New FIRST QUARTER 2018 · 2018. 6. 4. · Q1 17 Q1 18 LTM Q1 17 LTM Q1 18 *As defined in the Corral...

Transcript of New FIRST QUARTER 2018 · 2018. 6. 4. · Q1 17 Q1 18 LTM Q1 17 LTM Q1 18 *As defined in the Corral...

FIRST QUARTER 2018June 4, 2018

Petter Holland

CEO

Gunilla Spongh

CFO

2

Presenters

Disclaimer

This presentation has been prepared by Corral Petroleum Holdings AB (publ) and/or its subsidiaries and affiliates (“Corral”). The information contained in this presentation is for information purposes only.

Among other things, this presentation is intended to be used in connection with a scheduled international conference call for investors and analysts to be held on June 4, 2018 at 3:00 pm CET. The call-in number is US + 1 212 999 6659, UK +44 (0) 20 3003 2666 and Sweden +46 (0) 8 505 204 24 and the meeting code is Corral.

The conference call will also be available for replay for a limited time beginning on June 5, 2018 with access information to be posted via the "Press and Notices" heading of the Corral investors section of Preem's website at https://www.preem.se/en/in-english/investors/corral/results-and-reporting/.

The information contained in this presentation is not intended to be used as the basis for making an investment decision. You are solely responsible for seeking independent professional advice in relation to the information. This presentation is not and does not constitute an offer to sell or the solicitation, invitation or recommendation to purchase any securities in the United States or any other jurisdiction. Securities may not be offered or sold in the United States absent registration under the Securities Act of 1933 (the “Securities Act”) or an exemption from registration. This presentation may not be reproduced, disseminated, quoted or referred to, in whole or in part. This presentation speaks as of the date of this presentation. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of the information, opinions and conclusions contained in this presentation. Neither the shareholders of Corral nor any directors, officers, employees, agents or representatives of Corral, provide, grant or state, any representation, warranty, guarantee, undertaking or obligation, whether express or implied and whether by operation of law or otherwise, regarding or in relation to the completeness or the accuracy of the information contained in this presentation, and they are under no obligation to update or keep current the information contained in this presentation, to correct any inaccuracies which may become apparent, or to publicly announce the result of any revision to the statements made herein except where they would be required to do so under applicable law, and any opinions expressed in this presentation are subject to change without notice. No liability whatsoever for any loss, howsoever arising, from any use of this presentation or its contents is accepted by any such person in relation to such information.

Certain financial data included in the presentation are “non-IFRS financial measures.” These non-IFRS financial measures may not be comparable to similarly titled measures presented by other entities, nor should they be construed as an alternative to other financial measures determined in accordance with International Financial Reporting Standards (“IFRS”). Although Corral believes these non-IFRS financial measures provide useful information to users in measuring the financial performance and condition of its business, users are cautioned not to place undue reliance on any non-IFRS financial measures and ratios included in this presentation.

This presentation contains forward-looking statements. Examples of these forward-looking statements include, but are not limited to statements of plans, objectives or goals and statements of assumptions underlying those statements. Words such as “may”, “will”, “expect”, “intend”, “plan”, “estimate”, “anticipate”, “believe”, “continue”, “probability”, “risk” and other similar words are intended to identify forward-looking statements but are not the exclusive means of identifying those statements. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that such predictions, forecasts, projections and other forward-looking statements will not be achieved. A number of important factors could cause our actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements. Past performance of Corral cannot be relied on as a guide to future performance. Forward-looking statements speak only as at the date of this presentation. Corral, its agents and advisors and all of their employees expressly disclaim any obligations or undertaking to release any update of, or revisions to, any forward-looking statements in this presentation. No statement in this presentation is intended to be a profit forecast. As such, undue influence should not be placed on any forward-looking statement.

By attending this presentation or by reading the presentation slides, you are agreeing to be bound by the foregoing limitations and restrictions and, in particular, will be deemed to have represented, warranted and undertaken that you have read and agree to comply with the contents of this disclaimer.

3

MARKET AND MARKET OUTLOOK

5

Crude oil prices are rising in line with the reduction in global surplus stocks, and a few other things …

Source: Pira

6

Key factors impacting market next few months

o Factors pushing crude oil up:

US Iran sanctions

Generally increased geopolitical risk, in particular Iran /Israel conflict – but

also Venezuela, Nigeria …

Low storage levels -- increasing concerns of a tight market

Oil demand continue to be strong

o Factors having a negative impact on crude price:

Saudi ramp up

Rapid increase in US shale production

Poor OPEC compliance / softening of reduction targets.

Demand destruction from high oil prices.

Crude Oil Geopolitical Supply Disruptions Flat Around 3 MBD

Source: Pira

Source: DNB

7

Products demand

DEMANDStrong global demand despite high crude prices

o 2018 oil demand growth is forecast to be ~2 MBD (+1.9%), supported by 4% global GDP growth

o Lead light product volume growth in 2018 expected to be in:

1. Diesel up 520 kBD (+1.8%)

2. Gasoline up 460 kBD (+1.8%).

3. Jet up 170 kBD (+2.3%)

Source: Pira

8

Europe/U.S. Diesel and Gasoline Inventory Levels continue to fall- both are now at 12 year minimum or lower -

Source: PiraSource: Pira

Products

9

0

5

10

15

20

25

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

$/bbl Diesel cracks

5 yr Range (2013-2017) 2017

2018 5 yr Average (2013-2017)

0

5

10

15

20

25

30

35

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

$/bbl Gasoline cracks

5 yr Range (2013-2017) 2017

2018 5 yr Average (2013-2017)

-40

-35

-30

-25

-20

-15

-10

-5

0

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec$/bbl Fuel oil cracks

5 yr Range (2013-2017) 2017

2018 5 yr Average (2013-2017)

10

Projects and Activities

• Investment in a Vacuum Distillation Unit in Lysekil with a total capital expenditure plan of 1 600 MSEK during the period 2016 to 2018. The project is progressing according to plan. All major mechanical items and works have been contracted. Site groundwork are in its final stages and piping work is progressing well.

• Investment in a Hydrogen Production Unit in Gothenburg with a total capital expenditure of 635 MSEK is progressing with mechanical completion expected at year-end 2018.

• Strategic upgrade of IT systems progressing generally as planned with stepwise implementation in 2018 and 2019.

The 37 meter vacuum distillation tower is the heart of the new vacuum distillation plant to be completed in 2018.

Foundations for new HPU unit equipment under preparation in Gothenburg. HPU plant to be completed late 2018.

• We are aware that the ultimate sole shareholder of Corral Petroleum Holdings, Sheikh Mohammed Al-Amoudi, was one of a group of Saudi leading figures detained on November 5, 2017, at the Ritz-Carlton hotel in Riyadh. We are unable to provide further comments other than to say that Corral Petroleum Holdings and its subsidiaries are operating on a normal basis and remain unaffected by this development.

FIRST QUARTER 2018FINANCIAL SUMMARY

85 000

90 000

95 000

100 000

105 000

110 000

115 000

120 000

125 000

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 LTM2018

000's bbls

Throughput 10 year average 5 year average

12

LTM Mar-18 112 21710yr 113 3675yr 111 315

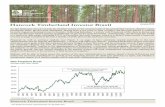

Refining Margin and Throughput 2008-2018

Refining margin Throughput

2,0

3,0

4,0

5,0

6,0

7,0

8,0

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 LTM2018

$/bbl

Refining margin ($/bbl) 10 year average 5 year average

LTM Mar-18 5.1710yr 4.745yr 4.80

1 259

327

3 786

3 257

Q1 17 Q1 18 LTM Q1 17 LTM Q1 18

*As defined in the Corral Petroleum Holdings AB (publ) report for the first quarter ended 31 March, 2018

Group First Quarter 2018 Results

Revenue (MSEK) Comments

Revenue

The increase in sales revenue is primarily a result of higher crude and product prices compared to the same period for 2017.

Adjusted EBITDA*

Adjusted EBITDA for the first quarter of 2018 was 327 MSEK, compared to 1 259 MSEK in the first quarter of 2017.

Operating loss for the first quarter of 2018 amounted to 22 MSEK, a decrease of 1 204 MSEK, compared to a profit of 1 182 MSEK for the first quarter of 2017.

The lower result is mainly due to weaker refining margins and maintenance stop in Lysekil.

Adjusted EBITDA

13

EBITDA Margin(% of Revenue) 6.9 % 1.6 % 6.1 % 4.6 %

13 %

14 %

-74 %

-14 %

18 159 20 609

62 47371 202

Q1 17 Q1 18 LTM Q1 17 LTM Q1 18

5,49 3,94 4,92 5,17

Q1 17 Q1 18 LTM Q1 17 LTM Q1 18

53,766,8

48,6 57,4

Q1 17 Q1 18 LTM Q1 17 LTM Q1 18

Throughput

In early March we had an unplanned shutdown of the Lysekil Vacuum Distillation Unit. We decided to utilize this opportunity by also moving other planned maintenance work on selected units (mainly the Iso-Cracker Unit and fluid catalytic cracker (FCC) Unit), from April into March. These maintenance activities were completed as planned, and all units are now back at full capacity again.

Average Brent Crude Price

The price of Dated Brent started the first quarter of 2018 at 67 $/bbl and was over 70 $/bbl for a couple of days during the quarter. Geopolitical risks were high during the first quarter and continue to be so – which in part is also a result of speculative actors putting their money into the financial oil market. The production cut of crude oil and increased global demand for products continued to reduce global inventory levels. The market structure remained in backwardation where current prices are higher than future prices.

Weighted Refining Margin

European refining margins were generally weaker during the first quarter of 2018 than during the fourth quarter of 2017. The increased value of refined products did not correspond to the increase in the cost of crude oil. The market, including financial speculators, invested (relatively) more in crude oil than products. The possible overreaction to the tighter supply and demand balance pushed crude oil prices higher, and products lagged behind, even as global products demand increased.

Comments

Average Brent Crude Price ($/bbl)

Throughput (000 bbls)

Weighted Refining Margin($/bbl)

-4 %

-4%

24 % 18 %

-28 % 5 %

Supply & Refining Segment

14

30 775 29 478

116 459 112 217

Q1 17 Q1 18 LTM Q1 17 LTM Q1 18

147 144

687 706

Q1 17 Q1 18 LTM Q1 17 LTM Q1 18

Revenue (MSEK) Comments

Revenue

Sales revenue in the first quarter of 2018 amounted to 5 166 MSEK compared to 4 232 MSEK in the first quarter of 2017, an increase of 934 MSEK.

Sales volumes were 13% higher in the first quarter of 2018 compared to the first quarter of the previous year driven by new major contracts within our business-to-business segment as well as our expansion in Norway.

Marketing EBITDA

Our Marketing segment reported an EBITDA of 144 MSEK for the first quarter of 2018 compared to 147 MSEK for the first quarter 2017, a decrease of 3 MSEK.

The decrease in operating profit is mainly attributable to higher selling expenses due to amortizations from the purchase of YX Bulk AS in Norway.

EBITDA (MSEK)

EBITDA Margin(% of Revenue)

4.2% 4.5% 4.7% 3.8%

15

22%

23%

-2 %

3 %

Marketing Segment

4 232 5 166

15 93519 614

Q1 17 Q1 18 LTM Q1 17 LTM Q1 18

Specific Projects

The VDU investment in Lysekil, 182 MSEK Q1 2018

Strategic IT project, 71 MSEK Q1 2018

HPU investment, 78 MSEK Q1 2018

Recurring maintenance

Less capex in Q1 2018 vs 2017 due to lower Refining maintenance

Regulatory/Environmental and Safety/Risk maintenance same level as Q1 2017

Capex by Purpose (MSEK)*

*Shown on a gross basis.

16

Comments

Capital Expenditures

164 100

774

1106

26 48

192

135

204 331

382

1096

Q1 17 Q1 18 FY 2016 FY 2017

Recurring maintenance Incremental improvements Specific projects

394 479

1348

2337

Cash Flow

Cash flow was positively impacted by movements in working capital of 2,059 MSEK for the first quarter of 2018 compared to a negative impact of 270 MSEK for the first quarter in 2017.

Cash flow from inventories amounted to 1,238 MSEK in 2018, primarily due to decreasing inventory volume in the first quarter.

Cash flow from operating receivables amounted to 161 MSEK for the first quarter of 2018, primarily due to lower volumes sold in March 2018 than in December 2017.

Cash flow from operating liabilities in 2018 amounted to 661 MSEK primarily due to higher volumes of unpaid crude oil by the end of March.

