Statutory Compliances & Checklist FROM: CA RASHMI KHETRAPAL NICASA CHAIRPERSON 1291-92, C BLOCK...

-

Upload

beverley-caitlin-french -

Category

Documents

-

view

232 -

download

2

Transcript of Statutory Compliances & Checklist FROM: CA RASHMI KHETRAPAL NICASA CHAIRPERSON 1291-92, C BLOCK...

FROM:CA RASHMI KHETRAPALNICASA CHAIRPERSON1291-92, C BLOCKSUSHANT LOK-1, [email protected]

Every employee of an establishment covered under the Act is entitled to bonus from his employer if he has worked in that establishment for not less than thirty working days in the year on a salary less than Rs. 10,000 per month.

If an employee is prevented from working and subsequently reinstated in service, employee’s statutory liability for bonus arises.

Disqualifications of an employee to claim bonus(sec.9).

An employee who has been dismissed from service for :

1) Fraud

2) Riotous or violent behavior.

3) Theft, misappropriation or sabotage of any property.

An employee in the following cases is entitled to bonus:

(i) Temporary workman

(ii) Part time employee as a sweeper engaged on a regular basis

(iii) Retrenched employee

(iv) Probationer

(v) Dismissed employee reinstated with back wages

(vi) Piece-rated worker

An employee in the following cases is not entitled to bonus:

1. An apprentice is not entitled to bonus.

2. An employee employed through contractors on building operation

Bonus which shall be

8.33% of the salary or wage or

Rs. 100, whichever is higher.

PAYMENT OF MAXIMUM BONUS (SEC.11)

Maximum 20% of such salary or wages.

Bonus expenses will be allowed only on cash basis. However if it is paid till the due date of filling of return i.e. 31st July or 30th September it will be allowed as expenses.

If it is not paid till the due date of filling of return, and paid after that, then this bonus will be allowed in the financial year in which it is actually paid.

THE EMPLOYEES’ PROVIDENT FUNDS AND

MISCELLANEOUS PROVISIONS ACT, 1952

SCOPE:It extends to the whole of India except the State of

Jammu & Kashmir. APPLICABILITY:

Establishment which is factory engaged in any industry specified in Schedule 1 and in which 20 or more persons are employed.

Any other establishment employing 20 or more persons which Central Government may, by notification, specify in this behalf.

Any establishment employing even less than 20 persons can be covered voluntarily under section 1(4) of the Act.

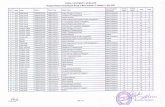

RATE OF CONTRIBUTIONSCHEME EMPLOYEE’S EMPLOYER’S CENTRA

L GOVT.

PROVIDENT FUND SCHEME

12% AMOUNT>8.33% (IN CASE WHERE CONTRIBUTION IS 12% OF 10%)

NIL

INSURANCE SCHEME

NIL 0.5% NIL

PENSION SCHEME

NIL 8.33% (DIVERTED OUT OF PROVIDENT FUND)

1.16%

DUE DATESLast date for deposit PF challan is 15th of

every month but grace period is 5.

Last date for deposit monthly PF return (Form 12-A) is 25th of every month.

Last date for deposit PF yearly return is 25th April of every year.

REPORTINGReporting is to be made by the auditor under

CARO, 2003 of:Non payment of undisputed PF and ESI dues, only if

more than 6 months old

Reporting under Tax Audit Report:Statutory Auditor needs to disclose amount in

Form 3CD in point 16 (b).

THE EMPLOYEES' STATE INSURANCE ACT, 1948It provides to workers not only accident

benefit but also other benefits such as sickness benefit, maternity benefit and medical benefit.

Applicability of the Act & Scheme:Is extended in area-wise to factories using

power and employing 10 or more persons and to non-power using manufacturing units and establishments employing 20 or more person upto Rs.15,000/- per month with effect from 01-May-2010. It has also been extend-ed upon shops, hotels, restaurants, roads motor transport undertakings, equipment maintenance staff in the hospitals.

Coverage of Employees:Drawing wages upto Rs. 15000.00 per month

engaged either directly or through contractor.

Rate of contribution of the wagesEmployer's 4.75%Employee's 1.75%

WAGES FOR ESI CONTRIBUTIONSRegisters / Files to be maintained by the employersTo be deemed as wages Not to be deemed as Wages

Basic pay Dearness Allowance House Rent Allowance City Compensatory Allowance Overtime Wages (but not to be taken into account for determining the coverage of employee) Payment for day of rest Production Incentive Bonus other than statutory bonus Night shift Allowance Heat, Gas & Dust Allowance Payment for unsubstituted holidays Meal / Food Allowance Suspension Allowance Lay off Allowance Children Education Allowance

Contribution paid by the employer to any pension / provident of under ESI Act. Sum paid to defray special expenses entailed by the nature of employment – Daily allowance paid for the period spent on tour. Gratuity payable on discharge Pay in lieu of notice of retrenchment compensation Benefits paid under the ESI Scheme Encashment of leave Payment of Inam which does not form part of the term of employment Washing Allowances for livery Conveyance amount towards reimbursement for duty related journey

DUE DATESFOR DEPOSIT :Due date is 21st of each month for cheque

deposit. 48 hrs grace time for collection.

FOR RETURN: ESIC Half Yearly Return due date : Within 42

days from the end of the half year. i.e. 12th November for April to September and 12th May for October to March.

REPORTINGReporting is to be made by the auditor under

CARO, 2003 of:Non payment of undisputed PF and ESI dues, only if

more than 6 months old

Reporting under Tax Audit Report:Statutory Auditor needs to disclose amount in

Form 3CD in point 16 (b).

FACTORIES ACT 1948It applies to EVERY industries in which ten or more than ten workers are employed on any day of the preceding twelve months and are engaged in manufacturing process being carried out with the aid of power or twenty or more than twenty workers are employed in manufacturing process being carried out without the aid of power, are covered under the provisions of this Act.

General penalty for offences.-

in respect of any factory there is any contravention of any of the provisions of this Act or of any rules made there under or of any order in writing given there under, the occupier and manager of the factory shall each be guilty of an offence and punishable with imprisonment for a term which may extend to two years or with fine which may extend to one lakh rupees or with both, and if the contravention is continued after conviction, with a further fine which may extend to one thousand rupees for each day on which the contravention is so continued Provided that where contravention of any of the provisions of Chapter IV or any rule made there under or under section 87 has resulted in an accident causing death or serious bodily injury, the fine shall not be less than 25 thousand rupees in the case of an accident causing death, and 5 thousand rupees in the case of an accident causing serious bodily injury.

Shop & commercial Establishment Act 1961

Applicability & Coverage:

It applies to all

Employee means a person wholly or principally employed whether directly or through any agency, whether for wages or other considerations in connection with any establishment.

Applicability:Every employee, including employee through contractor, but not a managerial capacity or supervisor capacity.

Payable:

For the month of June and December, every year

Rates:

Every employee contributes Re 1/- per month and employer makes a contribution of Rs 2/- per month

LABOUR WELFARE FUND

Documents required for LWF inspection:

a. Paid Challans

b. LWF Statement in respect of paid challans

GRATUITY ACT, 1972EXTENT & APPLICABILITY:

It extends to the whole of India except Jammu & Kashmir.

The Act applies to:

♦ every factory, mine, oilfield, plantation, port and railway company.

♦ every shop or establishment, in which 10 or more persons are employed, or were employed, on any day of the preceding twelve months

WAGES: Means all emoluments which are earned by an employee while on duty or on leave in accordance with the terms and conditions of his employments and which are paid or are payable to him in cash and includes D.A.

but does not include any bonus, commission, HRA, overtime wages and any other allowances.

EMPLOYEE: means any person (other than an apprentice) employed on wages, in any establishment, factory, mine, oilfield, plantation, port railway company or shop to do any skilled, semi-skilled or u skilled, manual, supervisory, technical or clerical work.

but does not include any such person who holds a post under the Central Government or a State Government and is governed by any other Act or by any rules providing for payment of gratuity

CALCULATION OF GRATUITY AMOUNT: (SEC. 4(2))

As prescribed under Accounting Standard 15 ,” PAYMENT OF GRATUITY”

INCOME TAX COMPLIANCE(SEC.43B)

Gratuity expenses will be allowed only on cash basis. However if it is paid till the due date of filling of return i.e. 31st July or 30th September it will be allowed as expenses.

If it is not paid till the due date of filling of return, and paid after that, then this Gratuity will be allowed in the financial year in which it is actually paid.

1. If TDS is not deducted by client then it is necessary to check

first that payment to a person is within threshold limit prescribed under relevant section.

2. It should be examine that rate used for deduction of TDS is as per relevant section and covered under the definition of relevant section.

3. TDS should be deducted against a valid PAN and TDS is credited to Valid PAN.

4. TDS should be deducted as per latest amendments, rules, notification and circulars.

5. If TDS is not deducted or short deposited then it must be reported in Audit Report by Auditor as per CARO, 2003. But before reporting it is necessary to check that client has valid certificate of non-deduction or short deduction of TDS under section 197 of Income Tax Act.

VERIFICATION OF TDS :

6. All foreign remittances are made under CA Certificate in prescribed form 15CB. Relevant provisions of DTAA is given due consideration in case of Foreign Remittances.

7. Client should furnish the return of TDS within due date prescribed under Income Tax Act otherwise penalty will be levied @ Rs.100 per day from next to due date till the date of return filed.

8. There is penalty of Rs.10000 if wrong TAN mentioned in TDS return.

1. TDS deducted in time, but not deposited on time – Interest for late deposit of TDS will be Applicable.

2. TDS not deducted, but deposited – TDS become

expenditure under Companies Act, but it is disallowed under Income Tax Act.

3. TDS not deducted and not deposited –

Expenditure on which TDS not deducted is totally disallowed.

4. TDS short deducted – Expenditure

proportionately disallowed to the extent of short deduction of TDS.

Some Specific points needs to given due consideration :

1. First of all, it must be necessary to understand relevant VAT Act applicable in the state .

2. It should verify list of goods mentioned in the Registration Certificate.

3. Examine Registration certificate for liability of assessee under State VAT Act and CST Act.

4. Goods on which input credit is taken is covered under the definition of Input under VAT Act.

5. VAT input is availed only if assessee has bill showing ownership in property of goods. There is proper record of Purchase which specify the name of dealer, TIN of dealer, rate of Vat, Taxable amount and Vat input. Input credit can be availed only on Tax invoice and purchase from registered dealer within the state.

VERIFICATION OF VAT :

6. Vat Output should be calculated on rate wise. Vat should be calculated inclusive of Excise Duty and exclusive of trade discount normally in practice of business.

7. Net vat amount should be examined and it vat output over vat input. Treasury challan should be verified for payment VAT.

8. There is proper record for Central Sales Tax. There is different treasury challan for Vat payment and CST payment.

9. Sales and purchases records need to be reconciled with books of accounts and VAT Returns.

10. There is proper record for C-Form, E-Form, F-Form, H-Form, I-Form issued under CST Act and Local Form issued under VAT Act.

11. Periodic returns to be verified with books of accounts and annual return submitted under VAT Act.

12. Generally assessee covered under Work Contract Scheme then input is not allowed to assessee because assessee has the benefit of lower tax payment under WCT Scheme. Therefore it is important to examine that work contractor has not taken input credit.

13. Some VAT Act has provision of entry tax (eg. Karnataka and Tamilnadu etc.) on central purchase from outside the state and this entry tax is allowed as input credit and adjusted against vat payable. Therefore in such case treasury challan for entry tax payment need to be verified.

14. Each state VAT act has its own interest and penalty provisions for late deposit of taxes and returns but it is important that assessee should comply all statutory provisions within time limit prescribed under VAT Act

REPORTING UNDER COMPANIES (AUDITOR’S REPORT) ORDER, 2003

AS PER PARA 4 (ix) (a)Is the company regular in depositing

undisputed statutory dues including Provident fund, Investor Education and Protection Fund, Employees’ State Insurance, Income-Tax, Sales Tax, VAT, Service Tax, Wealth Tax, Custom Duty, Excise Duty, Cess and any other statutory dues with appropriate authorities and if not, the extent of the arrears of outstanding statutory dues as at the last day of the financial year concerned for a period of more than six months from the date they became payable, shall be indicated by the auditor :

This clause requires the auditor to report upon the regularity of the company in depositing undisputed statutory dues.

The intention of the Government, in this clause is to ascertain how regular the company is in depositing statutory dues with the appropriate authorities.

Since the emphasis of the clause is one the regularity, the scope of auditor’s inquiry is restricted to only those statutory dues which the company is required to deposit regularly to an authority.

For the purpose of this clause, the auditor should consider a matter as “disputed” where there is positive evidence or action on the part of the company to show that it has not accepted the demand for payment of tax or duty, e.g., where it has gone into appeal.

It may be noted that penalty and/or interest levied under respective laws would be covered within the term “amounts payable”.

WHAT IS THE CEILING?In case the auditor is an individual – the ceiling is

‘specified number’

In case of a firm of auditors – the ceiling is ‘specified number’ for every partner of the firm.

Where any partner of the firm is also a partner of

any other firm of auditors – the ceiling is ‘specified number’ for such person in all the firms taken together.

Where any partner of a firm of auditors is also

practicing in his individual capacity – the ceiling is ‘specified number’ for such person in the partnership firm and in his individual capacity taken together.

MEANING OF ‘SPECIFIED NUMBER’‘Specified number’ means –

Not more than 20 companies (public)

Of which not more than 10 should be companies having a paid up capital of Rs. 25 lakhs or more.

AUDITS EXCLUDED:Following audits shall not be included while

computing ‘specified number’:Audit of a private companyAn audit of a guarantee company having no

share capitalAn audit of a foreign companyAudit of cooperative societies, trusts and

corporationsAn internal auditTax audits under Income tax act, 1961A branch auditSpecial audit and investigations

AUDITS INCLUDED:Following audits shall be included while

computing ‘specified number’:

A joint audit

An audit of a company licensed u/s 25

MAXIMUM NUMBER OF AUDITS

An auditor can accept a maximum of 30 audits including the audits of private companies (notification issued by ICAI).

Non-observance of this ceiling would amount to professional misconduct.