City of Greater Bendigo Proposed Budget 2012/2013

-

Upload

city-of-greater-bendigo -

Category

Documents

-

view

212 -

download

0

description

Transcript of City of Greater Bendigo Proposed Budget 2012/2013

PMS 1807 REDPMS 432 GREYPMS 142 GOLD

Proposed Budget 2012/13 Delivering for our community

TABLE OF CONTENTS Page

Introduction from the Mayor, Cr Alec Sandner 1

Chief Executive Officer’s Summary 2

Budget Processes 5

1. Linkage to the Council Plan 6

2. Activities, Initiatives and Key Strategic Activities 9

3. Budget Influences 30

4. Analysis of Operating Budget 34

5. Analysis of Budgeted Cash Position 41

6. Analysis of Capital Budget 45

7. Analysis of Budgeted Financial Position 50

8. Strategic Resource Plan and Key Financial Indicators 53

9. Rating Strategy 57

10. Other Strategies 60

Appendix A - Budgeted Standard Statements 63

Appendix B - Statutory Disclosures 68

Appendix C - Capital Works Program 79

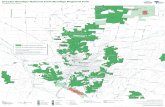

Appendix D - Maps 87

Appendix E - Glossary of Terms 90

Proposed Greater Bendigo City Council Budget 2012/13 1

Introduction from the Mayor, Cr Alec Sandner Delivering for Our Community The City of Greater Bendigo Council’s proposed Budget for 2012/2013 delivers major projects now and for the future, while providing value for money services and high quality facilities. Our region is experiencing a period of significant growth and this puts pressures on our infrastructure and the services we provide. The challenge for Council is to get the balance right so we can build for the future without placing too great a financial burden on our existing ratepayers. This proposed budget is about striking the right balance; it’s about delivering infrastructure and services for our community in a financially responsible manner. In 2012/2013, we propose increasing rates by 5.5 per cent. This is less than the 6 per cent increase forecast at the time of our last budget (to assist ratepayers of lower valued properties in meeting financial commitments, Council will reduce the Municipal Charge by a further $34.40 to $64.80. In return we will invest this money, plus the additional funds we receive in State and Federal grants and fees and charges, in projects and services that matter to our community. Service delivery is our core business. We provide services across a wide spectrum. In Aged and Disability Services we have allocated $10.4 million, including $3.2 million for General Home Care, $1.7 million for Personal Care and $1.1 million for Respite Care. The draft budget includes $7 million for Children and Family Services, including $2.2 million for Maternal and Children’s Health and $3.3 million for Long Day Care. The City collects some 28,000 tonnes of garbage from residential properties each year. In 2012/2013, we plan to spend $2.3 million on garbage collection and $1.9 million on recycling. The draft budget includes significant funding to maintain, upgrade and improve our many sport and recreation facilities and $8.1 million to manage our many parks and natural reserves. Our capital works budget will be $51.5 million. The City is responsible for maintaining around 1400kms of sealed roads and more than 1300kms of unsealed roads. We will provide $11 million for road infrastructure projects, including more than $7 million on road renewal work for sealed roads and $2 million on road renewal work for unsealed roads. More than $5.4 million has been set aside for drainage works, $1.2 million for bicycle and walking paths and $1.1 million for footpaths. The draft budget also includes $6.5 million towards the Bendigo Art Gallery expansion and $6.5 million for the Bendigo Redevelopment, $2 million for the completion of the Edward Street car park, and $500,000 to commence the Bendigo Theatre project. While we will deliver an extensive range of services and construction projects during 2012/13 we will also undertake planning for the future of Greater Bendigo. Our population is growing at 1.5% per year, and expected to reach 150,000 by 2036. Strategic planning is important to ensure we can maintain and improve the amenity of the city as we grow. In 2012/13 we will undertake a Residential Development Strategy to plan for future housing, an Integrated Transport and Land Use Strategy to ensure efficient movement of people, a Waste Management Strategy, and we will continue to implement policy that will protect our significant heritage assets into the future. I am confident that this proposed budget will continue the City of Greater Bendigo’s track record for delivering quality infrastructure and services through prudent financial management. Residents and other interested members of the community are welcome to view and make submissions on the budget. Detailed information is available at www.bendigo.vic.gov.au or by contacting our Council Offices. Cr Alec Sandner Mayor

2 Proposed Greater Bendigo City Council Budget - 2012/13

Chief Executive Officer’s Summary Council has prepared a Budget for the 2012/13 financial year which seeks to balance the demand for services and infrastructure with the community’s capacity to pay. Key budget information is provided below about the rate increase, operating result, cash and investments, capital works and financial position of the Council. Any columns in graphs below labelled A2010/11 reflect Actual figures for 2010/11, F2011/12 reflect Forecast figures for 2011/12, columns labelled B2012/13 reflect Budget figures for 2012/13 and columns labelled SRP reflect Strategic Resource Plan figures for years 2013-2016. 1. Rates

4.5

5.9 5.56.0 6.0 6.0

0.0

2.0

4.0

6.0

8.0

10.0

A2010/11 F2011/12 B2012/13 SRP2013/14 SRP2014/15 SRP2015/16

% r

ate

in

cre

The general rates increase by 5.5% for the 2012/13 year, will raise total rates and charges of $79.71 million, including $1.3 million generated from supplementary rates. 2. Operating Result

19.9021.52

14.3816.21 16.12

24.92

0.0

10.0

20.0

30.0

A2010/11 F2011/12 B2012/13 SRP2013/14 SRP2014/15 SRP2015/16

surp

lus

/ -

de

fici

The expected operating result for the 2012/13 year is a surplus of $14.38 million, which is a decrease of $7.14 million over 2011/12. The decrease is due mainly to increases in cost of service delivery, increased depreciation, and the impact of receiving six quarters of Grants Commission funding in 2011/12 resulting in only two quarters budgeted for 2012/13.

Proposed Greater Bendigo City Council Budget - 2012/13 3

3. Cash and Investments

33.76 34.95

27.22

31.58

39.31

0.0

10.0

20.0

30.0

40.0

A2010/11 F2011/12 B2012/13 SRP2013/14 SRP2014/15 SRP2015/16

cash

on

ha

nd

Cash and investments are expected to decrease by $7.73 million during the year to $27.22 million as at 30 June 2013. This reflects Council's strategy of using excess cash and investments to enhance service delivery and enable the renewal and upgrade of existing infrastructure and the creation of new infrastructure. 4. Capital Works

29.78

54.3151.53

40.0545.62

52.18

0.0

10.0

20.0

30.0

40.0

50.0

60.0

A2010/11 F2011/12 B2012/13 SRP2013/14 SRP2014/15 SRP2015/16

cap

ital w

ork

s

The Capital Works program for the 2012/13 year is $51.53 million. Some projects will be carried forward for completion from the 2011/12 year. The carried forward component is fully funded from the 2011/12 budget. Of the $51.53 million in Capital funding required, $24.04 million will come from Working Capital/Council operations, $15.63 million from external grants, contributions and asset sales, $11.30 million will come from loan borrowings and the balance of $560,000 from cash and investments. The capital expenditure program has been set and prioritised based on a process that has enabled Council to assess needs for projects. (Capital Works is forecast to be $54.31 million for the 2011/12 year).

