0706-16 Stephen Taylor Report (PDF)

Transcript of 0706-16 Stephen Taylor Report (PDF)

charteredaccountants.com.au

The Institute of Chartered Accountants in AustraliaGAAP-based financial reporting: measurement of business performance

Professor Stephen Taylor, The University of New South Wales, Sydney, Australia

The Institute of Chartered Accountants in Australia

GAAP-based financial reporting: measurement of business performance

The Institute of Chartered Accountants in Australia

The Institute of Chartered Accountants in

Australia (the Institute) is the professional

body representing Chartered Accountants

in Australia. Our reach extends to more than

53,000 of today and tomorrow’s business

leaders, representing some 43,000

Chartered Accountants and 10,000 of

Australia’s best accounting graduates who

are currently enrolled in our world-class

post-graduate program.

Our members work in diverse roles across

commerce and industry, academia,

government, and public practice throughout

Australia and in 107 countries around the world.

We aim to lead the profession by delivering

visionary thought leadership projects,

setting the benchmark for the highest

ethical, professional and educational

standards and enhancing and promoting

the Chartered Accountant brand. We also

represent the interests of members to

government, industry, academia and the

general public by actively engaging our

membership and local and international bodies

on public policy, government legislation and

regulatory issues.

The Institute can leverage advantages for its

members as a founding member of the Global

Accounting Alliance (GAA), an international

accounting coalition formed by the world’s

premier accounting bodies. The GAA has a

membership of 700,000 and promotes quality

professional services to share information and

collaborate on international accounting issues.

Established in 1928, the Institute is

constituted by Royal Charter. For further

information about the Institute, visit

charteredaccountants.com.au

Foreword

About this report

This monograph was written by Professor

Stephen Taylor from the University of New

South Wales in Sydney, Australia.

All materials in this monograph is current as at

July 2006.

In producing this monograph the author

acknowledges the benefit from discussions

with colleagues at the School of Accounting,

University of New South Wales, and particularly

the comments on earlier drafts by Jeff Coulton

(UNSW), Sarah McVay (NYU) and Caitlin

Ruddock (UNSW).

© The Institute of Chartered Accountants in Australia 2006

First published August 2006. First edition.

Published by: The Institute of Chartered Accountants in Australia

Address: 37 York Street, Sydney, New South Wales 2000

Author: Professor Stephen Taylor

ISBN: 1-921245-05-0

ABN 50 084 642 571 The Institute of Chartered Accountants in Australia Incorporated in Australia Members’ Liability Limited. 0706-16

Disclaimer: This monograph presents the opinions and comments of the author and not necessarily those of the Institute of Chartered

Accountants in Australia (the Institute) or its members. The contents are for general information only. They are not intended as professional

advice – for that you should consult a Chartered Accountant or other suitably qualified professional. The Institute expressly disclaims all liability

for any loss or damage arising from reliance upon any information contained in this paper.

The use of extensions to traditional financial reporting to capture performance

information, for example, the value of intangibles, corporate social responsibility

and sustainable strategies has become common practice. For accountants,

as preparers and interpreters of traditional financial statements, there is now

a required awareness of these new reporting extensions.

The Institute of Chartered Accountants in Australia, the premier accounting body

in the country, has a mandate to ensure that accounting as a discipline evolves to

meet these changes. This monograph was commissioned by the Institute and

written by Professor Stephen Taylor from the University of New South Wales in

Sydney. It provides an overview of the ‘conventional’ financial reporting produced

by the application of generally accepted accounting principles (GAAP). It is, in many

ways, a prequel to the reports, Extended performance reporting: an overview of

techniques, and Extended performance reporting: a review of empirical studies, both

produced by the Institute this year. The first, a stocktake report, provides a broad

overview of the major developments in extended performance reporting techniques

worldwide. The second reviews these methods of reporting and what recent

studies have found as to their value.

GAAP-based financial reporting: measurement of business performances reviews

GAAP to provide a clear understanding of the base from which extensions to

traditional financial reporting are moving on from.

The intention in producing this monograph, and the extended performance series,

is to ensure that accounting maintains its significance in the evolving reporting

landscape. I hope that you find it both interesting and valuable.

Neil Faulkner FCAPresident

Institute of Chartered Accountants in Australia

The Institute of Chartered Accountants in Australia 05 >

GAAP-based financial reporting: measurement of business performance

Contents

Executive summary 06

Introduction 08

1 How ‘useful’ are GAAP metrics for evaluating business performance? 12

1.1 Introduction 12

1.2 Does GAAP produce ‘value relevant’ measures? 14

1.3 How fully do market participants understand accrual accounting? 17

1.4 Direct evidence on the value relevance of GAAP performance measures 19

1.5 Conservatism and GAAP reporting 22

1.6 Summary 25

2 What is the quality of GAAP accounting measures? 26

2.1 Introduction 26

2.2 Measuring earnings quality and earnings management 27

2.3 Examples of earnings management 29

2.4 Incentives to report high quality earnings 32

2.5 Summary 35

3 Evidence on ‘modified GAAP’ reporting 36

3.1 Introduction 36

3.2 Comprehensive income 38

3.3 Street earnings — is this a selective narrowing of GAAP income (and does it improve

earnings as a measure of business performance)? 40

3.4 Pro-forma earnings — telling it like it is or how you want it to be seen? 43

3.5 Summary 46

4 Conclusion 47

Bibliography 48

The Institute of Chartered Accountants in Australia 07 >

GAAP-based financial reporting: measurement of business performance06 The Institute of Chartered Accountants in Australia

GAAP-based financial reporting: measurement of business performance

Executive summary

The report provides an overview ofcurrent knowledge about the state of‘conventional’ financial reporting and themeasurement of business performance.The term ‘conventional’ implies ananalysis of what we know about financialreporting produced by the application ofgenerally accepted accounting principles(GAAP). It is intended to inform thoseinterested in the future of financialreporting by providing a summary of keyevidence about the existing GAAPmodel. In particular, two key questionsare addressed:

> What are the factors underlying thedemand for measurement of businessperformance?

> How successful are existing, GAAP-based methods for the measurement ofbusiness performance?

The first question is important because the

answers can help us to understand why the

existing GAAP model looks like it does, in

contrast to alternatives which either modify

the measurement and/or recognition criteria

within GAAP, or fundamentally extend the

business reporting model to capture other

dimensions of performance (e.g.

environmental reporting). In effect, this is

simply saying ‘let’s understand why we have

what we have’, before we consider whether

we should have something different!

The second question is important because it

requires the identification of criteria against

which the success (or otherwise) of the GAAP

model can be evaluated. Of course, any such

answer must reflect a somewhat subjective

definition of success. Success is defined in a

number of ways, including the extent to which

periodic performance measures such as net

income are ‘value relevant’, as well as the

extent to which existing measures of periodic

financial reporting are susceptible to

manipulation. Although the findings outlined

are a reflection of the inevitably selective

summarisation of extant accounting research,

explicit recognition has been given to instances

where the conclusions offered may be disputed

by others. However, for the most part the

findings from a large body of archival-empirical

accounting research are quite clear.

