Coverage Perspectives © CLM Litigation Management Institute 2013. All rights reserved. The course...

-

Upload

margaretmargaret-hopkins -

Category

Documents

-

view

215 -

download

2

Transcript of Coverage Perspectives © CLM Litigation Management Institute 2013. All rights reserved. The course...

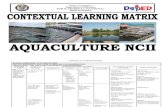

Coverage Perspectives

© CLM Litigation Management Institute 2013. All rights reserved. The course material presented herein does not represent the views or opinions of any of the individual faculty members or instructors or of any of the companies or entities with which they may be employed or affiliated. Nothing in the course materials presented should be construed as legal or professional advice or the rendering of a legal or professional opinion on any specific factual situation. Always seek appropriate legal and professional business advice in the context of specific cases.

Daniel CostelloKate Daly

Course Objectives1. Understand the most common ethical and strategic

considerations in defending insured litigation

2. Understand the ROR, its implications and what your client needs to know about it

3. Identify and resolve conflicts of issues

4. How best to respond to the policy requirements related to settlements: e.g., Hammer letter; need for consent

5. Practical Considerations on Coverage

What Does This Mean in the Real World?

Real Life is Stranger Than Fiction Justin GI (“Insured”) struck Daniel Fight (“Plaintiff”) with his

vehicle.

Plaintiff claims that he was initially struck on his left elbow and ankle; he suffered serious injuries, and six weeks later succumbed to his injuries. Plaintiff had $300,000 in medical bills before his death. Photos show dent in vehicle from hit.

Coverage-Commercial Auto Policy $500,000 in coverage.

You are staff counsel managing attorney – to whom case is assigned. Initial indication is auto case with a wrongful death and no coverage issues.

You speak with the Insured who reveals the following to you, all of which is unknown to the adjuster:

Accident on a residential street. Plaintiff thought Insured was speeding. Plaintiff was a large intimidating man at 6’2” tall and 275 pounds.

Insured could see that Plaintiff was not going to move out of the middle of the road, so he came to a complete stop.

As Justin pulled his vehicle up to Plaintiff, he stopped the car, and turned to his friend Scott and asked “what should we do?”

Real Life is Stranger Than Fiction

Client is a black belt in karate, won National Title for 13 year-olds, brown belt in Jujitsu, and former Army Ranger.

Insured attempted to leave the scene.

Plaintiff kicked in the side of his vehicle with his boots as Insured drove by. At no time did the vehicle ever strike the Plaintiff.

Stopped Vehicle to Confront Plaintiff – when he did, “sprinted” toward him to fight. Insured performed an “arm-bar”, breaking Plaintiff’s arm. Plaintiff sustained several other injuries as well, and several weeks later he died from his injuries.

Real Life is Stranger Than Fiction

Commercial Auto Policy

What are the Obligations of Each Party?

What Exclusions are Triggered?

Are There Any Ethical Conflicts?

Who has those Conflicts?

What Issues Does the Scenario Touch On?

Counsel Relationships

OR

Differing Views

Attorney has two clients – the insured and the insurer

Attorney has one client – the insured, and one quasi-client – the insurer

Attorney has one client – the insured and one partner or “agent” – the insurer

Attorney has one client, the insured.

Bipartite

Tripartite

Tripartite relationship between insurer, insured and counsel with common shared interest.

Dual representation is beneficial when shared goal is minimizing or eliminating liability to a third party.

What about when the allegations of complaint do not fall within the scope of coverage under the policy.

Creation of a Conflict

Conflicts of Interests: Real or Potential

What position is the Carrier taking?

Acknowledgment of Coverage?

Reservation of Rights?

Are there intentional acts or other allegations where coverage may be limited/excluded under the policy?

Expected/Intended Contractual Liability Liquor Liability Pollution Damage to Property

Does your client need independent counsel? Cumis/Pepper counsel? If a conflict exists, would the parties agree to waive?

What Are Your Obligations for a Conflict?

Ethical Issues

Are the Goals the Same For Uncovered Acts?

Are you maximizing coverage for the defendant?

The insured wants you to maximize coverage for the insured.

Are you saving the carrier money?

Carrier wants least amount of exposure to the policy

Knowing Who Your Client Is Makes A Difference

Ultimate Duty to the Insured

Staff Counsel v. Panel Counsel: Does it Matter? Insured’s lawyer “owes the insured the same type ofunqualified loyalty as if he had been originally employedby the insured” and “must at all times protect theinterests of the insured if those interests would becompromised by the insurer's instructions.”

A Final Word on Counsel Relationships

As noble as the approach demanding ultimate loyalty to the insured sounds, the solution is not that simple.