4 Proposed Greater Bendigo City Council Budget - 2012/13

5. Financial Position

1,096 1,136 1,167 1,204 1,240 1,285

0.0

200.0

400.0

600.0

800.0

1000.0

1200.0

1400.0

A2010/11 F2011/12 B2012/13 SRP2013/14 SRP2014/15 SRP2015/16

Ne

t A

sse

tsl

The financial position is expected to improve with net assets (net worth) to increase by $31.35 million to $1.17 billion although net current assets (working capital) will reduce by $2.90 million to $15.42 billion as at 30 June 2013. This is mainly due to the use of cash reserves to fund the capital works program. (Total equity is forecast to be $1.14 billion as at 30 June 2012). This budget has been developed through a rigorous process of preparation and review. More detailed budget information is available throughout this document. Craig Niemann Chief Executive Officer

Proposed Greater Bendigo City Council Budget - 2012/13 5

Budget Processes This section lists the budget processes undertaken in order to adopt the budget in accordance with the Local Government Act 1989 (the Act) and Regulations. The preparation of the budget begins with Officers preparing the operating and capital components of the annual budget between January and March. A draft consolidated budget is then prepared and various iterations are considered by Councillors at informal briefings during March and April. A proposed budget is prepared in accordance with the Act and submitted to Council in late May for approval in principle. Council is then required to give public notice that it intends to adopt a budget. It must give 28 days notice of its intention to adopt a proposed budget and make the budget available for inspection at its offices. To assist interested persons to understand the budget and make a submission, Council undertakes a community information process including a media briefings and a display of the proposed budget in the local media and on the City of Greater Bendigo's website. The final step is for Council to adopt the budget after receiving and considering any submissions from interested parties. The budget is required to be adopted and a copy submitted to the Minister by 31 August each year. The key dates for the budget process are summarised below:

Budget process Timing

1. Officers prepare operating and capital budgets Jan/Mar

2. Council considers draft budgets at informal briefings Mar/Apr

3. Proposed budget submitted to Council for approval 30 May

4. Public notice advising of Council’s intention to adopt the budget 2 June

5. Budget available for public inspection and comment 2 to 29 June

7. Submissions period closes (28 days) 29 June

8. Submissions considered by a Committee of Council 4 July

9. Budget and submissions presented to Council for adoption 25 July

10. Copy of adopted budget submitted to the Minister 1 August

6 Proposed Greater Bendigo City Council Budget - 2012/13

Strategies

Community Plans- Greater Bendigo 2036

- Small Town and

Neighbourhood Plans

Council Plan

Annual Actions

Community

Engagement

Framework

1. Deliberate

Consultation Activities

2. Communications and

Media

3. Customer Service

Requests

4. Small Towns

5. Individual Contacts

with Staff/Councillors

Council Plan

COGB Strategies

and Plans

Individual Work

Plans

Service Plans

Long Term

Financial and

Workforce Plan

(Strategic Resource

Plan)

Council Budget

including Annual

Capital Expenditure

Unit Budget

Annual Report to the

Community

Report to

Councillors on

progress against

Annual Actions and

Budget

Progress report to

Director

Progress report to

Supervisor

Report to councillors

on achievements in

strategies

ENGAGEMENTACTION

PLANNING

RESOURCE

PLANNINGREPORTING

1. Linkage to the Council Plan This section describes how the Annual Budget links to the Council Plan within an overall planning framework. This framework guides the Council in identifying community needs and aspirations over the long term (Greater Bendigo 2036), medium term (Council Plan and Strategic Resources Plan) and short term (Annual Actions and Budget) and then holding itself accountable (Annual Report and Audited Statements). 1.1 Strategic Planning Framework The Strategic Resource Plan, included in the Council Plan, summarises the financial and non-financial impacts of the objectives and strategies and determines the sustainability of these objectives and strategies. The Annual Budget is developed taking into account the activities and initiatives which contribute to achieving the Council’s strategic objectives. The diagram below depicts the strategic planning framework of Council.

Council's Planning and Reporting framework is underpinned by Federal, State and Regional Strategic Plans, Policies and Legislation.

Note: Lighter shades are for "internal only" documents.

Proposed Greater Bendigo City Council Budget – 2012/13 7

1.2 Our Purpose Our Vision Greater Bendigo will be the best place to live, work and visit where:

Growth and living standards are managed to sustain and enhance quality of life. A regional culture of learning, creativity and innovation allows people to flourish. Its rich natural and cultural heritage is conserved for today and tomorrow. Resilience, local spirit and identity are proudly celebrated.

Our Values Council will achieve its vision by working with the community and business displaying leadership in its decision making, operating in an open manner, and basing decisions on sound information. 1.3 Goal Areas and Strategic Objectives The Council delivers activities and initiatives under 33 major service categories or functional areas. Each contributes to the achievement of one of the four Goal Areas and the Strategic Objectives as set out in the Council Plan for the 2009-13 years and shown in the following table.

Goal Area Strategic Objective

1. Built and Natural Environment Built and Natural Environment

Value, conserve and enhance the rich built and natural heritage Protect and enhance our existing amenities Achieve high quality outcomes in planning and policy activities Encourage and foster high quality urban design to create environments that

support public wellbeing and economic successes Use sustainability principles in the management of assets, public places and

facilities Collaborate with the community and demonstrate leadership in responding to

the challenges facing the environment Be a leader and role model in climate change adaptation and ecologically

sustainable development Foster the ongoing development of an efficient, sustainable and economically

enabling transport network

2. Economic Development Built and Natural Environment

Conduct a range of advocacy activities to ensure community needs regarding education, industry and employment opportunities are met

Encourage and support a vibrant and resilient community which values innovation and creativity

Foster approaches which facilitate high employment levels across the community Foster new local developments and partnerships which promote sustainable

industry, commerce and exports

3. Community and Culture

Advocate on behalf of vulnerable community members, especially through effective partnerships with relevant agencies

Effectively engage and communicate with diverse community members and value their wisdom

Increase opportunities for the expression and celebration of cultural diversity Provide support services which foster community resilience, connectedness and

social capital Conserve and celebrate the rich cultural heritage Provide equitable access to services which will improve people’s health and

wellbeing throughout all life stagespr Encourage and support a vibrant and resilient community which values

innovation and creativity

8 Proposed Greater Bendigo City Council Budget - 2012/13

Goal Area Strategic Objective

4. Our People, Our Processes

Demonstrate good governance Deliver responsible financial management and business planning practices to

ensure long term sustainability Foster a motivated, responsive, innovative and performance orientated

workforce Provide quality customer services that respond to the needs of our whole

community Implement strong, clear and transparent corporate governance and strategies

and actions Adhere to best practice expectations in project management Conduct responsive Emergency Management coordination and support

Proposed Greater Bendigo City Council Budget – 2012/13 9

2. Activities, Initiatives and Key Strategic Activities This section provides a description of the activities undertaken by Service Units of the City of Greater Bendigo and the key initiatives funded in the Budget for the 2012/13 year which will be implemented by these Service Units. It also indicates how these initiatives contribute to achieving the strategic objectives specified in the Council Plan. The Strategic Objectives from the Council Plan have been referenced below where relevant. A number of key strategic activities and performance targets and measures are also included. In order to demonstrate full cost of Council services, the City of Greater Bendigo allocates the cost of a number of internal support areas to other service units of Council. These include Finance (general accounting, payroll, accounts payable, accounts receivable), Systems/Management Accounting, Information Management, People and Learning, Customer Service. 2.1 Council and Executive

Activity

(Expenditure) Revenue

Net Cost $'000

The Executive Services Unit provides administrative and executive support to Council, the Mayor, the CEO and the Executive Management Team. The Unit also ensures that systems and processes are in place to provide for good governance. Communications, media, community relations and government relations are supported through activities of the unit. The Legal Officer provides legal services in support of governance and to the organisation.

(2,395) 218 ($2,177)

Initiatives Council Plan Reference

1) Develop Councillors’ Extranet to facilitate induction of the Council following the 2012 Municipal Election

4.5

2) Develop and maintain an improved intranet site 4.2

3) Effectively manage the VEC Contract and other processes for the conduct of the 2012 Municipal Election

4.5

2.2 Organisation Support Directorate

Activity

(Expenditure) Revenue

Net Cost $'000

The Organisation Support directorate enables, strengthens and enhances our people, culture, systems, processes and finances to ensure sound corporate decision-making, the achievement of the organisation’s strategic objectives and the delivery of high quality services and programs.

