Third Quarter Report 2004 - Photocure · FIRST QUARTER REPORT 2016 PHOTOCURE GROUP Q1. Photocure...

Transcript of Third Quarter Report 2004 - Photocure · FIRST QUARTER REPORT 2016 PHOTOCURE GROUP Q1. Photocure...

2016

FIRST QUARTER REPORT 2016PHOTOCURE GROUP

Q1

Photocure – Results for first quarter 2016

Page 2 of 18

Highlights for first quarter 2016 (Numbers in brackets and comparisons are for the corresponding period in 2015.)

Hexvix/Cysview global in-market sales increased 19% to NOK 60 million in the first quarter. First quarter in-market unit sales increased 7%

Sales revenues increased 18% in first quarter to NOK 33.5 million (NOK 28.4 million)

Commercial segment EBITDA increased 19% to NOK 5.3 million (NOK 4.5 million) with EBITDA margin at 15% (15%)

New patent for Cevira granted in Europe, which extends patent coverage to 2030

Milestone reached in the US as Blue light enabled cystoscopy with Cysview was recommended in new bladder cancer guidelines released by the American Urology Association and Society of Urological Oncology in April

Key figures:

Figures in NOK million Q1 2016 Q1 2015 Change FY 2015

Sales revenues 33.5 28.4 18 % 122.3

Signing fee & milestone revenues 1.3 1.2 12.4

Total revenues 34.9 29.6 18 % 134.7

Operating expenses 36.2 34.2 6 % 144.6

EBITDA -3.7 -6.6 -18.1

EBITDA commercial franchise 5.3 4.5 19 % 28.7

EBITDA development portfolio -9.1 -11.1 -46.8

EBIT (Operating result) -4.9 -7.2 -22.0

Profit/loss(-) before PCI and tax -4.4 -7.0 -17.4

Earnings per share, diluted (NOK) -0.03 -0.51 -1.69

Cash & cash equivalents 120.6 134.0

President & CEO Kjetil Hestdal, M.D. Ph.D. comments:

“Photocure has started the year with continued growth in revenues as well as improved profitability in the Hexvix/Cysview commercial franchise. The revenue increase is driven by continued positive growth in the Nordics and US. The recent recommendation of Cysview in the new bladder cancer guidelines in the US provides strong recognition of the clinical benefits of Cysview/Hexvix and is an important foundation for future growth in the US. We are also pleased that the enrollment of bladder cancer patients into our phase 3 surveillance study with Cysview in the US is progressing as planned and is on track to finish by the end of 2016. In the first quarter of 2016 we continued to deliver financial improvement. With the increased profitability of our commercial franchise, we made significant progress towards our goal of becoming a sustainable specialty pharma company. We remain committed to securing partnerships for our two phase 3 ready development products, Cevira and Visonac.”

Photocure – Results for first quarter 2016

Page 3 of 18

Operational review

Photocure’s strategy is to create a Specialty Pharmaceutical Company maximizing its commercial presence and the opportunity of its flagship brand Hexvix/Cysview in urology. In addition, the company will continue to leverage its core competence developing products based on its proprietary Photodynamic Technology Platform targeting unmet medical needs in urology, dermatology and gynecology. We will seek to develop and commercialize new products alone or in partnerships with others to capture the full potential of our products.

Update commercial segment

The commercial segment continued to improve sales and EBITDA in the quarter. First quarter total revenue increased 18% to NOK 34.9 million (NOK 29.6 million) compared to last year, driven by improvements in sales performance for Hexvix/Cysview. Operating expenses increased to NOK 27.2 million (NOK 23.1 million) for the quarter, reflecting continued investments in US and Hexvix/Cysview market expansion surveillance trials. EBITDA for the first quarter was NOK 5.3 million (NOK 4.5 million).

Hexvix®/Cysview® – profitable growth Hexvix/Cysview is the first approved drug-device procedure for improved detection and management of bladder cancer. Photocure is commercializing Hexvix/Cysview directly in the US and the Nordic region, and has strategic partnerships for the commercialization of

