सम्मान आपके विश्िास का - UCO Bank · 2020-04-15 · यूको बकैं UCO BANK सम्मान आपके विश्िास

Intoduction of Uco Bank

-

Upload

anujdusad123 -

Category

Documents

-

view

226 -

download

0

description

Transcript of Intoduction of Uco Bank

INTODUCTION OF UCO BANK

Comparative Analysis of Home Loan with reference to UCO Bank and State Bank of IndiaPresented by:ANUJ DUSAD UCO BANK UCO Bank, formerly United Commercial Bank, established in 1943 inKolkata, is one of the oldest and major commercial banks of India.Ghanshyam Das Birla, an eminent Indian industrialist, during theQuit India movement of 1942, had conceived the idea of organizing acommercial bankwith Indian capital and management, and the United Commercial Bank Limited was incorporated to give shape to that idea. The Bank was started with Kolkata as its Head Office with an issued capital of 2 crores and a payed-up capital of1crore.

Its name was changed to UCO Bank, in 1985, by an act ofIndian Parliamentas a bank in Bangladesh existed with the name United Commercial Bank which caused confusion in the international banking arena. As of 6January2013the bank had 2550 Service Units spread all over India, with four overseas branches two each inSingaporeandHong Kong. The Bank has 44 Zonal Offices spread all over India.UCO Bank's headquarter is located on B.T.M. Sarani,Kolkata.

Mr. Arun Kaul is currently the Chairman and Managing director of UCO Bank.

PRODUCTS & SERVICES Deposit schemesNo-frills Savings Bank AccountMoney Back Recurring DepositsFriend-in-Need Schem Loan schemesUCO Home, UCO Car, UCO TraderEducation LoanUCO CashUCO RentUCO Mortgage

HOME LOAN ELIGIBLITYIndividual (including NRI and PIO) having minimum 21 years of age and maximum 60 years of age (salaried person) and 65 years of age (non-salaried person) inclusive of repayment period.PURPOSEPurchase and construction of independent house/ready built flat for residential, Extension/Repair/Renovation of existing house/flat, for furnishing of house property, Purchase of old house/flat INCOME CRITERIAFor salaried personNet take home pay should not be less than 40% of gross salary after deduction of P.F, IT and other statutory deduction including proposed EMI for applicants having gross monthly income up to Rs. 50 thousand.In case of Net take home pay up to 30% of gross salary & Net take home pay up to 25% of gross salary For non salaried personLast income tax assessment order/return

5Quantum of loan

FOR take over home loanMinimum loan =5 lac.Minimum loan= NO UPPER LIMIT

Location/CentreFor Construction/ Purchase/ Takeover A/CsFor Repair/ Extension/ RenovationMetro/Urban/Semi-urbanNo upper limitRs. 25 lac.RuralNo upper limitRs. 7.5 lac.CURRENT RATE OF INTEREST ON LOANS Base rate 10.20% p.aEMI for Rs 1 lac.MONTH EMI60 2135120 1333180 1087240 978300 923If the amount of loan less than 75 lac. The rate of interest is 10.20%If the amount of loan more than 75 lac. The rate of interest is 10.20% + .25%.

Processing Fee0.5% of the loan amount, minimum Rs.1500/- & maximum Rs. 15000/RepaymentThe maximum period of repayment is 25 years/300 EMI .Security & GuaranteeEMTD of property financed.No third party guarantee

Tax BenefitsTax relief on principal and interest components of this loan would be available as per provisions prevailing under Income Tax Act.InsuranceInsurance cover on house property under UCO Griha Raksha Yojana scheme to cover the risk of damage to home by natural calamities.UCO Griha Lakshmi Yojana to cover the outstanding loan in case of accidental or natural death of borrower.

STATE BANK OF INDIAState Bank of India(SBI) is a multinationalbankingandfinancial servicescompany based in India. It is agovernment-owned corporationwith its headquarters inMumbai, Maharashtra. As of December 2012, it had assets ofUS$501 billion and 15,003 branches, including 157 foreign offices, making it the largest banking and financial services company in India by assets. SBI provides a range of banking products through its network of branches in India and overseas, including products aimed atnon-resident Indians(NRIs). SBI has 14 regional hubs and 57 Zonal Offices that are located at important cities throughout the country.SBI is a regional banking behemoth and has 20% market share in deposits and loans among Indian commercial banks. The State Bank of India was named the 29th most reputed company in the world according toForbes2009 rankingsand was the only bank featured in the "top 10 brands of India" list in an annual survey conducted byBrand FinanceandThe Economic Timesin 2010.

PRODUCTS & SERVICES

RETAIL BANKINGTerm DepositsRecurring DepositsHome Loan Educational LoanPersonal Loan For Pensioners Against Mortgage of Property Against Shares & Debenture

HOME LOANELIGIBILTYMINIMUM 18 YEARSMAXIMUM 65 YEARS

PURPOSE Construction, repair, purchase flat , renovation.