(373) 0 (373)

Initiatives Council Plan Reference

4) Manage the Bendigo Library Redevelopment 1.1

10 Proposed Greater Bendigo City Council Budget - 2012/13

Library Services

Activity

(Expenditure) Revenue

Net Cost $'000

The Goldfields Library Service provides a public library service to four sites throughout the municipality in Bendigo, Kangaroo Flat, Eaglehawk and Heathcote along with the mobile library. With high visitation numbers, the service caters for the cultural, educational and recreational user, as well as research capability through the Regional Archive Centre Reading Room. The service is operated by the North Central Goldfields Library Corporation of which the City of Greater Bendigo is one of the four member municipalities.

(2,335) 0 (2,335)

Rates

Activity

(Expenditure) Revenue

Net Cost $'000

The Rates Unit provides administrative services in rates and charges generation and collection, maintaining the property database and its link with the mapping software, voters roll preparation, and maintaining the central name and address register.

(1,353) 347 (1,006)

Valuations

Activity

(Expenditure) Revenue

Net Cost $'000

The Valuations Unit undertakes a general revaluation of the municipality, supplementary valuations, asset and insurance valuations of Council owned property. It also provides valuations and property related advice for Council purposes, handles inquiries and objections to property values from owners and/or ratepayers and undertakes commercial/market orientated rent renewals and negotiations when requested.

(840) 518 (322)

Initiatives Council Plan Reference

5) Commence property revaluations for implementation in 2014 4.5

Proposed Greater Bendigo City Council Budget – 2012/13 11

Risk Management

Activity

(Expenditure) Revenue

Net Cost $'000

The Risk Management Unit is responsible for working with Service Units to develop and support an approach to risk culture and a safe working environment. The Unit ensures that Council's responsibilities are met in accordance with legislations requirements. It provides assistance and advice to all areas of Council's operations and to external organisations and community groups in areas of general risk management, insurance renewals and claims management, Workcover, Municipal Emergency Management Plan and sub plans including Municipal Fire Prevention, Emergency Management, and Occupational Health and Safety programs.

(1,411) 355 (1,056)

Initiatives Council Plan Reference

6) Refine Emergency Management Planning processes 4.7

Finance

Activity

(Expenditure) Revenue

Net Cost $'000

The Finance Unit is responsible for the sound and professional stewardship over City of Greater Bendigo finances. The Unit's key functions include adhering to all Legislative and Departmental reporting and financial control requirements and developing financial strategies which provide for sound debt and cash flow management, ensuring that City of Greater Bendigo is a viable organisation able to continue the provision of services into the future.

(1,419) Cost allocated

across other units 1,257 (162) 66 (96)

Initiatives Council Plan Reference

7) Review the vehicles policy, including exploring the option of a bike fleet, and reconsider types of vehicles purchased under the policy

4.1

8) Implement Procurement Action Plan to ensure best practice purchasing 4.1 Systems and Management Accounting

Activity

(Expenditure) Revenue

Net Cost $'000

The Systems and Management Accounting Unit is responsible for the preparation of informative, accurate and timely financial management reports. The unit is also responsible for the preparation and adoption of Council's annual budget and the utilisation of key corporate financial, HR-Payroll and land information software systems.

(431) Cost allocated

across other units 249

(182)

12 Proposed Greater Bendigo City Council Budget - 2012/13

Initiatives Council Plan Reference

9) Develop and roll out Business Intelligence Software to provide improved information/analysis for Financials, Carbon Accounting, HR-Payroll and other identified KPIs

4.1

Information Management

Activity

(Expenditure) Revenue

Net Cost $'000

The Information Management Unit provides information technology support and information services to the City of Greater Bendigo. The Unit is responsible for: records management; corporate servers; computers/laptops and the corporate network which includes over 20 sites; mobile networking; telephone systems; mobile phones; Freedom of Information requests; and Privacy matters. The Unit provides solutions and advice to staff and management.

(3,016) Cost allocated

across other units 2,751

(265)

Initiatives Council Plan Reference

10) Undertake a telecommunications review 4.2

11) Implement Web Strategy/Website improvements 4.2

12) Upgrade all COGB PCs to Office 2010 4.2

People and Learning

Activity

(Expenditure) Revenue

Net Cost $'000

The People and Learning Unit ensures organisational strategies, policies, programs and practices reflect the variety of needs, interests and aspirations our employees.

(1,583) Cost allocated

across other units 1,401

(182)

Initiatives Council Plan Reference

13) Implement system and process improvements to ensure the organisation captures and understands its total workforce profile, to inform sound, evidence-based decision making on key workforce changes

4.3

14) Provide centralised corporate training 4.3

15) Undertake bi-annual Employee Opinion Survey 4.3

16) Foster shared leadership and continue to develop people management capability through leadership development and learning programs and initiatives

4.3

Proposed Greater Bendigo City Council Budget – 2012/13 13

Contracts and Project Coordination

Activity

(Expenditure) Revenue

Net Cost $'000

The Contracts and Project Coordination Unit provides the organisation with centralised tendering and contracts processes. It also provides administration and project management support services for the Council Capital Works Program. Functions include: full tender process management; contract management; assistance with business case development; capital works program development; maintenance and promotion of the Council Project Management Manual and procedures; and supporting and enabling Unit and Project Managers to deliver projects and services in their area of responsibility.

(748) 0 (748)

Initiatives Council Plan Reference

17) Review State guidelines and tools to establish mechanisms for inclusion of social procurement and tendering processes

4.6

18) Implement improvements to Capital expenditure delivery 4.6 2.3 Planning and Development Directorate

Activity

(Expenditure) Revenue

Net Cost $'000

The Planning and Development directorate ensures a better quality of life for all members of the Greater Bendigo community by fostering sustainable development and enhancing public safety.

(377) 0 (377)

Statutory Planning

Activity

(Expenditure) Revenue

Net Cost $'000

The Statutory Planning Unit provides a variety of planning services for the Greater Bendigo community. The Unit facilitates quality development including buildings and subdivision, while maintaining and protecting the municipality’s environmental assets and respecting residents/community rights and amenity. Core services include: processing applications for planning permission; customer service and community consultation; providing Council with strategic and statutory advice; Council representation at VCAT and Planning Scheme Amendment panel hearings; providing services to external clients; planning enforcement; and internal liaison with other departments.

(2,908) 697 (2,211)

14 Proposed Greater Bendigo City Council Budget - 2012/13

Initiatives Council Plan Reference

19) Assess and process the planning scheme amendment for the Marong Industrial Park and Airport Industrial Park

1.6

20) Establish Developer Contribution Plans for Strathfieldsaye and Huntly 1.6

21) Implement changes to planning decisions as a result of Victorian Bushfire Royal Commission findings

4.7

Building and Property

Activity

(Expenditure) Revenue

Net Cost $'000

The Building and Property Services Unit aims to incorporate efficient service delivery and responsiveness in order to manage its statutory building responsibilities. The Unit will continue to work with both business and the community to improve public building safety by encouraging better compliance with building regulations and essential services. In addition, this Unit is responsible for managing CoGB's property portfolio of around 700 buildings and 100 structures, and for the planning and delivery of a major portion of the organisation’s Capital property works budget. The Unit is responsible for issuing and undertaking mandatory inspections on all Council funded or managed projects and provides a high level of direction and technical support for the community. It includes all activities associated with Council's statutory responsibilities under the Building Act and Regulations including Essential Safety Measures, complaint investigation, enforcement, building control administration and reporting. Lodgement and recording of private building permits and Council consents for variation of Building Regulations form an increasing part of this service.

(6,854) 1,228 (5,626)

Initiatives Council Plan Reference

22) Implement water and energy conservation practices at COGB public spaces and buildings

1.3

23) Implement a Building Asset Management Plan to provide a strategic direction to manage Council’s significant property portfolio, continue to inspect and record on Conquest property condition information for all buildings

1.11

24) Coordinate sale of the strategically situated Council owned properties 1.11 Parking and Animal Control

Activity

(Expenditure) Revenue

Net Cost $'000

The Parking and Animal Control Unit provides a range of statutory and community services which are primarily delivered under the specific guidelines, policies and direction of Council with regular reporting mechanisms in place. The Unit provides a 24 hour, 7 days per week service and deals with more than 6,500 customer requests each year.

