Return of Organization Exempt From Income Tax990s.foundationcenter.org/990_pdf_archive/231/... · 2...

Transcript of Return of Organization Exempt From Income Tax990s.foundationcenter.org/990_pdf_archive/231/... · 2...

a 3

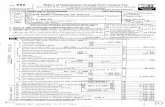

OMB No 1545-0047Return of Organization Exempt From Income TaxForm990

Under section 501 (c), 527, or 4947(a)(1) of the Internal Reveni i

ue Code ( except black lung 2004Department of the Treasury

t trust or private foundatbenef on ) Open to PublicInternal Revenue Service ► The orga nization may have to use a copy of this return to satisfy state reporting requirements. InspectionA For the 2004 calendar year , or tax year beginning JUL 1 2004 and ending JUN 3 0 2005B Check if Please C Name of organization D Employer identification number

applicableuse IRS

achangeschange nnt

labeloror

p CARSON VALLEY SCHOOL 23-1352623]Name type

SeeNumber and street (or P.O. box it mall is not delivered to street address) Room/suite E Telephone number

fet`urn spec,f,c 1419 BETHLEHEM PIKE 215-233-1945Final

E�:IreturnInstruc-Lions City or town, state or country, and ZIP + 4 F Accoun ti ng method E::]Cash® Accrual

LjrAmendedLOVRTOY91Y PA 19031 LJ Dst eci

Application • Section 501(c)(3 ) organizations and 4947 ( a)(1) nonexempt charitable trustsE]pencling H and I are not applicable to section 527 organizationsmust a ttach a completed Schedule A (Form 990 or 990 EZ)

H(a ) Is this a group return for affiliates? Yes ® NoG Website : WWW. CARSONVALLEY . ORG H(b) If 'Yes," enter number of aftlllates►J Organization ty pe (check only one)►® 501(c) ( 3 ) 44 (insert no) 4947(a)(1) or 0 527 H(c) Are all affiliates included? N/A Yes 0 NoK Check here ► El if the organization's gross receipts are normally not more than $25 The000

IF "No; attach a list.), .organization need not file a return with the IRS; but it the organization received a Form 990 Package

H(d) Is this a separate return filed by anorganization covered by a group ruling? 0 Yes ® No

in the mail, it should file a return without financial data. Some states require a complete return . I Group Exemption Number Poo,

M Check ►0 it the organization is not required to attachL Gross receipts: Add lines 6b, 8b, 9b, and 10b to line 12 ► 17,969,311.1 Sch. B (Form 990, 990-EZ, or 990-PF).Part I Revenue . Expenses . and Chances in Net Assets or Fund Balances

ncc

Q

1 Contributions, gifts, grants, and similar amounts recelved-a Direct public support 1a 723 366.b Indirect public support 1b 11 347.c Government contributions ( grants) 1cd Total ( add lines la through 1c ) ( cash $ 734,713. noncash$ ) ld 734 ,713.

2 Program service revenue including government fees and contracts ( from Part VII , line 93 ) 2 16, 991, 086.3 Membership dues and assessments 34 Interest on savings and temporary cash investments 45 Dividends and interest from securities 5 40, 950.6 a Gross rents SEE STATEMENT 1 6a 13,760.

b Less: rental expenses 6bc Net rental income or (loss) (subtract line 6b from line 6a) 6c 13, 760.

7 Other investment income ( describe ► 7C 8 a Gross amount from sales of assets other (A) Securities B Otherv than inventory 122,297. Bacc b Less: cost or other basis and sales expenses 100,585. 8b

c Gain or ( loss) (attach schedule ) 21 712 . 8cd Net gain or ( loss) (combine line 8c, columns ( A) and (B )) STMT 2 8d 21, 712.

9 nil activities attach schedule ). If any amount is from gaming , check here Po-a ITr$ 0 . of contributions

9a 46,036.b enses other than aising expenses 9b 2 9 6 9 7 .c �sAroft@&I Is (subtract line 9b from line 9a) SEE STATEMENT 3F

9c * 16 3 3 9 .10 a ventory, less re �t and allowances 10asales

b Id 10bc m les of I entory ( a ttach schedule ) ( subtract line 10b from li ne 10a) 10c

11 Other revenue ( from Part VII , line 103 ) 11 20, 469.12 Totalrevenue (addlines 1d 2 3 4 5 6c 7 8d 9c 10c and 11) 12 17, 839 029 .13 Program services ( from l in e 44, column ( B)) 13 11 276 980 .

two 14 Management and general ( from line 44, column ( C)) 14 6 090 849 .r-a) 15 Fundraising ( from line 44, column (D)) 15CLX 16 Payments to affiliates ( a ttach schedule) 16

17 Total expenses (add lines 16 and 44, column (A)) 17 17, 367 829.18 Excess or (deficit ) for the year ( subtract line 17 from line 12 ) 18 471 200 .

to 19 Net assets or fund balances at beginning of year ( from line 73, column ( A)) 19 21, 179 409 .Z 20 Other changes in net assets or fund balances (attach explanation ) SEE STATEMENT 4 20 - 18 8 809.

21 Net assets or fund balances at end of year ( combine lines 18, 19, and 20 ) 21 21 461 800 .01-13os LHA For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions . Form 990 (2004)

CARSON VALLEY SCHOOL 23-1352623Part 11 Statement of All organizations must complete column (A). Columns (B), (C), and (D) are required for section 501(c)(3) Page 2DFunctional Expenses and (4) organizations and section 4947(a)(1) nonexempt charitable trusts but optional for others.

Do not include amounts reported on fine6b, 8b 9b, 10b or 16 of Pa

rtI (A) Total (B) Program

services(C) Management

and general (p) Fundraising

22 Grants and allocations (attach schedule)

(cash $ noncash $ 22

23 Specific assistance to individuals (attach schedule) 2324 Benefits paid to or for members (attach schedule) 2425 Compensation of officers, directors, etc. 25 568,838. 0. 568,838. 0.26 Other salaries and wages 26 8,24 7 357. 7,169,708. 1 077,649.27 Pension plan contributions 27 165 090 . 165 090 .28 Other employee benefits 28 182 802 . 182 802 .29 Payroll taxes 29 687 611. 687 611.30 Professional fundraising fees 3031 Accounting fees 3132 Legal tees 3233 Supplies 33 251 543. 130 248. 121 295.34 Telephone 34 94,619. 39,588. 55,031.35 Postage and shipping 35 26,185. 7,460. 18,725.36 Occupancy 36 415,843. 415,843.37 Equipment rental and maintenance 3738 Printing and publications 3839 Travel 39 107 854. 102 798. 5,056.40 Conferences, conventions, and meetings 4041 Interest 41 14,559. 14,559.42 Depreciation, depletion, etc. (attach schedule) 42 521,587. 48,181. 473,406.43 Other expenses not covered above (itemize):

a 43ab 43bc 43cd 43de SEE STATEMENT 5 43e 6,08 3 941. 3 363 154. 2,720,787.-

44 Organizationsc00 pletlnpcolumn(Bj(D)carry heseieWls is lines 13-15 44 1 7 3 6 7 8 2 9. 11 2 7 6 9 8 0. 6,090,849.1 0.Joint Costs . Check ► ED if you are following SOP 98-2.Are any joint costs from a combined educational campaign and fundraising solicitation reported in (B) Program services?If Yes," enter ( i) the aggregate amount of these joint costs $

► 0 Yes ® No(ii) the amount allocated to Program services $

(iii) the amount allocated to Management and general $ and (iv) the amount allocated to FundraisingPart III Statement of Program Service AccomplishmentsWhat is the organization's primary exempt purpose' ► SEE STATEMENT 6

Program ServiceE

All organizations must describe their exempt purpose achievements in a clear and concise manner State the number of clients served , publications issued , etc Discussachievements that ar e not measurable (Section 501( cx3) and ( 4) organizations and 4947(aXt) nonexempt ch ar itable trusts must also enter the amount of grants andallocations to others)

xo(Required for

50do1(cand

(4) orgs and 4947(aXl)trusts , but optional for others )

a INSTITUTIONAL MENTAL HEALTH I AND EDUCATION- THE ORGANIZATIONUTILIZES RESOURCES TO ACHIEVE ITS EXEMPT PURPOSE OF HELPINGCHILDREN AND FAMILIES WITH SPECIAL NEEDS.

(Grants and allocations $ 1,921,080.b FOSTER CARE- THE ORGANIZATION UTILIZES RESOURCES TO HELPCHILDREN IN NEED OF HOUSING IN ACCORDANCE WITH ITSEXEMPT PURPOSE.

(Grants and allocations $ 2,926,698.c INSTITUTIONAL MENTAL HEALTH II, PARTIAL HOSPITALIZATION,AND MH/MR HOST FAMILIES- THE ORGANIZATION ACHIEVES ITSEXEMPT PURPOSE BY HELPING CHILDREN WITH SPECIAL NEEDS.

(Grants and allocations $ 6,011,662.d NURSERY SCHOOL, DAY CARE, KINDERGARTEN- THE ORGANIZATIONUSES ITS RESOURCES TO AID CHILDREN IN NEED OF CARE INACCORDANCE WITH ITS EXEMPT PURPOSE.

(Grants and allocations $ 417,540.e Other program services a ttach schedule (Grants and allocations $f Total of Program Se rvice Expenses (should equal line 44, column (B), Program services) ► 11,276,980.01-135 Form 990 (2004)-0

Form 990 (2004) CARSON VALLEY SCHOOL 23-1352623 Page 3

Part IV Balance Sheets

Note : Where required, attached schedules and amounts within the descnption column (A) (B)should be for end-of-year amounts only. Begi nning of year End of year

45 Cash - non-interest-bearing 1 ,800. 45 2, 250.46 Savings and temporary cash investments 373, 245. 46 356, 993.

47 a Accounts receivable 47a 5,758,135.b Less: allowance for doubtful accounts 47b 125,000. 4 4 2 4 3 6 7. 47c 5 ,633, 135.

48 a Pledges receivable 48ab Less: allowance for doubtful accounts 48b 48c

49 Grants receivable 4950 Receivables from officers, directors, trustees,

and key employees 50d 51 a Other notes and loans receivable 51atoa b Less: allowance for doubtful accounts 51b 51c

52 Inventories for sale or use 5253 Prepaid expenses and deferred charges 247, 609. 53 259, 695.54 Investments - securities STMT 7 STMT 8 ► 0 Cost ® FMV 821, 653. 54 866, 781.55 a Investments - land, buildings, and STMT 10

equipment: basis 55a

b Less: accumulated depreciation 55b 55c56 Investments - other 5657 a Land, buildings, and equipment: basis 57a 9,715,671.

b Less: accumulated depreciation 57b 5,631,875. 4, 012, 227. 57c 4 ,083, 796.58 Other assets (describe ► SEE STATEMENT 9 ) 12, 373, 393. 58 12 ,206, 068.

59 Total assets add lines 45 through 58 must equal line 74 22, 25 4 294. 59 23 ,408, 718.60 Accounts payable and accrued expenses 918 451. 60 986, 098.61 Grants payable 6162 Deterred revenue 156 434. 62 160, 820.

NT 63 Loans from officers, directors, trustees, and key employees 63

64 a Tax-exempt bond liabilities 64ab Mortgages and other notes payable 64b

65 Other liabilities (describe ► LINE OF CREDIT ) 65 800, 000.

66 Total liabilities add lines 60 through 65 1, 074, 885. 66 1 ,946, 918.Organizations that follow SFAS 117 , check here ► ® and complete lines 67 through

69 and lines 73 and 74.67 Unrestricted 8, 683, 374. 67 9 ,217, 504.68 Temporarily restricted 122, 642. 68 38, 228.

m 69 Permanently restricted 12, 373, 393. 69 12 ,206, 068.C Organizations that do not follow SFAS 117, check here ► and complete linesLL0 70 through 74° 70 Capital stock, trust principal, or current funds 70

71 Paid-in or capital surplus, or land, building, and equipment fund 71a 72 Retained earnings, endowment, accumulated income, or other funds 72Z 73 Total net assets or fund balances (add lines 67 through 69 or lines 70 through 72;

column ( A) must equal line 19; column ( B) must equal line 21) 21 17 9'4 0 9 . 73 21 ,461, 800.

74 Total liabilities and net assets / fund balances (add lines 66 and 73) 22, 254, 294.1 74 23 ,408, 718.Form 990 is available for public inspection and, for some people, serves as the primary or sole source of information about a particular organization. How the public

perceives an organization in such cases may be determined by the information presented on its return. Therefore, please make sure the return is complete and accurateand fully describes, in Part 111, the organization's programs and accomplishments

42302101-13-05

Form 990I Part IV-A Reconciliation of Revenue per Audited Part IV-B Reconciliation of Expenses per Audited

Financial Statements with Revenue per Financial Statements with Expenses perReturn Return

a Total revenue, gains, and other support a Total expenses and losses perper audited financial statements ► a 17785983. audited financial statements ► a 17397526.

b Amounts included on line a but not onb Amounts included on line a but not on line 17, Form 990,

line 12, Form 990: (1) Donated services(1) Net unrealized gains and use of facilities $

on investments $ -22, 664. (2) Prior year adjustments(2) Donated services reported on line 20,

and use of facilities $ Form 990 $(3) Recoveries of prior (3) Losses reported on

year grants $ line 20, Form 990 $(4) Other (specify): (4) Other (specify):STMT 11 $ 29,697. STMT 12 $ 29,697.

Add amounts on lines (1) through (4) ► b 7,033. Add amounts on lines (1) through (4) ► b 29,697.c Linea minus line b ► c 17778950. c L inea minus line b ► c 17367829.d Amounts included on line 12, Form d Amounts included on line 17, Form

990 but not on line a: 990 but not on line a:

(1) Investment expenses (1) Investment expensesnot included on not included online 6b, Form 990 $ line 6b, Form 990 $

(2) Other (specify): (2) Other (specify):STMT 13 $ 60,079. $

Add amounts on lines (1) and (2) ► d 60,079. Add amounts on lines (1) and (2) ► d 0.e Total revenue per line 12, Form 990 e Total expenses per line 17, Form 990

(line c plus lined) 10, 1 e 17839029.1 (line c plus lined) No, I e 17367829.Part V I List of Officers, Directors , Trustees, and Key Employees (List each one even if not compensated.)

A Name and address( )(B) Title and average hours

per week devoted toposition

( C) Compensation(if not p a id, enter

0 .

(D) Contnbutions toa ployee benefitplans 8 deferredcompensation

(E) Expenseaccount and

other allowancesJOHN TAAFFE EXECUTIVE DIRECTORC/O CARSON-VALLEY SCHOOL--------------------------------

40 150 421. 0. 7,150.JOHN CAVANAUGH CHIEF FINANCI AL OFFICERC/O-CARSON-VALLEY SCHOOL-------------------------------

40 93,942. 0. 0.DR. MARIE-O'DONNELL- - - - - - - - - - - - - - - ----------------- IR. OF CENTRAL RESOURCESC/O-CARSON-VALLEY SCHOOL-------------------------------

40 82,164. 0. 0.CYNTHIA ROBINSON IR. OF COMMUNITY PROG RAMSC/O-CARSON-VALLEY SCHOOL------------------------------

40 85,250. 0. 0.OSCAR PAGE______ IR. OF RES. RESOURCESC/O CARSON-VALLEY SCHOOL--------------------------------

40 76,083. 0. 0.SEAN HALLORAN IR OF BEHAVIORAL HEAL THC/O-CARSON-VALLEY SCHOOL------------------------------

40 80,978. 0. 0.SEE ATTACHED-LIST _________________ BOARD MEMBERSC/O-CARSON-VALLEY SCHOOL------------------------------

0 0. 0. 0.------------------------------------------------------------------

------------------------------------------------------------------

75 Did any officer , director, trustee, or key employee receive aggregate compensation of more than $ 100,000 from your organization and all relatedorganizations , of which more than $10 ,000 was provided by the related organizations? If "Yes, attach schedule ► 0 Yes [j]No

423031 01 - 13-05 Form 990 (2004)

Form 990 (2004) CARSON VALLEY SCHOOL 23-1352623 Page 5Part VI Other Information Yes No

76 Did the organization engage in any activity not previously reported to the IRS? If "Yes," attach a detailed description of each activity 76 X77 Were any changes made in the organizing or governing documents but not reported to the IRS? 77 X

It "Yes; attach a conformed copy of the changes.78 a Did the organization have unrelated business gross income of $1,000 or more during the year covered by this return? 78a X

b If "Yes," has it filed a tax return on Form 990 -T for this year? N/A 78b79 Was there a liquidation, dissolution, termination, or substantial contraction during the year? 79 X

If "Yes," attach a statement80 a Is the organization related (other than by association with a statewide or nationwide organization) through common membership,

governing bodies, trustees, officers, etc., to any other exempt or nonexempt organization'?b If "Yes," enter the name of the organization ►

81 a Enter direct or indirect political expenditures See line 81 instructions 81ab Did the organization file Form 1120-POL for this year?

82 a Did the organization receive donated services or the use of materials, equipment, or facilities at no charge or at substantially less thanfair rental value

b If 'Yes,' you may indicate the value of these items here. Do not include this amount as revenue in Part I or as anexpense in Part It. (See instructions in Part III.) 1 82b I N/A

83 a Did the organization comply with the public inspection requirements for returns and exemption applications'?b Did the organization comply with the disclosure requirements relating to quid pro quo contributions9

84 a Did the organization solicit any contributions or gifts that were not tax deductible9b If "Yes," did the organization include with every solicitation an express statement that such contributions or gifts were not

tax deductibles N/A85 501(c)(4), (5), or (6) organ izations a Were substantially all dues nondeductible by members? N/A

b Did the organization make only in-house lobbying expenditures of $2,000 or less'? N/AIf "Yes' was answered to either 85a or 85b, do not complete 85c through 85h below unless the organization received a waiver for proxy taxowed for the prior year.

c Dues, assessments, and similar amounts from membersd Section 162(e) lobbying and political expenditures 85d N/Ae Aggregate nondeductible amount of section 6033(e)(1)(A) dues notices 85e N/Af Taxable amount of lobbying and political expenditures (line 85d less 85e) 851 N/Ag Does the organization elect to pay the section 6033(e) tax on the amount on line 85f '? N/Ah If section 6033(e)(1)(A) dues notices were sent, does the organization agree to add the amount on lin e 85f to its reasonable estimate of dues

allocable to nondeductible lobbying and political expenditures for the following tax year? N/A86 501(c)(7) organizations Enter: a Initiation fees and capital contributions included on line 12 86a N/A

b Gross receipts, included on line 12, for public use of club facilities 86b N/A87 501(c)(12) organizations Enter: a Gross income from members or shareholders 87a N/A

b Gross income from other sources. ( Do not net amounts due or paid to other sourcesagainst amounts due or received from them ) - 87b N/A

88 At any time during the year , did the organization own a 5O% or greater interest in a taxable corporation or partnership,or an entity disregarded as separate from the organization under Regulations sections 301 .7701-2 and 301.7701-37If "Yes," complete Part IX

X

89 a 501(c)(3) organizations Enter: Amount of tax imposed on the organization during the year under:section 491 1 lo- 0 . ; section 4912 ► 0 . ; section 4955 ► 0.

b 501(c)(3) and 501(c)(4) organizations Did the organization engage in any section 4958 excess benefittransaction during the year or did it become aware of an excess benefit transaction from a prior year?If "Yes,' attach a statement explaining each transaction 89 13 X

c Enter: Amount of tax imposed on the organization managers or disqualified persons during the year undersections 4912, 4955, and 4958 ► 0.

d Enter: Amount of tax on line 89c, above, reimbursed by the organization ► 0.90 a List the states with which a copy of this return is filed ► PENNSYLVANIA

b Number of employees employed in the pay period that includes March 12, 2004 90b 25791 The books are in care of ► JOHN J. CAVANAUGH Telephone no. ► 215-233-1945

Located at ► 1419 BETHLEHEM PIKE, FLOURTOWN, PA ZIP + 4 ► 19 0 31

and check whether it is 0 exempt or El nonexempt.

92 Section 4947(a)(1) nonexempt charitable trusts filing Form 990 in lieu of Form 1041- Check here ►0and enter the amount of tax-exempt interest received or accrued during the tax year Do- 1 92 N/A

oii305Form 990 (2004)

Form 990 (2004p CARSON VALLEY SCHOOL 23 -1352623 Page6Part VII Analysis of Income -Producing Activities (See page 33 of the inst ructions)Note:Indic

93abcdef

94959697

ab

9899100

101102103

abcde

104105 Total (add line 104, columns (8), (D), and (E)) ► 17,104,316.Note. Line 105 plus line 1d, Part /, should equal the amount on line 12, Part

Part VI II Kelatlonsnlp OT Activities to the ACCOmpllsnment OT txempt Purposes (See page 34 of the instructions.)

Line NoV

Explain how each activity for which income is reported in column (E) of Part VII contributed importantly to the accomplishment of the organization'sexempt purposes (other than by providing funds for such purposes).

SEE STATEMENT 14

Part IX Information Regarding Taxable Subsidiaries and Disregarded Entities (See page 34 of the instructions.)A

Name, address, and)EIN of corporation,partnership, or disregarded entity

(B)Percentage of

ownership interest

(C) D E)Nature of activities Total Income Endof-year

assets

N/A %

Part X Information Reaardina Transfers Associated w(a) Did the organization, during the year, receive any funds, directly or indirectly, to(b) Did the organization, during the year, pay premiums, directly or indirectly, on a �Note : I( "Yes" to (b), file Form 8870 and Form 4720 (see instructions)

Under penaItie r perju ry , I decl ar e that I have examined this repO, including accompPlease correct and pl to D atron of preparer (other than oft is based on all inform,

SignHere Ignatu f officer Date

PaidPreparer 's

r parer'signature

Firm's name (orUse Only Yours it

self-employed),

423161n1-1a-n5

address, andZIP + 4

Enter ross amounts unless otherwise Unrelated business income Exclu ded by section 512 513, or 514gated

rogram service revenue:Businesscode

(B)Amount ExcCu_COde Amount

(E)

Related or exemptfunction income

DAY CARE 41 303 945.NURSERY SCHOOL 41 411 724.

Aedlcare/Medicaid paymentsees and contracts from government agencies 16,275,417.Aembershlp dues and assessmentsMerest on savings and temporary cash investments)Ivldends and interest from securities 14 40,950.let rental income or (loss) from real estate:lebt-financed propertylot debt-financed property 16 13,760.let rental income or (loss) from personal property)ther investment incomelain or (loss) from sales of assetsIther than inventory 18 21,712.et income or (loss) from special events 16,339.ross profit or (loss) from sales of inventoryther revenue:MISCELLANEOUS 20,469.

ubtotal (add columns (B) , (D), and (E)) 0. 792 091.

P

NGO

S 16,312,225.

LARSON ALLEN WEISHAIR &18 SENTRY PARK WEST, SUBLUE BELL. PA 19422-224

SCHEDULE A I Organization Exempt Under Section 501(c)(3)(Form 990 or 990-EZ) (Except Private Foundation) and Section 501(e), 501(f), 501(k),

501(n), or Section 4947(a)(1) Nonexempt Charitable Trust

Department of the Treasury Supplementary Information-(See separate instructions.)Internal Revenue Service ► MUST be completed by the above organizations and attached to their Form 990 or 990-EZ

OMB No 1545-0047

2004Name of the organization Employer identification number

CARSON VALLEY SCHOOL 23 1352623Part I Compensation of the Five Highest Paid Employees Other Than Officers, Directors , and Trustees

(See page 1 of the instructions . List each one . If there are none , enter 'None')

(a) Name and address of each employee paid()

(b ) Title and average hourser week devoted top c Compensation() p

(d) Contributions totemployee benefi

l d

(e) Expenseaccount and other

more than $50,000 positionans & deferrepcompensation allowances

CLARE_STRENGER--------------------- DEVELOPMENT

C/o CVS 40 72,562.

JOHN-CARVER _______________________PLANT MGR

C/o CVS 40 73,416.

DAVID_PUCHALSKI ____________________

-

ADMISSIONS

C/o CVS 40 70,110.

LISA-MATTHEWS______________________ COMMUNITY PR

C/o CVS 40 62,132.

CYNTHIA ROBINSON COMMUNITY

C/o CVS 40 85,250.Total number of other employees paidover $50,000 ► 0Part II Compensation of the Five Highest Paid Independent Contractors for Professional Services

(See page 2 of the instructions. List each one (whether individuals or firms). If there are none, enter "None')

(a) Name and address of each independent contractor paid more than $50,000

NONE--------------------------------------------

(b) Type of service I (c) Compensation

Total number of others receiving over$50,000 for professional services ► 0

423101111-24-04 LHA For Paperwork Reduction Act Notice , see the Instructions for Form 990 and Form 990 -EZ Schedule A (Form 990 or 990-EZ) 2004

Schedule A (Form 990 or 990-EZ) 2004 CARSON VALLEY SCHOOL 23-1352623 Paget

Part III Statements About Activities ( See page 2 of the in structions .) Yes No

1 During the year , has the organization attempted to influence national, state, or local legislation , including any attempt to influencepublic opinion on a legislative matter or referendum? If "Yes," enter the total expenses paid or incurred in connection with thelobbying activities ► $ $ (Must equal amounts on line 38, Part VI-A,or line i of Part VI-B.) XOrganizations that made an election under section 501 ( h) by filing Form 5768 must complete Part VI-A. Other organizations checking"Yes," must complete Part VI- B AND attach a statement giving a detailed description of the lobbying activities.

2 During the year, has the organization , either directly or indirectly, engaged in any of the following acts with any substantial contributors,trustees, directors , officers, creators , key employees , or members of their families , or with any taxable organization with which any suchperson is affiliated as an officer, director, trustee , majori ty owner , or principal beneficiary? (If the answer to any question is "Yes,attach a detailed statement explaining the transactions) SEE STATEMENT 15

a Sale, exchange , or leasing of property? 2a X

b Lending of money or other extension of credit? 2b X

c Furnishing of goods, services , or facilities? 2c X

d Payment of compensation ( or payment or reimbursement of expenses if more than $1 , 000)? 2d X

e Transfer of any part of its income or assets? 2e X

3 a Do you make grants for scholarships , fellowships, student loans, etc? ( If "Yes; attach an explanation of howyou determine that recipients quality to receive payments ) 3a X.

b Do you have a section 403(b ) annuity plan for your employees? 3b X

4 a Did you maintain any separate account for participating donors where donors have the right to provide adviceon the use or distribution of funds? 4a X

b Do you provide credit counseling, debt management, credit repair, or debt negotiation services? 4b X

Part IV Reason for Non-Private Foundation Status (See pages 3 through 6 of the instructions.)

The organization is not a private foundation because it is: (Please check only ONE applicable box.)5 0 A church , convention of churches , or association of churches . Section 170(b)(1)(A)(1).6 0 A school. Section 170(b)(1)(A)(n). (Also complete Part V.)7 0 A hospital or a cooperative hospital service organization . Section 170(b)(1)(A)(ui).8 A Federal, state, or local government or governmental unit. Section 170(b)(1)(A)(v).9 0 A medical research organization operated in conjunction with a hospital . Section 170( b)(1)(A)(m). Enter the hospital's name, city,

and state ►10 El An organization operated for the benefit of a college or university owned or operated by a governmental unit. Section 170(b)(1)(A)(w).

(Also complete the Suppo rt Schedule in Part IV-A.)11a 0 An organization that normally receives a substantial part of its support from a governmental unit or from the general public

Section 170(b)(1)(A)(vi). (Also complete the Suppo rt Schedule in Part IV-A.)1lb D A community trust. Section 170(b)(1)(A)(vi). (Also complete the Suppo rt Schedule in Part IV-A.)12 ® An organization that normally receives: ( 1) more than 33 1/3% of its support from contributions, membership fees, and gross

receipts from activities related to its charitable, etc., functions - subject to certain exceptions, and (2) no more than 33 1/3% ofits support from gross investment income and unrelated business taxable income (less section 511 tax) from businesses acquiredby the organization after June 30, 1975. See section 509(a)(2). (Also complete the Suppo rt Schedule in Part IV-A.)

13 0 An organization that is not controlled by any disqualified persons ( other than foundation managers ) and supports organizations described in:(1) lines 5 through 12 above; or (2) section 501(c)(4), (5), or (6), if they meet the test of section 509(a)(2). (See section 509(a)(3).)

Provide the following information about the supported organizations . ( See page 5 of the instructions.)

(a) Name(s) of supported organization(s) I (b)Lineffrom above

14 An organization organized and operated to test for public safety. Section 509(a)(4). (See page 5 of the instructions.)42311112-03-04 Schedule A (Form 990 or 990-EZ) 2004

Schedule A (Form 990 or 990-EZ) 2004 CARSON VALLEY SCHOOL 23-1352623 Page 3Part IV-A Support Schedule (Complete only if you checked a box on line 10, 11, or 12) Use cash method of accounting.

Note : You may use the worksheet in the instructions for convertin from the accrual to the cash method of accountingCalendar year ( or fiscal yearbeginning in) ► (a) 2003 (b) 2002 (c) 2001 (d) 2000 (e) Total15 Gifts, grants, and contributions

grantsSe fie28nclude unusual763,243. 851,153. 694,119. 1,042,011. 3,350,526.

16 Membership fees received17 Gross receipts from admissions,

merchandise sold or servicesperformed, or furnishing offacilities in any activity that isrelated to the organization'scharitable , etc., purpose 15974490. 15130030. 14010256. 10337003. 55 451 779.

18 Gross income from interest,dividends, amounts received frompayments on securities loans (sec-tion 512(a)(5)), rents, royalties, andunrelated business taxable income(less section 511 taxes) frombusinesses acquired by theorganization after June 30, 1975 41,800. 30,096. 46,733. 96,173. 214,802.

19 Net income from unrelated businessactivities not included in line 18

20 Tax revenues levied for theorganization's benefit and eitherpaid to it or expended on its behalf

21 The value of services or facilitiesfurnished to the organization by agovernmental unit without charge.Do not include the value of servicesor facilities generally furnished tothe public without charge

22 Other Income. Attach a schedule. SEE STATEMENT 16Do not include gain or (loss) fromsaleofcapitalassets 80,994. -16,834. 32,945. 61,235. 158 340.

23 Total of lines 15 through 22 16860527. 15994445. 14784053. 11536422. 59 175 447.24 Line 23 minus line 17 886 037. 864 415. 773 797. 1,199,419. 3,723,668.25 Enter s%of line 23 168 605. 159 944. 147 841. 115 364.26 Organizations described on lines 10 or 1 t a Enter 2% of amount in column (e), line 24 ► 26a N/A

b Prepare a list for your records to show the name of and amount contributed by each person (other than a governmentalunit or publicly supported organization) whose total gifts for 2000 through 2003 exceeded the amount shown in line 26a.Do not file this list with your return Enter the total of all these excess amounts ► 26b N/A

c Total support for section 509(a)(1) test: Enter tine 24, column (e) ► 26c N/Ad Add: Amounts from column (e) for lines: 18 19

22 26b ► 26d N/Ae Public support (line 26c minus line 26d total) ► 26e N/Af Public support percentage (line 26e (numerator) divided by line 26c (denominator)) ► 261 N/A %

27 Organizations described on line 12 : a For amounts included in lines 15, 16, and 17 that were received from a "disqualified person," prepare a list for yourrecords to show the name of, and total amounts received in each year from, each "disqualified person." Do not file this list with your return . Enter the sum ofsuch amounts for each year:(2003) 0 . (2002) 0. (2001) 0 . (2000) 0.

b For any amount included in line 17 that was received from each person (other than "disqualified persons'), prepare a list for your records to show the name of,and amount received for each year, that was more than the larger of (1) the amount on line 25 for the year or (2) $5,000. (Include in the list organizationsdescribed in lines 5 through 11, as well as individuals.) Do not file this list with your return After computing the difference between the amount received andthe larger amount described in (1) or (2), enter the sum of these differences (the excess amounts) for each year:(2003) 0. (2002) 0. (2001)

c Add: Amounts from column (e) for lines: 15 3,350,526. 1617 55,451,779. 20 21

d Add: Line 27a total 0. and line 27b totale Public support (line 27c total minus line 27d total)

► 27c 58,802, 305.► 27d 0 .► 27e 158,802.305.

I Total support for section 509(a)(2) test: Enter amount on line 23, column (e) ► 27f 59,175,447.g Public support percentage (line 27e (numerator ) divided by line 27f (denominator)) ► 27 99.3694%

0. (2000) 0.

28 Unusual Grants : For an organization described in line 10, 11, or 12 that received any unusual grants during 2000 through 2003, prepare a list for your recordsto show, for each year, the name of the contributor, the date and amount of the grant, and a brief description of the nature of the grant . Do not file this list withyour return . Do not include these grants in line 15.

423121 12-03-04 NONE Schedule A (Form 990 or 990-EZ) 2004

Schedule A (Form'990 or 990-EZ) 2004 CARSON VALLEY SCHOOL 23-1352623 Page 4Part V Private School Questionnaire (See page 7 of the instructions.) N/A

(To be completed ONLY by schools that checked the box on line 6 in Part I V)

Yes No29 Does the organization have a racially nondiscriminatory policy toward students by statement in its charter, bylaws, other governing

instrument, or in a resolution of its governing body?30 Does the organization include a statement of its racially nondiscriminatory policy toward students in all its brochures, catalogues,

and other written communications with the public dealing with student admissions, programs, and scholarships?31 Has the organization publicized its racially nondiscriminatory policy through newspaper or broadcast media during the period of

solicitation for students, or during the registration period if it has no solicitation program, in a way that makes the policy knownto all parts of the general community it serves?If "Yes," please describe; if "No," please explain. (If you need more space, attach a separate statement.)

32 Does the organization maintain the following:a Records indicating the racial composition of the student body, faculty, and administrative staff?b Records documenting that scholarships and other financial assistance are awarded on a racially nondiscriminatory basis?c Copies of all catalogues, brochures, announcements, and other written communications to the public dealing with student

admissions, programs, and scholarships?d Copies of all material used by the organization or on its behalf to solicit contributions?

If you answered 'No* to any of the above, please explain. (ft you need more space, attach a separate statement.)

33 Does the organization discriminate by race in any way with respect to:a Students' rights or privileges?b Admissions policies?c Employment of faculty or administrative staff?d Scholarships or other financial assistance?e Educational policies?t' Use of facilities?g Athletic programs?h Other extracurricular activities?

If you answered 'Yes" to any of the above, please explain. (If you need more space, attach a separate statement.)

34 a Does the organization receive any financial aid or assistance from a governmental agencyb Has the organization ' s right to such aid ever been revoked or suspended?

If you answered 'Yes" to either 34a or b, please explain using an attached statement.35 Does the organization certify that it has complied with the applicable requirements of sections 4.01 through 4.05 of Rev. Proc. 75-50,

1975-2 C.B. 587, covering r acial nondiscrimination? If " No," a ttach an explanation

Schedule A (Form 990 or 990-EZ) 2004

42313111-24-04

Schedule A (Form 990 or 990-EZ) 2004 CARSON VALLEY SCHOOL 23-1352623 Page 5Pori VI -A Lobbying Expenditures by Electing Public Charities ( See page 9 of the instructions.) N/A

(To be completed ONLY by an eligible organization that filed Form 5768)

Check ► a D if the organization belongs to an affiliated group . Check ► b if you checked "a" and "li mited control" provisions apply.

Limits on Lobbying Expenditures Affiliated)group To be competed for ALL(The term "expenditures" means amounts paid or incurred.) totals electing organizations

N/A36 Total lobbying expenditures to influence public opinion (grassroots lobbying) 3637 Total lobbying expenditures to influence a legislative body (direct lobbying) 3738 Total lobbying expenditures (add lines 36 and 37) 3839 Other exempt purpose expenditures 3940 Total exempt purpose expenditures (add lines 38 and 39) 4041 Lobbying nontaxable amount. Enter the amount from the following table -

If the amount on line 40 is - The lobbying nontaxable amount is -Not over $500,000 20% of the amount on line 40

Over $500,000 but not over $1,000,000 $100,000 plus 15% of the excess over $500,000

Over $ 1,000 , 000 but not over $1,500,000 $175,000 plus 10% of the excess over $1,000,000 41Over $1,500,000 but not over $17,000 000 $225,000 plus 5% of the excess over $1,500,000

Over $17,000,000 $1,000,000

42 Grassroots nontaxable amount (enter 25% of line 41) 4243 Subtract line 42 from line 36. Enter -0- it line 42 is more than line 36 4344 Subtract line 41 from line 38. Enter -0- if line 41 Is more than line 38 44

Caution : If there is an amount on either line 43 orlfne 44, you must file Form 4720

4-Year Averaging Period Under Section 501(h)(Some organizations that made a section 501(h) election do not have to complete all of the five columns

below. See the instructions for lines 45 through 50 on page 11 of the instructions.)

Lobbying Expenditures During 4-Year Averaging PeriodN/A

Calendar year ( or (a) (b ) ( c) (d) (e)fiscal year beginning in) ► 2004 2003 2002 2001 Total

45 Lobbying nontaxableamount 0.

46 Lobbying ceiling amount(150% of line 45(e)) 0 .

47 Total lobbyingexpenditures 0.

48 Grassroots nontaxableamount 0.

49 Grassroots ceiling amount(150% of line 48(e)) 0

50 Grassroots lobbyingexpenditures 0.

Part VI -B Lobbying Activity by Nonelecting Public Charities(For reporting only by organizations that did not complete Part Vl-A) (See page 11 of the instructions.) N/A

During the year, did the organization attempt to influence national, state or local legislation, including any attempt toYes No Amount

influence public opinion on a legislative matter or referendum, through the use of:a Volunteersb Paid staff or management (Include compensation in expenses reported on lines c through h.)c Media advertisementsd Mailings to members, legislators, or the publice Publications, or published or broadcast statementsf Grants to other organizations for lobbying purposesg Direct contact with legislators, their staffs, government officials, or a legislative bodyh Rallies, demonstrations, seminars, conventions, speeches, lectures, or any other meansi Total lobbying expenditures (Add lines c through h.) 77-7 0.

If 'Yes" to any of the above, also attach a statement giving a detailed description of the lobbying activities.423141-244 Schedule A (Form 990 or 990 -EZ) 2004

Schedule A (Form 990 or 990-EZ) 2004 CARSON VALLEY SCHOOL 23-1352623 Page 6Part•Vll Information Regarding Transfers To and Transactions and Relationships With Noncharitable

Exempt Organizations (See page 11 of the instructions.)51 Did the reporting organization directly or indirectly engage in any of the following with any other organization described in section

501(c) of the Code (other than section 501(c)(3) organizations) or in section 527, relating to political organizations9a Transfers from the reporting organization to a nonchantable exempt organization of: Yes No

(i) Cash 51a(i) X

(ii) Other assets a(ii) XOther transactions:(i) Sales or exchanges of assets with a noncharitable exempt organization b(i) X(ii) Purchases of assets from a noncharitable exempt organization b(ii) X

(iii) Rental of facilities, equipment, or other assets b(iii) X

(iv) Reimbursement arrangements b(iv) X(v) Loans or loan guarantees b(v) X(vi) Performance of services or membership or fundraising solicitations b(vi) XSharing of facilities, equipment, mailing lists, other assets, or paid employees c XIf the answer to any of the above is 'Yes," complete the following schedule. Column (b) should always show the fair market value of thegoods, other assets, or services given by the reporting organization. If the organization received less than fair market value in any

52 a Is the organization directly or indirectly affiliated with, or related to, one or more tax-exempt organizations described in section 501 ( c) of theCode ( other than section 501(c)(3 )) or in section 5279 ► 0 Yes ® No

11-24-04 bcneauie A (corm auu or yyu-tz) zuua

CARSON VALLEY SCHOOL

ACTIVITY GROSSNUMBER RENTAL INCOME

FORM 990 RENTAL INCOME STATEMENT 1

KIND AND LOCATION OF PROPERTY

1419 BETHLEHEM PIKE

TOTAL TO FORM 990, PART I, LINE 6A

1 13,760.

23-1352623

13,760.

FORM 990 GAIN (LOSS) FROM PUBLICLY TRADED SECURITIES STATEMENT 2

DESCRIPTION

INVESTMENTS

TO FORM 990, PART I, LINE 8

GROSS COST OR EXPENSE NET GAINSALES PRICE OTHER BASIS OF SALE OR (LOSS)

122,297. 100,585. 0. 21,712.

122,297. 100,585. 0. 21,712.

FORM 990 SPECIAL EVENTS AND ACTIVITIES STATEMENT 3

DESCRIPTION OF EVENTGROSS CONTRIBUT. GROSS DIRECT NET

RECEIPTS INCLUDED REVENUE EXPENSES INCOME

GOLF OUTING, FALL FAIR,ETC. 46,036. 46,036. 29,697.

TO FM 990, PART I, LINE 9 46,036. 46,036. 29,697.

16,339.

16,339.

FORM 990 OTHER CHANGES IN NET ASSETS OR FUND BALANCES STATEMENT 4

DESCRIPTION

UNREALIZED LOSS ON INVESTMENTSDECREASE IN VALUE OF PERPETUAL TRUSTRETROACTIVE CONTRACTUAL ADJUSTMENTS

TOTAL TO FORM 990, PART I, LINE 20

AMOUNT

-22,664.-167,325.

1,180.

-188,809.

STATEMENT (S) 1, 2, 3, 4

CARSON VALLEY SCHOOL 23-1352623

FORM 990 OTHER EXPENSES STATEMENT 5

(A) (B) (C)PROGRAM MANAGEMENT

DESCRIPTION TOTAL SERVICES AND GENERAL

AUTOMOBILE 75,611. 75,611.BAD DEBT 157,750. 157,750.DAY CARE/NURSERYSCHOOL SUBSIDY 30,075. 30,075.'UTILITIES 279,370. 95,546. 183,824.FOOD 334,108. 69,657. 264,451.GROUNDS 92,164. 92,164.INSURANCE 1,064,498. 1,064,498.LINENS AND BEDDING 3,574. 3,574.MISCELLANEOUS 150,293. 92,491. 57,802.PAYROLL SERVICE 31,974. 31,974.PERSONAL NEEDS 66,408. 59,246. 7,162.PEST CONTROL 2,422. 2,422.PROFESSIONALSERVICES 720,539. 411,953. 308,586.PUBLIC RELATIONS 63,450. 63,450.RADIO COMMUNICATIONS 290. 290.,RECRUITMENT 43,716. 440. 43,276.REPAIRS ANDMAINTENANCE 58,525. 58,525.SECRETARIAL SVCS &BOOKKEEPING 38,262. 38,262.'SEWER MAINTENANCE 4,615. 4,615.TRAINING 105,897. 64,282. 41,615.STAFF TUITION 77,787. 77,787.TRASH REMOVAL 11,040. 11,040.,UNEMPLOYMENT TAXES 33,095. 33,095.JANITORIAL 68,939. 68,939.ACTIVITIES 168,721. 168,721.ALLOWANCES 67,253. 67,253.CHRISTMAS EXPENSE 40,834. 40,834.CLOTHING 214,389. 214,389.EDUCATION 137,326. 137,326.FAMILY FEES 1,928,982. 1,928,982.RENEWALS &IMPROVEMENTS 12,034. 12,034.

TOTAL TO FM 990, LN 43 6,083,941. 3,363,154. 2,720,787.

(D)

FUNDRAISING

STATEMENT(S) 5

CARSON VALLEY SCHOOL 23-1352623

FORM 990 STATEMENT OF ORGANIZATION'S PRIMARY EXEMPT PURPOSE STATEMENT 6PART III

EXPLANATION

CARSON VALLEY SCHOOL IS A NONPROFIT SOCIAL SERVICE AGENCY WHICH PROVIDESRESIDENTIAL DIAGNOSTIC AND FORSTER CARE SERVICES TO CHILDREN AND THEIRFAMILIES WITH SPECIAL NEEDS FROM VARIOUS PENNSYLVANIA COUNTIES.

FORM 990 NON-GOVERNMENT SECURITIES STATEMENT 7

SECURITY DESCRIPTION COST/FMV

STOCKS FMVBONDS FMV

TO FORM 990, LINE 54, COL B

OTHERPUBLICLY TOTAL

CORPORATE CORPORATE TRADED NON-GOV'TSTOCKS BONDS SECURITIES SECURITIES

640,933. 640,933.75,816. 75,816.

640,933. 75,816. 716,749.

FORM 990 GOVERNMENT SECURITIES STATEMENT 8

U.S. STATE AND TOTAL GOV'TDESCRIPTION COST/FMV GOVERNMENT LOCAL GOV'T SECURITIES

TREASURY NOTES FMV 74,784. 74,784.

TOTAL TO FORM 990, LINE 54, COL B 74,784. 74,784.

FORM 990 OTHER ASSETS STATEMENT 9

DESCRIPTION

BENEFICIAL INTEREST IN PERPETUAL TRUST

TOTAL TO FORM 990, PART IV, LINE 58, COLUMN B

AMOUNT

12,206,068.

12,206,068.

STATEMENT(S) 6, 7, 8, 9

CARSON VALLEY SCHOOL 23-1352623

FORM 990 OTHER SECURITIES STATEMENT 10

OTHERSECURITY DESCRIPTION COST/FMV SECURITIES

MONEY MARKET FMV 75,248.

TO FORM 990, LINE 54, COL B 75,248.

FORM 990 OTHER REVENUE NOT INCLUDED ON FORM 990 STATEMENT 11

DESCRIPTION AMOUNT

SPECIAL EVENTS EXPENSE NETTED WITH REVENUE 29,697.

TOTAL TO FORM 990, PART IV-A 29,697.

FORM 990 OTHER EXPENSES NOT INCLUDED ON FORM 990 STATEMENT 12

DESCRIPTION

SPECIAL EVENTS EXPENSE NETTED WITH REVENUE

TOTAL TO FORM 990, PART IV-B

AMOUNT

29,697.

29,697.

FORM 990 OTHER REVENUE INCLUDED ON FORM 990 STATEMENT 13

DESCRIPTION AMOUNT

TEMPORARILY RESTRICTED GRANTS AND CONTRIBUTIONS

TOTAL TO FORM 990, PART IV-A

60,079.

60,079.

STATEMENT (S) 10, 11, 12, 13

CARSON VALLEY SCHOOL 23-1352623

FORM 990 PART VIII - RELATIONSHIP OF ACTIVITIES TO STATEMENT 14ACCOMPLISHMENT OF EXEMPT PURPOSES

LINE EXPLANATION OF RELATIONSHIP OF ACTIVITIES

93AB PROVIDES EDUCATION FOR DEPENDENT/NEGLECTED CHILDREN93G INCLUDES STRUCTURED RESIDENTIAL TREATMENT PROGRAM FOR ADOLESCENTS WHO93G HAD HAD DIFFICULTY IN PRIOR PLACEMENTS AS WELL AS PSYCHIATRIC/93G PSYCHOLOGICAL EDUCATIONAL, MEDICAL, FAMILY AND CHILD CARE ASSESSMENTS93G TO PROMOTE PRODUCTIVE BEHAVIOR101 RAISES FUNDS TO PROVIDE RESIDENTIAL AND DIAGNOSTIC SERVICES103 MISC INCOME AND FUNDS FROM ROBERT N. CARSON TRUST RAISES MONEY TO103 PROVIDE A FULL RANGE OF CLINICAL SERVICES AS WELL AS RESIDENTIAL AND103 DIAGNOSTIC SERVICES.

SCHEDULE A STATEMENT REGARDING ACTIVITIES WITH STATEMENT 15SUBSTANTIAL CONTRIBUTORS, TRUSTEES, DIRECTORS,

CREATORS, KEY EMPLOYEES, ETC,.PART III, LINE 2

2D - SEE PART V, FORM 990

SCHEDULE A OTHER INCOME STATEMENT 16

DESCRIPTION

MISCELLANEOUS

2003AMOUNT

80,994.

TOTAL TO SCHEDULE A, LINE 22 80,994.

2002AMOUNT

-16,834.

-16,834.

2001AMOUNT

32,945.

2000AMOUNT

61,235.

32,945. 61,235.

STATEMENT (S) 14, 15, 16

Revised - March 2005

NAMEIHOME ADDRESS

Dr Karl U Bortnick8105 Devon StreetPhiladelphia, PA 19118215-242-3551Email kbortnick[cDyahoo com

CARSON VALLEY SCHOOLFlourtown, PA

BOARD OF DIRECTORS

Dr Newman M Bort nick (Winter)509 Oreland M il l Road FL - 7845 Timberwood CirOreland, PA 19075 Sarasota, FL 34238215-887-3553 941-923-4966 X-7845

Mr Richard Collier, Jr400 Leah DriveFt Washington, PA 19034215-643-3259 Cell - 215-808-6456President

Dr David R. Contosta19 Laurence PlacePlymouth Meeting, PA 19462610-828-9808Email. ContostaAmsn corn

Mr Gerald M Cope17 Summit AvenuePhiladelphia, PA 19118215-242-6436

Mr. Michael S Coulton100 South Buckingham LaneNorth Wales, PA 19454215-822-1672Email mscoulton(obcomcast netSecretary

Mr James Elliott1288 Cedar Grove RoadMedia , PA 19063610-353-1759Email. ire1544(cD-aol com

Ms. Leola Hubbard920 S Pershing RoadPenllyn, PA 19422215-646-4720 / fax, 215-646-4720Email. Lehub(cDaol corn

OFFICE ADDRESS

City of PhiladelphiaOffice of Information Services1234 Market Street, 18th F1Philadelphia, PA 19107215-686-8200 / fax 215-686-8258Email. karl Bortnickp_phda.gov

Rohm and Haas Company727 Norristown RoadSpring House, PA 19477215-641-7575 / fax 215-619-1669Email- nbortnicknorohmhaas com

Land Concepts Group593 Skippack Pike, Suite 300Blue Bell , PA 19422215-646-2031 / fax, 215-619-9071Email rcplan(a)aol com

Chestnut Hill College9601 Germantown AvenuePhiladelphia, PA 19118215-248-7190

Cope Linder Architects30 South 15`h StreetPhiladelphia, PA 19102215-981-0200 / fax- 215-569-0740Email claadmin(15 aol com

Benjamin Obdyke Incorporated199 Precision DriveHorsham, PA 19044215-672-7200Email mcoulton(c�obdyke com

EMAN Community Living, Inc820 Vernon RoadPh iladelphia, PA 19119215-849-3377 / fax- 215-848-6267

NAMEIHOME ADDRESS OFFICE ADDRESS

Mr Jeffrey J Idler Brown Brothers Harriman & Company8412 Navajo Street 1531 Walnut StreetPhiladelphia, PA 19118 Philadelphia, PA 19102215-248-5868 215-864-1864/fax 215-864-1853Treasurer Email Jeff idler(abbbh com

Ms. Catherine G Lynch704 E Hartwell LaneWyndmoor, PA 19038215-836-2488Email Iynch(cDnetaxs com

Ms Joy McClendon Richboro Elementary School2005 Tulip Road 125 Upper Holland RoadGlenside, PA 19038 Richboro, PA 18954215-885-3824 215-953-9500 / fax- 215-953-9957Email loymcclend(o)aol.com Email. imcciendont crsd org

Dr Roseann B Nyin (Les) Springfield Township School District8614 Caroline Drive 1901 E Paper Mill RoadWyndmoor, PA 19038 Oreland, PA 19075215-233-0805 215-233-6000 (1013)Email rbnyin(Qaol com Email roseann nyiri(aD-sdst org

Ms Mans A Ogg Tower Bridge Advisors507 E Mill Road 4 Tower Bridge, Ste 222Flourtown, PA 19031 W Conshohocken, PA 19428215-836-0637 610-260-2216 / fax: 610-260-2239

Email mogg(a)towerbndgeadvisors.com

Marc Perry, Esq Post & Schell, P.C8307 MacArthur Road 1800 John F Kennedy BlvdWyndmoor, PA 19038 Philadelphia, PA 19103215-836-5006 215-587-6606/fax 215-587-1444Vice President Email mperry(apostschell com

John E Quinn, Esq Reed Smith, LLP2 Glen Loch Way 2500 Market StreetMalvern PA 19355 One Liberty Place610-296-7795 Philadelphia, PA 19103

215-851-8212 / fax. 215-851-1420Email Igumn((Dreedsmith com

Roseann Quinn, SSJ Chestnut Hill CollegeTrinity House 9601 Germantown Avenue1301 Oak Lane Philadelphia, PA 19118Philadelphia, PA 19126 215-248-7120215-224-7979 Email- gwnn(oD-chc eduEmail. rguinn at7aol com

Mr Artis T Ray1070 West Aliens LanePhiladelphia, PA 19119215-242-9422 / fax 215-242-2830 / cell 215-317-5870Email rayconsult(aaol com

NAMEIHOME ADDRESS

Mr Michael Renzi411 Pennsylvania AvenueLansdale , PA 19446215-361-9979Ema il - renzim (a-yahoo com

Ms Margaret P Rux8 Rich AvenueErdenheim , PA 19038215-836-1079Ema il imrux(anetreach.net

Jonathan M Sternlieb, M D604 Wade AvenueHorsham, PA 19044215-646-5190Email- ggonathan(o)comcast net

Mr Glenn S Worgan119 W Wissahickon AvenueFlourtown, PA 19031215-836-2353

OFFICE ADDRESS

Pennfield Middle School726 Forty-foot RoadHatfield, PA 19440215-368-9600, ext 647

(summer) Email. renzima(cDnpenn org (School year)

The Vanguard GroupP O Box 1103, Dept. ZA-1Valley Forge, PA 19482610-669-4380Email margaret rux(a)vanguard com

Gastrointestinal Associates, Inc1095 Rydal RoadRydal, PA 19046Pager 215-363-3718267-620-1100 / fax- 215-572-1279267-620-1153 Schedule with Walter Doyle

Penrose Properties, Inc.1650 Market Street, Ste 3820Philadelphia, PA 19103215-979-1662Email gworgan pennrose corn

EMERITUS

Dr Frances E GrantWilliam Penn House #14201919 Chestnut StreetPhiladelphia, PA 19103215-496-0323(No Meetings)

Lj

Form 8868(Rev December 2004)Department of the TreasuryInternal Revenue Service

OMB No 1545-1709

• If you are filing for an Automatic 3-Month Extension , complete only Part I and check this box ►• If you are filing for an Additional (not automatic) 3-Month Extension, complete only Part II (on page 2 of this form).Do not complete Part II unless you have already been granted an automatic 3-month extension on a previously filed Form 8868.

Part I Automatic 3-Month Extension of Time - Only submit original (no copies needed)

Form 990-T corporations requesting an automatic 6-month extension - check this box and complete Part I only ► El

All other corporations (Including Form 990-C filers) must use Form 7004 to request an extension of time to file income taxreturns Partnerships, REMICs, and trusts must use Form 8736 to request an extension of time to file Form 1065, 1066, or 1041

Electronic Filing (e-file). Form 8868 can be filed electronically if you want a 3-month automatic extension of time to file one of the returns notedbelow (6 months for corporate Form 990-T filers) However, you cannot file it electronically if you want the additional (not automatic) 3-monthextension, instead you must submit the fully completed signed page 2 (Part II) of Form 8868 For more details on the electronic filing of this form,visit www irs gov/efile

Type or Name of Exempt Organization Employer identification numberprint

CARSON VALLEY SCHOOL 23-1352623F il e by thedue date for Number, street, and room or suite no If a P 0 box, see instructionsfiling your 1419 BETHLEHEM PIKEreturn Seeinstructions City, town or post office, state, and ZIP code For a foreign address, see instructions

FLOURTOWN, PA 19031

Check type of return to be filed(file a separate application for each return)-

Form 990 Form 990-T (corporation) El Form 4720Form 990-BL E:1 Form 990-T (sec. 401(a) or 408(a) trust) El Form 5227

0 Form 990-EZ 0 Form 990-T (trust other than above) El Form 60690 Form 990-PF 0 Form 1041-A 0 Form 8870

• The books are in the care of ► JOHN JJ. CAVANAUGHTelephone No ► 215-233-1945 FAX No ►

• If the organization does not have an office or place of business in the United States , check this box -- ► 0• If this is for a Group Return , enter the organization 's four digit Group Exemption Number (GEN) If this is for the whole group , check thisbox ► 0 If it is for part of the group , check this box ► 0 and attach a list with the names and EINs of all members the extension wil l cover

1 I request an automatic 3-month (6-months for a Form 990-T corporation) extension of time until FEBRUARY 15 , 2 0 0 6 -to file the exempt organization return for the organization named above The extension is for the organization 's return for►0 calendar year or►® tax year beginning JUL 1, 2004 , and ending JUN 30 , 2005

2 If this tax year is for less than 12 months, check reason El Initial return El Final return 0 Change in accounting period

3a If this application is for Form 990-BL , 990-PF , 990-T, 4720, or 6069 , enter the tentative tax, less anynonrefundable credits See instructions

b If this application is for Form 990-PF or 990-T, enter any refundable credits and estimatedtax payments made Include any prior year overpayment allowed as a credit $

c Balance Due. Subtract line 3b from line 3a Include your payment with this form, or, if required, deposit with FTDcoupon or, if required, by using EFTPS (Electronic Federal Tax Payment System) See Instructions $ N/A

Caution . If you are going to make an electronic fund withdrawal with this Form 8868, see Form 8453-EO and Form 8879-EO for payment instructions

LHA For Privacy Act and Paperwork Reduction Act Notice , see instructions . Form 8868 (Rev. 12-2004)

Application for Extension of Time To File anExempt Organization Return

ication for each return► File a

42383101-10-05