Xisto Vieira Filho Regulatory Affairs & Planning March, 2002 The Current Status and Short Term...

-

Upload

raymond-sherman -

Category

Documents

-

view

213 -

download

0

Transcript of Xisto Vieira Filho Regulatory Affairs & Planning March, 2002 The Current Status and Short Term...

Xisto Vieira FilhoRegulatory Affairs & PlanningMarch, 2002March, 2002

The Current Status and Short Term Evolution of the Brazilian Power Sector:

A Focus on Thermal Generation Expansion

22

THE CURRENT STATUS OF THE BRAZILIAN POWER SECTOR: A FOCUS ON THERMAL GENERATION EXPANSION

(1) PRESENT SITUATION

Total GenerationTotal Generation and Supply and Supply

HydroHydro ThermalThermal OthersOthers

CoalCoal OilOilNaturalNatural

GasGas

65821 MW65821 MW(88.4%)(88.4%)

1415 MW1415 MW(2.0%)(2.0%)

1862 MW1862 MW(2.5%)(2.5%)

1740 MW1740 MW(2.3%)(2.3%)

1608 MW1608 MW(2.2%)(2.2%)

NuclearNuclear

1966 MW1966 MW(2.6%)(2.6%)

65.821 MW 6.983 MW 1.608 MW

74.412 MW

33

(2) SHORT TERM/MEDIUM TERM POLICY FOR GENERATION EXPANSION:

• Need to reduce strong dependence from hydrological conditions.

A bad “hydrological year”.

Difficulties to supply energy demand.

• Hydro potential to be explored still high.

new hydro plants more and more distant from main load centers. strong transmission requirements. environmental problems.

44

• new hydro plants are adding smaller reservoir capacity (storage capacity).

STORAGE CAPACITY BEHAVIOUR:

Storage Capacity / (Load - Thermal Capacity)

0

5

10

15

20

25

30

19

70

19

71

19

72

19

73

19

74

19

75

19

76

19

77

19

78

19

79

19

80

19

81

19

82

19

83

19

84

19

85

19

86

19

87

19

88

19

89

19

90

19

91

19

92

19

93

19

94

19

95

19

96

19

97

19

98

19

99

20

00

20

01

55

FURNAS RESERVOIR: ANNUAL INSTEAD OFPLURI-ANNUAL REGULARIZATION

UHE FURNASReservoir Level (%)

0

10

20

30

40

50

60

70

80

01

/01

/19

99

23

/02

/19

99

17

/04

/19

99

09

/06

/19

99

01

/08

/19

99

23

/09

/19

99

15

/11

/19

99

07

/01

/20

00

29

/02

/20

00

22

/04

/20

00

14

/06

/20

00

06

/08

/20

00

28

/09

/20

00

20

/11

/20

00

12

/01

/20

01

06

/03

/20

01

28

/04

/20

01

20

/06

/20

01

12

/08

/20

01

04

/10

/20

01

26

/11

/20

01

66

“INSURANCE” AGAINST CRITICAL

HYDROLOGICAL PERIODS

StorageStorage

Capacity Capacity

Thermal Thermal

GenerationGeneration

OROR

Being continuously reduced

New Hydro Plants aggregate small storage capacity (most are run-of-river plants)

Construction problems

“Need for thermal Generation to Complement the Predominantly Hydro System”.

77

ADOPTED STRATEGY:

• to develop a Priority Thermal Program (PPT) based on gas-fired thermal plants.• private investments.• to continue hydro expansion, but incentivating adequate thermal complementation.

962353 5544911.261

799

894

24862.829

4.0903.448

1.693

844554

2001 2002 2003 2004 2005

0

1.000

2.000

3.000

4.000

5.000

6.000

Aggregated Energy to the Interconnected System (MW):Aggregated Energy to the Interconnected System (MW):

((MWMW) )

PPT plants (under construction)PPT plants (under construction)

Hydro plantsHydro plants

88

WHAT ARE THE DIFFICULTIES FOR THERMAL GENERATIONAGENTS?

• Power Sector Model IS based on competition in G.

large state-owned G’s were not privatized.� market for short term transactions is not working yet.� market for long term transactions with difficulties –� uncertainties due to “Initial Contracts”. small amount of free consumers.�

• Regulatory uncertainties.

several present rules not “market oriented”.� a strong concern of the Regulatory Agency to avoid� higher tariffs for captive consumers – short term basis. changes in rules (mainly during rationing).�

99

• Gas supply.

gas price. take or pay and ship or pay contracts for a predominantly hydro system. pipelines development and open access.

Government decided to prepare new measures to overcomethese difficulties and to enhance the competitive model.

