The Finance in the Capital Market and Credit Rating in India

Transcript of The Finance in the Capital Market and Credit Rating in India

The Finance in the Capital Market and Credit Rating in India

Hideaki Ohta

Professor at Ehime University 3, Bunkyo-cho, Matsuyama City, Ehime Prefecture, 790-8577, Japan.

Phone/ Fax +81-89-927-9266 Email: [email protected] URL: http://www.ehime-u.ac.jp/

The paper is part of the research on “Model Building on Standardization of Assessment Methods of Credit Risk in Major Asian Countries”

Center for China and Asian Studies Nihon University College of Economics

1-3-2 Misaki-cho, Chiyoda-ku Tokyo 101-8360 Phone: +81-3-3219-3523

Fax: +81-3-3219-3529

[India] Table of Contents

1.Financial/ Capital Market in India (1)General Feature of the Capital Markets in India (2)Financial Markets and Corporate Finance (3)Bond Markets in India: Overview (4)Corporate debt market (5)Other Debt Instruments (6)Credit risks (for authorities, firms, investors) (7)Constraints of development of private debt markets 2. Credit Rating Agencies in India (1)General Feature (2)Systems of credit ratings (regulating authorities; regulations, etc.) (3)Overview of Credit rating agencies in India

ⅰ)Credit Rating Information Services of India Limited(CRISIL) [S&P affiliate] ⅱ)Investment Information and Credit Rating Agency of India (ICRA)

[Moody’s affiliate] ⅲ)Credit Analysis & Research Limited (CARE )

(4) Differences of domestic credit rating agencies and major foreign credit rating agencies

(5)Techniques / methods of credit ratings (6)Examples of credit ratings (7)Credit rating agencies and Basel II (8)Problems to be addressed for expanding local credit ratings 3. Problems to be solved and Outlook of Indian Capital Market (1)Constraints of development of corporate financial markets (2)Government policies towards capital markets (3) Problems to be solved for Credit Rating in India (4) Promotion of domestic financial and capital markets (in terms of direct finance) (5)Outlook and Prospects: Problems to be addressed for expanding the local debt

markets and credit rating activities References [Appendix] Example of Credit Ratings (CRISIL)

1.Financial/ Capital Market in India India is now one of the most promising developing countries in the 21st Century

and the economy has grown rapidly in the past decade. Although the Indian economy is now decelerating its growth rate with decrease in production together with accelerated inflationary pressures, it is expected that the country will sustain a steady growth path in the 2010s.

The capital / financial markets in India have significantly expanded in the past decades. Accordingly, financial assets of private households domestic savings rate has steadily climbed up, now reaching to 35 % per GDP. The growth of domestic savings rate would contribute to mobilization of financial resources for infrastructure investment, as well as agricultural support and human capital development.

Fig.1: Domest ic Saving Rates(Asia)

15

25

35

45

55

1988 90 92 94 96 98 00 02 04 06

Korea

Indonesia

Malaysia

Thailand

Philippines

China

Singapore

India

(GDP比、%)

Sources: IIF, ADB

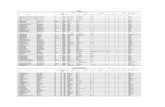

Table 1: India Profile2000/01 2001/02 2002/03 2003/04 2004/05 2005/06 2006/072007/08e2008/09f2009/10f

Population (mn) 1,019.0 1,037.0 1,055.0 1,073.0 1,090.0 1,107.0 1,124.0 1,140.9 - -GDPper capita (US$) 452 461 481 559 643 731 815 1,026 - -GDP (US$ bn) 460.2 477.8 507.1 599.4 700.9 808.7 916.4 1,170.5 1,301.2 1,473.9Real GDP (% Change) 4.4 5.8 3.8 8.5 7.5 9.4 9.6 9.0 6.2 5.0Wholesale Price 6.9 3.4 3.4 5.5 6.5 4.4 6.2 6.4 5.2 -Industrial production % change 6.4 2.4 6.8 6.0 8.5 8.1 10.6 8.1 - -

Agricultural production % change -0.2 6.2 -7.2 10.0 -0.1 5.9 3.8 4.5 - -Trade balance, customs ($ million) -993 -2,109 -2,887 -6,298 -15,465 -31,357 -36,691 382,141 496,150 - Exports, fob ($ million) 45,452 44,703 53,774 66,285 85,206 105,152 128,083 158,461 202,250 - % change previous year 19.5 -0.9 17.7 22.3 31.2 25.1 21.0 24.8 27.6 - Imports, fob ($ million) 52,123 50,652 58,021 72,006 107,023 141,357 172,137 223,680 293,900 - % change previous year 0.0 1.6 18.6 27.4 41.6 37.4 20.1 31.6 31.4 -Current Account Balance ($ million -2,666 3,400 6,345 14,083 -2,470 -9,902 -9,766 -17,403 -32,500 -19,000(Per cent of GDP) -0.6 0.7 1.3 2.3 -0.4 -1.2 -1.1 -1.5 -2.7 -1.5Reserve (ex.gold) ($ million) 40,172 51,670 72,566 108,761 136,531 145,854 192,395 299,603 250,188 260,509 (Months of imports) (6.0) (8.0) (9.8) (12.4) (10.5) (8.6) (9.2) (11.3) (8.5) (8.9)External Debt ($ million) 113,130 113,493 117,596 127,104 139,491 149,781 181,577 237,956 215,118 220,628 % of GDP 24.6 23.8 23.2 21.2 19.9 18.5 19.8 20.3 17.7 17.4 % of Exports 175.7 174.0 150.7 131.0 104.8 88.5 85.0 91.4 79.3 77.0Debt Service Ratio (%) 19.7 18.0 16.3 16.0 9.4 9.3 5.9 6.0 6.0 6.5Yield on 91-day Treasury bill 9.2 7.1 5.8 4.5 4.9 5.7 6.7 7.1 7.1 -BSE Sensex 30 (end-period) 3,604.4 3,469.4 3,048.7 5,590.6 6,492.8 11,280.0 13,072.1 15,644.4 9,092.7 -Exchange Rate (Rs/$, average) 45.7 47.7 48.4 46.0 44.9 44.3 45.2 40.3 45.2 48.0Notes: Sensex, Yield on 91-day Treasury bill figures for November 2008. Forecast figures are based on IIF.Source: IMF, World Bank, IIF

However, the country would still need a huge investment for infrastructure for further development. It is estimated that $475 billion investment in infrastructure projects (roads, ports, power stations, etc.) would be required by 2012. However, the

1

fund to be invested would need at least $162 billion, unless some domestic financial resources are to be found. Most of it should come from corporate bonds. Currently, the corporate bond market is about 3% of the country’s gross domestic product. The target figure of funding infrastructure development is 9 percent of GDP by 2012, and it would require the funding would be raised by 1 percent each year by FY2011/12. So far, it would be difficult to finance all the funding from domestic resources: additional funding may have to resort to foreign capital.

In this context, the market for corporate bonds is expected to play a critical role in providing capital funding for the sustaining growth of the Indian economy. As shown in Table 2, the share of domestic debt securities per GDP in India is about 36% and that of Pakistan is 26%, which are relatively low compared with other major ASEAN and East Asian countries.

Table 2: Financial Market Profile [2006]Domestic debt Equity market Banking

securities market capitalization assetsUS$ bn %, GDP US$ bn %, GDP US$ bn %, GDP

South Asia Bangladesh 7.3 11.9 3.6 5.8 32.7 52.8 India 325.7 35.9 818.9 90.4 587.4 64.8 Pakistan 33.4 26.3 45.4 35.3 50.7 39.4 Sri Lanka 13.7 50.8 7.8 29.8 10.3 38.2Total 381.3 33.6 877 77.5 685.4 60.6Other Asia China 1183.6 44.4 2426.8 90.9 3509.9 131.6 H.K 51 26.9 1715 903.6 297.6 156.8 Indonesia 76.4 21.0 138.9 38.1 128.6 35.3 Korea 1010 113.7 834.4 94.0 984 110.8 Malaysia 146.2 98.2 235.6 158.2 199.4 133.9 Philippines 44.9 38.4 67.9 58.0 51.5 44.0 Singapore 79.2 59.9 384.3 290.8 162.9 123.3 Thailand 109.7 53.2 140.2 68.0 228.7 110.9Total 2700.9 57.3 5942.5 126.0 5562.5 118.0OECD Germany 2247.7 77.3 1637.6 56.3 1063.7 139.8 Japan 8406.2 193.7 4795.8 110.5 8984.6 207.0 U.K 1237.6 52.8 3794.3 161.8 4423.2 188.6 U.S.A. 22827.6 172.9 19286.2 146.1 12260.4 92.8Source: BIS, World Bank "South Asian Bond Markets"(2008), Tab.1.3

(1)General Feature of the Capital Markets in India

India has fairly developed equities markets for a developing country. Since 1996, the ratio of equity market capitalization to GDP has increased to 130% in 2007 from 32.1% in 1996. The banking sector expanded to 78.2% of GDP from 46.3% during the same period.

