Courier C58866 Round 5 (With Scores)

-

Upload

jackmooreaus -

Category

Documents

-

view

25 -

download

2

description

Transcript of Courier C58866 Round 5 (With Scores)

Round: 5Dec. 31, 2018 C58866

AndrewsCongsi JIAONing Likai liuHao LuQingshao SuiJunyi Wu

BaldwinWan Ying ChaiWai Chak Billy ChunRu Ann ChungHo Fung Ronald MakMandy TeoWing Sze Yau

ChesterKaiyin LianShuyi SunYudi SunZHAO YINGRui ZhangJIREN ZHOU

DigbyDung DoanMeihua KwongNinh NguyenHiep NguyenBinh Hoang NguyenImmanuel Polii

Eriejiang heKe LiTian TANGcheng ZHANGJie ZhangYu Zhao

FerrisXueqing LiHuy NguyenYuhao WangJUE WANGYuan XuYuan Yue

Selected Financial StatisticsAndrews Baldwin Chester Digby Erie Ferris

ROS 2.2% 4.9% -0.1% -0.1% 3.2% 6.8%Asset Turnover 1.35 1.25 1.08 1.58 1.55 1.05ROA 2.9% 6.2% -0.1% -0.2% 5.0% 7.2%Leverage(Assets/Equity)

2.8 1.8 5.4 9.0 2.5 1.2

ROE 8.3% 10.9% -0.6% -1.8% 12.4% 8.6%Emergency Loan $0 $0 $0 $0 $0 $0Sales $269,284,560 $157,181,969 $147,160,073 $158,457,208 $117,153,191 $75,475,219EBIT $22,077,378 $17,879,930 $13,122,200 $9,703,636 $10,895,114 $9,096,760Profits $5,833,293 $7,779,710 ($156,029) ($201,672) $3,805,160 $5,152,963Cumulative Profit ($9,145,391) ($7,083,667) ($35,245,243) ($32,651,316) ($28,984,335) ($13,328,491)SG&A / Sales 13.2% 11.8% 15.3% 10.2% 19.6% 14.6%Contrib. Margin % 27.9% 23.7% 30.2% 22.8% 24.9% 30.4%

CAPSTONE® COURIER Page 1

Stock & Bonds C58866 Round: 5Dec. 31, 2018

Stock Market Summary

Company Close Change Shares MarketCap($M) Book Value EPS Dividend Yield P/E

Andrews $18.45 $7.00 3,892,299 $72 $18.10 $1.50 $0.00 0.0% 12.3Baldwin $27.10 $6.32 3,283,106 $89 $21.75 $2.37 $0.00 0.0% 11.4Chester $4.90 $3.90 2,735,968 $13 $9.21 ($0.06) $0.00 0.0% -87.5Digby $5.44 $4.44 2,000,000 $11 $5.55 ($0.10) $0.00 0.0% -54.4Erie $2.61 $1.61 3,636,423 $9 $8.44 $1.05 $0.00 0.0% 2.5Ferris $14.36 $5.73 4,958,420 $71 $12.15 $1.04 $0.00 0.0% 13.8

Bond Market SummaryCompany Series# Face Yield Close$ S&P Company Series# Face Yield Close$ S&PAndrews Digby

13.4S2019 $20,850,000 13.5% 99.04 C 13.4S2019 $20,850,000 13.6% 98.44 DDD10.7S2024 $18,800,000 12.5% 85.42 C 10.7S2024 $10,000,000 12.9% 83.06 DDD12.2S2025 $25,564,000 13.5% 90.29 C 12.0S2025 $20,000,000 13.8% 86.77 DDD13.3S2026 $14,000,000 14.1% 94.53 C 13.5S2026 $13,000,000 14.6% 92.42 DDD14.2S2028 $21,537,000 14.4% 98.47 C Erie

Baldwin 13.4S2019 $14,254,295 13.5% 99.39 CC10.7S2024 $7,656,466 11.5% 93.09 BB 10.7S2024 $6,500,000 12.3% 86.81 CC12.1S2025 $3,000,000 12.3% 98.65 BB 12.1S2025 $13,000,000 13.2% 91.45 CC13.0S2027 $12,436,000 12.6% 103.15 BB 12.5S2026 $5,600,000 13.5% 92.60 CC13.4S2028 $20,747,000 12.7% 105.56 BB Ferris

Chester 11.9S2025 $7,975,951 11.1% 107.21 AAA13.4S2019 $20,850,000 13.6% 98.52 DDD10.7S2024 $18,994,000 12.8% 83.39 DDD12.5S2025 $25,766,000 14.0% 89.22 DDD13.5S2026 $13,664,000 14.5% 92.84 DDD14.1S2027 $15,236,000 14.8% 95.25 DDD14.7S2028 $2,273,000 15.0% 98.00 DDD

Next Year's Prime Rate 8.90%

CAPSTONE® COURIER Page 2

Financial Summary C58866 Round: 5Dec. 31, 2018

Cash Flow Statement Survey Andrews Baldwin Chester Digby Erie FerrisCashFlows from operating activitiesNet Income(Loss) $5,833 $7,780 ($156) ($202) $3,805 $5,153Adjustment for non-cash items: Depreciation $16,126 $8,706 $13,246 $10,333 $5,995 $6,339 Extraordinary gains/losses/writeoffs $0 ($10,020) ($4,491) $0 ($10,813) ($4,482)Changes in current assets and liablilities Acounts payable ($1,157) ($2,790) ($8,740) $1,897 ($4,278) ($2,683) Inventory $18,753 $8,982 $27,744 $0 $19,398 $6,025 Accounts Receivable ($9,849) $1,104 $34,963 $3,689 $1,295 $2,178Net cash from operations $29,706 $13,760 $62,566 $15,717 $15,402 $12,530

Cash flows from investing activitiesPlant improvements(net) ($29,445) ($468) ($2,623) $0 $34,041 $31,099Cash flows from financing activitiesDividends paid $0 $0 $0 $0 $0 $0Sales of common stock $5,000 $11,371 $0 $0 $606 $7,000Purchase of common stock $0 $0 $0 $0 $0 $0Cash from long term debt issued $21,537 $20,747 $2,273 $0 $0 $0Early retirement of long term debt $0 ($30,747) $0 $0 ($6,477) ($40,000)Retirement of current debt ($17,694) $0 ($67,053) ($15,900) ($31,127) $0Cash from current debt borrowing $0 $0 $7,430 $15,000 $0 $0Cash from emergency loan $0 $0 $0 $0 $0 $0

Net cash from financing activities $8,843 $1,371 ($57,350) ($900) ($36,998) ($33,000)

Net change in cash position $9,104 $14,664 $2,592 $14,817 $12,444 $10,629Balance Sheet Survey Andrews Baldwin Chester Digby Erie FerrisCash $9,104 $38,094 $2,592 $17,804 $12,444 $15,013Accounts Receivable $44,266 $15,072 $18,143 $13,024 $9,629 $6,203Inventory $7,268 $423 $0 $0 $6,486 $0Total Current Assets $60,638 $53,589 $20,735 $30,828 $28,559 $21,216

Plant and equipment $241,884 $130,588 $198,686 $155,000 $89,930 $95,086Accumulated Depreciation ($102,625) ($58,273) ($83,839) ($85,827) ($42,879) ($44,237)Total Fixed Assets $139,259 $72,315 $114,847 $69,173 $47,051 $50,849

Total Assets $199,897 $125,904 $135,583 $100,002 $75,610 $72,065

Account Payable $28,702 $10,641 $6,159 $10,050 $5,577 $3,823CurrentDebt $0 $0 $7,430 $15,000 $0 $0Long Term Debt $100,751 $43,839 $96,783 $63,850 $39,354 $7,976Total Liabilities $129,453 $54,481 $110,372 $88,900 $44,931 $11,799

Common Stock $54,196 $53,137 $35,043 $18,360 $34,295 $48,201Retained Earnings $16,248 $18,286 ($9,833) ($7,258) ($3,615) $12,065Total Equity $70,444 $71,423 $25,210 $11,102 $30,679 $60,266

Total Liabilities & Owners'' Equity $199,897 $125,904 $135,583 $100,002 $75,610 $72,065

Income Statement Survey Andrews Baldwin Chester Digby Erie FerrisSales $269,285 $157,182 $147,160 $158,457 $117,153 $75,475Variable Costs(Labor,Material,Carry) $194,230 $120,005 $102,677 $122,269 $88,025 $52,540Depreciation $16,126 $8,706 $13,246 $10,333 $5,995 $6,339SGA(R&D,Promo,Sales,Admin) $35,525 $18,540 $22,493 $16,149 $22,923 $11,021Other(Fees,Writeoffs,TQM,Bonuses) $1,327 ($7,949) ($4,377) $2 ($10,685) ($3,522)EBIT $22,077 $17,880 $13,122 $9,704 $10,895 $9,097Interest(Short term,Long term) $12,845 $5,579 $13,362 $10,014 $4,879 $949Taxes $3,231 $4,305 ($84) ($109) $2,106 $2,852Profit Sharing $168 $216 $0 $0 $106 $143Net Profit $5,833 $7,780 ($156) ($202) $3,805 $5,153

CAPSTONE® COURIER Page 3

Production Analysis C58866 Round: 5Dec. 31, 2018

NamePrimary

SegmentUnitsSold

UnitInven

tory Revision DateAge

Dec.31 MTBFPfmn

CoordSize

Coord PriceMaterial

CostLaborCost

Contr.Marg.

