uco bank

-

Upload

sarabjeet-singh-rana -

Category

Documents

-

view

410 -

download

0

Transcript of uco bank

EXECUTIVE SUMMARY

The globalization has intensified the activities in the international

bank market to a very large extent.

The competition has increased manifold and each bank is in search

of mean to differentiate itself from the others. Similarly domestic

banks in developing countries are striving to sustain in the market.

Banks in the international arena are playing an important role in

bringing various sectors together. They are bridging the gap between

the lenders and borrowers in a more effective manner and are

participating in enhancing the world’s output.

Banks also need certain regulations to guide them.

Greater domestic and foreign competition can lift the efficiency of

local banks and other financial institutions. This is a development to

manage, but not to impede.

Supervisory oversight also needs to continuously evolve to keep pace

with market changes. Basel II is an important step in this direction.

Finally, accounting standards need, as far as possible, to become

more harmonized internationally.

1

INTRODUCTION

The emphasis is on the theory and practice of international banking,

because of its critical importance in the modern banking framework.

International banking is not a new phenomenon; international bank activity

can be traced back to as early as the 13th century. In this topic we

understand the difference between Indian banking and international.

International banking helps us to know how important international banking

for the progress of India and also for the counter. It is one of the most

important factors responsible for economic growth of the nation.

Banks in many nations have internationalized their operation since 1970.

The quantum of operation has increased in such a manner that the concept

evolved into a subject in itself. The term multinational banking signifies the

presence of banking facilities in more than one country. Aiber has defined

International banking as a subset of commercial banking transactions and

activity having a cross border or cross currency element. Domestic

operation such as the currency of denomination of the transaction, the

residence of the bank customer and location of the banking office the range

of transactions comprised by International banking can be easily

distinguished. A deposit or a loan transacted in local currency between a

bank in its home country and a resident of that same country is termed as

pure domestic banking.

2

BRIEF HISTORY

The origin of international banking dates back to the second century BC

when Babylonian temples safeguarded the idle funds and extended loans

to merchants to finance the movements of goods. The loans extended by

the Florentine banking houses were the first instance of international

lending by the prerunners of the modern banks to the forerunners of the

modern governments.

During the nineteenth century many innovations were witnessed in the

international lending, leading to trade financing and investment banking.

Trade financing started as short term lending. Of the two investments

banking accounted further great bulk of the international lending and

financial companies acted as agents or underwriters for the placement of

funds and thus originated the concept of “Capital Markets”.

By 1920, American banking institutions dominated international lending,

and the European nations were the major borrowers. There was perfect

international banking system existing till the time of First World War. The

Bretton system had installed a secured financial framework and

revolutionized the economic life by creating a global shopping center.

International banking speeded up after the first oil crisis in 1973. Progress

in the telecommunications sector across the world supplemented the

growth of international banking.

3

REASONS FOR THE GROWTH OF INTERNATIONAL

BANKING

There are number of explanations or theories provided to support the

growth in international banking operations. International banking theories

explain the reasons behind the banks choice of a particular location for

their banking facilities, maintaining a particular organizational structure, and

the underlying causes of international banking. Certain theories are as

such:-

Follow the leader, explanations suggests that banks expand across

national borders to continue to serve customers by establishing

branches or subsidiaries abroad.

Expansion abroad has a pervasive effect on competition.

Banks use management technology and marketing know how

developed countries for domestic uses at very marginal cost abroad.

Eletic theory of productions says that, banks can take ownership-

specific and location-specific advantages while operating abroad.

Market imperfections due to domestic rules, regulations and taxations

along with the drastic reduction in the cost of communications prompt

the banks to set up operations abroad.

Intercountry differences in the cost of capital attract banks to set up

their operations in different countries.

4

The multi-lateral system of payments came into existence after the

creation of the IMF and the World Bank. Resources were new raised

through financial markets for financing the development projects in

member countries. Effectively it was the commercial banks which

mobilized savings and channelized them to these institutions for

development use.

With the introduction of the flexible exchange rate system, exchange

rates were determined by market demand- supply forces. Since all

transactions went through the banking system involved with

International Banking were ideally placed to establish the demand

supply equilibrium. The role of establishing exchange rate was

therefore transferred from central banks to commercial banks.

5

CHARACTERISTICS AND DIMENSIONS

Though international banking concept is quite old, it has acquired certain

new characteristics and dimensions.

The number of participants, which at the beginning of the period were

mainly American banks, has widened to include German, UK, Japanese,

and French and Italian banks.

Nearly three quarters of the deficit of less developed countries are

financed by commercial banks operating internationally.

The maturities have risen considerably and now the average maturities

are about ten years. Banks have started diversifying their sources of

funds along with the assets.

Apart from the above, two novel kinds of overseas bank operations

characterized international bank expansion in the late 1960s and 1970s.

i) A multinational consortium bank, was created by several

established by parent banks, and

ii) The shell branch, which is not really a bank but a device to get

around the domestic government regulation, was created.

6

RECENT TRENDS

In the past two decades, people around the world have come

across complex developments in the financial sector which

have evolved gradually.

The increasing domination of securities of markets by financial

institutions managed by professional bankers has led to the

institutionalization of markets. Globalization has affected the

financial markets in the world almost entirely.

Foremost among the global trends in the world’s financial

industry are consolidation and convergence. These two

encompass financially driven mergers within domestic market.

TABLE 1

CAUSES OF GLOBALISATION CONSEQUENCES OF

GLOBALISATION

DEREGULATION ABROAD INCREASED CROSS BORDER

INVESTMENT

GREATER

INSTITUTIONALIZATION ABROAD

WIDER RANGE OF

ALTERNATIVES FOR CLINTS

SUCCESS OF EURO-MARKETS MARKET COMPLEXITIES

7

INTEGRATION OF MARKETS NEED FOR LARGER FIRMS

FEATURES OF INTERNATIONAL BANKING

International banks are organized in various formal and informal ways from

simply holding account with each other to holding common ownership.

i) CORRESPONDENT BANKING – This represents an informal

linkage between banks and its customers in different countries.