The financial and capital markets are well developed, especially in banking and stock trading. India has 23 small and 2 big stock exchanges (NSE and Bombay Stock Exchange, BSE) which account for about 90 % of trade. The domestic stock exchange

2

markets -National Stock Exchange (NSE), Bombay Stock Exchange (BSE) and other major stock exchanges in India have already equipped with electronically trading system. The National Stock Exchange(NSE), a nation-wide trading system, is the third largest in the world in the number of trades after NYSE and NASDAQ. The number of the listed companies on the stock exchanges is Over 7,000, the largest in the world. The average daily trading value of NSE is Rs.141,476 million and the trading value in FY2007/08 is Rs.35,510 billion. The number of securities available for trading was 1,624 at NSE (as of 30 June 2008). The total capitalization in India is US$1373.3 billion and the equity market turnover is US$394.2 billion as of the end of FY2007/08.

The market infrastructure in India has relatively been developed, where exist 11 custodian banks, 2 depositories with over 9 million beneficiary owner accounts, as well as internet trading clients at 1-2 million. An Indian company can raise foreign currency resources overseas through ADRs or GDRs, and foreign institutional investors (FIIs) could invest through sub-accounts in the stock markets in India. While the limit for investment in equity is 70 per cent, the rest could be invested in debt up to a maximum limit of 30 per cent.

The investment environment is favourable for investors, with regulations on corporate disclosure and protection for investors, as well as accounting standards close to international standards. The transactions are totally made electronically on a real time basis. It should be noted that India has T+1 and T+2 rolling settlement cycles as opposed to T+3 NYSE. The introduction of electronic transfer of securities brought down settlement costs markedly and also dematerialization has been progressed a paper-free securities market in the country. The Clearing Corporation of India Limited (CCIL) was established in 2001 to facilitate the clearing of trades and transactions in the foreign exchange and fixed income markets.

The development of government and corporate bond markets has not been so impressive in India: the bond market grew to a more modest 43.4% of GDP, from 21.3%.

Fig.2 : Equ ity Market Capital izat ion and Turover( India)

0

200

400

600

800

1,000

1,200

1,400

1990/91 1992/93 1994/95 1996/97 1998/99 2000/01 2002/03 2004/05 2006/07

050

100150

200250

300350

400450

MarketCapitalization(LHA)

Trading Turnover(RHA)

($ bn) ($ bn)

Source: IIF

3

Table 3: Total and Government Debt [US$ bn

Country

TotalDomestic.

OutstandingDebt (2007)

% ofGDP (a)

Govt.Securities

% ofGDP (b)

CorporateBonds

% ofGDP (c)

(d):(b)/(a)

India 458.4 39.3 416.9 35.8 41.5 3.6 90.9Indonesia 88.0 21.2 78.7 19.0 9.3 2.2 89.5Thailand 136.0 55.3 94.7 38.5 41.3 16.8 69.6Malaysia 66.6 40.3 59.2 39.7 31.2 18.9 88.9China 1,687.3 51.9 550.6 20.6 1,136.7 35.0 32.6Russia 40.6 3.2 40.6 3.2 - 100.0Turkey 220.2 45.7 219.7 54.6 0.5 0.1 99.8Brazil 658.8 51.9 512.2 48.0 234.5 18.5 77.7Korea 1,107.5 112.8 466.0 52.5 641.5 65.3 42.1USA 6,480.8 47.0 6,229.9 47.2 2,918.8 21.2 96.1Japan 7,034.1 161.9 6,747.8 154.5 703.0 16.2 95.9Germany 1,312.0 40.3 1,222.7 42.2 171.597 5.3 93.2France 1,377.1 54.8 1,209.3 53.7 292.0 11.6 87.8U.K. 901.0 32.7 835.1 34.9 23.5 0.9 92.7(出所)BIS, IIF etc.

Fig.3 : Financ ial sectordeve lopment (India)

21.332.1

46.343.4

78.2

130.5

0

20

40

60

80

100

120

140

bonds equities banks

1996 2007

Source: ADB Asia Bond Monitor

(% of GDP)

Fig.4 : Shares of Publ ic/Pr ivate Bonds[2007]

Govt,46.10%

Private

Corp,

27.20%

PSUBonds,

26.70%

Source: RBI

The bond market in India is characterized by predominance of public sector bonds(Government and PSU), of which issue size is Rs.702,530 million, compared with total share issued shares of Rs. 236,520 million in 2007. Although the issuance of corporate bonds had been relatively limited, corporate bonds have been increased since 2005, with the spur of economic growth in the past years .

The capital market is mainly monitored and regulated under the Securities Exchange Board of India (SEBI), and partly by Reserve Bank of India (RBI), with the latter responsible for supervision on the administration of public bonds.

4

Fig.5: Structure of the Indian Debt Market

Market Segment Issuers Instrumetns Investors

GOI dated securities RBICenral Govt Treasury Bills

Sovereign State Govt securities DFIs Issuer State Govt Index bonds, zero coupon bonds

BanksGvt Agencies Govt. GuaranteedState Bodies Bonds/ Debentures Pension

Public FundsSector PSUs PSU Bonds, Debentures, CP

FIIsCommercial CD, Debentures, BondsBanks/DFIs Corporates

Bonds, Debentures IndiviualsPrivate CP, Ploating Rates Notes FCDsSector PCDs, ZCBs Provident Funds

Pvt. Banks Bonds, Debentures InsuranceCPs & CDs Trusts,

Mutual Funds

Corporates

(2)Financial Markets and Corporate Finance

The Indian markets still have structural weakness in the primary as well as secondary markets, as given below.

Major resources for corporate financing are bank loans. Bank credit continues to dominate corporate debt finance; banks account overall for 90% of financial assets.

Fig.6 : Sources of Capital raised by fi rms (1998-2006)

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

India China Indonesia Malaysia Thailand Argentina Brazil Mexico Russia Turkey

Equity issues Bond issues Syndicated bank BorrowingSource: World Bank "GlobalDevelopment Finance 2007"

Under fairly limited corporate bond market, limited number of firms undertake private placement. Compared with government bonds and PSU Bonds, the market

5

facility for corporate bond trading is relatively weak, and the size and liquidity of the secondary market are also small.

Bank loans are six times bigger than the outstanding stock of Indian corporate bonds. There are not particular needs for firms to raise debt instruments, since abundant financial resources are available through bank loans. Also, many firms use their capital from self-financed resources. Therefore, the markets are generally characterized by lack of large and diverse investors and dedicated intermediaries.

With regard to relations between firms and banks, it is not very common to have special relationships in financing between firms and banks as seen in the post war Japan, which is called as ‘main bank’ system. There are no ‘leading banks’, nor ‘house banks’ in India. This could be partly accounted by the fact that it is forbidden in India to have financial institutions among the large holding company groups. It is therefore fairly common for ordinary firms to have commercial relationships and holding accounts in different banks in India.

Private placement is the most common way of issuance of corporate debt (bonds), and is the main scheme of issuance of corporate bonds from several reasons which include:

i) Generally lower costs than public issues; ii) Simple procedures, compared with public issues, which require lengthy issuance

procedures and complexity of administrative procedures/arrangements; iii) Deals can be tailor made to suit requirements of both issuer and the investor iv) Limited number of institutional investors in the corporate debt market.

(3)Bond Markets in India: Overview

The bond markets in India have been developed since 1991, dominated by the Government securities, and only small shares of corporate bonds.

The size and share of bond market in India is relatively small, compared with other emerging economies in Asia. The IPO value of equity in India is around $3 billion, while that of corporate debt is about $70 billion. The size of the capital market cannot be comparable to that of developed economies, nor NIEs or some ASEAN.

However, India's secondary market for public bonds is among the most liquid in Asia. It has 16 primary dealers that underwrite government debt sales and trade directly with the central bank. India also boasts an entire yield curve of securities with maturities as long as 30 years. Institutional facilities for bond markets are relatively favourable: BSE and NSE may make use of the existing infrastructure available with them for operating the trade matching platform for corporate bonds, with necessary modifications. It is described the Indian bond market’s potentiality is large as follows:

India is likely to become a huge player in the global bond business. "India's

6

domestic bond market is alongside Korea's in relative size and sophistication," says Marshall Mays, Hong Kong-based strategist at Emerging Alpha Asset Management. "Both could overtake Japan's under-used and Hong Kong's and Singapore's hamstrung markets within a few years."

Companies here are borrowing to expand as the economy surges. In just one example, Reliance Infocomm plans to borrow as much as $1 billion to fund expansion and cement its place as India's biggest cellphone company.

(International Herald Tribune OCTOBER 11, 2004)

Fig.7 : Domest ic Debt secur it iesin Major Emerging Economies

(outstanding)

0

200

400

600

800

1000

1200

1400

1600

1800

1994 1996 1998 2000 2002 2004 2006

Brazil China

India Malaysia

Russia Korea

($ bn)

Source: BIS

Fig.8 : Govt Bond in MajorEmerging Economies

(outstanding)

0

200

400

600

800

1,000

1,200

1994 1996 1998 2000 2002 2004 2006

Brazil China

India Malaysia

Russia Korea

($ bn)

Source: BIS

Fig.9 : Change in Domest ic Debt Secur it ies (India)

-10

-5

0

5

10

15

20

25

30

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007Source: BIS, IIF

Govt.

