GF-CAP INDUSTRY & COUNTRY VIEWS JAN2015

-

Upload

eric-j-weigel -

Category

Documents

-

view

61 -

download

0

Transcript of GF-CAP INDUSTRY & COUNTRY VIEWS JAN2015

INDUSTRY & COUNTRY

ALLOCATION

RECOMMENDATIONS

ERIC J. WEIGEL

January 2015

1

Motivation

• A top-down view has become an integral component in managing equity strategies in today’s capital markets

• Two commonly used top-down approaches used by global equity managers involve country/region and industries/sectors

• A significant portion of the value add and risk of equity strategies derives from these two top-down components

• The relative importance of these top-down components varies over time, but remains a significant driver of equity returns

• The growth and evolution of Exchange Traded Products (ETP) allows for efficient implementations of country and industry views

2

INDUSTRY VIEWS

3

Industry Selection Methodology

• MSCI industry indices denominated in US Dollars

• Expected return building blocks:• Valuation

• Income Generation

• Growth

• Profitability

• Sentiment/Momentum

• Industries are ranked from 1 (highest return potential) to 24 (least return potential)

• Deviations from benchmark weights are proportional to the expressed industry preference rankings

4

Developed Markets: Industry ViewsOVERALL RANK RANK RANK RANK RANK RANK RANK RANK RANK RANK TECHNICAL BENCH

NAME TYPE STATUS SCORE RANK 1 WK AGO 2 WK AGO 3 WK AGO 4 WK AGO 12 WK AGO VALUE INCOME GROWTH PROFIT MOM VOLATILITY STAGE WGT

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT INDUSTRY DEVELOPED 1.9469 1 1 1 1 1 6 11 13 4 2 1 16.91 BRK OUT 1.60

RETAILING INDUSTRY DEVELOPED 1.49843 2 5 4 4 5 5 1 22 8 11 10 11.77 BRK OUT 3.34

PHARMACEUTICALS BIOTECHNOLOGY & LIFE SCIENCES INDUSTRY DEVELOPED 1.2359 3 2 2 2 2 1 3 16 14 19 4 11.27 IMPROV 8.66

HEALTH CARE EQUIPMENT & SERVICES INDUSTRY DEVELOPED 1.03865 4 4 3 3 4 4 6 24 2 15.5 3 10.78 BRK OUT 3.06

SOFTWARE & SERVICES INDUSTRY DEVELOPED 0.87524 5 3 5 5 3 2 2 23 3 20 8 12.29 BRK OUT 6.62

REAL ESTATE INDUSTRY DEVELOPED 0.73241 6 6 6 6 7 12 8 4 16 15.5 7 7.44 BRK OUT 3.33

TECHNOLOGY HARDWARE & EQUIPMENT INDUSTRY DEVELOPED 0.60318 7 7 9 7 6 3 16 17 18 3 2 11.92 BRK OUT 4.34

COMMERCIAL & PROFESSIONAL SERVICES INDUSTRY DEVELOPED 0.48332 8 8 7 12 9 9 4 8 1 7 17 10.36 DETER 1.81

TRANSPORTATION INDUSTRY DEVELOPED 0.37006 9 10 8 11 8 11 15 18 11 8 6 10.49 BRK OUT 2.88

UTILITIES INDUSTRY DEVELOPED 0.26136 10 13 13 13 13 13 17 2 15 6 5 10.23 BRK OUT 3.52

HOUSEHOLD & PERSONAL PRODUCTS INDUSTRY DEVELOPED 0.15568 11 9 10 9 12 8 5 12 20.5 12 11 8.14 BRK OUT 1.80

MEDIA INDUSTRY DEVELOPED 0.05171 12 11 11 8 10 10 10 19 10 21 9 11.20 BRK OUT 2.93

FOOD BEVERAGE & TOBACCO INDUSTRY DEVELOPED -0.05171 13 12 12 10 11 7 9 7 20.5 18 13 8.61 IMPROV 6.08

FOOD & STAPLES RETAILING INDUSTRY DEVELOPED -0.15568 14 15 14 14 14 14 13 10 9 23 12 8.71 BRK OUT 2.42

CONSUMER SERVICES INDUSTRY DEVELOPED -0.26136 15 14 15 17 17 15 7 15 12 5 19 8.70 DETER 0.90

DIVERSIFIED FINANCIALS INDUSTRY DEVELOPED -0.37006 16 17 16 15 15 16 14 20 24 14 14 11.57 BRK OUT 3.99

CONSUMER DURABLES & APPAREL INDUSTRY DEVELOPED -0.48332 17 16 17 16 16 20 12 21 23 22 16 8.72 BRK OUT 2.09

CAPITAL GOODS INDUSTRY DEVELOPED -0.60318 18 18 19 18 18 18 18 11 19 9 21 10.11 DETER 7.53

INSURANCE INDUSTRY DEVELOPED -0.73241 19 19 20 20 19 19 23 6 7 10 15 9.22 BRK OUT 4.02

TELECOMMUNICATION SERVICES INDUSTRY DEVELOPED -0.87524 20 20 18 19 20 17 20 1 17 1 22 9.31 BRK DOWN 3.96

MATERIALS INDUSTRY DEVELOPED -1.03865 21 22 22 22 22 21 19 9 13 4 23 10.82 BRK DOWN 4.93

AUTOMOBILES & COMPONENTS INDUSTRY DEVELOPED -1.2359 22 21 21 21 21 24 22 14 6 17 20 11.03 DETER 3.22

BANKS INDUSTRY DEVELOPED -1.49843 23 23 23 23 23 23 24 5 5 24 18 10.32 BRK DOWN 9.37

ENERGY INDUSTRY DEVELOPED -1.9469 24 24 24 24 24 22 21 3 22 13 24 17.83 BRK DOWN 7.57

5

Developed Markets: Current Correlations

Avg Corr 0.55 0.63 0.75 0.74 0.72 0.66 0.70 0.70 0.69 0.63 0.66 0.64 0.51 0.63 0.65 0.71 0.70 0.76 0.54 0.66 0.55 0.63 0.63 0.58

Developed ENE MAT CAP GOODS COM SERV TRANS AUTO DURABLES SERVICES MEDIA RETAIL FOOD BEV H PROD HC EQUIP PHARMA BANK DIV FIN INS REAL EST SOFTWAREHARDWARE SEMI TELCO UTS

ENE 1.00 0.74 0.73 0.70 0.64 0.53 0.52 0.53 0.47 0.44 0.50 0.56 0.38 0.50 0.52 0.61 0.62 0.66 0.36 0.54 0.49 0.53 0.53 0.50

MAT 0.74 1.00 0.84 0.81 0.72 0.71 0.68 0.69 0.59 0.52 0.57 0.58 0.38 0.55 0.58 0.76 0.70 0.79 0.46 0.63 0.63 0.62 0.54 0.50

CAP GOODS 0.73 0.84 1.00 0.90 0.88 0.83 0.81 0.79 0.76 0.71 0.70 0.68 0.53 0.69 0.69 0.84 0.87 0.90 0.52 0.75 0.69 0.76 0.65 0.60

COM SERV 0.70 0.81 0.90 1.00 0.86 0.78 0.79 0.77 0.77 0.70 0.76 0.75 0.59 0.68 0.72 0.84 0.80 0.87 0.62 0.73 0.64 0.71 0.68 0.63

TRANS 0.64 0.72 0.88 0.86 1.00 0.74 0.79 0.77 0.78 0.70 0.71 0.69 0.54 0.68 0.71 0.80 0.78 0.84 0.65 0.74 0.59 0.75 0.66 0.64

AUTO 0.53 0.71 0.83 0.78 0.74 1.00 0.81 0.71 0.64 0.63 0.63 0.54 0.42 0.61 0.61 0.79 0.80 0.80 0.52 0.61 0.68 0.69 0.61 0.53