The linkage is setup when banks maintain correspondent accounts

with each other and facilitates international payments and

collections for customers.

ii) BANK AGENCIES – The agencies mostly deal in the local

currency markets and in the foreign exchange markets, arrange

loans and clears cheques.

iii) FOREIGN BRANCHES – These are operating banks and are

subject to local banking rules and the rules at home. These

branches most of the time offer quality services and safety that are

provided by a large bank to the customers in small countries.

8

INTERNATIONAL PRIVATE BANKING

International private banking consists of banking services primarily

provided for non-residents. It differs in the priorities given to the clients.

Investment options for the clients include:

Equity portfolio management

Fixed income portfolio

Balanced portfolio

Offshore mutual fund, and

Short-term Portfolio Management.

Private international banks also provide wide ranging personal services for

international clients on similar lines as those provided for domestic clients.

The globalization has intensified the activities in the international bank

market to a very large extent.

The competition has increased manifold and each bank is in search of

means to differentiate it from the others. Similarly domestic banks in

developing countries are striving to sustain in the market.

9

Banks in the international arena are playing a vital role in bringing various

sectors together.

Banks also need certain regulations to guide them.

WHAT YOU NEED TO KNOW ABOUT INTERNATIONAL

BANKING?

In order to be a success in your export activities, you need to know how to

finance your import or export and how to get paid, especially when dealing

in foreign currencies. Your banker can and should be a key member of

your advisory team. Finding a bank that is comfortable and proficient in

providing the various products and services required by exporting and

importing firms is becoming easier as international sales become more and

more common. The expansion of the internet and the advent of e-banking

are also helping to increase the number of banks that companies can work

with for their international banking requirements.

10

I. INTERNATIONAL BANKING (WITH CASE STUDY OF

UCO BANK)

UCOBANK has international presence for over 50 years now. UCO

presently has four overseas branches in two important international

financial centres in Singapore and Hong Kong and representative office at

Kuala Lumpur, Malaysia.

The international linkage from India is supported by a large Indian network

through Integrated Treasury Branch, International Banking Branches and

Authorized Forex Branches. UCO Bank’s other branches in India also

provide international banking facilities through the Authorized Branches of

UCO bank.

11

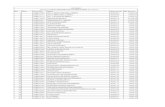

LIST OF AUTHORISED FOREIGN EXCHANGE BRANCHES

SL.

No

NAME OF BRANCH UNDER REGIONAL

OFFICE

1 Bangalore City Bangalore

2 Mysore Bangalore

3 Treasury Branch, Mumbai Mumbai

4 D. N. Road, Mumbai Mumbai

5 Nariman Point, Mumbai Mumbai

6 Worli, Mumbai Mumbai

7 Church Gate, Mumbai Mumbai

12

8 Santa Cruz Mumbai

9 Pune Camp Mumbai

10 Guntur Hyderabad

11 Hyderabad Main Hyderabad

12. Visakhapatnam Hyderabad

13. Jubilee Hills Hyderabad

14. International Banking Branch-

Chennai

Chennai

15. Mount Road Chennai

16. Tuticorin Chennai

17. Tirupur Chennai

18. Pondicherry Main Chennai

19. International Banking Branch,

Kolkata

Kolkata

20. Park Street, Kolkata Kolkata

21. Johar Bazar, Jaipur Jaipur

22. M. I. Road, Jaipur Jaipur

23. M. G. Road, Ernakulam Trivandrum

24. Trivandrum Trivandrum

25. Quilon Trivandrum

26. Cochin Main Trivandrum

13

27. Parliament Street, New Delhi New Delhi

28. Nehru Place, New Delhi New Delhi

29. Defence Colony, New Delhi New Delhi

30. Sector 17B, Chandigarh Chandigarh

31. Bhiwani Chandigarh

32. Civil Lines, Ludhiana Chandigarh

33. Jalandhar City Jalandhar

34. Phagwara Jalandhar

35. Shimla Main Shimla

36. Barotiwala Shimla

37. Silpukhuri, Guwahati Guwahati

38. Goalpara Guwahati

39. Shillong Guwahati

40. Karimganj Guwahati

41. Giridih Ranchi

42. Ashok Market, Bhubaneswar Bhubaneswar

43. Nehru Park, Jodhpur Jodhpur

44. Bhadohi Varanasi

45. Mirzapur Varanasi

46. Chandpur Varanasi

47. Moradabad Main Bareilly14

48. Arera Colony, Bhopal Bhopal

49. New Palasiya, Indore Indore

50. Cooch Behar Salt Lake

51. Ashram Road, Ahmedabad Ahmedabad

This international network is further augmented by correspondent

arrangements with leading Banks at all important world centre’s in various

countries.

Thus UCO has a true global presence and can offer a variety of

international banking products, services and financial solutions to all cross-

sections of clients, tailor-made to their banking requirements through one of

the best international banking relationship networks both in terms of

strength and spread.

15

1. PRODUCTS & SERVICES:

The international banking services in India is provided for the benefit of

Indian customers, corporate’s, NRIs, Overseas Corporate Bodies, Foreign

Companies/ Individuals as well as Foreign Banks etc. by UCO Banks

International Banking Branches, Authorized Forex Branches and Integrated

Treasury Branch. Other branches in India also provide international

banking facilities through the aforesaid network of UCO Banks branches.

All the facilities are subject to the prevalent rules & guidelines of the

Bank and RBI. Brief details of services provided are as under:-

1. NRI Banking (Please visit NRI Corner)

2. Foreign Currency Loans

3. Finance/Services to Exporters

4. Finance/Services to Importers

5. Remittances

6. Forex & Treasury Services

7. Resident Foreign Currency (Domestic) Deposits

8. Correspondent Banking Services

9. All General Banking Services (Please visit Domestic Banking

Sections)

16

DEPOSIT SCHEMES FOR NRI's

Foreign Currency Non resident (FCNR-B) Deposits:

Customer’s overseas earnings remain fully repatriable in an FCNR (B)

Deposit account with UCO bank.

Repatriability

The principal amount and interest earned are fully repatriable.

Tax Exemption

The Deposit is exempted from Indian Wealth tax. Interest is exempted from

Indian Income tax.

Choice of Currency

Place your deposit in any of the six international currencies USD, GBP,

Euro, JPY, AUD & CAD.

For deposit at any of our authorized branches in India, please remit money

to our Treasury Branch Mumbai accounts with full details.