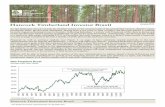

Hexvix/Cysview in Europe, Canada, Australia and New Zealand. Global in-market sales of Hexvix/Cysview increased 19% to NOK 60 million in the first quarter. Global in-market unit sales for the first quarter increased 7% compared to 2015. The volume growth was driven by positive market development in Nordic and US markets, and positively impacted by the reduced seasonality effects in the fourth quarter last year. Total sales revenues for Hexvix/Cysview increased 26% to NOK 33.5 million (NOK 26.7 million) in the first quarter. Revenue growth was positively impacted by increased demand in major markets, foreign exchange rates and price increases. Revenue growth in constant currencies was 15% for the quarter. Photocure Hexvix/Cysview sales Photocure’s sales revenues from its sales force in the US and Nordic region increased 38% to NOK 17.7 million in the first quarter, reflecting strong growth in both regions. Revenue in constant currencies grew 26% for the quarter compared to first quarter 2015. Nordic Hexvix sales Nordic revenues increased 23% in the first quarter compared to the prior year, mainly driven by customer demand, foreign exchange rates, and price increases. Revenue in constant currencies grew 14%. Photocure’s in-market unit sales in the Nordic region increased 20% in the first quarter. The increase was driven by strong development in Sweden (growth of 32%) as well as the reduced seasonality effect in the fourth quarter 2015. US Cysview sales In the US, first quarter revenue increased 66% compared to first quarter the prior year. The increase was driven by volume growth, positive foreign exchange rates and price increases. In constant currency, revenue grew 49% for the quarter compared to 2015. Unit sales in the US increased 37% in the first quarter compared to first quarter the prior year. US growth was driven both by the number of permanent blue light cystoscopes (BLCs) installed at leading US hospitals/urology centers and by increased average usage per center. The total number of permanent BLCs installed at leading

MNOK Q1 '16 Q1 '15

Nordic - Hexvix 10,1 8,3

US - Cysview 7,6 4,6

Partner - Hexvix 15,8 13,9

Hexvix / Cysview Total 33,5 26,7

API revenues 0,0 1,7

Signing fee & milestones 1,3 1,2

Total revenues 34,9 29,6YoYgrowth 18 %

Cost of goods sold -2,4 -2,0

Gross profit 32,5 27,6

Operating expenses -27,2 -23,1

EBITDA 5,3 4,5EBITDAmargin 15 % 15 %

Photocure – Results for first quarter 2016

Page 4 of 18

US hospitals/urology centers at the end of the fourth quarter was 73, an increase of 8 compared to end of 2015 and 21 (40%) compared to end of first quarter 2015. Photocure continues to work closely with key stakeholders to secure a long-term sustainable solution for Cysview Medicare reimbursement. A bill to secure coverage for US Medicare bladder patient access to state of the art treatment using up to date technology, including Cysview, was introduced in 2015 and during first quarter the bill continued to gain additional support of Congressional members and progress through the legislative process. Photocure will continue its work to obtain reimbursement for Cysview in the US. Hexvix/Cysview partner sales Partner revenue increased 14% in the first quarter to NOK 15.8 million (NOK 13.9 million), positively affected by foreign exchange and increased volumes. First quarter sales included the first shipment to BioSyent Pharma in Canada. Revenue in constant currency grew 4% in the quarter. End user unit sales increased 2% in the first quarter. It is anticipated that the first commercial sale of Cysview in Canada will take place second or third quarter 2016. Juno Pharmaceuticals, our partner in Australia and New Zealand, is expected to obtain marketing authorization in Australia in fourth quarter 2016. Marketing approval for Hexvix in Russia was received in 2015. Photocure is evaluating potential commercial partners in Russia. Hexvix/Cysview publications After quarter end, a study was published in Bladder Cancer, demonstrating that Blue Light Cystoscopy (BLC) with Hexvix/Cysview significantly prolonged time to disease progression and showed a trend in the reduction of the rate of progression in patients with non-muscle invasive bladder cancer (NMIBC). A significant milestone and recognition of the medical benefits of Cysview was achieved in April 2016 with recommendation of blue light enabled cystoscopy with Cysview in the new AUA/SUO Guidelines for bladder cancer. In recommending the use of Cysview, the guidelines highlight the importance of Cysview in increasing the detection and decreasing the recurrence rate of non-muscle invasive bladder cancer.

Hexvix/Cysview (hexaminolevulinate hydrochloride) is an innovative breakthrough technology for the diagnosis and management of non-muscle invasive bladder cancer. It is designed to selectively target malignant cells in the bladder and induce fluorescence during a cystoscopic procedure using a blue light enabled cystoscope. Using Hexvix/Cysview as an adjunct to standard white-light cystoscopy enables the urologist to better detect and remove lesions, leading to a reduced risk of recurrence. Hexvix/Cysview is approved in Europe, US, Canada and Russia. Bladder cancer has a high incidence, and is the fourth most common type of cancer in males in the US. An estimated 75,000 new cases of bladder cancer were diagnosed in 2014, with an estimated 15,600 people dying from the disease, according to the American Cancer Society. In Europe bladder cancer is the fifth most common cancer with an estimated 167,000 newly diagnosed cases and 59,000 deaths due to the disease in 2012 (Witjes JA et al., Eur Urol 2014). If bladder cancer is detected at an early stage, management and outcome for the patient is improved.

