3 Q4 Year Q1 Q2 Q3 Q4 Year Q1 Q2 Q3 Q4 Year

Year March March March March March Jun -09 Sep -09 Dec-09 Mar-10 March Jun -10 Sep -10 Dec-10 Mar-11 March Jun -11 Sep -11 Dec-11 Mar-12 March

Revenue 41.33 55.21 65.82 86.43 101.11 20.14 16.11 12.17 13.78 62.19 13.35 15.72 19.22 25.95 74.24 23.75 23.75 23.75 23.75 95.00

Graham 20.80 68.44 19.00 19.00 19.00 19.00 76.00

Energy Steel 5.10 5.80 4.75 4.75 4.75 4.75 19.00

COGS 33.79 39.25 49.00 55.27 59.40 11.86 10.25 8.35 9.50 39.96 9.50 10.38 14.35 18.04 52.27 16.63 16.63 16.63 16.63 66.50

Gross Margin 7.54 15.96 16.82 31.16 41.71 8.28 5.85 3.82 4.28 22.23 3.85 5.35 4.86 7.90 21.96 7.13 7.13 7.13 7.13 28.50

Operating Expenses

SG&A 7.69 9.82 10.34 13.07 14.83 3.25 3.03 2.72 3.10 12.09 2.57 3.02 3.58 3.85 13.02 4.13 4.13 4.13 4.13 16.50

Other 0 0 0 0 0 0 0 0

Operating Income (EBIT) -0.15 6.14 6.48 18.09 26.89 5.03 2.82 1.10 1.18 10.14 1.28 2.33 1.28 4.06 8.95 3.00 3.00 3.00 3.00 12.00

Taxes 0.086 2.167 0.758 7.07 9.272 1.529 1.24 0.35 0.581 3.7 0.414 0.78 0.442 1.295 2.931 1.02 1.02 1.02 1.02 4.08

Tax Effected EBIT -0.237 3.974 5.723 11.018 17.615 3.501 1.582 0.753 0.602 6.438 0.869 1.548 0.838 2.762 6.017 1.98 1.98 1.98 1.98 7.92

Shares Outstanding 9.84 9.84 9.84 9.84 9.84 9.83 9.84 9.83 9.84 9.84 9.83 9.84 9.83 9.84 9.84 9.83 9.84 9.83 9.84 9.84

EPS (0.02)$ 0.40$ 0.58$ 1.12$ 1.79$ 0.36$ 0.16$ 0.08$ 0.06$ 0.65$ 0.09$ 0.16$ 0.09$ 0.28$ 0.61$ 0.20$ 0.20$ 0.20$ 0.20$ 0.81$

Depreciation 0.78 0.78 0.87 0.86 0.98 0.42 0.84 0.75 -0.90 1.11 0.29 0.58 0.88 0.60 2.36 0.55 0.55 0.55 0.55 2.20

CAP EX 0.22 1.05 1.64 1.03 1.49 0.08 0.20 0.22 0.50 1.00 0.53 0.16 1.44 0.54 2.67 0.83 0.83 0.83 0.83 3.30

Sales YOY -5% 34% 19% 31% 17% -27% -33% -51% -45% -38% -34% -2% 58% 88% 19% 78% 51% 24% -8% 28%

COGS (as a % sales) 82% 71% 74% 64% 59% 59% 64% 69% 69% 64% 71% 66% 75% 70% 70% 70% 70% 70% 70% 70%

COGS as % Sales 1% -6% 3% -10% -21% 0% 8% 8% 1% 5% 11% -7% 13% -7% 2% -1% 0% 0% 0% 1%

Gross Margins 18% 29% 26% 36% 41% 41% 36% 31% 31% 36% 29% 34% 25% 30.5% 30% 30% 30% 30% 30.0% 30%

Gross Margins -4% 19% -8% 23% 58% 0% -12% -14% -1% -8% -19% 18% -26% 20% -5% 1% 0% 0% 0% -2%

SG&A (as a % sales) 19% 18% 16% 15% 15% 16% 19% 22% 22% 19% 19% 19% 19% 15% 18% 16% 16% 16% 16% 17%

SG&A as % Sales -1% 577% 9% 1% -12% 10% 17% 19% 1% 38% -1% 0% -3% -21% -22% -9% 0% 0% 0% 17%Operating Margins 0% 11% 10% 21% 27% 25% 18% 9% 9% 16% 10% 15% 7% 16% 12% 13% 13% 13% 13% 13%

Operating Margins -289% -49% -26% 46% 185% -6% -30% -48% -5% -34% -41% 54% -55% 135% 40% 5% 0% 0% 0% -19%

Tax Rate -57% 35% 12% 39% 34% 30% 44% 32% 49% 36% 32% 34% 35% 32% 33% 34% 34% 34% 34% 34%

CapEx (as a % sales) 1% 2% 2% 1% 1% 0% 1% 2% 4% 2% 4% 1% 7% 2% 4% 3% 3% 3% 3% 3%

EBITDA 0.63 6.92 7.36 18.95 27.86 5.45 3.66 1.85 0.28 11.25 1.57 2.91 2.16 4.66 11.31 3.55 3.55 3.55 3.55 14.20

EBITDA per share 0.06$ 0.70$ 0.75$ 1.93$ 2.83$ 0.55$ 0.37$ 0.19$ 0.03$ 1.14$ 0.16$ 0.30$ 0.22$ 0.47$ 1.15$ 0.36$ 0.36$ 0.36$ 0.36$ 1.44$

