Working with private equity How PEPTalks CEOs deliver top quartile returns · 2018-09-18 · How...

Transcript of Working with private equity How PEPTalks CEOs deliver top quartile returns · 2018-09-18 · How...

3 PEPTalks CEOs/Chairs share real experiences

Working with private equity

How PEPTalks CEOs deliver top quartile returns

How PEPTalks CEOs deliver top quartile returns

PE houses, having invested in a business, not unreasonably expect a relentless focus on achieving top quartile returns from their senior management team.

While there are endless theoretical opinions from professionals, real-world hands-on experience can tell some very different stories. We asked three successful PEPTalks members, all of whom have current or recent experience as CEO or Chairman in delivering stellar returns with PE backed businesses, to explain their approaches.

We asked each of them three fundamental questions:

• Do you have a model or methodology you employ?• Can you give some examples of how you significantly enhanced

value creation?• What mistakes did you make first time around? What common

pitfalls should CEOs avoid?

How PEPTalks CEOs deliver top quartile returns

Methodology?

There needs to be a simple plan everyone understands… “we expect to grow sales by x% a year for each of the next 4 years and we are going to do that by (for example) benefitting from the growing market for this/product service.”

There needs to be a clear plan as to how technology will enable the business not just to be more efficient (= low costs) but also more effective (= better sales and/or margins).

You need to be clear about the five key roles (not more!) necessary to make the business fly higher; you need plans in place to recruit (and/or switch out) for the positions where you have no one or the wrong person.

Simon McMurtrie is Chairman of Virgin Experience Days, backed by Inflexion. From December 2014 Simon was Chairman of Riviera Travel following Phoenix Equity’s purchase of the business from the owner until Phoenix’s successful exit in December 2017. Previously he was CEO of family-owned Direct Wines.

How PEPTalks CEOs deliver top quartile returns

Implementing change to enhance value?

You need a very simple presentation of numbers (profit and cash) which the whole management team understand and ensure that cash conversion as a minimum remains static in % terms, but ideally improves... “We are expecting profits to grow in line with sales; we expect profits to grow in % terms as we amortise our low operating costs against much greater business; we expect profits to grow as our margins improve as a result of our change in sourcing strategy.”

In Virgin Experience Days we identified that the business had more cash on the balance sheet than was needed to fund working capital and growth. We also established that it would be possible to put debt into the business as there was a strong revenue and profit growth over recent years. A refinancing and the excess cash enabled us to return a substantial % of the PE fund’s initial investment back to the fund within six months of the original deal!

At Riviera Travel, the concern about the decline of newspaper circulation and the business’s dependence on newspapers as the largest source of new customers, led to a focus on creating a Riviera branded direct to consumer strategy to recruit many more customers – online and offline – directly onto the Riviera brand. Stage 2 of that journey encouraged us to launch Riviera on TV to drive potential customers to the website to learn more about our holidays and to request a brochure. Over 50% of Riviera’s new customers now come directly onto the brand.

How PEPTalks CEOs deliver top quartile returns

Mistakes and pitfalls?

In Virgin Experience Days we recruited a new CTO (there was no one in the role) to enable us to own our technology strategy and to put in place a plan using internal and outsourced resources to create much better tools for managing the customer database and our relationship with experience providers. This shows the importance of identifying the five key roles.

The most common mistake that I (and others!) have made is to wait too long to put in place better people. The introduction of a heavyweight CMO at Riviera and a CTO at Virgin Experience Days significantly accelerated value creation.

The second most common mistake is to be too impatient in waiting for the results to flow through of new marketing initiatives. Assuming that the initial indicators are positive, it always pays to wait a few more months before jumping to any conclusions around new methods/channels etc.

A common pitfall to avoid is to fail to focus on cash. People typically focus on profit when it’s cash that can cause a real headache in businesses!

How PEPTalks CEOs deliver top quartile returns

Methodology?

A lot of value created at Pulsant was generated through M&A, but it’s important to note that ‘buy and build’ shouldn’t be your strategy…it’s part of how you achieve your strategy.

Developing your strategy is a 3-stage process:

First, you need a clear market position. What are you good at and what you aren’t. Understand your customers. Understand your competition. What are your differentiators? Being the most focussed business in our sector gave us a rarity value. We turned down a lot of attractive acquisition opportunities because we felt they wouldn’t drive our strategy forward.

Mark Howling is Non-executive Chairman of TIG and Gradwell, following 30 years successful experience in the ICT sector. He became CEO of Pulsant in 2010 and transacted a secondary buyout backed by Oak Hill Capital in 2014 before transitioning to Non-executive Director in 2017.

How PEPTalks CEOs deliver top quartile returns

Implementing change to enhance value?

Second, you need a growth strategy. Has the market got capacity for growth? You need to target what customers are really looking for, and you need to make sure your routes to market are clear. Pricing and sales are a part of this. You can’t just delegate this to marketing: the CEO should be intimately involved.

Third, you need to be clear about what success looks like, not just from the company’s point of view but from an exit point of view. Who are the potential buyers? Have a firm idea of value in 3-5 years’ time. Timing is everything: multiples change. Monitor value every year, and as exit becomes closer, go to quarterly. And bring in outside advisors to help you define success, even if only informally.