Update development portfolio

Progress in the clinical development programs

Indication Status

Visonac® Treatment of moderate to severe acne

Phase 3 ready

Cevira®

Treatment of HPV associated diseases of the cervix including precancerous lesions

Phase 3 ready

Hexvix® Cysview®

Detection of bladder cancer, surveillance segment

Phase 3 initiated

Hexvix®/Cysview® – growth opportunities An expansion of the use of Hexvix/Cysview into the surveillance patient segment will open a market segment estimated to be 2-3 times larger than the current segment. Hexvix/Cysview is currently used to optimize patient management through improved diagnosis and bladder cancer resection (TURB) in a surgical procedure. After patients are initially diagnosed and treated by TURB, they undergo cystoscopy examinations every 3-9 months. This surveillance is performed in the out-patient/office setting using flexible

Photocure – Results for first quarter 2016

Page 5 of 18

cystoscopes to detect any suspicious new lesions requiring referral for additional TURBs. In the fourth quarter last year, the first patient was enrolled in a 360 patient phase 3 clinical study examining bladder cancer detection rates using Cysview blue light flexible cystoscopy vs white light flexible cystoscopy. In first quarter, patient enrollment was in accordance with our plans and is on track to be completed by end of 2016 with final results expected in 2017 and possible FDA approval in 2018.

Visonac® – treatment of moderate to severe acne Visonac is a novel patented photodynamic treatment in late-stage development for treating moderate to severe, inflammatory acne. Visonac has been developed in combination with Photocure’s innovative full face red light lamp, Nedax®. The estimated global market value of available treatments in this segment, oral antibiotics and retinoids, is USD 900 million annually. Visonac will address a large unmet medical need as a second line treatment option for patients with moderate to severe acne estimated to affect more than 2 million patients each year in the EU and US. Research from GlobalData cites Visonac as one of the most highly anticipated introductions in the acne therapeutics market1. With alignment with regulatory authorities in both the US and Europe on the design and analysis of the global pivotal phase 3 registration program, Visonac is phase 3 ready. Photocure’s strategy is to establish a strategic partnership for Visonac for further development and commercialization. Discussions with companies that are leaders in dermatology continue to take place.

Visonac (methyl aminolevulinate 80mg/g) is in development for the treatment of moderate to severe acne. Acne is the single most common skin disease worldwide and affects up to 85% of all 12-24 year olds. There is a high unmet medical need for patients with moderate to severe acne, where the current mainstay of treatment is oral antibiotics and/or retinoids. By avoiding the risks of increased antibiotic resistance from long term exposure and providing a

1 http://healthcare.globaldata.com/media-center/press-releases/pharmaceuticals/novel-product-launches-to-reinvigorate-acne-treatment-market-by-2018-says-globaldata

better tolerated alternative than systemic retinoids, Visonac has the potential to satisfy a high unmet medical need.

Cevira® – treatment of HPV associated diseases of the cervix Cevira is a unique, non-invasive photodynamic therapy under development for the treatment of oncogenic human papilloma virus (HPV) infection and pre-cancerous cervical abnormalities. Cevira is the first in class of possible new medical treatments in this therapeutic area. The market opportunity for a successful product is significant. Each year in EU and the US approximately 1 million women are diagnosed with high grade lesions and an estimated 10-15 million women are diagnosed with oncogenic HPV. Photocure has consulted key regulatory agencies in both the US and EU to agree the design and target patient population for the pivotal phase 3 registration program. With alignment with FDA on Phase 3 clinical studies now obtained, Photocure continues to interact with FDA to finalize necessary documentation for the Cevira device to ensure readiness for the Phase 3 trial. During the first quarter, a new patent for Cevira was issued by the European Patent Office (EPO). The newly granted patent provides protection for the Cevira drug, its use and its combination with a drug delivery device, such as the Cevira device, until 2030. This new key patent in Photocure's Cevira portfolio complements the company's two proprietary European patents which protect different aspects of the Cevira device, and which expire in 2029. Cevira has the potential to treat HPV induced cervical high grade disease and prevent the development of cervical cancer, which globally affects more than 500,000 women annually. Photocure will continue discussions with leading companies in women's healthcare to secure a strategic partnership to support the phase 3 development and commercialization of Cevira.

Photocure – Results for first quarter 2016

Page 6 of 18

Financial review

(Numbers in brackets are for the corresponding period in 2015; references to the prior year refer to a comparison to the same quarter 2015, unless otherwise stated). Photocure has continued improving its financial performance in the first quarter with double-digit growth in revenues from Hexvix/Cysview and improved operating results. Revenues Revenues in the first quarter were NOK 34.9 million, an increase of 18% from the same quarter last year (NOK 29.6 million). This increase was driven mainly by positive effects of currency exchange rates, continued market penetration of Hexvix/Cysview and price increases. Total Hexvix/Cysview sales revenues for the first quarter were NOK 33.5 million, an increase of 26% from last year (NOK 26.7 million). Sales to US and Canada accounted for half of this growth. In constant currencies the revenue grew 15% for the quarter. Operating costs Total operating costs excluding depreciation and amortization were NOK 36.2 million (NOK 34.2 million) in the first quarter, an increase of 6%. The increases in operating costs were driven by changes in currency exchange rates, increased investments in US operations as well as increased activities related to expanding the use of Hexvix/Cysview into the flexible surveillance patient segment.