Defense counsel must be extremely cautious when dealing where guidelines or instructions restrict counsel’s judgment, independence and duty to the insured.

Crafting a Solution Drafting a Conflict Waiver

(Justin GI) Informed Consent

What Conflict Counsel Means. Understanding Coverage

Helps Define a Resolution Strategy. Carrier Does Understand Issues- Get a Coverage Position in Writing

Using Knowledge as Leverage Intentional Acts

Examining Coverage:Where Does it Come From?

Getting Coverage

SECTION I – COVERAGES COVERAGE A BODILY INJURY AND PROPERTYDAMAGE LIABILITY

1. Insuring Agreement

a. We will pay those sums that the insured becomes legally obligated to pay as damages because of "bodily injury" or "property damage” to which this insurance applies…

WHAT is covered? Bodily injury or property damage.

Getting Coverage

b. This insurance applies to "bodily injury" and "property damage" only if: (1)The "bodily injury" or "property damage" is caused by an "occurrence" that takes place in the "coverage territory"; WHERE? In the coverage territory identified in the policy.

b. This insurance applies to "bodily injury" and "property damage" only if:

(2) The "bodily injury" or "property damage“

occurs during the

policy period;

Getting Coverage

Whether Not a Claim is Covered Depends on Which State Law Governs

Considerations: Trigger of Coverage

When did the Bodily Injury or Property Damage occur?

Use of Extrinsic Evidence Is the Insured/Insurer limited to the facts

alleged in the Complaint to determine the date of injury/damage and other issues related to coverage?

Trigger of Coverage

ExposureINJURY/DAMAGE NOT NEEDED, JUST THE EXPOSURE

Lead Paint – Massachusetts

Silica – Idaho, Louisiana, Wisconsin, California

ManifestationINJURY AND/OR DAMAGE FIRST DISCOVERED

Asbestos – Maine, Massachusetts

1st party progressive property damage – Nevada

Everything but Asbestos – Pennsylvania

Continuousfrom exposure through to manifestation (in some cases beyond), whether or

not actual injury can be shown to have occurred at any point in between

Environmental Damage – Delaware; Environmental Injury - Arizona, Colorado, D.C., Illinois, Indiana, Maryland, Oregon, South

Carolina, Virginia New Jersey

the

Use of Extrinsic Evidence

Which facts will apply to determine if the loss is covered under the policy?This is important - If the policy is triggered then there is generally a Duty To Defend.What if you can’t tell from the complaint when the damage or injury occurred?What if you can show that the damage or injury did not occur during your policy period?

Duty to Defend Depends on State Law

What does the Complaint allege?

-corners-4 8OR

What are the true facts?EXTRINSIC EVIDENCE

The obligation of the insurer to defend does not depend on whether the injured party will successfully maintain a cause of action against the insured but on whether he has, in his complaint, stated facts that bring the injury within the coverage. Board of Education v. St. Paul Fire & Marine Ins. Co., 61 Conn. 37 (2002)

[C]ourts must first look to the factual allegations in the pleadings to ascertain whether the alleged conduct potentially requires coverage. St. Paul Fire & Marine Insurance Co. v. Green Tree Financial Corp., 249 F.3d 389 (5th Cir. 2001)

Is There a Duty To Defend Based on the Allegations in the Complaint?

An insurer is required to defend when the true facts — those which are known or reasonably ascertainable by the insurer — are within, or potentially within, coverage, even if the suit alleges facts that are outside the scope of coverage. (emphasis added).

National Indemnity Company v. Flesher,469 P.2d 360 (Alas. 1970)

So, what if the true facts reveal that the suit actually is alleging facts that are outside the scope of coverage?

When an insurer's independent investigation of the facts a complaint against insured reveals a claim patently outside of the risks covered by the policy, the insurer may properly refuse to defend.

Walton v. First American Title Ins. Co., 844 N.E.2d 143, 146 ( Ind. App. 2006)

Or Only for The Insured’s Benefit?But if the true facts would place the complaint outside coverage, the insurer must still defend if the facts alleged in the suit are potentially covered.

Sauer v. Home Indemnity Company,841 P.2d 176 ( Alas. 1992)

Extrinsic evidence not permitted: Colorado, Virginia, Pennsylvania

As a Shield for Insurers?

New York Law “…an insurer must defend whenever the four corners of a complaint suggest…a reasonable possibility of coverage.”

Continental Cas Co v. Rapid-American Corp, 609 N.E. 2d 506, 509 (1993)

This is true “even though the facts outside the four corners….indicate that the claim may be meritless or not covered.”