DURABLES 0.52 0.68 0.81 0.79 0.79 0.81 1.00 0.78 0.76 0.75 0.71 0.71 0.54 0.62 0.69 0.76 0.76 0.81 0.61 0.70 0.63 0.70 0.63 0.62

SERVICES 0.53 0.69 0.79 0.77 0.77 0.71 0.78 1.00 0.80 0.74 0.70 0.64 0.47 0.68 0.70 0.77 0.78 0.84 0.56 0.77 0.63 0.73 0.74 0.56

MEDIA 0.47 0.59 0.76 0.77 0.78 0.64 0.76 0.80 1.00 0.76 0.72 0.63 0.57 0.72 0.71 0.70 0.74 0.79 0.60 0.75 0.54 0.72 0.70 0.59

RETAIL 0.44 0.52 0.71 0.70 0.70 0.63 0.75 0.74 0.76 1.00 0.65 0.61 0.53 0.64 0.67 0.62 0.70 0.71 0.56 0.75 0.51 0.63 0.58 0.47

FOOD 0.50 0.57 0.70 0.76 0.71 0.63 0.71 0.70 0.72 0.65 1.00 0.74 0.67 0.67 0.67 0.71 0.66 0.74 0.68 0.60 0.50 0.50 0.69 0.75

BEV 0.56 0.58 0.68 0.75 0.69 0.54 0.71 0.64 0.63 0.61 0.74 1.00 0.80 0.56 0.67 0.63 0.59 0.70 0.63 0.58 0.50 0.53 0.67 0.72

H PROD 0.38 0.38 0.53 0.59 0.54 0.42 0.54 0.47 0.57 0.53 0.67 0.80 1.00 0.52 0.60 0.43 0.45 0.54 0.54 0.48 0.32 0.38 0.51 0.63

HC EQUIP 0.50 0.55 0.69 0.68 0.68 0.61 0.62 0.68 0.72 0.64 0.67 0.56 0.52 1.00 0.72 0.70 0.71 0.72 0.51 0.65 0.53 0.64 0.61 0.59

PHARMA 0.52 0.58 0.69 0.72 0.71 0.61 0.69 0.70 0.71 0.67 0.67 0.67 0.60 0.72 1.00 0.70 0.67 0.73 0.57 0.66 0.50 0.62 0.69 0.64

BANK 0.61 0.76 0.84 0.84 0.80 0.79 0.76 0.77 0.70 0.62 0.71 0.63 0.43 0.70 0.70 1.00 0.86 0.90 0.60 0.68 0.67 0.71 0.71 0.64

DIV FIN 0.62 0.70 0.87 0.80 0.78 0.80 0.76 0.78 0.74 0.70 0.66 0.59 0.45 0.71 0.67 0.86 1.00 0.91 0.46 0.77 0.64 0.73 0.64 0.51

INS 0.66 0.79 0.90 0.87 0.84 0.80 0.81 0.84 0.79 0.71 0.74 0.70 0.54 0.72 0.73 0.90 0.91 1.00 0.56 0.78 0.68 0.76 0.73 0.64

REAL EST 0.36 0.46 0.52 0.62 0.65 0.52 0.61 0.56 0.60 0.56 0.68 0.63 0.54 0.51 0.57 0.60 0.46 0.56 1.00 0.49 0.27 0.42 0.62 0.72

SOFTWARE 0.54 0.63 0.75 0.73 0.74 0.61 0.70 0.77 0.75 0.75 0.60 0.58 0.48 0.65 0.66 0.68 0.77 0.78 0.49 1.00 0.56 0.72 0.64 0.52

HARDWARE 0.49 0.63 0.69 0.64 0.59 0.68 0.63 0.63 0.54 0.51 0.50 0.50 0.32 0.53 0.50 0.67 0.64 0.68 0.27 0.56 1.00 0.62 0.53 0.35

SEMI 0.53 0.62 0.76 0.71 0.75 0.69 0.70 0.73 0.72 0.63 0.50 0.53 0.38 0.64 0.62 0.71 0.73 0.76 0.42 0.72 0.62 1.00 0.60 0.48

TELCO 0.53 0.54 0.65 0.68 0.66 0.61 0.63 0.74 0.70 0.58 0.69 0.67 0.51 0.61 0.69 0.71 0.64 0.73 0.62 0.64 0.53 0.60 1.00 0.62

UTS 0.50 0.50 0.60 0.63 0.64 0.53 0.62 0.56 0.59 0.47 0.75 0.72 0.63 0.59 0.64 0.64 0.51 0.64 0.72 0.52 0.35 0.48 0.62 1.00

6

Developed Market Industry Summary

• Highest Return Potential: Semiconductors, Retailing,

• Greatest Improvement (last 12 weeks): Real Estate, Semiconductors

• Lowest Return Potential: Energy, Banks

• Greatest Deterioration (last 12 weeks): Food & Beverage,

Technology Hardware

• Most Volatile: Energy, Semiconductors

• Least Volatile: Real Estate, Household/Personal Products

• Most Correlated: Insurance

• Least Correlated: Household Products

7

Portfolio Implications

• Expected Portfolio Volatility: 10.5% pa

• Largest allocations to Pharma & Software

• No/Negligible exposure to Automobiles, Consumer Services, Durables

• Stay with Health Care and Tech, minimize exposure to Energy, Materials and Finance

8

Portfolio Implications

• Expected Tracking Error: 1.50% pa

• Beta with Benchmark: 1.04

• Correlation to Benchmark: 0.99

• Active weights are proportional to expected return views

9

Emerging Markets: Industry ViewsOVERALL RANK RANK RANK RANK RANK RANK RANK RANK RANK RANK TECHNICAL BENCH

NAME TYPE STATUS SCORE RANK 1 WK AGO 2 WK AGO 3 WK AGO 4 WK AGO 12 WK AGO VALUE INCOME GROWTH PROFIT MOM VOLATILITY STAGE WGT

PHARMACEUTICALS BIOTECHNOLOGY & LIFE SCIENCESINDUSTRY EMERGING 1.9469 1 1 1 1 1 3 4 23 6 1 1 12.56 IMPROV 1.52

MEDIA INDUSTRY EMERGING 1.49843 2 2 2 2 2 4 1 24 12 5 3 26.05 BRK OUT 1.36

SOFTWARE & SERVICES INDUSTRY EMERGING 1.2359 3 4 3 3 3 2 2 22 1 24 7 17.11 DOWN TR 5.23

HOUSEHOLD & PERSONAL PRODUCTS INDUSTRY EMERGING 1.03865 4 3 5 5 5 5 3 19 7 15 5 12.42 IMPROV 1.47

HEALTH CARE EQUIPMENT & SERVICES INDUSTRY EMERGING 0.87524 5 6 6 6 6 7 6 18 20 13 8 13.55 IMPROV 0.70

CONSUMER SERVICES INDUSTRY EMERGING 0.73241 6 5 4 4 4 1 5 21 4 10 13 21.39 BRK DOWN 0.16

TECHNOLOGY HARDWARE & EQUIPMENT INDUSTRY EMERGING 0.60318 7 7 7 7 10 8 21 17 10 3 2 16.12 BRK OUT 5.19

INSURANCE INDUSTRY EMERGING 0.48332 8 10 12 12 12 11 18 14 2 9 4 15.11 BRK OUT 3.33

DIVERSIFIED FINANCIALS INDUSTRY EMERGING 0.37006 9 8 9 8 7 9 13 10 15 4 9 14.11 IMPROV 2.49

TRANSPORTATION INDUSTRY EMERGING 0.26136 10 9 8 11 11 17 10 16 13 11 10 11.06 BRK OUT 2.12

FOOD BEVERAGE & TOBACCO INDUSTRY EMERGING 0.15568 11 11 10 10 9 13 7 8 9 17.5 19 12.19 BRK DOWN 5.98

COMMERCIAL & PROFESSIONAL SERVICES INDUSTRY EMERGING 0.05171 12 12 11 9 8 6 12 13 3 8 15 17.02 BRK DOWN 0.70

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT INDUSTRY EMERGING -0.05171 13 13 14 14 14 18 14 12 24 2 6 16.76 BRK OUT 3.20

