Viet Nam Pocket Reference Book Low Nielsen 2013

Transcript of Viet Nam Pocket Reference Book Low Nielsen 2013

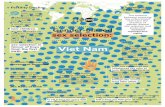

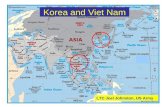

- 1.KNOW YOUR CONSUMER GROW YOUR BUSINESS 2013 POCKET REFERENCE BOOK: VIETNAM