Remit in any Currency

17

Customers can remit in any convertible currency. UCO Bank shall convert it

in any of the above six currencies of your choice.

During the customers visit to India the customer may also tender foreign

currency notes/travelers cheques to UCO banks branches.

Minimum & Maximum Amount

There is no upper ceiling; customer can put any amount in these deposits.

The minimum amount for each currency is:

USD 2,000 or its equivalent in any of the hard currencies.

Earn Attractive Interest

Large Number of Branches to choose from

Pease check the list of UCO Banks branches spread across India

accepting FCNR Deposits.

Choose the Term of Deposit

From a minimum period of 12 months to a maximum period of 60 months,

customer has the choice of keeping the deposit with the bank. Bank also

allows the customer the flexibility of closing the customers Fixed Deposit

account before the due date but the interest rate payable will be subject to

a penalty of 1%. Customers deposit should have run for a minimum period

of one year to be eligible for interest.

Automatic Renewal

18

Customers deposits are automatically renewed on maturity for the same

tenure in case no other instructions are received before due date.

Joint account

Customer can open a joint account with the bank with other Non-Resident

Indian(s).

Power of Attorney (P/A)

P/A to Residents permitted for local disbursements only.

Nomination

Customer can register nomination for this Account. Nomination Form

Loans available against FCNR deposits

Banks offer Rupee as well as Foreign Currency Loans in the currency of

Deposit against security of your FCNR Deposits in UCO banks authorized

branches in India. The overseas branches also offer foreign currency loans

against these deposits, subject to rules, if any, applicable in that country.

2) RESIDENT FOREIGN CURRENCY (RFC) DEPOSITS:

Returning Indians for permanent settlement, after staying abroad for not

less than one year, can

Retain their savings in foreign currency in a RFC account

with UCO

19

Get the proceeds of FCNR (B)/NRE Deposits credited to

this account

Repatriability

Permitted for bonafide purposes for self & dependents including exchange

required for travel, other personal purposes and investments.

Conversion into FCNR (B)/NRE

On becoming an NRI again, customers can transfer these funds into an

FCNR (B) or NRE account.

Choice of Currency

Place the deposit in any of the six international currencies USD, GBP,

Euro, JPY, CAD and AUD.

Remit in any Currency

Customers can remit in any convertible currency. Bank shall convert it in

any of the above six currencies of your choice.

Earn Attractive Interest

3) NON RESIDENT EXTERNAL (NRE) DEPOSITS :

NRE deposits can be placed with us in following a/cs

Savings Bank A/c – at present interest rate is 3.5%.

20

Fixed Deposit A/c – at following interest rates

For creation of NRE deposits, remittances from abroad should be made to

us in convertible rupees or in any hard currencies like USD, GBP, EUR and

JPY etc. Above deposits are repatriable in any currency

4) NON RESIDENT ORDINARY (NRO) DEPOSITS:

NRO account may be opened in the following manner:

Where an Indian citizen having a resident account leaves India and

becomes non-resident, his resident account should be designated as NRO

account.

Where non-resident Indian receives income in India, he can open a NRO

a/c with such funds.

NRO a/c may also be opened by foreign exchange remitted through normal

banking channels.

All types of a/c like SB, CD and all term deposits as applicable to domestic

deposits can be opened Interest rates are as per domestic deposits.

Interest is taxable.

Rupee Deposits - HIGHLIGHTS

Type of Accounts

You can open Savings Bank, Current, Recurring and Fixed Deposit

accounts with us.

21

Authorized Branches

For our Indian branches accepting Indian Rupee NRE Deposits, please get

in touch with NRI Relationship Centre at our Head Office or the respective

Regional Offices of your choice.

Interest Rate

We offer attractive rate of interest on your deposits.

Remit in any Currency

For NRE accounts you can remit in any convertible currency. We shall

convert it in Indian Rupees.

Joint Accounts, Power of Attorney, Nomination

NRE Accounts – Same as in case of FCNR (B).

NRO Accounts – Joint accounts with residents permitted, Nomination

facility available.

22

REMITTANCE TO INDIA

Remit through us EITHER to your own account with us or any other bank

OR to your near and dear ones.

We offer an efficient, easy and convenient channel to transfer money

back home in any corner in India.

Through our Overseas Branches

Just walk in to any of our branches in Singapore and Hong Kong or call

them for assistance.

Through our Accounts with Correspondents

The most convenient way of remitting the money from any part of

the world is a direct credit into UCOBANK Treasury Branch

Mumbai Account with correspondents.

We have correspondent arrangements worldwide. The details of our

Treasury Branch Mumbai accountsin six major currencies are placed on

the web for your convenience.

Just send full remittance instructions to your bank for a direct credit into our

Treasury Branch Mumbai Account with correspondents.

Through Drafts/Cheques

23

Send your Bank Drafts or Cheques to any of our branches in India with full

particulars of remittance/beneficiary.

If you are remitting from Singapore or Hong Kong, avail the facility of

remittance provided by our overseas branches.

1. LOANS TO NRIs

Against Deposits

Bank gives loans against NR deposits to NRI deposit account holder and

third parties in Indian Rupees.

Bank gives loans against FCNR (B) deposits to NRI deposit account holder

in foreign currency in India. This facility is available at our overseas

branches, subject to local directives, if any in that country.

NRI Home Loans

Bank has attractive schemes to accommodate the housing needs of NRIs.

1. Loans for Residential Property NRIs can avail of loans for

i. Construction of a new residential house

ii. Purchase of a residential flat or residential house

iii. Extension of a residential flat or residential house

24

2. Renovation of a residential flat or residential house

Loan for Plot of Land for residential use

NRIs can avail of loans for purchase of a residential plot of land for

residential use.

3. Loans against existing residential property

NRIs can avail of loans by mortgaging an existing residential property for

any of the following purposes. The loan shall be utilised for meeting the

borrower's personal requirements or for his own business purposes.

Education

Business

Medical treatment

Prohibition:

The proceeds of rupee loan should not be utilised for any of the following

activities:

i. The business of chit fund, or

ii. Agricultural or plantation activities or in real estate

business, or construction of farm houses, or

iii. Trading in Transferable Development Rights

(TDRs), or

25

iv. Investment in capital market including margin

trading and derivatives.