CAPITAL GOODS INDUSTRY EMERGING -0.15568 14 16 16 17 16 14 9 15 18 17.5 18 11.23 BRK DOWN 5.56

CONSUMER DURABLES & APPAREL INDUSTRY EMERGING -0.26136 15 15 13 13 13 10 15 7 22 6 14 10.99 BRK DOWN 1.03

UTILITIES INDUSTRY EMERGING -0.37006 16 17 18 15 18 12 20 3 19 7 12 11.50 BRK DOWN 4.20

TELECOM SERVICES INDUSTRY EMERGING -0.48332 17 14 15 16 15 15 16 4 11 22.5 17 12.37 DOWN TR 9.79

FOOD & STAPLES RETAILING INDUSTRY EMERGING -0.60318 18 18 19 18 19 16 8 9 8 12 22 14.63 BRK DOWN 1.93

RETAILING INDUSTRY EMERGING -0.73241 19 19 17 19 17 22 11 11 17 21 21 13.85 BRK DOWN 1.22

BANKS INDUSTRY EMERGING -0.87524 20 20 20 20 20 19 23 5 14 19 11 12.75 BRK DOWN 19.71

REAL ESTATE INDUSTRY EMERGING -1.03865 21 21 22 22 22 24 19 1 23 14 16 15.42 DETER 2.77

AUTOMOBILES & COMPONENTS INDUSTRY EMERGING -1.2359 22 22 21 21 21 20 22 20 5 20 20 16.32 BRK DOWN 3.08

MATERIALS INDUSTRY EMERGING -1.49843 23 23 23 23 23 21 17 6 16 16 23 12.35 BRK DOWN 7.54

ENERGY INDUSTRY EMERGING -1.9469 24 24 24 24 24 23 24 2 21 22.5 24 21.22 BRK DOWN 9.72

10

Emerging Markets: Current Correlations

Avg Corr 0.57 0.65 0.70 0.27 0.67 0.48 0.59 0.55 0.55 0.66 0.63 0.65 0.57 0.62 0.53 0.70 0.72 0.56 0.61 0.49 0.44 0.49 0.65 0.67

Emerging ENE MAT CAP GOODS COM SERV TRANS AUTO DURABLES SERVICES MEDIA RETAIL FOOD BEV H PROD HC EQUIP PHARMA BANK DIV FIN INS REAL EST SOFTWAREHARDWARE SEMI TELCO UTS

ENE 1.00 0.80 0.68 0.11 0.65 0.35 0.51 0.59 0.51 0.67 0.72 0.67 0.53 0.60 0.44 0.81 0.77 0.54 0.52 0.39 0.38 0.32 0.70 0.73

MAT 0.80 1.00 0.81 0.29 0.77 0.49 0.67 0.56 0.63 0.72 0.73 0.70 0.61 0.70 0.49 0.82 0.82 0.64 0.67 0.53 0.50 0.50 0.73 0.79

CAP GOODS 0.68 0.81 1.00 0.37 0.81 0.63 0.71 0.64 0.64 0.76 0.72 0.78 0.68 0.73 0.64 0.84 0.86 0.72 0.76 0.63 0.58 0.68 0.76 0.77

COM SERV 0.11 0.29 0.37 1.00 0.25 0.42 0.45 0.17 0.30 0.21 0.16 0.17 0.28 0.19 0.20 0.20 0.26 0.26 0.28 0.40 0.29 0.38 0.23 0.34

TRANS 0.65 0.77 0.81 0.25 1.00 0.54 0.68 0.66 0.63 0.76 0.71 0.85 0.71 0.76 0.58 0.85 0.84 0.62 0.70 0.56 0.48 0.54 0.76 0.80

AUTO 0.35 0.49 0.63 0.42 0.54 1.00 0.58 0.48 0.39 0.48 0.44 0.46 0.52 0.44 0.36 0.54 0.49 0.51 0.56 0.45 0.44 0.49 0.46 0.53

DURABLES 0.51 0.67 0.71 0.45 0.68 0.58 1.00 0.54 0.48 0.66 0.58 0.61 0.58 0.63 0.52 0.66 0.67 0.54 0.62 0.49 0.49 0.50 0.56 0.73

SERVICES 0.59 0.56 0.64 0.17 0.66 0.48 0.54 1.00 0.51 0.70 0.65 0.73 0.54 0.58 0.44 0.69 0.65 0.45 0.52 0.41 0.47 0.44 0.65 0.65

MEDIA 0.51 0.63 0.64 0.30 0.63 0.39 0.48 0.51 1.00 0.69 0.62 0.62 0.53 0.59 0.56 0.63 0.69 0.48 0.50 0.69 0.33 0.45 0.62 0.55

RETAIL 0.67 0.72 0.76 0.21 0.76 0.48 0.66 0.70 0.69 1.00 0.79 0.79 0.62 0.71 0.63 0.82 0.87 0.64 0.66 0.50 0.44 0.53 0.81 0.74

FOOD 0.72 0.73 0.72 0.16 0.71 0.44 0.58 0.65 0.62 0.79 1.00 0.81 0.61 0.72 0.57 0.81 0.83 0.56 0.60 0.42 0.39 0.45 0.80 0.74

BEV 0.67 0.70 0.78 0.17 0.85 0.46 0.61 0.73 0.62 0.79 0.81 1.00 0.69 0.69 0.64 0.83 0.83 0.52 0.66 0.51 0.42 0.48 0.78 0.82

H PROD 0.53 0.61 0.68 0.28 0.71 0.52 0.58 0.54 0.53 0.62 0.61 0.69 1.00 0.59 0.52 0.71 0.68 0.52 0.63 0.49 0.36 0.39 0.67 0.70

HC EQUIP 0.60 0.70 0.73 0.19 0.76 0.44 0.63 0.58 0.59 0.71 0.72 0.69 0.59 1.00 0.64 0.74 0.80 0.55 0.60 0.50 0.45 0.51 0.72 0.72

PHARMA 0.44 0.49 0.64 0.20 0.58 0.36 0.52 0.44 0.56 0.63 0.57 0.64 0.52 0.64 1.00 0.58 0.65 0.42 0.56 0.58 0.39 0.46 0.66 0.62

BANK 0.81 0.82 0.84 0.20 0.85 0.54 0.66 0.69 0.63 0.82 0.81 0.83 0.71 0.74 0.58 1.00 0.93 0.74 0.79 0.50 0.45 0.52 0.83 0.85

DIV FIN 0.77 0.82 0.86 0.26 0.84 0.49 0.67 0.65 0.69 0.87 0.83 0.83 0.68 0.80 0.65 0.93 1.00 0.73 0.74 0.54 0.55 0.60 0.86 0.85

INS 0.54 0.64 0.72 0.26 0.62 0.51 0.54 0.45 0.48 0.64 0.56 0.52 0.52 0.55 0.42 0.74 0.73 1.00 0.72 0.43 0.46 0.52 0.63 0.60

REAL EST 0.52 0.67 0.76 0.28 0.70 0.56 0.62 0.52 0.50 0.66 0.60 0.66 0.63 0.60 0.56 0.79 0.74 0.72 1.00 0.48 0.43 0.54 0.70 0.71

SOFTWARE 0.39 0.53 0.63 0.40 0.56 0.45 0.49 0.41 0.69 0.50 0.42 0.51 0.49 0.50 0.58 0.50 0.54 0.43 0.48 1.00 0.35 0.44 0.43 0.53

HARDWARE 0.38 0.50 0.58 0.29 0.48 0.44 0.49 0.47 0.33 0.44 0.39 0.42 0.36 0.45 0.39 0.45 0.55 0.46 0.43 0.35 1.00 0.64 0.42 0.45

SEMI 0.32 0.50 0.68 0.38 0.54 0.49 0.50 0.44 0.45 0.53 0.45 0.48 0.39 0.51 0.46 0.52 0.60 0.52 0.54 0.44 0.64 1.00 0.49 0.45

TELCO 0.70 0.73 0.76 0.23 0.76 0.46 0.56 0.65 0.62 0.81 0.80 0.78 0.67 0.72 0.66 0.83 0.86 0.63 0.70 0.43 0.42 0.49 1.00 0.77

UTS 0.73 0.79 0.77 0.34 0.80 0.53 0.73 0.65 0.55 0.74 0.74 0.82 0.70 0.72 0.62 0.85 0.85 0.60 0.71 0.53 0.45 0.45 0.77 1.00

11

Emerging Market Industry Summary

• Highest Return Potential: Pharma, Media

• Greatest Improvement (last 12 weeks): Transportation, Semis

• Lowest Return Potential: Energy, Materials

• Greatest Deterioration (last 12 weeks): Commercial and Consumer

Services

• Most Volatile: Media, Consumer Services

• Least Volatile: Capital Goods, Durables

• Most Correlated: Financials

• Least Correlated: Commercial Services

12

Portfolio Implications

• Expected Portfolio Volatility: 13.21% pa

• Largest allocations to Banks (primarily due to large index weight) and Technology

• No / Negligible exposure to Automobiles, Real Estate, Consumer Durables, Retailing

13

Portfolio Implications

• Expected Tracking Error: 1.50% pa

• Beta with Benchmark: 1.01

• Correlation to Benchmark: 0.99

• Active weights are proportional to expected return views

14

COUNTRY & REGIONAL

VIEWS

15

Country/Region Selection Methodology

• MSCI country indices denominated in US Dollars• 48 countries plus US large and US small cap aggregations

• Expected return building blocks:• Valuation

• Income Generation

• Growth

• Profitability

• Sentiment/Momentum

• Countries are ranked from 1 (highest return potential) to 50 (least return potential)

• Deviations from benchmark weights are proportional to the expressed country preference rankings

16

Equity Market / Country Views:OVERALL RANK RANK RANK RANK RANK RANK RANK RANK RANK RANK TECHNICAL

COUNTRY SCORE RANK 1 WK AGO 2 WK AGO 3 WK AGO 4 WK AGO 12 WK AGO VALUE INCOME GROWTH PROFIT MOM VOLATILITY STAGE WGT

ARGENTINA 3.02854 1 2 1 1 1 1 2 37 40 5 8 41.42 DETER 0.04

PAKISTAN 2.73422 2 3 2 2 2 2 11 6 1 42 12 15.09 BRK OUT 0.08

TURKEY 2.13733 3 1 6 18 10 23 15 43 3 40 6 25.12 UP TR 0.40

CHINA 1.93439 4 6 5 4 7 7 12 23 24 24 11 15.52 UP TR 3.59

ISRAEL 1.67519 5 5 3 3 3 5 18 33 37 3 7 13.25 DETER 0.19

INDIA 1.64575 6 11 10 14 5 10 44 46 2 30 2 15.58 UP TR 1.90

THAILAND 1.62937 7 7 9 12 15 22 24 25 16 38 5 14.3 DETER 0.62

EGYPT 1.51201 8 19 27 5 6 12 32 38 48 50 1 21.25 DETER 0.03

JORDAN 1.34825 9 10 12 11 13 3 6 13 17 16 30 17.9 IMPROV 0.02

TAIWAN 1.33589 10 8 7 6 4 6 22 27 11 13 13 13.39 UP TR 1.43

HONG KONG 1.26807 11 9 11 15 16 13 16 15 10 8 20 12.5 DETER 1.57

INDONESIA 1.1486 12 4 4 8 12 31 43 35 6 27 3 17.9 UP TR 0.55

NEW ZEALAND 0.91911 13 12 13 16 20 44 30 3 9 10 19 14.5 BRK OUT 0.05

NORWAY 0.85991 14 13 8 9 14 4 3 5 23 6 44 20.84 DOWN TR 0.34

CZECH REPUBLIC 0.6763 15 15 14 7 8 9 10 1 44 43 26 15.62 BRK DOWN 0.05

FINLAND 0.67071 16 17 15 10 9 8 29 10 20 1 23 15.11 UP TR 0.31

CANADA 0.66556 17 16 18 26 19 14 33 28 5 4 21 13.01 BRK OUT 3.29

SPAIN 0.49573 18 20 17 13 11 11 14 4 31 23 28 17.42 UP TR 1.35

BRAZIL 0.28247 19 24 21 21 22 27 7 8 19 29 43 34.93 DOWN TR 1.35

SRI LANKA 0.18914 20 14 16 17 17 18 41 40 15 28 9 12.14 UP TR 0.01

PHILIPPINES 0.15421 21 18 19 25 28 39 49 36 12 19 4 13.26 UP TR 0.33

SOUTH KOREA 0.12346 22 27 28 28 26 21 5 49 41 33 35 14.18 DOWN TR 1.92

JAPAN 0.06245 23 22 22 20 23 16 17 41 14 21 32 15.67 UP TR 7.74

SINGAPORE 0.03879 24 23 23 27 32 29 25 17 35 15 25 8.89 UP TR 0.69

SOUTH AFRICA -0.02642 25 25 26 29 21 26 40 26 22 7 16 8.43 BRK OUT 0.89

UNITED STATES -0.11762 26 26 24 23 25 17 46 39 18 26 10 10.92 UP TR 44.32

UNITED KINGDOM -0.12714 27 30 29 33 29 20 23 7 27 9 34 12.41 IMPROV 6.04

PERU -0.2753 28 21 20 19 18 38 38 48 25 20 14 18.55 DETER 0.08

US_SMALL -0.29809 29 29 34 36 35 43 45 47 4 22 18 15.91 UP TR 1.62

RUSSIA -0.30945 30 32 25 24 30 15 1 2 50 46 50 39.12 DOWN TR 0.65

SWEDEN -0.31554 31 31 31 22 24 24 35 19 7 14 33 14.19 UP TR 1.02

AUSTRALIA -0.37616 32 28 30 31 36 32 31 9 33 11 31 14.04 BRK OUT 2.23

COLOMBIA -0.43596 33 33 32 37 38 37 9 18 32 34 45 20.49 DOWN TR 0.19

BELGIUM -0.46352 34 35 36 32 31 25 42 32 13 45 17 13.18 UP TR 0.63

GERMANY -0.50387 35 37 37 35 34 30 20 30 26 18 37 15.32 BRK OUT 3.14

POLAND -0.6133 36 38 33 34 33 19 8 14 49 41 42 14.48 DOWN TR 0.25

FRANCE -0.61383 37 39 38 38 39 41 26 20 21 25 36 14.82 IMPROV 3.80

DENMARK -0.62283 38 34 35 30 27 28 48 42 8 12 15 13.72 UP TR 0.54

MOROCCO -0.72941 39 36 39 41 41 33 34 12 42 35 27 9.63 DETER 0.08

MALAYSIA -0.88447 40 41 40 42 43 34 27 21 30 17 39 11.5 DOWN TR 0.68

ITALY -1.06093 41 40 41 40 37 36 28 22 28 39 38 22.27 DOWN TR 0.93

SWITZERLAND -1.34029 42 42 42 39 40 42 47 24 34 32 24 10.18 UP TR 2.77

CHILE -1.44438 43 43 47 46 48 48 21 29 46 31 41 14.11 DOWN TR 0.29

NETHERLANDS -1.55051 44 44 44 43 44 45 39 34 39 44 29 13.36 UP TR 0.93

HUNGARY -1.58359 45 46 45 44 45 46 13 16 47 47 46 21.38 DOWN TR 0.02

GREECE -1.61377 46 48 43 48 46 35 4 50 36 49 49 43.15 DOWN TR 0.09

IRELAND -1.62631 47 45 48 45 42 47 50 44 38 2 22 19.66 UP TR 0.13

MEXICO -1.68298 48 47 46 47 47 40 36 45 29 36 40 15.1 DOWN TR 0.67

AUSTRIA -2.34416 49 49 49 49 49 49 19 31 45 48 47 17.63 DOWN TR 0.10

PORTUGAL -2.81972 50 50 50 50 50 50 37 11 43 37 48 23.99 DOWN TR 0.07

17

• Our top ranked region from an expected return perspective is emerging Asia

• EMEA looks cheap but lacks growth – serious value trap potential

• Developed Europe ranks last – valuations are not attractive enough to offset lack of growth and negative sentiment