Major findings can be summarised as follows:

> Forty years of academic research suggests

that existing measures of financial

performance (i.e. income) and financial

position (balance sheet) are value relevant —

that is, the measures are correlated with

market values and changes therein

> Periodic financial reporting is not very timely

— most value relevant information is

impounded into prices well before the

release of periodic financial reports

> The accrual accounting process does what

it is supposed to do — it provides better

matching of economic costs and benefits

than cash accounting

> Existing measures of financial performance

and position play an important part in the

measurement of business value

> Despite widespread understanding of how

accrual accounting ‘works’, it appears as

though market participants do not rationally

evaluate periodic financial reporting

measures in terms of differences between

attributes of cash and attributes of accrual

accounting

> ‘Value relevance’ is only part of how the

existing financial reporting model should be

evaluated. Periodic financial reporting has its

roots in the stewardship role of managers

who were separated from the owners and

who had to account for the use of the funds.

More broadly, this is the ‘contracting’ role of

accounting

> The use of financial reporting to define and

enforce contracts (both explicit and implicit)

gives rise to important characteristics of

financial reporting, such as verifiability and

conservatism. Such characteristics (and the

underlying demand) are often overlooked by

those who argue and/or enforce change in

the financial reporting model

> The demands placed on the financial

reporting model by its role in defining and

enforcing contractual relations (the

contracting role) may sometimes conflict with

the role of financial reporting as inputs to

investment evaluation procedures

> For example, shifts in the measurement basis

of GAAP towards mark-to-market could have

negative repercussions for the contracting

role of financial reporting

> On the other hand, conservatism in financial

reporting may be desirable from a contracting

perspective, but of little use in helping

investors use accounting numbers in

valuation models. Conservatism is also likely

to reflect regulators’ and politicians’ concerns

with minimising economic losses by investors

> The definition of high quality financial

reporting and, ultimately, decisions about

what is ‘best’, are inevitably dependent on

the perspective of those making such

judgement. Put simply, accounting quality

has many dimensions

> Approximately 40 years of empirical research

suggests that existing measures of financial

performance (i.e. GAAP reporting) display at

least some evidence of providing useful

information for contracting and investment

evaluation applications. On the other hand,

the extent to which alternative models for

business reporting display such attributes (to

a greater or lesser extent) is largely unknown

> There are a large number of studies that

support the view that managers are able to

manipulate GAAP accounting in response to

capital market incentives, examples of which

include avoiding losses, earnings declines

and earnings disappointments, as well as

capital raisings

> There are also a large number of studies that

show a link between accounting

manipulation and pay-offs from contracts

using accounting numbers — for example,

bonus plans and debt contracts. However,

this evidence is generally weaker than capital

market incentives

> Survey evidence suggests that, at least in

recent times, managers are more likely to

engage in economic manipulation in

preference to accounting manipulation. This

suggests that the GAAP reporting framework

is relatively robust, but that a by-product of

such robustness is dysfunctional behaviour

by management

> Although there is some evidence suggesting

that corporate governance is positively

related to accounting quality, it is not clear

whether better governance ‘causes’ better

quality accounting, or whether both are a

reflection of factors such as different

business models

> Managers’ attempts at highlighting ‘pro-

forma’ or ‘street’ earnings measures in

preference to GAAP earnings is often alleged

to be self-serving, but there is evidence

suggesting that these ‘modified GAAP’

measures may be more informative than their

GAAP counterparts

> Security analysts and other investment

professionals appear to favour the exclusion

of at least some non-recurring items from

what is otherwise GAAP-compliant income.

08 The Institute of Chartered Accountants in Australia

GAAP-based financial reporting: measurement of business performance

compensation is tied to a measure of

accounting earnings rather than simply share

price movements (Sloan 1993). Share prices

are a noisy measure of management

performance and, provided at least some of

this noise is not present in accounting

measures of performance such as periodic

income, then it is rational to include some

income-related component in compensation.

Evidence on the role of accounting numbers in

defining and enforcing financial contracts is

important, because the earliest instances of

explicit production of financial reports appear to

be in the context of accounting to owners for

investments in voyages of adventure (Watts &

Zimmerman 1983). Since that time contracts

that have ultimately come to be seen as

arranging terms of financing (e.g. debt

contracts) or for performance-based pay have

been able to select appropriate measures on

which to define the relationship and measure

compliance. As contracts have evolved with

changing business circumstances, so has the

demand for accounting as a technology for use

in contracting. Contracting parties are not

bound necessarily by the rules that determine

GAAP reporting as produced in external

financial reports. However, there is likely to be a

strong overlap between accounting used within

firms and that which is used externally.

Proponents of various extensions to the current

GAAP-based model of financial reporting must

surely be obliged to explain why measures that

they favour have not been used voluntarily

where it is (at least implicitly) alleged that more

efficient financial contracting would result. Put

simply, if there is really a ‘better’ measure for

performance evaluation, why is it not used in

settings other than statutory external reporting?

The ‘economic Darwinism’ reflected above

should not be interpreted as a claim that the

existing financial reporting model is not capable

of improvement. At no stage in this review is it

claimed that the existing GAAP-based model of

financial reporting cannot be improved as a

measure of business performance. It is one

thing, however, to agree that change may be

desirable, but another entirely to agree on what

those changes should be. Concepts such as

triple bottom line, sustainability reporting,

intellectual capital measurement and

environmental reporting all have their

proponents. For the most part though,

arguments in favour of what may be quite

fundamental changes (or at least extensions) to

GAAP-based financial reporting rarely

commence by carefully considering what we

currently have as the financial reporting model,

and why we have it.

In many senses, what follows is comparable

to the first stage of planning a trip. We cannot

hope to plan how to get to our destination if

we do not know where we are commencing

the journey. In a similar vein, it is hard to

rigorously evaluate recommendations for

change unless we have a solid grounding in

where we are currently. This monograph

attempts to provide such a roadmap of the

existing financial reporting landscape, not

saying where we should go, but rather

showing where we are currently. It is worth

considering why the existing financial

reporting model works the way it does and

why it takes the form that it does. Figure 1

summarises the structure of this review.

The Institute of Chartered Accountants in Australia 09 >

GAAP-based financial reporting: measurement of business performance

Introduction

This monograph is motivated by concernsthat the existing method of measuringfinancial performance and, by implication,financial position is in need of potentiallysignificant changes. Financial reportingencompasses not only the basic financialstatements (i.e. income statement, balancesheet and cash flow statement), but alsothe plethora of statutory reporting withinthe annual report (e.g. remuneration report)and even the ongoing requirements toensure an informed market via continuousdisclosure rules. However, most attention on possible changes

to the financial reporting model that result from

the application of GAAP are inevitably focused

on the periodic financial statements, and

especially the key summary measures that are

produced under the existing financial reporting

model.1 These are various measures of income

(often termed financial performance) and

corresponding measures of accounting

‘worth’, such as owners’ equity/net

assets/book value or total assets (often termed

measures of financial position). Evidence on

the ‘usefulness’ of these measures is therefore

the primary focus of this monograph.