(3,407) 5,678 2,271

Proposed Greater Bendigo City Council Budget – 2012/13 15

Initiatives Council Plan Reference

25) Review the service agreement with Vic Roads for stock control 1.11 26) Implement processes to deal with new “Breeding and Rearing” laws 1.11 27) Plan and implement systems and equipment at the new car park 1.11 28) Review the Domestic Animal Management Plan 1.11 29) Review and retender Animal Control Contract 1.11 30) Review and re-tender Animal Pound Contract 1.11

Environmental Health and Local Laws

Activity

(Expenditure) Revenue

Net Cost $'000

The Environmental Health and Local Laws Unit provides a variety of community safety services for the Greater Bendigo community. Many of those services are delivered in accordance with State Government statute that is delegated to Local Government. Services include: food safety and public health standards in registered premises, domestic wastewater management, nuisance complaint investigations infectious disease control and advice on public health management.

(1,468) 805 (663)

Initiatives Council Plan Reference

31) Review the Domestic Wastewater Management Plan (DWMP) to meet legislative requirements and allocate ongoing resources to guide DWMP implementation and ongoing COGB strategic response to wastewater management

1.4

32) Participate in the development and implementation of a National Preventative and Public Health Initiative project

3.7

33) Improve the knowledge of people in the hospitality industry in food hygiene and handling by conducting sessions to be delivered to TAFE students undertaking chef apprenticeships and year 11/12 school leavers

3.7

34) Review the Itinerant Trade Local Law to ensure that the objective and purpose is the most appropriate method of controlling itinerant trade activity

1.11

35) Review local laws governing the Mall and CBD to determine their effectiveness in relation to providing a safe and usable space for all

1.11

Strategy

Activity

(Expenditure) Revenue

Net Cost $'000

The Strategy Unit’s integrated planning approach incorporates strategic land use planning, community and social planning, corporate planning, heritage planning, sustainable transport planning, and facilitating the renewal and implementation of the Greater Bendigo +25 Community Plan. The Unit facilitates and coordinates the development of major Council adopted strategies. This requires that staff in the Unit remain abreast of major public policy issues, policy responses, and contemporary practice at the local, national and international level.

(2,530) 590 (1,940)

16 Proposed Greater Bendigo City Council Budget - 2012/13

Initiatives Council Plan Reference

36) Review planning and design for Bendigo Station Precinct for current and expected growth in demand

1.9

37) Work with State Government and universities to implement relevant COGB components of the Regional Strategic Plan including Settlement and Regional Land Use Planning

1.10

38) Complete a significant cultural landscape study for the Mandurang, Big Hill, Axe Creek area 1.5

39) Preparation of a Structure Plan for Maiden Gully 1.6 40) Plan for the Hospital Precinct 1.6 41) Undertake the Beehive Development Plan involving the next phase for the

Beehive/Bendigo Mining Exchange Project 1.6

42) Undertake a review of the existing Open Space Strategy to adequately scope the preparation of a new and current strategy for the management of open space within Greater Bendigo

1.6

43) Undertake a Heritage Study for East Bendigo/White Hills to inform preparation of citations and inclusion of properties in the Heritage Overlay

1.9

44) Complete Residential Strategy 1.10 45) Develop Sustainable Transport Plan in accordance with Council’s decision 1.12 46) Analysis of user needs and subsequent building fit-for-purpose across all

Eaglehawk CBD community facilities 3.3

47) Complete the process and implement the findings of the review of the Greater Bendigo Planning Scheme

1.10

48) Review the Commercial Land Strategy and implement in the Planning Scheme

1.10

49) Prepare and progress Planning Scheme Amendments to implement the Marong Plan, Eaglehawk Precinct, CBD Parking Policy and Airport

1.6

50) Review and Develop the Arts and Cultural Strategy 3.4 2.4 Community Wellbeing Directorate

Activity

(Expenditure) Revenue

Net Cost $'000

The Community Wellbeing Directorate comprises the functional areas of Aged and Disability Services, Children and Family Services, Community and Cultural Development, Customer Support, Recreation Services and Healthy Communities. This portfolio has a focus on a wide and diverse range of community services and projects, together with strategies that build on Bendigo’s unique qualities and lifestyle.

(383) (0) (383)

Proposed Greater Bendigo City Council Budget – 2012/13 17

Customer Service

Activity

(Expenditure) Revenue

Net Cost $'000

Due to its key customer contact role in the organisation the Customer Service Unit has a direct link with all other service units within the City of Greater Bendigo. The Unit provides many services aimed at assisting all enquiries to Council’s generic telephone number, emails, requests and other social media forms or over Council's Customer Service Counter at Lyttleton Terrace Bendigo and Heathcote.

(1,353) Cost allocated

across other units 723 (630) 25 (605)

Initiatives Council Plan Reference

51) Continue to implement the Customer Service Strategy to promote a whole of organisation attitude and culture for customer service

4.4

52) Develop a Customer Service Integrated Information Management System 4.2

53) Implement the findings/recommendations of the Customer Service Charter review process

4.4

Aged and Disability Services

Activity

(Expenditure) Revenue

Net Cost $'000

Services are provided to the frail aged and people with disabilities across the key programs: Home & Community Care (HACC); Veterans Home Care (VHC); and Community Aged Care Packages (CACPs).

(10,435) 8,797 (1,638)

Initiatives Council Plan Reference

54) Provide an additional five community care packages as allocated by the Loddon Mallee Consortium

3.11

55) Implement the Active Service Model (ASM) principles into service provision and client care plans and provide ASM training for all staff

3.11

56) Investigate the feasibility of redeveloping the Golden Square Senior Citizens Centre as a hub for community groups

3.11

57) Undertake a review of the Aged & Disability Services Unit (Stage 1) and implement Councils endorsed recommendations (Stage 2)

3.11

58) Implement the plan which addresses five special needs groups who are deemed to be most vulnerable

3.11

59) Assist high needs clients to become more self reliant and independent in the short term

3.11

18 Proposed Greater Bendigo City Council Budget - 2012/13

Children and Family Services

Activity

(Expenditure) Revenue

Net Cost $'000

Children and Family Services is a provider of services for the early childhood target group and their families. The Unit focuses on health promotion, early detection, prevention, care, education and advocacy. It has a strong commitment to community development by promoting and delivering Child Friendly initiatives.

(6,995) 4,932 (2,063)

Initiatives Council Plan Reference

60) Review and implement the Community Access and Inclusion Plan 3.6 61) Investigate options to assist with assessment of work loads of Maternal and

Child Health staff 3.11

62) Improve access for families by investigating an alternative booking system for Occasional Child Care

3.11

63) Facilitate changes to the Child Care Reform 3.11 64) Undertake a feasibility study to assess the need for an Early Learning Centre

at Golden Square and Maiden Gully 3.11

65) Continue the scholarship program to recruit Maternal and Child Health nurses

3.11

66) Undertake a review of Council's role in child care and preschool to ascertain where it should best allocate its resources

3.11

67) Complete and implement a Youth Strategy 3.11 Recreation

Activity

(Expenditure) Revenue

Net Cost $'000

The Recreation Unit is focused on delivering outcomes for sport and leisure related community groups across the municipality. Our aim is to provide a liaison point for sport and leisure organisations as well as undertake strategic planning to direct the provision of community sport and leisure opportunities for the future. The Unit is involved in planning, designing, managing, maintaining and creating public access to sport and leisure opportunities for the residents of and visitors to the City of Greater Bendigo.

(3,346) 362 (2,984)

Initiatives Council Plan Reference

68) Develop a Golfing Strategy that supports golf clubs in the future strategic directions of golf in Greater Bendigo 3.2

69) Complete and implement the Health and Active Lifestyle Framework 3.10 70) Review the Skate Park Strategy 3.10

Proposed Greater Bendigo City Council Budget – 2012/13 19

Community and Cultural Development

Activity

(Expenditure) Revenue

Net Cost $'000

Community and Cultural Development has an overarching social inclusion and community safety focus. The Unit prepares funding and service agreements, as well as developing and maintaining partnership arrangements to ensure that all community members have opportunities to: engage socially and in education, training and employment; access appropriate community and institutional resources; access appropriate services such as health and transport; access to sufficient material and economic resources including housing; and feel safe in the community including in their homes.