2. FOREIGN CURRENCY LOANS

a) In India (FCNR 'B' Loans):

The foreign currency denominated loans in India are granted out of the pool

of foreign currency funds of the Bank in FCNR Deposit etc. accounts as

permitted by Reserve Bank of India. These loans are commonly known as

FCNR Loans.UCO has a broad base of NRI customers/depositors.

Therefore, with the resource base of FCNR deposits etc. UCO is in a

position to offer the Foreign Currency Loans in India to our customers as

an alternative to loans in Rupees.

These loans are denominated in foreign currency such as US Dollars and

are offered as short term loans. The interest is fixed with a reasonable

spread over LIBOR

UCO also allows loans in foreign currency to NRIs against their FCNR

Deposits at the Indian Branches. The details are available in NRI

banking section.

b) From Outside India:

With presence at two major financial centers of the world, UCO has foreign

currency resources to arrange /grant Foreign Currency Loans to Indian as

well as multinational corporate’s at the competitive rates.The foreign

currencies denominated loans are granted by our overseas branches to

Indian Corporate’s as per External Commercial Borrowing (ECB)Policy of 26

Govt.ofIndia/RBI.

3. FINANCE/SERVICES TO EXPORTERS

UCOGOLD CARD FOR EXPORTERS

UCO launches Gold card for creditworthy exporters - Simplified access to

export credit on very good terms:

Better terms of credit including rates of interest than those extended to

other exporters by the Bank.

Processing of applications for credit faster than for other exporters.Simpler

norms, subject to specific requirements in each case, if any. 'In-principle'

limits for a period of 3 years with a provision for automatic renewal, subject

to fulfillment of the terms and conditions of sanction. Preference for grant of

packing credit in foreign currency (PCFC), subject to availability of foreign

currency funds. Lower charges schedule and fee-structure than those

provided to other exporters.

Relaxations in the norms in respect of security and collaterals, wherever

feasible. Other facility/benefit to the exporters, subject to the fulfillment of

extant rules and regulations applicable to export finance.

27

TYPES of FACILITIES FOR EXPORTS

a) Rupee Export Credit (pre-shipment and post-shipment):

UCO provides both pre and post shipment credit to the Indian exporters

through Rupee Denominated Loans as well as foreign currency loans in

India. Credit facilities are sanctioned to exporters who satisfy credit

exposure norms of UCO. Exporters having firm export orders or confirmed

L/C from a bank are eligible to avail the export credit facilities.

Rupee export credit is available for a maximum period of 180 days from the

date of first disbursement. In deserving cases extension may be permitted

within the guidelines of RBI. The corporate’s may also book forward

contracts with UCO in respect of future export credit drawls, if required, as

per the guidelines/directives provided by RBI.

b) Pre-shipment Credit in Foreign Currency (PCFC):

UCO offers PCFC in the foreign currency to the exporters enabling them to

fund their procurement, manufacturing/processing and packing

requirements. These loans are available at very competitive international

interest rates covering the cost of both domestic as well as import content

of the exports.

The corporate’s /exporters with a good track record can avail a running

account facility with UCO for PCFC. PCFC in foreign currency is available

28

for a maximum period of 180 days from the date of first disbursement

similar to the case of Rupee facility.

Features:

In the PCFC drawls permitted in a foreign currency other than the currency

of export, exporter bears the risk in currency fluctuations. The foreign

currency drawls are restricted to major currencies at present. In case, the

export order is in a non-designated currency, PCFC is given in US$. For

orders in Euro, Pound Sterling and JPY, PCFC can be availed in the

respective currencies or US$ at the choice of exporter.

Multi-currency drawls against the same order, are not permitted at present

due to operational inconvenience.

Repayment:

PCFC is to be repaid with the proceeds of the export bill submitted after

shipment. In case of cancellation of export order, the PCFC can be closed

by selling equivalent amount of foreign exchange at TT selling rate

prevalent on the date of liquidation.

The PCFC in foreign currency are granted at our various branches through

our Integrated Treasury Branch in Mumbai.

c) Negotiation of Bills under L/C:

UCO's International Banking Branches and Authorized Forex Branches are

active in negotiation/discounting of sight /usance international export bills

29

under L/Cs opened by foreign banks as well as branches of Indian banks

abroad. UCO offers the most competitive rates.

These transactions are undertaken by our branches within the

Bank/Country Exposure ceilings prescribed by UCO.

d) Export Bill Rediscounting:

UCO provides financing of export by way of discounting of export bills, as

post shipment finance to the exporters at competitive international rate of

interest. This facility is available in four currencies i.e. US$, Pound Sterling,

Euro and JPY.

The export bills (both Sight and Usance) drawn in compliance of FEMA can

be purchased/ discounted.

Exporters can avail this facility from UCO to cover the bills drawn under L/C

as well as other export bills.

e) Bank Guarantees:

UCO, on behalf of exporter constituents, issues guarantees in favor of

beneficiaries abroad. The guarantees may be Performance and Financial.

For Indian exporters, guarantees are issued in compliance to RBI

guidelines.

30

4. FINANCE/SERVICES TO IMPORTERS

a) Collection of Import Bills:

UCO has correspondent relationship with reputed International Banks

throughout the world and can thus provide valuable services to importers

who may be importing from any part of the Globe. The import bills are

collected by our International Banking Branches and Authorised Forex

Branches at very competitive rates. The import bills drawn on customers of

other branches are also collected through these branches.

b) Letter of Credit:

On account of UCO's presence in international market for decades, UCO

has established itself as a well known international bank. L/Cs of UCO are

well accepted in the International market. For any special requirement UCO

can get the L/C confirmed by the top international banks.

Thus UCO's L/C facility for the purchase of goods/services etc. fulfills the

requirements of all importers to arrange a reliable supply. UCO offers this

facility to importers in India within the ambit of FEMA and Exim policy of

Govt. of India. UCO uses state of the art SWIFT network to transmit L/Cs

31

and with a worldwide network of correspondents and our overseas

branches facilitates prompt & efficient services to the importers.

L/C facility is granted to the importers on satisfying credit exposure norms

of the Bank.

c) Financing of import:

Usance L/C facility

UCO's Usance L/C facility provides the importer an opportunity to avail

credit from their supplier/supplier's bank.