Of course, assessment of ‘usefulness’ invokes

an obvious question — useful to whom? The

structure of this monograph reflects the most

identifiable tension in assessing the usefulness

of the GAAP model of reporting for measuring

business performance. On the one hand, the

investment or valuation perspective suggests

that the usefulness of the financial reporting

model can be assessed by reference to its role

in providing information pertinent to the

assessment of value. Leaving aside issues

related to how such an objective can be

operationalised, the most obvious benchmark

would appear to be the correlation between

GAAP reporting and market prices. However,

a key plank in this review of empirical evidence

is the recognition that an equally if not more

important role of financial reporting is to

provide information useful for contracting.

What do we mean by contracting? Historical

evidence suggests that a primary determinant

of the demand for financial reporting (and

extensions to dimensions such as the auditing

of these reports) can be attributed to the

reliance on these numbers as a means of

defining and subsequently enforcing financial

relationships.2 In modern-day terms, think of a

debt contract — an instrument designed for

determining and then enforcing the conditions

under which a business may borrow funds and

then apply such funds to investment

opportunities. This contract uses various

measures either directly sourced from the

audited financial statements such as leverage

or interest coverage, or possibly measures that

reflect transparent modifications of these

numbers (e.g. net tangible assets rather than

net assets).3 Naturally, the exact design of debt

contracts varies with the fundamental attributes

of the debt finance (e.g. private versus public,

fixed versus floating, secured versus

unsecured, etc.). However, the overriding

lesson is clear — debt contracts use GAAP-

based numbers to define and enforce

lender/borrower relationships.

A similar contracting role for the financial

reporting system is evident in the

compensation of management, who typically

are entrusted to run the firm on behalf of the

shareholders. A common feature of executive

compensation schemes is some form of

bonus, which typically is tied to either reported

profit or measures that form part of the

calculation of profit. There are sound reasons

why some component of management

1 GAAP involves, at a minimum, relevant accounting standards, accounting ‘conventions’, specific regulations not in accounting standards and

auditing standards and conventions. The combination of all these extant influences is what shapes financial reporting, and is what is frequently

refer to as the ’GAAP model’.

2 See, for example, the review of early contracting-based explanations for accounting practices (including the demand for external auditing)

provided by Watts and Zimmerman (1983).

3 Cotter (1998) demonstrates that for private debt contracts used by Australian firms, the most common restrictions placed on the borrower are on

further borrowing and minimum levels of liquidity. Borrowing constraints are most commonly expressed in terms of leverage, interest coverage

and prior charges, all of which are products of the GAAP financial reporting system.

10 The Institute of Chartered Accountants in Australia

GAAP-based financial reporting: measurement of business performance

An example serves to illustrate the approach.

The method is to draw selectively on key

research papers to highlight what may be

viewed as ‘evidence’ about the current state of

the financial reporting model. In section 1,

evidence on the functionality of the existing

model is reviewed. This section commences by

considering capital markets research intended

to highlight how useful GAAP accounting is, at

least to equity investors. This research,

commencing from the path-breaking study by

Ball and Brown (1968), is a cornerstone of

modern thinking about how to define a

measure of the ‘usefulness’ of financial

reporting. However, an immediate dilemma

arises. Is a ‘good’ result necessarily a high

degree of correlation between changes in

market values and periodic accounting

performance? This ‘value relevance’

perspective is increasingly adopted to support

arguments in favour of market values as the

preferred method of measurement within the

existing GAAP model (Barth 2005). Yet even a

casual inspection of 500 or more years of

accounting history suggests that the

measurement of market values (and hence

‘value relevance’) has not been the primary

concern underlying the economic demand for

periodic financial reporting (Watts 2005).

Why is this? The most likely explanation, as

section 1 also highlights, is that the stewardship

role of accounting underlies the early economic

demand for business reporting, and the

susceptibility of market value accounting to

manipulation meant that historic costs are often

a preferred measurement basis in terms of the

reliability of financial reporting. This is especially

true of arm’s-length contracts (such as debt

contracts) that rely on well-understood,

relatively ‘reliable’ accounting rules and

conventions (i.e. GAAP) to form measures that

can be readily monitored (e.g. liquidity, leverage

and interest coverage). So section 1 highlights

an important concern, namely that the move

towards ‘mark-to-market’ accounting may be

viewed as at least partially inconsistent with the

underlying economic demand for financial

reporting. In this sense, standard-setters may

be ‘getting ahead’ of where the basis of

measurement for financial reporting should be.

In section 2, current knowledge as to the

‘quality’ of current GAAP reporting is reviewed.

The first dilemma here is to adequately define

just what we mean by ‘high quality’

accounting. The lead of recent research is

followed recognising that it is likely that

accounting quality has several different

dimensions. For example, predictability, value

relevance and conservatism may all be possible

measures of the quality of periodic accounts,

especially key summary measures such as net

income. Having recognised that accounting

quality is a complex concept, a review of

evidence consistent with accounting quality

being rewarded is given — that is, evidence

consistent with an economic demand for

accounting quality. Once again, an important

inference is that the current GAAP model has

been shaped by a variety of economic forces.

The extent of any link between the quality of

accounting and corporate governance is also

considered. Some argue that better corporate

governance is required to ensure better

financial reporting. However, these claims

frequently ignore the existing body of evidence

exploring such linkages.

Proposed changes to the existing financial

reporting model can be viewed as reflecting

one of two types — either the provision of

information beyond that provided under the

existing GAAP reporting model, or similar

information using rather different measurement

rules. Examples of the former include very

substantial deviations from the existing GAAP

model to include broader forms of stakeholder

reporting such as environmental reporting,

triple bottom line and the like, as well as less

dramatic recommendations such as the

reporting of comprehensive income. An

example of the latter would be the seemingly

inexorable shift towards mark-to-market

accounting, especially as reflected in current

and proposed standards produced under the

auspices of the International Accounting

Standards Board (IASB).

Section 3 extends the approach underlying

sections 1 and 2 to consider evidence on some

‘alternatives’ to GAAP. It is hard to scientifically

examine potential extensions to the existing

financial reporting model without actual

examples, so the focus of section 3 is on the

limited evidence to date of

extensions/modifications to GAAP reporting.

This includes those popularised by consulting

firms such as Stern Stewart’s Economic Value

Added (EVA), and the ad-hoc modification of

GAAP by reporting firms themselves to

produce measures such as pro-forma income.

The purpose here is to evaluate the usefulness

of such measures relative to GAAP, as well as

the scope for opportunistic manipulation by

those the financial reports are intended to

monitor. If, for example, managers are able to

choose the exact definition of income (i.e. pro-

forma income) that they wish to highlight, is

this likely to lead to less informative and/or

lower quality reporting?

Some conclusions are briefly summarised in

section 4. For the most part, however, this

monograph is not about conclusions per se.