First quarter research and development (R&D) costs were NOK 5.0 million (NOK 6.9 million). The R&D costs relate to regulatory work and

maintenance and expansion of our intellectual property as well as the development of the current pipeline. Expenses related to the Cysview phase 3 market expansion trial are capitalized. Marketing and sales costs increased 17% to NOK 20.1 million (NOK 17.2 million) in the first quarter compared to same period prior year, significantly impacted by changes in currency exchange rates, particularly the USD/NOK. Financial results EBITDA was at NOK -3.7 million for the first quarter, an improvement of 44% as compared to prior year (NOK -6.6 million). Impact from currency translation was approximately NOK 1.0 million positive for quarter. EBITDA in the commercial segment was NOK 5.3 million for the first quarter compared to NOK 4.5 million first quarter prior year. The development portfolio had an EBITDA of NOK -9.1 million for the quarter compared to NOK -11.1 million last year. First quarter depreciation and amortization was NOK 1.1 million (NOK 0.6 million). The increase from the prior year was driven by amortization on the investments in intangible assets related to the initiation of the phase 3 market expansion trial for Cysview. Net financial items were NOK 0.5 million (NOK 0.3 million) in the first quarter. Photocure’s net loss before tax was NOK 4.4 million in the first quarter (net loss of NOK 7.0 million). Photocure had at quarter end 9.96% of the shares in PCI Biotech Holding ASA. The market value of the shareholding was NOK 8.6 million at quarter end, resulting in a positive market value adjustment of NOK 2.6 million for the first quarter. Cash flow and statement of financial position Net cash flow from operations was negative NOK 9.3 million in the first quarter (negative NOK 11.9 million). Net cash flow from investments was negative NOK 5.1 million in the first quarter (negative NOK 3.6 million). This includes investments in intangible assets of NOK 4.1 million mainly related to the phase 3 market expansion trial for Cysview. Cash and cash equivalents were NOK 120.6 million at end of first quarter 2016. First quarter net change in cash was negative NOK 13.4 million (negative NOK 15.5 million).

Photocure – Results for first quarter 2016

Page 7 of 18

Shareholders’ equity was NOK 213 million at quarter end, an equity ratio of 86%. At the end of 2015, shareholders’ equity was NOK 210 million (equity ratio of 85%). As of 31 March 2016, Photocure held 809 own shares.

Risks and uncertainty factors

Photocure is exposed to risk and uncertainty factors, which may affect some or all of the company’s activities. Photocure has financial risk, market risk as well as operational risk and risk related to development of new products. The most important risks the company is exposed to for 2016 are associated with market development for Hexvix/Cysview, progress of partnering activities, as well as financial risks related to interest rates, liquidity and currency fluctuations. There are no significant changes in the risks and uncertainty factors compared to the descriptions in the Annual Report for 2015.

Outlook

Photocure expects increasing unit sales growth rates for Hexvix/Cysview through continued positive sales development of Cysview in the US, launch in new markets as well as growth in key mature markets. Photocure has built considerable experience in the urology sector through the Hexvix/Cysview franchise. The Company will continue to expand its commercial presence in urology by furthering the Hexvix/Cysview opportunity in the bladder cancer surveillance market with finalization of the new phase 3 clinical trial. The Company expects this trial to cost USD 8.5 million in total, of which an estimated USD 3.5 million will be invested in 2016. Operating expenses are expected to increase moderately in constant currencies due to increased sales and marketing activities supporting increased revenues and activities in the surveillance market. In 4Q 2016 Photocure is entitled to receive Euro 4 million from Galderma as the final payment related to the 2009 Metvix asset purchase agreement. Cash position is expected to remain solid throughout 2016 including committed deferred payments and milestones. Photocure is committed to establishing strategic partnerships for its non-urology pipeline products.

The Board of Directors and CEO Photocure ASA

Oslo, 9 May 2016

Bente-Lill B Romøren Chairperson

Synne H. Røine

Tom Pike

Xavier Yon

Grannum R. Sant

Kjetil Hestdal President and CEO

Photocure – Results for first quarter 2016

Page 8 of 18

Photocure Group –Accounts for first quarter 2016

Photocure Group – Statement of comprehensive income

2016 2015 2015

(all amounts in NOK 1 000 except per share data) Note 1.1-31.03 1.1-31.03 1.1-31.12