Fitzpatrick v. American Honda Motor Corp, 575 N.E 2d 90, 90

Where the pleadings “do not allege a covered occurrence, but the insurer has knowledge of facts demonstrating that the lawsuit does involve such an occurrence,” the insurer has a duty to defend. “even though facts outside the four corners of those pleadings indicate that the claim may be meritless or not covered.”

New Jersey Law Diacetyl (butter flavoring) Two lawsuits, alleging respiratory and other serious injuries Plaintiffs didn’t state when their injuries manifested (New Jersey is a

“manifestation” state). Discovery confirmed plaintiffs were hospitalized (one undergoing a

lung transplant) before insurers came on risk.

When the duty to indemnify depends on factual issues that will not be resolved in the underlying suit against the insured, the insurer may deny coverage and await judicial resolution based on the actual facts. Here, insurers examined extrinsic evidence to determine whether their policies were triggered. Insurers withdrew promptly after determining that claimants’ initial manifestations occurred prior to the inception of their policy periods.

Polarome International, Inc. v. Greenwich Insurance Co., et al., Docket A-0566-0771 (December 17, 2008)

The Reservation of Rights Letter

A 2006 Federal investigation reveals that U.S. Fruit Farmers, which has owned fruit farms in Central America for the past 15 years, has been paying protection money to revolutionary insurgents since 1990.

USFF settles with the DOJ in 2009, acknowledging that it knowingly violated 2001 Anti-Terrorist Laws, making its payments illegal from 2001 until the payments stopped in 2006.

USFF notifies all carriers of the following suits filed against it in 2007:

More than 100 Guatemalan families file suit under the Alien Tort Statute, either as injured or as survivors over the period from 1990 through 2006, seeking $8.5b in compensatory and $8.5b in punitive damages.

Twenty-two U.S. plaintiffs file under the Antiterrorism Act on behalf of their family members who were missionaries in Guatemala killed by the insurgents over a period from 1997 through 2006.

Derivative litigation for injuries and deaths that occurred throughout the 1990s.

Real Life: Stranger Than Fiction, TAKE 2

You have insured USFF since 2003, providing $100m excess $75m.

Litigation is consolidated – MDL , SDNY

Guatemalan Litigation (ATS) expected to be dismissed eventually, although defense expense will mount until dismissal is obtained.

You learn that attempts have already been made to settle the derivative litigation

The ATA litigation could be very troublesome for USFF.

ATA – cause of action for American nationals injured by acts of international terrorism outside the U.S.

Allegations: 1) Conspiracy; 2) Aiding and Abetting Terrorists; and 3) Providing Material Resources to Terrorists

Demand: $5b compensatory and $5b punitive.

Real Life: Stranger Than Fiction, TAKE 2

Effective Reservations

Timely

Identify the policy and the sections about which you have questions

Summarize the pleadings

Advise of right to independent counsel if required

Right to reimbursement

Continued cooperation of insured

Waiver and Estoppel Waiver – intentionally relinquishing a right Estoppel – stating something or acting in a way that causes the insured to

rely on the statements/acts to its detriment. Insurer assumes an initial defense without notifying the insured of

a ROR may be estopped from asserting coverage defenses – insured

prejudiced by loss of the right to control the litigation. Insured denies a defense to an insured who settles with plaintiffs in

excess of policy limits. insurer estopped from asserting policy exclusions against

plaintiff – insurer “may litigate only the validity of its disclaimer.”

K2 Invest. Grp. LLC v. Amer. Guar. & Liab. Ins. Co. NY Ct. of App., Case 106 (June 2013)

Complicating Factors

Continuing Duty of Good Faith

The covenant of good faith and fair dealing imposes on both the insurance company and its insured “a duty that neither shall do anything which impairs the right of the other to receive the benefit of [the] agreement.”

Austero v. National Cas. Co. of Detroit, Mich., 84 Cal. App. 3d 1, 26, 148 Cal. Rptr. 653, 669 (1978)

Bad faith involves an insurer’s “deliberate or reckless failure to place on equal footing the interests of [the insurance company’s] insured with its own interests… .”

Pinto v. Allstate Ins. Co., 221 F.3d 394, 399 (2d Cir. 2000)

Nature of the Ongoing Duty In addition to contractual duty, courts have held a “special

relationship” between insurer and insured.

“Special Relationship” imposes duty greater than those of ordinary commercial contract — “give at least as much consideration to the welfare of its insured as it gives to its own interests.”

Duty of good faith and fair dealing extends to manner in which insurer defends claims or contests coverage.