Deferred Payment Guarantee/Standby LC

UCO's Deferred Payment Guarantee/Standby LC facility also provides the

importer an opportunity to avail credit from their supplier/supplier's bank.

Foreign Currency Loans

Short term External Commercial Borrowings or Trade Credits for less than

three years as permitted by RBI for imports into India is allowed by our

overseas branches to Indian importers at very competitive rates. These are

generally backed by L/Cs opened by importer's bank. Indian importers can

also avail this facility from our overseas branches as roll-over credit on their

bank agreeing to extend the L/C in favor of our overseas branches.

d) Bank Guarantees:

32

UCO, on behalf of importer constituents or other customers, issues

guarantees in favor of beneficiaries abroad. The guarantees may be both

Performance and Financial.

5. REMITTANCES

UCO, through its worldwide network of correspondents, Indian branches

and overseas branches, offers prompt inward and outward foreign

remittance facilities at very competitive rates. The use of SWIFT network

adds to reliability and efficient handling.

The remittances are handled by our International Banking Branches and

Authorized Forex Branches. The outward remittances of customers of other

branches are also remitted through these branches. Through our well-

spread network of branches in India, inward remittances reach every nook

& corner in India. UCO has tie-up arrangements with Western Union Money

Transfer.

33

6. FOREX & TREASURY SERVICES

UCO operates in the Forex Market in India as well as abroad. In India the

inter-bank forex operations is centralized at our Integrated Treasury Branch

in Mumbai, country's undisputed financial hub. UCO's International Banking

Branches and Authorized Forex Branches undertake customer

transactions. The forex requirements of customers of other branches are

also routed through these branches. Overseas branches undertake the

forex treasury operations in Singapore and Hong Kong centre.

All the forex treasuries are equipped with state of art technology and

professionally skilled staff to handle forex treasury operations efficiently.

UCO deals in all the important international currencies. Our Forex

Treasuries generally undertake the following treasury related activities:-

Forex Inter Bank Placements/Borrowings

Sale & Purchase of currency on behalf of customers

34

Forward Cover Bookings

Cross Currency Swaps

Interest Rate Swaps (IRS)

Forward Rate Arrangements (FRAs)

Forex Money Market Operations

FOREX SERVICES FOR CORPORATES

To improve the standard of service to the valued clientele, UCO has

integrated its Forex and Domestic Treasury Operations under one roof in

Mumbai. UCO's Forex Inter-bank desk at Treasury Branch is an active

market player. UCO's integrated operation at one place in Mumbai enables

it to participate in inter-bank transactions on a large scale. Forex Dealing

Rooms in Singapore and Hong Kong and a worldwide network of

correspondents add to UCO's strength in providing the best forex corporate

services.

International Banking Branches and Authorized Forex Branches spread

across the country cater to needs of all customers in foreign exchange.

Corporate Forex Services include Foreign Currency Sale & Purchase,

Forward Booking, and Cross Currency Forward etc. Other products like

Collection & Negotiation of Export & Import Bills under LC, LC Issuance,

Advising & Confirmation Services, Arrangement of Trader Credits, the

35

guarantees on behalf of Indian Corporate/Projects, EEFC Accounts, and

Remittance etc. are all available to corporate customers from UCO.

UCO is establishing a Derivative Desk in India to offer various Derivative

Products, such as IRS, FRA, Cross-currency Options, and Currency Swaps

with Cross-currency Interest Rate Swap etc. With this UCO will also offer

structured products suitable for Corporate’s who have large receivables or

payment obligation in foreign currencies. Derivative Desk will deal in

hedging products to hedge the market risks i.e. interest rate risk and

foreign exchange risk in Bank's balance sheet.

7. RESIDENT FOREIGN CURRENCY (DOMESTIC) A/Cs

UCO also offers Resident individuals in India, the facility to open non-

interest bearing current account in foreign currency at the selected Indian

branches as permitted by RBI. A joint account with a resident eligible to

open RFC (D) account is permissible. Nomination facility is also permitted.

Thus UCO will provide an option to resident individuals to retain their

receipts from abroad in foreign currency as permitted by RBI.

8. CORRESPONDENT BANKING SERVICES

The extensive network of branches in India and presence in two important

international centre’s enables UCO to offer correspondent banking services

to the banks.

36

The International Banking Branches and Authorized Forex Branches in

India as well as our overseas branches are capable of providing the

services that an international correspondent Bank can offer.

UCO can provide the following main services:-

i) Collection of bills both Documentary and Clean.

ii) Advising/confirming of L/Cs opened by banks

iii) Discounting of Bills drawn under L/Cs

iv) Maintenance of foreign currency accounts in S$ and HK$

v) Maintenance of Rupee accounts in India

vi) Making foreign currency payments/remittance on behalf of customers of

banks.

UCO's excellent service with competitive charges provides a good

Correspondent Banking solution.

UCO's overseas branches are active in discounting of usance international

trade bills. With foreign currency resources of overseas branches, UCO

offers the most competitive rates for discounting of these bills. The bills

under the L/Cs of the most of the Indian Banks as well as International

Banks are also discounted at competitive rates. These transactions are

undertaken by them within the Bank/Country Exposure ceilings prescribed

by UCO.

37

EXTERNAL COMMERCIAL BORROWING (ECB)

The foreign currency loans to the Indian corporate are granted by UCO's

overseas branches. The borrowings raised by the Indian corporate from

specified banking sources outside India are termed "External Commercial

Borrowings" (ECBs). These ECBs can be raised within the Policy

guidelines of Govt. of India/Reserve Bank of India, as applicable from time

to time. ECB includes the following:-

i) Commercial Loans

ii) Syndicated Loans

iii) Floating/Fixed rate notes and bonds

iii) Lines of Credit from foreign banks and financial institutions

38

iv) Import loans, loans from the export credit agencies of other countries.

UCO is very active in granting and arranging various forms of ECB facilities

for the Indian Corporate. UCO can offer following services to the Indian

corporate’s in respect of cross border financing:-

i) Arranging/granting External Commercial Borrowings by way of Foreign

Currency Loans, FRNs, and Bonds for the Indian corporate’s.

ii) Arranging/underwriting International Syndicated Loans for the Indian

corporate’s.

iii) Participating in the International Loan Syndications.

iv) Granting loans backed by Export Credit Agencies.

v) Providing import finance for Indian Corporate’s.

vi) Issue of Guarantees such as Bids, Bonds, Performance, Advance

Payment etc. for the overseas projects bagged by the Indian Corporate’s.