2ndShift

&Over-

time

Automation

NextRound

CapacityNext

RoundPlant

Utiliz.Able Low 2,993 0 10/31/2018 2.0 19000 8.0 12.2 $24.00 $9.20 $8.03 29% 47% 7.0 1,900 132%Acre Low 3,579 0 6/22/2018 2.2 17000 3.7 16.6 $17.00 $5.72 $5.15 32% 88% 9.5 1,700 168%Adam High 1,052 302 8/1/2018 1.4 25000 13.1 7.2 $36.50 $14.21 $9.60 32% 33% 6.0 900 119%Aft Pfmn 1,244 0 6/30/2018 1.5 27000 14.1 13.1 $31.50 $13.53 $12.00 19% 98% 5.0 850 178%Agape Size 1,244 0 6/30/2018 1.5 21000 7.2 6.2 $31.50 $11.94 $12.00 24% 98% 5.0 850 178%Acl Low 447 0 6/26/2018 1.6 17000 3.9 16.4 $17.50 $5.86 $6.34 30% 65% 8.0 443 148%Abt Trad 358 0 11/14/2018 1.5 19000 8.2 12.1 $24.50 $9.30 $9.42 26% 53% 6.0 395 137%Adh High 89 0 7/8/2017 1.5 25000 13.1 7.2 $36.50 $14.21 $13.58 23% 39% 5.0 100 124%

Baker Trad 1,287 0 5/17/2018 1.7 19000 8.2 12.1 $23.50 $9.34 $9.84 18% 0% 4.7 1,700 76%Bead Low 49 0 9/15/2017 5.4 14000 3.9 16.4 $16.00 $0.00 $0.00 10% 0% 5.4 1 0%Bid High 1,009 17 6/24/2018 1.5 25000 13.1 7.2 $37.00 $14.28 $11.02 31% 22% 5.0 900 93%Bold Pfmn 1,281 0 6/18/2018 1.6 27000 14.1 13.1 $32.40 $13.59 $12.35 20% 100% 5.0 1,300 151%Buddy Size 1,455 0 6/16/2018 1.6 21000 7.2 6.2 $32.50 $11.99 $12.54 25% 100% 5.0 1,200 151%

Cake Trad 1,667 0 7/1/2018 1.8 19000 8.2 12.1 $24.50 $9.30 $6.22 37% 0% 7.0 2,000 45%Cedar Low 2,147 0 12/5/2017 5.3 17000 3.9 16.4 $17.50 $5.86 $5.76 32% 100% 8.0 1,400 152%Cid High 746 0 6/1/2018 1.5 25000 13.1 7.2 $36.50 $14.21 $12.43 24% 0% 5.0 700 28%Coat 0 0 6/9/2017 2.6 27000 13.1 13.8 $32.50 $0.00 $0.00 0% 0% 3.0 1 0%Cure 0 0 6/9/2017 2.6 21000 6.5 7.2 $32.00 $0.00 $0.00 0% 0% 3.0 1 0%Coffee Low 1,706 0 5/26/2018 1.5 17000 3.9 16.4 $17.50 $5.86 $7.68 22% 100% 7.0 1,320 152%Cheese High 281 0 6/22/2018 1.3 25000 13.1 7.2 $36.50 $14.21 $9.32 35% 0% 5.0 370 76%Cookie Trad 57 0 3/7/2016 2.8 19000 8.0 12.4 $24.50 $9.13 $4.66 42% 0% 8.0 125 76%

Daze Trad 2,045 0 5/23/2018 1.6 19000 8.2 12.1 $24.00 $9.67 $9.02 22% 16% 5.5 1,800 114%Dell Low 2,507 0 5/13/2017 3.9 17000 3.4 16.9 $17.50 $5.73 $7.39 24% 16% 6.5 2,200 114%Dixie High 883 0 6/5/2018 1.5 25000 13.1 7.2 $36.99 $14.78 $11.55 29% 0% 3.5 900 98%Dot Pfmn 589 0 5/25/2018 1.6 27000 14.1 13.1 $32.00 $14.06 $13.79 13% 33% 3.0 450 131%Dune Size 438 0 5/25/2018 1.6 21000 7.2 6.2 $32.00 $12.41 $12.32 23% 0% 3.0 450 97%

Eat Trad 1,311 0 5/18/2018 1.6 19000 8.2 12.1 $24.50 $9.32 $10.10 20% 0% 5.0 1,000 88%Ebb Low 674 0 4/22/2018 2.3 17000 3.6 16.7 $16.00 $0.00 $0.00 9% 0% 6.0 1 0%Echo High 728 266 7/18/2018 1.4 24500 13.7 6.6 $35.50 $14.51 $10.10 28% 0% 5.0 900 88%Egg Size 752 0 6/7/2018 1.5 20000 7.5 5.8 $31.49 $11.93 $11.79 25% 0% 4.0 750 88%Estar Pfmn 727 0 7/9/2018 1.2 26000 14.6 11.3 $34.00 $13.88 $8.42 34% 0% 6.0 800 88%

Fast Trad 1,753 0 6/23/2018 1.6 17000 8.2 12.1 $25.00 $8.78 $8.01 33% 0% 7.0 2,000 79%Feat Low 10 0 6/5/2017 4.1 14000 3.2 17.3 $17.00 $4.52 $7.21 19% 0% 6.5 1 94%Fist High 851 0 6/28/2018 1.5 25000 13.2 7.2 $37.00 $14.26 $12.82 27% 0% 6.0 900 82%Foam 0 0 6/30/2011 7.5 25000 9.1 16.1 $26.00 $0.00 $0.00 0% 0% 3.0 2 0%Fume 0 0 5/25/2011 7.6 19000 3.7 11.6 $31.00 $0.00 $0.00 0% 0% 3.0 1 0%

CAPSTONE® COURIER Page 4

Traditional Segment Analysis C58866 Round: 5Dec. 31, 2018

Traditional StatisticsTotal Industry Unit Demand 11,913Actual Industry Unit Sales 9,929Segment % of Total Industry 27.5%

Next Year's Segment Growth Rate 8.4%

Traditional Customer Buying CriteriaExpectations Importance

1. Age Ideal Age = 2.0 47%2. Price $17.50 - 27.50 23%3. Ideal Position Pfmn 8.2 Size 12.1 21%4. Reliability MTBF 14000-19000 9%

Top Products in Traditional Segment

NameMarketShare

UnitsSold to

SegRevisionDate

StockOut

PfmnCoord

SizeCoord

ListPrice MTBF

AgeDec.31

PromoBudget

Cust.Aware-ness

SalesBudget

Cust.Access-

ibility

Dec.Cust.

SurveyDaze 21% 2,045 5/23/2018 YES 8.2 12.1 $24.00 19000 1.64 $1,400 100% $3,000 85% 79Fast 18% 1,753 6/23/2018 YES 8.2 12.1 $25.00 17000 1.58 $1,400 100% $2,500 78% 63Cake 17% 1,667 7/1/2018 YES 8.2 12.1 $24.50 19000 1.83 $1,400 100% $2,250 85% 82Able 15% 1,465 10/31/2018 YES 8.0 12.2 $24.00 19000 1.97 $1,400 100% $3,000 91% 93Eat 13% 1,311 5/18/2018 YES 8.2 12.1 $24.50 19000 1.64 $2,000 98% $3,000 69% 69Baker 13% 1,287 5/17/2018 YES 8.2 12.1 $23.50 19000 1.67 $800 82% $1,400 55% 59Abt 3% 343 11/14/2018 YES 8.2 12.1 $24.50 19000 1.46 $2,000 90% $100 91% 64Cookie 1% 57 3/7/2016 YES 8.0 12.4 $24.50 19000 2.81 $500 38% $750 85% 37

CAPSTONE® COURIER Page 5

Low End Segment Analysis C58866 Round: 5Dec. 31, 2018

Low End StatisticsTotal Industry Unit Demand 15,970Actual Industry Unit Sales 12,663Segment % of Total Industry 36.8%

Next Year's Segment Growth Rate 13.5%

Low End Customer Buying CriteriaExpectations Importance

1. Price $12.50 - 22.50 53%2. Age Ideal Age = 7.0 24%3. Ideal Position Pfmn 3.9 Size 16.4 16%4. Reliability MTBF 12000-17000 7%

Top Products in Low End Segment

NameMarketShare

UnitsSold to

SegRevisionDate

StockOut

PfmnCoord

SizeCoord

ListPrice MTBF

AgeDec.31

PromoBudget

Cust.Aware-ness

SalesBudget

Cust.Access-

ibility

Dec.Cust.

