Altona - Ppt -_November_2013

-

Upload

jerry-thng -

Category

Documents

-

view

218 -

download

0

Transcript of Altona - Ppt -_November_2013

-

8/13/2019 Altona - Ppt -_November_2013

1/36

altonamining.com November 2013

Corporate Presentation

November 2013

www.altonamining.comACN 090 468 018

ASX: AOHFSE: A2O

-

8/13/2019 Altona - Ppt -_November_2013

2/36

altonamining.com November 2013 2.

Disclaimer and JORC ComplianceDisclaimer and JORC Compliance

What You Should Know

Find out more - This presentation is being used as a presenters aid with summarised information. See Altonasother periodic and continuous disclosure announcements lodged with the Australian Securities Exchange, which areavailable at www.asx.com.au or www.altonamining.com, for more information.

Third party information - Altona does not make any representations as to the accuracy or otherwise of third party

information, including where projections are given.

Forward-looking statements - Within this presentation there may be certain forward-looking statements, opinionsand estimates. These are based on assumptions and contingencies which are subject to change without notice andare not guarantees of future performance. Altona assumes no obligation to update such information.

Taking action - Please undertake your own evaluation of the information in this presentation and contact yourprofessional advisers if you wish to buy or sell Altona shares.

Competent Person Statement

The information in this report that relates to Exploration Results, Mineral Resources or Ore Reserves is based oninformation compiled by Dr Alistair Cowden BSc (Hons), PhD, MAusIMM, MAIG who is a full time employee of theCompany and has sufficient experience which is relevant to the style of mineralisation and type of deposit under

consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2012Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. DrCowden has consented to the inclusion in the report of the matters based on his information in the form and context inwhich it appears.

Copper Equivalence

Copper equivalence refers to production only where total revenues are expressed as copper revenues, ie. Revenuecopper price. It does not refer to Resources, Reserves or drill results.

-

8/13/2019 Altona - Ppt -_November_2013

3/36

altonamining.com November 2013

A sustained step change in copper markets in 2005

Post 2005 price averages: US$7,265 (US$3.30/lb)

We Believe in CopperWe Believe in Copper

3.

$1,577 $1,558

$1,780

$2,868

$3,684

$6,731$7,126 $6,952

$5,164

$7,540

$8,811

$7,958

$7,670

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013YTD

Today

-

8/13/2019 Altona - Ppt -_November_2013

4/36

altonamining.com November 2013 4.

Growing Copper Production and OptionalityGrowing Copper Production and Optionality

Underground copper-gold mine in Finland

Outokumpu Project Roseby Project

Development ready, 40ktpa copper

-

8/13/2019 Altona - Ppt -_November_2013

5/36

altonamining.com November 2013

Altona Overview and ObjectivesAltona Overview and Objectives

A profitable 9,000ktpa copper producer at Outokumpu in Finland withby-product gold, silver and zinc (12-13,000t copper equivalent) Considering production expansion at Outokumpu dependent on furtherreserve/resource growth from deep drill program Completed Definitive Feasibility Study for the Little Eva copper projectnear Mt Isa, Queensland has NPV of US$250 million

Little Eva could produce 39,000tpa copper and 17,000oz of gold peryear over a mine life in excess of 10 years at a C1 cash cost of US$1.73/lb

Pursuing a range of transactions to realise value / develop Roseby, withthe overriding objective being to maximise value for its shareholders5.

-

8/13/2019 Altona - Ppt -_November_2013

6/36

altonamining.com November 2013 6.

Corporate SnapshotCorporate Snapshot

Australian institutions: 32.0%

Foreign institutions: 20.0%

Board: 8.7%

German/Swiss retail: 7.0%

Top 20: 57.0%

Major Shareholders

ASX (Australia) code: AOH

FSE (Frankfurt) code: A2O

Share price (12-11-2013): A$0.15

Average daily turnover: 0.5M shares

Shares on issue: 532M

Market capitalisation: A$80M

Debt: US$21M

Cash (01-09-2013): A$26M

Research coverage: Credit Suisse

Market Status

Source: ASX

-

8/13/2019 Altona - Ppt -_November_2013

7/36

altonamining.com November 2013 7.

Outokumpu Copper Project in FinlandOutokumpu Copper Project in Finland

I metre

Massive copper sulphide ore indevelopment face

-

8/13/2019 Altona - Ppt -_November_2013

8/36

altonamining.com November 2013 8.

Finland is a Leading Mining DestinationFinland is a Leading Mining Destination

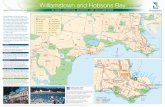

Al tonas projects are in eastern Fin land.

Geology is similar to other Archaeanand Proterozoic terrains in Australia and

Canada.

Euro zone country with a history of mining andmining equipment manufacturing, a stable taxregime (20.0%) and no royalties.

Major miners include Agnico Eagle, Anglo

American and First Quantum.

-

8/13/2019 Altona - Ppt -_November_2013

9/36

altonamining.com November 2013 9.

Mill, Mine and 5 Deposits in Historic OutokumpuMill, Mine and 5 Deposits in Historic Outokumpu

Keretti mine produced 1Mtcopper and 1 Moz goldfrom 1914 to 1989

Past or present mine

Resource

Prospect

-

8/13/2019 Altona - Ppt -_November_2013

10/36

November 2013altonamining.com 10.

Kylylahti Underground Mine

All infrastructure in place

-

8/13/2019 Altona - Ppt -_November_2013

11/36

November 2013altonamining.com 11.

Kylylahti Mine Key Facts

Status 600,000tpa, expansion underconsideration

Mine 5.5m x 5.5m decline tunnel,longhole open stopes with

cemented waste fill

Life of mineaverageproduction

Copper: 8,000tpaGold: 8,400ozpaZinc: 1,600tpa

Copper equiv: 12,000tpa

Mining cost 32/tonne including trucking

Mine life 7.6 years

Reserves 4.2Mt at 1.6% Cu, 0.7g/t Au,0.6% Zn

Resources 7.7Mt at 1.3% Cu, 0.7g/t Au,

0.5% Zn

Luikonlahti

Mill Interior

-

8/13/2019 Altona - Ppt -_November_2013

12/36

altonamining.com November 2013

Deep drilling underway to expand resources

Kylylahti Mine Open at Depth

12.

-

8/13/2019 Altona - Ppt -_November_2013

13/36

November 2013altonamining.com 13.

Luikonlahti Mill

-

8/13/2019 Altona - Ppt -_November_2013

14/36

November 2013altonamining.com 14.

Luikonlahti Mill Key Facts

Status 91.5% copper recovery.

71.5% gold recovery.

Products Copper-gold concentrate

Zinc concentrate.

Sales Bolidens Harjavaltasmelter 400km by truck,monthly payments.

FY2013 sales US$64M.

Plant capacity Up to 700,000tpa.

Milling cost 15/tonne plus 3/tonneconcentrate transport.

Cobalt Low-grade cobalt-nickel-copper concentrate in

storage dams

Interior Luikonlahti Mill Hall

Pebble mill 1 in action

-

8/13/2019 Altona - Ppt -_November_2013

15/36

November 2013altonamining.com

Mine and Mill Movie

15.

To view movie go towww.altonamining.com

-

8/13/2019 Altona - Ppt -_November_2013

16/36

November 2013altonamining.com 16.

Robust Quarterly Production PerformanceRobust Quarterly Production Performance

2012/2013 was a ramp up year and EBIT (earnings) were US$18.3 million.

* C1 cash cost calculated per Brook Hunt methodology. Cost data during commissioning period not meaningful.

0.5

0.7

0.9

1.1

1.3

1.5

1.7

1.9

2.1

2.3

2.5

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14

US$

/lb*T

onnes

By-products as Copper Equivalent Copper C1 Cost

-

8/13/2019 Altona - Ppt -_November_2013

17/36

altonamining.com November 2013 17.

Altona Among the Best ASX Copper ProducersAltona Among the Best ASX Copper Producers

Altonas C1 Cash cost calculated as per Brook Hunt methodology. Refer to websites of abovecompanies for their calculation method. Source: September quarterly activities reports of the

respective companies, except Hillgrove which is for the quarter ended 31 July.

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

C1 Cash Cost US$ / lb September Quarter

-

8/13/2019 Altona - Ppt -_November_2013

18/36

altonamining.com November 2013 18.

Increasing Resources and ReservesIncreasing Resources and Reserves

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

1.60

1.80

0

10000

20000

30000

40000

50000

60000

70000

80000

90000

FeasibilityStudy June2012 December2012 June2013

Co

pperGrade%

CopperTonnes

Productiondepletion OreReservesCut ReserveGrade

-

8/13/2019 Altona - Ppt -_November_2013

19/36

altonamining.com November 2013 19

Outokumpu Guidance FY2014Outokumpu Guidance FY2014

Metric Guidance Range

Ore (tonnes) 570,000 - 625,000

Copper grade (%) 1.50 - 1.65

Copper production (tonnes) 8,000 - 8,800Gold production (ounces) 8,400 - 9,200

C1 costs (US$/lb) 1.60 - 1.75

Production guidance increased after excellent first quarter

C1 cash cost guidance falls

Commence paying debt principal in Q3 FY2014

Capital expenditure will reduce significantly in FY2015

8,659 tonnes copper hedged to Q4 FY16 at 5,651/tonne (US$3.46/lb)

-

8/13/2019 Altona - Ppt -_November_2013

20/36

altonamining.com November 2013 20.