• Government has established 1 TF for each one of the measures:

1010

(3) MAIN COMMENTS ABOUT THE MEASURES TO ENHANCE THE SECTOR MODEL – PERSPECTIVES TO GAS FIRED THERMAL

GENERATION:

• The two big issues to solve:

Market

Gas supply

Short Term Market

Medium / Long Term Market

1111

(3.1) MAIN POINTS ABOUT THE SHORT TERM MARKET:

(a) THE WHOLESALE ENERGY MARKET (MAE) STRUCTURE:

PROBLEM: • MAE not working. • DISCO’s and GENCO’s would seldom agree about measures/rules. • a difficult and heavy structure.

PROPOSEDSOLUTION: • a light structure. • rules established by ANEEL, after public hearings. • 3 out of 5 Directors indicated by the Government. • Arbitrage chamber established to avoid “external disputes”.

COMMENTS: • Still with a considerable intervention. • Scheduled period for the intervention = 1 year.

1212

(b) SPOT PRICES:

PROBLEM: • determined by NEWAVE package. • results strongly dependent on short term hydrological condition forecasts. • results depend also on the perception of ANEEL and ONS about the

generation plan and about load behaviour.

PROPOSEDSOLUTION: • to improve the computer package on a temporary basis. • to implement an offer x demand system based on price (instead of cost) declarations.

COMMENTS: • It is one of the most important measures – PRICES MUST BE FORMED BY MARKET PERCEPTIONS. • An actual development to the market.

Computer Package should not be used to establish � PRICES.

1313

• Two different schemes to form prices:

Pspot Computer Package Pspot Market

• perceptions of “official entities”. • different perceptions of each agent.

Technical Parameters:• hydrological conditions.• new G evolution.• maintainance program.• load forescasts.

• Technical parameters.• Estimation of other agents’ behavior.• Estimation of Regulation evolution.• Estimation of Macroeconomic Aspects.

1414

• Example: The influence of short term estimation of NEI (Natural Energy Inflow)

• Price volatility with no market perceptions considered.

SE-CW Submarket

18.9 15.3 12.9 9.8 7.3 6.0 4.8 4.0

137.7

90.4

67.4

49.0

35.6 32.425.7

19.9

0.00

20.00

40.00

60.00

80.00

100.00

120.00

140.00

160.00

60% 70% 80% 90% 100% 110% 120% 130%

NEI Forecast (% Long Term Average)

Price (R$/MWh)

Current Storage Level 64%

Storage Level 30%

1515

DISCO

(3.2) MAIN POINTS ABOUT THE LONG TERM MARKET:

(a) A GENERATION PRICE CAP ESTABLISHED FOR PASSTHROUGH TO FINAL CONSUMERS:

TT

~~ ~~ ~~

PPA at a price p

Final Consumers (Captive)

Pmax that a DISCO can pass through to itscaptive consumers (based on VN).

• one typical spread sheet with data from an “average project”.• VN considered not atractive to private investors.

1616

COMMENTS:

• VN avoids or minimizes possibilities of G competition in the long term market.• 1 only VN for all the range of projects does not cover adequately several projects.

•VN x competitive market free consumers.

1717

(b) INCENTIVES TO FREE CONSUMERS:

• Actual Competition in Generation:

Will only take place if a considerable part of the consumers are free.

• Free Consumers:

less regulatory “constraints” dictated by ANEEL. possibility to actually choose their suppliers. currently for PD 3MW. apparent protection given by ANEEL to captive consumers.

1818

• Measures that will be analyzed:

to gradually reduce requirement to become free (PD 1 MW). establish tariffs to consumers that may become free and remain captive as Max VN; Pspot

Other Examples of Incentives

to allow free consumers to negotiate their required reliability (different prices). to allow free consumers to return to the status of captive consumers whenever they want

1919

(c) REVISION OF THE AMOUNT OF ENERGY HYDRO GENERATORS CAN SELL IN THE LONG TERM MARKET:

System AssuredEnergy (AE).

• Energy that hydro plants can trade in the long term market.• Confidence level of 95%.• Planning criterion: RD = 5%.

AE1

AE2

AE3

• • •

AE for each hydro plantfor a period of 5 years.

• works like a nameplate of energy for hydro plants.

Over estimated. Rationing occurred for conditions better than the 5% region of Risk

2020

To improve the issue of AE:

A complete revision in the methodology. Thermal plants must be considered adequately in the methodology. Constraints must also be considered. • Navigation. • Environment. • Security volume to avoid flood.

Very important measure to ensure the competitiveness of thermal generators.

2121

(3.3) MAIN ISSUES ABOUT GAS SUPPLY AND THERMAL PLANTS:

(a) CURRENT SITUATION OF GAS SUPPLY:

~~• • • ~GTN

GT1

GT2

Thermal Plantsof PPT

Bolivian Gas National Gas

Argentinean Gas

• PPT = 15.000 MW.• Gas Requirements for PPT = 69 MMm3/day. (until 2005)

CURRENT SUPPLY SITUATION

SUPPLY FROM AMOUNT OF SUPPLY (MMm3/day) CONSTRAINTS

BOLÍVIA 17 • Pipeline Capacity.

