February 2014 The Abacus Prompt™ · KSE-100 Index PerformanceTaliban contributed to KSE Feb 3...

Transcript of February 2014 The Abacus Prompt™ · KSE-100 Index PerformanceTaliban contributed to KSE Feb 3...

The Abacus Prompt™ Monthly Business Review – Pakistan

February 2014

February 2014

Issue 38, Vol. 4

Page 1 Consulting | Technology | Outsourcing

new

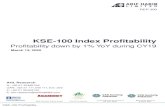

KSE-100 Index Performance

Feb 3 26,784 -3.74%

Feb 28 25,783

KSE

Market Cap - (PKR Billion) Feb 3 6,607

-4.95% Feb 28 6,280

KSE 100

Best Performing Stocks

Company Opening Price Closing Price Change

TRG 10.24 14.45 41% DAWH 67.6 83.15 23%

PAKT 654.25 801.07 22%

ARM 48 51 6%

ENGRO 178.26 188.75 6%

KSE 100

Worst Performing Stocks Company Opening Price Closing Price Change

CEPB 72.42 49.8 -31% NETSOL 45.42 32.86 -28%

NESTLE 12,480 9,287 -26%

ANL 9.84 7.35 -25%

TRIPF 235.01 188.51 -20%

Top Picks (Stocks Offering Maximum Upside Potential)

Company Closing Price Target Price Potential

AH

L ENGRO 188.75 315 67%

DGKC 87.14 129 48%

KOHC 113.03 166.5 47%

KA

SB

PPL 217.89 290 33%

DGKC 87.14 104 19%

OGDC 262.45 310 18%

AK

D FFC 108.81 138.62 27%

FATIMA 28.62 35.09 23%

DGKC 87.14 105.47 21%

JS

MLCF 29.19 41 40%

FATIMA 28.62 34 19%

HUBC 54.63 72 32%

Source: Abacus Research, KSE

Stock Market

Disappointing corporate results and uncertainty on the ongoing talks with Taliban contributed to KSE-100 index’s fall of 3.7% in Feb, closing at 25,783 points. Investor sentiment was most affected by the lukewarm progress made on the talks with Taliban. Terrorist attacks had continued while the military responded with their surgical strikes, making the way forward murkier. Instability on this front is likely to subdue foreign investment in the country while the government’s privatization plan could also be negatively affected. Net portfolio investment in Feb was registered at USD 9.3 million; a figure which is on the lower side.

Disappointing corporate results exacerbated the pressure on the index e.g. negative earnings surprises of Hubco and Kapco led to their fall of 15.4% and 9.8% respectively. The downbeat index failed to move up despite solid results posted by UBL, HBL, and PSO. Furthermore, regional markets’ recovery from earlier routs in Jan coupled with Pakistan’s weak performance made KSE a regional underperformer in Jan. However, analysts expect that valuations have yet to factor in banking sector’s solid performance, leaving some room for expansion in the index.

Source: Bloomberg

Pakistan’s market trades at a significant discount in comparison to its regional peers in terms of relative P/E valuations. The P/E multiple contracted to 7.9x, representing a deep discount relative to the average regional multiple of 12x. Analysts had earlier warned that multiples may be overstretched, making room for possible correction in the market.

JSCL assumed the title of highest traded stocks with 395mn shares traded while BOPR1 followed the lead for the month of Feb.

Source: KSE

-3.74%

0.4%1.8% 2.2% 2.3%

4.0% 4.1%

-5.0%

0.0%

5.0% Regional Comparison

Pakistan China Malaysia Singapore India Thailand Hong Kong

7.8 7.9

12.4 12.413.9 14.1

16.2

0

5

10

15

20Regional Valuations P/E (x) 2014E

China Pakistan Thailand India Hong Kong Singapore Malaysia

161 188219

349395

Highest Traded Stocks on KSE (Million Shares)