(3,134) 423 (2,711)

Initiatives Council Plan Reference

71) Facilitate a Farm Business Diversification Expo 2.5

72) Support the municipality’s Neighbourhood Houses to develop strategic plans that reflect their community’s needs and aspirations, and support planning for the relocation of Eaglehawk Community House

3.3

73) Implement the recommendations contained within the Youth Strategy 3.11

74) Facilitate opportunities for young people aged 12-25 to participate in civic engagement activities, increase their social connections and develop new knowledge and skills

3.11

75) Develop a pilot Multicultural Ambassadors Program to promote stronger linkages between City of Greater Bendigo and Culturally and Linguistically Diverse communities

3.5

76) Implement the recommendations contained within the Positive Ageing Strategy including special initiatives

3.11

77) Undertake a review of all Section 86 Committees of Council 4.5

78) Implement recommendations arising from review of City of Greater Bendigo grant making activities

4.5

79) Support those local communities that have been the focus of the State Government’s Neighbourhood Renewal Program to develop a Community Plan to guide ongoing community engagement and development

3.2

80) Support the implementation of an identified sustainable model for the continued provision of art house cinema within Greater Bendigo

3.4

81) Work with CBD traders and the community to develop programs and events that maximise activation of the Hargreaves Mall

2.5

Healthy Communities

Activity

(Expenditure) Revenue

Net Cost $'000

The Healthy Communities Unit, in partnership with Bendigo Community Health Services, is responsible for the implementation of the Prevention Community Model, a comprehensive approach to chronic disease prevention that is being delivered in 14 local government areas across Victoria. This Unit is fully funded

(991) 991 (0)

20 Proposed Greater Bendigo City Council Budget - 2012/13

Activity

(Expenditure) Revenue

Net Cost $'000

by the Federal Government. The Unit will focus on: rolling out a range of programs that provide skills and support for achieving better health; supporting prevention partnerships within the Greater Bendigo community; supporting community engagement and participation in determining local solutions; supporting health promoting policies and programs in schools and workplaces; tailoring health messages to local circumstances and needs; and contributing to research and evaluation.

Initiatives Council Plan Reference

82) Recruit the Healthy Communities workforce and establish the Project Control Model Governance Group

83) Develop and implement Local Partnership Strategy and relevant activities

84) Conduct social marketing activities in local communities on identified issues

85) Establish network of practitioners for healthy workplaces and workers

86) Project manage and facilitate access to local networks and resources in the development phase of the National Partnerships Agreement on Preventative Health integrated health promotion project for Greater Bendigo

3.7

2.5 City Futures Directorate

Activity

(Expenditure) Revenue

Net Cost $'000

The role of the City Futures directorate is to contribute to the economic, cultural and social prosperity of our region by identifying and supporting investment opportunities, employment generation and development of major projects, and in so doing continue to raise Greater Bendigo’s profile as an exceptional place in which to live, work, invest and visit.

(373) 0 (373)

Tourism

Activity

(Expenditure) Revenue

Net Cost $'000

The Tourism Unit provides leadership to the Greater Bendigo tourism industry. With several hundred tourism related businesses in the Bendigo Loddon region, the Unit works with the industry to brand and co-operatively market the destination regionally, into Melbourne, interstate and internationally. It identifies major infrastructure developments, fosters a high level of professional services across the broad industry sector and delivers high quality visitor services and experiences.

(3,191) 780 (2,411)

Proposed Greater Bendigo City Council Budget – 2012/13 21

Initiatives Council Plan Reference

87) Roll out smart phone application that can be used for visitors to access Greater Bendigo information

2.2

88) Support the establishment of new regional Tourism body 2.2 89) Increase in marketing for Easter events 2.2 90) Improve support and rewards for Tourism Ambassador Volunteers 2.2

Major Events

Activity

(Expenditure) Revenue

Net Cost $'000

The Major Events Unit is responsible for increasing the number of major events retained and attracted to Greater Bendigo in the high priority areas of sports, arts and culture, food and wine, music and car club events.

(1,401) 237 (1,164)

Initiatives Council Plan Reference

91) Continue to attract economically lucrative major sporting, cultural and business events, and carnivals, and an increased sponsorship focus

2.2

92) Research and access Government Funding and Corporate Sponsorship 2.2 Economic Development

Activity

(Expenditure) Revenue

Net Cost $'000

The Economic Development Unit has overall responsibility to facilitate and support the economic growth of the Greater Bendigo region and focuses heavily on supporting new, existing enterprises and attraction of new investment in the municipality as a result.

(1,776) 332 (1,444)

Initiatives Council Plan Reference

93) Continue to develop the Bendigo Inventor Awards 2.3 94) Continue to support the collaboration and promotion of industry and

secondary student linkages for work experience and possible work placements

2.4

95) Subject to State Government funding, continue to provide support, linkages and education to all sectors regarding employment of skilled migrants to fill shortages across Bendigo and region

2.4

96) Prioritise the advancement of the Marong Business Park as an integrated logistics base with allied manufacturing services

2.5

97) Prepare planning documentation for the Bendigo Airport Development, including design of the new runway

1.1

98) Review the Economic Development Strategy 2.5

22 Proposed Greater Bendigo City Council Budget - 2012/13

The Capital, Bendigo Town Hall and Bendigo Exhibition Centre

Activity

(Expenditure) Revenue

Net Cost $'000

Services provided by The Capital are broadly divided into two areas: Performing Arts/Special Events which presents a range of performing arts experiences for the Central Victorian Community; and Venue Services for The Capital, Bendigo Town Hall and Bendigo Exhibition Centre.

(3,614) 2,241 (1,373)

Initiatives Council Plan Reference

99) Develop and implement a Marketing Plan across all venues 2.6 100) Support the design and construction for the new Bendigo Theatre Project 1.1

Bendigo Art Gallery

Activity

(Expenditure) Revenue

Net Cost $'000

Bendigo Art Gallery showcases a diverse range of visual arts and museum based material in the form of temporary exhibitions for the public with a local, national and international focus. Education and public programs are offered within this international standard museum which houses a permanent collection of 19th, 20th and 21st Century art.

(2,462) 534 (1,928)

Initiatives Council Plan Reference

101) Undertake the Bendigo Art Gallery Expansion Project 1.1 Special Projects

Activities

(Expenditure) Revenue

Net Cost $'000

The Special Projects Unit focuses on projects that involve significant funding from external sources, significant stakeholder engagement and requiring detailed planning, design and delivery. The Unit provides the mechanism for delivery of the City’s identified major projects. Activities include: business planning, funding submission preparation; planning permit preparation; communications; stakeholder engagement; co-ordination of detailed planning; and design and project delivery.

(381) 0 (381)

Proposed Greater Bendigo City Council Budget – 2012/13 23

Initiatives Council Plan Reference

102) Implement the program of works to develop the Edward Street multi storey car park, office and retail complex including development of streetscape design for Edward Street

1.1

103) Implement the program of works to develop the extension to the Bendigo Art Gallery

1.1

104) Continue the design and development phase for the indoor aquatic facility in Kangaroo Flat 1.1

105) Provide project support for Bendigo Showgrounds Project 1.1 106) Administer Bendigo Theatre Project 1.1 107) Administer Finn Street (Hoffman/Thales) Industrial Subdivision and Access

Project

108) Implement the program of works for Bendigo Airport Project 1.1 109) Assist with the early phase planning and advocacy for the Cathedral

Precinct Project

2.6 Presentation and Assets Directorate

Activity

(Expenditure) Revenue

Net Cost $'000

The Presentation and Assets Directorate aims to provide and maintain high quality assets and services that help make Greater Bendigo a great place to live now while planning and delivering new assets and services to support Bendigo’s ongoing growth. Demonstrating environmentally responsible thinking and practices and encouraging this throughout the organisation and community is an important focus for the group.