It is an overview of the evidence. In short, it is

intended to be a relief map of where we are

now. It is therefore a necessary, but not

sufficient, condition for deciding how we get to

our target destination. A wide variety of interest

groups, including preparers, investors,

employees, regulators, auditors, politicians and

academics will no doubt continue to have

much to say about where a search for better

financial reporting will take us. However, that

search inevitably is informed better by an

adequate understanding of where we are now.

The Institute of Chartered Accountants in Australia 11 >

GAAP-based financial reporting: measurement of business performance

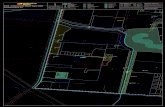

Figure 1: How useful is the existing GAAP-based reporting model for measuring business performance

Financial reporting quality

Alternative measures of financial performance

(Modified GAAP)

Value relevance Evidence Costly Contracting

Market reactionsCorrelation with share price changesCorrelation with price

Use of accounting numbersModification of accounting

Useful Financial Reporting

The use of value relevance as a criterion for

evaluating the performance of GAAP financial

statements also invokes some very important

assumptions. In several forms of value

relevance research, an important assumption is

that financial markets, especially markets in

which share prices are established, are

relatively efficient. The ‘efficient markets

hypothesis’, while a useful paradigm in which

to understand the process by which

information is impounded into the valuation

process, has come under increasing question.

Indeed, research that challenges the ability of

share market participants to understand

relatively basic properties of accrual accounting

(on which GAAP financial reporting is based)

has become more widespread in recent years

(Sloan 1996). In section 1.3 these

developments are briefly reviewed and their

significance to any evaluation of GAAP financial

reporting is considered. This analysis to recent

theoretical and empirical research addressing

‘value relevance’ of GAAP financial reporting is

extended further in section 1.4.

However, a more fundamental concern

expressed about the ‘value relevance’

construct is that it is not the only way to

examine the usefulness of GAAP financial

statements data as a measure of periodic

business performance. Indeed, it is possible

that if the value relevance criterion is the

dominant means of assessing the performance

of GAAP as a measure of periodic business

performance, then a clear implication is that

GAAP accounting should measure equity

value. This has implications for the choice of

measurement rules within GAAP, and possibly

underlies the move towards increasing use of

‘mark-to-market’ accounting. Yet it is clear that

direct equity valuation is not a primary

determinant of how GAAP rules and

conventions have evolved over time.

Apart from providing input into a valuation role,

there are several other functions that GAAP

financial reporting is asked to perform, and

which historically underlie the gradual

development of GAAP rules and conventions.

The most obvious of these roles is the

contracting role whereby financial reporting

serves as inputs in establishing and enforcing

contractual relations that make up the modern

firm. Obvious examples include debt contracts

and compensation contracts for employees,

but there are also many other ways in which

GAAP numbers may be implicitly incorporated

into decision making that affects the firm. An

obvious example here would be various forms

of regulatory action that rely on GAAP

numbers as input (e.g. profitability analysis in

rate regulation).4

An extensive literature has evolved over the

last 25 years examining the contracting role

of accounting, commencing from the

pioneering work of Watts and Zimmerman

(1978; 1979). Detailed reviews of this

literature are available, and direct evidence

on the contracting role of accounting is not

reviewed here. Rather, in section 1.5 one

specific attribute of GAAP accounting is

looked at that may impact on its use as a

measure of periodic business performance

and which is attributable to contracting

considerations. This attribute is

conservatism. How the demand for

conservatism in GAAP potentially conflicts

with suggestions that measurement rules

within GAAP should give more weight to

market values (i.e. mark-to-market

accounting) is also considered.

The Institute of Chartered Accountants in Australia 13 >

GAAP-based financial reporting: measurement of business performance

1 How ‘useful’ are GAAP metrics for evaluatingbusiness performance?

Key points> Claims that financial reports produced

under extant GAAP are not relevant to theevaluation of business performance have been repeatedly rebutted over thelast 40 years

> GAAP-based measures of financialperformance and position (income, netassets) are related to firms’ marketvaluations, as well as the way in whichthese values change over time

> There is theoretical, as well as empiricalsupport for the role of accountingnumbers produced under GAAP as inputto valuation metrics

> Accrual accounting as applied by GAAPimproves the ability to understand businessperformance over finite horizons

> There are legitimate concerns that capitalmarkets do not completely take account ofthe way in which accrual accounting‘works’ (i.e. the way accruals reverse)

> The usefulness of GAAP accounting is alsohighlighted by the way it has been used todefine and enforce contractual relations

> The contracting role of GAAP potentiallylimits the implications that can be drawnfrom evidence about ‘value relevance’

> Evidence of conservatism in financialreporting highlights the tension betweenthe contracting and value relevanceperspectives on how GAAP financialreporting should evolve.

1.1 IntroductionThis section reviews evidence addressing the

question ‘does GAAP accounting produce

measures that are useful for evaluating

business performance?’ Such a question is

fundamental to any consideration of how

GAAP reporting may be improved, either

incrementally via changes in certain

measurement rules or much more

fundamentally via substantially altered

performance measurement systems (e.g.

sustainability measures). As advocates of

allegedly improved or ‘better’ systems of

measuring business performance speak up, or

as entirely new concepts for measuring and

assessing business performance are offered,

the same underlying theme is inevitably present

— namely the alleged deficiencies (or even

failure) of GAAP accounting to produce metrics

which are useful. Of course, this in turn requires

us to identify what we mean as ‘useful’. To a

certain extent, the subject of this review helps

in that respect. If we are interested in the

measurement of business performance, then

presumably we are interested ultimately in

business valuation. Hence, one appropriate

benchmark against which to assess the

usefulness of extant GAAP measures is a

measure of value. This insight has been a

fundamental tenet of accounting research for

the last 40 years, dating from the pioneer study

of Ball and Brown (1968). In section 1.2, the role

of value relevance as a criterion for evaluating

GAAP financial reporting as a measure of

business performance is explained more fully,

along with a description of several important

research studies.

12 The Institute of Chartered Accountants in Australia

GAAP-based financial reporting: measurement of business performance

4 For a detailed review of the limitations of the ‘value relevance’ construct as a guide to assessing suggested modifications and/or extensions to

GAAP reporting, see Holthausen and Watts (2001).

statements produced under GAAP were ‘not

informative’ would be subject to empirical

testing. This is exactly what the pioneering Ball

and Brown study did, by examining the

association between accounting performance

measurements produced under GAAP (e.g. net

income, EPS) and share price changes over the

same period as captured by the financial

statements.5 This approach typified what came

to be known as ‘information content’ research.

Ball and Brown (1968)The study by Ball and Brown is widely

recognised as a ‘revolution’ in accounting

research, and the key points are

summarised below.

> The study is widely recognised as having

pioneered research in terms of

understanding whether accounting numbers

produced under GAAP have ‘information

content’. The principal test for which Ball and

Brown is best known was mapping the

relation between annual earnings changes

(i.e. a proxy for earnings surprises) and firms’

contemporaneous annual stock returns,

adjusted for the effect of market movements.