FCCL TRG LPCL BOPR1 JSCL

February 2014

Issue 38, Vol. 4

Page 2

The Abacus Prompt™

Monthly Business Review - Pakistan

The Abacus Prompt™ The Abacus Prompt™ The Abacus Prompt™

Pakistan Rupee Monthly Performance

Currency Open Rate Close Rate Change

105.49 104.89 0.57%

173.54 175.68 -1.23%

142.44 144.83 -1.68%

28.12 27.97 0.53%

28.72 28.55 0.59%

1.68 1.69 -0.60%

1.03 1.02 0.97%

KIBOR Monthly Movement

Tenor Open Rate Close Rate Change

1-Month 10.43 10.43 0.0% 3-Month 10.14 10.15 0.9% 6-Month 10.19 10.17 -0.2%

Key Commodities Monthly Price Movement

Commodity Description Opening Price

Closing Price

Change

Precious Metals

Gold

24Karat (PKR/Tola)

51,600 53,250 3.2%

Gold Spot (USD/oz) NY-Close 1,244 1,326 6.6%

Silver (PKR/Tola) 758 834 10%

Silver Spot (USD/oz)

NY-Close 19.18 21 10.7%

Gold- Silver Ratio

GSR 64.8 63.1

Oil

Crude Oil (US)

(USD/bbl). NYMEX 97.49 102.59 5.2%

Furnace Oil

(PKR/Ton ) IMPORT 79,683 79,683 0.0%

High Speed Diesel

(PKR/Ltr) 116.80 116.80 0.0%

Motor Spirit

(PKR/Ltr) 112.76 112.76 0.0%

Agriculture & Cement

KCA- Cotton

(PKR/ maund)

6,950 6,900 -0.7%

Urea

(PKR/Bag)

1,878 1,846 -1.7%

Cement (Avg.)

( PKR/50kg)

518 518 0.0%

Currency Market

United States Dollar

The dollar index slid by ~2% in Feb after a disappointing U.S. jobs report data was released. Although the weak data may be the result of abnormally adverse weather conditions, the report raised prospects of a slower reduction in the pace of Fed’s asset purchase program. PKR showed some muscle and appreciated by 0.57% against the USD, benefitting from a generally depressed USD and reports of CSF inflows and surging remittances which had soured by nearly 10.09% YoY

during 8MFY2014.

Euro, British Pound and Japanese Yen

Upbeat eurozone economic data, including strong German business sentiment survey and Mario Draghi’s optimistic outlook on the economy, propelled EUR higher against the USD, rising by almost 3% during Feb. Signs of improving UK economy and market expectations that interest rate would tighten sooner in UK than in U.S. helped GBP move up against USD by nearly 2% MoM. PKR slid against both EUR and GBP but managed to appreciate against SAR and AED. Yen was almost flat MoM against USD but BoJ increased its lending facilities, indicating possible depreciation for Yen in the coming months.

KIBOR

KIBOR rate for the 1-M tenure remained unchanged but marginally rose for the 3-M and fell for the 6-M tenures.

Commodities Market

Precious Metals

Gold registered its biggest monthly gain of 6.6% in Feb since last July, mainly on accounts of political tensions in Ukraine and fears of slowing Chinese economy. Gold has witnessed renewed investor interest lately, rising by more than 10% since the start of the year while flows into gold ETFs turned positive in Feb for the first time in over a year. A weakening dollar also pushed silver higher during the month. In domestic market, prices rose by ~3% while the APGMJA has called for lifting of the 30-day ban on gold imports.

Oil

Crude oil prices returned to bullish sentiment, rising by 5.2% MoM as exceptionally cold weather in the U.S. boosted demand for heating oil and stock levels fell during the month. Analysts highlighted that upcoming refinery maintenance mean that higher prices will be harder to maintain in the coming months. Domestic Motor Spirit prices remained flat during the month but the government committed to cut petrol prices by PKR 2.73 per liter in Mar.

Agriculture

According to provisional figures, Urea sales slid by 41% MoM and 14% YoY in Feb while growing by 5% YoY during 2MCY14. In the cotton market, lower yarn prices, gas shortage in Punjab and availability of India’s cheap yarn exports have adversely affected yarn sales from Pakistan reducing demand for domestic cotton.

