Source of income - University of Victoria · Employment income Income from government transfers...

Transcript of Source of income - University of Victoria · Employment income Income from government transfers...

Source of income

Health Service Delivery Area

Income fromemployment

(%)

Income fromgovernment

transfers(%)

Income fromother sources

(%)

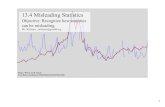

53 Northeast 87.4 6.7 5.952 Northern Interior 82.6 9.4 8.022 Fraser North 81.6 8.3 10.023 Fraser South 80.8 8.9 10.431 Richmond 79.7 8.8 11.551 Northwest 79.5 12.9 7.833 North Shore/Coast Garibaldi 77.3 7.2 15.432 Vancouver 77.2 7.6 15.221 Fraser East 76.9 12.1 11.011 East Kootenay 75.1 12.0 12.914 Thompson Cariboo Shuswap 74.0 12.8 13.241 South Vancouver Island 72.8 9.0 18.212 Kootenay Boundary 72.3 13.3 14.543 North Vancouver Island 71.9 12.9 15.213 Okanagan 69.8 13.4 16.842 Central Vancouver Island 68.2 13.8 18.0

British Columbia 77.1 9.6 13.4

There are three main sources providing incomes to

families. These are income from employment, income

from government, and income from a variety of other

sources. All are subject to variation over time. Each of

these indicators is new to the Atlas.

In BC as a whole in 2005, based on the 2006 Census,

77.1% of all income came from employment sources.

Median employment income in BC in 2005 was $42,230,

marginally higher than for Canada as a whole ($41,401).

The largest employer in BC was trade (over 350,000),

followed by health care and social assistance,

manufacturing, construction, accommodation and food,

professional, scientific and technical, and education, each

with more than 150,000 employees. Average weekly

wages were highest in forestry, fishing, mining, oil and

gas, followed by utilities and public administration, all with

weekly wages of over $1,000 in 2007 (Lu, 2010).

Geographically, the importance of employment income

varied by 20 percentage points between HSDAs.

Northeast received 87.4% of its income from employment

earnings, while at the other extreme, Central Vancouver

Island received just over two-thirds (68.2%) of its income

from this source. Geographically, employment income

was relatively most important in the northern half of the

province and parts of the lower mainland, and least

important relatively speaking in the south and central

interior of the province and on Vancouver Island.

This source of income provided close to one-tenth (9.6%)

of all income to individuals and families in 2005. Income

in this category consists of several sources, including a

variety of income assistance payments, employment

insurance for those who are unemployed, workers'

compensation payments, and government pensions and

supplements including tax credits. Government transfer

income was relatively most important in Central Vancouver

Island, which received 13.8% of all income from this

source, while Northeast had half that amount (6.7%) in its

income composition. Geographically, government transfer

income was most important in the southern and central

interior of the province as well as on Vancouver Island,

except the extreme southern part, while it was least

important in the southwest urban lower mainland region

and the extreme northeast of the province.

Employment income

Income from government transfers

Income from other sources

This source provided 13.4% of the total income of families

in 2005. It consists primarily of private pension payments

and investments. It was least important in Northeast,

where it comprised only 5.9% of total income, and most

important in South and Central Vancouver Island, where it

made up three times that amount (both over 18%).

Geographically, it was the least important source of

income in the northern half of the province, while it was of

much greater importance on Vancouver Island, Okanagan,

and Vancouver and North Shore/Coast Garibaldi in the

lower mainland.

56 BC Atlas of Wellness 2nd Edition

Source of income

Income fromemployment (%)

80.9 - 87.4

77.4 - 80.8

74.1 - 77.3

72.0 - 74.0

68.2 - 71.9

Income fromgovernmenttransfers (%)

13.0 - 13.8

12.2 - 12.9

9.0 - 12.1

7.7 - 8.9

6.7 - 7.6

Income fromother sources (%)

15.5 - 18.20

14.6 - 15.4

11.1 - 14.5

8.1 - 11.0

5.9 - 8.0

Source: BC Stats from 2006

Census of Canada,

Statistics Canada

see inset

14

52

53

51

43

43

33

33

21

41

42

1312

11

2331

22

33

32

57The Geography of Wellness Assets and Determinants