WHY BEGGAR THY INDIAN NEIGHBOR - Native Nations...

Transcript of WHY BEGGAR THY INDIAN NEIGHBOR - Native Nations...

WHY BEGGAR THY INDIAN NEIGHBOR?

THE CASE FOR TRIBAL PRIMACY IN TAXATION IN INDIAN COUNTRY

______________________________________________________

KellyS.Croman&JonathanB.Taylor

May4,2016

DISCUSSIONDRAFTSendcommentsto:

[email protected]&[email protected]

Joint Occasional Papers on Native Affairs JOPNA2016-1

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT ii NNI | HPAIED

ABOUTTHEAUTHORS

KellyCromanisChairoftheNationalIntertribalTaxAllianceandDirectoroftheOfficeofTribalAttorneyfortheConfederatedTribesoftheChehalisReservation.SheformerlyservedasCEOofIslandEnterprises,Inc.,theeconomicdevelopmentarmoftheSquaxinIslandTribe;GeneralCounselforMarineViewVentures,Inc.,theeconomicdevelopmentarmofthePuyallupTribe;andtribalattorneyfortheSquaxinIslandTribe.

JonathanTaylorisPresidentoftheTaylorPolicyGroup,aneconomicsandpublicpolicyconsultancy;aResearchAffiliateattheHarvardProjectonAmericanIndianEconomicDevelopmentattheKennedySchoolofGovernment;andaSeniorPolicyAssociateattheNativeNationsInstitute,UdallCenterforStudiesinPublicPolicy,UniversityofArizona,Tucson.

Theviewshereinaretheauthors’ownandnotnecessarilythoseoftheinstitutionswithwhichtheyareaffiliated.

ACKNOWLEDGEMENTS

WearegratefultoLeslieCushman,JohnDossett,EricEberhard,MiriamJorgensen,JosephKalt,SarahKrakoff,andJosephSingerfortakingthetimetoreviewourpaper,butofcoursetheybearnoresponsibilityforanyremainingerrorsoromissions.

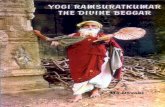

COVERPHOTOCREDITS

PhotoscourtesyoftheWashingtonIndianGamingAssociationandtheSuquamishTribeCommunicationsOffice(right).

©2016bytheNativeNationsInstitute,TheArizonaBoardofRegents,andtheHarvardProjectonAmericanIndianEconomicDevelopment

ThedevelopmentandpublicationoftheJOPNAseriesismadepossibleinpartthroughthegeneroussupportoftheMorrisK.andStewartL.UdallFoundation.

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT iii NNI | HPAIED

TABLEOFCONTENTS

AbouttheAuthors..........................................................................................................................iiAcknowledgements........................................................................................................................iiCoverPhotoCredits.......................................................................................................................ii

Abstract..........................................................................................................................................1

I. Introduction.............................................................................................................................1

II. TheDeJureCaseforChange....................................................................................................2FundamentalsofGoodTaxPolicyAreLong-EstablishedOutsideIndianCountry 2FederalLawandRelatedPracticalChallengesLimitTribes’RevenueOptions 4PrinciplesofSoundApportionmentAreNotGenerallyAppliedtoIndianCountry 8IndianTaxLawIsEconomicallyInefficientandInhibitsGrowth 9

III. TheDeFactoCaseforChange................................................................................................12IndianEconomicDevelopmentHelpsStateGrowth 14DoubleTaxationIsaDoubleBind 17TaxBreaksversusBrokenTaxes 20

IV. TheDeRectoCaseforChange................................................................................................22IndianPriority 22FairDealing 23Don’tBeggarYourNeighbor 24ParityinBreaks 25

V. Recommendations.................................................................................................................25FederalSolutions 26StateSolutions 27

References....................................................................................................................................30

JointOccasionalPapersonNativeAffairs....................................................................................40AbouttheNativeNationsInstitute..............................................................................................40AbouttheHarvardProjectonAmericanIndianEconomicDevelopment....................................41

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 1 NNI | HPAIED

ABSTRACT

ThelawgoverningtaxationinIndiancountryisamess.Theaccretionofcommonlawprecedentsandthegeneraltendencyofstatestoassertprimacyoverthetaxationofnon-Indianscreateabsurdoutcomes.Thisarticlemakesthecasethreeways.Theargumentbasedonthelawshowsthatparticularized,fact-specificprecedentscreateathicketofrulingsthatimpedebusinessdevelopment.Theargumentbasedonfactsshowsthattheseimpedimentstoeconomicdevelopmentharmnotonlytribaleconomies,butstateandlocaleconomies,too.Andtheargumentbasedonjustclaimstestifiestothefactthatthecurrentarrangementcouldhardlyhaveemergedfromtheactionsofwillingandinformedgovernmentsoperatingingoodfaith.ToborrowfromAdamSmith,statesbeggartheirIndianneighbors,seekingfiscalgaintothetribes’detrimentand,ultimately,theirown.WeconcludebyrecommendingactionstobringfairnessandcertaintytothelawgoverningtaxationinIndiancountry.

I. INTRODUCTION

ThepowertotaxisanessentialattributeofIndiansovereigntybecauseitisanecessaryinstrumentofself-governmentandterritorialmanagement.Thispowerenablesatribalgovernmenttoraiserevenuesforitsessentialservices.…[Itderives]fromthetribe’sgeneralauthority,assovereign,tocontroleconomicactivitieswithinitsjurisdiction,andtodefraythecostofprovidinggovernmentalservicesbyrequiringcontributionsfrompersonsorenterprisesengagedininsuchactivities.(Merrionv.Jicarilla,1982,p.130)

Thislanguage,froma1982U.S.SupremeCourtdecision,underscorestwoimportantconcepts.First,taxationisanimportantinstrumentofcontrol;andsecond,taxationfinancesgovernmentalfunctions.Aninfringementupontherighttotaxinfringesuponbothcoreattributesofsovereigngovernance.

Everygovernmentreliesontaxrevenuestofundessentialservicesandpublicgoods,includingbuildingandmaintaininginfrastructure(suchasroads,broadband,water,andwastewatersystems);permittingandlicensingbusinessesandprofessions;enforcingcontractsandresolvingdisputes;ensuringpublicsafety;educatingchildrenandworkers;enforcingbuildingcodesandothersafetymeasures;insuringagainstunemploymentandworkerinjury;andmore.Taxrevenuesareusedaswellfornaturalresourceandenvironmentalprotection,parksandrecreation,housing,communitydevelopment,andassistancetodisabledandneedycitizens.Governmentsalsodesigntaxesandtaxexemptionstoencouragebehaviorsinthepublicinterest,suchassmokingcessation,economicinvestment,pollutionreduction,andhomeownership.

Whiletherightsoftribestoimposetaxesarewellestablished,statesusuallyinsistonprimacywhenjurisdictionsoverlap.Theadhocaccretionofprecedentsresultingfromlitigationoversuchoverlapcreatesbizarreconstraintsontribalgovernments’abilitytoraiserevenueanddirectactivityintheirjurisdictions.Thisinfringementdiminishesthesovereigntyoftribal

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 2 NNI | HPAIED

governments,diminishesgovernmentservicesandpublicgoodsfortribalcitizensandothers,andencumbersstates,localgovernments,andtheirrespectivecitizens.

Ourpurposehereistodemonstratethatasalegalandeconomicmatter,Indiantaxpolicyisdeeplyflawedandmustbechanged.Ourargumentsarepresentedinthreecategories:legal(dejure),practical(defacto),andmoral(derecto).1Thedejure2argumentdemonstrateshowcourtprecedentshavemadeacomplexandoftenabsurdmessofwhatshouldbearelativelystraightforwardbodyoflaw.Thedefacto3argumentdocumentsthedeleteriousconsequencesofthoseprecedentsforIndianandnon-Indianeconomies.Thederecto4argumentexploresthemoralcaseforIndiantaxreform,acasebasedonjustclaims.Thefinalsectionofthepaperoffersrecommendations.ManyoftheexamplesbelowarefromWashingtonState,butourfindingshaveimplicationsacrossallthestateswhereinIndiancountry5isfound,sowehavealsoincludedexamplesfromfartherafield.

II. THEDEJURECASEFORCHANGE

FundamentalsofGoodTaxPolicyAreLong-EstablishedOutsideIndianCountry

FromTheFederalistPapersof1787tomodernpublicationsoftheAmericanInstituteofCertifiedPublicAccountantsandtheNationalConferenceofStateLegislatures,thereisasharedunderstandingthattaxsystemsoughttoatleast:

• Reliablyprovidesufficientgovernmentalrevenues;• Providecertainty;and• Promoteeconomicgrowthandefficiency.6

Theseprinciplesaremutuallyreinforcing.Certaintyreducesfinancialandpracticalbarrierstoeconomicgrowthandpromotesefficiency.Growthandefficiencyprovidealargertaxbaseand

1CreditgoestoJosephKaltandJosephSinger(2004)forintroducingustothistripartiteframework.2“dejure...[LawLatin‘asamatteroflaw’]Existingbyrightoraccordingtolaw”(Garner,2004,p.458).3“defacto...[LawLatin‘inpointoffact’]1.Actual;existinginfact;havingeffecteventhoughnotformallyorlegallyrecognized”(Garner,2004,p.448).4WeadoptKaltandSinger’sformulationofderectoas“bymoralprincipleorright”(2004,p.6).5“[T]heterm‘Indiancountry’…means(a)alllandwithinthelimitsofanyIndianreservationunderthejurisdictionoftheUnitedStatesGovernment,notwithstandingtheissuanceofanypatent,and,includingrights-of-wayrunningthroughthereservation,(b)alldependentIndiancommunitieswithinthebordersoftheUnitedStateswhetherwithintheoriginalorsubsequentlyacquiredterritorythereof,andwhetherwithinorwithoutthelimitsofastate,and(c)allIndianallotments,theIndiantitlestowhichhavenotbeenextinguished,includingrights-of-wayrunningthroughthesame.”(18USC§1151).6Forexample,byaddressingmarketfailuresandunderwritingpublicgoodsor,barringthat,byminimallydistortingincentives.See,e.g.,Smith’sWealthofNations(1776),Hamilton’sFederalistPapersNos.30–36(1961),theNationalConferenceofStateLegislatures’TaxPolicyHandbook(2010),theAmericanInstituteofCertifiedPublicAccountants’GuidingPrinciplesforTaxEquityandFairness(Swingen,2007),Musgrave&Musgrave(1984,p.224),Rosen&Gayer(2010,chapter16),andmanyothers.

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 3 NNI | HPAIED

improvedcompliance,thushelpingtoensuresufficiencyandreliabilityofrevenues.Andaneffectiveincome-generatingsystemreducestheneedforgovernmentstofrequentlyaltertaxcodes,reinforcingcertainty.

Concurrentjurisdiction—theauthorityofmorethanonejurisdictiontotaxthesameproperty,activity,ortransaction—complicatestheapplicationoftheseprinciples.Itcanreducecertaintyforbothtaxpayersandgovernments.Itcanimpedeeconomicgrowthwhenitresultsinexcessivetaxation.Moreimportantforouranalysishere,itcandiminishagovernment’spowersoreveneffectivelystripthemaway.

Ifonegovernmentoccupiesthefield,theothergovernmentcannotfullyexerciseitsauthoritytotaxwithoutdrivingresidentsandbusinessesfromitsjurisdiction.7Thisisanoldproblem—onerecognizedinthejurisprudenceofinterstatecommerce:

Multipletaxationistobeavoidedwithrespecttointerstatecommercebyapportionmentsothatnojurisdictionmaytaxallthepropertyofamultistatebusiness,andtheruleofapportionmentisenforcedbytheSupremeCourtwithjurisdictionoverallthestates.(CongressionalResearchService,2014,p.272)

Equitablyapportioningtaxauthoritywassomewhatsimplerinthecountry’searlyyearsthanitistoday.8Thedevolutionofresponsibilitiestostateandlocalgovernmentscomplicatesthetaskofmakingsoundtaxpolicyatagivenlevelofgovernmentwhilealsominimallydistortingeconomicactivityelsewhereinthefederalsystem(NationalConferenceofStateLegislatures,2007;P.E.Peterson,1995).Astribalgovernmentsexercisemoreoftheirauthorityandinteractmorefrequentlywithallthreelevelsofgovernmentinthefederalsystem,achievinginter-jurisdictionalequitybecomesmorechallengingstill.Statesandcountiesoweatleastthedeferencetheyofferotherstateandlocalgovernmentstotribalgovernments,whichmustalsoprovideservices,needrevenue,andarerecognizedassovereignintheUSConstitution.

Butatbest,federal,state,andlocalpolicymakersoverlooktribalgovernments.Sometimesthatisintentional,aswhenanon-tribalgovernmentviewsIndiancountryasapotentialsourceofrevenueratherthanasapolitywithinherentpublicfinancerequirements.“OutdatedandinaccurateperceptionsofAmericanIndiantribescontinuetoprevailinnon-Indiancommunitiesandstateofficialsmaynotunderstandthattribesarefunctioninggovernments”(Johnson,Kaufmann,Dossett,Hicks&Davis,2009,p.1).Evenwheretribalgovernmentsmightbe

7Manycountrieshaveaddressedtheseissuesthroughtaxtreatiestoeliminatedoubletaxation.See,e.g.,McIntyre(n.d.).8“TheframersoftheConstitutionenvisionedaconcurrenttaxsystemwherecertainpublicservices,suchasdefenseandtransportationinfrastructure,werefundedatthefederallevelandotheritems,suchaseducationandpublicsafety,werefundedatthestateandlocallevel.”(Swingen,2007,p.9)SeealsoHamilton’sFederalistPaperNo.32(1961).

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 4 NNI | HPAIED

acknowledged,non-tribalpolicymakersregularlyfailtoadequatelyunderstandorincorporatetribalfiscalprerogativesinstrikingfairtaxapportionments.9

Atworst,stateandlocalgovernmentsdeprecatethepoweroftribestosettaxrates.Fairapportionmentimpliesthatgovernmentshavecommensuratepowerstooffertaxincentives.Stateandlocalgovernmentsusetaxpolicytoenticecustomersandfirmstotransactwithintheirjurisdictions.Acompany’sthreattodepart(ornottolocatein)ajurisdictionmaygiverisetoanabatementracesubjecttothewinner’scurse:Thebiggesttaxcutterwinsthebusinessbutgarnersmeagerornonexistentnetfiscalbenefits.AstheNationalConferenceofStateLegislaturesobserves,“Anystatethatimposesataxburdenfardifferentfromthatofitsneighboringstatesrunstheriskofhurtingitseconomy”(2007,p.5).Whetherornotsuchmechanismsareadvisable,theuseoftaxincentivesissocommonamongalllevelsofgovernmentthatdenyingthistooltoonegovernmentwhileallowingitforothersundercutsfairapportionment.Nonetheless,tribesroutinelyconfrontpoliticalhostilityorlitigationfromjurisdictionswithhighertaxes.

Inacomplexglobaleconomyinwhichallgovernmentsarestrugglingwithincreasingcompetition,costs,andresponsibilities,maintainingataxsystemthatsatisfiesthefundamentalprinciplesarticulatedaboveischallenging.ThechallengeisamplifiedinIndiancountry,where,aswewillshow:

• Federallawlimitstribes’revenueoptions;• Indiantaxlawcreatesuncertainty;• Principlesoffairapportionmentarenotgenerallyapplied;and• Indiantaxlawiseconomicallyinefficientandinhibitsgrowth.

WhatisthenormthroughoutthecountryisturnedonitsheadinIndiancountry.

FederalLawandRelatedPracticalChallengesLimitTribes’RevenueOptions

Tribalgovernmentsprovidepublicgoodsandservicessimilartothoseprovidedbystateandfederalgovernments.Theymanageforestsandfisheries,generateelectricity,monitorairandwaterquality,operateschoolsandcolleges,buildandmaintainroadsandbridges,providehealthcare,operatecorrectionalfacilities,andassistfamiliesinpoverty.Theyalsohaveresponsibilitiesresemblingthoseofcountyandmunicipalgovernments:Theymaintainsewerlines,policeneighborhoods,provideemergencyservices,teachchildren,removesnow,providetransitservices,maintainparks,collecttrash,conductelections,maintaincemeteries,andprovidepublichousing.

9TheNationalConferenceofStateLegislatureshasproducedaverythoughtfuldocumenttitledGovernmenttoGovernment:ModelsofCooperationbetweenStatesandTribes(Johnsonetal.,2009)infurtheranceofitseffortstoassisttribesandstatestocooperativelyaddressmutualinterestsforthebenefitofcitizensofboth.Thesameorganization,however,producesotherpublicationsontaxpolicyandequitythatnevermentiontribalgovernments.

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 5 NNI | HPAIED

Tribalgovernmentshavetoperformthesefunctionsinalegalenvironmentthatdeprivesthemoftheusualmeansofraisinggovernmentfunds.“Tribalgovernmentshaveextremedifficultyinraisingrevenue;theyhavevirtuallynotaxbase”(Fletcher,2004,p.771).Propertytaxesareasignificantsourceofrevenueformoststateandlocalgovernments.10Tribalgovernments,however,maynotimposearealpropertytaxontrustlands,whichareownedbythefederalgovernment.Dependinguponthereservation,trustacreagemayreach100%ofatribe’slandbase.Meanwhile,inmostjurisdictions,tribalgovernmentsandtheircitizensaresubjecttostatepropertytaxesonfeelands,evenwithinreservationboundaries,absentanexemptionunderindividualstatelaws(CountyofYakimav.YakimaNation,1992).11Thisimportantandstablesourceofrevenueisthusoftenwhollyunavailabletotribalgovernments,andtribesmustlookelsewhere.

Incometaxesareimpractical,too.GiventhatreservationpercapitaincomesarelessthanhalftheUSaverage(Akee&Taylor,2014),proportionallymoreIndiansqualifyfornegativeincometaxes(principallytheEarnedIncomeTaxCredit),effectivelyprecludingtribesfromusingthiscommonandrobustrevenuesource.

Aswewilldescribe,statesgenerallycannotimposetaxeswherethelegalincidencefallsontribes,theircitizens,andtheirenterprises.Thisseeminglycreatesanopportunityfortribestoimpose,say,asalestaxwithoutcreatinganexcessiveburden.Buttaxingonlytheportionofthereservationeconomythatisimmunefromstateandlocaltaxeswouldbeimpractical.ImagineifWestVirginiaorCaliforniacouldtaxonlynative-bornresidents.Theanalogyisimperfect,buttheadministrativecomplexitywouldbeaboutthesame.Asfortribe-ownedbusinesses,thepowertotaxismoot:Theprofitsalreadyaccruetothegovernmentsthatownthem.Atribaltaxthatreducedthoseprofitswouldaltertheaccountingofthosegovernmentrevenuesbutnotincreasethem.

Insufficienttaxrevenuesmaketribaltreasuriesmoredependentthantheywouldliketobeonfederaltransfers,whicharewidelyacknowledgedtobeinadequate(USCommissiononCivilRights,2003),andontribe-ownedenterprises,whichbringnumerouschallenges.12

10IntheUS,“[p]ropertytaxeswerethemostprominentsourceofstateandlocaltaxrevenuesinfiscalyear2010”(Malm&Kant,2013).11ForfeelandallottedunderactsotherthantheGeneralAllotmentAct,thecourtsdisagree.IntheNinthCircuit,thecourtheldthattheLummiIndianNation’sfeepatentedreservationlandwasnotexemptfromadvaloremtaxesimposedbyWashingtonState,despitethefactthatthelandwasallottedundertheTreatyofPointElliot,nottheGeneralAllotmentAct.(LummiIndianTribev.WhatcomCounty,1993).TheSixthCircuitandtheCrowTribalCourthavereachedtheoppositeconclusion(Peasev.Yellowstone,1994;UnitedStatesv.Michigan,1997).12ThegrossproductofIndiancountrycontinuestobeheavilygovernment-ownedevenastheglobaleconomyislessandlessso,despitethebetterpricing,productivity,andprofitabilityprovidedbyprivateownership(Grant&Taylor,2007;Megginson&Netter,2001).Moreover,incontrasttotherelativelymodestcollectioncostsoftaxation,developingampledividendsfromtribalenterprisesrequiressubstantialcapitalinvestmentor,barringthat,steadymanagementoverlongtimehorizonssothatgrowthcompoundingcandoitswork.

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 6 NNI | HPAIED

Consequently,tribesarehobbledintheircompetitionwithothergovernments—notonlyinthedomainoftaxation,butalsoinpublicgoodsandservicesoffered.13

IndianTaxLawCreatesUncertainty

Putsimply,Indiantaxlawisamess.

AlthoughsomebasicprinciplesoffederalIndiantaxlawarewellestablished,thefieldisrifewithgrayareas.AsJusticeRehnquistobservedthirty-fiveyearsago,

Sinceearlyinthelastcentury,thisCourthasbeenstrugglingtodevelopacoherentdoctrinebywhichtomeasurewithsomepredictabilitythescopeofIndianimmunityfromstatetaxation.(Washingtonv.Colville,1980,p.176)14

Arecent320-pagejournalarticleattemptstomakesenseoftheinconsistenciesbutconcludesthatthethickethasyettobecleared:

Case-by-caseadjudicationbyacourtisanotoriouslydifficultwayofimposingorderandcoherenceonabodyofdoctrine.…TheSupremeCourthasnotdistinguisheditself,mischaracterizingthetaxbeforeit,abusingprecedent,lapsingintoipsedixit15reasoning,misreadingorignoringhistory,andretreatingintoformalism.(Pomp,2010,pp.1220−21)

Settlingwhatshouldbebasicquestionsrequiresnuanced,fact-specificanalysis.Notonlyisslowandcostlylitigationcommon,butitrarelyleadstocomprehensive,predictable,ortransferrablesolutionstotheissuesthatarisebetweentribesandneighboringstateandlocalgovernments.CourtrulingsinIndiantaxlitigationregularlycreatemoreuncertaintiesthantheyresolve,becauseinconsistentdecisionssooftenarisewhendisparatecourtsreviewcase-specificfacts.

Evenwhereclearrulesexist,thelawquicklybecomescomplicated,becausethedeterminativequestioninmanyIndiantaxcasesisnotWheredidthetransactionoccur?butWhobearsthelegalincidenceofastatetax?Theprinciplethat,absentanexpresscongressionalstatementtothecontrary,astatemaynotimposetaxesonanIndiantribeoritsmembersinIndiancountry(OklahomaTaxCommissionv.ChickasawNation,1995,pp.458−9)ostensiblyworksinthetribes’favor.Localgovernments,aspoliticalsubdivisionsofthestates,aresimilarlyproscribed.Asaresult,businessesownedandoperatedbytribesandtheircitizensintheirownIndiancountrywillgenerallybefreeofstateandlocaltaxessuchasbusiness,manufacturing,

13Governmentscompeteinthetaxabatementracesfamiliartonewspaperreaders(suchastoattractanewTeslafactorytoNevadaorTexas)andacrossthewholebundleofpublicgoods,services,taxes,andfees.Tieboutcompetition(1956)describestheprocesswherebycitizensvotewiththeirfeettoacceptorrejectlocalgovernments’offerings(e.g.,schoolqualityorinfrastructure)andprices(taxesandfees).ThesortingofcitizensintocommunitiesofsimilarpreferencesandwillingnesstopayforgovernmentserviceshasbeenempiricallyconfirmedacrossawidevarietyofUScontexts(Mueller,2009,pp.199−202).14Rehnquistwasconcurringinpart,concurringintheresultinpart,anddissentinginpart.15“ipsedixit…[Latin‘hehimselfsaidit’]Somethingassertednotproved”(Garner,2004,p.847).