• North America looks expensive and lacking enough growth and profitability. Sentiment is propping up the region. Large caps look more attractive than small caps

18

AVG VALUE INCOME GROWTH PROFIT MOM

REGION STATUS SCORE SCORE SCORE SCORE SCORE SCORE

ASIA EMERGING 1.22 0.63 -0.21 0.27 -0.16 0.37

EMEA EMERGING 0.21 1.09 0.75 -1.05 -0.45 -0.69

ASIA DEVELOPED 0.14 0.57 0.06 0.14 0.46 -0.56

NORTH AMERICA DEVELOPED -0.06 -0.50 -0.33 0.11 -0.14 0.48

NORTH AMERICA SMALL CAP -0.30 -0.54 -1.10 1.45 0.13 0.05

LATAM EMERGING -0.43 0.96 0.47 -0.44 -0.43 -1.23

EUROPE DEVELOPED -0.50 0.25 0.70 -0.38 0.21 -0.68

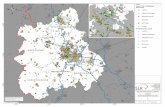

Equity Market Current Correlations

Avg Corr 0.32 0.40 0.39 0.43 0.36 0.42 0.47 0.36 0.30 0.32 0.24 0.46 0.39 0.05 0.44 0.42 0.50 0.48 0.33 0.33 0.25 0.20 0.35 0.18 0.34 0.44 0.02 0.26 0.31 0.07 0.11 0.40 0.27 0.48 0.40 0.30 0.30 0.31 0.06 0.36 0.39 0.35 0.46 0.39 0.32 0.33 0.27 0.42 0.35 0.42

ARGENTINA AUSTRIA AUSTRALIA BELGIUM BRAZIL CANADA SWITZERLAND CHILE CHINA COLOMBIA CZECH REPUBLIC GERMANY DENMARK EGYPT SPAIN FINLAND FRANCE UNITED KINGDOM GREECE HONG KONG HUNGARY INDONESIA IRELAND ISRAEL INDIA ITALY JORDAN JAPAN SOUTH KOREA SRI LANKA MOROCCO MEXICO MALAYSIA NETHERLANDS NORWAY NEW ZEALAND PERU PHILIPPINES PAKISTAN POLAND PORTUGAL RUSSIA SWEDEN SINGAPORE THAILAND TURKEY TAIWAN UNITED STATES US_SMALL SOUTH AFRICA

ARGENTINA 1.00 0.52 0.36 0.44 0.39 0.45 0.44 0.48 0.29 0.44 0.29 0.56 0.39 -0.02 0.50 0.46 0.61 0.51 0.40 0.25 0.12 0.06 0.40 0.21 0.21 0.59 -0.13 0.21 0.25 0.01 0.17 0.42 0.13 0.55 0.40 0.12 0.29 0.14 0.00 0.37 0.38 0.48 0.41 0.25 0.22 0.31 0.14 0.49 0.43 0.39

AUSTRIA 0.52 1.00 0.44 0.62 0.38 0.49 0.64 0.26 0.32 0.25 0.38 0.72 0.58 0.01 0.74 0.72 0.75 0.63 0.55 0.39 0.44 -0.04 0.63 0.26 0.18 0.72 0.06 0.37 0.22 0.05 0.10 0.35 0.16 0.72 0.51 0.26 0.32 0.13 0.14 0.54 0.66 0.47 0.63 0.33 0.18 0.34 0.18 0.54 0.49 0.34

AUSTRALIA 0.36 0.44 1.00 0.45 0.43 0.59 0.55 0.52 0.39 0.42 0.18 0.45 0.44 -0.02 0.48 0.54 0.55 0.60 0.31 0.51 0.21 0.27 0.34 0.21 0.41 0.43 0.03 0.39 0.46 0.00 0.17 0.45 0.31 0.48 0.48 0.56 0.42 0.42 0.04 0.34 0.50 0.39 0.62 0.56 0.37 0.44 0.34 0.47 0.43 0.61

BELGIUM 0.44 0.62 0.45 1.00 0.48 0.54 0.81 0.43 0.30 0.40 0.39 0.79 0.59 -0.08 0.64 0.65 0.81 0.73 0.49 0.35 0.39 0.19 0.64 0.12 0.30 0.61 -0.05 0.33 0.34 -0.02 0.12 0.55 0.24 0.80 0.57 0.29 0.41 0.24 0.03 0.51 0.55 0.43 0.69 0.46 0.33 0.37 0.19 0.69 0.57 0.58

BRAZIL 0.39 0.38 0.43 0.48 1.00 0.54 0.42 0.55 0.38 0.62 0.27 0.48 0.22 0.00 0.44 0.43 0.54 0.53 0.34 0.33 0.26 0.27 0.33 0.07 0.41 0.44 0.01 0.16 0.44 0.03 0.06 0.62 0.37 0.44 0.50 0.37 0.45 0.34 -0.08 0.34 0.43 0.58 0.40 0.44 0.42 0.47 0.31 0.35 0.21 0.63

CANADA 0.45 0.49 0.59 0.54 0.54 1.00 0.56 0.52 0.35 0.61 0.17 0.59 0.45 0.02 0.49 0.57 0.66 0.77 0.48 0.35 0.10 0.19 0.43 0.19 0.37 0.52 -0.09 0.33 0.44 0.05 0.09 0.52 0.27 0.55 0.76 0.43 0.54 0.29 0.11 0.31 0.52 0.52 0.61 0.39 0.35 0.38 0.37 0.69 0.58 0.69

SWITZERLAND 0.44 0.64 0.55 0.81 0.42 0.56 1.00 0.45 0.26 0.33 0.31 0.83 0.75 -0.03 0.67 0.69 0.84 0.79 0.46 0.40 0.42 0.19 0.63 0.27 0.37 0.62 -0.03 0.45 0.34 0.05 0.28 0.52 0.26 0.85 0.59 0.43 0.35 0.34 0.06 0.56 0.62 0.46 0.81 0.55 0.38 0.38 0.25 0.70 0.62 0.54

CHILE 0.48 0.26 0.52 0.43 0.55 0.52 0.45 1.00 0.45 0.52 0.33 0.43 0.23 0.02 0.34 0.31 0.46 0.49 0.37 0.43 0.30 0.30 0.33 0.02 0.46 0.37 -0.12 0.17 0.47 0.01 0.22 0.59 0.32 0.41 0.40 0.46 0.47 0.40 -0.06 0.34 0.34 0.49 0.40 0.43 0.37 0.44 0.43 0.41 0.27 0.66

CHINA 0.29 0.32 0.39 0.30 0.38 0.35 0.26 0.45 1.00 0.21 0.32 0.32 0.15 0.17 0.34 0.37 0.37 0.34 0.18 0.77 0.24 0.17 0.23 0.12 0.51 0.32 -0.08 0.24 0.61 0.02 0.02 0.38 0.34 0.37 0.15 0.30 0.29 0.41 0.01 0.30 0.25 0.29 0.32 0.39 0.34 0.34 0.52 0.26 0.24 0.49

COLOMBIA 0.44 0.25 0.42 0.40 0.62 0.61 0.33 0.52 0.21 1.00 0.18 0.35 0.27 -0.03 0.33 0.26 0.46 0.51 0.42 0.18 0.08 0.21 0.22 0.09 0.33 0.39 0.02 0.16 0.32 0.07 0.11 0.60 0.31 0.37 0.61 0.26 0.43 0.23 0.02 0.28 0.36 0.46 0.34 0.26 0.34 0.39 0.28 0.46 0.33 0.62

