Reliance Small Cap Fund Presentation

Transcript of Reliance Small Cap Fund Presentation

-

8/8/2019 Reliance Small Cap Fund Presentation

1/32

A Reliance Capital company

-

8/8/2019 Reliance Small Cap Fund Presentation

2/32

India Opportunity

Why Invest in Small Caps

Investment Case for Small Caps

Success Essentials and Reliance Mutual Fund Advantage

Reliance Small Cap Fund

Investment Strategy

Positioning

Product Features

Table Of ContentsTable Of Contents

-

8/8/2019 Reliance Small Cap Fund Presentation

3/32

...despite concerns of coalition politics, bureaucracy & poor infrastructure

Estimated for 2009-2011

Source: CIEC, RCAM Estimates

India Moving Towards Higher Growth TrajectoryIndia Moving Towards Higher Growth Trajectory

-

8/8/2019 Reliance Small Cap Fund Presentation

4/32

Estimated for 2010-2014Source: CMIE, MOSL, RCAM Estimates

IndiaIndia -- The Next Trillion Dollar OpportunityThe Next Trillion Dollar Opportunity

India took 60 years to get to its first USD 1 Trillion GDP in FY08, but the move to USD 2Trillion GDP will be in next 5-6 years, similar to that of China

Due to the huge consumption and savings/investment boom, USD 2 Trillion GDP is not adestination, but a milestone in Indias ongoing journey towards USD 4 Trillion GDP in thesubsequent 5-7 years, and so on

INDIAS GDP IN USD TRILLION

-

8/8/2019 Reliance Small Cap Fund Presentation

5/32

Presently, EM economies hold over 30%share in Global GDP, while their share inGlobal market cap is only 13%

Source: IMF GDP data, MSCI m-cap data, RCAM Estimates, DM : Developed Markets, EM: Emerging Markets

Period 1995-99 2000-04 2005-09 2009

Avg. World GDP $Bn 30,292 35,291 53,583 57,228

Proportion of the World Average GDP level (%)

DM countries 80.4 79.5 72.2 69.3

US 27.6 30.5 25.7 24.9

UK 4.4 4.9 4.6 3.8

Euro area 23.2 21.4 22.1 21.5

Japan 14.8 12.2 8.7 8.8

EM countries 19.6 20.5 27.8 30.7Brazil 2.6 1.7 2.4 2.6

Russia 1.0 1.1 2.2 2.2

India 2.2 1.5 1.9 2.2

China 3.1 4.3 6.5 8.3

South Africa 0.5 0.4 0.5 0.5

Growing size of EM economy andfading distinction between EMand DM economies should lead toincreased capital allocation to EMeconomies

Period 1995-99 2000-04 2005-09 2009

Avg.World M-Cap 14,047,039 17,734,308 25,689,296 24,630,640

Proportion of the Average World M-Cap (%)

DM markets 94.1 95.3 90.1 86.8

United States 46.6 51.9 44.3 42.5

United Kingdom 9.7 10.4 9.6 9.0

Europe (ex-EM) 30.0 29.1 29.0 27.3

Japan 13.8 9.0 9.5 8.6

EM markets 5.9 4.7 9.9 13.2Brazil 0.7 0.4 1.3 2.2

Russia 0.2 0.2 0.8 0.8

India 0.4 0.3 0.7 1.0

China 0.0 0.3 1.5 2.4

Korea 0.6 0.8 1.4 1.7

MSCI Indices used as proxy for market-cap data (Units: USD million)

Emerging Markets To Attract Higher InflowsEmerging Markets To Attract Higher Inflows

-

8/8/2019 Reliance Small Cap Fund Presentation

6/32

In 2014, BRICs combined GDP will be equal to US GDP At Market Cap GDP ratio of 1, BRIC countries will have a market cap of USD 16.36

Trillion

Significant FII money will flow into the BRIC markets India will gets its share ofinvestments

Source - RCAM Estimates, *FII numbers are approximations, BRIC Brazil, Russia, India, China

Investments Will Flow To IndiaInvestments Will Flow To India

USD (Trillion) CY2008 CY2014BRIC

GDP 8.29 16.36

Market Cap 5.61 16.36

FII Investments* 1.00 ??