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 7 NNI | HPAIED

andsalestaxes.ThisprincipleoffederalIndianlawhasalsobeenheldtobarstatesfromtaxingthepersonalpropertyoftribesandtheirmembersinIndiancountry(Bryanv.ItascaCounty,1976;Moev.ConfederatedSalish&KootenaiTribes,1976;OklahomaTaxCommissionv.SacandFoxNation,1993).Theruleissimpletoarticulate,butverifyingwherethelegalincidenceofataxfalls,andwhichindividualsandtransactionsareentitledtoanexemption,iscomplex.

Similarlyclearistheprecedentthatifthelegalincidenceofastatetaxfallsonanon-Indian—evenonactivitywithinIndiancountry—thestatecangenerallyimposeitstax(OklahomaTaxCommissionv.ChickasawNation,1995,p.459).However,exceptionstothisgeneralrulethatempowertribestopreemptstatetaxationarecomplexandinconsistentlyapplied.Atfirstglance,theexceptionsappearsimpleandcertain.Ifthetaxispreemptedbyfederallaw,orifitinterfereswithatribe’sabilitytoexerciseitssovereignfunctions,itdoesnotapplytonon-IndiansinIndiancountry(RamahNavajoSch.Bd.v.BureauofRevenueofNM,1982,p.837;WhiteMountainApacheTribev.Bracker,1980,p.142).Eitherexceptioncanbesufficientbasisforinvalidatingastatetaximposedonnon-Indians,butthetwobarriersareusuallyanalyzedtogetherandsometimesconflated(RamahNavajoSch.Bd.v.BureauofRevenueofNM,1982,p.837;WhiteMountainApacheTribev.Bracker,1980,p.143).IntherelativelyrareinstanceswherefederallawexplicitlyprohibitsapplicationofataxinIndiancountry,ittrumpsstatelaw.Butmorebroadly,outcomeshavebeeninconsistentandconfusingbecausecourtshavedelvedintonuancedandfact-specificanalysesthatarisefromfederalregulatoryschemesorpreemptionanalyses—“balancingtests”—usedtodeterminewhetherthecombinedfederalandtribalinterestsoutweighthestate’sinterests(GilaRiverIndianCommunityv.Waddell,1992;GilaRiverIndianCommunityv.Waddell,1996;NewMexicov.MescaleroApacheTribe,1983;Yavapai-Prescottv.Scott,1997).

Thesebalancingtestshavearisenbecauseofthecourt’sholdingthatthereis“norigidrulebywhichtoresolvethequestionwhetheraparticularstatelawmaybeappliedtoanIndianreservationortotribalmembers”(WhiteMountainApacheTribev.Bracker,1980,p.142).Thetestismeanttoreflect

[t]hetraditionofIndiansovereigntyoverthereservationandtribalmembers…reflectedandencouragedin[federalstatutes]demonstratingafirmfederalpolicyofpromotingtribalself-sufficiencyandeconomicdevelopment.(WhiteMountainApacheTribev.Bracker,1980,p.143)

Underthis“Brackeranalysis,”tribalandfederalinterestsinanactivityareweighedagainststateinterests.Ifthebalancefavorsthestate,itmayimposeitstaxandmayalsoimposeminimalburdensonthetribeoritsmemberstoassistincollectingthetax.16Otherwise,thestatetaxonthenon-Indianispreempted.

16Consider,however,whetheranon-Indianretailerwoulddeemita“minimalburden”toberequiredtoconfirmthecitizenshipofallpurchasersattheregisterandtocollectandremittaxestoaneighboringjurisdictiononthebasisofthecitizenshipofthosepurchasers,whentheproductssubjecttotaxandthetaxratesonthoseproductsdifferedinthetwojurisdictions.IndianlawprecedentsallowstatestoimposethatburdenontribesintheirownIndiancountry.

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 8 NNI | HPAIED

Preemptioncasesareextremelyfact-specific,andaccretedinconsistentholdingsstrengthenincentivesforstateandlocalgovernmentstolitigate.Contrast,forexample,WhiteMountainApachev.Bracker(inwhichtheSupremeCourtfoundthatfederalregulationofIndiantimberis“comprehensive”and,therefore,Arizona’smotor-carrierlicensetaxandfueltaxescouldnotbeappliedtoanon-Indiancompanyworkingundercontractwithatribalcorporation)withCottonPetroleumCorp.v.NewMexico(1989),(inwhichtheCourtupheldthesimultaneousimpositionofstateandtribalseverancetaxesonanon-IndiancompanyextractingoilandgasonJicarillatrustlands).Federalregulationofbothtrustresources—timberandminerals—iscomprehensive,andinbothcasesresourcerevenuesconstitutedthelargestsourceoftribalgovernmentrevenue.Thetwocasescannotbereconciled,17makingitdifficulttopredictoutcomesinbalancingtestcases.

Inessence,Brackerbalancingputscourtsinthepositionofconvertingquestionsinshadesofgray—tribalandfederalversusstateinterests—intoanswersofblackorwhite:Thestateisorisnotpreempted.Vaguestandardsregardingimproperstateinterferenceintribalself-governmentcompoundthechallenge,especiallywhencourtsconflatethisanalysiswiththeweighingofinterestsratherthananalyzinginterferenceasaseparatebasisforpreemption.Andadditionaluncertaintyarisesbecausevaryingcase-by-caseadjudicationdeterminespracticaltribaltaxingcapacity,notaconstitutional,statutory,orregulatoryarticulationofpowers.Theharmdonetotribalandstategovernmentsandtheircitizensbyunpredictableandincoherenttaxpolicyisreal:Dollarsandtimearewasted,resourcesgountapped,government-to-governmentrelationshipsfesterandbreakdown,andabsurditiesinbusinessdevelopmentpracticesprevail(aswewillshowbelow).Economicdevelopmentthatshouldoccurdoesnot.

PrinciplesofSoundApportionmentAreNotGenerallyAppliedtoIndianCountry

Generally,outsideIndiancountry,stateandlocalgovernmentscannottaxindividualsandbusinessesmakingpurchasesanddoingbusinessinotherjurisdictionsexceptinthosefewcaseswhereausetaxapplies.18Forexample,MassachusettscannotgenerallytaxpurchasesbyMassachusettsresidentsinsales-tax-freeNewHampshire.Evenwhereausetaxapplies,collectionandenforcementareextremelylimitedforpracticalreasons.19However,undermostcircumstancesstateandlocalgovernmentsarefreetotaxnon-IndiansinIndiancountrywithoutregardtotheexistenceofatribaltaxsystemortheprinciplesofsoundapportionment(Moev.ConfederatedSalish&KootenaiTribes,1976;OklahomaTaxCommissionv.PotawatomiTribe,17“TheCourt’sanalysis[inCotton]failstorecognizetheoppositeoutcomesofCottonPetroleumandCrowTribe,and,indeed,reconcilingthesetwooutcomeswouldbedifficult.”(Alexander,1997,p.399)18InWashingtonState,forexample,usetaxisdueongoodspurchasedinanotherstatethathasnosalestaxorasalestaxlowerthanWashington’s,butonlywhenthosegoodsarepurchasedforuseinWashington.Theburdenofreportingandremittingtheusetaxisonthetaxpayer(WashingtonStateDepartmentofRevenue,2010).19Manystatesrequireconsumerstoreporttheirusetaxliabilitiesontheirincometaxreturns,butcomplianceislessthan1percentinmanystatesandonly10percentinthemostcompliantstate(Agrawal&Mardan,2015,p.1).AccordingtoaMay2014studybytheWashingtonStateDepartmentofRevenue,“Washingtonbordercountieswilllose$3billionintaxableretailsalestocasualcross-borderevasioninFiscalYear2014.Thisrepresents$193millioninstateand$54millioninlocalsalestaxrevenueslosttoevasion,$247millionintotal”(WashingtonStateDepartmentofRevenue,2014b,p.1).

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 9 NNI | HPAIED

1991;Washingtonv.Colville,1980).Thisisasignificantdeparturefromprevailingpracticeandintroducesadoublebind.Atribeseekingtoraiserevenuefromthebusinessesandindividualstowhichitprovidesgoodsandservicesmustweightheeffectofaddingitsowntaxestostateandlocaltaxes(therebydiscouragingmuch-neededeconomicactivity)againsttheconsequencesofnotraisingtherevenue.Thedoublebindfrustratestriballeaders.PresidentPetersonZahoftheNavajoNationobservedincongressionaltestimony:

“[D]oubletaxationinterfereswithourabilitytoencourageeconomicactivityandtodevelopeffectiverevenuegeneratingtaxprograms.Manybusinessesmayfinditeasiertoavoiddoingbusinessonourreservationsratherthan…bearthebruntofanaddedtaxburden….”(ascitedinMichiganv.BayMillsIndianCommunity,2014)

Andthedoublebindhasbeennotedasasignificantobstaclebyfederalofficials.Inpromulgatingleasingregulations,theSecretaryoftheInteriorperformeda“comprehensiveanalysis…showinghowtribalinterestsareaffectedbystatetaxesonleasesofrestrictedIndianland”(SeminoleTribeofFloridav.StateofFlorida,2014,p.4):

[T]heSecretarydetailedthepracticalreality…that“theverypossibilityofanadditionalStateorlocaltaxhasachillingeffectonpotentiallesseesaswellasthetribethatasaresultmightrefrainfromexercisingitsownsovereignrighttoimposeatribaltaxtosupportitsinfrastructureneeds.”(citingBureauofIndianAffairs,2012,p.72448;SeminoleTribeofFloridav.StateofFlorida,2014,pp.5−6)

Whilefairapportionmentisrecognizedasafundamentalprincipleofgoodtaxpolicyatthenationalandstatelevels,stateandlocalgovernmentsaggressivelyprotecttheirtaxprimacyinIndiancountry.

IndianTaxLawIsEconomicallyInefficientandInhibitsGrowth

Asdescribedabove,thefundamentalprinciplesofgoodtaxpolicyaregenerallyabsentinIndiancountry.Lackingreliableandsufficienttaxrevenues,tribaleconomicdevelopmentisofteninefficientandsometimescompletelyinhibited.

Legaluncertaintyandthetimeandfinancialcostsoflitigationmotivatetribestostructuretheireconomicventuresinthemannermostlikelytowinataxcaseortolimittheabilityofthestatetoenforceitstax,ratherthaninthemannerthatmakesthebestbusinessorpolicysenseforthetribe.Fortheirpart,non-IndianinvestorsandpartnersarerarelywillingtoenduretheexpenseanddelayofobtainingcertaintyontaxationinIndiancountry.20Taxrulingscanbeobtainedfrommanystatetaxingagencies,buttheyarefact-specificanddependenton20“Indianreservationshavetocompetewithothervenuestoattracteconomicactivities.Tobesuccessful,tribesmustofferinvestorstheopportunitytoearneconomicreturnscommensuratewiththereturnstheymightearnelsewhere.Investmentdollarshavetocomefromsomewhere.Investorriskisraisedifthereisuncertaintyintaxandregulatorypoliciesthatapplytoon-reservationbusinessortransactions.”(Atkinson&Nilles,2008,pp.I−2)

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 10 NNI | HPAIED

notoriouslyvariablecaselawunderpinningsoronthetermsofnegotiatedstate-tribalcompactswithexpirationdatesthatmaynotaffordtheinvestorsufficientsecurityoverthelifeoftheproject.Thechoiceofbusinessstructure—afundamentalconsiderationforinvestorsandpartners—alsohassignificanttaximplicationsfortribes(Atkinson&Nilles,2008).Evenwhenatribeultimatelyprevails,litigationisoftennecessarytoestablishstatetaxexemptionortribalpreemptionwheneveranon-tribalpartnerorinvestorisinvolved.

TheGreatWolfLodgecaseisagoodexampleofboththelackofcertaintyinIndianlawandthecreationofperverseincentives.TheConfederatedTribesoftheChehalisReservationformedaDelawareLLCwithGreatWolfResorts,Inc.inwhichtheTribeshad51%ownership.TheLLCconstructedandoperatesaresort,conferencecenter,andwaterparkonlandsheldintrustfortheTribesunderaleaseapprovedbytheBureauofIndianAffairs(ChehalisTribesv.ThurstonCounty,2013,p.1154).TheTribesandtheirpartnertookgreatpainstostructureabusinessdealin2005tominimizeuncertaintyregardingtheapplicationofstateandlocaltaxes.Asextrainsurance,theTribesobtainedarulingin2007fromtheWashingtonStateDepartmentofRevenueestablishingexemptionfromstatetax.Butcountyofficialsbeganassessingpropertytaxesthatyear,andtheTribesfiledsuitin2008.Notuntil2013,andaftersignificantexpensebyallparties,wasthedisputefinallyresolvedintheTribes’favor(ChehalisTribesv.ThurstonCounty,2013).

Ultimately,theNinthCircuitdecidedthecaseonaverynarrowissuerelatedtoaspecificprovisionofafederalstatute,21butalongthewaythecourtsexaminedthesmallestdetailsofthedeal’sstructure,financing,andoperations—detailsthattheTribesanditspartnerhadnegotiatedattheoutsetinanattempttoavoidjustsuchadispute.NotwithstandingtheTribes’legalvictory,theWashingtonDepartmentofRevenueaddedtotheuncertaintybyissuingtemporaryguidancethatcontradictedtheclearrulingofthecourt,onlytoreversecoursein2014(WashingtonStateDepartmentofRevenue,2014a).

Evenwhenlegalresultsaresuperficiallysimilar,theycanmaskvariationinlegalreasoning,whichthenraisesthecostofdoingbusinessinIndiancountry.ThewaterparkatGreatWolfLodge,forexample,hasthreedistincttaxcharacterizations.Asstatedabove,theNinthCircuitruledthatwhetherthepermanentimprovementwasownedbyanon-IndianoranIndiandidnotmatter—thestatepropertytaxwaspreemptedbyfederallawonthebasisofthelandstatus.TheThurstonCountyBoardofEqualizationruledonwhetherthefurnitureandequipmentweretaxable,findingthattheLLCwasatribalentityandthus,underfederallaw,immunefromthecounty’spersonalpropertytaxes.TheWashingtonDepartmentofRevenueruledontheissueofwhetherstatesalestaxappliedtonon-Indiancustomersatthewaterpark.ItfoundthattheLLCwasnon-Indian(i.e.,subjecttotax),yetusedthebalancingtesttorulethat“alloftheWashingtonstatesalesandusetaxesareexemptedunderfederalpreemption.”22Onesetof21“Atissueinthiscaseiswhetherstateandlocalgovernmentshavethepowertotaxpermanentimprovementsbuiltonnon-reservationlandownedbytheUnitedStatesandheldintrustforanIndiantribe.Pursuantto25U.S.C.§465,andMescaleroApacheTribev.Jones,411U.S.145(1973),weholdthattheydonot.”(ChehalisTribesv.ThurstonCounty,2013)22WashingtonStateDepartmentofRevenueLetterRuling,February27,2007.

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 11 NNI | HPAIED

businessfactsproducedthreesimilarlegalresults(thetaxwaspreempted),buttheanalyticalpremiseswerenotevenclose.ThoughtheTribeswerenodoubtgratifiedtohavethreefavorableoutcomes(arareenoughoccurrenceinIndiantaxlaw),thethicketofrationalesmeansthatfutureIndianbusinessdealshavemoreneedlestothread.

Sometimestheoutcomeisevenworsethanadelayedorbyzantinedeal—itisanuneconomicone.ThetaxstatusofIndianland,andfailuretoobserveapportionmentprinciples,areattherootoftheproblem.AsJusticeSotomayorobservedinarecentconcurringopinion:

Ifnon-IndianscontrolledonlyasmallamountofpropertyonIndianreservations,andifonlyanegligibleamountoflandwasheldinfee,thedouble-taxationconcernmightbelesssevere.ButformanyTribes,thatisnotthecase.Historyexplainswhythisisso:Federalpoliciesenactedinthelate19thandearly20thcenturiesrenderedadevastatingblowtotribalownership....Indeed,by1934,theamountoflandthatpassedfromIndianTribestonon-Indianstotaled90millionacres…[and][s]ixtymillionacresoflandpassedtonon-Indianhandsasaresultofsurplusprograms.Thesepolicieshaveleftadevastatinglegacy,asthecasesthathavecomebeforethisCourtdemonstrate.(Michiganv.BayMillsIndianCommunity,2014)

Instarkcontrasttothegeneralpracticewherebygovernmentswithoverlappingjurisdictionapportiontheirtaxpowers,nosuchruleorpracticeexistsinfederalIndianlaw.Indeed,Indianlandstatusaddsevenmorecomplexity.Whilestatesmaygenerallytaxnon-Indiansanywhere,includinginIndiancountry,tribesmayimposetaxesonnon-Indiansonlyontrustland(oronfeelandwithinIndiancountrywheretheyhaveaconsensualrelationshipwiththetaxpayer).ThisaddsastronggeographiccomponenttoIndiantaxlaw,whichresultsinsiteselectionsbasednotprimarilyoninfrastructure,access,size,andothercommercialattributesbutontruststatus.

Imagine,forexample,thatatribeisconsideringtwoparcelsoflandwithinitsreservationfordevelopmentofastoresellingproductsmanufacturedbythetribe.Thetribe’sstrategicgoalistotaxsalestocustomersinsupportofpublicgoodsandinfrastructure.Thefirstparcel,ownedbythetribeinfee,islocatedonabusyintersectionwithgoodvisibilityandparking.Thesecondparcel,heldintrustforthetribe,issixmilesfromthenearestintersection,attheendofanunpavedtribalroad.Ifthetribeopensitsstoreonthefeeparcel,thestatewillhaveastrongerargumentthatunderthebalancingtest,stateinterestsoutweightribalandfederalinterests,andthereforestatetaxationofsalestonon-Indiancustomersshouldnotbepreempted.

Ofcourse,whetherthestatewouldprevailinsuchanargumentdependsonthefact-specificandunpredictableapplicationofthebalancingtest.Butthetribemustdecidewhethertorisklocatingitsbusinesswherethestatewillhaveabetterlikelihoodofprevailingandthereforeagreaterincentivetolitigatetheissue.Moreoftenthannot,thetribewillselectthetrustparceltoavoidtheexpenseanddelayoflitigationandtheriskofanegativeoutcome.Worse,manytribeshaveinsufficientIndiancountrylandholdingsandwilldefereconomicdevelopmentwhileawaitingfederalapprovaltotakelandintotrust—aprocessthatmaytakeyearsandinvolvesadditionaluncertaintyandexpense.

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 12 NNI | HPAIED

Itisnoaccident,then,thattribalgovernmentstendtoconcentrateongoodsthataretaxedheavilyoffreservations.Theirlongstandingdependenceoncigarettesales,morerecentdependenceongasolinesales,andemerginginterestinmarijuanasalesareexamplesofthis.23Whilecasinogaming—whichfaceshighstate-erectedbarrierstoentryandtaxes—allowsthemasomewhatdiversifiedeconomy,overdependenceonthesefewsectorscontinuestolimittribaleconomies.

III. THEDEFACTOCASEFORCHANGE

Theprecedentsgoverningtaxationontriballandsmayhavemadesenseintheiroriginalcontext,buttodaytheyproduceabsurditiesworthyofCatch-22.Afewexampleswillmakethatclear.

SupposeaQuinaultmanandaYakamawomanmarryandmakeahomeontheQuinaultIndianReservationwhileretainingtheirNativecitizenships(Figure1).AbusinessmaysellgoodsandservicestothehusbandinQuinaultIndiancountryimmunefromWashingtonStatetaxation.However,becauseWashingtoncanlegallyinsistthatthevendorcollectandremitsalestaxesfromYakamaIndianslivingonQuinaultbutmakesanexceptioninthecaseofmarriage,thewifehastoprovesheismarriedtotheQuinaultmembertoenjoytheexemption.(WAC§458-20-192(5))Thisnotonlyputsastrangeburdenontheretailer—whomustaskforproofoftribalaffiliationandmaritalstatusattheregister—butalsointrudesintohouseholddecision-making.DoesMr.orMrs.UnderwoodhavethepaperworktodotheSaturdayshopping?(Washingtonlawdoesnotextendtheexemptiontochildrenorotherrelativesofthecouple.)

Figure1Citizenship-BasedTaxation

Taximmunitymaydependontribalcitizenship(andmaritalstatus)

23“Themainsourceofemploymentonreservationsthatdonotenjoytheprosperityofgamingcomesfromthegasstationsandcigaretteshopsthattraditionallyselltheseproductstax-free.Thiseconomicadvantagehelpstribesachieveself-sufficiencyassovereignnations.Mosttribesarenotblessedwithoilreserves,orthousandsofacresoftimber(shouldtheybewillingtocutitdown),providingasoundeconomicbase.Mosttribes,infact,weregiventhepoorestlandorsuchasmallparcelthatanyattemptatself-sufficiencywouldbeverydifficult.Thisdifficultywasacknowledgedwhenreservationswerecreated.”(Lazore,1997)

QuinaultReservation

NOT State-Taxable w/tribal ID

State-Taxable w/o proof of marriageStore YakamaWife

QuinaultHusband

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 13 NNI | HPAIED

Evenmorecomplexityarisesif,insteadofahousehold,thequestioninvolvesanIndian-ownedentitydoingbusinessontheQuinaultReservation.UnderWashingtonlaw,ifthebusinessisincorporatedandis“comprisedsolely”ofmembersofonetribe,thecorporationwillbeexemptfromstatetaxonbusinessconductedinthattribe’sIndiancountry(andontreatyfisheryactivityconductedoutsideIndiancountry).Partnershipsorotherentities“comprisedsolely”ofenrolledmembersofatribearetreatedthesame.However,ifthecompany“includesafamilymemberwhoisnotamemberofthetribe…togetherdoingbusinessonthe…reservation,thebusinesswillbeconsideredassatisfyingthe‘comprisedsolely’criteriaifatleasthalfoftheownersareenrolledmembersofthetribe”(WAC§458-20-192(5)(d)).SoifaQuinaulthusbandandhisYakamawifeformapartnership,theirbusinessmaymaketax-exemptpurchasesintheIndiancountryofeithertribe.ButiftheirYakamadaughterjoinsthepartnership,thetaxexemptionislostatQuinault.Ifretailersanddistributorsarenotwillingtonavigatethesecomplexities,thebusinessownersmayhavetopaythestatetaxandseekarefundlater,whichcouldbedetrimentaltotheircashflow.Despitethecomplexityofthisrule,Washingtonoffersmoreclaritythanstatesthathavenotsetforthanyguidanceonthetaxtreatmentofbusinessentitiesowned,inwholeorinpart,byIndians.

Asnotedabove,undertheBrackeranalysis,ifanIndiancountry−basedtribalbusinessprovidesaserviceoraddsvaluetoaproduct,thesaleofthatserviceorgoodmaybeimmunefromstatetaxationinthattribe’sIndiancountryifthebalanceofinterestsfavorsthetribe.SupposeaCheyenneRiverSiouxmetalworkingfacilityturnedsheetsteelintowaterproofmetalboxessuitableforfirstaidkitsorammunition(Figure2).ThoseboxescouldbesoldthroughadistributororretailerontheCheyenneRiverReservationtonon-IndiansimmunefromstatetaxationifthedistributororretailerwerealsoownedbyCheyenneRivermembersorbythetribe.Butifthesameproductweresoldinanyothertribe’sIndiancountry,includingtheadjacentStandingRockSiouxReservation,thestatecouldinsistontaxingsalestonon-Indians.

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 14 NNI | HPAIED

Figure2Place-BasedTaxation

ValueaddedbyanIndiancompanyisimmunefromstatetaxationinsomeplacesbutnotothers

Theseabsurditiesarisefromhistoricalcontingencies,butfiscalmyopiaexplains,atleastinpart,howtheymaintaintheirforcetoday.Twouncontroversialpropositionsshouldmakeclearwhytheymustbeeliminated:

1. Tribesthatprovidetax-fundedessentialpublicgoodsandinvestintheirbusinessesencourageeconomicgrowth.

2. Asreservationeconomiesgrow,sodostateeconomiesandstatetaxcollections.

Nonetheless,whenstatesasserttaxauthority,policymakerstendtothinkinzero-sumterms—thatis,theycannotimaginethatstateeconomiesmightbenefitfromgivinggroundontheprimacyofstatetaxes.Thisviewisshortsightedforseveralreasons.

IndianEconomicDevelopmentHelpsStateGrowth

Tribaleconomicdevelopmentaddsdirectlytogrossstateproductwhenitbringsunderutilizedresourcesintoproduction;triballand,infrastructure,naturalresources,andotherphysicalcapitalareputtohigherandbetteruse.TwoexamplesaretheTulalipTribes’replacementofadefunctBoeingfacilityatQuilCedaVillageandtheinvigorationoftheGilaRiverIndianCommunityindustrialparksouthofPhoenix.InfartoomanyplacesaroundIndiancountry,physicalcapitalgoesunderutilized.Thisisnotmerelyafeatureofremoteness(thoughthatplaysapart);itisoftenaconsequenceoftheuncertaintiesandabsurditiesoftherulesgoverningIndianeconomicdevelopment.

CRST Manufacturing

Cheyenne River Sioux Tribe Standing Rock Sioux Tribe

Distribution

GenerallyNOT State-Taxable

UsuallyState-Taxable

Retail

CRST Distribution

CRSTRetail

Usually State-Taxable

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 15 NNI | HPAIED

Moreimportant,humanresourcesarebetterengagedwheneconomicgrowthimproves.From2008to2012,theunemploymentrateamongIndiansonWashingtonreservationsaveraged20%.Suchrateswouldindicateeconomiccalamityiftheyoccurredonanationwideorstatewidescale.WashingtonStateaveraged8.8%inthesameperiod.Theunemploymentratedoesnotcountdiscouragedworkers(thosewhohavegivenupseekingwork),soitpaystolookatothermeasures,suchasthelaborforceparticipationrate.InWashington,laborforceparticipationonthereservationsis53%,asopposedto66%statewide(USCensus,2014).Nationwidefrom2006to2010,thepicturewasnobetter:UnemploymentamongIndianslivingonreservationsinthelowerforty-eightstateswasalsomorethantwicetheall-racesrate(Akee&Taylor,2014).24Addressingthisissueisahighpriorityfortribalgovernments.Itshouldbeforthestates,too.Afterall,Indiansarealsostatecitizens.

Whenanunemployedworkergetsajob,thegainsforgrossstateproductcanbelarge.Notonlyisthatworkerproductivelyengagedintheeconomy(personalincomeisthelion’sshareofgrossnationalproduct),butheorsheisnolongerdependentonfamilymembers,taxpayers,orboth.ThustheswinginGSPmaybesubstantiallylargerthanjustthesalarybenefit,dependingonthesituation.

Inaddition,whentribalgovernmentspendingaddressessocial,educational,housing,environmental,andhealthdeficits,itbenefitsastate’seconomy.Ofcourse,thereisadirecteffectonthestatetreasurywhen,forexample,atribalsocialworkerspendsherpaycheckongroceriesandelectricity.GiventhatIndiancountryeconomiesarepredominantlysmall,undiversified,andremote,virtuallyalltheirhouseholdsandbusinessesturntotheoff-reservationeconomyforgoodsandservices.

Moreimportant,whenthesocialdeficitsthemselvesareaddressed,thestateeconomybenefits.Takeeducation.TheMcKinseyGlobalInstitute(2009a)estimatesthataddressingtheracialgapinUSeducationwouldraisenationalGDPfrom2.2%to3.7%.“TheseeducationalgapsimposeontheUnitedStatestheeconomicequivalentofapermanentnationalrecession”(McKinseyandCompany,2009b,p.5).25BlackandLatinotestscores(notIndianscores)determineMcKinsey’s“racialgap”inaccordancewiththosegroups’largernumbers,butcomparabletestscoresforIndianschoolchildrenwereatthelowendofthosegroups’(NationalCenterforEducationStatistics,2012),makingthepercapitaimpactofclosingtheIndianeducationgapevenlarger.

Andsoitgoeswithearlychildhoodeducation,drugrehabilitation,collegescholarships,diabetesprevention,financialliteracytraining,andmyriadothertribalsocialinvestments:StateeconomiesbenefitwhenIndiansparticipatemoreinthestateeconomyandarebettereducated,healthier,andmoresecure.Whatgovernorwouldseektocreatepocketsoflimitedhumancapitalwithinstateborders?24RecentratesofreservationunemploymentforallbutthelargestreservationsareavailableonlyintheCensusBureau’sAmericanCommunitySurvey(ACS)five-yearaverages.Forstrictcomparability,thestatewide(andnationwide)all-racesACSfive-yearaveragesarealsoused.25SeealsoAuguste,Hancock,andLaboissière(2009).

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 16 NNI | HPAIED

Statescommonlyopposetribes’sovereigntyandtheeconomicactivitygeneratedbythatsovereigntyonthegroundthatsuccessfulbusinessandemploymentcreationreducesbusinessincomesandemploymentinsurroundingnon-tribalareas.Nowherearesuchclaimsmorefrequentthaninthecaseoftribalcasinos.Astoundingly,somecriticsoftribaleconomicsovereigntyarguethatIndiancasinoshavearecessionaryimpact(Anderson,Cotton&Watkins,2003).SomewhatmorereasonablecriticsclaimthatstaterevenuecollectiondropswhenIndianeconomicdevelopmenttakesoff(Anders,Siegel&Yacoub,1998;WashingtonResearchCouncil,2002).

Implicitlyorexplicitly,thethinkingbehindtheseclaimsisthatwhenJaneandherfriendsvisitthePuyallupTribe’sEmeraldQueenCasinoforasteakdinner,aJayLenoshow,andanhourortwoattheslots,theyarenotatthelocal—andstate-taxed—P.F.Chang’s,AMCTheater,andColdStoneCreamery.Appealingasthestorymaybe,theconclusionthatIndianeconomicgrowthcausesstatefiscalshrinkagegoesbeggingforpersuasiveempiricalsupport(Taylor,2005pp.33–38).

Andforgoodreason:Noreservationeconomycanprovideallthecarpeting,electricity,pokerchips,asphalt,computers,andpolicecruisersthattribalgovernmentsandbusinessesrequire.Theyhavetoturntotheoff-reservationeconomy.InWashingtonState,two-thirdsofalltribalemployeesarenon-Indians—18,000outof27,000in2010(Taylor,2012a).Inaddition,Washingtontribesbuythevastpreponderance—morethan94%—oftheirgoodsandservicesfromoff-reservationsuppliers(Taylor,2006).Thisheavyrelianceonoff-reservationresources—widespreadinIndiancountry—explainswhyclaimsofeconomicharmfromIndianeconomicdevelopmentshouldbemetwithskepticism.Non-IndianworkersandsupplierspaypropertyandsalestaxesinWashingtonandotherstates(andincometaxes,too,inthestatesthatlevythem).

Theevidencethatreservationeconomicgrowthbenefitsstateeconomiesisaccumulating.Triballeadersknowthisfirsthand.Anoff-reservationRVrepairshopownerinShelton,Washington,toldSquaxinIslandtriballeadersthatbusinessboomedafterthetribeopeneditsnearbyLittleCreekRVPark.BusinessleadersinPayson,Arizona,sharedtheirreliefthattheTontoApacheTribe’sMazatzalCasinobecameoneofthelargestemployersintownjustasitssawmillwasshuttingdown(Taylor,Grant,Jorgensen&Krepps,1999).Alocalchamberofcommercereported:

ThesinglelargestcontributingfactortoeconomicsuccesshasbeentheMillBayCasino[ontheColvilleReservation].Theiraggressivemarketingstancehasdrawnvisitorsbythebusloadtoourhotels,boostingoccupancyduringatimeperiodwhichtraditionallyhasmeantemployeelayoffs.…Theyarethesinglelargestprivatebusinessemployerintheregion,pumpingpayrolldollarsintoeveryfacetofourcommunitythroughdirectpurchases,indirectpurchases,payrolltaxes,schooltaxes,salestaxesandmore.(LakeChelanChamberofCommerce,1996,p.402)

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 17 NNI | HPAIED

Morerecently,acoalitionofsixtowns,fivechambersofcommerce,acounty,andsevenotheroff-reservationgovernmentagenciesandprivateassociationsobservedinanamicusbrieftotheUSSupremeCourtthat:

The[Match-E-Be-Nash-She-Wish]Band’seconomicdevelopmenteffortsonthetrustlandshavedirectlycreated900newjobsandinfusedareahotels,restaurants,andotherbusinesseswithmuch-neededcustomersandrevenues.…TheBand’seconomicdevelopmenteffortshavefacilitatedintergovernmentalservice-sharingagreementsthatarecriticaltotheregion’srecovery.(WaylandTownship,2012,p.5)

TheseobservationsreflectthedestinationeffectsandregionalmultiplierimpactsthatIndianeconomicactivityproducesfortheoff-reservationeconomy—includinginnon-Indianemploymentandstatetaxcollection.Direct,indirect,andinducedimpacts26ongrossregionalproduct,employment,andtaxcollectionhavebeenvariouslydocumentedinstudiesoftribalcolleges(Coon,Bangsund&Hodur,2013;Diaz&Pina,2013),tribaltimberoperations(Clements&Marcouiller,2008;Kalt,1993),tribalprocurementbusinesses(Taylor,2012b),andtribalcasinos(Carstensenetal.,2000;Ha&Ulmer,2007;S.Peterson,2010;Thornberg,Levine,Shepard&Meux,2012).27

Impactmodelestimatesareconfirmedbybefore-afterandadjacent-remotedataoneconomicactivity.Forexample,accordingtotheThurstonCountytaxassessor’srecords(2009),whentheGreatWolfLodgeopened,privatelyowned,off-reservationpropertieswithinamileexperiencedanaverageof14%growthinvalue,whileparcelsinthecountyasawholeappreciatedbyonly4%(ascitedinKalt,2009).BroadstatisticalandeconometricanalysesshowemploymentgainsinnearbycountieswhenanIndiancasinoopens(Baxandall&Sacerdote,2005;Baxandall,O’Brien&Sacerdote,2005;Evans&Topoleski,2002;Taylor,Krepps&Wang,2000)andincomegainsinCaliforniacensustractsnearIndiancasinos(Akee,Spilde&Taylor,2014;Martinetal.,2006).Theeconomics,anecdotes,models,data,andeconometricscorroborateoneanother:Reservationeconomicgrowthbegetsnearbyeconomicgrowth.

DoubleTaxationIsaDoubleBind

InviewofthebenefitstothestateofIndianeconomicdevelopment,theburdenofdoubletaxationappearsparticularlycounterproductive.WhenstatesandcountiesinsistonapplyingtheirtaxpowersinIndiancountry,atribeaddstotheresidents’taxburdenifitinstitutesitsown

26“Directeffects…[are]theimpacts(e.g.,changeinemployment)fortheexpendituresand/orproductionvaluesspecifiedasdirectfinaldemandchanges[ofagivenprojectoreconomicactivity];indirecteffects…[are]theimpacts(e.g.,changeinemployment)causedbytheiterationofindustriespurchasingfromindustriesresultingfromdirectfinaldemandchanges;inducedeffects…[are]theimpacts(e.g.,changeinemployment)onalllocalindustriescausedbytheexpendituresofnewhouseholdincomegeneratedbythedirectandindirecteffectsofdirectfinaldemandchanges.”(MinnesotaIMPLANGroup,2004,p.81)27SeealsotheannotatedbibliographycompiledbyGardner,Spilde,&Kalt(2005)andmorerecentworkbyoneofus(Taylor,2005;2006;2008;2009;2012a;2015).

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 18 NNI | HPAIED

tax.Companies,behavingrationally,fleeIndiancountry.TheUSGovernmentAccountabilityOfficehasnoted,forexample,that:

[d]ualtaxationofresourcesdoesnotoccuronprivate,state,andfederallyownedresourcesandcanmakedevelopmentlesseconomicallyattractiveanddiscouragedevelopmentofIndianresources.(2015,pp.29−30)

Statesandcountiesmakenomeaningfulefforttospurreservationeconomicdevelopment,sotribesmustdoitthemselves—ironicallywithouttheabilitytotaxtheveryactivitiesthatenablethetribetounderwriteitscreation.

Doubletaxationputstribalgovernmentsinadoublebind:Levyataxtorecoverinvestmentsindevelopmentandcausebusinessestoflee,ordonotlevyataxandfailtorecoverthecostsofinvestingindevelopment.Theconsequenceisthatmosttribeshaveaverylimitedcommercialtaxbase(Fletcher,2004).Generally,theyturntogovernment-owned-enterpriseprofits,leaserevenue,andnaturalresourcesalesforrevenue—sourcestappedminimallybyallbutthemostresource-richstates(e.g.,Alaska)—becausetribalmembershavefewtaxableresourcesoractivitiesfortheirgovernmentstotax.Therestoftheworldisprivatizing,andforgoodreason(Megginson&Netter,2001),buttheshareofIndiancountryGDPthatisownedbytribalgovernmentsisburgeoning,dominatedbycasinosandresourceindustries.ToparaphrasethecomplaintofatleastonetribalCEO,federallawforcestribestobesocialistintheownershipofproduction.

QuilCedaVillage,afederallycharteredmunicipalityontheTulalipIndianReservation,demonstratesthechallengepresentedbyastate’sinsistenceontheprimacyofitsownsalestax.BeforetheTulalipTribesdevelopedthevillage,thecorridorwestofInterstate5ontheeastendofthereservationcontainedlittlemorethanvacantlandandanabandonedindustrialbuilding,onceleasedtoBoeing.Tospurdevelopment,theTribesreplannedthearea,createdagoverningboard,charteredthemunicipalityunderfederallaw,andbuiltinfrastructure—theroads,waterlines,watertreatmentfacility,telecomlines,andothercapitalnecessarytorecruitandretaintenants.ItthenleasedspacetocompaniesrangingfromCabela’sandHomeDepottoWalmartandSeattlePremiumOutlets.

Asalandlord,theTulalipTribesearnleaserevenuefromtenantscommensuratewiththeTribes’positioninthemarketplaceforcommercialrealestate.Asagovernment,however,Tulalipcannotreapwhatithassown,becausethestate’sinsistenceoncollectingvarioustaxesattheshopsinQuilCedaVillageprecludesthetribalgovernmentfromimposingitsowntax.Thevillageproducesmillionsforthestate.Ityieldedanestimated$26millioninsalesandusetaxesin2005(Taylor,2006).By2013thatfigurewas$37million,withanadditional$2.1millioninbusinessandoccupationtaxes(Tulalipv.Smith(Compl.),2015,pp.18−19;Tulalipv.Smith(SmithAnsw.),2015,pp.9−10).ThestatealsocollectspersonalpropertyandothertaxesatQuilCeda.Yetthegovernmentthatcreated,maintains,polices,andsupportsthevillagehasreceivednoneofthesetaxreceipts.ThevacantlandandtheBoeingfacilitywereoncewastingassets;nowmorethan1,000peoplegotoworkatQuilCeda,andtensofthousandsvisitthere.AllaroundIndiancountry,idlelandprovokesthequestion,Whateconomicbenefitswouldemergeif

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 19 NNI | HPAIED

uncertaintyandintransigencedidnotpreventtribesfromreapingthetaxrevenuesfromwhateverinvestmentstheymightmakeinpublicgoodsandinfrastructure?Theanswerisplain:Ifstatesallowedtribalgovernmentstoreaptaxrevenuewheretheysowedeconomicinfrastructure,reservationandstateeconomieswouldgrow.

Muchoftheforegoingdiscussionmightbemootifstatesprovidedinfrastructure,publicgoods,andservicesonreservationsinproportiontotribalneeds.Butgenerallytheyspendlessonreservationsthanelsewhere,choosingtodefertothefederalandtribalgovernments.Thispracticerunsagainstthegrainofintrastatefinancingrulesthatcauseallorthevastmajorityofcertaintaxestoflowbacktothejurisdictionsthatgeneratethem.Statesalestaxrevenue,forexample,maybegeneratedonthereservations,butitflowsbacktostateandlocalgovernments.

TheMandan,Hidatsa,andArikaraNationinNorthDakotaisexperiencinganextremeversionofthisphenomenon.DevelopmentoftheBakkenformationinandarounditsFortBertholdReservationhasbeenaggressive,puttingtheregiononparwithTexasandAlaskainfossilfuelproduction.ThehundredsofmillionsofdollarsthatNorthDakotahascollectedfromthereservationinrecentyearshavehelpedtocreatea$3.3billionstatesurplusfund(Murphy,2015).Meanwhile,accordingtoSecretaryoftheInteriorKenSalazar,developmentoftheformationhasdamagedreservationroadsandincreasedtrafficaccidentsandcrime(2013).Thetribesobservethatin2011alone,NorthDakotacollected$82millionintaxesfromenergydevelopmentbutspentlessthan$2milliononstateroadsandzeroontribalandBIAroads(Mandan,Hidatsa,andArikaraNations,2015).Theproductioncompaniesthemselvesareundertakingroadmaintenance,anarrangementtheyrecognizeasunsustainableastheyasktheelectedleadershipofNorthDakotatorecognize“thegrowingneedforadditionalfundingforFortBertholdandthepeopleoftheMHANation”sothattheycanaddress“theimpactsthatcomewithrapidgrowth,includinghousingshortages,inadequateemergency,healthandsocialservices,andgrowingmaintenanceneedsforroadsandinfrastructure”(Ness,2013).AsthepresidentoftheNorthDakotaPetroleumCouncil,RonNess,furthernotesontheirbehalf:

ThereisanincredibleopportunityresultingfromoilandgasproductionforallNorthDakotacitizens,includingthoselivingonFortBerthold.TheavailabilityofincreasedfundingwillhelptheMHANationmeettheirinfrastructureneeds,willprovidebenefitstothesurroundingcommunitiesandprovideimportantassurancethatNorthDakotacontinuestobeastatethatprovidesopportunityandfairtreatmentforallitscitizens.(2013,emphasisadded)

PrivateenterpriseseesandbearstheconsequencesofambiguityinIndiantaxpolicy,andthedisincentivesofdoubletaxationfornaturalresourcedevelopmentcancreatenetlossesfortheeconomy,particularlywheretheresourcesinquestionareclosetothemargin.28

28AsAlexander(1997)pointsout,statetaxationpoweroverIndiannaturalresourcesintroducestheriskthattaxesonresourcerentswillexceednondistortionarylevelsandtherebyintroducedeadweightlossesincontextsthatwouldnototherwisesufferthem.Thisriskmaybesmallforinfra-marginalresourcessuchastheBakken,butitis

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 20 NNI | HPAIED

TaxBreaksversusBrokenTaxes

WhilethestatesinsistonassertingtaxjurisdictionoverIndiancountry,tothedetrimentofIndiansandnon-Indians,theygivetaxbreakstomyriadothergroups.A2012WashingtonStateTaxExemptionStudyidentified452stateandlocaltaxexemptionsworth$29.3billionoverthe2011−2013biennium.Byitsaccounting,someexemptionseclipsedactualcollections:Businessandoccupancyexemptions($7.7billion)were117%ofthe$6.5billioncollected.Theretailsalesandusetaxexemptionsinthatbienniumamountedto45%ofthetotalpotentialtaxbase(WashingtonStateDepartmentofRevenue,2012a,pp.2–4).

Certaintaxesareoutsidethelegislature’sreachandmustbeexempted,includingthosethatwoulddiscriminateagainstorexcessivelyburdeninterstatecommerce,soWashingtonlawspecificallyexempted$2.2billioninthatbiennium.Somestatetaxexemptionsexistbecauseotherwisemoneywouldmovefromonegovernmentalpockettoanother—thoughwhenitcomestotaxingtribalgovernmentsortheindividualsandbusinessestowhomtheyprovideservices,thisprincipleisrarelyrecognizedandtheresultingexemptionsarefairlytortured.29Otherexemptionsrecognizeimpracticalitiessuchasapportioningtaxliabilityforstocksandbondsorotherintangibleproperty.Shouldthetaxpayerbethebusinessortheshareholder?Easierjusttoexempttheproperty(WashingtonStateDepartmentofRevenue,2012a,pp.6,8).

Nonetheless,thepreponderanceofexemptions—upto91%—resultfrompolicychoicesthelegislaturehasmadeorcouldundo.Amongtheirmanypurposesare:recruitingbusinessestothestate,shelteringlow-incomeconsumers,aidingfarmers,andassistingnonprofithospitals(WashingtonStateDepartmentofRevenue,2012a,pp.5−7).Theseforgonetaxescanbequitelarge:ThoughWashingtondoestaxsomeservices,itdidnotcollect$4.8billioninsalestaxeson“personalandprofessionalservices”inthebiennium—equivalenttomorethanaquarterofallsalesandusetaxexemptions(WashingtonStateDepartmentofRevenue,2012b).WehaveneitherthescopenorthespaceheretoweighthemeritsofWashington’smanyexemptions.Sufficeittosaythattaxbreaksarearegularandandlargefeatureofstatefiscalpolicy.30

Againstthisbackdrop,thestate’sinsistenceontaxjurisdictioninIndiancountryappearsparticularlyclosefisted—especiallyabsentanyevidencethatitstaxpoliciesarespurringreservationeconomicgrowth.Aback-of-the-envelopecalculationputsthisintoperspective:If

likelytoburdentheverytimber,oil,coal,andgasthatitshouldnot—theresourcesinIndiancountrythathavethethinnestmargins.29Forexample,aWashingtonStatepropertytaxexemptionfortribalfeelandsusedforessentialgovernmentalpurposesmakesclearthatcommercialactivitiesonrecentlyacquiredlandsareexcludedinthedefinition(RCW84.36.010),althoughrevenuefromthoseactivitiesmaysupportessentialgovernmentfunctionspreciselybecausethetribelacksanadequatetribaltaxbase.30Interestingly,oneargumentfrequentlyofferedbystateandlocalofficialsforarefusalorreluctancetoretrocedefromstatetaxationinIndiancountryisafearthattribeswillnotimposetaxes,orwillimposetaxesatlowerrates,andtherebyencouragebusinessestolocateinIndiancountry.Althoughthispracticeisstandardandwellacceptedamongnations,states,andlocalgovernments,somestateandlocalofficials(andjudges)apparentlybelievethattribalsovereignsshouldnotbepermittedtouseittodeveloptheireconomies.

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 21 NNI | HPAIED

everyoneofthe29federallyrecognizedtribesinthestateweretodevelopaQuilCedaVillageassuccessfulastheoriginal,andWashingtonweretoforgothesalestaxrevenuestherein,andtherewerenoaccompanyingimpetustogrowthstatewide(contraeconomics),theannualtax“break”wouldamounttoabout2%ofWashington’sannualexemptionsinthe2003−2005biennium(Welch,2004).31

Theseareherculeanifs.FewtribescouldgeneratethesalesmadepossiblebyTulalip’sproximitytoI-5andthestate’slargestpopulationcenter.What’smore,growthonthereservationswouldindeeddrivegrowthinthestate-taxableeconomy,raisingrevenue—thesesuccessfulQuilCedaVillageswouldcreatethousandsofjobsthatproducedtheirownbenefitstothestatetreasury.AndWashington’staxconcessiontotribesneednotmeanataxdisappearance—tribalgovernmentscananddomimicstatetaxrates,whethercompactedtoornot.Inotherwords,2%greatlyoverstatestheforgonegovernmentrevenuestatewide.

Thus,Washingtonisineffectsaying,We’rewillingtospureconomicgrowthandaidgroupswecareaboutbyforgoingtaxescompletely,solongasIndiansaren’tinvolved.

Howisthatjustifiable?

Consider,incontrast,Nevada’spositiononsalestaxinIndiancountry.Bylaw,NevadadoesnotcollecttaxonsalesoftangiblepersonalpropertyinIndiancountryif:i)thetribaltaxisequaltoorgreaterthanthetaximposedunderstatelaw;andii)acopyofanapprovedtribaltaxordinanceimposingthetaxhasbeenfiledwiththestateDepartmentofTaxation(NRS372.805).Sincetheadoptionofthisprovision,in1989,theReno-SparksIndianColonyhasdiversifieditseconomyfrom“solerelianceontobaccorevenues”andnowleasesanddevelopscommercialsitestosupporttribalgovernmentfunctions.TenantsincludeWalmart,aMercedesBenzdealership,andlocallyownedandoperatedbusinesses.TheavailabilityofataxbasehasallowedtheTribetocontributetotheregion’sinfrastructure,ofteninpartnershipwithnearbygovernmentsandcompanies,andtoprovideservicestoIndianandnon-Indiancitizensbyinstallingtrafficsignals,buildinglevees,operatingahealthclinicopentonon-memberIndians,andperformingenvironmentalcleanup(Reno-SparksIndianColony,2015).FitchRatingsupgradedtheTribe’slong-termissuerdefaultratingtoBB+fromBBin2013,notingthat“Theupgradereflectsimportantstridesindiversifyingawayfromdecliningtobaccorelatedsalestaxrevenues”butthattribal“revenuesremainconcentratedandheavilydependentoneconomicallysensitivesalesandexcisetaxes”(Meyer,2013).

OtherstateshaveceasedcollectingthefullamountofstatetaxesinIndiancountryundercompactsandotheragreementswithindividualtribes.Althoughnumeroussuchagreementsexist,theyaddressjustasmallfractionoftheissuesresultingfromconcurrenttaxjurisdiction.State-tribaltaxagreementstendtobenegotiatedonlywhenthetribehasstronglegalleverageand/orthestatehasenforcementlimitations.Theyalsogenerallyhaveexpirationdates,puttingtheirrenewalatriskinsubsequentelectioncycles,andstatesareoftenabletoinsistontax31TheolderbienniumisusedhereformacroeconomiccomparabilitytotheavailabledatafromtheDepartmentofRevenueforQuilCedaVillagecollections.Thepercentageestimatedherewouldvaryovertime,ofcourse.

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 22 NNI | HPAIED

parityand/orrevenue-sharingprovisionsthatrestrictthetribe’sabilitytoattracteconomicdevelopmentandestablishasufficienttaxbase.

Althoughtheseagreementsareanexceptionallysuccessfulmodelforsometribesandstates,theyarefarfromacompletesolutiontotheproblem.Tieboutcompetitionbetweengovernments(seenote13)impliesthatagiventribe’seconomic,demographic,andresourcecontextoughttobereflectedinitstaxstrategy.TheimplicationoftheReno-Sparksstoryandothersuccessfulnegotiatedsolutionsisthatresolvingthedoublebindcanbepowerful.Certaintyaboutapportionmentcanbringeconomicvibrancythatbenefitstribesandstates,evenintheabsenceoftribalrateadvantagesorwhenresolvedfullyinthetribe’sfavor.

IV. THEDERECTOCASEFORCHANGE

TheprecedingsectionsmadedejureanddefactoargumentsforreformingstateapproachestotaxationinIndiancountry:Thelawisamessandhobbleseconomicdevelopment.Thereisalsoaprincipledmoralcasetobemade,onebasedonjustclaims.

IndianPriority

Thesovereignstatusoftribes,andtheirrelationshiptothefederalgovernmentasnationspredatingtheformationoftheUnitedStates,hasbeenconsistentlyaffirmedbytheSupremeCourt.In1832,theCourtmadeclearthatthistribal-federalrelationshippreemptedinterferencebythestates:

TheCherokeenation,then,isadistinctcommunity,occupyingitsownterritory,withboundariesaccuratelydescribed,inwhichthelawsofGeorgiacanhavenoforce,andwhichthecitizensofGeorgiahavenorighttoenterbutwiththeassentoftheCherokeesthemselves,orinconformitywithtreatiesandwiththeactsofCongress.ThewholeintercoursebetweentheUnitedStatesandthisnationis,byourConstitutionandlaws,vestedintheGovernmentoftheUnitedStates.(Worcesterv.Georgia,1832,p.520)

Intheabsenceofcongressionalauthorization,stateregulatoryincursionsinIndiancountry,andthecourtdecisionsthatallowthem,violatetheveryessenceofthenation-to-nationrelationshipestablishedbetweentribesandthefederalgovernment.

IftribespreexisttheUnitedStates,oughtnotfirst-in-timetribalgovernmentsbefirstintherighttotax,too?AstheSupremeCourtnotedoftheTreatywiththeYakamaof1855,“[T]hetreatywasnotagrantofrightstotheIndians,butagrantofrightsfromthem—areservationofthosenotgranted”(USv.Winans,1905,p.381).Ifthetribalpowertotaxhasnotbeenextinguished,howisitthattribalgovernmentsshouldbesecondinlinetotax?Dowegivethesecondhomesteaderthewaterrightsofthefirst?Ofcoursenot.Andunlikewaterrights,soundtaxpolicyisnotaboutdividingscarcenaturalresourcesbut,rather,aboutunderwritingtheeconomicallybeneficialproductionofpublicgoodswithpositivespilloverssuchasinfrastructureandcommunityhealth—inthisinstanceforreservationsthatdesperatelyneedboth.

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 23 NNI | HPAIED

FairDealing

TribesareconstitutivesovereignsoftheUnitedStates.AsKalt&Singerobserve:

IndiannationsweretheoriginalsovereignsandownersofthelandnowoccupiedbytheUnitedStates.…TheUnitedStateswasnotformedmerelybytheConstitution,butbythetreatiesenteredintowithIndiannations.ThosetreatiesformtheoriginalframeworkofAmericangovernmentandrecognizebothtribes’sovereigntyandretainedpropertyrights.(2004,p.15)

IndianlandcessionsgavethegovernmentsoftheUnitedStatestheirgeographicandpoliticalfieldsofaction.WashingtoncantaxeconomicactivityinSeattletodaybecausetheDuwamish,Suquamish,Snoqualmie,Snohomish,Skagit,Swinomish,andotherscededtheterritoryforitatMuckl-te-ohin1855.Atthesametime,thetribesretainedlandandrights.(TreatyofPointElliott,1855,2014)

Yetbyatortuouslegalandpoliticalpath,Washingtontribeshavearrivedtodayatastateofaffairswhere:

1. ThestatetaxesIndiansandnon-IndiansonlandscededbyIndians2. andinsistsontaxingnon-IndiansonlandsIndiansdidnotcede,3. renderingtribeseffectivelyunabletotaxontheirownlands,4. thoughthetribesbeargoverningresponsibilitiestoIndiansandnon-Indianswithin

thoselands,5. andthestateabdicatesitsresponsibilitiesthere,6. forcingreservationeconomicactivitytorushintotribalgovernmentownership,adopt

contractualcontortions,orlanguishaltogether.

TobelievethatIndiantreatysignatoriesintendedtocreatethismessviolatesthelogicoffairdealing.Thinkaboutitfederally:WouldwegiveMassachusettstherighttotaxitscitizens’purchasesatthecashregistersofsales-tax-freeNewHampshire(asWashingtoninsistsontaxingsaleswithinTulalip-createdQuilCedaVillage)or,forthatmatter,theirleaseholdinterestsinaFloridatimeshare?Probablynot.

Moretothepoint,evenifso,wouldwesimultaneouslynotgiveNewHampshireorFloridathereciprocalrighttotaxitscitizenswithinMassachusetts?Absolutelynot.ButthatishowdoubletaxationworksforIndiantribes.Asreasonableaseveryprecedentialstepalongthewaymayhaveseemed,Indiantaxlawtodayisaheads-states-win,tails-tribes-loseproposition.Notribecouldconceivablyhaveagreedtoit.Itwascompelled.Itwasimposed.

ModernSupremeCourtcasesgivingstatesthepowertoharmtribesnotonlyburdenreservationeconomiesbutcontradictlong-standingcongressionalandexecutivebranchpoliciesrespectingtribalsovereignty,advancingIndianself-determination,andembracinggovernment-

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 24 NNI | HPAIED

to-governmentrelationships.32Indiantaxlawisincongruouswithcurrentpolicy,thoughthepolicyiscreditedwithpartialrecoveryinIndiancountry:

Sincethe1970s,federalAmericanIndianpolicyintheUnitedStateshasbeenaimedatpromotingself-determinationthroughself-governancebyfederally-recognizedtribes.Thispolicyhasproventobetheonlypolicythathasworkedtomakesignificantprogressinreversingotherwisedistressedsocial,cultural,andeconomicconditionsinNativecommunities.(Cornell&Kalt,2010,p.v)33

Don’tBeggarYourNeighbor

Inprincipalpart,tribeslacksignificanttaxrevenuenotbecausetheirpowertotaxhasbeennullifiedbutbecauseWashingtonandotherstatesinsistonassertingtaxjurisdictioninIndiancountry.Whentribescannotpreemptthatjurisdiction,theyarerelegatedtosecond-classstatus.WhenstatesinflictonthemtheHobson’schoiceofdouble-taxingeconomicactivityornottaxingatall,theybeggartheirneighbors,touseAdamSmith’sphrase;theyeasetheirownfiscalburdensbyworseningthetribes’.34

Thelawmayallowthis,butdejuremightdoesnotmakederectoright.Tothecontrary,insistingonstatetaxprimacyforcesacontinuingtransferfromIndianstostates. Tribesmaybuildinfrastructuretorecruitbusinesses,asatQuilCeda,butunlessthestaterelents,theydon’tdareaddasecondtax.Meanwhile,statesreaprevenuewheretheydidnotsow.

Andthatisthebenignstory.Tribesrefrainfrominvestinginpublicgoodsandserviceswhenlegaluncertaintymakescostrecoverythroughtaxcollectiondoubtfulorentirelyoutofreach.Thus,theyleavevacantlandvacantandemptybuildingsempty,andreservationpovertygrindson.Statepolicymakerswhoarecomfortablewiththemoralimplicationsofnotrelentingonstatetaxprimacymaywanttothinkagain.Howisthisnotanongoing,modern-dayexpropriationfromIndians?

32Asadvanced,forexample,byexecutiveordersandpronouncements(G.H.W.Bush,1991;G.W.Bush,2004;Carter,1979;Clinton,1994,2000;Nixon,1970;Obama,2009;Reagan,1983);bytribal“treatmentasstatestatus”intheCleanAirAct(45USC§7601(d)(1)(A))andCleanWaterAct(42U.S.C.§300j–11);andbymanystatutesthatencouragetribalauthority,discretion,andcontrol,suchastheIndianSelf-DeterminationandEducationalAssistanceActof1975(PL93-638)andtheNativeAmericanHousingAssistanceandSelf-DeterminationActof1996(PL104-330).33SeealsoThestateoftheNativenations:conditionsunderUSpoliciesofself-determinationbytheHarvardProjectonAmericanIndianEconomicDevelopment(2008).34“[N]ationshavebeentaughtthattheirinterestconsistedinbeggaringalltheirneighbours.Eachnationhasbeenmadetolookwithaninvidiouseyeupontheprosperityofallthenationswithwhichittrades,andtoconsidertheirgainasitsownloss.Commerce,whichoughtnaturallytobe,amongnationsasamongindividuals,abondofunionandfriendship,hasbecomethemostfertilesourceofdiscordandanimosity.”(Smith&Cannan,2003,p.621)

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 25 NNI | HPAIED

Thecenturies-longhistoryofstateandfederalpoliciesaimedat(orhavingtheeffectof)capitalizingtheUSeconomywithtribalassetshasbeeninjuryenough.35Inlightofabundantcontemporaryevidenceshowingthattribalmanagementoftribalassetsbenefitsbothon-andoff-reservationeconomies,36statetaxprimacyinIndiancountryappearsparticularlyanachronistic.

ParityinBreaks

Asnotedabove,Washingtonexemptstaxesworthbillionsofdollarsformanyreasons,notleastofwhichiseconomicdevelopment.ThestatehasrefrainedfromfullytaxingBoeing,lawyers,farmers,andmanyothers.Yetitcannotseemtodorightbytribesonthisfront(nottomentionactinitsowneconomicinterest)unlesscompelledtodoso.Otherstatesaresimilar.WhyshouldstatesbelesseagertochampionpoliciesthatfostereconomicdevelopmentinIndiancountrythantheyaretospurandsupporteconomicdevelopmentinruralareasanddepressedcountiesortoattractandretainmultinationalfirms?

V. RECOMMENDATIONS

Althoughtaxpolicyisneversettled,thefundamentalprinciplesofgoodtaxpolicyandthepracticalandeconomicbenefitsofintergovernmentalaccommodationhavechangedlittleovercenturies.Federal,state,andlocalgovernmentssharethegoalsofcertainty,economicgrowthandefficiency,andreliabilityofrevenues,andhavefoundwaystoarriveatreasonablyfairapportionment.Unfortunately,tribeshaveusuallybeenoverlookedorexploitedinthisprocess.Theyoperateunderacomplexsetoflegalprecedentsthatskew,delay,andoftenpreventeconomicdevelopmentinIndiancountry,damagingtheabilityoftribalgovernmentstofundessentialfunctions.Thelossofeconomicactivityandjobcreationisharmfultoallgovernmentsandcitizens,tribalandnon-tribal.

Muchofthecaselawinthisarea,andtheattitudesthatpolicymakersbringtotheseissues,arebasedonprecedentsandideasformedlongbeforetribesdevelopedmoderneconomiesandhadthefinancialresourcestobeginprovidingsignificantgovernmentalprogramsandservices.ThelawandthepolicyareshotthroughwiththefalsepresumptionthatstateorlocalgovernmentsareprovidingsignificantbenefitsinIndiancountrywhilethetribesaremerely“marketingtaxadvantages,”asintheopinionoftheUSSupremeCourtthat:

Washington’staxesarereasonablydesignedtopreventtheTribesfrommarketingtheirtaxexemptiontononmemberswhodonotreceivesignificanttribalservices

35Forexample,WilkinsonreportsthatIndianlandholdingsfellfrom138millionacresin1887to52millionin1934(i.e.,wellafterthetreaty-makingperiod)underthetermsoftheDawesAct(1987,p.20),legislationthatwasapparentlysupportedbywell-meaningreformers,notjustopportunistsseekingland(Carlson,1981).36Forexample,KreppsandCaves(1994)showthatbyresolvingprincipal-agentslippage,tribalmanagementoftribalforestsproducesmoreharvestingofthesustainableyieldandhigherpricesforcommoditylumber,allelsebeingequal.

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 26 NNI | HPAIED

andwhowouldotherwisepurchasetheircigarettesoutsidethereservations.(Washingtonv.Colville,1980,p.157)

Butstateandlocalgovernmentshavelongmarketedtaxadvantagestoattractandretainbusiness.Forexample,pertheNewHampshireDepartmentofResourcesandEconomicDevelopment:

It’stimetogetreal—inNewHampshire—whereshoppingisinfinitelymoreblissfultodothantoimagine.Afterall,eventhatbigonlineretailerwillchargeyousalestaxthesedays,buthereinNewHampshire,westillsay“no”totaxingpurchases(2015).37

ThisWeb-basedmarketingisapparentlyaddressedeventoout-of-statevisitors“whodonotreceivesignificant[NewHampshire]servicesandwhowouldotherwisepurchasetheir[retailgoods]outsidethe[state],”toadaptColville’slanguagetoaninterstatecontext.

Thisviewisantiquatedwhenmosttribesprovidethesameinfrastructureandservicesthattheirneighboringnon-tribaljurisdictionsdo(ifnotmore).Inthiscontext,theconventionthateachgovernmentshalltaxwhatgoesoninitsjurisdictionmakesmoresense.

Theplaceoftribalgovernmentsinourcollectiveandinterdependenteconomymustbereassessedifgoodtaxpolicyistobeachieved.Justasfederal,state,andlocalgovernmentsignoretheimpactoftheglobaleconomyattheirperil,afailuretorecognizethattheirtribalneighborsactivateeconomicresourcesandprovideessentialgovernmentalprogramsandservicesisself-destructive.

Buthowcantaxpolicyberepairedinanarenawithsomanydeepandhistoricalflaws?

FederalSolutions

ResolvingIndiantaxissuesonastate-by-statebasishashadmixedresults,takesalongtime,andhasverydifferentoutcomesdependingonpoliticalandeconomicgoalsandtheleverageoftheparties,exacerbatingthetendencytolitigate.CongressandtheBureauofIndianAffairscouldsignificantlyreduceuncertaintyandconflict.

CongresscouldeliminatestateandlocalgovernmenttaxationinIndiancountrythatisbasedonthecitizenshipstatusofbusinessesandcustomers.Tribescouldbeaffordedthesamecomprehensiveandexclusivetaxauthoritythatstatesnowhaveintheirgeographicjurisdictions.Suchlegislationwouldhaveasignificanteconomicimpactonstateandtribalgovernments,andmightentailthetransferofresponsibilityforsomegovernmentalfunctions.Aphase-inperiod

37OrTravelPortland:“InPortland,[Oregon,]you’llfindeverythingyouexpectfrombig-cityshopping—exceptthesalestax.PickupeverythinginPortland(everything!)withoutsalestax.Fromhandmadeitemstodesignergoods,you’llfinditall,tax-free”(2015).AndtheAnchorage(Alaska)ConventionandVisitorsBureautouts“nosalestax”(n.d.).

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 27 NNI | HPAIED

wouldensureasmoothtransitionandallowstatesandtribestonegotiateagreementswhereappropriateonissuessuchastaxadministrationandprovisionofservices.

Intermediateandpiecemealsolutionsarealsopossible.Congresscould,forexample,createanexemptionfromstatetaxwhereasubstantiallyequivalenttribaltaxisimposed,therebyeliminatingthespecterofdualtaxationthatcreatesuncertaintyfortribesandnon-Indianinvestorsalike.Congresscouldalsoactwithregardtoanyspecificsubsetofstatetaxes,suchassalesorexcisetaxes;couldpermanentlyextendtaxcreditsavailabletoemployersinIndiancountry;andcouldbroadentheavailabilityoftax-exemptbondfinancinginIndiancountrybygivingtribesthesamelatitudethatstateandlocalgovernmentshavetofinanceprojectssuchasgolfcoursesandconferencecenters.Themorepiecemealtheapproach,thelesslikelythatgoodtaxpolicywouldbeachieved.Butinasystemsobroken,astagedapproachwouldbebetterthanthestatusquo.

TheBureauofIndianAffairscouldincreasecertaintywithinexistinglawthroughacomprehensiveupdateoftheIndianTraderregulationsat25C.F.R§140.Theseregulations,whichhavenotbeenupdatedsince1957,utterlyfailtoaddresstheneedsofIndiancountrytodayandimposeanunnecessaryburdenontribaleconomicdevelopment.And,astheNationalCongressofAmericanIndianshasobserved,

Theunderlyinglawat25USC§262isbroadandflexibleauthorityfortheDepartmentofInteriortoadoptnewregulationsthatwouldmeettheeconomicdevelopmentandtaxrevenueneedsofIndiantribalgovernmentsinthe21stCentury.(2015,p.1)

JustastheBIA(2012,2016)clarifiedtaxtreatmentofactivitiesoccurringonleasedIndianlandswithregulationsthatbecameeffectiveinJanuary2013,andofrights-of-wayonIndianlandwithregulationsthatbecameeffectiveinMarch2016,theagencycouldthroughIndianTraderregulationsprovidecomprehensiveanalysisandguidanceontaxrelatedtoallbusinessactivitiesinIndiancountry.Similarly,theInternalRevenueServicecouldprovidemoderninterpretationsofexistingstatutes.

StateSolutions

Intheabsenceoffederallegislationorregulation,stateshavetremendousopportunitytoresolveIndiantaxissuesinwaysthataddressuniquelocalcircumstancesandbenefitallcitizensofthestate.Allthatislackinginmanycasesisacceptanceofthewell-establishedfactthatencouragingtribaleconomicdevelopmentthroughgoodtaxpolicyhelpsstateandlocaleconomies.Solongasstateofficialsandthepublicincorrectlybelievethatstrengtheningthetribaltaxbasewillhurtstateorlocaleconomies,itwillbeimpossibletomusterthepoliticalwilltoengageinproductivenegotiationsandlegislation.

LikeCongress,statescouldeliminatestateandlocaltaxesinIndiancountrythatarebasedonthecitizenshipstatusofbusinessesandcustomers.Again,aphase-inperiodwouldallowforagreementstobenegotiatedwhereappropriate.

Double Taxation Croman Taylor 2016

DISCUSSION DRAFT 28 NNI | HPAIED