As Non-executive Chairman of Gradwell, which was an IT business with a foot in telecoms and a range of other IT services. I applied the 3 step process and for a £7m T/O business it was clear that it was trying to do too much. We decided to focus on VoIP and sell off the IT side. This alone made the business much more attractive.

How PEPTalks CEOs deliver top quartile returns

I was CEO at Digica, backed by Bridgepoint. When I joined in 2003 they were struggling for growth, but trying to sell IT outsourcing to small, medium and big companies. Selling to small companies was fine except they were so small the margins were not good enough and cost of sale far too high. And selling to big companies was highly competitive. So we decided to focus on the mid-market where growth was substantial and where the big outsourcers were not realty focussed. We more than doubled the business and successfully exited to Computacenter in 2007.

At Pulsant, in order to maximise the value of the businesses we had acquired; I made sure I had an integration plan before the deal was completed and treated it like a project. I would typically hire an interim project manager from outside the business who would be able to dedicate the time and bring real expertise to the integration process. This paid off at the exit point as companies we had acquired at single digit multiples during the cycle were sold at double digit multiples once properly integrated into the larger group. We also found that achieving a certain scale in itself helped us command a higher multiple.

At Pulsant, we introduced Net Promoter Score as a key KPI to measure customer satisfaction and this provided our new investors with great confidence that the organisation could withstand fast growth without compromising on quality.

How PEPTalks CEOs deliver top quartile returns

Mistakes and pitfalls?

The most common mistake is forecasting that’s too optimistic. Failing to deliver what you said you would deliver erodes trust – even if what you deliver is actually quite good.

Sometimes markets change. You might need to reduce your numbers. Re-set expectations as soon as you can. Bite the bullet. Your PE will appreciate reduced expectations rather than bad news after the event. If they trust your numbers, you’ll always get support even through the bad times.

How PEPTalks CEOs deliver top quartile returns

Methodology?

In order to achieve change quickly, you need to focus the whole organisation on a very clear strategy and make sure all resource is targeted in the same direction. It’s as much about identifying what you aren’t going to do as it is what you are.

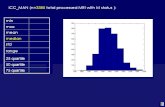

I’ve used the ‘Rapid Strategy Deployment’ model multiple times (see figure 1) to breakdown the strategic intent into short term actions with accountable owners. I’ve found that this process helps to align the organisation and enables those at the coalface to understand how they contribute towards the bigger picture.

Rather than build a business with an exit in mind develop a strategy that combines strong EBITDA growth with unique market positioning, this will make you attractive to numerous buyers and will result in the highest multiple.

Chris Noblet was previously CEO of Rivo, Avelo and Ramesys, all of which he exited on behalf of PE houses.

How PEPTalks CEOs deliver top quartile returns

You have to communicate the plan to the whole team. Show them what good looks like. Just as important, tell them what they should stop doing. Especially with smaller businesses it’s vital to get away from what you’re not good at. Do fewer things well, not lots of things badly.

Make sure you agree with the senior team what good likes like. What needs to happen to get there? PEs love the process because it gives clarity.

You set targets but they’re not just financial. Financial targets can be short term. They don’t describe the long term opportunities

Figure 1: Rapid Strategy Deployment Model

How PEPTalks CEOs deliver top quartile returns

Implementing change to enhance value?

With founder organisations, you have to develop scalability. The strength of their personality drives the business but it can weaken when the business gets bigger. Middle management can get left too far away, bogged down in tools, processes, mechanisms, so you need to keep the vision clear. As CEO you have share the business objectives and the business achievements.

At Avelo, an M&A strategy was employed to create the only software business in the UK that touched every aspect of the distribution chain of financial products. Three disparate businesses were acquired at multiples in the range of 7-10 times and were fully integrated under the new brand of Avelo. As a result of being a larger business that now owned the entire distribution channel (a unique market position in the UK), Avelo was able to command a multiple closer to 15 x cash EBITDA.

At Avelo we brought in ‘The Times Best Companies to Work For’ survey to help us uncover what was going wrong in the business. This helped us to develop strong targets on culture change on top of our financial measures. The turnaround we managed to achieve in employee engagement as a result had a material impact on our ability to achieve our exit valuation, as this was seen as a key enabler, by our new owners, in achieving their business objectives.

How PEPTalks CEOs deliver top quartile returns

Mistakes and pitfalls?

What I’ve seen a couple of times in private equity is that an opportunistic acquisition can be rushed through without having a proper integration plan. Before completing you should have a day 1 communication strategy outlined as well as a 100-day plan, to be implemented by a project management team.

I inherited a situation in one of my CEO roles where the leadership team was disparate and fragmented and the CFO was at conflict with the PE house. It was clear that changes needed to happen but I didn’t go with my gut instinct at an early stage, meaning the whole process took 6 months longer than it should have. I should have acted a lot earlier.

About PEPTalks

PEPTalks brings CEOs together on a regular and confidential basis to share experiences, to learn and support one another. As they say, ‘it’s tough at the top’, and PEPTalks creates a high-level forum where the special challenges of working with private equity as your major shareholder can be shared for the mutual benefit of all concerned. If you’d like to know more about PEPTalks and how membership could work for you and your business, contact Joe Berwick at [email protected].