They examined annual earnings data for US

firms between 1957 and 1965 for a sample in

excess of 2,500 firm-years

> Ball and Brown showed that most of the

association between the sign of the earnings

change and contemporaneous annual stock

returns occurs prior to the release of the

earnings number. Hence, earnings measured

under the prevailing GAAP rules and

principles was seen to be an informative

metric in terms of explaining changes in

value, but it is not especially timely as a

source of new information

> The results reported by Ball and Brown were

consistent with the existence of numerous

other sources of information that are

correlated with earnings performance. These

observable signals result in much of the total

information in earnings being incorporated

into prices before the actual announcement

of the earnings result

> The most widely cited aspect of Ball

and Brown is their diagram illustrating the

correlation between three measures

of annual earnings changes and

contemporaneous stock returns.

This is reproduced below.6

The Institute of Chartered Accountants in Australia 15 >

GAAP-based financial reporting: measurement of business performance

1.2 Does GAAP produce ‘valuerelevant’ measures?

The concept of ‘value relevance’ is not one that

is explicitly recognised by those charged with

setting the standards that underlie GAAP. Most

conceptual framework-type projects

undertaken by standard setting agencies

recognise concepts such as ‘relevance’ and

‘reliability’, but not the term ‘value relevance’.

Nevertheless, the relation between accounting

information produced under GAAP rules and

the level and/or changes in value would seem

to be an intuitively reasonable way for

accounting researchers to operationalise these

criteria. GAAP accounting information is

unlikely to be either relevant or reliable if it does

not reflect information that is impounded into

the firms’ share price (Barth et al. 2001).

There are a number of ways that the value

relevance concept has been operationalised by

accounting researchers. Four primary

approaches outlined by Francis and Schipper

(1999) are:

1. Financial statement information is value

relevant if the accounting information leads

prices by capturing intrinsic values which

share prices then approach

2. Financial statement information is value

relevant if it contains variables used in a

valuation model or helps predict those

variables

3. Financial statement information is value

relevant if it changes the total mix of

information in the marketplace

4. Financial statement information is value

relevant if it is correlated with ‘other’

information used by investors.

Of course, it is possible that GAAP financial

statement data may be value relevant but not

‘decision relevant’, if the information contained

in GAAP financial statements is not especially

timely. To the extent that GAAP provides a

measure of periodic performance, and this

performance reflects factors that are

themselves observable over time via a large

number of other sources, then it would not be

surprising if GAAP financial statements were

not a very timely source of ‘new’ information for

investment decision-making purposes. In other

words, while periodic financial statements

produced under GAAP may be, on average,

strongly correlated with the underlying periodic

economic performance of the business, these

reports may have relatively little impact at the

time of their release due to the correlation

between performance measurement under

GAAP and other metrics which are observable

to market participants during the course of the

financial period.

Although Barth et al. (2001) argue that the term

‘value relevance’ does not appear to have been

used in accounting research prior to the early

1990s, the foundations of this approach date

back to the pioneering work of Ball and Brown

(1968). Prior to this time accounting research

was either purely descriptive or of a normative

nature directed at identifying what might be

argued to be ‘best’ accounting practices.

A prime example of this approach can be found

in Chambers (1966), who argued eloquently

and passionately for the introduction of a

system of accounting measurement known as

continuously contemporary accounting

(CoCoA). Of course, fundamental to such work

was the criticism, explicit or implicit, that

existing accounting practice was of little value

to users for tasks such as assessing business

performance. However, with the development

of modern finance theory (particularly the

efficient markets hypothesis) and the

concurrent availability of computerised

databases of accounting and share price

information, it is not surprising (at least with

hindsight) that the claims that periodic financial

14 The Institute of Chartered Accountants in Australia

GAAP-based financial reporting: measurement of business performance

5 In the remainder of this report, the term ‘contemporaneous stock returns’ is used to capture the share price change over a period of time

corresponding to a financial reporting period.

6 Similar pioneering evidence for Australian firms was reported by Brown (1970).

1.12

1.10

1.08

1.06

1.04

1.02

1.00

0.98

0.96

0.94

0.92

0.90

0.88

Month relative to annual report announcement date-12 -10 -8 -6 6-4 4-2 20

Variable 3

Variable 2

Variable 1

Figure 2: Abnormal indexes for various portfolios

annual earnings and, finally, a four-year

aggregate measure of earnings. Over

27,000 US firm-years were examined for

the period 1960–1989

> As the length of the performance

measurement interval was increased, the

relative advantage of GAAP earnings over

cash flow (i.e. the contribution of accruals)

declined. Over very short intervals (e.g.

quarterly measurement), GAAP earnings was

far more informative than cash flow. This

result is primarily attributable to operating

accruals (i.e. changes in working capital)

> Accruals were relatively more important in

measuring periodic performance with the

length of the firm’s operating cycle

> Accruals were relatively more important in

measuring periodic performance as the

volatility of the firm’s working capital

requirements increased

> In effect, Dechow demonstrated that

accruals create a measure of periodic

performance that results in better matching

than a simple cash-flow based measure

would provide. This result contrasts with the

view that accruals somehow ‘scramble’ the

message provided by periodic cash flow

> Dechow’s conclusions were premised on the

assumption that contemporaneous stock

returns are an appropriate benchmark — that

is, stock returns reflect all ‘new’ information

that becomes available during the period.

In summary, Dechow (1994) is representative

of a shift in accounting researchers’ approach

to evaluating GAAP financial reporting. Instead

of focusing on the extent to which the release

of the information impacts on market

participants’ expectations (via changes in share

prices), she considers the correlation between

market and accounting-based performance

measures. In doing so, Dechow demonstrates

that periodic performance measures produced

via GAAP rules and principles achieve precisely

what the accrual accounting process is

designed to accomplish, namely better

revenue recognition and matching processes

than would arise if periodic financial reporting

simply tracked cash flows.

1.3 How fully do marketparticipants understandaccrual accounting?

As mentioned in the context of explaining the

origination of capital markets-based accounting

research, efficient capital markets (EMH) are an

important assumption where share prices, or

changes therein, are relied on to assess the

performance, or value relevance, of periodic

financial reporting under GAAP. For example, it

is a necessary assumption in Dechow’s (1994)

study that all value-relevant information is

reflected in share prices — in effect that

markets are informationally efficient. While this

has been a fundamental tenet of capital

markets research in accounting since Ball and

Brown (1968), the assumption has come under

an increasing amount of challenge.

Sloan (1996)Of particular interest to those wanting to

understand the usefulness of GAAP measures

in explaining business performance is the

evidence in Sloan. He directly examines the

extent to which the very basic distinction within

GAAP accounting (i.e. cash flow versus

accruals) appears to be understood.

Specifically, Sloan points to the differing

persistence in the cash flow and accrual

components of earnings. Operating accruals

are relatively transient, whereas cash flow tends

to be more persistent. Indeed, the idea that

accruals reverse is fundamental to why accrual

accounting achieves better ‘matching’ of

revenues and associated expenses, as

discussed above. Sloan identifies several

important implications that follow from this

most basic appreciation of how accrual

accounting ‘works’.