Cash flow used in financing activities is attributable to (net) repayment of loans under Preem’s revolving credit facility as a consequence of the positive cash flow from operating activities.

Comments

17

(MSEK) Q1 18 Q1 17 LTM Q1 18 LTM Q1 17

Profit before taxes -787 934 1 205 128

Adjustments for items not included in cash flow 1 191 565 2 385 4 708

Tax paid -3 -2 -5 -1

Decrease(+)/Increase(-) in inventories 1 238 -66 -928 -3 078

Decrease(+)/Increase(-) in operating receivables 161 320 -1 044 -372

Decrease(-)/Increase(+) in operating liabilities 661 -523 1 781 1 479

Changes in working capital 2 059 -270 -192 -1 971

Cash flow from operating activities 2 461 1 227 3 393 2 863

Cash flow used in investing activities -487 -403 -2 431 -1 528

1 974 824 962 1 335

Amortization/Raising of loans -2 235 -1 017 -992 43

Loan expenditure 0 0 0 -679

Cash flow used in financing activities -2 235 -1 017 -992 -636

Cash flow for the period -261 -193 -30 701

*Cash and debt figures exclude deeply subordinated debt held by our ultimate shareholder.**Exchange rate (USD/SEK) – as of March 31, 2018

Continued strong focus on paying cash coupons on the 2021 Notes.

Comments

18

Simplified Capital Structure

Cap Structure at the end of Q1 2018

MSEK $M USDx Adjusted

EBITDA

Cash-393 -47 -0.1

RCF 4 815 576 1.5

Other interest bearing liabilities and transaction expenses

-247 -30 -0.1

Total net debt at Preem 4 175 499 1.3

2021 Corral Notes6 367 762 2.0

Transaction expenses-454 -54 -0.1

Cash-876 -105 -0.3

Total 3rd party debt9 212 1 102 2.8

Adj EBITDA3256 389

USDSEK exch.rate8.36

Note: Drawdown and availability figures are not IFRS measures and are based on month end values averaged over the course of the year. In part, these values are internal calculations based on variables that are subjectively determined and which may not be comparable in approach to similar calculations of other companies

Stable liquidity position

19

Liquidity Reserves

660 695 699

1 138

1 356 1 405

FY 2016 FY 2017 LTM Q1 2018

$M USD

Average Drawdown Average RCF Availability, Cash and A3 Facility

Adjusted EBITDA means EBITDA adjusted to exclude inventory gains/losses and foreign currency gains/losses

Dated Brent Crude is a cargo of North Sea Brent blend crude oil that has been assigned a date when it will be loaded onto a tanker. In this Annual Report, references to

the price of Dated Brent Crude are derived from data provided by Platts, a division of McGraw Hill Financial Inc.

Gross Refining Margin means the difference between the sales revenue received from the sale of refined products produced by a refinery and the cost of crude oil and

(where relevant) other immediate feedstocks processed by it.

HVO Diesel is a tall oil based hydrotreated vegetable oil diesel.

Hydrogen Production Unit (HPU) is a refinery unit that produces hydrogen for use refinery processes.

Marketing EBITDA is not an IFRS measure and consists of the EBITDA of our Marketing & Sales segment which includes the operating profit and the depreciation of our

Marketing & Sales segment, as described in Note 4 to our Consolidated Financial Statements

Refining Margin is Gross refining margin less variable refining costs, which consist of volume related costs, such as the cost of energy. See “Management's Discussion and

Analysis of Financial Condition and Results of Operations” for further discussion.

Vacuum Distillation Unit (VDU) is a secondary processing unit consisting of vacuum distillation columns. Vacuum distillation helps to produce products out of the heavier

oils left over from atmospheric distillation.

2021 Notes refers to the (i) €570,000,000 aggregate principal amount of euro-denominated 11.750% / 13.250% senior PIK toggle notes due 15 May 2021, issued by CPH on

May 9, 2016, and (ii) SEK 500,000,000 aggregate principal amount of Swedish krona-denominated 12.250% / 13.750% senior PIK toggle notes due 15 May 2021, issued by

CPH on May 9, 2016

Definitions

20

For further information, please contact:Christer Tärndal

Head of Group ControllingTel: + 46-10-450 13 92

Email: [email protected]