Cement

Figures released by the APCMA reveal that cement sales grew by 4% YoY to 2.7mn tons in Feb on the back of recovery in local volumes in the Northern region. Subdued export volumes to Afghanistan have translated into flat sales figures of 21.57mn tons during 8MFY14. Analysts expect demand to pick up on account of PSDP fund disbursements and general growth in the economy. Local sales registered growth of 9% YoY while exports shrank by 11% YoY.

USD

JPY

EUR

SAR

AED

INR

GBP

Sources: SBP, XE.com, Investats, Bloomberg, FX.pk and KITCO

February 2014

Issue 38, Vol. 4

Page 3

The Abacus Prompt™

Monthly Business Review - Pakistan

The Abacus Prompt™ The Abacus Prompt™ The Abacus Prompt™

Economy of Pakistan

Sources: SBP, PBS, Statpak, FBR *Inflation rebased to FY08 (Sep 2011) (P): Provisional

Monetary Policy

The SBP had earlier decided to keep the DR unchanged at 10 percent for a two month period starting Jan 2014. This continuation of the policy rate was due to improvements in the balance of payments position as well as settlement of energy sector circular debt (till May 31), increased credit disbursements and private businesses as well as greater economic activity. Against the backdrop of benign inflation figures for the month of Feb and resurgent foreign exchange reserves, upward revisions to the policy rate in upcoming policy statements seem unlikely. The fundamental weakness in the balance of payments remains however remains persistent and is fueled by a severe contraction in net financial inflows since FY08. Substantial repayments of IMF loans have led to pressure on forex reserves and high volatility of PKR. The stress in BOP is expected to alleviate with healthy financial inflows expected in H2FY14. These include proceeds from privatization of PTCL, floatation of Euro bonds, auction of 3G and 4G licenses, as well as additional flows from bilateral and multilateral sources under the new IMF program (which during H1FY14 were negative USD 925.2mn). Furthermore, the export receipts are expected to grow and the positive impact of the accord of GSP Plus status to Pak exports by the EU was visible in Feb as exports grew at a staggering rate of 18.09% YoY. Despite a cautiously optimistic BOP outlook, SBP has had to juggle with rising CPI budgeted at 8%. However, currently the CPI figure of 7.9% is below the budgeted figure but nonetheless expected to range between 10 – 11% for FY14. A lower CPI figure will allow more room for an accommodative monetary policy.

As per provisional figures, FBR managed to collect PKR 162bn during Feb, up 17.3% YoY, compared to PKR 138bn in the same period last year. The figure was however below the targeted amount of PKR 172bn. Total collection during 8MFY2014 stood at PKR 1,363bn as compared to PKR 1,162bn last year. Tax officials however maintain that a growth rate of 17% in the coming month of FY2014 remains in sight. The FBR has implemented effective monitoring programs for tax collection (including the use of computerized payment receipts (CPRs), checking revenue leakages and also strict enforcement of taxation laws. The aggregate tax collection target of PKR 2,475bn still looks unrealistic and analysts view IMF’s prediction of PKR 2,345bn as attainable.

Power Sector

Circular debt for the power sector again resurfaced with the Ministry of Water and Power admitting that circular debt had resurged to PKR 180 billion after clearance of PKR 480 billion in July 2013. This PKR 180 billion does not include payments owed to oil companies'. This rampant rise has raised alarm bells in the Senate, with the Standing Committee on Water and Power, expressing serious concerns over the performance of the sector. In other power sector related developments, the Finance Minister, revealed that the installed capacity would be increased from the existing 19,000 MW to 24,000 MW within the next four years. The Minister underscored the need to harness hydel power, and made the case to foreign investors to invest in the sector, promising safeguard to investors in the sector.

Inflation

According to PBS, CPI remained unchanged at 7.9% YoY in Feb, registering no growth over the previous month. Stagnant petrol prices and good supply of essential commodities contributed to the trend. Food inflation was recorded at 7.6% YoY, which rose from 7.2 % during Jan. Core inflation (NFNE) was recorded at 7.8% YoY.