39

TELE- BANKING

The Bank has planned to provide tele-banking facility to its valued clients in

some select branches to start with, which will be gradually extended to

more number of branches. Besides facilitating balance enquiry, customers

will be able to requisition Statement of Account by fax as well as place

requests for issuance of cheque books. Enquiries on latest Interest Rates

on deposits as also last five transactions in the account can also be made.

Instructions to stop payment too can be given by the customer through this

facility of tele-banking.

40

II. INTERNATIONAL BANKING SERVICES OF

STATE BANK OF INDIA (CASE STUDY)

International Banking services of State Bank of India are delivered for the

benefit of its Indian customers, non-resident Indians, foreign entities and

banks through a network of 67 offices/branches in 29 countries, spread

over all time zones. The network is augmented by a cluster of Overseas

and NRI branches within India and correspondent links with over 522

banks, the world over. Bank's Joint Ventures and Subsidiaries abroad

further underline the Bank's international presence.

The Bank has carved a niche for itself in the Euro land with branches

located in Antwerp, Paris and Frankfurt. Indian banks and corporate’s are

able to avail single-window Euro services from the Bank's Frankfurt branch.

These services include:-

A. TRADE FINANCE

Trade finance includes gamut of services which include credit for

both pre shipment and post shipment activities. These primarily

include:-

Export Avenue

Rupee Export Credit (Pre-Shipment and Post-

Shipment)

41

PRE-SHIPMENT EXPORT CREDIT:-

Pre- Shipment credit (Packing Credit) is extended to the exporters for

financing purchase, processing, manufacturing or packing of goods

prior to shipment. This would mean any loan or advance can be extended

by SBI on the basis of:

a) Letter of Credit opened in the favor of the customer or in favor of some

other person, by an overseas buyer

b) A confirmed and irrevocable order for the export of goods from India

c) Any other evidence of an order or export from India having been placed

on the exporter or some other person, unless lodgment of export order

or Letter of Credit with the bank has been waived.

Packing Credit is granted for a period depending upon the circumstances of

the individual case, such as the time required for procuring, manufacturing or

processing (where necessary) and shipping the relative goods.

Packing credit is released in one lump sum or in stages, as per the

requirement for executing the orders/LC. The pre-shipment / packing credit

granted has to be liquidated out of the proceeds of the bill dawn for the

exported commodities, once the bill is purchased/discounted etc., thereby

converting pre-shipment credit into post-shipment credit.

42

POST-SHIPMENT EXPORT CREDIT:-

SBI extend Post-shipment Credit that is any loan / advance granted or any

other credit provided by SBI for purposes such as export of goods from

India.

It runs from the date of extending credit, after shipment of goods to the date

of realization of export proceeds and includes any loan / advance granted

on the security of any duty drawback allowed by the Govt. from time to

time. Post-shipment credit has to be liquidated by the proceeds of export

bills received from abroad in respect of goods exported.

The exporter has the following options at post-shipment stage:

i. To get export bills purchased /discounted / negotiated;

ii. To get advances against bills for collection;

iii. To receive advances against duty drawback receivable from Govt.

The exporter has the option to avail of pre-shipment and post-shipment

credit either in rupee or in foreign currency. However, if the pre-shipment

credit has been availed in foreign currency, the post-shipment credit has

necessarily to be under EBR Scheme since foreign currency pre-shipment

credit has to be liquidated in foreign currency.

43

Pre Shipment Credit in Foreign Currency (PCFC)

SBI‘s Pre-shipment Credit in Foreign Currency (PCFC) facilitates funds in

foreign currency. SBI’s PCFC gives the choice of four different currencies

in which to operate the scheme - the US Dollar, Pound Sterling, Euro and

the Japanese Yen.

SBI has 64 branches across the country handling the PCFC facility for the

customers’ exclusive convenience. The Bank’s Foreign Department, based

at Calcutta, is the nodal centre for raising and deploying offshore and

onshore funds for lending under PCFC.

How do the schemes operate?

PCFC & EBR schemes go hand in hand. The operation of these schemes

is in three stages, viz.

i) Disbursement of PCFC

ii) Disbursement of EBR and simultaneous repayment of PCFC and

iii) Repayment of EBR.

When the exporter has sufficient drawing power available within his overall

limit to accommodate the proposed PCFC advance, PCFC is made

available to him either in foreign currency for payment of his import bills or

in Indian rupees for purchase of domestic raw material by converting the

foreign currency of PCFC at T.T. Buying rate.

44

PCFC is operated like cash credit account with balances in foreign

currency. The liability of the exporter to the Bank on account of PCFC is in

foreign currency. The rupee equivalent will be shown in the account only at

notional rates which really doesn't concern the exporter. Interest on PCFC

will be arrived in foreign currency and the rupee equivalent thereof will be

recovered at quarterly intervals from the exporter's CC or Current account.

Export Bill Rediscounting

The EBR advance which is a foreign currency loan will be eventually closed

when the overseas buyer pays the bill and the export proceeds are

realized.

LETTER OF CREDIT

SBI offers Letters of Credit to facilitate purchase of goods in international

trading operations. The bank's vast network of branches and correspondent

banks enables one’s enterprise to sustain a seamless flow of business on a

wide platform. Further, the bank's informed trade finance crew can provide

with sophisticated credit and trade information, and market knowledge,

helping to extract more value from business.

Since the Bank establishing the Letter of Credit undertakes the

responsibility of honoring the drafts drawn there under, the ability of the

importer to meet its obligation, the integrity of the exporter, the nature of

goods, besides observance of Exchange Control regulations etc. are

considered.

45

IMPORT AVENUE

Foreign Currency import credit

This facility is ideal for both Indian importers and their foreign suppliers. SBI

offers credit to foreign suppliers of Indian importers by purchasing the

import bill for its full value through one of the bank's overseas offices. The

tenor of this form of supplier's credit does not exceed 180 days. The

supplier gets 100 per cent of the invoice value immediately, making his

deal practically a cash sale.

Importers get credit for a maximum period of 180 days, enabling them to

manage their liquidity better. Further, their interest payables could be lower

since international interest rates are currently lower than domestic rates.

These facilities are useful for import by sellers in the domestic market as

well as export-related import.

Supplier's credit

Suppliers' Credit essentially represents credit sales affected by the supplier

on the basis of accepted bills or promissory notes with or without a

collateral security. Any credit facility arranged with recourse to the supplier

for financing upto 180 days import into India which is not backed up in the

form of any letter/document/guarantee/agreement, etc. issued by the LC

opening banks or in any other manner except normal routine commercial

transactions like an LC, can be treated as a suppliers' credit. The

underlying commercial contract between the exporter and the Indian

46

importer should provide for drawing of usance drafts with an upper cap of

180 days on the usance period.

When documents under such usance LCs are discounted by our foreign

offices and other banks, it is not based on any mandate/letter of

comfort/guarantee given by the LC opening bank in India either on their

own behalf or at the instance of the importer, i.e.. the buyer of goods.

Indian importers are free to enjoy a credit period of 180 days on their

imports from the date of shipment provided interest for the period does not

exceed the prime rate for the currency in which the goods are invoiced.

Prior approval of RBI/GOI was required for exceeding this time limit, till

September 2002.

With a view to simplifying the procedure for imports into India, RBI, in

September 2002, decided that the Authorized dealers may approve

proposals received in form ECB for short term credit for financing, by way

of Suppliers' Credit, of import of goods into India, provided.

The credit is being extended for a period of less than 3 years. The amount

of credit does not exceed USD 20 million (approx. Rs. 94 crores now) per

import transaction.

The 'all-in-cost' per annum, payable for the credit does not exceed LIBOR +

50 basis points for credit up to one year and LIBOR + 125 basis points for

credit for periods beyond one year but less than three years.

47

B. CORRESPONDENT BANKING

The Correspondent Banking Division develops and maintains relationship

with Banks and Financial Institutions across the Globe. This

network Correspondent Banks forms the foundation for all international

operations of SBI. SBI has correspondent banking relations with around

522 leading banks worldwide. The Rupee Vostro accounts of International

Banks and Institutions are maintained and serviced at SBI’s International

Services branch (ISBM) at Mumbai and at Overseas Branches at Kolkata

(Calcutta), Chennai, Cochin, Bangalore and New Delhi. ACU accounts are

also serviced at the overseas branches.

C. MERCHANT BANKING

SBI’s Merchant Banking Group is strongly positioned to offer perfect

financial solutions to the respective business. It provides the resources,

convenience and services to meet the needs of the customer by arranging

Foreign Currency credits through:

Commercial loans

Syndicated loans

Lines of Credit from Foreign Banks and Financial Institutions

FCNR loans

Loans from Export Credit Agencies

Financing of Imports.

Products and services include:-48

1) Arranging External Commercial Borrowings (ECB)

2) Arranging and participating in international loan syndication

3) Loans backed by Export Credit Agencies

4) Foreign currency loans under the FCNR (B) scheme

5) Import Finance for Indian corporate

D. PROJECT EXPORT FINANCE

State Bank of India is an active participant in the area of finance of Project

export activities. These activities will mainly involve financing the fund

based and non fund based requirements of the project exporters. Project

export contracts are generally of high value and exporters undertaking

them are required to offer competitive terms to be able to secure orders

from foreign buyers in the face of stiff international competition.

SBI’s vast network of branches spread all over the country which are

authorized to handle trade related transactions, substantial presence

overseas with branches/offices in all major commercial centers of the world

covering all time zones and strong network of correspondent relationship

with top ranking banks in several countries adds to the competitive

strengths to facilitate and meet various requirements of project exporters.

Credit facilities offered:- Various types of credit facilities, both non

fund and fund based that project exporters may need at the time of bidding

and / or for execution of the project is extended by the Bank.

Non Fund Based Facilities

49

Letter of Credit facility on behalf of our customer enabling him to import raw

material required for manufacturing goods for project export is provided by

the Bank and also all other following types of guarantees required for

project export contract are issued by SBI:-

Bid Bond Guarantee

Advance Payment Guarantee

Retention Money Guarantee

Maintenance Guarantee

Overseas Borrowing Guarantee

Fund based facilities include:-

i) Pre-shipment credit both in Indian rupees and in foreign currency to

extend financial assistance for procuring/ manufacturing/ processing/

packing/ shipping goods meant for export.

ii) Rupee/ Foreign currency supplier's credit: - When a project export is

on deferred credit terms, we meet the financial requirement of our

exporter in Indian rupees or foreign currency.

iv) Buyer’s credit: Bank also participates in grant of credit to foreign

buyers under the Buyer’s Credit Scheme’ of Exim Bank.

E. EXPORTER GOLD CARD

50

State Bank of India has launched "SBI EXPORTERS GOLD CARD

SCHEME" to meet the working capital needs of exporters with good track

record and credit worthiness, subject to their fulfilling the specified eligibility

norms. The salient features of the scheme are as under:

Assessment norms have been simplified and for units with export turnover

up to Rs. 100 crore. Standby limit of 20% will be sanctioned to all the SBI

Exporters Gold Card holders over and above the sanctioned limit to meet

credit demands arising out of receipt of sudden orders. Limits sanctioned

will be valid for a period of three years.

Interest will be charged at concessional rate from the Gold Card holders.

The present rate for Packing Credit up to 180 days and Post-shipment

credit up to 365 days would be 3.75% below the Bank's benchmark Prime

Lending Rate. Also, SBI Gold Card holders will be given preference for

grant of packing credit in foreign currency.

International Credit/Debit cards and Internet Banking facilities shall be

extended to the SBI Exporters Gold Card holders on priority basis.

F. OBU (OFFSHORE BANKING UNIT)

State Bank of India has opened the first Offshore Banking Unit (OBU) in

India at the Special Economic Zone, New Bank Building, Andheri (East)

Mumbai 400,096 on 17th July 2003 - another landmark in the history of

India's Financial Sector.

G.USA PATRIOT ACT CERTIFICATION

51

Following the USA PATRIOT Act and the final rules issued by the U.S.

Department of Treasury, Banks ("Foreign banks") are required to issue

Certification to U.S. banks or broker-dealers in securities ("Covered

Financial Institutions") with which they maintain Correspondent

accounts.