Private Debts

(US$ bn)

Capital markets dominated by Indian Government bonds and most of the domestically issued bonds are government bonds and/ or PSU (local government bonds). The government debt securities have achieved impressive growth in the past decade, and the market has become sophisticated, with a sovereign benchmark yield curve extending to 30 years. Since 1991 the Reserve bank of India (RBI) has introduced auctions in the primary market. The central government issues treasury bills through the RBI with maturities of 91, 182 and 364 days and dated securities, with maturities of 2-30 years.

7

The secondary market of the public bonds is liquid, but not for corporate bonds. The turnover ratio for government bonds is lower than most of emerging East Asia, and limited number of outstanding bonds indicates that the secondary market is small and illiquid. Most of the traded bonds are government and public bonds in the secondary market. While corporate debt securities have been issued, especially since 1997, when banks were permitted to hold corporate debt securities, most securities are dominated by paper issued by state-owned enterprises (public sector undertakings, PSUs), and trading is fairly limited.

Government bonds are mostly owned by financial institutions like large commercial banks and UTI and other institutional investors (e.g. pension funds; private financial assets; etc). Banks tend to prefer holding ‘safe’ financial portfolio, which includes government bonds, rather than corporate bonds. Government and public sector bonds provide some advantage over corporate bonds and other financial instruments, since public sector banks are usually required to invest government securities, and regulated interest rates assured holding Govt. securities Besides, financial institutions are required to follow banking regulations, such as statutory liquidity reserve (SLR): banks are mandated to invest 25% of the net demand and time liabilities in government bonds or other approved government securities.

Under the current conditions of strict capital controls by the authority, it would be unrealistic to expect growth of domestic debt market of corporate bonds, since international investors cannot be authorized to trade debt instruments.

Very few public offered corporate debt (debentures) in the market traded, since there are not particular needs for firms to raise debt instruments: abundant financial resources are available through bank loans. Also, bond issuance through private placement is utilized as a pseudo financial scheme for many firms in India. Therefore, the cases of public offering of corporate bonds are very few in the capital market in India. It is also noted that there is little demand to hold private debt, either because retail investors have more attractive alternatives, or prohibited from participating in the market.

It is also to be noted that the Asian bonds schemes proposed for trading among the Asian markets might be fairly unrealistic to be realized in the near future, especially for the Indian context. There would be several steps to be undergone for India to introduce such bond schemes. Reliance on public bonds: background

The current situation of dominant public bonds, especially Government bonds could be account for by the traditional structure of the fiscal balances have been deficit in India. Particularly, the central government has to provide the local states with financial support, and that have increased the general government spending. Although

8

fiscal balance has been improved recently, there still needs to issue government bonds locally. It is to be noted that the deficits of the central government are mostly financed by domestic financial resources; however, the needs of further financial resources are increasing especially in the spending for public purposes in the next decade.

Table 4: Fiscal Balances in India (% of GDP)Gross Fiscal Deficit Primary Deficit

FY General Central States General Central States2002/03 -9.5 -5.9 -4.1 -3.1 -1.1 -1.22003/04 -8.4 -4.5 -4.4 -2.0 0.03 -1.52004/05 -7.5 -4.0 -3.4 -1.4 0.04 -0.72005/06 -7.2 -4.4 -2.5 -1.0 -0.4 -0.22006/07 -7.4 -4.4 -3.0 -0.9 -0.2 -0.42007/08 -4.9 -3.4 -1.5 -0.2 0.2 -0.12008/09 -4.6 -2.5 -2.1 -0.2 0.2 -0.1Note: Central government figures include off-budget programSource: Reserve Bank of India, IIF. 2008/09 fig. forecasted by IIF

Fig.10: Fiscal Def ic it ( India)

-10

-8

-6

-4

-2

0

1980/81 1983/84 1986/87 1989/90 1992/93 1995/96 1998/99 2001/02 2004/05 2007/08e

Central Govt.

General

(%, GDP)

Source: RBI, IIF

Table 5: Financing of the Central Government Budget (Rs. bn)2006/07 2007/08 2008/09

Budgest Balance 1,425.7 (100.0) 1,298.1 (100.0) 1,332.9 (100.0) Domestic Fiancing, net 1,341.0 (94.1) 1204.9 (92.8) 1,223.0 (91.8) Market borrowing 1104.5 1106.7 1005.7

(% GDP) (2.7) (2.4) (1.9) Other receipts 127.2 387.2 145.1 Cash balnce 109.3 -289 72.2 Foreign financing, net 84.7 (5.9) 93.2 (7.2) 109.9 (8.2)Source: Ministry of Finance and IIF

On the other hand, corporate bonds markets are still to be developed, and the share of the corporate debt per GDP is still small by international comparison.

Institutional facilities for bond markets are relatively favourable: BSE and NSE may make use of the existing infrastructure available with them for operating the trade matching platform for corporate bonds, with necessary modifications. Institutional infrastructure of bond markets are also to be monitored through three organizations: the Primary Dealers Association, the Fixed Income Money Markets Dealers Association (FIMMDA), and the NSE’s Committee for the Development of the

9

Debt Market. The Primary Dealers Association is usually coordinating with the RBI in Government securities.

(4)Corporate debt market

As described above, major financial resources (corporate financing) are bank loans in India, and it has been lagged behind the development of other financial instruments as issuance of stocks. Commercial papers (CP), Certificate of Deposits (CD), corporate debentures, bonds, and the fixed income securities are issued by financial institutions and local authorities. Corporate debt market has not been developed, due to institutional constraints, market liquidity, as well as merits of holding corporate bonds are not so large, compared with government bonds.

The composition of the debt markets is predominantly dominated by public debts (Govt. [central & state] Bonds; PSU Bonds), and the share of the public bonds among total debt issued is around 70%. It is also to be noted that frequently traded bonds are concentrated in relatively few numbers; 5 most traded corporate bonds: 58.45%; 10 (71.29%); 15(78.31%).

Table 6: Debt Issuance in India (bn Rupee)Total Debt Issued Growth (%)

Total Corporate Govt. Total Corporate Govt.1999/00 1,727 594 1,1332000/01 1,850 565 1,284 7.1 -4.9 13.32001/02 2,040 515 1,525 10.3 -8.8 18.82002/03 2,350 531 1,819 15.2 3.1 19.32003/04 2,509 527 1,981 6.8 -0.8 8.92004/05 2,050 594 1,456 -18.3 12.7 -26.52005/06 2,636 818 1,817 28.6 37.8 24.82006/07 2,926 924 2,002 11.0 12.8 10.2Source: RBI, National Stock Exchange

Table 7: Resource mobilisation by the corporate sector (Rs. bn)

Debt issues3 PublicIssues

4 Privateplacements 5 Total

2000/01 24.79 41.39 524.34 565.73 590.52 92.7 95.802001/02 10.82 53.41 462.20 515.61 526.43 89.6 97.972002/03 10.39 46.93 484.24 531.17 541.56 91.2 98.082003/04 178.21 43.24 484.28 527.52 705.73 91.8 74.752004/05 214.32 40.95 553.84 594.79 809.11 93.1 73.512005/06 266.95 24.50 682.77 707.27 974.22 96.5 72.602006/07 315.35 84.70 1,031.12 1,115.82 1,431.17 92.4 77.97Source: Researve Bank of India

8 Share ofdebt1 FY

6 Totalresources

(2+5)

2 Publicequity issues

7 Share ofprivate

placements

Nature of corporate bond through private placement Corporate bonds are usually issued as private placement1 and mostly by public

1 Securities Exchange Board of India (SEBI) has defined 'private placement’ as an offer or invitation made

10

sector corporations. It is noted that private placements in India are not really issuance of bonds in true sense, but issued bonds under private placement are usually disguised form of borrowing from banks and investors, since major purchasers of bonds are banks and particular companies which have close relations with the issuers. Therefore, bond issuance through private placement is utilized as a pseudo financial scheme for many firms in India. Private placements usually undertaken in those areas as: i) Issued by small or poorly rated firms; ii) Small amount of issues, which would not justify the distribution costs of public offer iii) Linked to a particular project

Public offerings of corporate bonds are very few in the capital market in India. [Private placements] (2006/07) ①Numbers: Private financial(39%); Private non-financial(53%); Public financial (6%); Public non-financial (2%) ②Value: Private financial (35%); Private non-financial (23%); Public financial (34%); Public non-financial (8%)

Fig.11: Distribution of Private Placement of Debt(2006/7)

Public SectorUndertakings

(PSU)6.7%

All FinancialInstitutions/

Banks75.5%

Private Sector15.7%

State LevelUndertakings

0.8%State Financial

Institutions1.3%

Source: National Stock Exchange of India, Securities Market in India - An Overview

Fig.12 : Share of Pr ivatePlacement of Equ ity[No . ]

(2007)

Privateplaceme

nt

91%

Publicoffering

9%

* Apr. - Dec.Source: RBI

Fig.13 : Share of Pr ivatePlacement of Equ ity

[amount](2007)

Publicoffering

34%Privateplacem

ent66%

* Apr. - Dec.Source: RBI

to less than fifty persons to subscribe to the debt securities.