US

GDP 14.20 16.47

Market Cap 12.09 16.47

FII Investments* 10.64 ??

-

8/8/2019 Reliance Small Cap Fund Presentation

7/32

Currently market is evenly poised with positive bias

India has emerged stronger from the global slump and is back on track to grow in excessof 7-8% per annum

For a sustained long term growth, the 3 growth drivers are in place:

Savings Domestic savings are among the highest in the world Consumption Set to explode

Investments At 34% of the GDP, again among the highest in the world

Policy announcements will have significant impact on the direction of the market

Themes for the coming year

Big valuation disparity among large, mid caps & small caps. Opportunity for alphacreation

Stock selection will be the key

Investment OutlookInvestment Outlook

Source: Bloomberg, RCAM Estimates

-

8/8/2019 Reliance Small Cap Fund Presentation

8/32

Why Invest In Small Caps?Why Invest In Small Caps?

-

8/8/2019 Reliance Small Cap Fund Presentation

9/32

Key Benefits Of Investing In Small CapsKey Benefits Of Investing In Small Caps

Presence in Emerging SectorsPresence in Emerging Sectors Large UniverseLarge Universe

Higher Earnings GrowthHigher Earnings Growth

Und

er

Und

er--Re

search

ed

Res

earche

d

HighG

rowthP

otential

HighG

rowthP

otential Scop

eof

Re

Scop

eof

Re--R

atin

g

R

atin

g

Entrepre

neuria

lPassion

Entrepre

neuria

lPassion

SmallSmall

CapCap

-

8/8/2019 Reliance Small Cap Fund Presentation

10/32

TodayTodays Smalls Small

CapsCaps ..Are TomorrowAre Tomorrows Potentials Potential

Mid Caps,Mid Caps,Which May EventuallyWhich May Eventually

Become Large CapsBecome Large Caps

StartUp

StartUp

Growth

Growth

MaturityMaturity

Small CapsSmall Caps Mid CapsMid Caps Large CapsLarge Caps

Emergence Of Small Caps To Large CapsEmergence Of Small Caps To Large Caps

-

8/8/2019 Reliance Small Cap Fund Presentation

11/32

Limited Moderate Widely

Very

LimitedModerate Large

Low Moderate Fair

ReRe Rating Potential For Small CapsRating Potential For Small Caps

-

8/8/2019 Reliance Small Cap Fund Presentation

12/32

Indian entrepreneurial skills / mindset / spirit has been globally acknowledged over aperiod of time

End of License Raj has opened many business opportunities for entrepreneur

Multiple sources of fund raising at various stage of business has been of tremendous

help

Competitive talent is being attracted & retained by rewarding performance linked

incentives, ESOPs, etc

In todays economic environment, individuals with entrepreneurial mindset are exploring

new business opportunities that will not only survive in a recession but will also thrive

Thus, Emerging India is offering various growth opportunities to entrepreneurs, be it first

generation entrepreneur or otherwise

Entrepreneurial PassionEntrepreneurial Passion

-

8/8/2019 Reliance Small Cap Fund Presentation

13/32

In a developing economy like India, multiple sectors provide opportunities for growth

Example: Retailing, Food Processing, Pharmaceuticals, Media & Entertainment,

Real Estate, Education, Hospitality etc

Once established and successful, ramp up can be rapid

Thus, emerging sectors are true reflection of entrepreneurial spirit, new opportunities

and creation of global behemoths

Emerging Sectors Offer Opportunities For GrowthEmerging Sectors Offer Opportunities For Growth

-

8/8/2019 Reliance Small Cap Fund Presentation

14/32

Dynamics Of MultiDynamics Of Multi -- BaggersBaggers

Market Capitalization = Net Profits X PerceptionMarket Price = EPS X PE

High Growth Potential / Scalability

Differentiated Business Model

Emergence of Educated &

Passionate Management

Niche focus & ability to attract talent

in form of Quasi Entrepreneurs &

Stock Options

Under Ownership, Under

Researched & Under Covered

Understanding Value of Market Cap

Various Modes of Fund Raising

Emerging Sectors start small

Technology, Retail, Real Estate,

Insurance etc

This simultaneous impact on both EPS & PE creates a MULTI BAGGER

-

8/8/2019 Reliance Small Cap Fund Presentation

15/32

There is no scientific methodology to classify Large Caps, Mid Caps and Small Capsbut there are pre-defined indices on BSE & NSE

Mentioned below is the categorization of the same on the basis of market capitalization

as on August 2010

Indices CategorizationNo. Of

Companies

Index Market Cap

Range

(Rs. Crs)

Total Market

Cap approx

(Rs Crs)

BSE SENSEX Large Cap 30 15,300 329,400 2,761,687

BSE Mid Cap Mid Cap 273 1000 12,350 1,078,821

BSE Small Cap Small Cap 534 170 2300 351,840

Source:www.bseindia.com, 5thAugust 2010 , Index Market Cap Range given implies companies with the smallest market cap and largest market cap in that particularindices respectively as on August 5, 2010. Small Cap stocks for the purpose of the Reliance Small Cap Fund are stocks whose market capitalization is in between the

highest and lowest market capitalization of companies on BSE Small Cap Index

How Small Caps Are Classified ?How Small Caps Are Classified ?

-

8/8/2019 Reliance Small Cap Fund Presentation

16/32

-

8/8/2019 Reliance Small Cap Fund Presentation

17/32

Small Caps are still available at better valuations compared to Large Caps

Investment Case For Small CapsInvestment Case For Small Caps

Performance Over The Last 2 Years (31st July 08 - 30th July 10)

Index CAGR (%)

Outperformance of

BSE SMALL CAPRelative To Indices

S&P CNX Nifty 11.32 5.00

BSE SENSEX 11.58 4.74

BSE MIDCAP 15.37 0.95

BSE SMALL CAP 16.32

Valuation As On 31st July 2010

Index P/E Price To Book Value

S&P CNX Nifty 22.31 3.78

BSE SENSEX 21.20 3.40

BSE MIDCAP 19.24 2.90

BSE SMALL CAP 15.66 2.34

Source :www.bseindia.com, Capitaline Neo as on 6thAugust 2010

-

8/8/2019 Reliance Small Cap Fund Presentation

18/32

Examples of how Small Cap companies have emergedExamples of how Small Cap companies have emerged

as Large Cap companies over a period of timeas Large Cap companies over a period of time

creating wealth for the shareholderscreating wealth for the shareholders

The companies chosen herein are purely for illustrative purpose only

Reliance Mutual Fund or Reliance Small Cap Fund may or may not invest in the shares of these companies

The investment decision of Reliance Mutual Fund to invest in any company is based on several factors including

research, market potential, future outlook etc

-

8/8/2019 Reliance Small Cap Fund Presentation

19/32

Company Name

Market Capitalization

(July 30th 2001)

Market Capitalization

(July 30th 2010) Outperformance relative toBSESENSEX

(July 30th 2001- July 30th 2010)(Rs. Cr) (Rs. Cr)

Pantaloon Retail (India) 19.98 9457.13 19,316%

PAT

Rs.140.58 Crs(30th June 2009)

PAT

Rs.6.40 Crs

(30th June 2001)

Increase

dBy22T

imes

RetailingRetailing

Source as on 31st July 2010, Capitaline Neo

-

8/8/2019 Reliance Small Cap Fund Presentation

20/32

Source as on 31st July 2010, Capitaline Neo

PAT

Rs.1,195.53 Crs(31st March 2009)