For this purpose and as permitted by the final rules, State bank of India

has prepared a Certification for use by any financial institution that

needs a USA PATRIOT Act Certification from State Bank of India or one

of its branches.

UCO Bank all set to slug it out news Venkatachari Jagannathan

18 June 2002

file it to cabinet

attach label to it

bookmark it

send to friends

save note

add it to tracker

print it

currency converter

MERCHANT RATES AND FEES WITH REGARDS TO INTERNATIONAL BANKING:-

52

A Merchant Account has a variety of fees, some periodic, others charged

on a per-item or percentage basis. Some fees are set by the merchant

account provider, but the majority of the per-item and percentage fees are

passed through the merchant account provider to the credit card issuing

bank according to a schedule of rates called interchange fees, which are

set by Visa and MasterCard. Interchange fees vary depending on card type

and the circumstances of the transaction. For example, if a transaction is

made by swiping a card through a credit card terminal it will be in a different

category than if it were keyed in manually.

DISCOUNT RATES

The discount rate comprises a number of dues, fees, assessments,

network charges and mark-ups merchants are required to pay for accepting

credit and debit cards, the largest of which by far is the Interchange fee.

Each bank or ISO/MLS has real costs in addition to the wholesale

interchange fees, and creates profit by adding a mark-up to all the fees

mentioned above. There are a number of price models banks and

ISOs/MLSs use to bill merchants for the services rendered. Here are the

more popular price models:

3-TIER PRICING

The 3-Tier Pricing is the most popular pricing method and the simplest

system for most merchants, although the new 6-Tier Pricing is gaining in

popularity. In 3-Tier Pricing, the merchant account provider groups the

53

transactions into 3 groups (tiers) and assigns a rate to each tier based on a

criterion established for each tier.

QUALIFIED RATES

A qualified rate is the percentage rate a merchant will be charged

whenever they accept a regular consumer credit card and process it in a

manner defined as "standard" by their merchant account provider using an

approved credit card processing solution. This is usually the lowest rate a

merchant will incur when accepting a credit card. The qualified rate is also

the rate commonly quoted to a merchant when they inquire about pricing.

The qualified rate is created based on the way a merchant will be accepting

a majority of their credit cards. For example, for an internet merchant, the

internet interchange categories will be defined as Qualified, while for a

physical retailer only transactions swiped through or read by their terminal

in an ordinary manner will be defined as Qualified.

MID- QUALIFIED RATES

Also known as a partially qualified rate, the mid-qualified rate is the

percentage rate a merchant will be charged whenever they accept a credit

card that does not qualify for the lowest rate (the qualified rate). This may

happen for several reasons such as:

A consumer credit card is keyed into a credit card terminal instead of

being swiped

A special kind of credit card is used like a rewards card or business

card

54

A mid-qualified rate is higher than a qualified rate. Some of the transactions

that are usually grouped into the Mid-Qualified Tier can cost the provider

more in interchange costs, so the merchant account providers do make a

markup on these rates.

The use of "rewards cards" can be as high as 40% of transactions. So it is

important that the financial impact of this fee be understood.

NON- QUALIFIED RATES

The non-qualified rate is usually the highest percentage rate a merchant

will be charged whenever they accept a credit card. In most cases all

transactions that are not qualified or mid-qualified will fall to this rate. This

may happen for several reasons such as:

A consumer credit card is keyed into a credit card terminal instead of

being swiped and address verification is not performed

A special kind of credit card is used like a business card and all

required fields are not entered

A merchant does not settle their daily batch within the allotted time

frame, usually past 48 hours from time of authorization.

A non-qualified rate can be significantly higher than a qualified rate and can

cost the provider much more in interchange costs, so the merchant account

providers do make a markup on these rates.

INTERNATIONAL BANKING- A SURVEY

55

TWO DISTINCTS sets of issues are involved in the analysis of international

banking; one set, the industrial organization issues, centers on the patterns

of expansion of foreign branches and subsidiaries of banks headquartered

in the United States, Great Britain, Japan and few other industrial countries

and on the nature of the advantage that these branches and subsidiaries

have in relation to their host country competitors. The second set, the

international finance issues, involves the role of banks in cross-border and

cross-currency financial flows, both from their head offices and from their

foreign branches and subsidiaries.

Despite the attention to international banking, there are few uniquely

international institutions; rather international banks are a subset of

domestic banks with significant numbers of foreign branches and

subsidiaries. Moreover there are few uniquely international banking

activities; although foreign exchange trading may seem to be one; in many

countries most or all foreign exchange trading involves domestic banks with

few if any foreign branches.

CONCLUSION56

Banks have influenced economies and politics for centuries. Historically,

the primary purpose of a bank was to provide loans to trading companies.

Banks provided funds to allow businesses to purchase inventory, and

collected those funds back with interest when the goods were sold. For

centuries, the banking industry only dealt with businesses, not consumers.

Banking services have expanded to include services directed at individuals,

and risk in these much smaller transactions is pooled.

International banking has become an important aspect of world economy. It

deals with various aspects of financial services. Banks offer many different

channels to access their banking and other services. Though international

banking concept is quite old, it has acquired certain new characteristics and

dimensions.

Now international banking has become a very important for international

trading and financial transaction. Its importance is increasing through the

globalization of world economy and we will see its benefits in the near

future very soon.

Bibliography

57

1. BOOKS -

a) International Banking Finance

- By ICFAI

b) Merchant Banking

- By K.C. Gupta

2. WEB SITES -

a) www.icfai.org

b) www.google.co.in

c) www.wikipedia.com

INDEX

Sr.No. Topic Page No.

58

Executive Summary 1

Introduction to International Banking 2

International Banking with case study of UCO bank 11

Types of Facilities For Export 27

Forex Services For Corporates 34

TELE- BANKING 39

International Banking with a case study of State Bank Of India

Pre-Shipment Export Credit 40

Post-Shipment Export Credit

42

Import Avenue 44

Merchant Rates And Fees 51

International Banking- A Survey 54

Conclusion 55

Bibliography 56

59

60

PROJECT REPORT

on

“INTERNATIONAL BANKING”

Guru Gobind Singh Indraprastha University,Delhi

PRESENTED BY

SARABJEET SINGH RANA

01316608909

61