Fonavipo ENG

-

Upload

lina-salazar -

Category

Documents

-

view

221 -

download

0

description

Transcript of Fonavipo ENG

public-private partnership for Low-Cost Housing investments

FONAVIPO combines subsidies withsolid business practices

el salvador has developed a unique and sustainablefinancial business model that enables low-incomeconsumers to improve and expand their homes bymobilizing resources from both the public andprivate sectors, including commercial banks andmultilateral institutions. ese resources aresubsequently channeled to microfinance institutionsaround the country, serving a market of low-incomeborrowers and homeowners who otherwise wouldbe without access to credit.

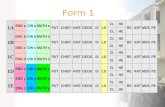

Central to this financing model is FOnaVipO, thestate-owned national Low-income Housing Fund.it acts as a second-tier financial lender to 55microfinance institutions, including cooperativesand other nongovernmental organizations, whichoperate under a different set of rules compared withregulated, commercial banks. FOnaVipO alsoadministers a government subsidy program thatprovides homeowners with grants of up to $3,000to enable less affluent consumers to participate inthe housing market.

FOnaVipO, which operates 150 agencies throughout thecountry, has earned a reputation for combining rigorousfinancial practices, including an innovative risk assessmentmodel and sustainable lending policies, with technicalassistance for consumers at the bottom of the economic andsocial pyramid.

a $7 million iDB loan for a five-year term, from its Opportunitiesfor the Majority facility, will enable FOnaVipO to providenew financing to microfinance institutions, which in turn willprovide loans to 2,300 low-income families. ese customerswill be empowered to buy a lot or progressively construct,expand or improve an existing structure. e average loan will beabout $3,000.

e program will be strengthened by technical assistance,including the establishment of an information and advisory centerand mobile administrative units, which will help low-incomehomeowners or potential homeowners submit the properdocuments and complete the required paperwork to qualify forloans and subsidies. training also will be offered to personnel ofthe participating microfinance institutions to improve customerservice and lending methods and to expand the client base.

Lessons learned from the project will be applied to additionalexpansion of FOnaVipO’s low-income housing program,which has already demonstrated a sustainable capacity to investin the low end of the housing market, a sector that traditionallyhas been ignored by large, formal and regulated banks. e low-cost housing market remains underserved and accounts for animportant part of the national housing deficit.

e Opportunities for the Majority financing is part of a muchbigger national lending program for el salvador’s housing sectorthat will be supported by an additional loan from the iDB and byresources from other international organizations. el salvador’spresident Mauricio Funes described the government’s inclusivehousing investment plan, known as Casa para Todos (a House forall), as fundamental to achieving “universal social protection” andto combating a cyclical economic slowdown.

For more information about the programcontact: [email protected]

O P P O R T U N I T I E S M A J O R I T Yf o r t h e

![03 [Wk02L1] Eng design & eng geometry.ppt](https://static.fdocuments.in/doc/165x107/577cd6241a28ab9e789bcb7a/03-wk02l1-eng-design-eng-geometryppt.jpg)