CZECH REPUBLIC 0.29 0.38 0.18 0.39 0.27 0.17 0.31 0.33 0.32 0.18 1.00 0.39 0.29 0.21 0.38 0.27 0.39 0.31 0.28 0.12 0.38 0.04 0.29 0.04 0.22 0.38 0.07 0.05 0.35 -0.08 0.21 0.30 0.16 0.38 0.19 0.05 0.23 0.30 -0.16 0.49 0.32 0.20 0.25 0.28 0.11 0.06 0.30 0.29 0.19 0.30

GERMANY 0.56 0.72 0.45 0.79 0.48 0.59 0.83 0.43 0.32 0.35 0.39 1.00 0.67 -0.08 0.73 0.72 0.92 0.81 0.45 0.32 0.42 0.12 0.66 0.24 0.36 0.73 -0.01 0.33 0.34 0.03 0.23 0.50 0.21 0.87 0.57 0.28 0.40 0.23 0.07 0.62 0.62 0.54 0.79 0.43 0.28 0.38 0.26 0.68 0.63 0.53

DENMARK 0.39 0.58 0.44 0.59 0.22 0.45 0.75 0.23 0.15 0.27 0.29 0.67 1.00 0.01 0.61 0.56 0.70 0.63 0.45 0.27 0.32 0.17 0.60 0.25 0.28 0.59 0.04 0.41 0.23 0.04 0.21 0.37 0.24 0.68 0.52 0.32 0.29 0.26 0.08 0.59 0.57 0.31 0.70 0.42 0.31 0.33 0.17 0.55 0.49 0.37

EGYPT -0.02 0.01 -0.02 -0.08 0.00 0.02 -0.03 0.02 0.17 -0.03 0.21 -0.08 0.01 1.00 0.04 -0.01 -0.02 0.04 0.06 0.07 -0.05 0.14 -0.01 0.08 0.22 0.07 0.09 0.06 0.04 0.19 0.04 0.14 0.11 0.03 0.02 0.02 0.01 0.17 0.11 0.13 -0.05 0.05 0.05 0.12 0.12 -0.07 0.04 0.11 0.06 -0.02

SPAIN 0.50 0.74 0.48 0.64 0.44 0.49 0.67 0.34 0.34 0.33 0.38 0.73 0.61 0.04 1.00 0.68 0.82 0.65 0.58 0.40 0.32 0.06 0.58 0.34 0.40 0.88 0.04 0.32 0.34 0.04 0.17 0.47 0.21 0.75 0.53 0.33 0.38 0.24 0.03 0.49 0.73 0.42 0.63 0.40 0.30 0.40 0.25 0.56 0.48 0.44

FINLAND 0.46 0.72 0.54 0.65 0.43 0.57 0.69 0.31 0.37 0.26 0.27 0.72 0.56 -0.01 0.68 1.00 0.75 0.74 0.44 0.42 0.30 0.00 0.57 0.24 0.33 0.64 -0.04 0.46 0.29 -0.02 0.11 0.35 0.23 0.75 0.57 0.40 0.35 0.17 0.15 0.43 0.62 0.50 0.71 0.47 0.26 0.34 0.20 0.60 0.52 0.50

FRANCE 0.61 0.75 0.55 0.81 0.54 0.66 0.84 0.46 0.37 0.46 0.39 0.92 0.70 -0.02 0.82 0.75 1.00 0.82 0.55 0.39 0.38 0.14 0.69 0.26 0.42 0.84 -0.01 0.36 0.40 0.04 0.20 0.56 0.25 0.90 0.66 0.37 0.44 0.31 0.08 0.57 0.72 0.53 0.80 0.47 0.37 0.42 0.26 0.71 0.65 0.57

UNITED KINGDOM 0.51 0.63 0.60 0.73 0.53 0.77 0.79 0.49 0.34 0.51 0.31 0.81 0.63 0.04 0.65 0.74 0.82 1.00 0.50 0.38 0.22 0.16 0.58 0.25 0.39 0.65 -0.03 0.48 0.42 0.01 0.12 0.51 0.25 0.80 0.75 0.35 0.49 0.28 0.08 0.45 0.62 0.52 0.77 0.46 0.31 0.30 0.32 0.76 0.67 0.64

GREECE 0.40 0.55 0.31 0.49 0.34 0.48 0.46 0.37 0.18 0.42 0.28 0.45 0.45 0.06 0.58 0.44 0.55 0.50 1.00 0.16 0.22 0.09 0.62 0.19 0.21 0.61 0.00 0.27 0.20 -0.03 0.06 0.40 0.10 0.51 0.46 0.22 0.28 0.16 -0.01 0.40 0.64 0.30 0.42 0.17 0.22 0.28 0.18 0.53 0.41 0.36

HONG KONG 0.25 0.39 0.51 0.35 0.33 0.35 0.40 0.43 0.77 0.18 0.12 0.32 0.27 0.07 0.40 0.42 0.39 0.38 0.16 1.00 0.29 0.32 0.26 0.17 0.43 0.33 -0.12 0.38 0.55 0.14 0.07 0.34 0.40 0.39 0.22 0.47 0.29 0.47 0.11 0.27 0.23 0.37 0.41 0.55 0.41 0.46 0.48 0.26 0.26 0.47

HUNGARY 0.12 0.44 0.21 0.39 0.26 0.10 0.42 0.30 0.24 0.08 0.38 0.42 0.32 -0.05 0.32 0.30 0.38 0.22 0.22 0.29 1.00 0.18 0.22 0.11 0.28 0.26 0.06 0.08 0.21 0.10 0.13 0.34 0.24 0.43 0.22 0.18 0.20 0.24 0.17 0.51 0.33 0.38 0.33 0.36 0.15 0.31 0.29 0.16 0.08 0.30

INDONESIA 0.06 -0.04 0.27 0.19 0.27 0.19 0.19 0.30 0.17 0.21 0.04 0.12 0.17 0.14 0.06 0.00 0.14 0.16 0.09 0.32 0.18 1.00 0.09 0.11 0.36 0.08 0.09 0.13 0.26 0.14 0.03 0.27 0.47 0.09 0.19 0.29 0.22 0.52 0.13 0.30 -0.01 0.17 0.23 0.46 0.57 0.51 0.23 0.13 0.06 0.39

IRELAND 0.40 0.63 0.34 0.64 0.33 0.43 0.63 0.33 0.23 0.22 0.29 0.66 0.60 -0.01 0.58 0.57 0.69 0.58 0.62 0.26 0.22 0.09 1.00 0.12 0.18 0.58 -0.06 0.28 0.31 -0.06 0.05 0.34 0.08 0.65 0.40 0.19 0.32 0.22 -0.03 0.41 0.57 0.33 0.60 0.32 0.25 0.28 0.16 0.54 0.51 0.38

ISRAEL 0.21 0.26 0.21 0.12 0.07 0.19 0.27 0.02 0.12 0.09 0.04 0.24 0.25 0.08 0.34 0.24 0.26 0.25 0.19 0.17 0.11 0.11 0.12 1.00 0.33 0.28 0.09 0.19 0.09 0.12 0.05 0.13 0.17 0.30 0.23 0.14 0.08 0.28 0.15 0.24 0.23 0.08 0.34 0.25 0.16 0.15 0.19 0.25 0.23 0.09

INDIA 0.21 0.18 0.41 0.30 0.41 0.37 0.37 0.46 0.51 0.33 0.22 0.36 0.28 0.22 0.40 0.33 0.42 0.39 0.21 0.43 0.28 0.36 0.18 0.33 1.00 0.38 0.02 0.24 0.44 0.15 0.14 0.45 0.43 0.43 0.35 0.32 0.29 0.59 0.09 0.29 0.30 0.37 0.38 0.48 0.58 0.37 0.56 0.40 0.33 0.53