Stock Price 3.5 7.8 6.6 17.5 9.6 14.8 14.9 20.7 18.7 23.5 19.5 20.5 21.5 22 23.5 24 24 24 24 24

P/EBITDA 54.8 11.1 8.8 9.1 3.4 6.7 10.0 27.4 164.9 20.6 30.4 17.3 24.4 11.6 20.5 16.6 16.6 16.6 16.6 16.6

P/EBIT -228.1 12.5 10.0 9.5 3.5 7.2 13.0 46.1 38.9 22.8 37.4 21.7 41.3 13.3 25.8 19.7 19.7 19.7 19.7 19.7

P/E -145.0 19.3 11.3 15.6 5.4 10.4 23.2 67.6 76.4 35.9 55.1 32.6 63.1 19.6 38.4 29.8 29.8 29.8 29.8 29.8

-

8/3/2019 Ghm Stock Report_updated 6-21-11

34/35

[34]

Annual Report 2010. Graham Corporation. Web. 27 Jan. 2011. .

Athabasca Oil Sands. (2011, January 3). Retrieved January 22, 2011, from Wikipedia:

http://en.wikipedia.org/wiki/Athabasca_oil_sands

Businesswire. (2011, January 6). Graham Corporation Wins Two Ejector System Orders Valued at $4

Million. Retrieved January 22, 2011, from Businesswire:

http://www.businesswire.com/news/mfrtech/20110106006949/en/Graham-Corporation-Wins-

Ejector-System-Orders-Valued

Corporation, G. (2011, January 27). History. Retrieved January 27, 2011, from Graham Corporation:

http://www.graham-mfg.com/index.asp?pageId=42

Corporation, G. (2011, January 27). Our Strategy. Retrieved January 17, 2011, from Graham Corporation:

http://www.graham-mfg.com/index.asp?pageId=41

Daly, S. (2011, January 10). Graham Corp.: In the Sweet Spot of the Energy Bull-Market. Retrieved

January 22, 2011, from Seekingalpha: http://seekingalpha.com/article/245664-graham-corp-in-

the-sweet-spot-of-the-energy-bull-market

Datamonitor. (2010). Chemicals in the United States. New York: Datamonitor.

First Research. (2010, November 1). Industry Profile: Chemicals. Retrieved January 23, 2011, from First

Research: http://williamandmary.firstresearch-learn.com/industry.aspx?chapter=0&pid=17

First Research. (2010, November 22). Industry Profile: Petroleum Refining. Retrieved January 23, 2011,

from First Research: http://williamandmary.firstresearch-

learn.com/industry.aspx?chapter=0&pid=155

First Research. (2010, October 25). Industry Profile: Power. Retrieved January 23, 2011, from First

Research: http://williamandmary.firstresearch-learn.com/industry.aspx?chapter=0&pid=241

Glajch, J. (2009). Capacity to Grow. Singular Research Conference (pp. 1-33). Graham Corporation.

Glajch, J. (2011, January 21). Chief Financial Officer. (P. Jacob, Interviewer)

Jackson, L. (2011, June 13). The EPA's War On Jobs. The Wall Street Journal .

Nelson, G. (2011, January 21). With Extension Denied, EPA Sends Boiler Rules to White House.Retrieved January 22, 2011, from New York Times:

http://www.nytimes.com/gwire/2011/01/21/21greenwire-with-extension-denied-epa-sends-boiler-

rules-t-75622.html

WORKSCITED

-

8/3/2019 Ghm Stock Report_updated 6-21-11

35/35

Pulizzi, H. J. (2010, February 16). Obama Unveils Loan Guarantees for Georgia Nuclear Plant. Retrieved

January 22, 2011, from Wall Street Journal:

http://online.wsj.com/article/SB10001424052748704804204575069301926799046.html

SBI. (2006). Heat Exchangers & Steam Condensers and Power Boilers in the U.S. New York: SBI.

SBI Reports. (2007). Compressors and Vacuum Pumps and Industrial Spraying Equipment in the U.S.

New York: SBI.

Thompson. (2011, January 28). Deals. Retrieved January 28, 2011, from Thompson Banker:

http://mergers.thomsonib.com/NASApp/DealSearch/TDWhiteLabel.htm?component=overviewde

alsTearsheet&currScreenName=XX&source=XX&reptype=standard&outputFormat=xml&dealn

umber=2047149020&category=MA&hidelinks=yes&PRODUCT_CODE=Banker&tfn_locale=en

-US&SessionID=E

Thompson. (2011, January 27). Officer & Directors. Retrieved January 27, 2011, from Thompson ONE

Banker: http://banker.thomsonib.com/ta/?ExpressCode=wmary

Whitlock, C. (2011, January 7). Pentagon to Cut Spending by $78 Billion, Reduce Troop Strength.

Retrieved January 22, 2011, from Washington Post: http://www.washingtonpost.com/wp-

dyn/content/article/2011/01/06/AR2011010603628.html