> He examined how efficiently stock prices

reflect information about future earnings that

is readily available from current earnings. He

pointed to the differing persistence of the

accrual and cash flow components of

earnings. Cash flows are more persistent

than accruals, which follows from the

manner in which most (operating) accruals

reverse relatively quickly. Sloan examined

annual earnings data for US firms between

1962 and 1991, with over 40,000 firm-years

included in the analysis

The Institute of Chartered Accountants in Australia 17 >

GAAP-based financial reporting: measurement of business performance

What ensued following Ball and Brown (1968)?

Empirical research directed towards the

information content of accounting rapidly

expanded. Chief among researchers’ concerns

was the development of better measurements

of the ‘impact’ that release of accounting

information had on share prices. This involved

identifying shorter and shorter ‘windows’ in

which to measure price changes around

information releases, as well as better

measures of the associated earnings surprise,

such as measures based on analysts’ forecasts

rather than the time series behaviour of

earnings. A further extension involved

examining the determinants of the differences

in how prices changed in response to news

contained in GAAP financial statements (i.e.

determinants of earnings response

coefficients). These developments are

comprehensively reviewed by Kothari (2001).7

Although the Ball and Brown (1968) study and

those that followed suggest that information

contained in GAAP accounting reports is useful

for assessing periodic business performance

(and, ultimately, valuation), this research does

not necessarily address what specific

properties of GAAP are fundamental to the

result. Most simply, GAAP financial statements

reflect the combination of two components,

namely cash flows and accrual adjustments.

Indeed, GAAP accounting is really just the

accrual accounting technology applied (via a

set of rules and conventions) to what would

otherwise simply be cash flow reports. This

raises an obvious question — does accrual

accounting do what it is supposed to do?

Dechow (1994) Dechow is a widely cited study that directly

addresses the question of whether accruals

generated under GAAP ‘do the job’. She

recognises that if earnings are to be a useful

summary measure of business performance

(relative to cash flow), then that is likely to occur

via two important principles which underlie

GAAP accruals, namely the revenue

recognition principle and the matching

principle. These can be summarised as follows:

> Revenue recognition principle — recognise

revenue when a firm has performed all or

substantially all of the services to be

performed (or provided goods) and the

receipt of cash is reasonably certain

> Matching principle — outlays that are directly

associated with revenue recognised during

the period must be expensed in that period

before income for the period can

be determined.

These two principles are fundamental to

GAAP accounting providing periodic

performance measures that more closely

reflect business performance.

The revenue recognition principle and the

matching principle are fundamental reasons

why accrual accounting is expected to yield

more informative periodic performance

measures than simply relying on a cash-based

measure of periodic performance. It is the

accrual process, on the other hand, that is also

widely viewed as being most subject to

manipulation, thereby possibly reducing the

ability of GAAP measures such as income to

serve as a useful measure of business

performance.8 Indeed, a widely held view in

texts used to teach finance courses is ‘only

trust cash flow’, or ‘cash is king’. Dechow’s

(1994) study is therefore important in

providing a relatively straightforward method

for understanding why, and how, accrual

accounting measures produced via GAAP are

better measures of business performance

over finite periods. The key results are

summarised below.

> This study examined the circumstances

under which accruals improve the ability of

earnings to measure firm performance. This

was assessed by reference to the ability of

earnings to explain contemporaneous

market-adjusted stock returns. Several

different earnings periods were examined,

beginning with quarterly earnings, through

16 The Institute of Chartered Accountants in Australia

GAAP-based financial reporting: measurement of business performance

7 Additional background on the development of Ball and Brown and its subsequent implications is discussed by Brown (1989).

8 This issue is considered more fully in Section 2, which addresses concerns about the ‘quality’ of GAAP financial reporting measures.

> Dechow et al. examine in excess of 150,000

US firm-years covering the period

1950–2003. They find that the higher

persistence of cash flows relative to accruals

is entirely due to the high persistence of cash

applied to the amount of equity financing

> Stock prices act as if investors correctly

anticipate the lower persistence of cash

applied to debt financing, but overestimate

the persistence of cash that is applied to the

firm’s cash balance (i.e. cash retained within

the firm)

> One interpretation of the results was that

investors overestimated the persistence of

earnings that were held within the firm.

Hence, the so-called accrual anomaly would

appear to be a reflection of hubris regarding

the future value of new investment

opportunities, as accruals and retained cash

flow both were associated with higher

future investment outlays, as well as lower

stock returns.

These results are still of concern if we expect

that markets rationally and efficiently process

available information. However, what they

contribute that is important to the issue at hand

is that it is not a misunderstanding of the

properties of GAAP accruals per se that appears

to somewhat mislead investors. Rather, a more

general hubris is evident in terms of how

retained cash is viewed. In this sense, the

original conclusion from Dechow (1994) that

accruals ‘do what they are supposed to do’

appears reasonable.

1.4 Direct evidence on the valuerelevance of GAAPperformance measures

As noted above, there has been a shift in

researchers’ priorities away from examining

how the release of periodic accounting reports

impacts market participants to what has

become popularly termed ‘value relevance’

tests. These studies typically examine the

relation between periodic accounting measures

and share prices, or the ability of such

measures to identify firms where the share

price differs from what would be predicted.

Central to this research is a theory linking

accounting measures to value. Ohlson (1995)

frequently is credited with providing the

underlying theory to support this approach.

Ohlson outlines the role of periodic accounting

measures in explaining (or predicting) value,

using what is commonly known as the residual

income model (RIM). Although the RIM is not

attributed to Ohlson (i.e. it has existed for a

much longer period of time), the contribution

made by Ohlson was to highlight how, under

certain assumptions, the RIM and discounted

cash flow (DCF) methods should yield the

same result. The key inputs to the residual

income model from the system generating

periodic accounting reports are the current

measure of worth (i.e. book value) and the

expectation of future earnings relative to the

required accounting return on equity (i.e.

accounting return on equity (ROE)). Value, as

measured from periodic accounting data, is the

current book value plus the present value of

abnormal earnings.10

In effect, where there is no reasonable basis on

which to project accounting earnings that differ

from the required rate of return, then market

value and book value should be the same (i.e.

the market-to-book ratio would be one.) Where

expected earnings differ from the required rate

of return, then the necessary horizon over

The Institute of Chartered Accountants in Australia 19 >

GAAP-based financial reporting: measurement of business performance

> Using a simple model of annual earnings

prediction, Sloan showed that the accrual

component of earnings was significantly less

persistent than the cash flow component

> Sloan then showed that size-adjusted stock

returns (a measure of ‘abnormal’ returns) can

be explained by differences between the

actual persistence of cash flows and accruals

and the implied persistence from a model

explaining size-adjusted returns. This result

implied that the market puts too much

weight on earnings changes that are driven

by accruals, and insufficient weight on

earnings changes that are caused by cash

flow changes. Put simply, the result

suggested that investors fail to anticipate

fully the fact that accruals are less persistent

than cash flows

> Sloan also demonstrated that a trading

strategy based on this apparent market

inefficiency would have yielded larger than

expected returns. These returns were

clustered around subsequent earnings

announcements for up to three years after

the earnings result of interest. This was

consistent with investors ‘slowly’ realising

the error in their weighting of information in

cash flows and accruals respectively. In

literature that has followed Sloan’s study,

the basic result has come to be known as

the ‘accrual anomaly’.