Sales revenues 33 531 28 369 122 330

Signing fees and milestone revenues 1 321 1 206 12 387

Total revenues 34 852 29 575 134 717

Cost of goods sold -2 371 -1 986 -8 221

Gross profit 32 481 27 589 126 496

Indirect manufacturing expenses 3 -2 752 -2 393 -10 410

Research and development expenses 3 -5 615 -7 105 -31 337

Marketing and sales expenses 3 -20 146 -17 186 -73 399

Other operating expenses 3 -8 836 -8 112 -33 336

Total operating expenses -37 349 -34 795 -148 482

EBIT -4 868 -7 206 -21 986

Financial income 1 282 2 529 8 856

Financial expenses -768 -2 274 -4 304

Net financial profit/loss(-) excluding PCI shares 515 255 4 552

Profit/loss(-) before PCI and tax -4 353 -6 951 -17 434

Impairment loss shares in PCI Biotech Holding - - -10 636

Profit/loss(-) before tax -4 353 -6 951 -28 070

Tax expenses 4 3 647 -4 000 -8 108

Net profit/loss(-) -706 -10 951 -36 178

Other comprehensive income 5 2 373 2 860 865

Total comprehensive income 1 667 -8 091 -35 313

Net profit/loss(-) per share, undiluted 6 -0,03 -0,51 -1,69

Net profit/loss(-) per share, diluted 6 -0,03 -0,51 -1,69

Photocure – Results for first quarter 2016

Page 9 of 18

Photocure Group – Statement of financial position

Photocure Group – Changes in equity

(Amounts in NOK 1 000) Note 31.03.2016 31.03.2015 31.12.2015

Non-currrent assets

Machinery & equipment 7 1 980 2 977 2 289

Intangible assets 7 16 926 5 094 11 877

Other investments 8, 9 8 574 45 290 5 933

Deferred tax asset 4 27 137 27 063 23 490

Total non-current assets 54 617 80 424 43 589

Current assets

Inventories 17 620 13 331 13 800

Accounts receivable 9 866 7 616 12 259

Other receivables 10 46 759 9 094 44 384

Cash and short term deposits 8 120 622 149 737 134 026

Total current assets 194 867 179 777 204 469

Total assets 249 484 260 201 248 058

Equity and liabilities

Equity

Share capital 11 10 738 10 697 10 738

Other paid-in capital 49 805 38 694 43 073

Retained earnings 152 968 183 643 156 249

Shareholders' equity 213 511 233 034 210 060

Long-term liabilities

Pension liabilities 4 216 3 261 3 960

Total long-term liabilities 4 216 3 261 3 960

Current liabilities 31 757 23 906 34 038

Total liabilities 35 973 27 167 37 998

Total equity and liabilities 249 484 260 201 248 058

2016 2015 2015

(Amounts in NOK 1 000) 1.1-31.03 1.1-31.03 1.1-31.12

Equity at beginning of period 210 060 240 058 240 058

Capital increase 2 415

Share-based compensation (share options employees) 800 1 066 2 899

Treasury shares decrease 984 -

Comprehensive income 1 667 -8 091 -35 313

Equity at end of period 213 511 233 034 210 060

Photocure – Results for first quarter 2016

Page 10 of 18

Photocure Group – Cash flow statement

2016 2015 2015

(Amounts in NOK 1 000) 1.1-31.03 1.1-31.03 1.1-31.12

Profit/loss(-) before tax -4 353 -6 951 -28 070

Depreciation and amortisation 1 148 591 3 899

Gain sale of financial asets - -1 342 -1 342

Impairment loss shares - - 10 636

Share-based compensation 800 1 066 2 899

Net interest income -771 -590 -986

Changes in working capital -5 219 -4 775 -2 250

Other operational items -867 104 -5 819

Net cash flow from operations -9 263 -11 897 -21 033

Investments in fixed assets -1 759 -236 -520

Development expenditures -4 137 -5 308 -14 410

Received financial payments 771 1 932 2 328

Cash flow from investments -5 126 -3 612 -12 602

Cash flow from financing activities 984 - 2 415

Net change in cash during the period -13 404 -15 509 -31 221

Cash & cash equivalents at beginning of period 134 026 165 246 165 246

Cash & cash equivalents at end of period 120 622 149 737 134 026

Photocure – Results for first quarter 2016

Page 11 of 18

Note 1 – General accounting principles

General information Photocure ASA is a public limited company domiciled in Norway. The business of the Company is associated with research, development, production, distribution, marketing and sales of pharmaceutical products and related technical medical equipment. The Company’s shares are listed on the Oslo Stock Exchange. The Company’s registered office is Hoffsveien 4, NO-0275 Oslo, Norway. Photocure Group (Photocure) comprises Photocure ASA and the wholly owned subsidiary Photocure Inc. that is a US registered company.

Basis of preparation These condensed interim financial statements have been prepared in accordance with IAS 34 Interim Financial Reporting. These interim financial statements should be read in conjunction with the consolidated financial statements for the year ended 31 December 2015 (the Annual Financial Statements) as they provide an update of previously reported information. The accounting policies used are consistent with those used in the Annual Financial Statements. The presentation of the interim financial statements is consistent with the Annual Financial Statements. The interim report has not been subject to an audit. The Board of Directors approved the interim financial statements on 9 May 2016. Photocure has Norwegian kroner (NOK) as its functional currency and presentation currency. In the absence of any statement to the contrary, all financial information is reported in whole thousands. As a result of rounding adjustments, the figures in the financial statements may not add up to the totals.