11

Relevant legal frameworks of corporate finance

Major regulations and rules on stocks/corporate bonds, etc. and legal framework of corporate finance are mainly based on Securities Contracts Regulation Act (SCRA) as a main capital market law, as well as Securitisation and Reconstruction of Financial Assets & Enforcement of Security Interest (SARFAESI) Act: clarification of the status of securitization.

However, regulatory responsibility on the capital market in India is not very clear, especially on the corporate debt market. Although government bonds are mainly regulated under the auspice of the Reserve Bank of India, many regulatory matters are to be handled by SEBI (Securities Exchange Board of India). In this context, the SCRA is currently being amended to make SEBI the regulator for securitisation.

Involvement of banks means that RBI also has an interest in straight bonds, and its regulations will have an important impact on the market. (e.g. “Guidelines on Securitisation of Standard Assets” [Feb. 2006]) The guideline has imposed more severe capital requirement than Basel Ⅱ, in terms of first loss, and it might have affected bank loans activities, especially personal loans. The RBI guidelines only apply to securitizations, which defined as a structure involving an SPV, which would cause a growth of direct assignments (e.g. bilateral transactions of assets and cash flows) that are unregulated and do not involve any capital market issues of securities.

(5)Other Debt Instruments

Although the absolute size of India’s market for structured finance products is still small, compared with matured markets in industrialized countries, India is the second largest market in emerging Asia for domestic issuance of structured finance markets, including asset-backed securities (ABS); mortgage-backed securities (MBS); collaterised debt obligations (COD); etc., with issuances much higher than $14 billion, after Korea which had issuances close to $20 billion in 2006. China, on the other hand, issues much lower than $5 billion during the year. The market grew more than doubled from $6.7 billion to $14.6 billion (Rs 588,380 million) in 2007. Sales of collateralized loan obligations and asset-backed securities led the growth in India, where the instruments were not as complex as in more developed markets.

The asset-backed securities (ABS) have picked up in India, along with single-loan sell downs (SLSD), which is easily issued, since only a single borrower is involved and the securities issued from such loans also have shorter tenors. (6)Credit risks (for authorities, firms, investors)

It is felt that investment risks are to be well informed among the investors, and in this respect, financial organizations should be responsible for disseminating the risks of trading all the securities.

12

Under Basel Ⅱ, while the minimum CAR is unchanged at 9%, the risk weights assigned to assets would be proportionate to the credit risk of these assets. Within BASEL Ⅱ, various approaches have been prescribed with progressively increasing risk sensitivity. Banks are required to have relatively high statutory reserve requirement of 25%.

Adoption of Basel Ⅱ in India has not been delayed even compared with the major industrialized countries like the USA ( to be delayed by 2010). Foreign banks and all Indian Banks with foreign branches adopted BaselⅡon 1March2008. All other commercial banks (except Local Area Banks and Regional Rural Banks) are to migrate by not later than March 2009.

RBI has prescribed that all unrated exposures of Banks over Rs.500 million migrating to Basel Ⅱ would carry a 150% risk weight for the financial year 2008-09. The threshold is Rs. 100 million from April 1, 2009. In the first stage, Indian Banks would have to adopt ‘Standardized approach’ for Credit risk. Credit ratings awarded by recognized rating agencies would be used to assign risk weights to bank exposures.

It is considered that the adoption of Basel Ⅱ would have some positive impact on the banking business in general, since more practical risk weights are introduced, depending the sectors to be financed. Formerly, the risk weights were uniformly determined as 100% in the case of Basel Ⅰ. Fore example, lending to those sectors as agriculture, retail and small and medium enterprises (SMEs) is now counted as risk assets of 75 %, in stead of 100%, which would facilitate overall accounting risk assets.

On the other hand, credit to small firms might be decreased, due to the adoption of BaselⅡ. Furthermore, it should be noted that it would take some period to see the real impact of BASELⅡon the domestic economy in India. The overall favourable effects of adoption of BaselⅡ might be carefully examined from the point of view of its effects upon small and medium enterprises (SMEs). With the application of prudential regulations under Basel Ⅱ, it is likely to increase the cost of bank lending to developing countries as a whole2.

Therefore, the government authority would have to take some practical measures to minimize the negative impact upon small and medium firms with the application of risk weights in financial institutions, especially for banks to be utilized by small entities in India.

(7)Constraints of development of private debt markets

Its is commonly recognized that the past unfortunate experiences in the bond markets in India in the late 1990s when many issued debentures and corporate bonds defaulted, due to the deterioration of the economy, have resulted in lost confidence among the investors in India. Among the total bond issued in India, only 4-5 of the

2 Griffith-Jones and Persaud (2008)

13

total amount (approx. Rs.30 trillion) were issued publicly, and almost all the bonds have been issued through private placement. The share of bonds among the mutual funds is about 20 % of the total (Rs. 6 trillion).

It is generally difficult for small and medium firms to issue bonds, due to unexpected risks and costs to be borne by the companies. Most bonds are issued by large firms and relatively limited

There are also several constraints for bond markets in micro aspects as follows:

ⅰ)Complexities in taxation ( in particular stamp duty)

-stamp duty is high, typically 0.375% for debentures, strictly ad-valorem, no volume discount) -The rates of stamp duty are different in each state, and also variable depending upon both location and the nature of the issuer

The rates of stamp duty are not uniform in different states, and that ranged from 0.2% to 11%, typically 0.375%, depending upon location (various states have set their own rates). The unevenness of stamp duty is one of the most important barriers for development of corporate bond markets in India.

ⅲ)Absence of parallel debt-oriented risk management tools in particular, the lack of bond futures, corporate bond repos and credit derivative markets)

ⅳ)regulatory conflict (e.g. SEBI, RBI)

ⅴ)complexity of issuance process and time to be required for public offering (disclosure requirements for prospectus; no provision of shelf registration, etc.)

ⅵ)costs to be borne for disclosure and due diligence for public offering are high for issuers, especially small firms

On the other hand, macro aspects of constraints include as follows:

ⅰ)Crowding-out effects of government capital requirements

ⅱ)Limited demand of bond finance

ⅲ)State-dominated nature of much of the banking system

ⅳ)Limitations on international investment

ⅴ)Remaining effects of exchange control

There are also institutional aspects of constraints for expanding domestic bond markets as follows:

ⅰ)Incentives for bond trading are relatively low, since state bank deposits are guaranteed, and favourable conditions for individual savings ⅱ)Government guarantees remains present in the market, explicitly or implicitly

14

ⅲ)Commercial banks remain closer to state sector (dependent upon the state business; non-performing loan(NPL) situation of the banks has improved substantially ⅳ)No special needs for investors for bonds issued through private placement to increase transparency Essentially corporate bonds and other debt securities include risks such as:

① interest rate risk ( higher in future [fall in debt prices]) ② reinvestment risk (fall in interest rates in the future) ③ inflation risk (reduce effective income) ④ liquidity risk ⑤ default risk (higher risk associated with higher risk premium and yield)

Considerable efforts have been made to establish free and open debt markets and

removal of constraints for development of corporate bonds markets. So far, relatively little has been dome to reduce barriers to institutional investors, as follows:

① Strict control on private issuance of corporate bonds ② deregulation on listing of corporate bonds (listing norms to be eased) ③ harmonization of stamp tax ④ relaxation of the investment mandates of institutional investors ⑤ reforms of regulations of the investment mandates of institutional investors ⑥ trading, clearing , settlement systems to be reformed

(1) Others ( specific local conditions in the capital / financial markets)

Under the current financial turmoil in the world, Indian firms might be affected in overall profit among the increased conditions in business risks, and as a result, credit ratings could be downgraded and increase in default rates in the coming years. 2. Credit Rating Agencies in India (1)General Feature

Credit Rating Agency system and rating agencies in India are relatively well developed and experienced. Their ratings in general have gained confidence in the domestic market.

There are three different credit rating categories: one is ‘national scale’ which covers local currency bonds and other debt instruments; the others are ‘global scale’ ratings under which sovereign and local currency denominated debt instruments. Credit ratings fall under four categories: long-term, short-term, fixed deposit, and corporate credit ratings. The long-term instruments include bonds, debentures, other securities, term loans, and other fund-based and non-fund-based facilities. The short-term instruments refer to commercial paper, short-term debentures, certificate of deposit, inter-corporate deposits, working capital borrowings, etc.

Local rating agencies evaluate all issuers by local standards of risk assessment in

15

the ‘national scale’, with the top rating of “AAA” awarded to the best local companies. The national scale is different from the “global scale” ratings, in the sense that the latter would not only evaluate the credit risks of particular companies but also the sovereign risks of each country. The gaps between the national and global scale ratings could be adjusted with the application of the sovereign ratings undertaken by agencies like S&P and Moody’s as the maximum rating scales. However, there would be still some difference in ratings by local rating agencies and global scale agencies, since several factors are to be considered: i)strong ties to the government; ii)support from members of the same corporate groups; iii) main bank relations; iv) degrees of disclosure and corporate governance, etc.

Although the absolute size of the corporate debt market in India is still small, ratings of corporate debt has increased significantly, especially in the past five years.