SurveyAcre 28% 3,579 6/22/2018 YES 3.7 16.6 $17.00 17000 2.19 $1,400 100% $3,000 93% 45Dell 20% 2,507 5/13/2017 YES 3.4 16.9 $17.50 17000 3.89 $1,400 100% $3,000 84% 42Cedar 17% 2,147 12/5/2017 YES 3.9 16.4 $17.50 17000 5.33 $1,400 100% $2,250 91% 61Coffee 13% 1,706 5/26/2018 YES 3.9 16.4 $17.50 17000 1.51 $1,400 100% $2,250 91% 38Able 12% 1,528 10/31/2018 YES 8.0 12.2 $24.00 19000 1.97 $1,400 100% $3,000 93% 0Ebb 5% 674 4/22/2018 YES 3.6 16.7 $16.00 17000 2.31 $0 53% $0 45% 24Acl 4% 447 6/26/2018 YES 3.9 16.4 $17.50 17000 1.63 $1,500 99% $100 93% 35Bead 0% 49 9/15/2017 YES 3.9 16.4 $16.00 14000 5.44 $0 57% $0 35% 33Abt 0% 14 11/14/2018 YES 8.2 12.1 $24.50 19000 1.46 $2,000 90% $100 93% 0Feat 0% 10 6/5/2017 YES 3.2 17.3 $17.00 14000 4.13 $0 67% $0 46% 21

CAPSTONE® COURIER Page 6

High End Segment Analysis C58866 Round: 5Dec. 31, 2018

High End StatisticsTotal Industry Unit Demand 5,664Actual Industry Unit Sales 5,664Segment % of Total Industry 13.1%

Next Year's Segment Growth Rate 21.7%

High End Customer Buying CriteriaExpectations Importance

1. Ideal Position Pfmn 13.1 Size 7.2 43%2. Age Ideal Age = 0.0 29%3. Reliability MTBF 20000-25000 19%4. Price $27.50 - 37.50 9%

Top Products in High End Segment

NameMarketShare

UnitsSold to

SegRevisionDate

StockOut

PfmnCoord

SizeCoord

ListPrice MTBF

AgeDec.31

PromoBudget

Cust.Aware-ness

SalesBudget

Cust.Access-

ibility

Dec.Cust.

SurveyAdam 19% 1,052 8/1/2018 13.1 7.2 $36.50 25000 1.44 $1,400 100% $3,000 90% 81Bid 18% 1,009 6/24/2018 13.1 7.2 $37.00 25000 1.51 $1,400 100% $3,000 87% 74Dixie 16% 883 6/5/2018 YES 13.1 7.2 $36.99 25000 1.51 $1,400 100% $3,000 79% 69Fist 15% 851 6/28/2018 YES 13.2 7.2 $37.00 25000 1.50 $1,400 100% $3,000 87% 72Cid 13% 746 6/1/2018 YES 13.1 7.2 $36.50 25000 1.53 $1,400 100% $2,250 86% 73Echo 13% 728 7/18/2018 13.7 6.6 $35.50 24500 1.37 $2,000 99% $2,500 88% 51Cheese 5% 281 6/22/2018 YES 13.1 7.2 $36.50 25000 1.29 $500 38% $750 86% 51Adh 2% 89 7/8/2017 YES 13.1 7.2 $36.50 25000 1.48 $2,000 62% $100 90% 56Estar 0% 25 7/9/2018 YES 14.6 11.3 $34.00 26000 1.23 $1,500 97% $3,000 88% 0

CAPSTONE® COURIER Page 7

Performance Segment Analysis C58866 Round: 5Dec. 31, 2018

Performance StatisticsTotal Industry Unit Demand 4,996Actual Industry Unit Sales 3,815Segment % of Total Industry 11.5%

Next Year's Segment Growth Rate 17.1%

Performance Customer Buying CriteriaExpectations Importance

1. Reliability MTBF 22000-27000 43%2. Ideal Position Pfmn 14.1 Size 13.1 29%3. Price $22.50 - 32.50 19%4. Age Ideal Age = 1.0 9%

Top Products in Performance Segment

NameMarketShare

UnitsSold to

SegRevisionDate

StockOut

PfmnCoord

SizeCoord

ListPrice MTBF

AgeDec.31

PromoBudget

Cust.Aware-ness

SalesBudget

Cust.Access-

ibility

Dec.Cust.

SurveyBold 34% 1,281 6/18/2018 YES 14.1 13.1 $32.40 27000 1.57 $1,400 100% $3,000 84% 77Aft 33% 1,244 6/30/2018 YES 14.1 13.1 $31.50 27000 1.54 $1,400 100% $3,000 86% 85Estar 18% 702 7/9/2018 YES 14.6 11.3 $34.00 26000 1.23 $1,500 97% $3,000 35% 9Dot 15% 589 5/25/2018 YES 14.1 13.1 $32.00 27000 1.61 $0 37% $0 18% 29

CAPSTONE® COURIER Page 8

Size Segment Analysis C58866 Round: 5Dec. 31, 2018

Size StatisticsTotal Industry Unit Demand 4,801Actual Industry Unit Sales 3,889Segment % of Total Industry 11.1%

Next Year's Segment Growth Rate 18.2%

Size Customer Buying CriteriaExpectations Importance

1. Ideal Position Pfmn 7.2 Size 6.2 43%2. Age Ideal Age = 1.5 29%3. Reliability MTBF 16000-21000 19%4. Price $22.50 - 32.50 9%

Top Products in Size Segment

NameMarketShare

UnitsSold to

SegRevisionDate

StockOut

PfmnCoord

SizeCoord

ListPrice MTBF

AgeDec.31

PromoBudget

Cust.Aware-ness

SalesBudget

Cust.Access-

ibility

Dec.Cust.

SurveyBuddy 37% 1,455 6/16/2018 YES 7.2 6.2 $32.50 21000 1.57 $1,400 100% $3,000 85% 97Agape 32% 1,244 6/30/2018 YES 7.2 6.2 $31.50 21000 1.53 $1,400 100% $3,000 87% 105Egg 19% 752 6/7/2018 YES 7.5 5.8 $31.49 20000 1.51 $1,800 100% $3,000 70% 75Dune 11% 438 5/25/2018 YES 7.2 6.2 $32.00 21000 1.59 $0 37% $0 19% 37

CAPSTONE® COURIER Page 9

Market Share C58866 Round: 5Dec. 31, 2018

Actual Market Share in Units Potential Market Share in UnitsTrad Low High Pfmn Size Total Trad Low High Pfmn Size Total

Industry Unit Sales 9,929 12,663 5,664 3,815 3,889 35,960 Units Demanded 11,913 15,970 5,664 4,996 4,801 43,344% of Market 27.6% 35.2% 15.8% 10.6% 10.8% 100.0% % of Market 27.5% 36.8% 13.1% 11.5% 11.1% 100.0%

Able 14.7% 12.1% 8.3% Able 9.2% 0.6% 2.7%Acre 28.3% 10.0% Acre 15.9% 5.9%Adam 18.6% 2.9% Adam 14.6% 1.9%Aft 32.6% 3.5% Aft 34.4% 4.0%Agape 32.0% 3.5% Agape 29.2% 3.2%Acl 3.5% 1.2% Acl 11.8% 4.4%Abt 3.5% 0.1% 1.0% Abt 12.3% 0.3% 3.5%Adh 1.6% 0.3% Adh 10.1% 1.3%Total 18.2% 44.0% 20.2% 32.6% 32.0% 30.6% Total 21.4% 28.6% 24.6% 34.4% 29.2% 26.9%

Baker 13.0% 3.6% Baker 11.3% 3.1%Bead 0.4% 0.1% Bead 10.2% 3.8%Bid 17.8% 2.8% Bid 14.0% 1.8%Bold 33.6% 3.6% Bold 31.4% 3.6%Buddy 37.4% 4.1% Buddy 27.1% 3.0%Total 13.0% 0.4% 17.8% 33.6% 37.4% 14.1% Total 11.3% 10.2% 14.0% 31.4% 27.1% 15.3%

Cake 16.8% 4.6% Cake 15.9% 4.4%Cedar 17.0% 6.0% Cedar 18.8% 6.9%Cid 13.2% 2.1% Cid 14.0% 1.8%Coffee 13.5% 4.7% Coffee 12.5% 4.6%Cheese 5.0% 0.8% Cheese 9.9% 1.3%Cookie 0.6% 0.2% Cookie 10.3% 2.8%Total 17.4% 30.4% 18.1% 18.4% Total 26.2% 31.3% 23.8% 17.2% 13.4% 25.3%

Daze 20.6% 5.7% Daze 15.1% 4.2%Dell 19.8% 7.0% Dell 14.2% 5.2%Dixie 15.6% 2.5% Dixie 13.2% 1.7%Dot 15.4% 1.6% Dot 12.0% 1.4%Dune 11.3% 1.2% Dune 10.2% 1.1%Total 20.6% 19.8% 15.6% 15.4% 11.3% 18.0% Total 15.1% 14.2% 13.2% 12.0% 10.2% 13.6%

Eat 13.2% 3.6% Eat 13.3% 3.7%Ebb 5.3% 1.9% Ebb 8.4% 3.1%Echo 12.9% 2.0% Echo 10.3% 1.3%Egg 19.3% 2.1% Egg 20.1% 2.2%Estar 0.4% 18.4% 2.0% Estar 0.5% 4.3% 0.6%Total 13.2% 5.3% 13.3% 18.4% 19.3% 11.7% Total 13.3% 8.4% 10.7% 4.3% 20.1% 10.8%