Summary of significant accounting policies The new and amended standards and interpretations from IFRS that were adopted by the EU with effect from 2016 did not have any significant impact on the reporting in 2016. Photocure has not chosen an early implementation of any new or amended IFRS’s or IFRIC interpretations.

Important accounting valuations, estimates and assumptions Preparation of the accounts in accordance with IFRS requires the use of judgment, estimates and assumptions that have consequences for recognition in the balance sheet of assets and liabilities, the estimation of contingent liabilities and recorded revenues and expenses. The use of estimates and assumptions is based on the best discretionary judgment of the Group management.

Photocure – Results for first quarter 2016

Page 12 of 18

Note 2 - Photocure Group – Segment information

Photocure has two segments; Commercial Franchise and Development Portfolio. Commercial Franchise includes Hexvix/Cysview by sales channel, own sales and partner sales, and other sales, currently including sale of active ingredients. Development Portfolio includes development of commercial products and pipeline products.

1 Jan - 31 March 2016

Hex/Cys Hex/Cys Other Total Hex/Cys Total Grand

(Amounts in NOK 1 000) Own sales Partner Sales Sales Develop. Pipeline R&D Total

Sales Revenues 17 725 15 806 - 33 531 - - - 33 531

Milestone revenues - - 1 320 1 320 - - - 1 320

Cost of goods sold -648 -1 722 - -2 371 - - - -2 371

Gross profit 17 077 14 084 1 320 32 481 - - - 32 481

Gross profit of sales % 96 % 89 % 93 % 93 %

R&D - - - - -822 -4 148 -4 970 -4 970

Sales & marketing -17 365 -1 889 - -19 254 - -828 -828 -20 082

Other & allocations -3 013 -4 726 -159 -7 897 -827 -2 426 -3 253 -11 150

Operating expenses -20 378 -6 615 -159 -27 151 -1 649 -7 402 -9 050 -36 202

EBITDA -3 301 7 469 1 162 5 330 -1 649 -7 402 -9 050 -3 721

Commercial Products Development products

1 Jan - 31 March 2015

Hex/Cys Hex/Cys Other Total Hex/Cys Total Grand

(Amounts in NOK 1 000) Own sales Partner Sales Sales Develop. Pipeline R&D Total

Sales Revenues 12 836 13 853 1 680 28 369 - - - 28 369

Milestone revenues - - 1 206 1 206 - - - 1 206

Cost of goods sold -565 -1 420 - -1 985 - - - -1 985

Gross profit 12 272 12 433 2 886 27 590 - - - 27 590

Gross profit of sales % 96 % 90 % 100 % 93 % 93 %

R&D - - - - -1 481 -5 465 -6 946 -6 946

Sales & marketing -14 388 -2 127 - -16 515 - -639 -639 -17 154

Other & allocations -2 715 -3 725 -145 -6 585 -732 -2 785 -3 517 -10 102

Operating expenses -17 103 -5 852 -145 -23 101 -2 213 -8 889 -11 102 -34 202

EBITDA -4 832 6 581 2 740 4 490 -2 213 -8 889 -11 102 -6 612

Commercial Franchise Development Portfolio

1 Jan - 31 December 2015

Hex/Cys Hex/Cys Other Total Hex/Cys Total Grand

(Amounts in NOK 1 000) Own sales Partner Sales Sales Develop. Pipeline R&D Total

Sales Revenues 61 684 54 101 6 545 122 329 - - - 122 329

Milestone revenues - 7 450 4 939 12 388 - - - 12 388

Cost of goods sold -2 483 -5 738 - -8 221 - - - -8 221

Gross profit 59 201 55 812 11 484 126 497 - - - 126 497

Gross profit of sales % 96 % 89 % 100 % 93 % 93 %

R&D - - - - -4 709 -24 849 -29 558 -29 558

Sales & marketing -61 568 -8 684 - -70 252 - -3 021 -3 021 -73 273

Other & allocations -11 169 -15 769 -602 -27 541 -3 069 -11 134 -14 203 -41 744

Operating expenses -72 737 -24 453 -602 -97 793 -7 778 -39 004 -46 782 -144 575

EBITDA -13 536 31 359 10 881 28 704 -7 778 -39 004 -46 782 -18 078

Commercial Franchise Development Portfolio

Photocure – Results for first quarter 2016

Page 13 of 18

Note 3 – Income statement classified by nature

Note 4 – Tax

The Company has recognized a deferred tax asset regarding net temporary differences in the parent company in Norway but not for the subsidiary Photocure Inc. The parent company had a profit before tax year to date March 31, 2016 of NOK 1.8 million compared to NOK 9.0 million same period in 2015. Photocure has in 2015 changed the transfer price method in the Group from a resale method to a profit/loss split method for the business in US. The taxable profit in the parent company is related to changes in temporary differences. The deferred tax asset is in 2016 increased by NOK 3.6 million to NOK 27.1 million. The basis for the recognition is the assessment that it is more-likely-than-not that the deferred tax benefit will be utilized. There is no expiry on losses to be carried forward in Norway while it expires after 20 years in US.