PAT

Rs.13.57 Crs

(31st March 2003)

Increased

By88Tim

es

RealtyRealty -- ConstructionConstruction

Company Name

Market Capitalization

(July 31st 2003)

Market Capitalization

(July 30th 2010) Outperformance relative toBSESENSEX

(July 31st 2003- July 30th 2010)(Rs. Cr) (Rs. Cr)

Unitech 72.44 20,457.53 17,550%

-

8/8/2019 Reliance Small Cap Fund Presentation

21/32

Source as on 31st July 2010, Capitaline Neo

PAT

Rs.140.33 Crs

(31st March 2009)

PAT

Rs.14.00 Crs

(31st March 2006)

Increased

By10Times

ComputersComputers -- EducationEducation

Company Name

Market Capitalization

(Jan 31st 2006)

Market Capitalization

(July 30th 2010) Outperformance relative toBSESENSEX

(Jan 31st 2006- July 30th 2010)(Rs. Cr) (Rs. Cr)

Educomp Solutions 447.20 5,797.46 904%

-

8/8/2019 Reliance Small Cap Fund Presentation

22/32

Source as on 31st July 2010, Capitaline Neo

PAT

Rs.130.03 Crs

(31st March 2010)

PAT

Rs.30.92 Crs

(31st March 2002)

IncreasedBy4Times

HealthcareHealthcare

Company Name

Market Capitalization

(Jan 31st 2001)

Market Capitalization

(July 30th 2010) Outperformance relative toBSESENSEX

(Jan 31st 2001- July 30th 2010)(Rs. Cr) (Rs. Cr)

Apollo Hospitals 715.31 4,841.08 20%

-

8/8/2019 Reliance Small Cap Fund Presentation

23/32

Source as on 31st July 2010, Capitaline Neo

PATRs.46.71 Crs

(31st March 2010)

PAT

Rs.0.94 Crs

(31st March 2003)

Increased

By49Tim

es

FMCGFMCG Food & Dairy ProductsFood & Dairy Products

Company Name

Market Capitalization

(July 1st 2003)

Market Capitalization

(July 30th 2010) Outperformance relative to

BSESENSEX

(July 01st 2003- July 30th 2010)(Rs. Cr) (Rs. Cr)

Zydus Wellness 2.31 2,015.23 9,924%

-

8/8/2019 Reliance Small Cap Fund Presentation

24/32

Stock Selection

Small Cap investing is all about stock selection rather than asset allocation

Stock selection based on

Size of opportunity

Possible higher growth and its sustainability

Emerging theme / sector (Example: real estate, retail, food processing etc)

Zeal of management to scale and grow

Stock price movement tend to be more volatile

Limited research

Lesser/negligible institutional ownership

However the sharp volatility subsides over a longer period and makes way for

higher profitability

Dynamics Of Successful Small Cap InvestingDynamics Of Successful Small Cap Investing

-

8/8/2019 Reliance Small Cap Fund Presentation

25/32

Our Expertise

Bottom up approach has been strongly advocated as the key investment strategy of

Reliance Mutual Fund.

Well-experienced team of investment professionals having

Collective experience of over 150 years in Indian equities

Most members individually tracking Indian equity markets for well over 15 years

In depth research capabilities to identify small caps with huge growth potential

Our research capability empowers the Fund Manager to be BOLD in identifying high

growth potential stocks & manage the RISK associated with it

Only fund in RMFs product basket with a pre-dominant investment focus on small

cap companies where stock selection would play a key rolePast Performance may or may not be sustained in future

Reliance Mutual Fund AdvantageReliance Mutual Fund Advantage

-

8/8/2019 Reliance Small Cap Fund Presentation

26/32

Reliance Mutual FundReliance Mutual Fund

PresentsPresents

Reliance Small Cap FundReliance Small Cap Fund

A Fund WithA Fund With

A Very Aggressive Investment StyleA Very Aggressive Investment Style

-

8/8/2019 Reliance Small Cap Fund Presentation

27/32

With an endeavor to maximize returns & minimize risks by reasonable diversification ,primary focus would be on small cap stocks

Investment in Equities of Small Cap Companies : 65%-100%*

Investment in Equities of any other Companies : 0%-35%*

Investment in Debt & Money Market Securities : 0% - 35%*

Small cap stocks, for the purpose of the fund are defined as stocks whose market

capitalization is in between the highest & lowest market capitalization of companies

on BSE Small Cap Index

Investment with a longer term horizon

* Please refer detailed asset allocation on slide no 29. Market Capitalization: Market value of the listed company, which is

calculated by multiplying its current market price by number of its shares outstanding

Investment PhilosophyInvestment Philosophy

-

8/8/2019 Reliance Small Cap Fund Presentation

28/32

A very aggressive small cap oriented fund

A relatively high risk/high return oriented fund characterized by volatility which will get

smoothened out over long term investment horizon Reliance Small Cap Fund will be a vital part of an investors core portfolio that aims to

create an alpha for their investments

Positioning Of Reliance Small Cap FundPositioning Of Reliance Small Cap Fund

Risk

Returns

High Medium Low

HighReliance Small

Cap Fund

Medium

Low

-

8/8/2019 Reliance Small Cap Fund Presentation

29/32

Equity & equity related securities of small cap companies including derivatives# -65%-100%

Equity & equity related securities of any other companies including derivatives# -0%-35%

Debt & Money Market Securities **(including investments in securitised debt)- 0% - 35%

** including securitised debt up to 30%

# The Scheme proposes to invest at least 65% of the corpus in Equity & equity related instruments of smallcap companies which may go upto 100% of the corpus. The investment in Equity & equity related instrumentsof any other companies other than small cap companies will be in the range of 0-35% of the corpus

BSE Small Cap Index

Proposed AssetAllocation

Fund Manager Sunil Singhania

Scheme FeaturesScheme Features

Investment Objective

The primary investment objective of the scheme is to generate long term capital

appreciation by investing predominantly in equity and equity related instruments ofsmall cap companies and the secondary objective is to generate consistentreturns by investing in debt and money market securities

Benchmark

New Fund Offer Price: Rs.10/- per unit

-

8/8/2019 Reliance Small Cap Fund Presentation

30/32

Load Structure : During New Fund Offer &Continuous Offer including SIP Installments

Entry Load: Nil

Exit Load:

2% If redeemed or switched out on or before completion of

12 months from the date of allotment of units

1% If redeemed or switched out after 12 months but on or

before completion of 24 months from the date of allotment

of units

Nil If redeemed or switched out after the completion of 24

months from the date of allotment of units

In accordance with the requirements specified by the SEBI circular no. SEBI/IMD/CIRNo.4/168230/09 dated June 30, 2009 no entry load will be charged for purchase / additionalpurchase / switch-in accepted by the Fund. Upfront commission shall be paid directly by theinvestor to the AMFI Registered Distributor based on the investors assessment of various

factors including the services rendered by the AMFI Registered Distributor.

Choice of Plans/OptionsGrowth Plan:

Growth & Bonus OptionDividend Plan :

Dividend Payout OptionDividend Reinvestment Option

Minimum Application Amount

Rs.5000 & in multiples of Re. 1 thereafter

Additional Purchase Amount

Rs.1000 (plus in the multiple of Re.1)

SIP

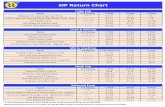

Mode of Payment : Auto Debit/ECS

Scheme FeaturesScheme Features

-

8/8/2019 Reliance Small Cap Fund Presentation

31/32

-

8/8/2019 Reliance Small Cap Fund Presentation

32/32

A Reliance Capital company

Thank YouThank You