ITALY 0.59 0.72 0.43 0.61 0.44 0.52 0.62 0.37 0.32 0.39 0.38 0.73 0.59 0.07 0.88 0.64 0.84 0.65 0.61 0.33 0.26 0.08 0.58 0.28 0.38 1.00 0.12 0.28 0.29 0.09 0.17 0.48 0.25 0.77 0.58 0.31 0.38 0.25 0.11 0.50 0.77 0.44 0.60 0.38 0.29 0.41 0.24 0.55 0.48 0.40

JORDAN -0.13 0.06 0.03 -0.05 0.01 -0.09 -0.03 -0.12 -0.08 0.02 0.07 -0.01 0.04 0.09 0.04 -0.04 -0.01 -0.03 0.00 -0.12 0.06 0.09 -0.06 0.09 0.02 0.12 1.00 -0.02 -0.07 0.30 -0.06 -0.02 0.06 0.00 0.08 0.01 0.17 0.10 0.13 0.01 0.07 0.01 0.03 0.01 0.16 0.02 -0.01 -0.04 -0.03 -0.10

JAPAN 0.21 0.37 0.39 0.33 0.16 0.33 0.45 0.17 0.24 0.16 0.05 0.33 0.41 0.06 0.32 0.46 0.36 0.48 0.27 0.38 0.08 0.13 0.28 0.19 0.24 0.28 -0.02 1.00 0.24 0.13 -0.01 0.26 0.19 0.40 0.29 0.30 0.14 0.28 -0.06 0.21 0.32 0.30 0.35 0.46 0.28 0.23 0.24 0.51 0.45 0.33

SOUTH KOREA 0.25 0.22 0.46 0.34 0.44 0.44 0.34 0.47 0.61 0.32 0.35 0.34 0.23 0.04 0.34 0.29 0.40 0.42 0.20 0.55 0.21 0.26 0.31 0.09 0.44 0.29 -0.07 0.24 1.00 -0.07 0.06 0.40 0.36 0.29 0.25 0.22 0.28 0.48 -0.04 0.27 0.25 0.32 0.37 0.48 0.34 0.31 0.57 0.30 0.27 0.53

SRI LANKA 0.01 0.05 0.00 -0.02 0.03 0.05 0.05 0.01 0.02 0.07 -0.08 0.03 0.04 0.19 0.04 -0.02 0.04 0.01 -0.03 0.14 0.10 0.14 -0.06 0.12 0.15 0.09 0.30 0.13 -0.07 1.00 0.06 0.05 0.08 0.08 0.13 0.05 0.12 0.21 0.34 0.04 -0.02 0.10 0.12 0.14 0.17 0.10 0.05 0.06 0.05 -0.02

MOROCCO 0.17 0.10 0.17 0.12 0.06 0.09 0.28 0.22 0.02 0.11 0.21 0.23 0.21 0.04 0.17 0.11 0.20 0.12 0.06 0.07 0.13 0.03 0.05 0.05 0.14 0.17 -0.06 -0.01 0.06 0.06 1.00 0.11 0.11 0.17 0.13 0.28 0.10 0.13 0.03 0.24 0.13 0.02 0.20 0.14 0.13 0.00 0.06 0.00 0.03 0.14

MEXICO 0.42 0.35 0.45 0.55 0.62 0.52 0.52 0.59 0.38 0.60 0.30 0.50 0.37 0.14 0.47 0.35 0.56 0.51 0.40 0.34 0.34 0.27 0.34 0.13 0.45 0.48 -0.02 0.26 0.40 0.05 0.11 1.00 0.40 0.53 0.48 0.33 0.39 0.37 -0.06 0.41 0.35 0.51 0.47 0.48 0.44 0.52 0.32 0.59 0.45 0.65

MALAYSIA 0.13 0.16 0.31 0.24 0.37 0.27 0.26 0.32 0.34 0.31 0.16 0.21 0.24 0.11 0.21 0.23 0.25 0.25 0.10 0.40 0.24 0.47 0.08 0.17 0.43 0.25 0.06 0.19 0.36 0.08 0.11 0.40 1.00 0.22 0.27 0.36 0.22 0.47 0.16 0.27 0.18 0.35 0.24 0.59 0.48 0.44 0.45 0.27 0.16 0.37

NETHERLANDS 0.55 0.72 0.48 0.80 0.44 0.55 0.85 0.41 0.37 0.37 0.38 0.87 0.68 0.03 0.75 0.75 0.90 0.80 0.51 0.39 0.43 0.09 0.65 0.30 0.43 0.77 0.00 0.40 0.29 0.08 0.17 0.53 0.22 1.00 0.59 0.31 0.39 0.30 0.11 0.56 0.65 0.52 0.77 0.45 0.30 0.37 0.28 0.70 0.64 0.52

NORWAY 0.40 0.51 0.48 0.57 0.50 0.76 0.59 0.40 0.15 0.61 0.19 0.57 0.52 0.02 0.53 0.57 0.66 0.75 0.46 0.22 0.22 0.19 0.40 0.23 0.35 0.58 0.08 0.29 0.25 0.13 0.13 0.48 0.27 0.59 1.00 0.39 0.35 0.22 0.14 0.41 0.59 0.50 0.62 0.38 0.29 0.31 0.17 0.60 0.47 0.58

NEW ZEALAND 0.12 0.26 0.56 0.29 0.37 0.43 0.43 0.46 0.30 0.26 0.05 0.28 0.32 0.02 0.33 0.40 0.37 0.35 0.22 0.47 0.18 0.29 0.19 0.14 0.32 0.31 0.01 0.30 0.22 0.05 0.28 0.33 0.36 0.31 0.39 1.00 0.34 0.37 0.12 0.25 0.42 0.23 0.42 0.54 0.47 0.41 0.30 0.23 0.18 0.43

PERU 0.29 0.32 0.42 0.41 0.45 0.54 0.35 0.47 0.29 0.43 0.23 0.40 0.29 0.01 0.38 0.35 0.44 0.49 0.28 0.29 0.20 0.22 0.32 0.08 0.29 0.38 0.17 0.14 0.28 0.12 0.10 0.39 0.22 0.39 0.35 0.34 1.00 0.34 0.02 0.20 0.32 0.34 0.37 0.26 0.35 0.28 0.28 0.36 0.30 0.44

PHILIPPINES 0.14 0.13 0.42 0.24 0.34 0.29 0.34 0.40 0.41 0.23 0.30 0.23 0.26 0.17 0.24 0.17 0.31 0.28 0.16 0.47 0.24 0.52 0.22 0.28 0.59 0.25 0.10 0.28 0.48 0.21 0.13 0.37 0.47 0.30 0.22 0.37 0.34 1.00 0.02 0.23 0.18 0.32 0.31 0.60 0.62 0.35 0.54 0.27 0.23 0.46

PAKISTAN 0.00 0.14 0.04 0.03 -0.08 0.11 0.06 -0.06 0.01 0.02 -0.16 0.07 0.08 0.11 0.03 0.15 0.08 0.08 -0.01 0.11 0.17 0.13 -0.03 0.15 0.09 0.11 0.13 -0.06 -0.04 0.34 0.03 -0.06 0.16 0.11 0.14 0.12 0.02 0.02 1.00 0.09 0.06 0.00 0.24 0.16 0.14 0.13 0.03 0.04 -0.02 -0.07

POLAND 0.37 0.54 0.34 0.51 0.34 0.31 0.56 0.34 0.30 0.28 0.49 0.62 0.59 0.13 0.49 0.43 0.57 0.45 0.40 0.27 0.51 0.30 0.41 0.24 0.29 0.50 0.01 0.21 0.27 0.04 0.24 0.41 0.27 0.56 0.41 0.25 0.20 0.23 0.09 1.00 0.44 0.39 0.55 0.39 0.29 0.42 0.13 0.36 0.27 0.41

