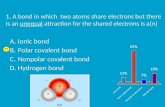

Ionic bond Polar covalent bond Nonpolar covalent bond Hydrogen bond

Build a Better Bond James C. McClendon, Chief Investment Officer & Managing Director.

-

Upload

clara-shaw -

Category

Documents

-

view

215 -

download

0

Transcript of Build a Better Bond James C. McClendon, Chief Investment Officer & Managing Director.

Build a Better Bond

James C. McClendon, Chief Investment Officer & Managing Director

Interest Rates

Fixed Income Sector Returns

Source: J. P. Morgan Asset Management

Treasuries

Mortgage Related

Corporates

AgenciesAsset Backed

The Bond Market Has Many Different Components

Total Bond Market

Interest Rate Sensitive Economically Sensitive

Fixed Income market has changed

Source: Guggenheim Partners, SIFMA, Credit Suisse, Barclays. Data as of June 30, 2013

Global Bond Market• Bond market has evolved, so

has volatility

Global Opportunities = Higher Vol

STANDARD DEVIATIONIndex 1 Year 3 Year 5 Year

Barclays US Aggregate Bond Index 2.58 2.67 2.83

Barclays Global Aggregate Bond Index 4.18 4.17 5.19

JPMorgan Emerging Markets Bond Index 6.37 8.02 7.40

Price Impact of 1% Change in Interest Rates

• Large impact on returns across sectors with 1% increase in rates.

• No where to run• No where to hide

Price Impact of 1% Change in Interest Rates

• Floating Rate Fixed income Portfolio would be down -0.1%

• 30yr UST Portfolio would be down -17.4%

Portfolio returns could range

from -0.1% to -17.4%

Taper Tantrum

4 month return = -4.5%

11

Taper Tantrum

4.5% Drawdown

Rolling Returns

• One Year Rolling Returns

J F M A M J J A S O N D J F M A

Rolling Returns

• Three Year Rolling Returns

JFMAMJJASONDJFMAJJASONDJFMAMJJASONDJFMAMJJASONDJFMAMJJASOND

Barclays Intermediate Government/CreditRolling Returns 1 – 15 years

1 3 5 7 9 11 13 15 17 19 21 23 2518.06% 15.19% 11.18% 11.15% 11.07% 9.77% 9.68% 9.48% 8.98% 9.02% 8.51% 8.02% 7.88%-1.93% 2.90% 3.99% 4.39% 4.23% 4.13% 4.94% 4.98% 5.36% 5.76% 5.58% 6.05% 6.44%7.23% 7.16% 7.06% 7.03% 6.95% 6.92% 6.95% 6.93% 6.95% 6.96% 6.93% 7.00% 7.05%

Expectations of Return

• For Returns: BONDS*Average Return Range of Returns

1 Yr -1.93 to 18.13 Yrs 2.90 to

15.195 Yrs 3.99 to 11.187 Yrs 4.39 to 11.159 Yrs 4.23 to 11.0711 Yrs 4.13 to 9.77

1 Yr 7.233 Yrs 7.165 Yrs 7.067 Yrs 7.039 Yrs 6.9511 Yrs 6.92

*BARCLAYS INTERMEDIATE GOVT/CREDIT Interm Index (1/1/1984 through 12/31/2013)

Interest Rates

Rates and bond prices move in opposite directions

A Better Bond Portfolio

Bonds

Equities

TraditionalBalanced Portfolio

Traditional Balanced Portfolio

• Combining stocks and bonds in a Balanced Portfolio offers investors diversification and an opportunity to achieve improved risk-adjusted performance

Bridging the performance gap between stocks and bonds (10yrs)

100% 100% 60% StocksBonds Stocks 40% Bonds

2003 4.10% 28.68% 18.64%2004 4.34% 10.88% 8.35%2005 2.43% 4.91% 3.94%2006 4.33% 15.79% 11.14%2007 6.97% 5.49% 6.19%2008 5.24% -37.00% -21.63%2009 5.93% 26.46% 18.46%2010 6.54% 15.06% 12.19%2011 7.84% 2.11% 4.98%2012 4.21% 16.00% 11.37%2013 -2.02% 32.39% 17.73%

Annual Returns

S&P 500 TR

Traditional Balanced Portfolio

Barclays Agg Bond

22

Drawdown (10 yrs)

Taper Tantrum

4 month return = -4.5%

How did Traditional Balanced Portfolio performed during 4/2013 through 11/2013?

24

Taper Tantrum

Barclays drop = -4.5%

Traditional Balanced drop = -1.3%

Traditional Balanced Portfolio• The 60/40 Traditional Balanced portfolio provides

an opportunity for improved risk-adjusted performance, capturing 90% of the return delivered by equities with only 65% of the volatility

Equities

Bonds

Risk/Reward profile

Traditional Balanced Portfolio

• Higher return than Bond Portfolio• Lower volatility than Equity Portfolio• Steady, consistent, predictable returns

A Better Balanced Portfolio

TPFG Better Balanced PortfolioGuarantee no annual lossUse annuities to offset equityStrong risk-adjusted-returns

TPFG Better Balanced Portfolio

Annuity

Equities

TPFGBalanced Portfolio

30

TPFG Balanced 30% Fixed, 70% Equity

Traditional Balanced

TPFG Balanced 50% Fixed, 50% Equity

TPFG Balanced 70% Fixed, 30% Equity

Barclays US Agg Bond

S&P 500

Taper Tantrum

4 month return = -4.5%

How about TPFG Better Balanced Portfolio performance during this time?

Taper Tantrum

Barclays Agg with 0% loss

Barclays Agg.

33

Taper Tantrum

Traditional Balanced drop = -1.3%

Barclays drop = -4.5%

TPFG Better Balanced Portfolios never dropped below zero

Deliver predictable results with reasonable risk

TPFG’s ROLE

THANK YOU!

QUESTIONS?

Risk Management

Risk Management

Use the right tools to build the right portfolio for your client