(22,172) 0 (22,172)

Asset Planning and Design

Activity

(Expenditure) Revenue

Net Cost $'000

The Asset Planning and Design Unit are responsible for the development and provision of physical infrastructure for the delivery of Council services. This includes the development of capital works projects to provide renewal and new assets to meet the expanding population of Bendigo and increasing community expectations, and the strategic planning of infrastructure through asset management and development of strategic plans for asset groups. The Unit also provides support services across the organisation in areas of asset management and GIS.

(3,286) 402 (2,884)

24 Proposed Greater Bendigo City Council Budget - 2012/13

Initiatives Council Plan Reference

110) Completion of Gateway Park Master Plan including community consultation and Council adoption

1.7

111) Detailed design for initial works at Lake Weeroona 1.6

112) Development of Asset Management Plans for civil infrastructure and open space assets

1.13

113) Continue to improve the road network through the East Bendigo industrial area

1.12

114) Detailed design and hydraulic investigation for the implementation of the Bendigo Botanic Gardens Master Plan

1.6

115) Implement the O’Keefe Rail Trail extension between Axedale and Heathcote

1.11

116) Implement drainage works identified in the 5 year drainage plan 1.11

Waste Services

Activity

(Expenditure) Revenue

Net Cost $'000

Services provided are collection of garbage from domestic and commercial properties, collection and sorting of kerbside recycling, operation of landfills and transfer stations, street cleaning, and drain and pit cleaning.

(14,898) 5,711 (9,187)

Infrastructure Services (Bencon)

Activity

(Expenditure) Revenue

Net Cost $'000

Bencon Maintenance includes maintenance and development of sealed and unsealed roads, drains, concrete footpaths, kerb and channel, and bridges. It also includes traffic and pedestrian management, emergency response, supply of labour, plant and traffic management to the Major Events Unit, maintenance of bike tracks. Bencon Construction undertakes new civil construction projects for Council including roads, drainage, sporting fields and car parks.

(10,558) 1,641 (8,917)

Bendigo Livestock Exchange

Activity

(Expenditure) Revenue

Net Cost $'000

The Bendigo Livestock Exchange provides for the efficient operation and management of weekly lamb/sheep sales, weekly cattle sales, fortnightly pig/calf sales and special store sales conducted throughout the year.

(915) 998 83

Proposed Greater Bendigo City Council Budget – 2012/13 25

Initiatives Council Plan Reference

117) Conduct an audit and review of the Livestock Exchange operations to determine development and upgrade needs in the next 10 years

2.5

Parks and Natural Reserves

Activity

(Expenditure) Revenue

Net Cost $'000

The Parks and Natural Reserves Unit is responsible for the management of a large portfolio of parks, gardens, reserves, sports fields and areas of open space for the City of Greater Bendigo. The diversity of these assets requires a skilled and committed team that are responsible for the implementation of a range of specialist park management, horticultural and environmental techniques and practices. The aim of the Unit is to effectively and sustainably manage these important assets through the efficient use of available resources and the provision of high levels of customer service while meeting both Council and stakeholder needs.

(7,956) 110 (7,846)

Initiatives Council Plan Reference

118) Increased investment in tree maintenance to address reduction in backlog of customer requests, power line clearance, meet safety standards and increase proactive works on a rolling program

1.7

119) Increased resourcing for QEO to ensure that the improved quality achieved through capital upgrade is maintained

1.7

Sustainable Environment

Activity

(Expenditure) Revenue

Net Cost $'000

The Sustainable Environment Unit's role is to provide a coordinated approach to the development of environmental policies, strategies, programs and processes. The Unit supports the development and growth of community environmental and sustainability groups and provides advice to the community on sustainable living, waste and recycling practices, land management, and adapting to climate variability. It also identifies the implications of Federal and State Government policies on the organisation and the community, and develops strategic directions in waste management.

(1,279) 130 (1,149)

26 Proposed Greater Bendigo City Council Budget - 2012/13

Initiatives Council Plan Reference

120) Facilitate the delivery of Sustainability Accord Project – Creating a Climate-Resilient Southern Loddon Mallee Region

1.3

121) Implement actions to reduce corporate emissions (scope 1 and 2) from City of Greater Bendigo operations, works and facilities

1.3

122) Complete a Waste and Resource Management Strategy covering all areas of City of Greater Bendigo responsibility

1.4

123) Develop an Environment Strategy (Green Plan 3) 1.3

124) Undertake review of the Adaptive Stormwater Management Project 1.2

125) Prepare for the bulk change over of street lighting to approved energy efficient lights in 2013/14

1.2

126) Develop Business Model for QEO Co-generation Plan 1.7

127) Undertake Building Audits for following years capital works program 1.11

128) Identify and investigate approaches to respond to the potential social impacts of Climate Change and Climate Change Adaptation

1.3

Proposed Greater Bendigo City Council Budget - 2012/13 27

2.7 Key Strategic Activities

Strategic Indicator Key Strategic Activities Target 2012/2013

Built and Natural Environment

1 Waste management effectiveness

Reduction in kilograms of domestic waste per household to landfill

Increased per household volume of

recyclable material received at CoGB sorting facility

2009/10 <622kg 2010/11 = 642kg

2009/10 >250kg 2010/11 = 258kg

2 Develop a sustainable integrated transport network

Complete the Sustainable Transport and Land Use Plan

Completed by June 2013

Economic Development

3 People live, work, invest in and visit Bendigo

Delivery of the Inventor Awards in partnership with industry and business

Hold award ceremony

4 Economic Development effectiveness

Percentage of actions completed by target date in Economic Development Strategy

90%

Community and Culture

5 Work collaboratively to promote community safety and healthy living throughout life stages

Performance targets set under The Food Act (1984)

Meet or exceed targets

People and Process

6 Effectiveness of community engagement framework

Increased use of YoBendigo website 2010/11 Unique users 13,685

Jul to Dec 2010 Hits 990,070

7 Provide effective customer service in dealing with the public

Customer Service telephone enquiries: o A service level where 85% of calls

are answered within 20 seconds o 70% of telephone calls are

resolved at point of contact o A call abandonment rate of =<5%

2009/10 81.89% 2010/11 87.5%

2009/10 67.34%

2010/11 65%

2009/10 3% 2010/11 2.9%

28 Proposed Greater Bendigo City Council Budget - 2012/13

Strategic Indicator Key Strategic Activities Target

2012/2013

8 Financial sustainability

Underlying result % - A positive result indicates a surplus. The larger the percentage, the stronger the result. A negative result indicates a deficit. Liquidity – Measures the ability to pay existing liabilities in the next 12 months. Self financing – Measures the ability to replace assets using cash generated by the entity's operations. Indebtedness – Comparison of non-current liabilities (mainly comprised of borrowings) to own-sourced revenue. The higher the percentage, the less able to cover non-current liabilities from the revenues the entity generates itself. Capital replacement – Comparison of the rate of spending on infrastructure with its depreciation. Operational efficiency - improve organisational processes to achieve financial efficiency

Ensure a low or medium risk rating for all

financial sustainability

measures issued by the Victorian Auditor General

$600,000

2.8 Performance Statement The Key Strategic Activities (KSA) detailed above, their performance measures, targets and results are audited at the end of the year and are included in the Performance Statement as required by Section 132 of the Act. The Annual Report for 2012/2013 will include the audited Performance Statement which is presented to the Minister for Local Government and the local community.

Proposed Greater Bendigo City Council Budget - 2012/13 29

2.9 Reconciliation with Budgeted Operating Result (Net Cost)

Revenue $’000

Expenditure $’000

Revenue $’000

Council and Executive (2,177) 2,395 218

Organisation Support (6,565) 7,851 1,286

Planning and Development (8,546) 17,544 8,998

Community Wellbeing (10,384) 25,914 15,530

City Futures (6,974) 13,198 6,224

Presentation and Assets (52,072) 61,064 8,992

Total activities and initiatives (86,718) 127,966 41,248

Other non-attributable 8,759

Deficit before funding sources (77,959)

Rates and charges 79,711

Capital grants 9,645

Contributions to capital works 2,980

Total funding sources 92,336

Surplus for the year 14,377

30 Proposed Greater Bendigo City Council Budget - 2012/13

3. Budget Influences This section sets out the key budget influences arising from the internal and external environment within which the Council operates. 3.1 Snapshot of Greater Bendigo City Council Located within central Victoria, Greater Bendigo has a catchment of over 200,000 people and a population of 105,563 as at 30 June 2011. Population growth within Greater Bendigo was estimated to be 1.5% for the year ended 30 June 2011. The population is projected to be around 150,000 by 2036. The area of the municipality covers 2,999kms2. Greater Bendigo is the second largest city in regional Victoria. Its gross economic output is attributable to major industries and employment sectors including health and community services, retail, manufacturing, education, construction, property and business services, government administration, accommodation and hospitality, and banking and financial services. Being north of the Great Dividing Range, Bendigo enjoys a temperate climate. It has a proud gold mining heritage, boasting some of the finest examples of Victorian architecture and streetscapes in Australia. Bendigo is the home of Australia's longest running annual festival, The Bendigo Easter Festival. The City's cultural attractions include Bendigo Art Gallery, The Capital - Bendigo's Performing Arts Centre, Golden Dragon Museum, Central Deborah Mine, Bendigo Tramways and Bendigo Pottery. The municipality includes two National Parks - Greater Bendigo and Heathcote Greytown, both of which protect large areas of Box-Ironbark forest. 3.2 Emerging Issues with direct local short term impacts The Council Plan has been a significant influence in preparing the 2012/13 budget. In that document the emerging issues are outlined in detail, as well as being summarised below:

State and Federal focus on regional Australia. Supporting cultural diversity and tolerant neighbours. Approaches to supporting population behaviour changes. Climate change adaptation. Our City: Planning for growth. Access to high-speed broadband internet services.

3.3 External Influences In addition, external budget influences are:

Constrained Federal and State Government fiscal environment. The increasing regulatory environment which requires City of Greater Bendigo to apply

resources to meet legislation standards specifically: o The increase in the levy which City of Greater Bendigo is required to pay to the

Environment Protection Authority for the disposal of waste to landfill. o The impact of carbon price related to the disposal of waste to landfill. o Expected substantial increase in utility costs. o Changes in emergency management requirements. o The increased environmental standards relating to waste management impacting on the

future development of the landfill site. o Changes to Child Care Centre regulations requiring higher staff to child ratios.

Selection of Greater Bendigo by the Federal Government to undertake the Healthy Communities Project.

Proposed Greater Bendigo City Council Budget - 2012/13 31

3.4 Internal Influences There are a number of internal influences which have had a significant impact on the preparation of the 2012/13 Budget being:

Prioritisation by Council of several large capital works projects that will require increased funding both through rate revenue and loan borrowings.

Recognition that the achievement of Strategic Objectives must allow for the organisational capacity to deliver them in an environment of limited financial resources and the availability of appropriately skilled staff.

Additional staffing required to meet service requirements. Investment in developing workforce capability. The requirement to address the renewal gap caused by ageing infrastructure by funding capital

renewal and upgrades. Introduction of a one per cent efficiency target on operations. Improvement to on-line presence through website development. Commitment to increased service standards regarding tree clearances and grass slashing in

rural and urban areas. Increased effort in drainage maintenance and upgrade of drainage assets. Introduction of a higher quality road resheeting program.

3.5 Budget Principles

Theme Principle

1 Best Value Take account of Best Value Principles as per the Local Government Act:

All services must meet quality and cost standards All services must be responsive to the needs of the

community Each service must be accessible by those members of the

community for whom the service is intended Council must achieve continuous improvement in the

provision of services to the community Council must develop a program of consultation with the

community in relation to the services it provides and report regularly to the community.

2 Alignment Council's budget will take account of Council Plan and other strategic plans.

3 Balance The budget will aim to balance the demand for services and infrastructure with the community's ability to pay. Proposals for service delivery expansion or capital works projects must demonstrate consideration of social, economic and environmental impacts on the community.

4 Capital Works The Capital Works program will allow for Council's asset renewal needs in line with its Asset Management Plans and Policy.

5 Borrowings Debt servicing costs to rate revenue will be less than 10%.

32 Proposed Greater Bendigo City Council Budget - 2012/13

Theme Principle

6 User Fees and Charges

Progress toward achieving full cost recovery for the major non-statutory fees and charges for services unless justification for another method is provided. Fees and charges (other than the major fees and charges), are to be increased in line with CPI or market levels, unless an alternative business case is approved.

7 Revenue sources New revenue sources are to be identified where possible.

8 New staffing positions

New employee proposals which are not cost neutral are to be justified through a business case that demonstrates increased service demand or the development of a new service/initiative which is aligned with the Council Plan.

9 Working capital ratio

Aim to maintain a working capital ratio of no less than 120%, which means for every $1 of current liabilities, CoGB has $1.20 of current assets.

10 Service growth Service expansions or improvements are initially to be funded by more efficient use of resources.

11 Efficiency target Achieve a 1% reduction in costs related to Contract Payments, Materials and Services across the operating budget. This is to be calculated as Prior Year budget (Local Government Cost Index + 1% business growth) less 1% efficiency target.

12 Community Capacity Building

Work is to be undertaken with the community in building their capacity to become self sufficient

Budget Principles 1 to 10 are similar to those utilised in the development of the 2011/12 budget. The additional Budget Principles (11 and 12) are to: ensure the Organisation's continued focus on achieving efficiencies in operations. While

currently being an important focus in the operations of the City of Greater Bendigo, it is useful to be explicit in the budget principles regarding this requirement. Council has set a budget principle to achieve one per cent efficiency in materials contracts and services. This target of $600,000 relates to the operating budget. During 2012/13, the organisation will review processes and systems to find savings by increasing efficiency and eliminating waste. Further work is being undertaken to establish a systematic approach to achieving efficiencies, in line with the obligation to deliver Best Value to the community.

reduce community reliance on the City of Greater Bendigo by building community capacity. The development of community capacity enables improved outcomes for the community, as people become more self-sufficient. It will also enable resources currently allocated to undertaking community work and funding community projects, to be diverted to areas of new and emerging community needs over time.

3.6 Legislative Requirements Council is required to prepare and adopt an annual budget for each financial year. The budget is required to include certain information about the rates and charges that Council intends to levy as well as a range of other information required by the Local Government (Finance and Reporting) Regulations 2004 (the Regulations) which support the Act. This budget is for the year 1 July 2012 to 30 June 2013 and is prepared in accordance with the Act and Regulations. The budget includes standard statements being a budgeted Income Statement, Balance Sheet, Cash Flow and Capital Works. These statements have been prepared for the year

Proposed Greater Bendigo City Council Budget - 2012/13 33

ended 30 June 2013 in accordance with Accounting Standards and other mandatory professional reporting requirements and in accordance with the Act and Regulations. It also includes detailed information about the rates and charges to be levied, the capital works program to be undertaken and other financial information, which Council requires in order to make an informed decision about the adoption of the budget. The budget includes consideration of a number of long term strategies to assist Council in adopting the Budget in a proper financial management context. These include a Strategic Resource Plan for the years 2012/13 to 2015/16 (Section 8), Rating Strategy (Section 9) and Other Strategies (Section 10) which include borrowings, infrastructure and service delivery.

34 Proposed Greater Bendigo City Council Budget - 2012/13

4. Analysis of Operating Budget 4.1 Budgeted Operating Statement

Ref

Forecast Actual

2011/12 $’000

Budget 2012/13

$’000

Variance $’000

Operating Revenue 4.2 149,310 148,495 (815)

Operating Expenditure 4.3 127,793 134,118 (6,325)

Surplus (Deficit) for the year 21,517 14,377 (7,140) Net loss on disposal/write off of property, plant and equipment 3,000 3,000 0 Grants – Capital 4.2.8 (4,933) (9,645) (4,712) Granted assets (5,230) (5,870) (640) Underlying surplus (deficit) 14,354 1,862 (12,492)

4.1.1 Underlying surplus ($12.49 million decrease) The underlying result is the net surplus or deficit for the year adjusted for capital grants, contributions of non-monetary assets and other once-off adjustments. It is a measure of financial sustainability as it is not impacted by non-recurring or once-off items of revenues and expenses which can often mask the operating result. The underlying result for the 2012/13 year is a surplus of $1.86 million compared to the 2011/12 forecast surplus of $14.35 million. This decrease is heavily influenced by the timing of the Victorian Grants Commission funding which is based on receipt of five quarterly payments in 2011/2012 which reduces the number of quarters budgeted to be received in 2012/13 to two quarters only. The 2012/13 result also includes considerably higher capital grants for projects such as Bendigo Art Gallery Expansion and Bendigo Library Redevelopment. 4.2 Operating Revenue

Revenue Types Ref

Forecast Actual

2011/12 $’000

Budget 2012/13

$’000

Variance $’000

Rates and charges 4.2.1 73,800 79,711 5,911 Statutory fees and fines 4.2.2 2,922 3,121 199 User charges, fees and fines 4.2.3 21,635 21,025 (610) Reimbursements 4.2.4 326 336 10 Contributions - cash 4.2.5 4,773 5,755 982 Contributions - non monetary assets 4.2.6 5,230 5,870 640 Government Grants - operating 4.2.7 34,224 21,075 (13,149) Government Grants - capital 4.2.8 4,933 9,645 4,712 Interest revenue 4.2.9 1,467 1,957 490

Total Operating Revenue 149,310 148,495 (815)

Proposed Greater Bendigo City Council Budget - 2012/13 35

Operating Revenue

Interest

Grants - Cap

Grants - Oper

Contributions

User Fees

Rates &

Charges

Stat Fees/Fines

-16,000

-14,000

-12,000

-10,000

-8,000

-6,000

-4,000

-2,000

0

2,000

4,000

6,000

8,000

$'000

Change 11/12-12/13

Source: Appendix A 4.2.1 Rates and Charges ($5.9 million increase) Rates and charges represent the Council's income from general rates, municipal charges, garbage and recycling charges. The overall rates and charges income reflects an increase of 8.0% or $5.9 million over 2011/2012 forecast. Supplementary rates are expected to contribute $1.3 million to rate revenue in 2012/2013. Section 9 'Rating Strategy' includes a more detailed analysis of the rates and charges to be levied for 2012/13. 4.2.2 Statutory Fees and Fines ($.20 million increase) Statutory fees and fines relate to fees and fines levied in accordance with legislation and include animal registrations, parking fines, Health Act registrations and fines and various planning and building fees. Increases in statutory fees are made in accordance with legislative requirements. Statutory fees and fines are projected to increase by 6.8% or $200,000. The statutory fees and fines applicable for 2012/2013 are available on Council’s web site and can also be inspected at Council’s Customer Service Centres. 4.2.3 User Charges, Fees and Fines ($.61 million decrease) User charges relate mainly to the recovery of service delivery costs through the charging of fees to users of Council’s services. These services include use of leisure, entertainment and other community facilities and the provision of human services such as home care and child care services. In setting the budget, the key principle for determining the level of user charges has been to maintain parity of user charges with service delivery costs where possible, taking into account the economic climate.

36 Proposed Greater Bendigo City Council Budget - 2012/13

User charges, fees and fines are projected to decrease by 2.73% or $610,000 over the 2011/12 forecast. The main areas contributing to the decrease are Bendigo Art Gallery ticketed exhibitions will reduce significantly in 2012/2013 resulting in a $2.74 million decrease in income and a corresponding decrease in shop sales of $403,000. The reduced exhibitions also impact The Capital Box Office $296,000. There is increased income from Children’s Services $247,000, parking (including the Edward St Multi Deck Carpark) $708,000 and Landfill Fees $951,000. The fees and charges applicable for 2012/2013 are available on Council’s web site and can also be inspected at Council’s Customer Service Centres. 4.2.4 Reimbursements ($.01 million increase) Reimbursements include amounts from workcover and insurance claims. 4.2.5 Contributions - cash ($.98 million increase) Contributions include monies paid by developers in accordance with planning permits issued for property development, and contributions made by various parties towards provision of services and Capital/Major Projects. Contributions are projected to increase by $.98 million or 20.57% compared to the 2011/12 forecast. This includes an increase of $1.02 million in contributions towards Capital/Major Projects due to the nature of the projects in the 2012/13 budget, bi-annual contribution from Valuer General towards revaluation information $490,000 and a reduction in development contributions of $405,000 based on anticipated development applications. 4.2.6 Contributions – non monetary assets ($.64 million increase) Non monetary assets include developer constructed assets contributed by developers in accordance with planning permits issued for property development. The increase reflects the trend of developers constructing assets and transferring ownership to City of Greater Bendigo. 4.2.7 Grants – operating ($13.15 million decrease) Operating grants include all monies received from State and Federal sources for the purposes of funding the delivery of Council’s services to ratepayers. Overall, the level of operating grants has decreased by 38.42% or $13.15 million compared to 2011/12 forecast. Significant movements in grant funding are summarised below:

Grant Funding Types

Forecast Actual

2011/12 $’000

Budget 2012/13

$’000

Variance $’000

Risk Management 1,605 0 (1,605) Major Project Funding Marong Early Learning Centre 835 0 (810) Major Project Funding Restoration Bendigo Creek 840 0 (840) Victorian Grants Commission 18,025 7,528 (10,497)

The decrease in Risk Management grant funding of $1.61 million relates to one off grants anticipated to be received in 2011/12 towards the recovery from the January/February 2011 storms. A one off grant will be received in 2011/12 towards the development of the Marong Early Learning Centre with Council acting as the auspice body. The decrease in Victorian Grants Commission funding is based on receipt of five quarterly payments in 2011/2012 which reduces the number of quarters budgeted to be received in 2012/13 to 2 quarters only.

Proposed Greater Bendigo City Council Budget - 2012/13 37

4.2.8 Grants - capital ($4.71 million increase) Capital grants include all monies received from State, Federal and community sources for the purposes of funding the Capital Works program. Overall the level of capital grants has increased by 95.5% or $4.71 million compared to the 2011/12 forecast due to specific funding for some large capital works projects in 2012/13 such as $3.78 million for Bendigo Art Gallery Expansion and $2.21 million for Bendigo Library Redevelopment. Section 6 “Analysis of Capital Budget” includes a more detailed analysis of the grants and contributions expected to be received during the 2012/13 year. 4.2.9 Interest Revenue ($.49 million increase) Interest revenue includes interest on investments and rate arrears. Interest is budgeted to increase by 33.4% or $490,000 compared to the 2011/12 forecast. This is mainly attributable to cash flow predictions, particularly in relation to Capital Works funding and corresponding expenditure in 2012/2013. 4.3 Operating Expenditure

Expenditure Types Ref

Forecast Actual

2011/12 $’000

Budget 2012/13

$’000

Variance $’000

Employee benefits 4.3.1 44,369 47,764 (3,395) Contracts, materials and services 4.3.2 50,197 50,324 (127) Plant and equipment operating costs 4.3.3 3,750 4,112 (362) Borrowing costs 4.3.4 438 1,146 (708) Bad debts 4.3.5 43 55 (12) Net loss on sale/write off of assets 3,000 3,000 0 Depreciation and amortisation 4.3.6 25,996 27,717 (1,721)

Total Operating Expenditure 127,793 134,118 (6,325)

Operating Expenditure

Plant

Deprec'n

Bad debts

Borrowing Costs

Cont, Mat & Serv

Emp Benefits

-1,000

0

1,000

2,000

3,000

4,000

$'000

Change 11/12-12/13

Source: Appendix A

38 Proposed Greater Bendigo City Council Budget - 2012/13