Table 8: Ratings Assigned for Long-term Corporate Debt Securities [% of Total]

AAA AA A BBB Total

Share(No.)

Share(value

)

Share(No.)

Share(value

)

Share(No.)

Share(value

)

Share(No.)

Share(value

)

Share(No.)

Share(value

)No. Rs.

Bn1999/00 35.0 83.0 25.9 9.4 25.0 6.1 7.7 0.8 6.4 0.6 220 1,1772000/01 38.3 76.6 33.6 10.1 21.4 11.6 3.1 1.3 3.7 0.3 295 1,2792001/02 31.7 61.6 33.5 27.8 24.0 9.3 7.8 1.1 3.0 0.2 334 1,4122002/03 45.6 76.0 27.1 13.8 18.2 7.5 6.3 1.6 2.8 1.0 351 1,4182003/04 53.3 77.5 26.3 14.9 18.3 6.1 6.9 1.1 1.1 0.4 377 1,6702004/05 56.7 73.1 22.4 22.2 11.8 3.7 7.1 1.9 1.8 0.3 490 2,1872005/06 54.6 73.2 30.8 16.3 9.4 7.6 4.4 0.3 0.8 0.0 478 3,8262006/07 57.4 79.5 26.5 16.0 9.7 1.8 6.1 2.7 0.4 0.0 544 3,3562007/08 39.6 73.2 30.4 19.4 19.8 5.7 7.5 1.5 3.2 0.3 845 6,208Source: Reserve banko f India, SEBI Bulletin

Non-Investment

(2)Systems of credit ratings (regulating authorities; regulations, etc.)

All the capital market in the primary and secondary markets are governed by the Securities Exchange Board of India (SEBI), and the domestic credit ratings agencies are also under supervision of the SEBI

Credit agencies in India usually undertake default studies. Definition of default is defined as any missed payment on its rated instrument, with some exception of missed payments attributable to technical reasons (e.g. procedural delays caused by government machinery etc.) which are likely to be rectified within a short time, are not placed in the default grade immediately. If, however, such delays are not rectified within a short time, ratings are placed in the default grade.

However, many debt, including Government Bonds and corporate bonds and other securities are owned by financial institutions, including banks and mutual funds(UTI, etc.), so that RBI(Reserve Bank of India) is also involved in the financial market policies. SEBI and RBI are in general not coordinated among each other.

Since several authorities/ organizations are involved in the financial and capital

16

markets in India, several policy-related matters are not well-coordinated among the parties concerned, especially RBI and SEBI. (3)Overview of Credit rating agencies in India

Local credit rating agencies in India undertake those bonds and other financial instruments in local scale, while both foreign and local currency denominated bonds in global scale are to be covered by international credit rating agencies (e.g. S&P and Moody’s). The credit rating of local credit rating agencies (CRAs) usually follow the processes of collection of relevant information either published data and close consultations with issuers, followed by internal rating procedures.

Fig.14: Rating Process in India

Issuer(Client) Credit Ratting Agencies

Request for Rating Rating team Assigned

provide information Team analyses

Interacts with teamProvision of additionalinformation

Acceppts Rating Rating assignedor Appeal

Rating disseminatedPublish in Website

Rating kept under

Rating Committee forendorsement

Team conducts site visits andperform analysis

17

Table 9: Profiles of Credit Rating Agencies in IndiaCRISIL ICRA CARE

1 Year of establishment 1987 1991 1993

2 status/nature Subsidiary of Standard and Poor's(S&P) Subsidiary of Moody's Independent Indian agency (by

Indian banks[IDBI, SBI, Canara])3 Ownership structure Majority(55.57%) by S&P (listed) Largest share by Moody's yet to be listed4 Covered issues 11,026 issues and 5,716

issuers(Rs.22.52 trillion of debt,)companies to over 500 Indian andinternational clients acrossfinancial, corporate, consulting andpublic sectors. (as at December

Approx. 4380 instruments, approx.500 issues, outstanding debt of Rs.14.79 trillion rated.

Total 4677assignment; (Rs 12699billion as at June 2008); totalinstruments rated 3850; totalissues rated 1190 (as on Dec. 31,2007)

5 Major activities①credit ratings and riskassessment;

-Rating schemes

①Debt instruments(manufacturing companies, banks,financial institutions (FIs),infrastructure;state governmentsand municipal corporations); ②Structured finance; ③Funds; ④Governance & Value Creation; ⑤Real Estate Developers/ProjectRating; ⑥ Maritime G

①Debt Instruments; ②Structuredfinance; ③Sector-specificobligations(e.g. infrastructure); ④Corporate governance rating; ⑤Shareholder Value andGovernance Rating; ⑥ProjectFinanceRating; ⑦Line creditrating, etc.

①Debt Instruments; ②IssuerRating; ③Loan Rating; ④ClaimsPaying Ability Rating of InsuranceCompanies; ⑤CorporateGovernance Ratings; ⑥FundCredit Qaulity Rating; ⑦SMErating; ⑦IPO Rating; ⑧Microfinance Institution (MFI)Grading; ⑨ Project, Project consul

-clients/ assigned bodies

Corporate Sector Companies;Banks/ Financial institutions;Housing finance companies;Infrastructure sector companies;services; Municipal and localbodies; State gov.; non-bankingfinance companies; Real estate

j D b f d

Manufacturing firms; Banks/financial institutions; Housingfinance companies; Infrastructuresector companies; services;Municipal and local bodies; Stategov.; non-banking financecompanies

Corporate, Banks, FinancialInstitutions (FIs), Public SectorUndertakings (PSUs), StateGovernment bodies, MunicipalCorporations, Non-bankingFinance Companies (NBFCs),SMEs, Micro finance institutions

- others

structured finance; guaranteedsecurities

Grading Services(constructionentities; real estate development;mutual fund schemes; healthcare;maritime training; Small scaleenterprises)

commericial paper; Fixed Deposit,Bonds; Debentures; Hybridinstruments; Structured Finance;Preference Shares, Loans, AssetBacked Securities(ABS), etc.

②Economic / industrialresearches

Research on India's eocnomy,industries and companies, globalequity research

responsible by ICRA Ltd. responsible by CARE

③management advisoryservices

Overall management issues,including risk management

by ICRA Management ConsultingServices (IMaCS)

④Others

Fund services, etc. Group includes ICRA TechnoAnalytics Ltd.( IT, software), ICRAOnline Ltd., Mutual FundServices.

6 Rating Methodology Factors considered: Factors considered: Factors considered(see also Table on creditrating risk assessment)

Corporate governance practices byCRISIL GVC diagnostic study

companies' profits/ losses ofcompany, and others such as

Corporate GovernanceRatings(CGR), Corporate & ValueCreation(CGV) Ratings

Financial Ratios (e.g. capitalstructure; interest coverage; debtservice coverage; net worth;profitability margin; return oncapital employed; net cash accrualsto total debt ratio; current ratio)

industry characteristics;regulations; competitive position ofthe issuer; operational efficiency;mangement quality; new projectsrisks and other associatecompanies; funding policies of theissuer; financial flexibility;accounting quality; profitability;financial risks(level of leveraging);liquidity position, etc.

Quantiative factors(asset quality,resources; liquidity, etc.);Qualitative factors (ownership;management; accounting quality,etc.)

7 Mapping (long-term andshort-term)

①Long-term (AAA~BBB-) ; Short-term(A1+ ~A3) ②Long-term(BB+~C-); Short-term(P4) ③Long-term(D); Short-term(P5) Prefixused : 'F'(financial sector), 'CCR'(corporate credit rating)

①Long-term (LAAA~LBBB-) ;Short-term(A1+ ~A3) ②Long-term(LBB+~LC-); Short-term(A4)③Long-term(LD); Short-term(A5)

①Long-term (CARE AAA~CAREBBB-) ; Short-term(PR1 ~PR3) ②Long-term(CARE BB+~CARE C-);Short-term(PR4) ③Long-term(CARE D); Short-term(PR5)CARE

Rating responsible for Local scale (local currency) under four categories: long-term, short-term, fixeddeposit, and corporate credit ratings

CARE Advisory Services(independent division) for bidprocess management, business andfinancial restructuring, enterprisevaluations, financial appraisals,credit capacity assessments,risukmanagemnt strategies, duediligence studies, etc.