Although Sloan’s conclusions have been

controversial, they also appear to have been

relatively robust. Several studies addressing

possible methodological explanations have

been conducted, but there is not always

agreement among researchers on the

appropriateness of various ‘adjustments’ which

have been shown to possibly affect the results.9

LaFond (2005)Extensions to other countries, such as the

evidence in LaFond, reveals similar evidence

of the accrual anomaly. However, what is

puzzling is that the most obvious explanations

for such an anomaly do not appear to have

any ability to explain systematic variation in

the extent of this evidence.

> LaFond (2005) examined the extent to which

the ‘accrual anomaly’ of Sloan (1996) is

evident internationally. He examined data

from 17 countries over the period 1989–2003

to provide evidence on whether there was

systematic variation across and within

countries. Within countries, the study

examined the role of managerial discretion

(proxied by income smoothing),

informational environment (proxied by

analyst following) and ownership structure

> LaFond was unable to detect systematic

relations between the accrual anomaly

and any of the three ‘causal’ factors

suggested above

> LaFond also examined whether the returns

associated with the accrual anomaly were

correlated across countries. If they were, this

would suggest that perhaps some part of the

accrual anomaly was really a reflection of

systematic risk factors prevalent in

internationally integrated stock markets.

However, there was no evidence to this effect.

Given the results of Sloan (1996) and

subsequent studies such as LaFond (2005),

does that leave a serious concern that a study

of the usefulness of accruals that underlie

GAAP accounting such as Dechow (1994) is

on shaky ground, relying as it does on market

prices rationally reflecting value-relevant

information? A resolution of this apparent

conflict is to be found in a recent study by

Dechow, Richardson and Sloan.

Dechow, Richardson and Sloan (2005) > This study provided a more careful

examination of why the cash component of

earnings is more persistent than the accrual

component (a fundamental part of the

accrual anomaly). They decomposed the

cash component of earnings into three

components; first, cash retained by the firm;

second, cash applied to debt financing; and

third, cash applied to equity financing. Earlier

evidence on the so-called accrual anomaly

treated all of the cash components of

earnings as a single measure

18 The Institute of Chartered Accountants in Australia

GAAP-based financial reporting: measurement of business performance

9 Examples of this disagreement can be found by comparing Kraft et al. (2006) with the discussion provided by Core (2006). 10 For a further discussion of the RIM approach, and also extensions to the basic model outlined by Ohlson (1995), see Penman (2004) and

Palepu, Healy and Bernard (2004).

which forecasting must occur is the period

over which the difference between actual

accounting ROE and required accounting ROE

is expected to persist. Importantly, competitive

forces as well as the accrual accounting

process itself mean that expected abnormal

earnings are unlikely to persist over a large

number of periods. This has the advantage of

creating a finite forecasting horizon, in contrast

to the DCF (and related) approaches to

estimating value.

The existence of a formal model providing

a theoretical link between periodic GAAP

accounting results and value is an important

consideration in examining the ‘usefulness’

of the existing system of periodic reporting

for measuring business performance.

Some evidence in support of the practical

advantages evident from the RIM approach is

provided by Penman and Sougiannis. This

evidence is reviewed below.

Penman and Sougiannis (1998)> Penman and Sougiannis investigated the

practical advantage of accounting-based

valuation multiples (including a RIM) relative

to cash flow techniques (i.e. dividend

discount model and DCF). In theory, all

methods reflect the same assumptions, and

should yield the same valuation estimates.

However, this is dependent on the use of

differential forecasting horizons appropriate

to each model

> Using a sample of US data averaging over

4,000 firm-years each year between 1973

and 1990, the authors compared prediction

errors for each technique based on different

forecasting horizons

> The results showed that the practical

advantage of accrual accounting-based

valuation methods, particularly the RIM, was

due to the greater efficiency in forecasting.

DCF and dividend discounting models

require longer forecasting horizons to yield

similar prediction errors

> One interpretation of the results was that

accrual accounting assists in bringing

expected outcomes into the reporting

process more quickly than would occur

using a cash-based system.

Following the theoretical work of Ohlson

(1995) and others, it has become common

for researchers examining the linkage between

accounting measures and share price levels to

cite the RIM as justification for this approach.

Most commonly, the method is to regress a

measure of market value (share price) on

current earnings and book value. The relative

weight attached to each of these two summary

measures should reflect the relevant

characteristics of the firms (and financial

period) used for this estimation. Although the

linkage between the RIM and this approach

(to either explain or predict equity values) is

not without some dispute (Ohlson 1998),

researchers have adopted this approach to

address a number of claims that fall under

the broad notion of ‘value relevance’. In the

summary below three examples of the

questions addressed are highlighted:

1. Have GAAP financial statements become

less value relevant over time? Many critics

have argued that GAAP financial reporting is

unable to adequately reflect the performance

drivers of the modern corporation. This

criticism became especially popular during

the so-called ‘tech boom’ of the late 1990s.

Francis and Schipper (1999) is one of the first

studies to systematically address this claim,

and demonstrate that, contrary to populist

and anecdotal evidence, GAAP financial

reporting has continued to demonstrate a

strong association with market pricing

2. Are there ‘obvious’ measures that GAAP

reporting excludes, but which are important

to determining the value of modern

businesses? The answer to many may be a

self-evident ‘yes’, but it is difficult to subject

potential improvements to empirical analysis

unless the data is otherwise available.

One example is the value of brands, which

in many cases reflect the overall importance

of what are often termed ‘intangible’

assets. Barth et al. (1998) examine the

additional information contained in a

proprietary measure of brand values which

GAAP excludes from measurement.

They find that these brand values are ‘value

relevant’ over and above the information

contained in periodic GAAP-based financial

20 The Institute of Chartered Accountants in Australia

GAAP-based financial reporting: measurement of business performanceThe Institute of Chartered Accountants in Australia 21 >

GAAP-based financial reporting | Measurement of business performance

reports. However, as the authors themselves

recognise, this does not automatically mean

that GAAP reporting should be modified to

explicitly measure brand values

3. How do accruals improve the value relevance

of GAAP financial statements? Barth et al.

(2004) use the RIM approach to predict

equity values, and find that separating out

the accrual component of expected income

improves the predictive power of the

valuation model. This research extends the

inferences made from Dechow (1994) to a

somewhat broader notion of value relevance.

These three studies are summarised below.

Francis and Schipper (1999) Francis and Schipper considered the extent

to which GAAP financial statements may have

progressively lost value relevance over time.

> They operationalised value relevance in two

ways; first, a measure of what investors

could have earned based on foreknowledge

of the financial statements; and second, the

ability of earnings to explain

contemporaneous stock returns, and the

combined ability of earnings and book value

to explain stock prices

> The authors examined data from US firms

over the period 1952–1994

> Although the authors found some decline

in the value relevance of earnings, they also

documented a corresponding increase in the

value relevance of balance sheet information

(e.g. measures of book value)

> When the analysis is confined to ‘high-tech’

firms, the authors found little evidence of

systematic changes over time.

Barth, Beaver, Hand and Landsman (2004) This study examined the usefulness of accruals

for predicting equity values.

> Barth et al. examined over 17,000 US

firm-years between 1987 and 2001

> They examined the prediction errors for

a model of equity value (i.e. share price)

prediction based on the insights of Ohlson

(1995) that equity value is a weighted

multiple of book value, earnings and

‘other information’

> The valuation prediction model used

progressively more disaggregated measures

of income in order to establish whether

accruals increase the usefulness of cash-

based earnings for measuring value

> The results indicated that prediction errors

were reduced when the accrual component

of income is included separately in the

valuation model.

Barth, Clement, Foster and Kasznik (1998)Barth, Clement, Foster and Kasznik considered

whether a commercial estimate of brand values

had incremental value relevance over and

above financial statement data.

> They examined over 1,200 brand valuations

for 595 US firm-year observations covering

the period 1992–1997

> To test the value relevance of brands, Barth

et al. regressed share price on book value,

earnings and the brand valuation, which is

not recognised within GAAP financial

statements. They also examined the

association between changes in brand value

and contemporaneous stock returns. In both

cases, they also included several additional

controls, and their results were robust to

these additional controls, as well as a

simultaneous equations approach to control

for the possibility that brand values reflect

share prices (i.e. causality may go in the

opposite direction to the hypothesis)

> Barth et al. found that brand valuations not

recognised in GAAP financial statements

were value relevant. They also found that

brand valuations were positively associated

with advertising expense, brand operating

margin and brand market share. However,

the brand valuations were not significantly

related to sales growth.

It is also seems pertinent to note that the

overwhelming number of criticisms about the

‘timeliness’ of GAAP earnings put forward by

regulators, politicians and investor groups

refers to a failure to reflect bad economic news

on a timely basis. It is extremely rare to find a

firm’s financial statements criticised for failing

to reflect good economic news quickly enough!

This extends to criticisms about the effect of

corporate governance mechanisms such as

audit quality on the quality of financial reporting

(Ruddock et al. 2006).

The essential insight gained from the above is

that timely loss recognition (conditional

conservatism) is likely to be valued as an

attribute of periodic financial reporting, even

if it means that such measures are less timely

under certain circumstances (i.e. good

economic news) than they might otherwise be.

Researchers have contributed to an

understanding of this phenomenon in a

number of ways. First, they have documented

systematic evidence of timely loss recognition

as an attribute clearly evident in GAAP financial

statements (Basu 1997). Second, they have

shown circumstances where timely loss

recognition is more likely to be valued, and

hence apparent (Ball & Shivakumar 2005; Ball

et al. 2005). Third, they have reconciled timely

economic loss recognition with the audit

process and notions of audit quality (Ruddock

et al. 2006). Finally, they have identified timely

recognition of economic losses as a

component of the surprisingly high frequency

with which publicly-traded firms report losses,

and the persistence of such losses (Balkrishna

et al. 2006). Each of these studies is briefly

reviewed below.

Basu (1997)In this study, Basu tested for the extent to

which earnings reported by US firms displayed

evidence of reflecting bad news more quickly

than good news (i.e. conditional conservatism).

> He examined in excess of 43,000 firm-years

drawn from the period 1963–1990

> Two primary tests were used to identify

conditional conservatism. First, earnings

were regressed on contemporaneous stock

returns, including a dummy variable and

interaction effect which identified cases

where stock returns were negative (a proxy

for bad news). A second test regressed the

current earnings change on the previous

earnings change, with a dummy variable and

interaction effect identifying cases where the

prior earnings change was negative

> Both tests suggested that annual earnings

reported by US firms are conditionally

conservative. Bad economic news is

reflected in earnings much more quickly, and

negative earnings changes are much more

likely to reverse than positive earnings

changes, consistent with bad news being

reflected more quickly.

Ball and Shivakumar (2005)A study by Ball and Shivakumar examined the

extent of conditional conservatism in a large

sample of private and public UK firms.

> They hypothesised that conservatism would

be less prevalent in private firms, as market

demands for conservative reporting is less

likely to be prevalent among firms that are

not publicly traded

> They examined data for the period

1989–1999, with over 54,000 firm-years for

publicly-traded UK firms and over 140,000

firm-years for UK firms that did not have a

stock exchange listing (i.e. ‘private firms’)

> Ball and Shivakumar used two methods for

measuring conservatism. Like Basu (1997),

they examined the time series behaviour of

earnings changes, and second, they

examined the extent to which the relation

between accruals and operating cash flows

varies depending on the sign of operating

cash flow

> The finding that private firms’ earnings

were significantly less conservative than

those of publicly-traded firms was robust

to controls for differences between the two

groups such as leverage, size, industry and

fiscal year. The result also cannot be

explained by risk or tax differences.

The Institute of Chartered Accountants in Australia 23 >

GAAP-based financial reporting: measurement of business performance

1.5 Conservatism and GAAPreporting

The use of a value relevance criterion for

considering the usefulness of the existing

GAAP-based system of periodic financial

reporting (and possible extensions/

modifications thereto) ignores the many other

ways in which business performance is

measured (or monitored) for purposes other

than valuation per se. For example,

measurement of business performance is an

integral part of executive compensation

contracts, which specify GAAP (or GAAP-

related) performance measures as part of the

set of criteria against which executive

performance is assessed and rewarded.

Similarly, the provision of debt financing

typically entails some commitments on behalf

of the borrowing entity which are defined and

monitored using variables derived from the

GAAP financial statements.

The use of GAAP-based measures in various

types of contracting creates a demand for

certain properties within GAAP-based

accounting. These properties may be at odds

with a pure ‘value relevance’ perspective. One

such example is the demand for conservatism.

What is conservatism in financial reporting?

Fundamentally there are two types of

conservatism (Watts 2003a; 2003b). First,

there is what can be termed unconditional

conservatism. This simply reflects a preference

for accounting methods that result in lower (or

the lowest possible) value of assets and hence

owners’ equity. This is a systematic bias in

accounting, and as such can be readily

adjusted. It is hard to see how such a

systematic bias would improve periodic

financial reporting. While it does not assist in

achieving greater value relevance, it also is

unlikely to be of value in facilitating more

efficient contracting arrangements between the

various parties of which the firm is comprised.

In contrast, conditional conservatism arises

where financial reporting requires a higher

standard of verification for the reporting of

good news as compared to bad. This reflects

a perspective similar to that of ‘anticipate no

gains, but anticipate all losses’. In effect,

this results in an asymmetrical timeliness —

periodic financial reporting reflects bad

economic news more quickly than good.

A simple example provided by Basu (1997)

illustrates the asymmetrical treatment of good

versus bad economic news. Imagine a machine