Fast 17.7% 4.9% Fast 12.6% 3.5%Feat Feat 7.3% 2.7%Fist 15.0% 2.4% Fist 13.6% 1.8%Total 17.7% 15.0% 7.3% Total 12.6% 7.3% 13.6% 0.7% 8.0%

CAPSTONE® COURIER Page 10

Perceptual Map C58866 Round: 5Dec. 31, 2018

Andrews Baldwin ChesterName Pfmn Size Revised Name Pfmn Size Revised Name Pfmn Size RevisedAble 8.0 12.2 10/31/2018 Baker 8.2 12.1 5/17/2018 Cake 8.2 12.1 7/1/2018Acre 3.7 16.6 6/22/2018 Bead 3.9 16.4 9/15/2017 Cedar 3.9 16.4 12/5/2017Adam 13.1 7.2 8/1/2018 Bid 13.1 7.2 6/24/2018 Cid 13.1 7.2 6/1/2018Aft 14.1 13.1 6/30/2018 Bold 14.1 13.1 6/18/2018 Coat 13.1 13.8 6/9/2017Agape 7.2 6.2 6/30/2018 Buddy 7.2 6.2 6/16/2018 Cure 6.5 7.2 6/9/2017Acl 3.9 16.4 6/26/2018 Coffee 3.9 16.4 5/26/2018Abt 8.2 12.1 11/14/2018 Cheese 13.1 7.2 6/22/2018Adh 13.1 7.2 7/8/2017 Cookie 8.0 12.4 3/7/2016

Digby Erie FerrisName Pfmn Size Revised Name Pfmn Size Revised Name Pfmn Size RevisedDaze 8.2 12.1 5/23/2018 Eat 8.2 12.1 5/18/2018 Fast 8.2 12.1 6/23/2018Dell 3.4 16.9 5/13/2017 Ebb 3.6 16.7 4/22/2018 Feat 3.2 17.3 6/5/2017Dixie 13.1 7.2 6/5/2018 Echo 13.7 6.6 7/18/2018 Fist 13.2 7.2 6/28/2018Dot 14.1 13.1 5/25/2018 Egg 7.5 5.8 6/7/2018 Foam 9.1 16.1 6/30/2011Dune 7.2 6.2 5/25/2018 Estar 14.6 11.3 7/9/2018 Fume 3.7 11.6 5/25/2011

CAPSTONE® COURIER Page 11

HR/TQM Report C58866 Round: 5Dec. 31, 2018

HUMAN RESOURCES SUMMARYAndrews Baldwin Chester Digby Erie Ferris

Needed Complement 950 827 497 794 429 306Complement 950 827 497 794 429 3061st Shift Complement 569 572 335 703 429 3062nd Shift Complement 381 255 162 91 0 0

Overtime Percent 0.0% 0.0% 0.1% 0.1% 0.0% 0.0%Turnover Rate 8.2% 30.7% 32.1% 10.2% 13.4% 10.8%New Employees 78 254 160 209 57 33Separated Employees 140 123 455 0 306 270Recruiting Spend $5,000 $0 $4,000 $0 $0 $1,000Training Hours 80 0 10 0 0 15Productivity Index 113.6% 100.0% 100.0% 100.0% 100.0% 100.0%

Recruiting Cost $465 $254 $798 $209 $57 $66Separation Cost $700 $615 $2,275 $0 $1,530 $1,350Training Cost $1,520 $0 $99 $0 $0 $92Total HR Admin Cost $2,685 $869 $3,172 $209 $1,587 $1,508

Labor Contract Next YearWages $49.09 $39.74 $41.43 $50.00 $49.50 $49.64Benefits 5,091 2,546 2,546 5,020 4,470 4,817Profit Sharing 3.4% 3.0% 1.8% 3.5% 3.4% 3.5%Annual Raise 8.3% 7.5% 4.5% 9.0% 8.3% 8.8%

Starting Negotiation PositionWages $48.18 $26.80 $29.86 $50.00 $49.00 $44.80Benefits 5,091 0 0 4,500 3,500 4,130Profit Sharing 3.0% 2.2% 0.0% 3.5% 2.9% 3.5%Annual Raise 7.0% 5.5% 0.0% 9.0% 6.9% 8.5%

Ceiling Negotiation PositionWages $53.00 $29.48 $32.85 $55.00 $53.90 $49.28Benefits 5,600 0 0 4,950 3,850 4,543Profit Sharing 3.3% 2.4% 0.0% 3.9% 3.2% 3.9%Annual Raise 7.7% 6.1% 0.0% 9.9% 7.6% 9.4%

Adjusted Labor DemandsWages $50.00 $50.00 $50.00 $50.00 $50.00 $50.00Benefits 5,091 5,091 5,091 5,091 5,091 5,091Profit Sharing 3.5% 3.5% 3.5% 3.5% 3.5% 3.5%Annual Raise 9.0% 9.0% 9.0% 9.0% 9.0% 9.0%

Strike Days 11 84 84 3 41 18

TQM SUMMARYAndrews Baldwin Chester Digby Erie Ferris

Process Mgt Budgets Last YearCPI Systems $0 $0 $0 $0 $0 $1Vendor/JIT $0 $0 $0 $0 $0 $1Quality Initiative Training $0 $0 $0 $0 $0 $1Channel Support Systems $0 $1 $0 $0 $0 $1Concurrent Engineering $0 $1 $0 $1 $0 $1UNEP Green Programs $0 $0 $0 $1 $0 $1

TQM Budgets Last YearBenchmarking $0 $1 $0 $0 $0 $1Quality Function Deployment Effort $0 $0 $0 $0 $0 $1CCE/6 Sigma Training $0 $1 $0 $0 $0 $1GEMI TQEM Sustainability Initiatives $0 $0 $0 $0 $0 $1Total Expenditures $0 $4 $0 $2 $0 $10

Cumulative ImpactsMaterial Cost Reduction 11.80% 11.42% 11.80% 8.32% 11.68% 11.73%Labor Cost Reduction 14.00% 13.64% 14.00% 13.21% 13.57% 13.81%Reduction R&D Cycle Time 40.01% 36.85% 40.01% 40.01% 40.01% 29.25%Reduction Admin Costs 60.02% 56.48% 60.02% 0.00% 60.02% 55.78%Demand Increase 14.40% 14.11% 14.40% 13.82% 14.40% 13.69%

CAPSTONE® COURIER Page 12

Annual ReportAnnual Report Andrews C58866 Round: 5

Dec. 31, 2018

Balance SheetDEFINITIONS:Common Size: The common sizecolumn simply represents each item as apercentage of total assets for that year.Cash: Your end-of-year cash position.Accounts Receivable: Reflects the lagbetween delivery and payment of yourproducts. Inventories: The currentvalue of your inventory across all products. Azero indicates your company stocked out.Unmet demand would, of course, fall to yourcompetitors. Plant & Equipment: Thecurrent value of your plant. AccumDeprec: The total accumulateddepreciation from your plant. AcctsPayable: What the company currentlyowes suppliers for materials and services.Current Debt: The debt the companyis obligated to pay during the next year ofoperations. It includes emergency loans usedto keep your company solvent should you runout of cash during the year. LongTerm Debt: The company'slong term debt is in the form of bonds, and thisrepresents the total value of your bonds.Common Stock: The amount ofcapital invested by shareholders in thecompany. Retained Earnings:The profits that the company chose to keepinstead of paying to shareholders as dividends.

ASSETS 2018Common

Size

2017

Cash $9,104 4.6% $0Account Receivable $44,266 22.1% $34,417Inventory $7,268 3.6% $26,021Total Current Assets $60,638 30.3% $60,438

Plant & Equipment $241,884 121.0% $212,439Accumulated Depreciation ($102,625) -51.3% ($86,499)Total Fixed Assets $139,259 69.7% $125,940Total Assets $199,897 100.0% $186,378LIABILITIES & OWNER'SEQUITY

Accounts Payable $28,702 14.4% $29,859Current Debt $0 0.0% $17,694Long Term Debt $100,751 50.4% $79,214Total Liabilities $129,453 64.8% $126,767

Common Stock $54,196 27.1% $49,196Retained Earnings $16,248 8.1% $10,415Total Equity $70,444 35.2% $59,611Total Liab. & O. Equity $199,897 100.0% $186,378

Cash Flow StatementThe Cash Flow Statement examines what happened in the CashAccount during the year. Cash injections appear as positive numbers andcash withdrawals as negative numbers. The Cash Flow Statement is anexcellent tool for diagnosing emergency loans. When negative cash flowsexceed positives, you are forced to seek emergency funding. For example,if sales are bad and you find yourself carrying an abundance of excessinventory, the report would show the increase in inventory as a hugenegative cash flow. Too much unexpected inventory could outstrip yourinflows, exhaust your starting cash and force you to beg for money to keepyour company afloat.

Cash Flows from Operating Activities 2018 2017NetIncome(Loss) $5,833 ($7,153)Depreciation $16,126 $14,163Extraordinary gains/losses/writeoffs $0 ($129)Accounts Payable ($1,157) $8,108Inventory $18,753 ($26,021)Accounts Receivable ($9,849) $343

Net cash from operation $29,706 ($10,689)Cash Flows from Investing ActivitiesPlant Improvements ($29,445) ($19,955)Cash Flows from Financing ActivitiesDividends Paid $0 $0Sales of Common Stock $5,000 $12,204Purchase of Common Stock $0 $0Cash from long term debt $21,537 $0Retirement of long term debt $0 ($13,771)Change in current debt(net) ($17,694) $14,694

Net Cash from financing activities $8,843 $13,127Net Change in cash position $9,104 ($17,517)Closing cash position $9,104 $0

Annual Report Page 14

Annual Report Andrews C58866 Round: 5Dec. 31, 2018

2018 Income Statement(Product Name) Able Acre Adam Aft Agape Acl Abt Adh 2018

TotalCommon

SizeSales $71,834 $60,850 $38,389 $39,175 $39,175 $7,829 $8,768 $3,266 $269,285 100.0%

Variable Costs:Direct Labor $24,629 $20,323 $10,378 $14,928 $14,928 $2,837 $3,372 $1,215 $92,609 34.4%Direct Material $26,260 $20,960 $14,919 $16,767 $14,793 $2,636 $3,116 $1,298 $100,748 37.4%Inventory Carry $0 $0 $872 $0 $0 $0 $0 $0 $872 0.3%Total Variable $50,889 $41,284 $26,168 $31,695 $29,720 $5,473 $6,488 $2,512 $194,230 72.1%

Contribution Margin $20,945 $19,566 $12,221 $7,480 $9,454 $2,355 $2,280 $753 $75,055 27.9%

Period Costs:Depreciation $4,307 $4,987 $1,800 $1,473 $1,473 $1,122 $790 $173 $16,126 6.0%SG&A: R&D $844 $480 $591 $501 $501 $489 $881 $0 $4,286 1.6% Promotions $1,400 $1,400 $1,400 $1,400 $1,400 $1,500 $2,000 $2,000 $12,500 4.6% Sales $3,000 $3,000 $3,000 $3,000 $3,000 $100 $100 $100 $15,300 5.7% Admin $917 $777 $490 $500 $500 $100 $112 $42 $3,439 1.3%Total Period $10,468 $10,643 $7,281 $6,874 $6,874 $3,311 $3,883 $2,315 $51,651 19.2%

Net Margin $10,477 $8,923 $4,939 $606 $2,580 ($956) ($1,603) ($1,562) $23,404 8.7%

Definitions: Sales: Unit Sales times list price. Direct Labor: Labor costs incurred to produce theproduct that was sold. Inventory Carry Cost: the cost unsold goods in inventory. Depreciation:Calculated on straight-line. 15-year depreciation of plant value. R&D Costs: R&D departmentexpenditures for each product. Admin: Administration overhead is estimated at 1.5% of sales.Promotions: The promotion budget for each product. Sales: The sales force budget for eachproduct. Other: Chargs not included in other categories such as Fees, Write offs, and TQM. The feesinclude money paid to investment bankers and brokerage firms to issue new stocks or bonds plus consulting fees your instructor might assess. Write-offs include the loss you might experience when you sell capacity orliquidate inventory as the result of eliminating a production line. If the amount appears as a negative amount, then you actually made money on the liquidation of capacity or inventory. EBIT: Earnings Before Interestand Taxes. Short Term Interest: Interest expense based on last year''s current debt, including short termdebt, long term notes that have become due, and emergency loans, Long Term Interest: Interest paid onoutstanding bonds. Taxes: Income tax based upon a 35% tax rate. Profit Sharing: Profits sharedwith employees under the labor contract. Net Profit: EBIT minus interest, taxes, and profit sharing.

Other $1,327 0.5%EBIT $22,077 8.2%Short Term Interest $0 0.0%Long Term Interest $12,845 4.8%Taxes $3,231 1.2%Profit Sharing $168 0.1%Net Profit $5,833 2.2%

Annual Report Page 15

Annual ReportAnnual Report Baldwin C58866 Round: 5

Dec. 31, 2018

Balance SheetDEFINITIONS:Common Size: The common sizecolumn simply represents each item as apercentage of total assets for that year.Cash: Your end-of-year cash position.Accounts Receivable: Reflects the lagbetween delivery and payment of yourproducts. Inventories: The currentvalue of your inventory across all products. Azero indicates your company stocked out.Unmet demand would, of course, fall to yourcompetitors. Plant & Equipment: Thecurrent value of your plant. AccumDeprec: The total accumulateddepreciation from your plant. AcctsPayable: What the company currentlyowes suppliers for materials and services.Current Debt: The debt the companyis obligated to pay during the next year ofoperations. It includes emergency loans usedto keep your company solvent should you runout of cash during the year. LongTerm Debt: The company'slong term debt is in the form of bonds, and thisrepresents the total value of your bonds.Common Stock: The amount ofcapital invested by shareholders in thecompany. Retained Earnings:The profits that the company chose to keepinstead of paying to shareholders as dividends.

ASSETS 2018Common

Size

2017

Cash $38,094 30.3% $23,430Account Receivable $15,072 12.0% $16,176Inventory $423 0.3% $9,405Total Current Assets $53,589 42.6% $49,011

Plant & Equipment $130,588 104.0% $143,634Accumulated Depreciation ($58,273) -46.3% ($71,764)Total Fixed Assets $72,315 57.4% $71,870Total Assets $125,904 100.0% $120,881LIABILITIES & OWNER'SEQUITY

Accounts Payable $10,641 8.5% $13,432Current Debt $0 0.0% $0Long Term Debt $43,839 34.8% $55,177Total Liabilities $54,480 43.3% $68,609

Common Stock $53,137 42.2% $41,766Retained Earnings $18,286 14.5% $10,506Total Equity $71,423 56.7% $52,272Total Liab. & O. Equity $125,904 100.0% $120,881

Cash Flow StatementThe Cash Flow Statement examines what happened in the CashAccount during the year. Cash injections appear as positive numbers andcash withdrawals as negative numbers. The Cash Flow Statement is anexcellent tool for diagnosing emergency loans. When negative cash flowsexceed positives, you are forced to seek emergency funding. For example,if sales are bad and you find yourself carrying an abundance of excessinventory, the report would show the increase in inventory as a hugenegative cash flow. Too much unexpected inventory could outstrip yourinflows, exhaust your starting cash and force you to beg for money to keepyour company afloat.

Cash Flows from Operating Activities 2018 2017NetIncome(Loss) $7,780 ($2,413)Depreciation $8,706 $9,576Extraordinary gains/losses/writeoffs ($10,020) ($104)Accounts Payable ($2,790) $5,087Inventory $8,982 ($9,405)Accounts Receivable $1,104 ($2,919)

Net cash from operation $13,760 ($177)Cash Flows from Investing ActivitiesPlant Improvements ($468) ($12,474)Cash Flows from Financing ActivitiesDividends Paid $0 $0Sales of Common Stock $11,371 $9,675Purchase of Common Stock $0 $0Cash from long term debt $20,747 $12,436Retirement of long term debt ($30,747) ($10,748)Change in current debt(net) $0 $0

Net Cash from financing activities $1,371 $11,363Net Change in cash position $14,664 ($1,289)Closing cash position $38,094 $23,430

Annual Report Page 16

Annual Report Baldwin C58866 Round: 5Dec. 31, 2018

2018 Income Statement(Product Name) Baker Bead Bid Bold Buddy NA NA NA 2018

TotalCommon

SizeSales $30,251 $785 $37,333 $41,511 $47,302 $0 $0 $0 $157,182 100.0%

Variable Costs:Direct Labor $12,671 $456 $11,103 $15,823 $18,183 $0 $0 $0 $58,235 37.1%Direct Material $12,122 $253 $14,470 $17,399 $17,475 $0 $0 $0 $61,719 39.3%Inventory Carry $0 $0 $51 $0 $0 $0 $0 $0 $51 0.0%Total Variable $24,793 $708 $25,623 $33,223 $35,658 $0 $0 $0 $120,005 76.3%

Contribution Margin $5,458 $77 $11,710 $8,288 $11,644 $0 $0 $0 $37,177 23.7%

Period Costs:Depreciation $2,811 $2 $1,560 $2,253 $2,080 $0 $0 $0 $8,706 5.5%SG&A: R&D $379 $0 $484 $467 $463 $0 $0 $0 $1,792 1.1% Promotions $800 $0 $1,400 $1,400 $1,400 $0 $0 $0 $5,000 3.2% Sales $1,400 $0 $3,000 $3,000 $3,000 $0 $0 $0 $10,400 6.6% Admin $259 $7 $320 $356 $406 $0 $0 $0 $1,348 0.9%Total Period $5,649 $9 $6,764 $7,476 $7,348 $0 $0 $0 $27,246 17.3%

Net Margin ($191) $68 $4,946 $812 $4,295 $0 $0 $0 $9,931 6.3%

Definitions: Sales: Unit Sales times list price. Direct Labor: Labor costs incurred to produce theproduct that was sold. Inventory Carry Cost: the cost unsold goods in inventory. Depreciation:Calculated on straight-line. 15-year depreciation of plant value. R&D Costs: R&D departmentexpenditures for each product. Admin: Administration overhead is estimated at 1.5% of sales.Promotions: The promotion budget for each product. Sales: The sales force budget for eachproduct. Other: Chargs not included in other categories such as Fees, Write offs, and TQM. The feesinclude money paid to investment bankers and brokerage firms to issue new stocks or bonds plus consulting fees your instructor might assess. Write-offs include the loss you might experience when you sell capacity orliquidate inventory as the result of eliminating a production line. If the amount appears as a negative amount, then you actually made money on the liquidation of capacity or inventory. EBIT: Earnings Before Interestand Taxes. Short Term Interest: Interest expense based on last year''s current debt, including short termdebt, long term notes that have become due, and emergency loans, Long Term Interest: Interest paid onoutstanding bonds. Taxes: Income tax based upon a 35% tax rate. Profit Sharing: Profits sharedwith employees under the labor contract. Net Profit: EBIT minus interest, taxes, and profit sharing.

Other ($7,949) -5.1%EBIT $17,880 11.4%Short Term Interest $0 0.0%Long Term Interest $5,579 3.5%Taxes $4,305 2.7%Profit Sharing $216 0.1%Net Profit $7,780 4.9%

Annual Report Page 17

Annual ReportAnnual Report Chester C58866 Round: 5

Dec. 31, 2018

Balance SheetDEFINITIONS:Common Size: The common sizecolumn simply represents each item as apercentage of total assets for that year.Cash: Your end-of-year cash position.Accounts Receivable: Reflects the lagbetween delivery and payment of yourproducts. Inventories: The currentvalue of your inventory across all products. Azero indicates your company stocked out.Unmet demand would, of course, fall to yourcompetitors. Plant & Equipment: Thecurrent value of your plant. AccumDeprec: The total accumulateddepreciation from your plant. AcctsPayable: What the company currentlyowes suppliers for materials and services.Current Debt: The debt the companyis obligated to pay during the next year ofoperations. It includes emergency loans usedto keep your company solvent should you runout of cash during the year. LongTerm Debt: The company'slong term debt is in the form of bonds, and thisrepresents the total value of your bonds.Common Stock: The amount ofcapital invested by shareholders in thecompany. Retained Earnings:The profits that the company chose to keepinstead of paying to shareholders as dividends.

ASSETS 2018Common

Size

2017

Cash $2,592 1.9% $0Account Receivable $18,143 13.4% $53,106Inventory $0 0.0% $27,744Total Current Assets $20,735 15.3% $80,850

Plant & Equipment $198,686 147.0% $202,350Accumulated Depreciation ($83,839) -61.8% ($81,371)Total Fixed Assets $114,847 84.7% $120,979Total Assets $135,583 100.0% $201,829LIABILITIES & OWNER'SEQUITY

Accounts Payable $6,159 4.5% $14,899Current Debt $7,430 5.5% $67,053Long Term Debt $96,783 71.4% $94,510Total Liabilities $110,372 81.4% $176,462

Common Stock $35,043 25.8% $35,043Retained Earnings ($9,833) -7.3% ($9,677)Total Equity $25,210 18.6% $25,366Total Liab. & O. Equity $135,583 100.0% $201,829

Cash Flow StatementThe Cash Flow Statement examines what happened in the CashAccount during the year. Cash injections appear as positive numbers andcash withdrawals as negative numbers. The Cash Flow Statement is anexcellent tool for diagnosing emergency loans. When negative cash flowsexceed positives, you are forced to seek emergency funding. For example,if sales are bad and you find yourself carrying an abundance of excessinventory, the report would show the increase in inventory as a hugenegative cash flow. Too much unexpected inventory could outstrip yourinflows, exhaust your starting cash and force you to beg for money to keepyour company afloat.

Cash Flows from Operating Activities 2018 2017NetIncome(Loss) ($156) ($5,667)Depreciation $13,246 $13,490Extraordinary gains/losses/writeoffs ($4,491) ($660)Accounts Payable ($8,740) $6,741Inventory $27,744 ($27,744)Accounts Receivable $34,963 ($9,288)

Net cash from operation $62,566 ($23,128)Cash Flows from Investing ActivitiesPlant Improvements ($2,623) ($15,670)Cash Flows from Financing ActivitiesDividends Paid $0 $0Sales of Common Stock $0 $0Purchase of Common Stock $0 ($144)Cash from long term debt $2,273 $15,236Retirement of long term debt $0 ($13,900)Change in current debt(net) ($59,623) $24,790

Net Cash from financing activities ($57,350) $25,982Net Change in cash position $2,592 ($12,815)Closing cash position $2,592 $0

Annual Report Page 18

Annual Report Chester C58866 Round: 5Dec. 31, 2018

2018 Income Statement(Product Name) Cake Cedar Cid Coat Cure Coffee Cheese Cookie 2018

TotalCommon

SizeSales $40,838 $37,567 $27,239 $0 $0 $29,857 $10,258 $1,400 $147,160 100.0%

Variable Costs:Direct Labor $10,251 $12,354 $10,024 $0 $0 $13,100 $2,621 $266 $48,615 33.0%Direct Material $15,592 $13,050 $10,765 $0 $0 $10,118 $3,999 $538 $54,062 36.7%Inventory Carry $0 $0 $0 $0 $0 $0 $0 $0 $0 0.0%Total Variable $25,844 $25,404 $20,789 $0 $0 $23,218 $6,620 $804 $102,677 69.8%

Contribution Margin $14,995 $12,164 $6,451 $0 $0 $6,640 $3,639 $595 $44,483 30.2%

Period Costs:Depreciation $4,533 $3,547 $1,213 $1 $1 $2,992 $641 $317 $13,246 9.0%SG&A: R&D $503 $0 $421 $0 $0 $404 $480 $0 $1,808 1.2% Promotions $1,400 $1,400 $1,400 $0 $0 $1,400 $500 $500 $6,600 4.5% Sales $2,250 $2,250 $2,250 $0 $0 $2,250 $750 $750 $10,500 7.1% Admin $995 $915 $663 $0 $0 $727 $250 $34 $3,584 2.4%Total Period $9,681 $8,112 $5,948 $1 $1 $7,773 $2,621 $1,601 $35,738 24.3%

Net Margin $5,314 $4,052 $503 ($1) ($1) ($1,133) $1,018 ($1,005) $8,745 5.9%

Definitions: Sales: Unit Sales times list price. Direct Labor: Labor costs incurred to produce theproduct that was sold. Inventory Carry Cost: the cost unsold goods in inventory. Depreciation:Calculated on straight-line. 15-year depreciation of plant value. R&D Costs: R&D departmentexpenditures for each product. Admin: Administration overhead is estimated at 1.5% of sales.Promotions: The promotion budget for each product. Sales: The sales force budget for eachproduct. Other: Chargs not included in other categories such as Fees, Write offs, and TQM. The feesinclude money paid to investment bankers and brokerage firms to issue new stocks or bonds plus consulting fees your instructor might assess. Write-offs include the loss you might experience when you sell capacity orliquidate inventory as the result of eliminating a production line. If the amount appears as a negative amount, then you actually made money on the liquidation of capacity or inventory. EBIT: Earnings Before Interestand Taxes. Short Term Interest: Interest expense based on last year''s current debt, including short termdebt, long term notes that have become due, and emergency loans, Long Term Interest: Interest paid onoutstanding bonds. Taxes: Income tax based upon a 35% tax rate. Profit Sharing: Profits sharedwith employees under the labor contract. Net Profit: EBIT minus interest, taxes, and profit sharing.

Other ($4,377) -3.0%EBIT $13,122 8.9%Short Term Interest $988 0.7%Long Term Interest $12,374 8.4%Taxes ($84) -0.1%Profit Sharing $0 0.0%Net Profit ($156) -0.1%

Annual Report Page 19

Annual ReportAnnual Report Digby C58866 Round: 5

Dec. 31, 2018

Balance SheetDEFINITIONS:Common Size: The common sizecolumn simply represents each item as apercentage of total assets for that year.Cash: Your end-of-year cash position.Accounts Receivable: Reflects the lagbetween delivery and payment of yourproducts. Inventories: The currentvalue of your inventory across all products. Azero indicates your company stocked out.Unmet demand would, of course, fall to yourcompetitors. Plant & Equipment: Thecurrent value of your plant. AccumDeprec: The total accumulateddepreciation from your plant. AcctsPayable: What the company currentlyowes suppliers for materials and services.Current Debt: The debt the companyis obligated to pay during the next year ofoperations. It includes emergency loans usedto keep your company solvent should you runout of cash during the year. LongTerm Debt: The company'slong term debt is in the form of bonds, and thisrepresents the total value of your bonds.Common Stock: The amount ofcapital invested by shareholders in thecompany. Retained Earnings:The profits that the company chose to keepinstead of paying to shareholders as dividends.

ASSETS 2018Common

Size

2017

Cash $17,804 17.8% $2,987Account Receivable $13,024 13.0% $16,712Inventory $0 0.0% $0Total Current Assets $30,828 30.8% $19,699

Plant & Equipment $155,000 155.0% $155,000Accumulated Depreciation ($85,827) -85.8% ($75,493)Total Fixed Assets $69,173 69.2% $79,507Total Assets $100,002 100.0% $99,207LIABILITIES & OWNER'SEQUITY

Accounts Payable $10,050 10.0% $8,153Current Debt $15,000 15.0% $15,900Long Term Debt $63,850 63.8% $63,850Total Liabilities $88,900 88.9% $87,903

Common Stock $18,360 18.4% $18,360Retained Earnings ($7,258) -7.3% ($7,056)Total Equity $11,102 11.1% $11,304Total Liab. & O. Equity $100,002 100.0% $99,207

Cash Flow StatementThe Cash Flow Statement examines what happened in the CashAccount during the year. Cash injections appear as positive numbers andcash withdrawals as negative numbers. The Cash Flow Statement is anexcellent tool for diagnosing emergency loans. When negative cash flowsexceed positives, you are forced to seek emergency funding. For example,if sales are bad and you find yourself carrying an abundance of excessinventory, the report would show the increase in inventory as a hugenegative cash flow. Too much unexpected inventory could outstrip yourinflows, exhaust your starting cash and force you to beg for money to keepyour company afloat.

Cash Flows from Operating Activities 2018 2017NetIncome(Loss) ($202) $187Depreciation $10,333 $10,333Extraordinary gains/losses/writeoffs $0 ($990)Accounts Payable $1,897 $4,537Inventory $0 $0Accounts Receivable $3,689 ($5,637)

Net cash from operation $15,717 $8,430Cash Flows from Investing ActivitiesPlant Improvements $0 $3,510Cash Flows from Financing ActivitiesDividends Paid $0 $0Sales of Common Stock $0 $0Purchase of Common Stock $0 $0Cash from long term debt $0 $0Retirement of long term debt $0 ($13,900)Change in current debt(net) ($900) $900

Net Cash from financing activities ($900) ($13,000)Net Change in cash position $14,817 ($1,060)Closing cash position $17,804 $2,987

Annual Report Page 20

Annual Report Digby C58866 Round: 5Dec. 31, 2018

2018 Income Statement(Product Name) Daze Dell Dixie Dot Dune NA NA NA 2018

TotalCommon

SizeSales $49,076 $43,872 $32,665 $18,839 $14,004 $0 $0 $0 $158,457 100.0%

Variable Costs:Direct Labor $18,447 $18,526 $10,201 $8,118 $5,392 $0 $0 $0 $60,684 38.3%Direct Material $19,913 $14,836 $13,068 $8,312 $5,456 $0 $0 $0 $61,586 38.9%Inventory Carry $0 $0 $0 $0 $0 $0 $0 $0 $0 0.0%Total Variable $38,360 $33,362 $23,269 $16,430 $10,848 $0 $0 $0 $122,269 77.2%

Contribution Margin $10,716 $10,510 $9,396 $2,410 $3,156 $0 $0 $0 $36,188 22.8%

Period Costs:Depreciation $3,360 $4,693 $1,200 $540 $540 $0 $0 $0 $10,333 6.5%SG&A: R&D $397 $0 $431 $401 $401 $0 $0 $0 $1,630 1.0% Promotions $1,400 $1,400 $1,400 $0 $0 $0 $0 $0 $4,200 2.7% Sales $3,000 $3,000 $3,000 $0 $0 $0 $0 $0 $9,000 5.7% Admin $408 $365 $272 $157 $117 $0 $0 $0 $1,318 0.8%Total Period $8,565 $9,458 $6,303 $1,098 $1,058 $0 $0 $0 $26,482 16.7%

Net Margin $2,151 $1,052 $3,094 $1,312 $2,098 $0 $0 $0 $9,706 6.1%

Definitions: Sales: Unit Sales times list price. Direct Labor: Labor costs incurred to produce theproduct that was sold. Inventory Carry Cost: the cost unsold goods in inventory. Depreciation:Calculated on straight-line. 15-year depreciation of plant value. R&D Costs: R&D departmentexpenditures for each product. Admin: Administration overhead is estimated at 1.5% of sales.Promotions: The promotion budget for each product. Sales: The sales force budget for eachproduct. Other: Chargs not included in other categories such as Fees, Write offs, and TQM. The feesinclude money paid to investment bankers and brokerage firms to issue new stocks or bonds plus consulting fees your instructor might assess. Write-offs include the loss you might experience when you sell capacity orliquidate inventory as the result of eliminating a production line. If the amount appears as a negative amount, then you actually made money on the liquidation of capacity or inventory. EBIT: Earnings Before Interestand Taxes. Short Term Interest: Interest expense based on last year''s current debt, including short termdebt, long term notes that have become due, and emergency loans, Long Term Interest: Interest paid onoutstanding bonds. Taxes: Income tax based upon a 35% tax rate. Profit Sharing: Profits sharedwith employees under the labor contract. Net Profit: EBIT minus interest, taxes, and profit sharing.

Other $2 0.0%EBIT $9,704 6.1%Short Term Interest $1,995 1.3%Long Term Interest $8,019 5.1%Taxes ($109) -0.1%Profit Sharing $0 0.0%Net Profit ($202) -0.1%

Annual Report Page 21

Annual ReportAnnual Report Erie C58866 Round: 5

Dec. 31, 2018

Balance SheetDEFINITIONS:Common Size: The common sizecolumn simply represents each item as apercentage of total assets for that year.Cash: Your end-of-year cash position.Accounts Receivable: Reflects the lagbetween delivery and payment of yourproducts. Inventories: The currentvalue of your inventory across all products. Azero indicates your company stocked out.Unmet demand would, of course, fall to yourcompetitors. Plant & Equipment: Thecurrent value of your plant. AccumDeprec: The total accumulateddepreciation from your plant. AcctsPayable: What the company currentlyowes suppliers for materials and services.Current Debt: The debt the companyis obligated to pay during the next year ofoperations. It includes emergency loans usedto keep your company solvent should you runout of cash during the year. LongTerm Debt: The company'slong term debt is in the form of bonds, and thisrepresents the total value of your bonds.Common Stock: The amount ofcapital invested by shareholders in thecompany. Retained Earnings:The profits that the company chose to keepinstead of paying to shareholders as dividends.

ASSETS 2018Common

Size

2017

Cash $12,444 16.5% $0Account Receivable $9,629 12.7% $10,924Inventory $6,486 8.6% $25,884Total Current Assets $28,559 37.8% $36,808

Plant & Equipment $89,930 119.0% $142,300Accumulated Depreciation ($42,879) -56.7% ($65,907)Total Fixed Assets $47,051 62.2% $76,393Total Assets $75,610 100.0% $113,201LIABILITIES & OWNER'SEQUITY

Accounts Payable $5,577 7.4% $9,855Current Debt $0 0.0% $31,127Long Term Debt $39,354 52.0% $45,950Total Liabilities $44,931 59.4% $86,932

Common Stock $34,295 45.4% $33,689Retained Earnings ($3,615) -4.8% ($7,421)Total Equity $30,680 40.6% $26,268Total Liab. & O. Equity $75,610 100.0% $113,201

Cash Flow StatementThe Cash Flow Statement examines what happened in the CashAccount during the year. Cash injections appear as positive numbers andcash withdrawals as negative numbers. The Cash Flow Statement is anexcellent tool for diagnosing emergency loans. When negative cash flowsexceed positives, you are forced to seek emergency funding. For example,if sales are bad and you find yourself carrying an abundance of excessinventory, the report would show the increase in inventory as a hugenegative cash flow. Too much unexpected inventory could outstrip yourinflows, exhaust your starting cash and force you to beg for money to keepyour company afloat.

Cash Flows from Operating Activities 2018 2017NetIncome(Loss) $3,805 ($13,583)Depreciation $5,995 $9,487Extraordinary gains/losses/writeoffs ($10,813) ($65)Accounts Payable ($4,278) $5,041Inventory $19,398 ($25,884)Accounts Receivable $1,295 ($2,220)

Net cash from operation $15,402 ($27,224)Cash Flows from Investing ActivitiesPlant Improvements $34,041 $6Cash Flows from Financing ActivitiesDividends Paid $0 $0Sales of Common Stock $606 $0Purchase of Common Stock $0 ($159)Cash from long term debt $0 $0Retirement of long term debt ($6,477) ($13,810)Change in current debt(net) ($31,127) $31,127

Net Cash from financing activities ($36,998) $17,158Net Change in cash position $12,444 ($10,060)Closing cash position $12,444 $0

Annual Report Page 22

Annual Report Erie C58866 Round: 5Dec. 31, 2018

2018 Income Statement(Product Name) Eat Ebb Echo NA Egg Estar NA NA 2018

TotalCommon

SizeSales $32,130 $10,791 $25,836 $0 $23,681 $24,715 $0 $0 $117,153 100.0%

Variable Costs:Direct Labor $13,398 $6,067 $7,256 $0 $8,794 $6,118 $0 $0 $41,633 35.5%Direct Material $12,291 $3,791 $10,509 $0 $8,956 $10,067 $0 $0 $45,613 38.9%Inventory Carry $0 $0 $778 $0 $0 $0 $0 $0 $778 0.7%Total Variable $25,690 $9,858 $18,543 $0 $17,749 $16,184 $0 $0 $88,025 75.1%

Contribution Margin $6,440 $933 $7,293 $0 $5,932 $8,531 $0 $0 $29,129 24.9%

Period Costs:Depreciation $1,733 $2 $1,560 $0 $1,100 $1,600 $0 $0 $5,995 5.1%SG&A: R&D $382 $311 $551 $0 $436 $528 $0 $0 $2,208 1.9% Promotions $2,000 $0 $2,000 $0 $1,800 $1,500 $0 $0 $7,300 6.2% Sales $3,000 $0 $2,500 $0 $3,000 $3,000 $0 $0 $11,500 9.8% Admin $525 $176 $422 $0 $387 $404 $0 $0 $1,915 1.6%Total Period $7,640 $490 $7,034 $0 $6,724 $7,032 $0 $0 $28,919 24.7%

Net Margin ($1,200) $444 $259 $0 ($792) $1,499 $0 $0 $210 0.2%

Definitions: Sales: Unit Sales times list price. Direct Labor: Labor costs incurred to produce theproduct that was sold. Inventory Carry Cost: the cost unsold goods in inventory. Depreciation:Calculated on straight-line. 15-year depreciation of plant value. R&D Costs: R&D departmentexpenditures for each product. Admin: Administration overhead is estimated at 1.5% of sales.Promotions: The promotion budget for each product. Sales: The sales force budget for eachproduct. Other: Chargs not included in other categories such as Fees, Write offs, and TQM. The feesinclude money paid to investment bankers and brokerage firms to issue new stocks or bonds plus consulting fees your instructor might assess. Write-offs include the loss you might experience when you sell capacity orliquidate inventory as the result of eliminating a production line. If the amount appears as a negative amount, then you actually made money on the liquidation of capacity or inventory. EBIT: Earnings Before Interestand Taxes. Short Term Interest: Interest expense based on last year''s current debt, including short termdebt, long term notes that have become due, and emergency loans, Long Term Interest: Interest paid onoutstanding bonds. Taxes: Income tax based upon a 35% tax rate. Profit Sharing: Profits sharedwith employees under the labor contract. Net Profit: EBIT minus interest, taxes, and profit sharing.

Other ($10,685) -9.1%EBIT $10,895 9.3%Short Term Interest $0 0.0%Long Term Interest $4,879 4.2%Taxes $2,106 1.8%Profit Sharing $106 0.1%Net Profit $3,805 3.2%

Annual Report Page 23

Annual ReportAnnual Report Ferris C58866 Round: 5

Dec. 31, 2018

Balance SheetDEFINITIONS:Common Size: The common sizecolumn simply represents each item as apercentage of total assets for that year.Cash: Your end-of-year cash position.Accounts Receivable: Reflects the lagbetween delivery and payment of yourproducts. Inventories: The currentvalue of your inventory across all products. Azero indicates your company stocked out.Unmet demand would, of course, fall to yourcompetitors. Plant & Equipment: Thecurrent value of your plant. AccumDeprec: The total accumulateddepreciation from your plant. AcctsPayable: What the company currentlyowes suppliers for materials and services.Current Debt: The debt the companyis obligated to pay during the next year ofoperations. It includes emergency loans usedto keep your company solvent should you runout of cash during the year. LongTerm Debt: The company'slong term debt is in the form of bonds, and thisrepresents the total value of your bonds.Common Stock: The amount ofcapital invested by shareholders in thecompany. Retained Earnings:The profits that the company chose to keepinstead of paying to shareholders as dividends.

ASSETS 2018Common

Size

2017

Cash $15,013 20.8% $4,383Account Receivable $6,203 8.6% $8,381Inventory $0 0.0% $6,025Total Current Assets $21,216 29.4% $18,789

Plant & Equipment $95,086 132.0% $153,054Accumulated Depreciation ($44,237) -61.4% ($67,619)Total Fixed Assets $50,849 70.6% $85,435Total Assets $72,065 100.0% $104,225LIABILITIES & OWNER'SEQUITY

Accounts Payable $3,823 5.3% $6,506Current Debt $0 0.0% $0Long Term Debt $7,976 11.1% $49,606Total Liabilities $11,799 16.4% $56,112

Common Stock $48,201 66.9% $41,201Retained Earnings $12,065 16.7% $6,912Total Equity $60,266 83.6% $48,113Total Liab. & O. Equity $72,065 100.0% $104,225

Cash Flow StatementThe Cash Flow Statement examines what happened in the CashAccount during the year. Cash injections appear as positive numbers andcash withdrawals as negative numbers. The Cash Flow Statement is anexcellent tool for diagnosing emergency loans. When negative cash flowsexceed positives, you are forced to seek emergency funding. For example,if sales are bad and you find yourself carrying an abundance of excessinventory, the report would show the increase in inventory as a hugenegative cash flow. Too much unexpected inventory could outstrip yourinflows, exhaust your starting cash and force you to beg for money to keepyour company afloat.

Cash Flows from Operating Activities 2018 2017NetIncome(Loss) $5,153 ($1,889)Depreciation $6,339 $10,204Extraordinary gains/losses/writeoffs ($4,482) ($144)Accounts Payable ($2,683) $2,665Inventory $6,025 ($6,025)Accounts Receivable $2,178 ($622)

Net cash from operation $12,530 $4,187Cash Flows from Investing ActivitiesPlant Improvements $31,099 ($14,400)Cash Flows from Financing ActivitiesDividends Paid $0 $0Sales of Common Stock $7,000 $3,152Purchase of Common Stock $0 $0Cash from long term debt $0 $0Retirement of long term debt ($40,000) ($17,000)Change in current debt(net) $0 $0

Net Cash from financing activities ($33,000) ($13,848)Net Change in cash position $10,629 ($24,061)Closing cash position $15,013 $4,383

Annual Report Page 24

Annual Report Ferris C58866 Round: 5Dec. 31, 2018

2018 Income Statement(Product Name) Fast Feat Fist Foam Fume NA NA NA 2018

TotalCommon

SizeSales $43,830 $173 $31,472 $0 $0 $0 $0 $0 $75,475 100.0%

Variable Costs:Direct Labor $13,960 $90 $10,810 $0 $0 $0 $0 $0 $24,860 32.9%Direct Material $15,467 $50 $12,163 $0 $0 $0 $0 $0 $27,681 36.7%Inventory Carry $0 $0 $0 $0 $0 $0 $0 $0 $0 0.0%Total Variable $29,428 $139 $22,973 $0 $0 $0 $0 $0 $52,540 69.6%

Contribution Margin $14,403 $33 $8,499 $0 $0 $0 $0 $0 $22,935 30.4%

Period Costs:Depreciation $4,533 $2 $1,800 $2 $1 $0 $0 $0 $6,339 8.4%SG&A: R&D $482 $0 $497 $0 $0 $0 $0 $0 $979 1.3% Promotions $1,400 $0 $1,400 $0 $0 $0 $0 $0 $2,800 3.7% Sales $2,500 $0 $3,000 $0 $0 $0 $0 $0 $5,500 7.3% Admin $1,011 $4 $726 $0 $0 $0 $0 $0 $1,741 2.3%Total Period $9,927 $6 $7,423 $2 $1 $0 $0 $0 $17,360 23.0%

Net Margin $4,476 $27 $1,076 ($2) ($1) $0 $0 $0 $5,575 7.4%

Definitions: Sales: Unit Sales times list price. Direct Labor: Labor costs incurred to produce theproduct that was sold. Inventory Carry Cost: the cost unsold goods in inventory. Depreciation:Calculated on straight-line. 15-year depreciation of plant value. R&D Costs: R&D departmentexpenditures for each product. Admin: Administration overhead is estimated at 1.5% of sales.Promotions: The promotion budget for each product. Sales: The sales force budget for eachproduct. Other: Chargs not included in other categories such as Fees, Write offs, and TQM. The feesinclude money paid to investment bankers and brokerage firms to issue new stocks or bonds plus consulting fees your instructor might assess. Write-offs include the loss you might experience when you sell capacity orliquidate inventory as the result of eliminating a production line. If the amount appears as a negative amount, then you actually made money on the liquidation of capacity or inventory. EBIT: Earnings Before Interestand Taxes. Short Term Interest: Interest expense based on last year''s current debt, including short termdebt, long term notes that have become due, and emergency loans, Long Term Interest: Interest paid onoutstanding bonds. Taxes: Income tax based upon a 35% tax rate. Profit Sharing: Profits sharedwith employees under the labor contract. Net Profit: EBIT minus interest, taxes, and profit sharing.

Other ($3,522) -4.7%EBIT $9,097 12.1%Short Term Interest $0 0.0%Long Term Interest $949 1.3%Taxes $2,852 3.8%Profit Sharing $143 0.2%Net Profit $5,153 6.8%

Annual Report Page 25

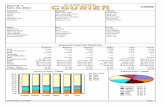

Overall C58866 Champion

Overall Andrews Baldwin Chester Digby Erie FerrisScore 5.65 5.70 2.75 2.40 2.15 2.80

0.00

1.00

2.00

3.00

4.00

5.00

6.00

Andrews Baldwin Chester Digby Erie Ferris