AUG. 20-21, 2018 AUG. 22-24, 2018 - Constant...

Transcript of AUG. 20-21, 2018 AUG. 22-24, 2018 - Constant...

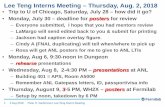

COMMUNITY BANKING CONFERENCES

AUG. 20-21, 2018 AUG. 22-24, 2018West Des Moines, IA Blue Springs, MO

A special THANK YOU to the sponsors for helping provide exceptional, yet affordable, conference content to our attendees.

In the Midwestit’s not just a bank, it’s the

cornerstone of the community.

10:45–11:45 a.m. The Regulatory Relief Legislation and Implications to Banks from Rising Interest Rates: What Every Banker Needs to Know Julie Stackhouse, Executive Vice President, Supervision, Credit, Community Development and the Center for Learning Innovation, Federal Reserve Bank of St. Louis

We will discuss the relief impact to banks resulting from the passage of the Economic Growth, Regulatory Relief, and Consumer Protection Act. She will also look at recent trends in short-term interest rates and discuss the impact on banks and consumers.

11:45 a.m.–12:30 p.m. Lunch

12:30–1:30 p.m. Good Times Are Here Again, But Let’s Not Forget The Importance of Banking Fundamentals. Allen North, Assistant Vice President, Safety and Soundness Supervision, Federal Reserve Bank of St. Louis

It’s been a while since the Financial Crisis, but memories can be short. Exercising strong banking fundamentals in terms of risk taking and overall risk management practices are as important as ever. We will cover current agricultural conditions and best credit risk practices, challenges in managing liquidity, and helpful hints for capital planning for smaller community banks. Additionally, we will demonstrate the importance of key operating controls by sharing recent “war stories.”

1:30–2:30 p.m. The Current State of CECL and What We’ve Learned So Far Bert Purdy, CPA, CTFA, BKD

The CECL standard has been finalized for two years now and we’re quickly approaching its effective date. In this session, attendees will be updated on the most common practices to date as well as some best practices to implement during implementation.

2:30–2:45 p.m. Refreshment Break with Exhibitors

2:45–3:45 p.m. A Community Banker’s Guide to Faster Payments Sheila Noll, EVP/Chief Operations Officer, MIB Bob Steen, CEO, Bridge Community Bank

Faster payments are about much more than just staying relevant. Community Bankers, as their customers’ most trusted advisors, have an opportunity in this brave new world of payments to provide valuable and competitive offerings to their market, but they must first devise a payment strategy that fits the mold of their individual bank in order to take advantage of that opportunity. Join us as we talk through what the market is doing and what you can be doing to prepare your bank and your customers for the faster payment revolution.

3:45–4:45 p.m. The Informant Bob Herndon, Supervisory Special Agent, FBI (retired)

The inside story of an investigation that became a New York Times bestseller and was the basis for the movie The Informant, starring Matt Damon. The presentation centers on how greed brought down one of America’s most politically connected corporations while also briefly touching upon embezzlement trends, the value of customer due diligence, and the importance of SAR’s.

4:45–5:00 p.m. Conference Wrap-up, Prizes and Adjournment

DAY 1 – MONDAY, AUG. 20 12:00–1:00 p.m. Registration

1:00–2:30 p.m. Twitter, LinkedIn, Facebook, Instagram Chris Lorence, ICBA, Group Executive Vice

President, Member Engagement & Strategy/Chief Marketing Officer

So many social media channels but which, if any, should you and your community bank consider using? We’ll explore how to maximize the opportunities for engagement while developing relationships that translate to meaningful referrals and new business. Learn the three simple steps to take charge of your social media presence and extend your reach into the community without ever leaving your office. #SocialBoss

2:30–2:45 p.m. Afternoon Break

2:45–3:45 p.m. How to Make Your Marketing Relevant and Responsive to the Bottom Line

Becki Drahota, CEO, Mills Marketing Sarah Bacehowski, President, Mills Marketing

The days of treating marketing as an expense are gone. Heightened competition, digital channels and AI-driven customer experiences demand a new mission, operating model and skill set for your marketing resources. How do you make the transition? How long will it take? What will you lose by not taking action? Get the answers—and a plan—in this high energy session.

3:45–5:00 p.m. Marketing Panel Moderator — Chris Lorence, ICBA, Group Executive

Vice President, Member Engagement & Strategy/ Chief Marketing Officer Penny Gray, VP/Marketing - First Security Bank & Trust, Charles City Becki Drahota, CEO, Mills Marketing Sarah Bacehowski, President, Mills Marketing

5:00–6:00 p.m. Registration Desk Open

DAY 2 – TUESDAY, AUG. 217:30–8:15 a.m. Registration & Continental Breakfast

8:15–8:30 a.m. Conference Welcome and Introductions

8:30–9:30 a.m. The Case of the Missing Bank Dave Defazio, Partner, StrategyCorps

The scene is set. You’ve arrived at your destination and your Uber payment is already complete. But where was your bank’s debit card in the transaction? The financial institution has gone missing, and it’s up to you to solve the mystery of how to bring it back to the forefront of modern payments.

9:30–9:45 a.m. Refreshment Break with Exhibitors

9:45–10:45 a.m. Navigating Your Vendor Contracts Sherry Jessen, Manager, CliftonLarsonAllen, LLP

Avoid reactionary technology decisions that may provide short-lived relief, but long-term consequences. Instead, gain some practical advice on navigating through your vendor relationships and securing favorable contracts that are aligned with organizational needs strategically, operationally, functionally, and economically. This session will provide you with proven strategies and experiences helping you to better assess your current vendors and prepare you for future selection and/or negotiation with lasting benefits.

IOWA CONFERENCE AGENDA

Media Sponsor

11:15 a.m.–12:15 p.m. The Regulatory Relief Legislation and Implications to Banks from Rising Interest Rates: What Every Banker Needs to Know Julie Stackhouse, Executive Vice President, Supervision, Credit, Community Development and the Center for Learning Innovation, Federal Reserve Bank of St. Louis

We will discuss the relief impact to banks resulting from the passage of the Economic Growth, Regulatory Relief, and Consumer Protection Act. She will also look at recent trends in short-term interest rates and discuss the impact on banks and consumers.

12:15–1:15 p.m. Lunch

1:15–2:15 p.m. BREAKOUT SESSION I

A Community Banker’s Guide to Faster Payments Sheila Noll, EVP/Chief Operations Officer, MIB

Faster payments are about much more than just staying relevant. Community Bankers, as their customers’ most trusted advisors, have an opportunity in this brave new world of payments to provide valuable and competitive offerings to their market, but they must first devise a payment strategy that fits the mold of their individual bank in order to take advantage of that opportunity. Join us as we talk through what the market is doing and what you can be doing to prepare your bank and your customers for the faster payment revolution.

Good Times Are Here Again, But Let’s Not Forget The Importance of Banking Fundamentals. Allen North, Assistant Vice President, Safety and Soundness Supervision, Federal Reserve Bank of St. Louis

It’s been a while since the Financial Crisis, but memories can be short. Exercising strong banking fundamentals in terms of risk taking and overall risk management practices are as important as ever. We will cover current agricultural conditions and best credit risk practices, challenges in managing liquidity, and helpful hints for capital planning for smaller community banks. Additionally, we will demonstrate the importance of key operating controls by sharing recent “war stories.”

Accessibility 101 for Banking Keith Bundy, Digital Accessibility Consultant & Trainer, Siteimprove

Why should banks be concerned about online accessibility? In this session we will explain several reasons why they need to be concerned. In addition, we will give ten steps toward accessibility that can be quickly implemented by your bank.

2:15–2:30 p.m. Refreshment Break with Exhibitors

2:30–3:30 p.m. BREAKOUT SESSION II

Good Times Are Here Again, But Let’s Not Forget The Importance of Banking Fundamentals. Allen North, Assistant Vice President, Safety and Soundness Supervision, Federal Reserve Bank of St. Louis

Repeat from Session I

Payment Technologies Today and on the Horizon Patrick O’Boyle, Partner, MSP Consulting Steve Beene, Partner, MSP Consulting

This session is an overview of omni-channel payment acceptance (mobile, e-commerce & beyond). Making sense of the often confusing marketplace. What payment solutions are in the more distant future?

DAY 1 — WEDNESDAY, AUG. 22 12:00–1:00 p.m. Registration

1:00–2:30 p.m. Twitter, LinkedIn, Facebook, Instagram Chris Lorence, ICBA, Group Executive Vice President,

Member Engagement & Strategy/Chief Marketing Officer

So many social media channels but which, if any, should you and your community bank consider using? We’ll explore how to maximize the opportunities for engagement while developing relationships that translate to meaningful referrals and new business. Learn the three simple steps to take charge of your social media presence and extend your reach into the community without ever leaving your office. #SocialBoss

2:30–2:45 p.m. Afternoon Break

2:45–3:45 p.m. How to Make Your Marketing Relevant and Responsive to the Bottom Line

Becki Drahota, CEO, Mills MarketingThe days of treating marketing as an expense are gone. Heightened competition, digital channels and AI-driven customer experiences demand a new mission, operating model and skill set for your marketing resources. How do you make the transition? How long will it take? What will you lose by not taking action? Get the answers—and a plan—in this high energy session.

3:45–5:00 p.m. Marketing Panel Moderator — Chris Lorence, ICBA, Group Executive

Vice President, Member Engagement & Strategy/ Chief Marketing Officer Jen Barrow, CFMP, Marketing Officer, Two Rivers Bank Becki Drahota, CEO, Mills Marketing Amanda Lee, Assistant Cashier, First State Bank of Purdy

5:00–6:00 p.m. Registration Desk Open

DAY 2 — THURSDAY, AUG. 23 7:00–8:00 a.m. Registration Desk Open & Continental Breakfast

8:00–8:15 a.m. Conference Welcome and Introductions

8:15–8:25 a.m. Introduction of Keynote Speaker Team Member of Western Union

8:25–9:55 a.m. Leadership Excellence: The Power Of Stories To Influence and Engage Benjamin Akande, motivational speaker

When the right stories are told, remarkable things happen. Authentic leaders use stories to influence, inspire, and engage others. Stories are critical for

communicating your leadership vision, building a sense of collective purpose, and expanding your sphere of influence. Participants in this session will learn how to achieve greater impact and improved results through the effective use of stories

9:55–10:10 a.m. Refreshment Break with Exhibitors

10:10–11:15 a.m. The Informant Bob Herndon, Supervisory Special Agent, FBI (retired)

The inside story of an investigation that became a New York Times bestseller and was the basis for the movie The Informant, starring Matt Damon. The presentation centers on how greed brought down one of America’s most politically connected corporations while also briefly touching upon embezzlement trends, the value of customer due diligence, and the importance of SAR’s.

continued on back

MISSOURI CONFERENCE AGENDA

Keynote Speaker Sponsor (Thursday)

Lunch Sponsor

Media Sponsor

Break Sponsor

The Changing Landscape of Community Bank Taxation after Tax Reform Amanda Garrett, Financial Institution Principal, CliftonLarsonAllen, LLP

The Tax Cuts and Jobs Act (TCJA) signed last December was the most significant piece of tax legislation passed in the last 30 years. Both C Corporation and S Corporation banks and their owners need to carefully consider how the new law impacts their long term strategic plans and corporate structure. Join us for this informative session regarding the new tax law.

3:35–4:45 p.m. BREAKOUT SESSION III

Skimming / Card Cloning Mike Burke, Robbery & Crisis Management Consultant, SHAZAM

When you understand the fine details of skimming and cloning cards, everyone stays safe. This presentation prepares you to identify internal and external skimmers at the ATM, POS and fuel dispensers along with cameras that capture PINs. Real-life photos show you exactly what to look for while videos highlight how thieves set up these devices and steal from financial institutions, accountholders and merchants. A live demonstration will emphasize just how quick and easy it is to clone a card and make an immediate transaction.

The Current State of CECL and What We’ve Learned So Far Bert Purdy, CPA, CTFA, BKD

The CECL standard has been finalized for two years now and we’re quickly approaching its effective date. In this session, attendees will be updated on the most common practices to date as well as some best practices to implement during implementation.

Using Cybersecurity To Regain The Trust Of Banking Customers Jarrett Kolthoff, President/CEO, SpearTip

Consumer mistrust in corporate cybersecurity is reaching all-time highs this year. A recent study conducted by the New York-based American Institute of CPAs (AICPA) stated that 81% of Americans are at least somewhat concerned about the ability of businesses to safeguard their financial and personal information, with two out of every five (40 %) reporting that they are extremely or very concerned. With a strategic cyber security roadmap implemented, you can demonstrate that you’re acting in a reasonable and prudent manner, with the best interests of your customers as your foremost goal.

5:00–6:30 p.m. Reception

MISSOURI CONFERENCE AGENDA(continued)

Day 3 – FRIDAY, AUG. 247:30–8:00 a.m. Buffet Breakfast

8:00–9:00 a.m. The Case of the Missing Bank Dave Defazio, Partner, StrategyCorps

The scene is set. You’ve arrived at your destination and your Uber payment is already complete. But where was your bank’s debit card in the transaction? The financial institution has gone missing, and it’s up to you to solve the mystery of how to bring it back to the forefront of modern payments.

9:00–10:00 a.m. Navigating Your Vendor Contracts Janine Wright, Director, CliftonLarsonAllen, LLP

Avoid reactionary technology decisions that may provide short-lived relief, but long-term consequences. Instead, gain some practical advice on navigating through your vendor relationships and securing favorable contracts that are aligned with organizational needs strategically, operationally, functionally, and economically. This session will provide you with proven strategies and experiences helping you to better assess your current vendors and prepare you for future selection and/or negotiation with lasting benefits.

10:00–10:15 a.m. Refreshment Break

10:15–11:45 a.m. Regulatory Panel with participation from the FDIC, Federal Reserve Bank-Kansas City, OCC & Division of Finance

11:50 a.m.–12:50 p.m. Cybercrime: How to Protect Yourself Against the Latest Threats Jeff Lanza, FBI (retired)

A retired FBI agent and security expert uses real life examples of the latest hacks, security breaches and computer scams to demonstrate how cybercrime occurs and what countermeasures we can take to combat the innovations of criminals.

12:50–1:15 p.m. Conference Wrap up, Prizes and Adjournment

Box Lunch Sponsor

A special thank you to the sponsors whohave helped defray the cost of this conference.

Reception Sponsors

![arXiv:1711.03225v3 [cs.CL] 28 Aug 2018](https://static.fdocuments.in/doc/165x107/626753c33a1cb8149c143824/arxiv171103225v3-cscl-28-aug-2018.jpg)

![arXiv:1710.11248v2 [cs.LG] 13 Aug 2018](https://static.fdocuments.in/doc/165x107/624f2cd535f37a79882dbe7b/arxiv171011248v2-cslg-13-aug-2018.jpg)

![arXiv:1805.12564v3 [cs.CV] 6 Aug 2018](https://static.fdocuments.in/doc/165x107/6200c0ec44d8c76bb4158962/arxiv180512564v3-cscv-6-aug-2018.jpg)

![arXiv:1808.09839v1 [cs.SI] 29 Aug 2018](https://static.fdocuments.in/doc/165x107/6202f0d1b1edf3284f408685/arxiv180809839v1-cssi-29-aug-2018.jpg)

![arXiv:1706.07269v3 [cs.AI] 15 Aug 2018](https://static.fdocuments.in/doc/165x107/61bd0ab561276e740b0ec216/arxiv170607269v3-csai-15-aug-2018.jpg)