ARGENTINE 2 • Pipeline Capacity.

BRAZIL 25 • Pipeline Capacity.

• Production.

TOTAL 44 30 MM m3/day for internal consumption.

2222

(b) WHAT IS NEEDED TO ENHANCE THE EXPANSION OF NG THERMAL PLANTS:

(b.1) TO INCREASE THE PIPELINE CAPACITY:

Open Season for new capacity in the Existing Pipelines.

• Schedule for the end of June.•PETROBRÁS will not be allowed to acquire more than 40% of the new capacity only if there are not other candidates.• Compression stations and loops, basically.

2323

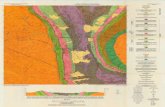

CURRENT PIPELINE STRUCTURE IN BRAZIL:

Uruguaiana-Porto Alegre: 615 km Segment 1: 25 km

Segment 2: 565 km

Segment 3: 25 km

Pipelines: 8.071 km

Transpetro: 2.397 km

Bolívia-Brasil (in Brazil): 2.583 km

North Segment: 1.418 km

South Segment: 1.165 km

Under Constrution

UPGNsCapitals

Refineries

In Operation

Urucu

Coari

Cáceres

Corumbá

Cuiabá

Paulínia

Guararema

Uruguaiana

P. Alegre

Campos Basin

Santos Basin

Rio Grande

Fortaleza

Salvador

Under Constrution

UPGNsCapitals

Refineries

In Operation

Lateral Cuiabá (in Brazil): 267 km

2424

(b.2) HOW TO CONSIDER THE DISPATCH OF NG THERMAL PLANTS IN THE BRAZILIAN PREDOMINANTLY HYDRO POWER SYSTEM:

~~• • • ~GHN

GH1

GH2

~~

~

GT1

GT2

GTj

• • •

BRAZILIAN PREDOMINANTLYHYDRO SYSTEM

• system centrally dispatched.• tight pool approach.• ONS performs an optimization process for dispatch.

OBJECTIVE FUNCTION

to maximize overall available energy. to minimize the probability of spillage.

2525

NG Thermal Plants Contracts. • take or pay. • ship or pay

FLEXIBILITY LEVEL DECLARATION TO ONS

NG GT DECLARATION CONSEQUENCES

Totally Inflexible • dispatched for any spot price.

• Increase spillage risks for hydro generators.

Totally Flexible at a certain variable cost.

• dispatched only if declared cost < spot price.

• predominantly wet and “average” years.

• increase risk of flaring gas.

• A NEW PARADIGM NEEDED.• TIGHT POOL LOOSE POOL OFFER X DEMAND PRICING SYSTEM.

2626

• The influence of creating/incentivating a “secondary market” for gas:

New Trading Arrangements. • industry. • major free consumers of potential gas.

Other types of use for gas. • usage in cities. • vehicle.

Increase of storage capacity.

“Green Taxes” for poluent fuels.

2727

(c) IMPROVEMENTS IN REGULATION:

Unbundling of exploration, transportation in gas supply.

Expansion of transportation structure and open access with adequate pricing system.

Taxes for gas must be re-analysed.

2828

Gas price

GAS PRICE

(US$/MMBTU)

COMMODITY TRANSPORTATION TOTAL

NATIONAL 2.04 0.25 2.29*

IMPORTED 1.57 1.6588 3.3488**

PPT Plants ___ ___ 2.581**

A MEASURE UNDER ANALYSIS:TO SUBSIDIZE PART OF THE GAS PRICE FOR THERMAL PLANTS OF THE PPT.

Note:*In accordance with the administrative rule MF/MME 03/2000 ** ANP Source ***In accordance with the administrative rule MF/MME 176/2001

2929

(3) CONCLUSIONS:

• A re-structuring process now happening in the Brazilian power sector.

• Importance of including NG Thermal Plants in the country’s Energy Matrix.

• Some challenges for enhancing the competitive model:

• State-owned G companies privatization.• To minimize Government influence in the market.• To incentivate consumers to be free.

3030

• Regulatory rules for the power sector to be improved. rules not to be changed.

RULES CONCERNING SPOT PRICESWERE CHANGED SEVERALTIMES DURING RATIONING SPOT PRICE REDUCTION.

IT CAN BE PROVED THAT REGULATORY INTERVENTION IN THEMARKET TO KEEP PRICES LOW LEADS TO FUTURE DEFICITS INGENERATION CAPACITY (RATIONING AND BLACKOUTS).

A Recent Example: