.R>OQBOIV/BSFBT PLC -ARR … · 2019. 10. 31. · nsorbo rl arb7 4op #onsqibtsoqr &tnd...

Transcript of .R>OQBOIV/BSFBT PLC -ARR … · 2019. 10. 31. · nsorbo rl arb7 4op #onsqibtsoqr &tnd...

Fund Russell 1000® Value Index

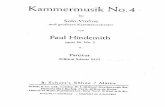

Sector Weightings: Defines what % of each sector this fund holdscompared to its benchmark listed here.

QTD YTD

Sector Attribution: Describes how sector weighting decisions affectedreturns by sector.

Sector Attribution Details:Sector Fund Weight Q T D Y T D

Communication Services 8.81 -0.06 -0.24

Consumer Discretionary 5.81 -0.02 -0.40

Consumer Staples 8.04 -0.11 -0.50

Energy 7.04 0.13 -0.07

Financials 25.59 -0.32 -0.15

Health Care 12.88 -0.11 -0.92

Industrials 9.37 0.03 -0.19

Information Technology 6.90 0.14 0.41

Materials 3.72 -0.01 -0.16

Real Estate 4.42 -0.16 -0.33

Utilities 6.04 -0.09 -0.17

Cash 0.35 -0.11 -0.22

Quarterly Portfolio Commentary:

Martin Poirier, CIMA Investment Director Investment Experience: 19 Years

HIGHLIGHTS• U.S. indexes advanced during the quarter amidst political turbulence,uncertainty surrounding global growth, and questions about interest ratemovement.• The index posted positive results across seven of the 11 economicsectors.• Defensive stocks led cyclical stocks, while the large-cap value indexled the mid-cap and small-cap value counterparts.• Active large-cap value managers outperformed passive indexes as theMorningstar U.S. Large Value Category bested the Russell 1000® ValueIndex.• The Fund underperformed the Russell 1000 Value Index, with thefinancials and health care sectors being the greatest detractors ofquarterly performance.• Stock selection in the information technology sector was positive forthe quarter and helped minimize underperformance relative to thebenchmark

Fund Objective: This Fund seeks to create a diversified portfolio of equity securities in order to outperform the total return performance of itsbenchmark, the Russell 1000® Value Index*.

These materials and the platform of investments made available by MassMutual are offered without regard to the individualized needs of any plan, itsparticipants, or beneficiaries. These materials are not intended as impartial investment advice or to give advice in a fiduciary capacity to any plan.

NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE

Quarterly Review

R5 SHARE CLASS TICKER: MEPSX

As of 09/30/2019

MassMutual Premier Disciplined Value FundBarings LLC

Com

m. S

ervi

ces

Con

sum

er D

iscr

.

Con

sum

er S

tapl

es

Ene

rgy

Fin

anci

als

Hea

lth C

are

Indu

stria

ls

Info

rmat

ion

Tec

h.

Mat

eria

ls

Rea

l Est

ate

Util

ities

Cas

h

0.0

7.5

15.0

22.5

30.0

Per

cent

of P

ortfo

lio

Com

m. S

ervi

ces

Con

sum

er D

iscr

.

Con

sum

er S

tapl

es

Ene

rgy

Fin

anci

als

Hea

lth C

are

Indu

stria

ls

Info

rmat

ion

Tec

h.

Mat

eria

ls

Rea

l Est

ate

Util

ities

Cas

h

-1.35

-0.90

-0.45

0.00

0.45

Val

ue A

dded

vs.

Ben

chm

ark

(%)

Quarterly Portfolio Commentary

During the third quarter of 2019, domestic equity markets muddled through political turbulence, uncertainty surrounding global growth, and questionsabout interest rate movement. Investor optimism responded favorably as the U.S. Federal Open Market Committee FOMC cut interest rates twice duringthe quarter standing by its commitment to reduce recessionary pressures and promote a strong U.S. economy. The Russell 1000® Value Index ended thequarter up by low single digits in support of a 17.8% YTD return. The more defensive and yield-producing sectors led returns for the quarter. The utilities,real estate, and consumer staples sectors posted positive returns, though stock valuations remain high. Oil supply and demand imbalances caused volatilityin the energy sector, while macro-economic factors put pressure on returns in the health care, materials, and industrials sectors.

The Fund’s performance lagged the Russell 1000 Value Index for the quarter. Stock selection in the financials sector was the greatest detractor. Of theFund’s holdings within the sector, CIT Group Inc., a financial and bank holding company, was down in the period. Falling interest rates put pressure on netinterest income for banks. Further, the amount of market trades betting against the stock, known as short-selling, increased in the quarter. Other stocks inthe sector such a Chubb, a Swiss-based insurance company, performed well. However, an underweight to this stock and other financials sector holdings,detracting from results. Stock selection in the health care sector also held back performance. Pfizer, a leading multinational pharmaceutical company andtop holding for the Fund, was down sharply in the quarter as the market expressed concern with their announcement of plans to combine one of theirdrug units with another firm.

A positive driver of performance for the period came from strong stock selection in the information technology sector. Shares of Lam Research Corp, asemiconductor manufacturer, surged in the quarter as sell side research firms upgraded the outlook broadly for chip makers. Another holding contributingto performance was Micron Technology, a computer memory and data storage company. Shares of the company surged in the quarter as the firm issuedstrong earnings growth projections and announced improvement of some inventory challenges. The Fund also benefited from an underweight to theenergy sector. Falling oil prices, driven by expectations for declining demand and higher supply, led to losses for many stocks in the sector. The Fund’saversion to some of the more volatile stocks in the sector was rewarded.

TICKER: MEPSX Fund Inception: 12/19/2000Morningstar Category: Large Cap Value

Average Annual Total Return

Q T D Y T D 1 Year 3 Year 5 Year 10 year

MassMutual Premier Disciplined Value R5 0.36% 14.09% -1.32% 8.15% 6.39% 10.53%

Russell 1000® Value Index 1.36% 17.81% 4.00% 9.43% 7.79% 11.46%

Category Average Return -- -- 1.93% 9.43% 7.30% 10.66%

Category Rank -- -- 78 78 74 57

# of Funds in Category -- -- 1,217 1,090 944 693

Performance shown is for class R5 shares. Gross expenses = 0.67%, Net expense = 0.67%. Max Sales charge for R5 is 0%Performance shown is past performance. Past performance does not guarantee future results . You can lose money, includingloss of pr incipal , by invest ing in this fund. Investors should careful ly consider investment objectives, r isks , charges andexpenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can beobtained from www.massmutualfunds.com and should be read careful ly before invest ing. A l ist of the Fund’s holdings can alsobe obtained from www.massmutualfunds.com. Current performance may be lower or higher than return data quoted herein. Formore current information, including month-end performance, please cal l 1-866-444-2601. You cannot invest directly in an index.Investment Risks - The Fund’s Princ ipa l R isks include - Cash Position Risk, Derivatives Risk, Equities Risk, Frequent Trading/Portfolio Turnover Risk,Indexing Risk, Large Company Risk, Liquidity Risk, Management Risk, Market Risk, Valuation Risk, Value Company Risk. Please refer to the summaryprospectus (a copy can be obtained by sending an email to [email protected]) for more information on the specific risks.The Morningstar percenti le ranking is based on the fund’s total-return percenti le rank relat ive to al l funds that have the samecategory for the same t ime period. The highest (or most favorable) percentile rank is 1%, and the lowest (or least favorable) percentile rank is 100%.Morningstar total return includes both income and capital gains or losses and is not adjusted for sales charges. © 2019 Morningstar, Inc. All RightsReserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) isnot warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from anyuse of this information.

MassMutual Premier Disciplined Value Fund

Quarter to Date:

Top 5 Contributors F u n dW e i g h t

AbsoluteReturn*

Portfol ioContr ibut ion

Procter & Gamble Co 1.76 14.17 0.23

Verizon Communications Inc 2.48 6.78 0.17

AT&T Inc 1.13 14.64 0.15

Intel Corp 1.77 8.37 0.14

Target Corp 0.62 24.39 0.13

Top 5 Detractors F u n dW e i g h t

AbsoluteReturn*

Portfol ioContr ibut ion

Pfizer Inc 1.97 -16.28 -0.36

Johnson & Johnson 2.75 -6.42 -0.19

Exxon Mobil Corp 1.56 -6.70 -0.11

Altria Group Inc 0.79 -12.52 -0.11

DXC Technology Co 0.14 -46.15 -0.09

Year to Date:

Top 5 Contributors F u n dW e i g h t

AbsoluteReturn*

Portfol ioContr ibut ion

Cisco Systems Inc 1.57 28.16 0.69

Citigroup Inc 1.85 35.50 0.55

Procter & Gamble Co 1.59 38.23 0.55

JPMorgan Chase & Co 2.19 23.34 0.51

AT&T Inc 1.34 39.08 0.48

Top 5 Detractors F u n dW e i g h t

AbsoluteReturn*

Portfol ioContr ibut ion

Pfizer Inc 1.95 -15.46 -0.40

Herbalife Nutrition Ltd 0.31 -35.78 -0.16

Altria Group Inc 0.27 -12.52 -0.12

Senior Housing PropertiesTrust 0.11 -27.76 -0.12

Occidental Petroleum Corp 0.37 -24.14 -0.11

RS9093b RS-45363-05

Portfolio Holdings:

Fund Weightings are shown as an average for the time period.*Absolute Return is the return that an asset achieves over a certain period of time. This measure looks at the appreciation or depreciation (expressed as apercentage) that a holding achieves over a given period of time.For a complete listing of fund holdings, visit massmutualfunds.com or please call 1-866-444-2601. The mention of individual stocks and other securities inthis document does not constitute investment advice.

MassMutual Premier Disciplined Value Fund

© 2019 Massachusetts Mutual Life Insurance Company (MassMutual®), Springfield, MA. All rights reserved. www.MassMutual.com Principal Underwriter:MML Distributors, LLC. (MMLD) Member FINRA and SIPC (www.FINRA.org and www.SIPC.org) MMLD is a subsidiary of Massachusetts Mutual LifeInsurance Company, 100 Bright Meadow Blvd., Enfield, CT 06082. Investment advisory services provided to the Funds by MML Investment Advisers, LLC.

THIS PAGE INTENTIONALLY LEFT BLANK

![New & Used Cars in India | Upcoming Cars & Bikes | Latest ... · A^]`bg 7\ab`c[S\b 1ZcabS` \R @]e /`[`Sab 3\VO\QSR 9\SS 1ZSO`O\QS 4]` 1][T]`bOPZS 2`WdS2cOZ B]\S 7\bS`W]`a eWbV 4OP`WQ](https://static.fdocuments.in/doc/165x107/5f9290fc06fa40028b3f9504/new-used-cars-in-india-upcoming-cars-bikes-latest-abg-7abcsb.jpg)

![ºv Ó ¿ :UO 9UO UM49UIS 4OP>4UO 9I4< 4>?TU L4>49U ... · mooooooooooooooö h hhhhhhhhhhhhhhhhhhhh eat?xd? 8aacw 8 8 ]öl 8 ☐ hk3(/01 q ¼3(/01| mooooooooooooooö](https://static.fdocuments.in/doc/165x107/5fd7a0b888b5c6724559045f/v-uo-9uo-um49uis-4op4uo-9i4-4tu-l449u-moooooooooooooo.jpg)