PORTUGAL 0.38 0.66 0.50 0.55 0.43 0.52 0.62 0.34 0.25 0.36 0.32 0.62 0.57 -0.05 0.73 0.62 0.72 0.62 0.64 0.23 0.33 -0.01 0.57 0.23 0.30 0.77 0.07 0.32 0.25 -0.02 0.13 0.35 0.18 0.65 0.59 0.42 0.32 0.18 0.06 0.44 1.00 0.35 0.59 0.31 0.22 0.32 0.18 0.49 0.43 0.38

RUSSIA 0.48 0.47 0.39 0.43 0.58 0.52 0.46 0.49 0.29 0.46 0.20 0.54 0.31 0.05 0.42 0.50 0.53 0.52 0.30 0.37 0.38 0.17 0.33 0.08 0.37 0.44 0.01 0.30 0.32 0.10 0.02 0.51 0.35 0.52 0.50 0.23 0.34 0.32 0.00 0.39 0.35 1.00 0.42 0.37 0.30 0.38 0.27 0.43 0.35 0.49

SWEDEN 0.41 0.63 0.62 0.69 0.40 0.61 0.81 0.40 0.32 0.34 0.25 0.79 0.70 0.05 0.63 0.71 0.80 0.77 0.42 0.41 0.33 0.23 0.60 0.34 0.38 0.60 0.03 0.35 0.37 0.12 0.20 0.47 0.24 0.77 0.62 0.42 0.37 0.31 0.24 0.55 0.59 0.42 1.00 0.49 0.38 0.35 0.19 0.66 0.62 0.52

SINGAPORE 0.25 0.33 0.56 0.46 0.44 0.39 0.55 0.43 0.39 0.26 0.28 0.43 0.42 0.12 0.40 0.47 0.47 0.46 0.17 0.55 0.36 0.46 0.32 0.25 0.48 0.38 0.01 0.46 0.48 0.14 0.14 0.48 0.59 0.45 0.38 0.54 0.26 0.60 0.16 0.39 0.31 0.37 0.49 1.00 0.51 0.52 0.44 0.39 0.23 0.52

THAILAND 0.22 0.18 0.37 0.33 0.42 0.35 0.38 0.37 0.34 0.34 0.11 0.28 0.31 0.12 0.30 0.26 0.37 0.31 0.22 0.41 0.15 0.57 0.25 0.16 0.58 0.29 0.16 0.28 0.34 0.17 0.13 0.44 0.48 0.30 0.29 0.47 0.35 0.62 0.14 0.29 0.22 0.30 0.38 0.51 1.00 0.48 0.36 0.34 0.25 0.44

TURKEY 0.31 0.34 0.44 0.37 0.47 0.38 0.38 0.44 0.34 0.39 0.06 0.38 0.33 -0.07 0.40 0.34 0.42 0.30 0.28 0.46 0.31 0.51 0.28 0.15 0.37 0.41 0.02 0.23 0.31 0.10 0.00 0.52 0.44 0.37 0.31 0.41 0.28 0.35 0.13 0.42 0.32 0.38 0.35 0.52 0.48 1.00 0.23 0.31 0.19 0.51

TAIWAN 0.14 0.18 0.34 0.19 0.31 0.37 0.25 0.43 0.52 0.28 0.30 0.26 0.17 0.04 0.25 0.20 0.26 0.32 0.18 0.48 0.29 0.23 0.16 0.19 0.56 0.24 -0.01 0.24 0.57 0.05 0.06 0.32 0.45 0.28 0.17 0.30 0.28 0.54 0.03 0.13 0.18 0.27 0.19 0.44 0.36 0.23 1.00 0.29 0.22 0.51

UNITED STATES 0.49 0.54 0.47 0.69 0.35 0.69 0.70 0.41 0.26 0.46 0.29 0.68 0.55 0.11 0.56 0.60 0.71 0.76 0.53 0.26 0.16 0.13 0.54 0.25 0.40 0.55 -0.04 0.51 0.30 0.06 0.00 0.59 0.27 0.70 0.60 0.23 0.36 0.27 0.04 0.36 0.49 0.43 0.66 0.39 0.34 0.31 0.29 1.00 0.86 0.55

US_SMALL 0.43 0.49 0.43 0.57 0.21 0.58 0.62 0.27 0.24 0.33 0.19 0.63 0.49 0.06 0.48 0.52 0.65 0.67 0.41 0.26 0.08 0.06 0.51 0.23 0.33 0.48 -0.03 0.45 0.27 0.05 0.03 0.45 0.16 0.64 0.47 0.18 0.30 0.23 -0.02 0.27 0.43 0.35 0.62 0.23 0.25 0.19 0.22 0.86 1.00 0.45

SOUTH AFRICA 0.39 0.34 0.61 0.58 0.63 0.69 0.54 0.66 0.49 0.62 0.30 0.53 0.37 -0.02 0.44 0.50 0.57 0.64 0.36 0.47 0.30 0.39 0.38 0.09 0.53 0.40 -0.10 0.33 0.53 -0.02 0.14 0.65 0.37 0.52 0.58 0.43 0.44 0.46 -0.07 0.41 0.38 0.49 0.52 0.52 0.44 0.51 0.51 0.55 0.45 1.00

19

Portfolio Management Implications• The cap weighted global equity market is significantly skewed toward

the US (44% weight)

• Even though we rank the US in the middle of the pack, it still merits a

36% weighting in our target portfolio

• While each equity market weight in our target portfolio might be small,

in aggregate emerging markets have a target weight of 30%

• Larger equity markets are, in general, underweight

20

Portfolio Management Implications• Expected Tracking Error: 2.00%

• Expected Volatility: 9.68%

• Beta with Benchmark: 0.94, Correlation to Benchmark: 0.98

• Active weights are proportional to expected return views

• Underweight in the US finances emerging market over-weight

21

Asia is a valuation and recovering growth story.

Sentiment is highly volatile within Developed

Asia markets as Japanese economic policies

are significant drivers of performance

22

EMEA may prove to be a value trap while

we expect Developed Europe to be of

interest to some income seeking investors

but currency risk should be hedged

23

Valuations in North America are stretched

with sentiment propping up the regional

outlook. Latin America is inexpensive, but

lacks growth and sentiment is poor

24

Industry and Country Views - Summary

• The US equity market rates possesses middle of the pack expected returns

• Valuations appear stretched and positive sentiment is propping the market up. We recommend an under-weight position

• European equities do not appear inexpensive enough to warrant significant positions. We rate Developed Europe as under-weight and favor instead concentrated stock picking approaches

• EMEA as a block carries too much risk and despite low valuations we would stay away at the moment

• We recommend an over weight to Asian equities (developed and emerging). Macroeconomic developments in China and Japan are expected to swamp stock specific issues

25

Industry and Country Views - Summary

• Our Developed and Emerging markets structural models show, at the

moment, a remarkable similarity in terms of industry predictions

• Energy, Materials and Banks rate as relative unattractive

• Valuations are not attractive enough and income potential will be significantly at

risk

• Expect a large number of dividend cuts in these industries

• Stock picking will be of greatest value within these sectors

• Health Care and Technology industries are expected to continue their

out-performance in 2015

• Health Care stocks do no appear expensive despite their impressive run. I would

expect more investors to demand better uses of cash either through higher

dividends or aggressive M&A activity

• Technology stocks usually carry significant stock specific risk, but as whole the

sector still rates as attractive given decent growth and in-check valuations

(except for some micro pockets exhibiting extreme growth). Some stress is

expected among tech companies serving alternative energy industries such as

solar and wind

26

FOR FURTHER INFORMATION ON OUR

RESEARCH PRODUCTS AND/OR ASSET

MANAGEMENT STRATEGIES PLEASE

CONTACT:

Eric J. Weigel at [email protected]

617-529-2913

www.gf-cap.com

27