Outokumpu: Sustainable GrowthOutokumpu: Sustainable Growth

PRODUCTION AND GROWINGCASHFLOW

Currently 12 - 13,000tpa Cueq*, 7.6 yearlife. Reserve expansion likely, targeting700,000tpa throughput

STRATEGIC ASSET Leverage our mill and competencies in theNordic region

FINANCIALLY STRONGCash in bank, no net debt and positive

cashflow

EXPLORATION UPSIDE We control a major historic copper field

POTENTIAL FOR COBALT-NICKEL REVENUE

Storing US$50M of valuable metals inconcentrates in dams each year

* See Disclaimer.

-

8/13/2019 Altona - Ppt -_November_2013

21/36

November 2013altonamining.com

Roseby Copper Project

Litt le Eva

21.

Looking north-west

from Green Hills

-

8/13/2019 Altona - Ppt -_November_2013

22/36

November 2013altonamining.com 22.

3 Elements to the Litt le Eva Project3 Elements to the Litt le Eva Project

Lit tle Eva: A Development Ready Project

Fully permitted with DFS completed on a simple39,000tpa copper open pit mine and flotation plant

Major Resource Inventory

1.52Mt copper including 0.84Mt copper in deposits

within Little Eva Project tenure

Exploration

750km of exploration tenure prospective for copper,gold and zinc-lead-silver surrounds the Resources.800km2 Roseby South JV with Chinalco Yunnanleverages exploration exposure

-

8/13/2019 Altona - Ppt -_November_2013

23/36

altonamining.com November 2013 23.

A Strategic AssetA Strategic Asset

-

8/13/2019 Altona - Ppt -_November_2013

24/36

altonamining.com November 2013 24.

Little Eva is a Large DepositLittle Eva is a Large Deposit

1.3km long, 20-370m wide

Drilled up to 300m deep (511 drillholes,76km)

Large bulk IOCG style deposit similar toErnest Henry

Strip ratio of 1.8:1 after 15Mt pre-strip

Reserve: 53Mt ore at 0.6% copper, 0.1g/t

gold Additional 6Mt reserves in 3 small

satellite pits

15Mt of low grade ore stockpiled and

treated at end of mine life 11 year mine life

Underground potential

-

8/13/2019 Altona - Ppt -_November_2013

25/36

altonamining.com November 2013

May 2012 Definitive Feasibili ty StudyMay 2012 Definitive Feasibili ty Study

25.

Bankable DFS by GR EngineeringServices

Large, simple and well drilledresource

Straightforward open pit mining andprocessing for 11 years

Simple processing route

Quality copper-gold concentrate

Stable, skilled mining jurisdiction

Native title, environmental permitsand mining leases all in place

A$252 million NPV

A$320 million capital cost

US$1.73/lb cash cost Ernest Henry Mine Truck

-

8/13/2019 Altona - Ppt -_November_2013

26/36

altonamining.com November 2013

DFS Update PendingDFS Update Pending

DFS costs were top of market

Mining contractor rates downfrom DFS estimates

Engineering margins down Resource/Reserves

Incorporate post DFS drilling atTurkey Creek, Lady Clayre and Ivy

Ann Little Eva resource/reserve re-

modelling

Outlook

Lower operating costs

Lower capital costs

Longer mine life (>11 years)

26.

-

8/13/2019 Altona - Ppt -_November_2013

27/36

November 2013altonamining.com 27.

What Next for Little Eva?What Next for Little Eva?

Altona needs a partner todevelop Little Eva

Altona pursuing partnering,sale and corporate

opportunities that flow fromhaving a large developmentready copper asset

China has bought up the

Mt Isa area, eg: ShanxiDonghui A$160 million bid forcopper miner Inova

A number of Chinese partiesand others in the data room

Major land positions in Mt Isa

-

8/13/2019 Altona - Ppt -_November_2013

28/36

altonamining.com November 2013 28.

The Altona AdvantageThe Altona Advantage

PRODUCTION & CASHFLOWDe-risked copper-gold-zinc mine and millin Finland with strong growth profile

COPPER LEVERAGE1.66Mt (3.7mlbs) copper and 0.76Mozgold in resources

STRATEGIC OPTION

Little Eva copper-gold deposit nearing

decision to build / value realisation

STRONG FINANCIALSCash in bank, no net debt and positivecashflow

EXPLORATION UPSIDE We control two major copper fields

-

8/13/2019 Altona - Ppt -_November_2013

29/36

November 2013altonamining.com 29.

2011 was a turbulent year,2012 will be Altonas year to shine

Termite mounds watching summer

storms at the Blackard deposit

APPENDICES

-

8/13/2019 Altona - Ppt -_November_2013

30/36

altonamining.com November 2013 30.

An Experienced TeamAn Experienced Team

Al tona Management

Jarmo VesantoGeneral Manager Finland

Geologist

25 years Outokumpu Oyj in Finland,Canada and Australia

6 years as Manager in Finland

Al tona Board

Kevin Maloney

Non-Executive Chairman, founder of The Mac Services. Extensive career in retail banking,finance and resources

Paul Hallam Non-Executive Director, formerly Director of Operations at Fortescue and EGM Developmentand Projects for Newcrest

Peter Ingram Non-Executive Director , 45 years mining industry experienceSteve Scudamore Non-Executive Director , 28 years as a partner at international accounting and financial

services firm KPMG

Al istair CowdenManaging Director

Over 30 years experience as a geologistand mining company executive

Instrumental in listing Vulcan Resources,

Rox Resources, Archaean Gold andMagnetic Minerals

Eric HughesChief Financial Officer

Accountant, formerly BHP Billiton

20 years experience in financialmanagement of resources companies

10 years experience as CFO of listedcompanies

Iain ScottChief Operating Officer

Metallurgist, formerly Straits, Renison

25 years experience in mining andprocessing

15 years experience at COO and MDlevels

-

8/13/2019 Altona - Ppt -_November_2013

31/36

altonamining.com November 2013

Top 10 Shareholders (53.6%)Top 10 Shareholders (53.6%)

31.

Rank Shareholder Country No. of Shares %

1 Perpetual Investments Australia 73,422,491 13.8%

2 L1 Capital Australia 58,006,278 10.9%3

German retail clients throughClearstream Luxembourg

Germany 38,947,372 7.3%

4 Kevin Maloney (Chairman) Australia 35,348,000 6.6%

5 Thomas Roeggla and clients Monaco 29,626,422 5.6%

6 Colonial First State - Growth Australian Australia 11,200,000 2.1%

7 Matchpoint Investment Management Hong Kong 11,114,261 2.1%

8 Finnish Industry Investment Finland 10,261,300 1.9%9 Dr Alistair Cowden (MD) Australia 10,010,960 1.9%

10 Pareto Growth Norway 7,399,233 1.4%

-

8/13/2019 Altona - Ppt -_November_2013

32/36

altonamining.com November 2013 32.

Share Price has Outperformed other ASX CoppersShare Price has Outperformed other ASX Coppers

Altona commenced trading on 23 February 2010

0

50

100

150

200

250

300

350

Altona Hillgrove Ivanhoe Tiger OZMinerals AllOrdinaries

-

8/13/2019 Altona - Ppt -_November_2013

33/36

November 2013altonamining.com

I metre

Roseby Resource Estimates

DEPOSIT

TOTALCONTAINED

METAL MEASURED INDICATED INFERRED

Tonnes Grade Copper Gold Tonnes Grade Tonne Grade Tonnes Grade

millionCu(%)

Au(g/t)

tonnes ounces millionCu(%)

Au(g/t)

millionCu(%)

Au(g/t)

millionCu(%)

Au(g/t)

COPPER-GOLD DEPOSITS

Little Eva 100.3 0.54 0.09 538,000 271,000 36.3 0.63 0.08 41.4 0.48 0.08 22.6 0.49 0.11

Ivy Ann 7.5 0.57 0.07 43,000 17,000 5.4 0.60 0.08 2.1 0.49 0.06

Lady Clayre 14.0 0.56 0.20 78,000 85,000 3.6 0.60 0.24 10.4 0.54 0.18

Bedford 1.7 0.99 0.20 17,000 11,000 1.3 1.04 0.21 0.4 0.83 0.16

Sub-total 123.4 0.55 0.10 675,000 384,000 36.3 0.63 0.08 51.7 0.52 0.09 35.5 0.51 0.13

COPPER ONLY DEPOSITS

Blackard 76.4 0.62 475,000 27.0 0.68 6.6 0.60 42.7 0.59

Scanlan 22.2 0.65 143,000 18.4 0.65 3.8 0.60

Longamundi 10.4 0.66 69,000 10.4 0.66

Legend 17.4 0.54 94,000 17.4 0.54

Great Southern 6.0 0.61 37,000 6.0 0.61

Caroline 3.6 0.53 19,000 3.6 0.53

Charlie Brown 0.7 0.40 3,000 0.7 0.40Sub-total 136.7 0.61 840,000 27.0 0.68 25.0 0.64 84.7 0.59

TOTAL 260.1 0.58 0.05 1,515,000 384,000 63.2 0.65 0.05 76.7 0.55 0.06 120.1 0.56 0.04

See ASX release of 26 July 2011, 19 December 2011, 23 April 2012, 3 July 2012 and 22 August 2012 for full details of resourceestimation methodology and attributions.

Note: All figures may not sum exactly due to rounding.

Little Eva is reported above a 0.2% copper lower cut-off grade, all other deposits are above 0.3% copper lower cut-off grade.

33.

-

8/13/2019 Altona - Ppt -_November_2013

34/36

November 2013altonamining.com

Little Eva Project - Resource and Reserve EstimatesLittle Eva Project - Resource and Reserve Estimates

Tonnes(m)

Copper(%)

Gold(g/t)

ContainedCopper

(t)

ContainedGold(oz)

RESERVES

Proven 31.2 0.64 0.08 198,000 85,000Probable 28.1 0.53 0.10 149,000 90,000

Sub Total 59.3 0.59 0.09 347,000 174,000

Probable (stockpile) 15.3 0.18 0.06 28,000 31,000

Total 74.7 0.50 0.08 375,000 204,000Mining Inventory 1.9 0.51 0.23 10,000 14,000

Little Eva Project reserves are drawn from Little Eva, Lady Clayre and Ivy Ann.

34.

See ASX release of 14 May 2012 for full details of Reserve estimation methodology and attribution and 26 July 2011,19 December 2011, 23 April 2012 and 22 August 2012 for full details of Resource estimation methodology and attribution.

O t k R d R E ti tO t k R d R E ti t

-

8/13/2019 Altona - Ppt -_November_2013

35/36

altonamining.com November 2013 35.

Outokumpu Resource and Reserve EstimatesOutokumpu Resource and Reserve Estimates

Deposit Classification

Tonnes

(m)

Copper

(%)

Gold

(g/t)

Zinc

(%)

Cobalt

(%)

Nickel

(%)

Saramki Inferred 3.40 0.71 - 0.63 0.09 0.05

Vuonos Inferred 0.76 1.76 - 1.33 0.14 -

Hautalampi

Measured 1.03 0.47 - 0.06 0.13 0.47

Indicated 1.23 0.30 - 0.07 0.11 0.42

Inferred 0.90 0.30 - 0.10 0.10 0.40

Total 3.16 0.36 - 0.07 0.11 0.43Riihilahti Indicated 0.14 1.69 - - 0.04 0.16

Valkeisenranta Indicated 1.54 0.29 - - 0.03 0.71

Srkiniemi Indicated 0.10 0.35 - - 0.05 0.70

Sarkalahti Inferred 0.19 0.33 - - - 1.02

TOTAL 16.98 0.93 0.31 0.44 0.15 0.26

Kylylahti

Tonnes

(m)

Copper

(%)

Gold

(g/t)

Zinc

(%)

Cobalt

(%)

Nickel

(%)RESOURCES

Measured 1.4 1.22 0.56 0.55 0.23 0.20

Indicated 5.4 1.44 0.72 0.54 0.25 0.20

Inferred 0.9 0.64 0.59 0.36 0.17 0.25

TOTAL 7.7 1.31 0.68 0.52 0.23 0.21

Contained metal (t) 100,670167,850oz 40,360

18,000 15,900RESERVES

Proven 0.6 1.51 0.75 0.66 0.25 0.15

Probable 3.5 1.62 0.73 0.62 0.27 0.17

TOTAL 4.2 1.60 0.73 0.63 0.27 0.16

Contained metal (t) 66,700 97,700oz 26,100 11,100 6,900

See ASX release of 29 August 2013 for full details as required by the 2012 Edition of the Australasian Code for Reporting of

Exploration Results, Mineral Resources and Ore Reserves (JORC Code).

-

8/13/2019 Altona - Ppt -_November_2013

36/36

November 2013altonamining.com

Telephone: +61 8 9485 2929Facsimile: +61 8 9486 8700Email: [email protected]

www.altonamining.com