2016 2015 2015

(Amounts in NOK 1 000) Q1 Q1 1.1-31.12

Sales revenues 33 531 28 369 122 330

Signing fees and milestone revenues 1 321 1 206 12 387

Cost of goods sold -2 371 -1 986 -8 221

Gross profit 32 481 27 589 126 496

Payroll expenses -22 100 -21 250 -80 358

R&D costs excl. payroll expenses/other operating exp. -2 229 -3 244 -15 117

Ordinary depreciation and amortisation -1 148 -595 -3 899

Other operating expenses -11 872 -9 707 -49 108

Total operating expenses -37 349 -34 795 -148 482

EBIT -4 868 -7 206 -21 986

(Amounts in NOK 1 000) 31.03.2016 31.12.2015

Income tax expense

Tax payable 535

Changes in deferred tax -3 647 7 573

Total income tax expense -3 647 8 108

Tax base calculation

Profit before income tax -4 353 -28 070

Permanent differences 500 13 390

Temporary differences 16 334 -11 150

Utilisation of tax loss carried forward -1 754 -9 294

Change in tax loss carried forward -10 727 35 124

Tax base 0 0

Temporary differences:

Total -121 765 -137 885

Tax loss carried forward 428 129 438 793

Net temporary differences 306 364 300 908

Write down of deferred tax benefit -197 818 -206 948

Deferred tax benefit 108 546 93 960

Deferred tax asset 27 137 23 490

Photocure – Results for first quarter 2016

Page 14 of 18

Note 5 – Other comprehensive income

Items may be subsequently reclassified to profit or loss.

Note 6 – Earnings per share

Earnings per share are calculated based on the profit/loss for the year after tax but excluding other comprehensive items. The result is divided by a weighted average number of outstanding shares over the year, reduced by acquisition of treasury shares. The diluted earnings per share is calculated by adjusting the average number of outstanding shares by the number of employee options that can be exercised. Anti-dilution effects are not taken into consideration.

Note 7 – Fixed Assets

Photocure has from 2015 capitalized a new clinical study for Cysview in US and a project for new solvent device.

2016 2015 2015

(Amounts in NOK 1 000) Q1 Q1 1.1-31.12

Market value adjustment PCI Biotech Holding ASA 2 640 2 715 0

Currency translation -267 146 865

Total other comprehensive income 2 373 2 860 865

2016 2015

(Figures indicate the number of shares) 1.1-31.03 1.1-31.12

Issued ordinary shares 1 January 21 476 295 21 393 301

Effect of treasury shares -809 -35 476

Effect of share options exercised -20 191 -49 639

Effect of shares issued - 82 994

Weighted average number of shares 21 455 295 21 391 180

Effect of outstanding share options 78 176 83 495

Weighted average number of diluted shares 21 533 471 21 474 675

Earnings per share in NOK -0,03 -1,69

Earnings per share in NOK diluted -0,03 -1,69

Machinery &

(Amounts in NOK 1 000) equipment Intangible

Net book value 31.12.15 2 289 11 877

Net investments 31.03.16 -7 5 895

Depreciation and amortization -301 -847

Net book value 31.03.16 1 980 16 926

Photocure – Results for first quarter 2016

Page 15 of 18

Note 8 – Other investments

Note 9 – Fair value

The table below analyses financial assets recognized in the balance sheet at fair value according to the valuation method. The different levels have been defined as follows: Level 1: Noted prices in active markets for corresponding assets or liabilities Level 2: Available value measurements other than the noted prices classified as Level 1, either

directly observable in the form of agreed prices or indirectly as derived from the price of equivalent.

Level 3: Value measurements of assets or liabilities that are not based on observed market values

Note 10 – Other receivables

Note 11 – Share capital

Registered share capital in Photocure ASA amounts to:

(Amounts in NOK 1 000) 31.03.2016 31.12.2015

Market value PCI Biotech Holding ASA 8 574 5 933

Total other investments 8 574 5 933

Market value hierarchy

(Amounts in NOK 1 000) Level 1 Level 2 Level 3 Total

Financial assets available for sale:

- Shares in PCI Biotech Holding ASA 8 574 - - 8 574

- Money market funds 100 084 - - 100 084

Total 108 657 - - 108 657

(Amounts in NOK 1 000) 31.03.2016 31.12.2015

Booked part of remaining settlement from sale of Metvix/Aktilite 33 774 32 805

Prepayments and other receivables 12 985 11 579

Total other receivables 46 759 44 384

No. of

shares

Nominal

value per

share

Share capital

in NOK

Share capital at 31 December 2015 21 476 295 NOK 0.50 10 738 148

Share capital at 31 March 2016 21 476 295 NOK 0.50 10 738 148

Treasury shares:

Holdings of treasury shares at 31 December 2015 35 476 17 738

Buy-back of treasury shares - NOK 0.50 -

Share option exercise -34 667 NOK 0.50 -17 334

Holdings of treasury shares at 31 March 2016 809 405

Photocure – Results for first quarter 2016

Page 16 of 18

The table below indicates the status of authorizations at 31 March 2016:

Shares owned, directly or indirectly, by members of the board, the President and CEO and senior management and their closely related associates as of 31 March 2016:

Note 12 – Share options

At 31 March 2016, employees in Photocure had the following share option schemes:

(Figures indicate the number of shares)

Purchase,

treasury

shares

Ordinary

share issue

Employee

share issues

Authorisation issued at the General Meeting on 30 April 2015 2 139 330 2 139 330 800 000

Share issues after the General Meeting on 30 April 2015 - - 82 994

Purchase of treasury shares - - -

Remaining under authorisations at 31 March 2016 2 139 330 2 139 330 717 006

No. of

No. of subscription

Name Position shares rights

Kjetil Hestdal President and CEO 103 873 116 000

Ambaw Bellete Head, US Cancer Commercial Operations - 54 100

Erik Dahl Chief Financial Officer - 69 000

Kathleen Deardorff Chief Operating Officer - 135 095

Inger Ferner Heglund Vice President Research and Development 8 200 82 280

Grete Hogstad Vice President Strategic Marketing 10 500 74 050

Espen Njåstein Head, Nordic Cancer Commercial Operations - 57 650

Gry Stensrud Vice President Technical Development & Operations 1 845 70 050

Tom Pike Board member 3 400 -

Year of allocation

2015 2014 2012/2013 2012

Option programme 2015 2014 2012 2011

Number 344 870 183 002 260 743 253 794

Exercise price (NOK) 32,78 27,39 38,50 48,75

Date of expiry (31 December) 2019 2018 2017 2016

Photocure – Results for first quarter 2016

Page 17 of 18

The number of employee options and average exercise prices for Photocure, and developments during the year:

Average exercise price for allocated, invalid, outstanding and exercisable options are all adjusted for paid dividend of NOK 2.00 in 2013.

Note 13 – Shareholders

Overview of the major shareholders at 31 March 2016:

No. of

shares

Average

exercise

price (NOK)

No. of

shares

Average

exercise

price (NOK)

Outstanding at start of year 1 119 543 37,00 1 153 312 39,05

Allocated during the year - - 407 700 32,78

Become invalid during the year 42 467 40,40 129 725 38,66

Exercised during the year 34 667 28,37 86 994 29,02

Expired during the year - - 224 750 42,00

Outstanding at end of period 1 042 409 37,15 1 119 543 37,00

Exercisable options at end of period 927 452 37,69 768 728 39,57

Q1 2016 2015

Shareholder

Account

type Citizen

No of

shares %

J.P. MORGAN CHASE BANK N.A. LONDON NOM GBR 3 151 024 14,67 %

HIGH SEAS AS NOR 1 575 000 7,33 %

RADIUMHOSPITALETS FORSKNINGSSTIFTELSE NOR 1 429 000 6,65 %

KLP AKSJE NORGE VPF NOR 1 279 984 5,96 %

FONDSFINANS NORGE NOR 905 000 4,21 %

KOMMUNAL LANDSPENSJONSKASSE NOR 900 000 4,19 %

MP PENSJON PK NOR 823 000 3,83 %

SKAGEN VEKST NOR 626 466 2,92 %

DANSKE INVEST NORSKE INSTIT. II. NOR 418 103 1,95 %

VERDIPAPIRFONDET EIKA NORGE NOR 406 517 1,89 %

FONDSFINANS GLOBAL HELSE NOR 380 000 1,77 %

BERGEN KOMMUNALE PENSJONSKASSE NOR 370 000 1,72 %

DANSKE INVEST NORSKE AKSJER INST NOR 358 314 1,67 %

VICAMA AS NOR 345 384 1,61 %

RUL AS NOR 281 475 1,31 %

EUROCLEAR BANK S.A./N.V. NOM BEL 273 832 1,28 %

POLAR CAPITAL GLOBAL HEATHCARE GROWTH GBR 254 537 1,19 %

VERDIPAPIRFONDET DNB NORGE (IV) NOR 248 088 1,16 %

HOLMEN SPESIALFOND NOR 200 000 0,93 %

VERDIPAPIRFONDET DNB SMB NOR 197 992 0,92 %

Total 20 largest shareholders 14 423 716 67,16 %

Total other shareholders 7 052 579 32,84 %

Total number of shares 21 476 295 100,00 %

Photocure – Results for first quarter 2016

Page 18 of 18

For more information, please contact: Kjetil Hestdal, President and CEO Mobile: +47 913 19 535 E-mail: [email protected] Erik Dahl, CFO Mobile: +47 450 55 000 E-Mail: [email protected]

Photocure ASA Hoffsveien 4 NO – 0275 Oslo Norway Telephone: +47 22 06 22 10 Fax: +47 22 06 22 18