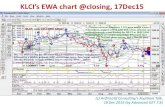

Weekly Trading Strategy of Singapore STI & Malaysia KLCI (24-28 March 2014)

-

Upload

alex-gray -

Category

Economy & Finance

-

view

104 -

download

2

description

Transcript of Weekly Trading Strategy of Singapore STI & Malaysia KLCI (24-28 March 2014)

TRADING STRATEGY

SINGAPORE

E X C H A N G E

G l o b a l R e s e a r c h L i m i t e d

24th to 28th March, 2014

www.capitalvia.com.sg

www.capitalvia.com.sg

SINGAPORE

E X C H A N G E

G l o b a l R e s e a r c h L i m i t e d

TRADING STRATEGY - 24th to 28th March,2014

{ b◘ Counter Name %CHG/ I ! bD9 IN

POINTSHIGH LAST RATE LOW Range R4 R3 R2 R1 PIVOT S1 S2 S3

1 CapitaLand Ltd 0.7350 0.0200 2.7400 2.7400 2.7000 0.0400 2.8467 2.8067 2.7667 2.7133 2.7267 2.7133 2.6867 2.6467

2 CapitaMall 1.3400 0.0250 1.9050 1.8900 1.8650 0.0400 2.0067 1.9667 1.9267 1.8833 1.8867 1.8683 1.8467 1.8067

3 CapMallsAsia 1.1870 0.0200 1.7150 1.7050 1.6800 0.0350 1.8050 1.7700 1.7350 1.6950 1.7000 1.6850 1.6650 1.6300

4 CITY DEVELOPMENTS 2.9540 0.2700 9.4100 9.4100 9.1500 0.2600 10.1033 9.8433 9.5833 9.2367 9.3233 9.2367 9.0633 8.8033

5 ComfortDelgro Corp Ltd 1.5670 0.0300 1.9450 1.9450 1.9150 0.0300 2.0250 1.9950 1.9650 1.9250 1.9350 1.9250 1.9050 1.8750

6 DBS Group Holdings Ltd 1.0860 0.1700 15.9400 15.8300 15.6500 0.2900 16.6767 16.3867 16.0967 15.7833 15.8067 15.6733 15.5167 15.2267

7 Genting SP 0.7660 0.0100 1.3150 1.3150 1.3000 0.0150 1.3550 1.3400 1.3250 1.3050 1.3100 1.3050 1.2950 1.2800

8 GLOBAL LOGISTIC PROP LIMITED 1.5500 0.0400 2.6300 2.6200 2.5800 0.0500 2.7600 2.7100 2.6600 2.6000 2.6100 2.5900 2.5600 2.5100

9 GoldenAgr -1.7390 -0.0100 0.5750 0.5650 0.5650 0.0100 0.5983 0.5883 0.5783 0.5717 0.5683 0.5617 0.5583 0.5483

10 Hong Kong Land Holdings Ltd USD -0.6480 -0.0400 6.2900 6.1300 6.1300 0.1600 6.6633 6.5033 6.3433 6.2367 6.1833 6.0767 6.0233 5.8633

11 HPH Trust US$ 2.4190 0.0150 0.6350 0.6350 0.6200 0.0150 0.6750 0.6600 0.6450 0.6250 0.6300 0.6250 0.6150 0.6000

12 Jardine C&C 3.5180 1.4700 43.2500 43.2500 41.8100 1.4400 47.0900 45.6500 44.2100 42.2900 42.7700 42.2900 41.3300 39.8900

13 JMH 400US$ -3.7780 -2.1800 58.9600 55.5200 55.5200 3.4400 66.9867 63.5467 60.1067 57.8133 56.6667 54.3733 53.2267 49.7867

14 JSH 500US$ -4.3730 -1.5000 35.0000 32.8000 32.8000 2.2000 40.1333 37.9333 35.7333 34.2667 33.5333 32.0667 31.3333 29.1333

15 Keppel Corp Ltd 1.4380 0.1500 10.5800 10.5800 10.4000 0.1800 11.0600 10.8800 10.7000 10.4600 10.5200 10.4600 10.3400 10.1600

16 NOBLE GROUP LTD - - 1.0700 1.0650 1.0500 0.0200 1.1217 1.1017 1.0817 1.0583 1.0617 1.0533 1.0417 1.0217

17 Oversea-Chinese Banking Corporation Ltd 0.9740 0.0900 9.3900 9.3300 9.2400 0.1500 9.7700 9.6200 9.4700 9.3100 9.3200 9.2500 9.1700 9.0200

18 OLAM INTERNATIONAL LTD R 0.9050 0.0200 2.2300 2.2300 2.2100 0.0200 2.2833 2.2633 2.2433 2.2167 2.2233 2.2167 2.2033 2.1833

19 Semb Corp 1.9460 0.1000 5.2700 5.2400 5.1100 0.1600 5.6867 5.5267 5.3667 5.1733 5.2067 5.1433 5.0467 4.8867

20 SembCorp Marine Ltd 1.5270 0.0600 3.9900 3.9900 3.9300 0.0600 4.1500 4.0900 4.0300 3.9500 3.9700 3.9500 3.9100 3.8500

21 Singapore Exchange Ltd 0.4490 0.0300 6.7500 6.7100 6.6800 0.0700 6.9233 6.8533 6.7833 6.7167 6.7133 6.6767 6.6433 6.5733

22 Singapore Airlines Ltd -0.3910 -0.0400 10.2600 10.1900 10.1600 0.1000 10.5033 10.4033 10.3033 10.2167 10.2033 10.1467 10.1033 10.0033

23 SIA ENGINEERING CO LTD 1.4550 0.0700 4.8800 4.8800 4.8300 0.0500 5.0133 4.9633 4.9133 4.8467 4.8633 4.8467 4.8133 4.7633

24 Singapore Telecommunications Ltd 0.5710 0.0200 3.5400 3.5200 3.4900 0.0500 3.6667 3.6167 3.5667 3.5133 3.5167 3.4933 3.4667 3.4167

25 Singapore Press Holdings Ltd 0.9800 0.0400 4.1200 4.1200 4.0600 0.0600 4.2800 4.2200 4.1600 4.0800 4.1000 4.0800 4.0400 3.9800

26 Singapore Technologies Engineering Ltd 0.8110 0.0300 3.7300 3.7300 3.6900 0.0400 3.8367 3.7967 3.7567 3.7033 3.7167 3.7033 3.6767 3.6367

27 Starhub Ltd - - 4.0500 4.0400 4.0100 0.0400 4.1533 4.1133 4.0733 4.0267 4.0333 4.0167 3.9933 3.9533

28 Thai Beverage Public Co Ltd. 1.6260 0.0100 0.6250 0.6250 0.6100 0.0150 0.6650 0.6500 0.6350 0.6150 0.6200 0.6150 0.6050 0.5900

29 United Overseas Bank Ltd 2.2330 0.4500 20.6500 20.6000 20.1900 0.4600 21.8600 21.4000 20.9400 20.3600 20.4800 20.3100 20.0200 19.5600

30 Wilmar International - - 3.4500 3.4300 3.4000 0.0500 3.5767 3.5267 3.4767 3.4233 3.4267 3.4033 3.3767 3.3267

S4

2.6067

1.7667

1.5950

8.5433

1.8450

14.9367

1.2650

2.4600

0.5383

5.7033

0.5850

38.4500

46.3467

26.9333

9.9800

1.0017

8.8700

2.1633

4.7267

3.7900

6.5033

9.9033

4.7133

3.3667

3.9200

3.5967

3.9133

0.5750

19.1000

3.2767

www.capitalvia.com.sg

SINGAPORE

E X C H A N G E

G l o b a l R e s e a r c h L i m i t e d

Investment in equity shares has its own risks.Sincere efforts have been made to present the right investment perspective. The information contained herein is based on

analysis and up on sources that we consider reliable. We, however, do not vouch for the accuracy or the completeness thereof. This material is for personal information

and we are not responsible for any loss incurred based upon it & take no responsibility whatsoever for any financial profits or loss which may arise from the

recommendations above. The stock price projections shown are not necessarily indicative of future price performance. The information herein, together with all estimates

and forecasts, can change without notice. We does not purport to be an invitation or anoffer to buy or sell any financial instrument. Any surfing and reading of the

information is the acceptance of this disclaimer. All Rights Reserved.

DISCLAIMER