Other Key Indicators

Forex reserves were recorded at USD 8.74bn (Feb 28), rising 9.0% MoM but were lower by 32.4% YoY. Reserves held with SBP totaled USD 3.92bn (up 23.3% MoM), and with commercial banks USD 4.82bn (up 0.16% MoM). Pakistan paid an installment of USD 149mn in Feb on the IMF in loan but in flows on account of IMF’s loan tranche and Coalition Support Fund (CFS) funds during the month supported the foreign reserves.

14.6 14.8 14.9 14.3 13.5 13.8 13.6

12.9 12.2 11.8 11.5 11.0

10.2 9.99 9.999.52

8.24 8.52 8.028.74

Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun

Foreign Exchange Reserves (USD Billion)

FY2013 FY2014

1.21.26

1.14

1.37

1.02

1.13 1.091.03

1.121.22

1.19 1.16

1.40

1.23 1.28 1.35

1.13

1.381.24 1.21

Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun

Foreign Remittances (USD Billion)

FY2013 FY2014

2.1 2.1 2.2 2.2 2.1 2.0

2.6

1.91.8

2.32.1 2.2

3.7 3.94.3

3.9 3.8 3.6 3.83.3

3.7 3.64.1

3.6

Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb

Imports and Exports (USD Billion)

Exports Imports Trade Deficit

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb

Inflation*

Food Inflation Core Inflation CPI

111 126

172

138 145

211

114 138

182 172 170

245

120

145

202

168 169

216.0

168 162

Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun

Federal Tax Collection (PKR Billion)

FY2013 FY2014

February 2014

Issue 38, Vol. 4

Page 4

The Abacus Prompt™

Monthly Business Review - Pakistan

The Abacus Prompt™ The Abacus Prompt™ The Abacus Prompt™

FY13

(B) FY13

(Revised) FY14 (B)

Real GDP Growth 4.2% 3.2% 4.4%

GDP (mp) (PKR bn) 23,655 23,655 26,001

Average CPI 11-12% 10% 11 – 12%

Remittances (USD bn) 14.1 14.1 15.0

Total Debt (PKR bn) NA NA NA

Total Debt (% of GDP) 56.5% 61.8% 61.3%

External Debt (USD bn) NA NA NA

External Debt (% of GDP) NA NA NA

Exports (fob) (USD bn) 25.9 25.9 26.6

Imports (fob) (USD bn) 42.7 42.7 43.3

Tax Collection (PKR bn) 2,381 2,007 2,475

Fiscal Deficit (% of GDP) 4.7% 6.5% 6.3%

Current Account Balance (% of GDP)

-1.9% -1.0% -1.1%

Sovereign Credit Ratings (foreign and local currency debt)

S&P: B- / Stable / C (Foreign and Local-Short and Long term)

Moody’s: Caa1/Negative (LT Issuer Rating-foreign and local currency)

Economy of Pakistan

Major News & Events

Source: SBP, Economic Survey of Pakistan, Budget Review FY13, Planning Commission. IMF Public Information Notice No.12/135 Nov 2012 (P): Provisional; (B): Budgeted; (e): Estimated; Proj.: Projections

Sovereign Credit Ratings (foreign and local currency debt):

Standard & Poor’s: B-/ Stable/ C Moody’s: B3 – Stable (foreign and local currency debt)

(P=Provisional, B=Budgeted)

Other Key Indicators

Overseas remittances during Feb amounted to USD 1.21bn and were down by 2.9% MoM from USD 1.24bn in Jan. Remittances for the 8MFY14 combined were recorded at USD 10.24bn and were up 10.9% compared to the corresponding period FY13. At current pace, total remittance may reach record highs in FY14 and support balance of payments.

Pakistan’s exports stood at USD 2.167bn in Feb, up 5.14% MoM from USD 2.061bn in Jan. On a YoY basis exports were up by 18.09%. The strong results were probably due to the GSP+ status in EU that came into effect last month. Pak-EU trade volume is estimated at USD 10.9bn with Pakistan registering a trade surplus of USD1.78bn. Full utilization of the status is expected to boost exports by up to USD 2.0bn, according to estimates. Imports for Feb were recorded at USD 3.6bn, compared to USD 4.137bn in Jan (down 12.98% MoM) and USD 3.383bn in Feb 2013 (up 6.41% YoY). It was for the first during 8MFY2014 that the import bill has remained below the official reserves held by the SBP. Consequently, the trade deficit for the month contracted to USD 1.433bn from USD 2.076bn in Jan 2014 and USD 1.548bn in Feb 2013. Trade deficit during 8MFY14 totaled USD 12.54bn, and was 5% less than the deficit recorded in the same period last fiscal year. According to the SBP’s latest annual report, a high product and geographic concentration of exports (currently three percent of total export items account for about 75% of the country’s export value) increases the country’s risk to external account sustainability.

The current account deficit for 7MFY14 was recorded at USD 2.05bn, up from USD up from USD 441mn for the same period last fiscal year. Analysts warn that the government will have to speed up the privatization process, 3G & 4G auctions, and issuance of Eurobonds to prevent a BOP crisis.

Note: This report is for information purposes only and no action is being solicited through it. The material used is based on information we believe to be reliable but we do not guarantee its accuracy or completeness. AbacusConsulting will not be responsible for the consequence of reliance upon any opinion or statement herein or for any omission. This report or any part of it may not be reproduced or published without prior permission.

Asian Development Bank (ADB) has agreed to provide USD 900 million loan to Pakistan for Jamshoro coal-fired power project while add 1200 MW of power to the national grid.

An agreement between Pakistan and China was signed to build an airport and upgrade the Karakorum Highway in a bid to strengthen trade ties between the two countries.

According to reports, during the next five years Pakistan stands to benefit from China’s plan to import goods and service worth USD 10 trillion from 30 countries including Pakistan.

US debt limit was raised through March 2015 without any previously witnessed political deadlock. A shutdown of the government would have sent the financial markets into deep turmoil.

Around 70,000 pro-western Ukrainians took to the heart of Kiev on Feb 9, vowing to oust President Viktor Yanukovych for his alliance with Russia.

ECB left interest rates unchanged at 0.25% and stressed that it stood ready to act should the emerging market turmoil hit the eurozone.

Noteworthy earnings releases during the month included that of OGDC, Hubco, and Lucky cement. OGDC’s EPS of PKR 7.82 for 2QFY14 came in well above analysts’ expectation. Hubco’s EPS figure of PKR 0.97 suffered a downfall of 38% QoQ and was below expectations. Lucky cement registered an EPS of PKR 8.63 on consolidated basis, which came almost in line with analysts’ forecasts.

A Special Court trying former President Pervez Musharraf on high treason charges turned down his plea for medical treatment in the US, issuing bail able arrest warrants. Musharraf was finally ordered to be summoned before the court on March 11.

The on-going talks with Taliban suffered major setbacks during the month as terrorist attacks continued and the military responded with surgical strikes, raising prospects of a full-blown operation in the tribal regions.

Ishaq Dar revealed on Feb 21 that auctions of 3G and 4G licenses will finally be held in April. The 3G license will cost USD 295 million while the 4G will cost USD 210 million.

Pakistan is all set to receive the third IMF loan tranche worth USD 550 million later this year. IMF has expressed satisfaction with progress made on economic reforms.

Failure to clear outstanding advertisement dues has cast doubt on the government’s ability to appoint 3 financial advisors by end of March, as was previously committed to the IMF.

Pakistan received on Feb 11 a CSF tranche worth USD 352 million, easing pressure on the foreign exchange reserves of the country.

The Council of Common Interest on Feb 9 approved the issuance of sovereign guarantee for Thar coal mining projects and furthermore decided the privatization of Discos and Gencos.

Huge borrowings to reduce fiscal deficit have pushed total domestic debt and liabilities to PKR 10 trillion by the end of first half of FY2014.