Many courts hold unfair claims practices are not limited to pre-litigation claims handling and impose an ongoing duty on insurers to act fairly in evaluation and resolution.

Complicating Factors

Consent Clauses and Hammer Letters

The Company shall not commit any Insured to settlement without the consent of the {Insured}, which consent shall not be unreasonably withheld.

The Company shall have the right to recommend settlement of Claims. If Insured refuses to consent to settlement, then Company’s liability will not exceed amount the Claim could have been settled, and Claim Expenses incurred up to the date of such refusal.

Consent and Hammer Clauses

Insurer still has right to settle but: “Consent policies” require insured's consent to settle but:

Consent may not be "unreasonably" withheldWhat if consent is withheld?

Insurer negotiates settlement subject to insured's consent

Need to keep insured informed of negotiationsSend Hammer Letter

Hammer Letters

Complicating Factors

Coverage Availability

Deductibles and SIRs Eroding or burning limits Covered claims/non-covered claims Excess exposures

Coverage Complications

DeductibleCoverage is written on a first dollar basis and the deductible amount is owed to the insurance company by the insured. In third party claims, this means that the insurance company pays the whole claim and then recovers the deductible amount from the insured.

Self-Insured Retention (Sir) Just like it sounds, this is an amount for which the insured retains the risk. The insured is responsible to the third party claimant for a set amount and literally has no insurance until that amount is met. SIRs may or may not be eroded by claim expenses.

SIR v. Deductible

Who Can Satisfy the SIR?

Check the SIR and see if there is Condition Precedent language that says the insured (and only the insured) must pay before the policy applies.

If there is no language to this effect then payment for defense by other carriers could constitute payment of the SIR for the insured.

SIR v. Deductible

Typical excess policies (follow-form) will usually have language similar to the following:

“The terms and conditions of Primary Insurance in effect at the inception date of this policy apply to this policy, unless they are inconsistent with any provision of this policy or relate to any renewal agreement.”

aka “FOLLOW FORM COVERAGE”

Excess vs. Umbrella Coverage

USFF Tower of Coverage Eroding or Burning Limits

50

Umbrella policies-“broader” coverage but with exclusions Coverage “A” – Follow Form – Policy “follows form” to the policy they schedule as Underlying Insurance. Coverage “B” by virtue of being Umbrella Coverage, will provide broader coverage than Coverage A – Follow Form.

“Coverage B does not apply to any claim or Suit: a. Which is covered by Primary Insurance or Coverage A

of this policy; or b. Which would have been covered except for the

exhaustion of the limits of such insurance.“ When Coverage “B” is triggered you have to look to the Insuring Agreement/Exclusions/Conditions to see how the coverage applies.

Excess vs. Umbrella Coverage

USFF Tower of Coverage Eroding or Burning Limits

52

Horizontal, Vertical Exhaustion and Target Tenders

Non-continuous trigger – the Norm – triggered the same way as Primary policies. ALL underlying coverage must be exhausted before they are triggered. Continuous trigger” losses – the underlying triggers horizontally and therefore the Excess carrier will look at all underlying coverage to exhaust before they step in and pay. What if primary and excess coverage under two or more policies or programs of insurance?

If more than one insurer is potentially obligated to defend or indemnify a claim, in some states the insured may “target” or “select” one insurer and forgo or reserve coverage from any other non-selected insurer.

Excess Coverage

USFF Tower of Coverage Eroding or Burning Limits

54

Other Insurance - Excess Policy Condition:If there is any Other Insurance available to any Insured, this policy applies excess of and does not contribute with such Other Insurance. However, this does not apply if the Other Insurance is specifically written to be excess over this policy.

Levels of Attachment The level of attachment is designated by the list of Underlying

Insurance or Primary Insurance designated in the Declarations of the policy. The Declarations Page will also designate the policy that is being followed.

Policy’s plain language required the underlying policies to be exhausted solely as a result of payment of losses and not by the mere accrual of losses in the form of liability.

Ali v. Federal Ins. Co., 2013 WL 2396046 (2d. Cir. June 4, 2013)

Excess Coverage

USFF Tower of Coverage Eroding or Burning Limits

56

Impact of Publicity Negative media/press coverage Loss of business reputation Need media strategy

Uninsurable Costs Human resources/staff time/productivity Downtime and loss of revenue Profits diminished

Competing Perspectives

1. Identify Conflicts and Resolution Strategies.

2. Know What the Policy Says

3. Map Where Not to Tread

4. Use a Guiding Light

Coverage Perspectives Recap

Coverage Perspectives

Daniel CostelloKate Daly