LOAN AMOUNT1)Income of your spouse/ your son/ daughter living with you, provided they have a steady income and his/ her salary account is maintained with SBI.2) Expected rent accruals (less taxes, cess, etc.) if the house/ flat being purchased is proposed to be rented out.3)Depreciation subject to condition.

SECURITY:Primary:- The loan will be secured by Equitable / Registered mortgage/extension of mortgage of the land and building/flat for which the loan is to be sanctioned.Collateral:- If mortgage of the property being financed is not possible, Bank may accept, at it discretion, security of adequate value in the form of Life Insurance policies, Government Promissory Notes.

INTEREST RATE:Base Rate: 9.70% .

REPAYMENT PERIOD: 30 YEARS.

PROCESSING FEES:0.25% OR 1000/- Rs min. or 10000/-Rs. Inspection: The Bank will have the right to inspect, at all reasonable times, the borrowers property by an officer of the Bank or a qualified auditor or a technical expert as decided by the Bank and the cost thereof shall be borne by the customer. Insurance:The house/flat shall be insured comprehensively for the market value covering fire, flood, Earthquake etc. In the joint names of the Bank and the borrower. Cost of the same shall be borne by the borrower.

COMPARISIONUCO BANKSBI BANKELIGIBILITYMIN. 21 YEARS,MAX. 60 YEARS.MIN 18 YEARS , MAX. 60 YEARSREPAYMENT PERIOD25 YEARS30 YEARSPROCESSING FEES0.5% OR MIN. FEES 1500/-MAX. FEES 15000/-.0.25% OR MIN. FEES 1000/- & MAX. FEES 1000/- SANCTIONED TIMING

4 DAYS6 DAYSPRE PAYMENT CHARGES IN TAKE OVER LOANNO CHAGES2% CHARGESUCO BANKSBI BANKINTEREST RATE10.20%9.70%THIRD PARTY GUARANTEENOT REQUIREDREQUIREDRESEARCH METHODOLOGYOBJECTIVES OF THE STUDYTo study the cost of home loans provided by the bank.To know that which bank provide batter loan schemes.To analyze the home loan schemes by UCO bank and SBI bank.To know the customer perception about the home loan of UCO bank and SBI bank.To know the customer satisfaction level about home loan.To analyze the history of UCO bank and SBI bank.To study consumer preference for the above two mentioned housing finance players.SCOPE OF THE STUDYThis study is analysis and comparison of home loans provided by the UCO and SBI banks. It is helpful in analyzing the home loan service provided to the customer andtheir comparison. Research Design: DESCRIPTIVE RESEARCH DESIGN to know the Comparative analysis of home loan with reference to UCO bank and State Bank of India This helped us in having enough provision for protection against bias and maximizes reliability. Descriptive study, as its name implies, is designed to describe something for example, the characteristics of the users of a given product, the degree to which product use varies with income, age, or other characteristics.

Data Collection MethodPRIMARY DATA COLLECTIONPrimary data was collected with the help Of questionnaire.

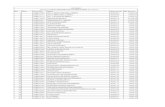

SECONDARY DATA COLLECTIONUco Bank And Sbi bank report, Articles, Newspapers, Journals, Magazines, Handouts, Pamphlets Describing the banks.SAMPLE PLANQUESTIONNAIRESAMPLING METHODRANDOM SAMPLINGSAMPLE SIZE25 each Respondents of UCO & SBISAMPLE UNITRespondents in JaipurSAMPLINGFINDINGS & DATA ANALYSISUCO BANKSBI BANK2.From how many years you are associated with this bank?UCO BANK

SBI BANK

3.How do you come to know about the home loan schemes of that bank?4.Are you aware of these type of home loans?UCO BANK

SBI BANK5.Are you aware all terms andconditions of home loans?6.Are you satisfy with the interest rate charges by your bank?UCO BANK

SBI BANK

7.Your bank offer which type of services?8.Do you agree that your bank loan processing is fast?9.Do you satisfy with the after home loan services provided by your bank are bestas compareto otherbank? 10.Does the cost of home loan is appropriate, according to your demand?11.Are you satisfy with the employees behavior of the bank?12.Does the bank give any discount upon loan services?13.Are you satisfy by the time taken in sanctioning the loan?14.Have you face any difficultyduring taking the loan15.Which grade you want to give of home loan schemes of the bank?SUGGESTIONDaily reducing option should be introduced.Relevant information should be provided to customers time to time.Reduce the interest rate 10.20 % to 9.80%.Reduce the processing fees 1500/- to 1000/- rupees.People who deal with customers should have complete knowledge about the housing finance industry.Reduce the EMI 923/- rupees to 880/- rupees.Repayment period increase the 25 year to 30 year.Gave the advertisement in the newspaper in month one to two week. Gain the customer satisfaction level.