18

19

8 Rating Outputs default study (1992-2007);transition study

Default study (2002-2007) Default study (2003-2007) [staticpool/ Cohort used. (mainly by) ;tracks long/medium term ratings ]

9 Major focus on rating andanalysis

The introduction of CRISILComplexity Levels for financialinstruments Criterion usedinclude: i)Ease of calculation ofpayout and returns; ii)Clarity ontiming of cash flows; iii)Number ofcounterparties involved in thetransaction; iv)Financial flexibility

Assess future cashgenerationcapability and debtservicing ability of the issuer

Assess future cashgenerationcapability and theiradquacy to meet debt obligations inadverse conditions; to determinethe long-term fundamentals andthe changes

10 Special features World fourth largest credit ratingfirm with over a 70% share of theIndian ratings market

a founder of ACRAA (Association ofCredit Rating Agencies in Asia)

Firstly introduced default study inIndia in 1992

Overseas advisory activities (e.g.an Mexican ratings firm)

Independent Committee of the BoardNo significant invlovement by S&Pin management and credit ratingactivitiesStability rates of ratings(85%)Abundant data set (4642 long-term; 1669 structured finance datapoints)

Sources: CRISIL, ICRA, CARE

Close Cooperation with Moody's inlocal credit ratings (in particularinformation services for globalscale ratings)

Table 10: Assessment of RisksCRISIL ICRA CARE

1Economy (1)Industry risk ①Industry characteristics (1)Industry/Economic risk Industry ・Macroeconomic factors ②Regulations in the sectors ・Economic industry environment

・growth prospects; demand-supply dynamics ③level of technological development・Economy wide factors2 Business ・technological change; ・Business cycles, etc. risks ・Market sizes ・Changes in technology

・Extent of competition, cyclicality ・International/ domestic competitive factors in industry・regulatory environment ⑤competitive position of the issuer (2)Market Position (2)Market Position operational efficiency ・Market share・Key competitive advantages ⑥Operational efficiency ・Entry barriers・Market share movement ・Demand supply factors・Pricing power(ability to pass on input cost increases) ・Price trends・distribution network ・Diversification・Brand strength ・Seasonalty and Cyclicality(3)Operating efficiency (3)Operating efficiency・Cost structure ・Size (financial flexibility)・Technological factors ・Cost structure (effeiciency)・capital intensity/ utilization ・Capital intensity・R&D capabilities

①Financial ratios

( growth ratios; profitability ratios; leverages andcoverage ratios; Turnover ratios; liquidity ratios)②Cash flows

③Financial flexibility(alternative access to financialresources)

③Existing Fin structure,Adequacy of cash flows ④Capital adequacy ④Validation of projections(debt servicing capability) ⑤hedging of risks and sensitivity analysis(stress test )④Capital adequacy & Financial flexibility①Goals, philosophies and strategies ①management quality ①Track record②Corporate strategy ②funding policies of the issuer (liquidity; competitive pressures, new project; expansion

& diversification)③organizational and reporting structure ②Corporate strategy④ability to manage change in the external environment ③Performance of group companies⑤succession ④Organizational structure

⑤Control systems⑥Personnel policies

①risks associated with the project and factors in these commitment to new projects②time and cost over-runs and technology risk③existing product line and company's track record

Source: CRISIL, ICRA, CARE

3 Financial risk

4 ManagementEvaluation

5 Project riskevaluation

④sensitivity to possible changes inbusiness/economic circumstances

②Existing & Future fin position(Capital structure;Profitability; Debt protection ratios; Sensitivityanalysis; Liquidity/short term factors operational coststructure; profit potential; projected profitability)

①Future earnings undervarioussensitivity scenarios (3-5years)

①Accounting quality( overstatement/ understatement;qualifications made by auditors;methos of incomerecognition and depression;inventory valuation policies;off-balancesheet items, etc.)

②financial flexibility③Adequacy of cash flows

20

During the courses of evaluation, several aspects and elements of risk factors of issuers are considered. Major risk weights include industrial and sartorial situations and other macroeconomic factors, financial and managerial factors for generation of profits and prospects of the companies/ entities. It is generally considered that a credit rating indicates the issuer’s ability and willingness to pay interest and principal on time.

With regard to affiliates of major credit agencies like CRISIL (S&P) and ICRA (Moody’s), there are some differences in their positions on overall policies of credit rating exercises. While CRISIL has kept relatively independent positions in credit ratings exercises locally, ICRA is more involved in credit rating activities of local firms by the parent company (Moody’s).

Rating-default statistics from domestic rating agencies in India are prone to greater variability than those from international rating agencies. Performance of local credit rating agencies (accumulated default ratings; transition; yields and ratings, etc.) are shown by each credit rating agencies, which include: Crisil Default Study (2007), CARE default study i) Credit Rating Information Services of India Limited(CRISIL) [S&P affiliate]

Among the credit rating agencies in India, CRISIL is one of the leading credit ratings agencies which cover extensive sectors of industries and follow procedures for fair rating through substantial analyses in India. CRISIL was established as an independent body in 1992, and became affiliates of S & P in 1996. CRISIL was taken over by S&P in 2004, which holds stake of 51% of CRISIL.

As one of the major characteristics of CRISIL on credit ratings and default study, CRISIL has default rate for company analyses in credit rating exercises. Other credit rating agencies are mainly focusing on failures of debt. Unlike ICRA (affiliate of Moody’s), CRISIL has an independent committee on the local credit ratings and not much involved by S&P in local bond ratings.

The rating methods have been established through the relatively long experience of credit rating. To cater for uniform valuations CRISIL launched the CRISIL Bond Valuation Matrix (CRISIL BVM), which has since been mandated by SEBI/AMFI as a uniform pricing standard for the mutual fund industry. As of date nearly Rs. 80,000 crore (US $ 18 billion) of fund portfolio holdings are marked-to-market everyday, based on the CRISIL Bond Valuation Matrix. The launch of the CRISIL BVM has not only set a uniform pricing standard but has also led to a considerable deepening of the corporate bond market and helped develop the broader concept of identifying and pricing “risk” inherent in securities of a portfolio.

Rating Methodologies

CRISIL's analysis on each credit is carried out by a team of at least two analysts.

21

The analysis is based on information obtained from the issuer, and on an understanding of the business environment in which the issuer operates; it is carried out within the framework of clearly spelt-out rating criteria. The analysis is then presented to a rating committee comprising members who have the professional competence to meaningfully assess the credit, and have no interest in the entity being rated. The rating committee determines the rating to be assigned.

CRISIL has introduced a qualitative cum quantitative approach for banks and financial institutions, following a structured methodology called the ‘CRAMEL’ model , which comprises i)capital adequacy; ii)resource-raising ability; iii)asset quality; ⅳ )management and systems evaluation; ⅴ )earnings potential; ⅵ )liquidity/asset liability management.

Long-term rating categories range from ‘AAA’ to ‘D’, and apply ‘+’ or ‘-‘ signs as suffixes to ratings from ‘AA’ to ‘C’. Short-term rating categories range from ‘P1’ to ‘P5’; a ‘+’ sign also applied for ratings from ‘P1’ to ‘P3’.

Major credit rating agencies in India like CRISIL undertake cumulative default rates for structured finance securities, which are now increasing in the domestic capital market in India. Default study (by CRISIL) indicates declining trend in CRISIL-rated default rates for the last 3 years (2007 study) and that the ratings are highly stable (85%)

Table 11: CRISIL Average Cumulative Default Rates (1992-9 (%)Rating Sample Size 1-Year 2-Year 3-Year

AAA(①) 419 0.00 0.00 0.00AA(②) 593 0.00 0.22 0.22A(③) 239 0.42 1.03 1.97BBB(④) 86 3.49 5.42 8.47Investment Grade (①~④ 1337 0.30 0.63 0.99Speculative Grade 84 15.48 20.58 20..58Note: withdrawal-adjusted figuresSource: CRISIL Ratings

Table 12-1: Short-term Average One-Year Transition Rates (1992-2007 (%)

Ratings Sample P1+ P1 P2+ P2+ P3 Speculative

P1+ 2783 97.6 1.9 0.3 0.1 0.1 0.0P1 400 17.0 80.3 1.5 0.8 0.5 0.0P2+ 34 0.0 17.6 76.5 2.9 2.9 0.0P2 20 0.0 15.0 5.0 55.0 0.0 5.0P3 3 20.0 0.0 0.0 0.0 66.7 33.3Speculative 2 0.0 0.0 0.0 0.0 0.0 100.0Total 6311Source: CRISIL Rating

22

Table 12-2: Average One-Year Transition Rates (1992-2007) (%)

Ratings Sample AAA AA A BBB BB B C D

AAA 1845 98.2 1.5 0.1 0.0 0.0 0.0 0.1 0.1AA 1606 2.7 90.2 6.2 0.5 0.3 0.1 0.0 0.0A 1705 0.0 4.3 83.3 6.2 4.6 0.2 0.6 0.8BBB 667 0.0 0.3 5.2 74.8 13.3 1.3 2.0 3.1BB 372 0.0 0.5 0.0 4.0 73.1 1.6 4.9 15.9B 34 0.0 0.0 0.0 5.9 0.0 55.9 8.8 29.4C 82 0.0 0.0 0.0 1.2 0.0 0.0 69.5 29.3Total 6311Source: CRISIL Rating

Table 13: One-Year Stability Rates (1992-2007)Years AAA AA A BBB Overall

1992-2007 97.4 90.3 82.7 73.7 84.91992-2006 97.6 89.9 82.6 73.6 84.51992-2005 97.2 89.7 84.4 73.3 84.01992-2004 96.9 89.3 82.4 73.2 83.61992-2003 96.4 89.2 82.3 73.3 83.2Source: CRISIL Rating

BVM(Bond Valuation Matrix)

CRISIL Bond Valuation Matrix (CRISIL BVM), which has since been mandated by SEBI/AMFI as a uniform pricing standard for the mutual fund industry. The launch of the BVM has not only set a uniform pricing standard but has also helped develop the broader concept of identifying and pricing “risk” inherent in securities of a portfolio. As of date nearly Rs. 80,000 crore (US $ 18 billion) of fund portfolio holdings are marked-to-market everyday, based on the CRISIL Bond Valuation Matrix.

The CRISIL BVM identifies the various risk factors like credit risk, interest risk and liquidity risk and using gilt yields as a benchmark, corporate bonds are priced. This is done by applying a spread or yield premium over Gilt across different duration buckets & for different categories of credit risk categories (such as AAA, AA+, etc).

The CRISIL Mutual Fund Indices were constructed in response to the need of providing the fixed income market with a reliable benchmark. Currently, CRISIL gives out the values of CRISIL Gilt Bond Index and the AAA Corporate Bond Index on a daily basis to its clients

Bank Loan Ratings (BLR)

A CRISIL BLR is CRISIL's opinion on the relative degree of risk associated with timely payment of interest and repayment of principal on a specified bank facility. CRISIL assigns BLRs on the same long-term and short-term rating scales as it does its other credit ratings. BLRs can be used by banks to determine risk weights for their loan exposures, in keeping with the Reserve Bank of India's (RBI's) April 2007 Guidelines for Implementation of the New Capital Adequacy Framework.

23

ii) Investment Information and Credit Rating Agency of India (ICRA) [Moody’s affiliate]

ICRA has been providing investors with independent, professional and reliable rating opinions on debt instruments since 1991. ICRA has fully supported the credit rating of local firms by Moody’s, including provision of data and information on the firms concerned. While Moody’s has its responsibility in credit ratings of local Indian firms for foreign currency denominated bonds, ICRA usually provide relevant information and assist Moody’s with local credit analyses. ICRA undertakes approximately 50 to 60 firms in credit ratings in foreign currency. The services provided by ICRA include ratings, grading, information and advisory for local firms, investors, and clients. ICRA has broad-based its services to the corporate and financial sectors, both in India and overseas, and offers its services with internationally recognized standards and methods.

Table 14: ICRA Cumulative Default Rates (2002-07) (%)Rating 1-Year 2-Year 3-Year

LAAA(①) 0.00 0.00 0.00LAA(②) 0.00 0.00 0.00LA(③) 2.62 2.62 2.62LBBB(④) 1.60 3.12 3.12Investment Grade (①~④) 4.22 5.74 5.74Note: withdrawal-adjustedSource: ICRA Update for 2007: Performance of ICRA-Assigned Ratings

Table 15: ICRA Average One-Year Transition RatesLong-term Ratings(2003-2007) (%)

Rating LAAA LAA LA LBBB NIAAA 97.7 2.3 0.0 0.0 0.0AA 4.4 93.9 1.7 0.0 0.0A 0.0 4.6 87.5 6.8 1.1BBB 0.0 0.0 9.7 83.9 6.5Source: ICRA

Table 16: Risk Weights under CategoryCategory of exposure Risk wei ghtsResidential mortgage 5 ~75%*Common

0property 150%

Schedule Commercial Banks(SCBs) 20%Exposure to subordinated debt of banks 100%Exposure to capital market and non-banking 125% or 150%Commercial real estates/ venture capital 150%State government guaranteed exposures 20%Note: risk weight subject to a loan-to-value (LTV) ratio of 75%Source: ICRA New Capital Adequacy Framework under Basel Ⅱ Guidelines

iii) Credit Analysis & Research Limited (CARE )

CARE is an independent rating agency promoted by major banks and financial institutions in India. CARE was established by the leading Indian banks and financial

24

institutions including Industrial Development Bank of India (IDBI), with investment institutions, banks and finance companies in 1993, followed by its first rating in November 1993. The three largest shareholders of CARE are IDBI Bank, Canara Bank and State Bank of India. CARE has been granted registration by SEBI under the Securities & Exchange Board of India Regulation, 1999.

CARE is a board managed company with eminent professionals on the board, and the entire Board comprises of Independent Directors. CARE is the only rating agency in India which operates with an independent rating committee comprising of senior and reputed professionals. CARE has yet to be listed in the Stock Markets in India, and it is under consideration for listing in the national markets. Disclosure has been promoted to meet the standards of listing, including dissemination of information on Web pages.

CARE Ratings cover all types of debt instruments including Commercial Papers, Fixed Deposits, Bonds, Debentures, Hybrid Instruments, Preference Shares, Loans Structured Obligations, Assets Backed Securities, Residential Mortgage Backed Securities, etc.

CARE’s rating covers various types of instruments. The total issues rated are 1493 and CARE completed 4677 rating assignments, covering 4324 instruments, having aggregate value of about Rs 12699 billion (as at June 2008), since its inception in April 1993. Rating Methodologies Rating methodologies include:

- utilize own data base that include other reliable sources - Assess future cash generation capability and their adequacy to meet debt

obligations in adverse conditions. - Determine the long-term fundamentals and the probabilities of change in

these fundamentals, which could affect the credit-worthiness of the borrower. - Deals with the operational characteristics and financial characteristics. - Consider qualitative aspects like assessment of management capabilities - Determine experienced and holistic judgment, based on the relevant

quantitative and qualitative factors affecting the credit quality of the issuer.

Table 17: CARE 3-Year Cumulative Default Rates(%)

Ratings SampleAAA 0.0AA 1.1A 1.9BBB 7.7Sub-Investment Grade 20.0Source: CARE Ratings

25

Table 18: CARE Average One-Year Transition Rates (2003-200 (%)

Ratings Sample AAA AA A BBB Sub-InvestmentGrade

AAA 70 100.0 0.0 0.0 0.0 0.0AA 172 1.2 97.7 0.6 0.0 0.6A 82 0.0 4.9 85.4 6.1 3.7BBB 57 0.0 0.0 1.8 84.2 14.0Speculative 11 0 0 9.09 0 90.91Source: CARE Ratings

Table 19: One-Year Stability Rates (2003-2007)Years AAA AA A BBB Overall

2003-2007 100 97.7 85.4 84.2 91.8Source: CARE Rating

Table 20: CARE Rating Risk Weight (%)Long Term AAA AA A BBB BB+ below UnratedRisk Weight(%) 20 30 50 100 150 100

Short Term PRI+ PR1,PR1-

PR2+,PR2,PR2-

PR3+,PR3,PR3-

PR4 & PR5 Unrated

Risk Weight(%) 20 30 50 100 150 100Source: CARE "Implications of BASELⅡon Corpporate Borrowers"

(4) Differences of domestic credit rating agencies and major foreign credit rating agencies

It is common for local credit ratings agencies in India that undertake only domestic credit ratings for short and long-term in local currencies, while international credit ratings in both foreign and local currency (Rupee). Thus, a sort of ‘division of labour’ is commonly observed between the local credit rating agencies and international credit rating agencies. Credit rating exercises are usually undertaken in accordance with internationally accepted standards and methods, even in local credit rating. It is not precisely adjusted for local credit rating with the sovereign and foreign currency denominated bonds, so that mapping of local credit rating would not be applicable for international credit ratings of local firms.

Mapping of local credit rating in the long and short-term rating is as shown below.

Table 21-1: Mapping of long/short-term debt instruments (CRISIL)Long-term Short-termAAAAA+AAAAA ~ LAA-A+ P1+A P1A-BBB+ P2+BBB P2BBB- P3+ P3Source: CRISIL

26

Table 21-2: Mapping of locally isssued debt instruments (ICRA): Short-termLAAALAA+LAALAA-LA+ A1+LALA- A1LBBB+LBBB A2LBBB- A3LBB+LBBLBB-LB+LBLB-LC+LC+LC- A4LD A5Source: ICRA

It is also common that sovereign ceiling of India could be applicable for international bond ratings, while some local firms could have the best credit rating scale in local currency and raising thorough local markets in Rupee currency. (5)Techniques / methods of credit ratings

Credit ratings agencies in India provide the most reliable opinion on risk by combining their evaluating risk and the risk frameworks in the context of business strategies. As in other international credit rating agencies, the major focus is placed on the likelihood of timely payment of the obligations under the rated instrument. The rating agencies in India usually follow the processes of several meetings of issuers and analyses of business environment. Rating methodology for several sectors of industries, including manufacturing companies may involve intensive risk analysis on business/ industry risks, (incl.market positions; technology; operational efficiency; capacity utilization and flexibility, etc.), financial risks (incl. adequacy of cash flows; financial flexibility; etc.), management and project risks. The analysis is primarily aimed at determining the quantum and stability of the company futures cash flows, considering debt servicing requirements. In the banks/ financial sector, special features of the entities are focused: capital adequacy; resource-raising ability; asset quality; management and systems; earnings potential; liquidity / asset liability management, etc. (6)Examples of credit ratings

27

Credit ratings cover several methods and analyses from IPO to financing for the companies, which include: bank loans (cash credit, term loan, long-term loans, etc.); letter of credit; non convertible debentures; commercial papers, etc. Some examples of credit rating services for Tata group companies by CRISIL are shown in the appendix.

(7)Credit rating agencies and Basel II

On April 27, 2007, The Reserve Bank of India (RBI) issued new guidelines on capital adequacy for banks. These guidelines require banks to link the minimum size of their capital to the credit risk in their portfolios. This is a departure from the present framework, under which banks calculate the minimum size of their capital as a proportion of the entire loan portfolio, regardless of the degree of credit risk. To determine credit risk in their loan portfolios, banks will need to use credit ratings assigned by approved External Credit Assessment Institutions (ECAIs), which include CRISIL, ICRA, and CARE in India. The revised framework for capital adequacy has been effective since March 31, 2008, for all Indian banks having an operational presence outside India (12 public sector banks and five private sector banks) and for all foreign banks operating in India. It will apply to all other commercial banks (except local area banks and regional rural banks) from March 31, 2009.

Under the new framework, banks will need to provide capital for credit risk based on the risk associated with their loan portfolios, if a bank has high-quality credit exposures. The expected effects of Basel Ⅱmight be positive for the banking sector in general, since the risk weight for small industries reduced from 100% to 75% (formerly, the risk weight was uniformly 100%).

Credit rating agencies in India are expected to analyse the banking sector more carefully from the increased transparency of the financial status and balance sheets of each bank. RBI stipulates a minimum CAR of 9%; Indian Banks have been maintaining higher CAR, in the range of 11-12%. RBI has limited the extent of ‘capital relief ’ a bank enjoy compared to capital required as per BaselⅠ.

Table 22: BaselⅠvs. BaselⅡ- Risk Weights and Capital Release (%)

Ratings BaselⅠ Basel Ⅱ

RiskWeights

CapitalRequired

RiskWeights for

RatedExposures

RatedExposures

CapitalRequiredUnrated

Category A

UnratedCategory B

CapitalReleaseUnrated

Category A

RatedCategory B

LAAA 100 9 20 1.8 9 13.5 7.2 11.7LAA 100 9 30 2.7 9 13.5 6.3 10.8LA 100 9 50 4.5 9 13.5 4.5 9.0LBBB 100 9 100 9.0 9 13.5 0.0 4.5Notes Category A = existing exposures and < Rs. 50 crore fresh exposure/ renewals

Category B = fresh exposures/ renewals > Rs. 50 croreRisk Weights for New Exposure or Renewal if total exposure is > Rs. 500mn: 150%, <Rs.500mn: 100%

Source: CARE Ratings

(8)Problems to be addressed for expanding local credit ratings

28

In India, the majority of financial resources for firms are bank lending, and pseudo lending through private placement. This situation will affect potential credit rating activities in the local markets.

There are several problems in the domestic bond markets in India for further enhancement of market as follows.

First, very few public offered corporate bonds are issued in the domestic market in India. Most corporate bonds are issued by private placement, due to complexity of procedures, and cost and time to be spent for public offering. Also, the absolute needs for issuance of public bonds are not very large.

Second, the requirement of private placement is not strict and easy for issuance, and it tends to depend on private placement among many firms in India. This is very different from the case of public offering of debt (corporate bond), where cumbersome procedures, including detailed prospectus and other information materials are to be prepared before issuance. The volume of required material to be prepared is normally large and it would take costs and time for public offering, compared with private placement.

Third, technical problems of local scale ratings to be mapped to the international; standard of ratings would be also constraints for promoting locally promoted bonds.

Several deregulation measures have been proposed by public committees, including, the Patil Report [December 2005] (the Report of the High Level Expert Committee on Corporate Bonds and Securitization), which proposes enhancement of the issue base as well as investor base. Several measures have already been taken, including improvement of market infrastructure of corporate bond trading, etc. (see Chapter 2)

The constraints of expanding credit rating activities would not be credit rating agencies per se, but the local financial and capital market conditions are not favourable for credit rating of corporate bonds. Therefore, it is strongly suggested that policy measures are to be further introduced in promoting local bond markets.

29

3. Problems to be solved and Outlook of Indian Capital Market (1)Constraints of development of corporate financial markets

Corporate bonds are traded over the counter and through NSE(National Stock Exchange, but the over-the-counter(OTC) market has no depository and clearing house arrangements, as compared with the government securities market, arranged by RBI (Reserve Bank of India). Corporate bond OTC transactions are settled bilaterally between the counterparties, and there is no institutional body of central party.

Corporate bond transactions are not usually reported unless they involve brokers, and not electronic settlement for real-time price discovery mechanism. The constraints for development of local bond markets include:

- Insufficient demand structure of the markets; - Fund-raising habits, depending on bank loans and self-financial resources - Strong bias towards public bonds over private debentures/ corporate bonds, due to stability and market facilities in terms of liquidity

- Procedures and costs of public offering (vs. private placement) - Environment for corporate bond markets not favourable, due to high and unequal rates of stamp duty in different states

- There would be no urgent need for expanding domestic bond markets, i) Incentives for bond trading are relatively low, since state bank deposits are guaranteed, and favourable conditions for individual savings ii) Government guarantees remain present in the market, explicitly or implicitly iii) Commercial banks remain closer to state sector (dependent upon the state

business; non-performing loan (NPL) situation of the banks has improved substantially

Among the above factors, relatively heavy burden of stamp duty could be one of the reasons why corporate bonds have not widely accepted, compared with government and PSU bonds, which have not been levied such duties. The costs to be borne by issuers of corporate bonds are also constraint for issuance of debentures and other commercial paper. At present, private placement is a sort of ‘disguised’ form of loans from the financial institutions through the capital markets.

The rates of stamp duty are not uniform in different states in India, and that ranged from 0.2% to 11%. The unevenness of stamp duty is one of the most important barriers for development of corporate bond markets in India. The advantage of holding PSU bonds is transferred by endorsement and delivery, with no stamp duty payable. In this respect, corporate bonds have disadvantages over Government and PSU bonds.

30

Table 23: Report of the High Level Expert Committee (December, 2005)Points Recommendation Current Status

1. Primary Market

Stamp Duty Standardize nationally ( in every states)The proposals/suggestions given by SEBI are beingexamined by the concerned entities in theGovernment. (As of March 2008)

Tax Deduced Source Exemption of tax (as Govt. Bonds)

Reduce time & cost of public issuance SEBI framed the Draft Regulations on Issue andListing of Debt Securities (Jan.2008)

Simplify disclosures required for already listedissuersReduce disclosures requirementReform of provident/ pension funds' investment guidelines

Encourage retail investors to access market though mutual funds and exchnages

Foreign institutional investorsConsolidate fragmentedprivate placement bonds Use stamp duty capto encourage re-opening of existing bonds

Bond database Compile and publish list of available bonds andupdate credit events (by stock exchanges)

2.Secondary Market Government issues clarifications on regulatoryjurisdiction over corporate bond market(Dec. 2006)

Trade reporting system Increase transparency

SEBI rationalizes the provisions of continuousdisclosures made by issuers (Jan.2007);NSE &BSEoperationalises its reporting platform for corporatebond(Apr.2007);FIMMDA reporting platformbecomes operation (Sep.2007)

Interst rate derivatives Increae transparency for OTC tradingIntroduce exchange traded interest rate derivatives

Market makers Encourage large intermiediries to act as market makersClearing & sttlement Conform to international standards of Deliery

versus Payment(DvP)anonymous order matching platform, a multilateralnetting facility (NSE, BSE)

Trading platform Develop order-matching platform

NSE & BSE to set up a reporting platform; corporatebond trading platform (Jul.2007); SEBI has alreadygranted permission to Fixed Income Money Marketand Derivatives Association of India (FIMMDA) forsetting up of trade reporting platform, which is thethird reporting platform, other than those at BSE andNSE.

Repos RBI to permit repos in corporate bonds BSE and NSE to confirm their preparedness for goingin for introduction of repos in corporate bonds

Market lot size Reduce to Rs 100,000SEBI decides to reduce tradable lots in corporatebonds in respect of all entities including QualifiedInstitutional Investors to Rs.1 lakh (Apr. 2007)

3.SecuritizationStamp duty appropriate rates nationwideTaxation Clarification of the tax treatment of pass through payments

No withholding taxListing Define bonds issued by SPVs legally

Widen investor base Allow larger NBFC and non-NBFC corporates to invest in securitized paper

Source: Report of the High Level Expert Committee on Corporate Bonds and Securitisation (Dec. 2005)

Enhancement of theinvestor base

Enhancement of the issuerbase Section 60A of the Companies A ct 1956 is also being

amended by the Government.

In general, there are several risks in issuance of corporate debt securities as follows: i) interest rate risk ( higher in future [fall in debt prices]) ii) investment risk (fall in interest rates in the future) iii) inflation risk (reduce effective income) iv) liquidity risk v) default risk (higher risk associated with higher risk premium and yield)

For development of financial markets, especially debt market, the Government has already established a high level expert committee (‘Patil’ Committee’) for further development of debt markets in India.

31

(2)Government policies towards capital markets

In the past, the Indian government has introduced several policy measures to enhance domestic savings rate by national savings schemes with guarantee and favourable terms of savings for households. The financing resources have been delivered through indirect financing from banks.

However, the government authority has recently encouraged bond markets in India to expand the domestic capital and financial market. Considerable efforts have been made to establish free and open debt markets for development of corporate bonds markets, as follows: