ANTITRUST Music : Gustav Mahler, Symphony No. 1 (1888) Performed by Bavarian Radio Symphony...

-

Upload

barnard-lawson -

Category

Documents

-

view

219 -

download

0

Transcript of ANTITRUST Music : Gustav Mahler, Symphony No. 1 (1888) Performed by Bavarian Radio Symphony...

ANTITRUST

Music:

• Gustav Mahler, Symphony No. 1 (1888)

• Performed by Bavarian Radio Symphony Orchestra, Conductor: Rafael Kubelik (1968)

FACTORS AFFECTING DEMAND

• PERSONAL TASTE

• INCOME

• PRICE OF COMPLEMENTARY GOODS

• PRICE OF SUBSTITUTES

FIXED v. VARIABLE COSTS

• FIXED COSTS: DO NOT VARY IN SHORT RUN

• VARIABLE COSTS: VARY WITH LEVEL OF PRODUCTION

TOTAL v. AVERAGE COST

• TOTAL COST: ALL COSTS ASSOCIATED WITH PRODUCT LINE

• AVERAGE COST: MEAN COST PER ITEM PRODUCED

TOTAL v. AVERAGE COST

• TOTAL COST: ALL COSTS ASSOCIATED WITH PRODUCT LINE

• AVERAGE COST: MEAN COST PER ITEM PRODUCED– AVERAGE TOTAL COST

– AVERAGE VARIABLE COST

OPTIMUM CONDITIONS FOR COMPETITIVE EQUILIBRIUM• FUNGIBLE PRODUCT

• SUPPLIERS CAN’T AFFECT EACH OTHERS PRICING/OUTPUT

• MOBILITY/EQUALITY OF RESOURCE AVAILABILITY

• GOOD INFORMATION/LOW TRANSACTION COSTS

OPTIMUM CONDITIONS FOR COMPETITIVE EQUILIBRIUM• FUNGIBLE PRODUCT

• SUPPLIERS CAN’T AFFECT EACH OTHERS PRICING/OUTPUT

• MOBILITY/EQUALITY OF RESOURCE AVAILABILITY

• GOOD INFORMATION/LOW TRANSACTION COSTS

OPTIMUM CONDITIONS FOR COMPETITIVE EQUILIBRIUM• FUNGIBLE PRODUCT

• SUPPLIERS CAN’T AFFECT EACH OTHERS PRICING/OUTPUT

• MOBILITY/EQUALITY OF RESOURCE AVAILABILITY

• GOOD INFORMATION/LOW TRANSACTION COSTS

OPTIMUM CONDITIONS FOR COMPETITIVE EQUILIBRIUM• FUNGIBLE PRODUCT

• SUPPLIERS CAN’T AFFECT EACH OTHERS PRICING/OUTPUT

• MOBILITY/EQUALITY OF RESOURCE AVAILABILITY

• GOOD INFORMATION/LOW TRANSACTION COSTS

OPTIMUM CONDITIONS FOR COMPETITIVE EQUILIBRIUM• FUNGIBLE PRODUCT

• SUPPLIERS CAN’T AFFECT EACH OTHERS PRICING/OUTPUT

• MOBILITY/EQUALITY OF RESOURCE AVAILABILITY

• GOOD INFORMATION/LOW TRANSACTION COSTS

Q P TR MRI MC TC Pft 4 21 84 15 7 28 565 19 95 11 7 35 606 17 102 7 7 42 607 15 105 3 7 49 568 13 104 -1 7 56 489 11 99 -5 7 63 3610 9 90 -9 7 70 2011 7 77 -13 7 77 012 5 60 -17 7 84 -24

Q P TR MRI MC TC Pft 4 21 84 15 7 28 565 19 95 11 7 35 606 17 102 7 7 42 607 15 105 3 7 49 568 13 104 -1 7 56 489 11 99 -5 7 63 3610 9 90 -9 7 70 2011 7 77 -13 7 77 012 5 60 -17 7 84 -24

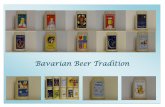

BARRIERS TO ENTRY

• LIMITED ACCESS TO KEY RESOURCES

• GOVERNMENT REGULATION

• HIGH FIXED COSTS

• BRAND LOYALTY